Key Insights

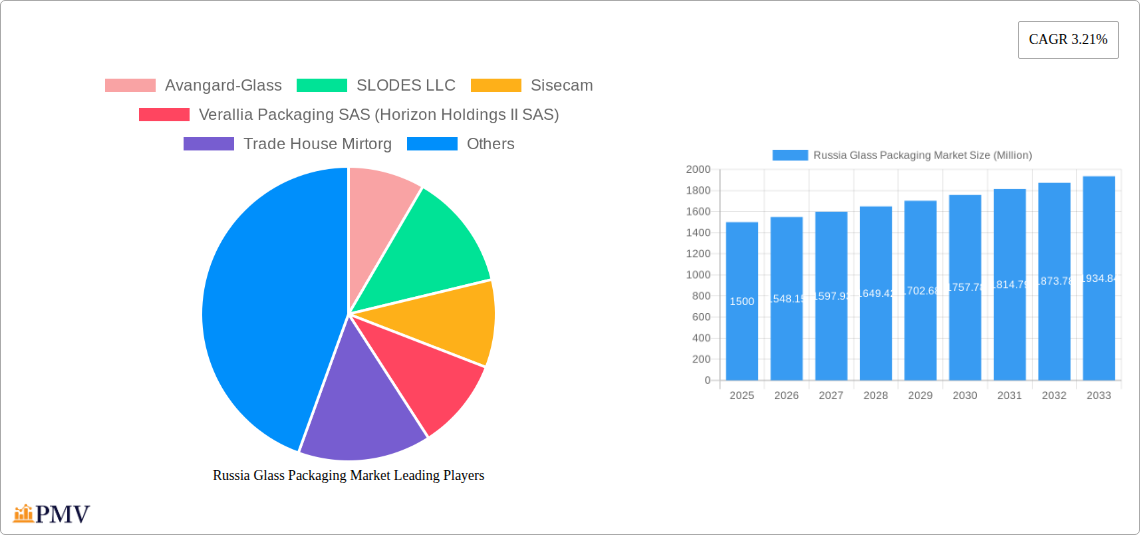

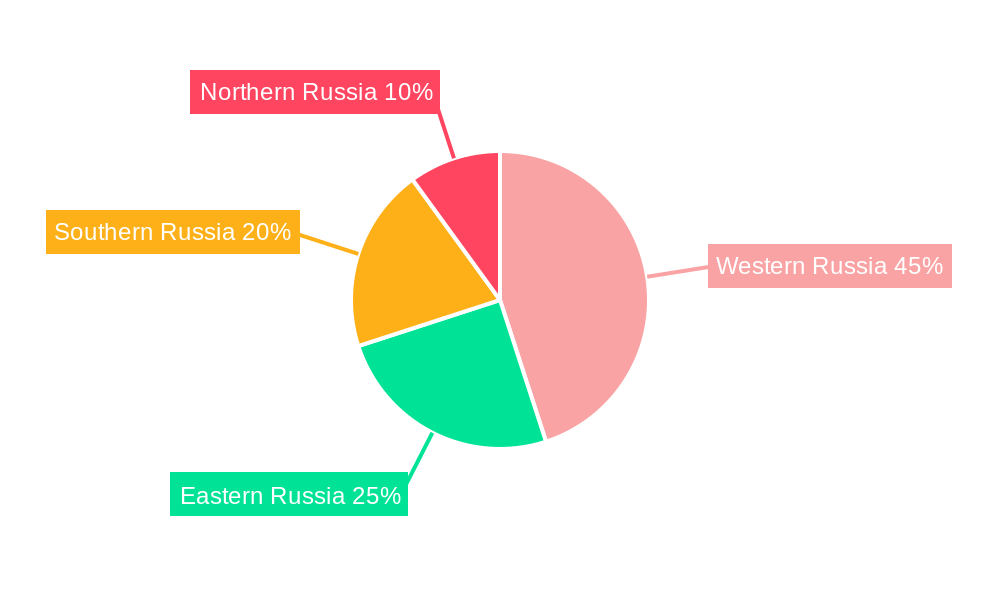

The Russia glass packaging market, valued at approximately $XX million in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.21% from 2025 to 2033. This growth is fueled by several key factors. The burgeoning beverage industry, particularly within the food and alcoholic sectors, is a significant driver, demanding increased quantities of glass bottles and containers for product packaging. Furthermore, the increasing preference for sustainable and eco-friendly packaging solutions is boosting demand for glass, as it is recyclable and perceived as a more environmentally responsible alternative to plastic. Growth is also evident in the pharmaceutical and cosmetics sectors, which utilize ampoules, vials, and jars for product containment and preservation. However, the market faces some restraints, including fluctuations in raw material prices (e.g., silica sand, soda ash) and potential supply chain disruptions impacting the production and distribution of glass packaging. The market is segmented by product type (bottles & containers, ampoules, vials, syringes, jars, etc.) and end-user industry (beverage, food, cosmetics, pharmaceuticals, others), providing a diverse landscape with varying growth trajectories. Competition amongst established players like Avangard-Glass, Sisecam, Verallia Packaging, and Ardagh Group, alongside regional manufacturers, characterizes the market dynamics. Regional variations in growth rates are anticipated, with potentially faster expansion in Western Russia due to higher consumption levels and established infrastructure.

The forecast period (2025-2033) anticipates continued market expansion, albeit at a moderate pace. This moderate growth is a reflection of both the positive drivers mentioned above and the challenges presented by economic fluctuations and potential geopolitical uncertainties impacting the Russian market. To maintain momentum, companies in the sector must strategically adapt to evolving consumer preferences, innovate in packaging designs, and explore opportunities within niche segments like premium beverage packaging and specialized pharmaceutical applications. The focus on sustainability and eco-conscious practices will be crucial for maintaining competitiveness and driving future growth. Understanding regional variations in market dynamics will further enable companies to effectively tailor their strategies for long-term success.

Russia Glass Packaging Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Russia glass packaging market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033, and uses 2025 as the base year. The report meticulously examines market dynamics, competitive landscapes, segment-specific growth trajectories, and future outlook, incorporating recent geopolitical events and their profound impact on the industry. The total market size in 2025 is estimated at xx Million.

Russia Glass Packaging Market Market Structure & Competitive Dynamics

The Russia glass packaging market exhibits a moderately concentrated structure, with several key players holding significant market share. The market is characterized by a complex interplay of established domestic players and international corporations. Innovation is primarily driven by advancements in manufacturing technologies, improved sustainability initiatives, and the development of specialized packaging solutions catering to specific end-user needs. Regulatory frameworks concerning material safety and environmental standards significantly influence operations. Product substitutes, such as plastic and metal packaging, pose a constant competitive challenge. Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values varying considerably depending on the size and strategic importance of the acquired entities.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Innovation: Focus on lightweighting, enhanced barrier properties, and sustainable materials.

- Regulatory Framework: Stringent quality and safety regulations impact production costs and market access.

- Product Substitutes: Competition from plastic and metal packaging remains significant.

- M&A Activity: Limited significant M&A activity observed recently, with deal values typically in the range of xx Million to xx Million. Further consolidation is anticipated in the coming years.

- End-User Trends: Shifting consumer preferences towards premium and sustainable packaging influence product demand.

Russia Glass Packaging Market Industry Trends & Insights

The Russia glass packaging market has experienced fluctuating growth in recent years, influenced by macroeconomic factors, geopolitical instability, and evolving consumer preferences. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of glass packaging in various segments varies, with the food and beverage sectors exhibiting the highest adoption rates. Technological disruptions, such as automation in manufacturing processes and advancements in design capabilities, are driving efficiency and product innovation. The increasing consumer preference for sustainable and eco-friendly packaging is further shaping market growth. The impact of the ongoing geopolitical situation has created uncertainty, leading to fluctuating raw material costs and supply chain disruptions. The market's recovery is expected to be gradual, however, driven by the continued demand for glass packaging in key segments.

Dominant Markets & Segments in Russia Glass Packaging Market

The beverage sector represents the most dominant end-user industry for glass packaging in Russia, owing to the substantial demand for bottles and containers within the alcoholic and non-alcoholic beverage segments. Within the product type category, bottles and containers account for the largest market share, reflecting the prevalent use of glass for packaging various beverages and food products.

- Key Drivers in Beverage Sector:

- Strong demand for bottled beverages (alcoholic and non-alcoholic).

- Established distribution networks for glass packaging.

- Consumer preference for glass as a premium and safe packaging material.

- Key Drivers in Bottles and Containers Segment:

- Versatility across various product applications.

- Established manufacturing infrastructure.

- Consumer familiarity and acceptance.

The dominance of these segments is attributed to established consumer preferences, well-developed infrastructure, and the suitability of glass for preserving the quality and aesthetics of packaged products. However, other segments, such as pharmaceuticals and cosmetics, are also showcasing growth potential, driven by increasing consumer spending and the demand for high-quality packaging solutions.

Russia Glass Packaging Market Product Innovations

Recent product innovations within the Russian glass packaging market focus on lightweighting designs to reduce material costs and improve sustainability, while simultaneously enhancing barrier properties to extend product shelf life. New production techniques and advanced coatings are improving the durability and aesthetics of glass packaging. This enhances the product's visual appeal and brand value in the highly competitive market.

Report Segmentation & Scope

This report segments the Russia glass packaging market across several key dimensions:

- By End-User Industry: Beverage (alcoholic and non-alcoholic), Food, Cosmetics, Pharmaceutical, Other End-user Industries. Growth projections for each segment vary, driven by industry-specific trends and regulatory developments.

- By Product Type: Bottles and containers, Ampoules, Vials, Syringes, Jars, Other Product Types. Market sizes and competitive dynamics differ considerably across product types, with bottles and containers dominating.

Each segment's analysis includes growth projections, market size estimates, and a competitive landscape overview.

Key Drivers of Russia Glass Packaging Market Growth

Several factors contribute to the growth of the Russia glass packaging market. These include rising consumer demand for packaged goods, increased adoption of glass packaging in premium segments, and the development of innovative, lightweight, and sustainable packaging solutions. The growing middle class and evolving consumer preferences towards safe and aesthetically pleasing packaging are also driving growth. Moreover, investments in manufacturing infrastructure and technological advancements continue to improve production efficiency and increase capacity.

Challenges in the Russia Glass Packaging Market Sector

The Russia glass packaging market faces several challenges. Fluctuating raw material prices, primarily energy costs, present a significant hurdle, impacting production costs and profitability. Geopolitical instability and sanctions have disrupted supply chains and impacted the availability of raw materials and components. Competition from alternative packaging materials, such as plastic and metal, further poses a significant challenge. Strict environmental regulations are also driving the need for sustainable manufacturing practices. These factors combined significantly impact market growth and forecast accuracy. In 2025, these challenges are estimated to impact market growth by approximately xx%.

Leading Players in the Russia Glass Packaging Market Market

- Avangard-Glass

- SLODES LLC

- Sisecam

- Verallia Packaging SAS (Horizon Holdings II SAS)

- Trade House Mirtorg

- Ardagh Group S A

- SIBSTEKLO LTD

- Saverglass

- Melnir

- GRODNO GLASSWORKS JSC

Key Developments in Russia Glass Packaging Market Sector

- August 2022: European energy crisis highlights the dependence of some glass manufacturers on Russian gas, potentially affecting production capacity and costs. This directly impacts the supply of glass packaging, leading to price increases and potential shortages. The Riedel example showcases the impact of energy costs on even large producers.

- November 2022 – February 2022: The ongoing conflict between Russia and Ukraine significantly impacted global wine trade and glass packaging supply chains, due to disruptions in raw materials and logistics. This resulted in price volatility and supply chain uncertainty for glass packaging companies.

Strategic Russia Glass Packaging Market Market Outlook

The Russia glass packaging market presents significant opportunities for growth despite the challenges. Focusing on sustainable and innovative packaging solutions, improving supply chain resilience, and leveraging technological advancements will be key to success. Expansion into high-growth segments, such as pharmaceuticals and cosmetics, holds substantial potential. Strategic partnerships and investments in manufacturing capacity will enable companies to capitalize on the market’s long-term growth prospects. The market's recovery and subsequent growth hinges on resolving geopolitical issues and stabilizing the energy market.

Russia Glass Packaging Market Segmentation

-

1. Product Type

- 1.1. Bottles and Containers

- 1.2. Ampoules

- 1.3. Vials

- 1.4. Syringes

- 1.5. Jars

- 1.6. Other Product Types

-

2. End-User Industry

-

2.1. Beverage

- 2.1.1. Liquor

- 2.1.2. Beer

- 2.1.3. Soft Drinks

- 2.1.4. Other Beverages

- 2.2. Food

- 2.3. Cosmetics

- 2.4. Pharmaceutical

- 2.5. Other End-user Industries

-

2.1. Beverage

Russia Glass Packaging Market Segmentation By Geography

- 1. Russia

Russia Glass Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Shift Towards Sustainable Packaging Due to Stringent Regulations; Growing Adoption of Premium Glass packaging in End-user Industries such as Beverage and Cosmetics; Bottles are Expected to Hold Prominent Share

- 3.3. Market Restrains

- 3.3.1. Alternative Forms of Packaging is Challenging the Market Growth

- 3.4. Market Trends

- 3.4.1. Bottles are Expected to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bottles and Containers

- 5.1.2. Ampoules

- 5.1.3. Vials

- 5.1.4. Syringes

- 5.1.5. Jars

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Beverage

- 5.2.1.1. Liquor

- 5.2.1.2. Beer

- 5.2.1.3. Soft Drinks

- 5.2.1.4. Other Beverages

- 5.2.2. Food

- 5.2.3. Cosmetics

- 5.2.4. Pharmaceutical

- 5.2.5. Other End-user Industries

- 5.2.1. Beverage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Western Russia Russia Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Avangard-Glass

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 SLODES LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sisecam

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Verallia Packaging SAS (Horizon Holdings II SAS)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Trade House Mirtorg

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Ardagh Group S A *List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SIBSTEKLO LTD

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Saverglass

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Melnir

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 GRODNO GLASSWORKS JSC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Avangard-Glass

List of Figures

- Figure 1: Russia Glass Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Glass Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Glass Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Glass Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Russia Glass Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Russia Glass Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Glass Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russia Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russia Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russia Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russia Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russia Glass Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: Russia Glass Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 12: Russia Glass Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Glass Packaging Market?

The projected CAGR is approximately 3.21%.

2. Which companies are prominent players in the Russia Glass Packaging Market?

Key companies in the market include Avangard-Glass, SLODES LLC, Sisecam, Verallia Packaging SAS (Horizon Holdings II SAS), Trade House Mirtorg, Ardagh Group S A *List Not Exhaustive, SIBSTEKLO LTD, Saverglass, Melnir, GRODNO GLASSWORKS JSC.

3. What are the main segments of the Russia Glass Packaging Market?

The market segments include Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Shift Towards Sustainable Packaging Due to Stringent Regulations; Growing Adoption of Premium Glass packaging in End-user Industries such as Beverage and Cosmetics; Bottles are Expected to Hold Prominent Share.

6. What are the notable trends driving market growth?

Bottles are Expected to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Alternative Forms of Packaging is Challenging the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022 - Russia's invasion of Ukraine in February 2022 unexpectedly impacted the global wine trade. It drove up the price and availability of wine bottles and glassware. Thus, glass packaging companies have faced turbulent times.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Glass Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Glass Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Glass Packaging Market?

To stay informed about further developments, trends, and reports in the Russia Glass Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence