Key Insights

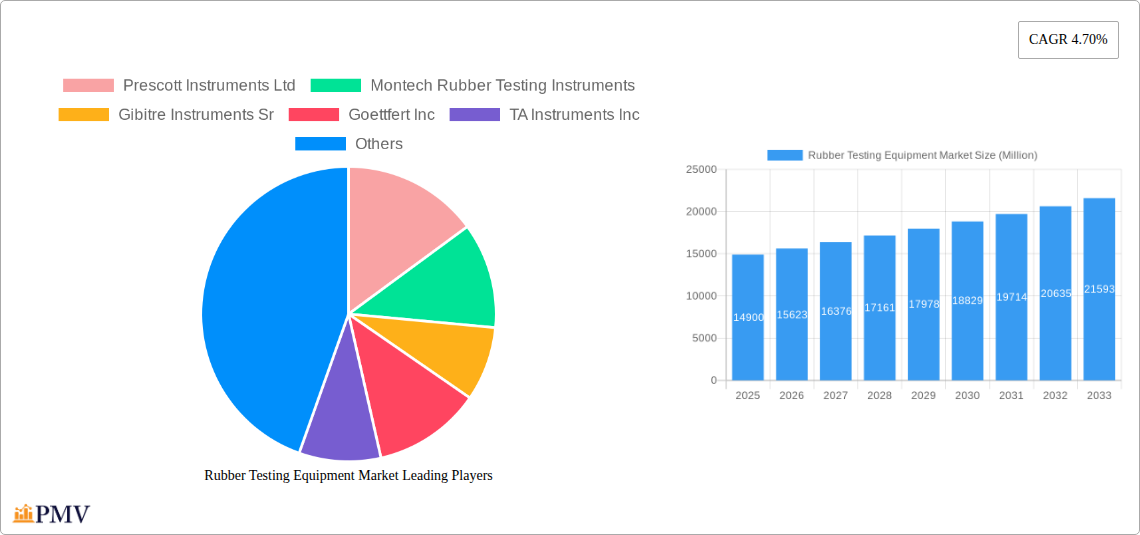

The global Rubber Testing Equipment market is poised for steady growth, projected to reach a market size of $14.90 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.70% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning automotive industry, particularly the increasing demand for high-performance tires, is a significant driver. Stringent quality control standards enforced across various rubber product manufacturing sectors necessitate advanced testing equipment, contributing to market growth. Furthermore, the rising adoption of automation and sophisticated testing techniques within manufacturing processes enhances efficiency and precision, increasing the demand for these specialized instruments. The market is segmented by testing type (density, viscosity, hardness, flex, and other types) and end-user application (tires, general rubber goods, industrial rubber products, and general polymers/compounds), offering diverse opportunities for manufacturers. North America and Asia-Pacific are expected to dominate the market, driven by significant manufacturing hubs and robust industrial growth in these regions.

Rubber Testing Equipment Market Market Size (In Billion)

However, certain challenges hinder market expansion. High initial investment costs associated with procuring advanced testing equipment can pose a barrier for smaller manufacturers. Furthermore, the market faces competitive pressures from numerous established and emerging players, requiring companies to continuously innovate and offer superior solutions to maintain their market position. Technological advancements, particularly in areas like automated testing and data analysis, are crucial for sustained growth. The ongoing development of new materials and evolving industry standards also require adaptation and investment in new testing equipment, presenting both opportunities and challenges for the market. The continued emphasis on product safety and quality assurance will remain a key driver shaping this market's future.

Rubber Testing Equipment Market Company Market Share

Rubber Testing Equipment Market: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the global Rubber Testing Equipment market, offering valuable insights for stakeholders across the industry. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report segments the market by type of testing (Density, Viscosity, Hardness, Flex, and Other) and end-user application (Tire, General Rubber Goods, Industrial Rubber Products, General Polymer, and Compound). Key players analyzed include Prescott Instruments Ltd, Montech Rubber Testing Instruments, Gibitre Instruments Sr, Goettfert Inc, TA Instruments Inc, Alpha Technologies, U-Can Dynatex Inc, Norka Instruments Shanghai Ltd, Ektron Tek Co Ltd, and Gotech Testing Machines. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Rubber Testing Equipment Market Structure & Competitive Dynamics

The global Rubber Testing Equipment market exhibits a moderately consolidated structure, with the top 10 players holding an estimated xx% market share in 2025. Innovation is driven by a mix of established players investing in R&D and smaller companies introducing niche technologies. Regulatory frameworks, particularly those related to safety and environmental compliance, significantly impact market dynamics. Product substitutes, such as advanced analytical techniques, pose a moderate competitive threat. End-user trends, including increasing demand for high-performance rubber products and stricter quality control standards, are major growth drivers. The market has witnessed several M&A activities in recent years, with deal values totaling approximately xx Million in the historical period (2019-2024). These transactions aim to expand market reach, enhance technological capabilities, and consolidate market share.

- Market Concentration: Moderately consolidated, with top 10 players holding xx% market share (2025).

- Innovation Ecosystems: Blend of established players and smaller companies driving technological advancements.

- Regulatory Frameworks: Stringent safety and environmental regulations influence market growth.

- Product Substitutes: Advanced analytical techniques pose a moderate competitive threat.

- M&A Activities: Significant consolidation activity with deal values totaling approximately xx Million (2019-2024).

Rubber Testing Equipment Market Industry Trends & Insights

The Rubber Testing Equipment market is experiencing robust and dynamic growth, propelled by the ever-increasing demand for high-performance and specialized rubber products across a multitude of critical industries. This expansion is significantly amplified by ongoing technological advancements, particularly in the realms of intelligent automation, sophisticated sensor technology, and AI-driven data analytics. These innovations are collectively enhancing the precision, efficiency, and overall capabilities of modern testing equipment, enabling more comprehensive and insightful material characterization.

Consumer and industrial preferences for exceptionally durable, consistently reliable, and safety-compliant rubber products are necessitating more rigorous and advanced quality control measures. This imperative is a primary catalyst for the escalating demand for sophisticated testing solutions. The burgeoning tire manufacturing sector, with its continuous pursuit of enhanced performance, fuel efficiency, and longevity, alongside the expanding industrial rubber products segment—spanning applications in construction, manufacturing, and consumer goods—are pivotal contributors to this market's sustained expansion.

The competitive landscape is characterized by a strategic interplay of competitive pricing and, increasingly, innovation-led differentiation. Manufacturers are actively responding to market needs by developing integrated testing platforms that consolidate multiple testing functionalities into single, user-friendly systems, thereby optimizing laboratory space and operational workflows. This trend towards comprehensive, multi-functional solutions is poised to drive higher market penetration for advanced testing systems.

Looking ahead, the Rubber Testing Equipment market is projected to witness significant growth at a Compound Annual Growth Rate (CAGR) of approximately 6.5% to 7.5% from 2025 to 2033. This optimistic forecast is underpinned by several key factors, including substantial and sustained investments in research and development, the growing global demand for advanced, customized testing solutions to meet evolving material science challenges, and the accelerating adoption of automation technologies across manufacturing and R&D facilities.

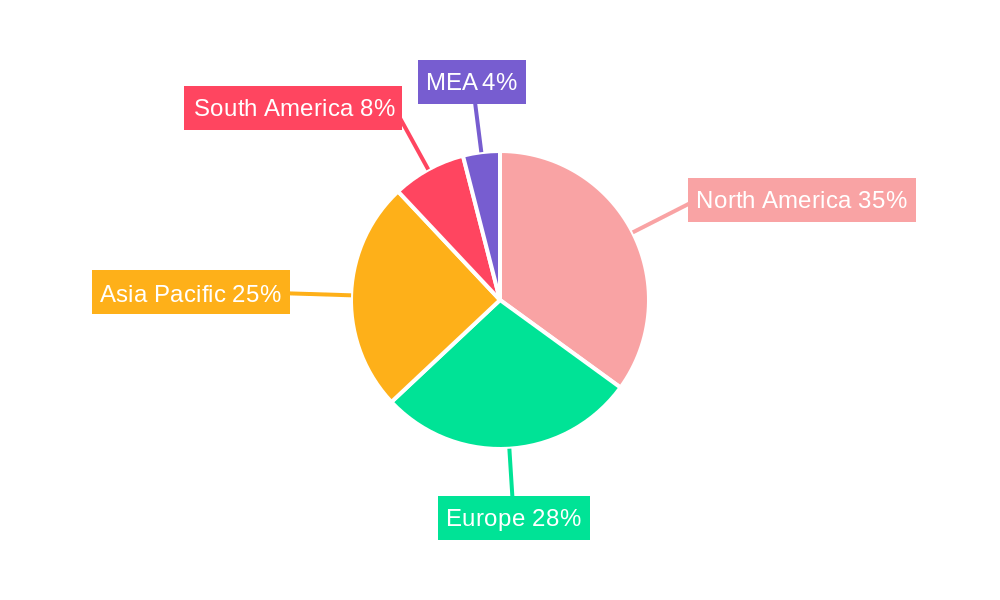

Dominant Markets & Segments in Rubber Testing Equipment Market

The North American region holds a dominant position in the global Rubber Testing Equipment market, driven by factors such as a strong automotive industry, a well-established rubber manufacturing base, and stringent quality control standards. Within the segments, Hardness Testing holds the largest market share, followed by Density and Viscosity Testing. The Tire industry represents the largest end-user segment, owing to the high volume of rubber utilized in tire production and the critical need for quality assurance.

Key Drivers in North America: Strong automotive sector, robust rubber manufacturing base, stringent quality standards.

Hardness Testing Dominance: Driven by the widespread need for accurate hardness measurement in various rubber applications.

Tire Industry Leadership: High rubber consumption and critical quality control needs in tire manufacturing.

Key Drivers in Asia-Pacific: Rapid industrialization, growing automotive sector, increasing government investments in infrastructure.

General Rubber Goods Segment Growth: Driven by rising demand for various rubber products in diverse sectors.

Rubber Testing Equipment Market Product Innovations

Recent and ongoing product innovations in the Rubber Testing Equipment market are strategically focused on elevating key performance indicators such as testing accuracy, levels of automation, and user-friendliness. Manufacturers are at the forefront of developing and deploying advanced software suites designed for sophisticated data analysis, comprehensive reporting, and predictive modeling. The trend towards integrating diverse testing functionalities onto unified platforms is gaining momentum, simplifying complex testing protocols and reducing the need for multiple standalone instruments. Furthermore, the incorporation of cutting-edge sensor technologies is revolutionizing precision, enabling the detection of even the subtlest material variations and ensuring higher fidelity in test results.

These innovations are meticulously engineered to address the escalating global requirement for testing solutions that are not only efficient and reliable but also cost-effective, thereby supporting robust quality control frameworks. The market is also witnessing a notable emergence of highly portable and miniaturized testing devices. These compact solutions are particularly valuable for on-site testing applications, facilitating immediate quality assessment and troubleshooting in diverse and often challenging environments, from manufacturing floors to field installations.

Report Segmentation & Scope

This report segments the Rubber Testing Equipment market by Type of Testing: Density Testing, Viscosity Testing, Hardness Testing, Flex Testing, and Other Types of Testing. Each segment offers unique growth prospects, with Hardness Testing expected to maintain its leading position due to its widespread application. The market is also segmented by End-user Application: Tire, General Rubber Goods, Industrial Rubber Products, General Polymer, and Compound. The Tire industry is expected to remain the largest segment due to its high volume of rubber consumption and stringent quality control requirements. The report provides detailed market size estimations, growth projections, and competitive landscape analysis for each segment.

Key Drivers of Rubber Testing Equipment Market Growth

The robust growth trajectory of the Rubber Testing Equipment market is propelled by a confluence of powerful drivers. Paramount among these is the escalating global demand for high-performance, specialized rubber products that meet increasingly stringent performance and safety benchmarks. This demand is further intensified by the implementation of rigorous quality control regulations and international standards across various industries, compelling manufacturers to invest in advanced testing capabilities.

Technological advancements in testing equipment itself, including enhanced automation, real-time data acquisition, and sophisticated analytical tools, are making testing more efficient, accurate, and insightful. The progressive adoption of automated testing processes across industrial sectors is streamlining operations, reducing human error, and accelerating product development cycles.

Key end-user industries such as automotive (for tires, seals, hoses), aerospace (for critical components), and healthcare (for medical devices and implants) are significant contributors to this market's expansion. These sectors have a critical reliance on advanced testing solutions to guarantee the utmost reliability, durability, and safety of their rubber components, often operating under extreme conditions.

Challenges in the Rubber Testing Equipment Market Sector

The Rubber Testing Equipment market faces challenges such as the high initial investment cost of advanced testing equipment, the need for skilled operators, and the potential for obsolescence due to rapid technological advancements. Supply chain disruptions and increasing competition from low-cost manufacturers also pose significant challenges. These factors can lead to price pressure and impact profitability in the market.

Leading Players in the Rubber Testing Equipment Market

- Prescott Instruments Ltd

- Montech Rubber Testing Instruments

- Gibitre Instruments Sr

- Goettfert Inc

- TA Instruments Inc

- Alpha Technologies

- U-Can Dynatex Inc

- Norka Instruments Shanghai Ltd

- Ektron Tek Co Ltd

- Gotech Testing Machines

Key Developments in Rubber Testing Equipment Market Sector

- June 2023: Goettfert Inc. launched a new automated hardness tester with improved accuracy and data analysis capabilities.

- October 2022: TA Instruments Inc. acquired a smaller competitor, expanding its product portfolio and market reach.

- March 2021: Prescott Instruments Ltd. introduced a new line of portable density testing equipment for on-site quality control.

Strategic Rubber Testing Equipment Market Outlook

The future of the Rubber Testing Equipment market looks promising, driven by continued technological advancements, increasing demand for high-performance rubber products, and the growing adoption of automation and data analytics. Strategic opportunities exist for companies to invest in R&D, expand their product portfolios, and explore new geographic markets. Focusing on developing innovative solutions that address the evolving needs of end-users will be crucial for success in this dynamic market.

Rubber Testing Equipment Market Segmentation

-

1. Type of Testing

- 1.1. Density Testing

- 1.2. Viscocity Testing

- 1.3. Hardness Testing

- 1.4. Flex Testing

- 1.5. Other Types of Testing

-

2. End-user Application

- 2.1. Tire

- 2.2. General Rubber Goods

- 2.3. Industrial Rubber Products

- 2.4. General Polymer

- 2.5. Compound

Rubber Testing Equipment Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Rubber Testing Equipment Market Regional Market Share

Geographic Coverage of Rubber Testing Equipment Market

Rubber Testing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Durable Goods; Technological Advancements in Rubber Testing

- 3.3. Market Restrains

- 3.3.1. High Cost of Ownership

- 3.4. Market Trends

- 3.4.1. The Rising Demand for Tires to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Testing

- 5.1.1. Density Testing

- 5.1.2. Viscocity Testing

- 5.1.3. Hardness Testing

- 5.1.4. Flex Testing

- 5.1.5. Other Types of Testing

- 5.2. Market Analysis, Insights and Forecast - by End-user Application

- 5.2.1. Tire

- 5.2.2. General Rubber Goods

- 5.2.3. Industrial Rubber Products

- 5.2.4. General Polymer

- 5.2.5. Compound

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Testing

- 6. North America Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Testing

- 6.1.1. Density Testing

- 6.1.2. Viscocity Testing

- 6.1.3. Hardness Testing

- 6.1.4. Flex Testing

- 6.1.5. Other Types of Testing

- 6.2. Market Analysis, Insights and Forecast - by End-user Application

- 6.2.1. Tire

- 6.2.2. General Rubber Goods

- 6.2.3. Industrial Rubber Products

- 6.2.4. General Polymer

- 6.2.5. Compound

- 6.1. Market Analysis, Insights and Forecast - by Type of Testing

- 7. Europe Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Testing

- 7.1.1. Density Testing

- 7.1.2. Viscocity Testing

- 7.1.3. Hardness Testing

- 7.1.4. Flex Testing

- 7.1.5. Other Types of Testing

- 7.2. Market Analysis, Insights and Forecast - by End-user Application

- 7.2.1. Tire

- 7.2.2. General Rubber Goods

- 7.2.3. Industrial Rubber Products

- 7.2.4. General Polymer

- 7.2.5. Compound

- 7.1. Market Analysis, Insights and Forecast - by Type of Testing

- 8. Asia Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Testing

- 8.1.1. Density Testing

- 8.1.2. Viscocity Testing

- 8.1.3. Hardness Testing

- 8.1.4. Flex Testing

- 8.1.5. Other Types of Testing

- 8.2. Market Analysis, Insights and Forecast - by End-user Application

- 8.2.1. Tire

- 8.2.2. General Rubber Goods

- 8.2.3. Industrial Rubber Products

- 8.2.4. General Polymer

- 8.2.5. Compound

- 8.1. Market Analysis, Insights and Forecast - by Type of Testing

- 9. Australia and New Zealand Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Testing

- 9.1.1. Density Testing

- 9.1.2. Viscocity Testing

- 9.1.3. Hardness Testing

- 9.1.4. Flex Testing

- 9.1.5. Other Types of Testing

- 9.2. Market Analysis, Insights and Forecast - by End-user Application

- 9.2.1. Tire

- 9.2.2. General Rubber Goods

- 9.2.3. Industrial Rubber Products

- 9.2.4. General Polymer

- 9.2.5. Compound

- 9.1. Market Analysis, Insights and Forecast - by Type of Testing

- 10. Latin America Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Testing

- 10.1.1. Density Testing

- 10.1.2. Viscocity Testing

- 10.1.3. Hardness Testing

- 10.1.4. Flex Testing

- 10.1.5. Other Types of Testing

- 10.2. Market Analysis, Insights and Forecast - by End-user Application

- 10.2.1. Tire

- 10.2.2. General Rubber Goods

- 10.2.3. Industrial Rubber Products

- 10.2.4. General Polymer

- 10.2.5. Compound

- 10.1. Market Analysis, Insights and Forecast - by Type of Testing

- 11. Middle East and Africa Rubber Testing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type of Testing

- 11.1.1. Density Testing

- 11.1.2. Viscocity Testing

- 11.1.3. Hardness Testing

- 11.1.4. Flex Testing

- 11.1.5. Other Types of Testing

- 11.2. Market Analysis, Insights and Forecast - by End-user Application

- 11.2.1. Tire

- 11.2.2. General Rubber Goods

- 11.2.3. Industrial Rubber Products

- 11.2.4. General Polymer

- 11.2.5. Compound

- 11.1. Market Analysis, Insights and Forecast - by Type of Testing

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Prescott Instruments Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Montech Rubber Testing Instruments

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Gibitre Instruments Sr

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Goettfert Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 TA Instruments Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Alpha Technologies

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 U-Can Dynatex Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Norka Instruments Sanghai Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Ektron Tek Co Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Gotech Testing Machines

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Prescott Instruments Ltd

List of Figures

- Figure 1: Global Rubber Testing Equipment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Rubber Testing Equipment Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Rubber Testing Equipment Market Revenue (Million), by Type of Testing 2025 & 2033

- Figure 4: North America Rubber Testing Equipment Market Volume (K Unit), by Type of Testing 2025 & 2033

- Figure 5: North America Rubber Testing Equipment Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 6: North America Rubber Testing Equipment Market Volume Share (%), by Type of Testing 2025 & 2033

- Figure 7: North America Rubber Testing Equipment Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 8: North America Rubber Testing Equipment Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 9: North America Rubber Testing Equipment Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 10: North America Rubber Testing Equipment Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 11: North America Rubber Testing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Rubber Testing Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Rubber Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Rubber Testing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Rubber Testing Equipment Market Revenue (Million), by Type of Testing 2025 & 2033

- Figure 16: Europe Rubber Testing Equipment Market Volume (K Unit), by Type of Testing 2025 & 2033

- Figure 17: Europe Rubber Testing Equipment Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 18: Europe Rubber Testing Equipment Market Volume Share (%), by Type of Testing 2025 & 2033

- Figure 19: Europe Rubber Testing Equipment Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 20: Europe Rubber Testing Equipment Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 21: Europe Rubber Testing Equipment Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 22: Europe Rubber Testing Equipment Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 23: Europe Rubber Testing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Rubber Testing Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Rubber Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Rubber Testing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Rubber Testing Equipment Market Revenue (Million), by Type of Testing 2025 & 2033

- Figure 28: Asia Rubber Testing Equipment Market Volume (K Unit), by Type of Testing 2025 & 2033

- Figure 29: Asia Rubber Testing Equipment Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 30: Asia Rubber Testing Equipment Market Volume Share (%), by Type of Testing 2025 & 2033

- Figure 31: Asia Rubber Testing Equipment Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 32: Asia Rubber Testing Equipment Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 33: Asia Rubber Testing Equipment Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 34: Asia Rubber Testing Equipment Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 35: Asia Rubber Testing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Rubber Testing Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Rubber Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Rubber Testing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Rubber Testing Equipment Market Revenue (Million), by Type of Testing 2025 & 2033

- Figure 40: Australia and New Zealand Rubber Testing Equipment Market Volume (K Unit), by Type of Testing 2025 & 2033

- Figure 41: Australia and New Zealand Rubber Testing Equipment Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 42: Australia and New Zealand Rubber Testing Equipment Market Volume Share (%), by Type of Testing 2025 & 2033

- Figure 43: Australia and New Zealand Rubber Testing Equipment Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 44: Australia and New Zealand Rubber Testing Equipment Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 45: Australia and New Zealand Rubber Testing Equipment Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 46: Australia and New Zealand Rubber Testing Equipment Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 47: Australia and New Zealand Rubber Testing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Rubber Testing Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Rubber Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Rubber Testing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Rubber Testing Equipment Market Revenue (Million), by Type of Testing 2025 & 2033

- Figure 52: Latin America Rubber Testing Equipment Market Volume (K Unit), by Type of Testing 2025 & 2033

- Figure 53: Latin America Rubber Testing Equipment Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 54: Latin America Rubber Testing Equipment Market Volume Share (%), by Type of Testing 2025 & 2033

- Figure 55: Latin America Rubber Testing Equipment Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 56: Latin America Rubber Testing Equipment Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 57: Latin America Rubber Testing Equipment Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 58: Latin America Rubber Testing Equipment Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 59: Latin America Rubber Testing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Rubber Testing Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: Latin America Rubber Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Rubber Testing Equipment Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Rubber Testing Equipment Market Revenue (Million), by Type of Testing 2025 & 2033

- Figure 64: Middle East and Africa Rubber Testing Equipment Market Volume (K Unit), by Type of Testing 2025 & 2033

- Figure 65: Middle East and Africa Rubber Testing Equipment Market Revenue Share (%), by Type of Testing 2025 & 2033

- Figure 66: Middle East and Africa Rubber Testing Equipment Market Volume Share (%), by Type of Testing 2025 & 2033

- Figure 67: Middle East and Africa Rubber Testing Equipment Market Revenue (Million), by End-user Application 2025 & 2033

- Figure 68: Middle East and Africa Rubber Testing Equipment Market Volume (K Unit), by End-user Application 2025 & 2033

- Figure 69: Middle East and Africa Rubber Testing Equipment Market Revenue Share (%), by End-user Application 2025 & 2033

- Figure 70: Middle East and Africa Rubber Testing Equipment Market Volume Share (%), by End-user Application 2025 & 2033

- Figure 71: Middle East and Africa Rubber Testing Equipment Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Middle East and Africa Rubber Testing Equipment Market Volume (K Unit), by Country 2025 & 2033

- Figure 73: Middle East and Africa Rubber Testing Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Rubber Testing Equipment Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 2: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 3: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 4: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 5: Global Rubber Testing Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 8: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 9: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 10: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 11: Global Rubber Testing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 14: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 15: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 16: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 17: Global Rubber Testing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 20: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 21: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 22: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 23: Global Rubber Testing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 26: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 27: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 28: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 29: Global Rubber Testing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 32: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 33: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 34: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 35: Global Rubber Testing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Global Rubber Testing Equipment Market Revenue Million Forecast, by Type of Testing 2020 & 2033

- Table 38: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Type of Testing 2020 & 2033

- Table 39: Global Rubber Testing Equipment Market Revenue Million Forecast, by End-user Application 2020 & 2033

- Table 40: Global Rubber Testing Equipment Market Volume K Unit Forecast, by End-user Application 2020 & 2033

- Table 41: Global Rubber Testing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Rubber Testing Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rubber Testing Equipment Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the Rubber Testing Equipment Market?

Key companies in the market include Prescott Instruments Ltd, Montech Rubber Testing Instruments, Gibitre Instruments Sr, Goettfert Inc, TA Instruments Inc, Alpha Technologies, U-Can Dynatex Inc, Norka Instruments Sanghai Ltd, Ektron Tek Co Ltd, Gotech Testing Machines.

3. What are the main segments of the Rubber Testing Equipment Market?

The market segments include Type of Testing, End-user Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Durable Goods; Technological Advancements in Rubber Testing.

6. What are the notable trends driving market growth?

The Rising Demand for Tires to Drive the Market.

7. Are there any restraints impacting market growth?

High Cost of Ownership.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rubber Testing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rubber Testing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rubber Testing Equipment Market?

To stay informed about further developments, trends, and reports in the Rubber Testing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence