Key Insights

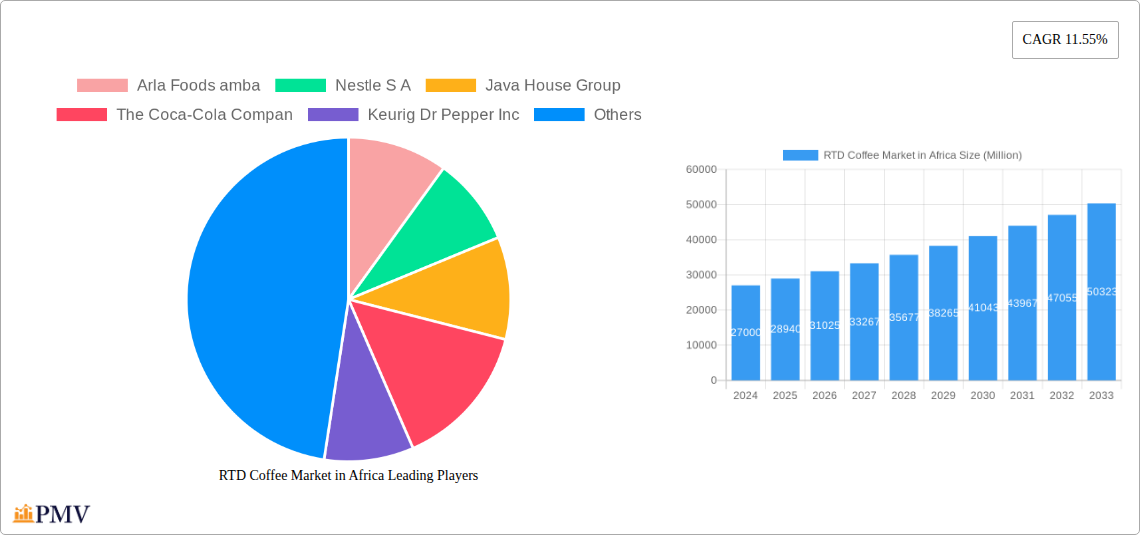

The Ready-to-Drink (RTD) coffee market in Africa is poised for significant expansion, driven by a confluence of evolving consumer preferences, increasing disposable incomes, and a growing demand for convenient and on-the-go beverage options. With a current market size estimated at $26.2 billion in 2024, the sector is projected to witness a robust Compound Annual Growth Rate (CAGR) of 7.2% from 2025 to 2033. This growth is underpinned by several key drivers. The burgeoning youth population across the continent, coupled with a more urbanized lifestyle, is fueling the adoption of RTD coffee as a regular beverage choice. Furthermore, a rising awareness and appreciation for diverse coffee flavors and brewing methods, including cold brew and iced coffee varieties, are contributing to market penetration. The expansion of modern retail formats, such as supermarkets, hypermarkets, and online retail platforms, alongside the presence of on-trade channels like cafes and restaurants, are enhancing accessibility for consumers. Packaging innovations, particularly the widespread use of PET bottles and aseptic packages, are also playing a crucial role by offering convenience and extended shelf life, further stimulating market demand across various African nations.

RTD Coffee Market in Africa Market Size (In Billion)

Despite the promising outlook, the RTD coffee market in Africa faces certain restraints that could temper its rapid ascent. The primary challenges include the relatively high cost of premium RTD coffee products, which can be a barrier for a significant segment of the price-sensitive African consumer base. Fluctuations in the global coffee bean prices, a key raw material, can also impact production costs and ultimately retail pricing. Additionally, a lack of widespread cold chain infrastructure in some regions may hinder the efficient distribution and availability of chilled RTD coffee products. Nonetheless, the overall market trajectory remains overwhelmingly positive. Key segments poised for substantial growth include cold brew coffee and iced coffee, catering to the demand for refreshing and flavor-forward options. The adoption of convenient packaging like PET bottles and metal cans is expected to dominate, while off-trade channels, particularly online retail and supermarkets, will be the primary avenues for sales, supported by the increasing digitalization and e-commerce penetration across the continent.

RTD Coffee Market in Africa Company Market Share

Unlocking Growth: Comprehensive RTD Coffee Market Analysis in Africa (2019-2033)

This in-depth report offers a panoramic view of the Ready-to-Drink (RTD) Coffee Market in Africa, meticulously analyzing its evolution from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this research provides critical insights into market dynamics, African RTD coffee trends, cold brew coffee Africa, and iced coffee market Africa. Discover the growth trajectory, key players, and untapped opportunities within this burgeoning beverage sector. This report delves into RTD coffee packaging Africa, RTD coffee distribution Africa, and emerging African beverage market opportunities, making it an indispensable resource for manufacturers, investors, and stakeholders.

RTD Coffee Market in Africa Market Structure & Competitive Dynamics

The African RTD coffee market exhibits a dynamic and evolving structure, characterized by increasing competition and a growing emphasis on innovation. Market concentration is gradually shifting as established global players like Nestle S.A. and The Coca-Cola Company expand their footprint alongside ambitious regional champions such as Java House Group. The innovation ecosystem is thriving, fueled by a demand for convenient, high-quality coffee experiences. Regulatory frameworks across African nations present varying degrees of complexity, influencing market entry and expansion strategies for companies like Arla Foods amba and Keurig Dr Pepper Inc. Product substitutes, including traditional coffee, tea, and energy drinks, pose a constant challenge, necessitating robust product differentiation and marketing efforts. End-user trends indicate a rising preference for premium and health-conscious RTD coffee options, with a significant surge in demand for cold brew coffee and iced coffee. Mergers and acquisitions (M&A) activities, while still nascent, are expected to gain momentum as companies seek to consolidate market share and acquire new technologies. For instance, strategic partnerships, like the one involving Java House, KEVIAN, and Bio Food Products Ltd., highlight a growing trend of collaboration to leverage manufacturing and distribution capabilities. Understanding these intricate dynamics is crucial for navigating the African ready-to-drink coffee sector.

- Market Concentration: Fragmented with increasing consolidation opportunities.

- Innovation Ecosystem: Flourishing, driven by consumer demand for convenience and unique flavors.

- Regulatory Frameworks: Diverse across the continent, requiring tailored market entry strategies.

- Product Substitutes: Traditional coffee, tea, energy drinks, and other beverages.

- End-User Trends: Growing preference for premium, convenient, and healthier RTD coffee.

- M&A Activities: Anticipated to increase as companies seek market expansion and synergistic growth.

RTD Coffee Market in Africa Industry Trends & Insights

The RTD Coffee Market in Africa is poised for remarkable expansion, driven by a confluence of socio-economic and technological advancements. The rising disposable incomes and the increasing urbanization across the continent are fueling a greater demand for convenient beverage solutions that cater to the fast-paced lifestyles of consumers. This trend is a significant growth driver for RTD coffee Africa, as it offers a readily available and portable coffee experience. Technological disruptions, particularly in packaging and brewing technologies, are enhancing product quality, shelf-life, and consumer appeal. The development of advanced cold brew coffee techniques, which minimize bitterness and acidity, is significantly boosting the popularity of this segment. Furthermore, the growing digital penetration and e-commerce adoption in Africa are revolutionizing distribution channels, making online retail for RTD coffee increasingly accessible and popular. Consumer preferences are evolving rapidly, with a discernible shift towards healthier options, including reduced sugar formulations and the incorporation of functional ingredients. This presents a fertile ground for iced coffee and specialized RTD coffee variants. Competitive dynamics are intensifying, with both global giants and agile local players vying for market dominance. Companies are investing heavily in marketing and product development to capture market share. The African beverage market is witnessing a paradigm shift, with RTD coffee emerging as a key growth category. The estimated CAGR for the RTD coffee market in Africa is expected to be robust, indicating significant investment opportunities. Market penetration is still relatively low in many regions, signifying substantial untapped potential for future growth. The increasing adoption of aseptic packages and PET bottles contributes to the market's growth by offering cost-effective and convenient packaging solutions. The demand for ethical sourcing and sustainable practices is also gaining traction, influencing product development and brand perception. The expansion of the convenience stores segment as a key distribution channel further amplifies the market's accessibility.

Dominant Markets & Segments in RTD Coffee Market in Africa

The RTD Coffee Market in Africa showcases distinct regional and segment dominance, offering clear pathways for strategic market penetration. South Africa currently leads the market due to its established retail infrastructure, higher disposable incomes, and a mature coffee culture. However, countries like Nigeria, Egypt, and Kenya are rapidly emerging as high-growth markets, driven by burgeoning youth populations and increasing urbanization. The soft drink type segment is witnessing significant traction in Cold Brew Coffee, appealing to a younger demographic seeking less acidic and smoother coffee profiles. Iced coffee remains a strong contender, particularly in warmer climates, capitalizing on its refreshing qualities.

- Leading Region: South Africa, with strong growth potential in Nigeria, Egypt, and Kenya.

- Dominant Soft Drink Type:

- Cold Brew Coffee: Growing rapidly due to its smooth taste and health perceptions.

- Iced Coffee: Consistent demand, especially in warmer regions.

- Dominant Packaging Type:

- PET Bottles: Leading due to their affordability, recyclability, and lightweight nature, crucial for distribution in diverse African landscapes.

- Metal Cans: Gaining popularity for their perceived premium quality and good shelf-life.

- Dominant Distribution Channel:

- Off-trade:

- Supermarket/Hypermarket: The primary channel due to widespread consumer access and product variety.

- Convenience Stores: Experiencing substantial growth as RTD coffee becomes a staple on-the-go beverage.

- Online Retail: Rapidly expanding, offering convenience and wider product selection.

- Off-trade:

- Key Drivers of Segment Dominance:

- Economic Policies: Supportive trade agreements and investment incentives in key countries.

- Infrastructure Development: Improved logistics and cold chain capabilities in leading markets.

- Consumer Affordability: The cost-effectiveness of PET bottles and access through supermarkets.

- Lifestyle Trends: The rise of on-the-go consumption habits favoring convenience.

- Technological Advancements: Innovations in brewing and packaging that cater to specific segment demands.

RTD Coffee Market in Africa Product Innovations

Product innovation is a critical differentiator in the African RTD coffee market. Companies are actively developing novel formulations and flavor profiles to cater to diverse consumer preferences. The emergence of cold brew coffee with infused natural flavors and functional ingredients, such as adaptogens and added vitamins, is a significant trend. Java House’s recent launch of cold brew using 100% Kenyan Arabica beans exemplifies this focus on premium quality and local sourcing. Innovations in iced coffee are also addressing demand for sugar-free or low-calorie options. Advancements in aseptic packaging ensure extended shelf-life and maintain product freshness, crucial for navigating the continent’s logistical challenges. These innovations not only enhance product appeal but also offer a competitive advantage by meeting evolving consumer demands for taste, health, and convenience.

Report Segmentation & Scope

This comprehensive report segments the RTD Coffee Market in Africa across key parameters, providing detailed analysis and growth projections. The market is categorized by Soft Drink Type, including Cold Brew Coffee, Iced coffee, and Other RTD Coffee. Analysis extends to Packaging Type, encompassing Aseptic packages, Glass Bottles, Metal Can, and PET Bottles, each offering distinct market advantages. Distribution channels are meticulously examined, differentiating between Off-trade (including Convenience Stores, Online Retail, Specialty Stores, Supermarket/Hypermarket, and Others) and On-trade segments. Each segment is analyzed for its current market size, projected growth rates, and competitive dynamics, offering a granular understanding of the market landscape.

Key Drivers of RTD Coffee Market in Africa Growth

The RTD Coffee Market in Africa is propelled by several significant growth drivers. Technologically, advancements in brewing methods, such as cold brewing, are enhancing product quality and appeal. Economically, rising disposable incomes and a growing middle class in many African nations are increasing consumer purchasing power for premium beverages. Regulatory factors, including efforts to streamline trade and reduce import duties on beverage ingredients in certain countries, can also foster market expansion. The increasing adoption of e-commerce and digital platforms is also a crucial driver, expanding reach and accessibility for RTD coffee products.

Challenges in the RTD Coffee Market in Africa Sector

Despite its promising growth, the RTD Coffee Market in Africa faces several challenges. Regulatory hurdles and inconsistencies across different African countries can complicate market entry and expansion strategies. Supply chain inefficiencies, including underdeveloped logistics and a lack of adequate cold chain infrastructure in some regions, can impact product availability and shelf-life. Intense competition from established global brands and local producers, coupled with price sensitivity among a segment of consumers, also presents a significant challenge. Furthermore, fluctuating raw material costs and currency volatility can affect profitability and pricing strategies for market players.

Leading Players in the RTD Coffee Market in Africa Market

- Arla Foods amba

- Nestle S A

- Java House Group

- The Coca-Cola Company

- Keurig Dr Pepper Inc

- King Car Group

Key Developments in RTD Coffee Market in Africa Sector

- December 2023: Costa Coffee’s Moroccan franchisee Goldex Morocco has planned to launch five new outlets in Morocco by the end of Q3 2023 at a cost of USD m. Two will be in Casablanca, two in Rabat and the final outlet will be opened in Bouskoura.

- August 2023: Java House has launched its latest innovation, cold brew coffee, a ready-to-drink made from 100% Kenyan Arabica coffee beans. The innovation was a collaboration between Java House; KEVIAN, manufacturer of Afia and Pick n Peel fruit juices, and dairy processor Bio Food Products Ltd.

- January 2023: Goldex Morocco, part of UK-based Goldex Investments Group, opened a second Costa Coffee store in Casablanca in May 2023. Goldex Investments Group further plans to open six or seven more outlets in 2024, probably in Casablanca, Rabat, Tangier, and Agadir. It aims to have opened 30 to 40 cafes within the next five years.

Strategic RTD Coffee Market in Africa Market Outlook

The strategic outlook for the RTD Coffee Market in Africa is exceptionally positive, marked by substantial growth accelerators. The increasing demand for convenience, coupled with a burgeoning youth demographic keen on exploring new beverage experiences, presents a significant opportunity. Innovations in product formulation, particularly in healthier options like sugar-free and functional RTD coffees, will be key growth drivers. Furthermore, the expansion of online retail and evolving distribution channels are unlocking new consumer segments. Strategic partnerships and localized marketing efforts will be crucial for companies to capitalize on the untapped potential and establish a strong market presence, positioning RTD coffee as a leading beverage category across the continent.

RTD Coffee Market in Africa Segmentation

-

1. Soft Drink Type

- 1.1. Cold Brew Coffee

- 1.2. Iced coffee

- 1.3. Other RTD Coffee

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Glass Bottles

- 2.3. Metal Can

- 2.4. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Specialty Stores

- 3.1.4. Supermarket/Hypermarket

- 3.1.5. Others

- 3.2. On-trade

-

3.1. Off-trade

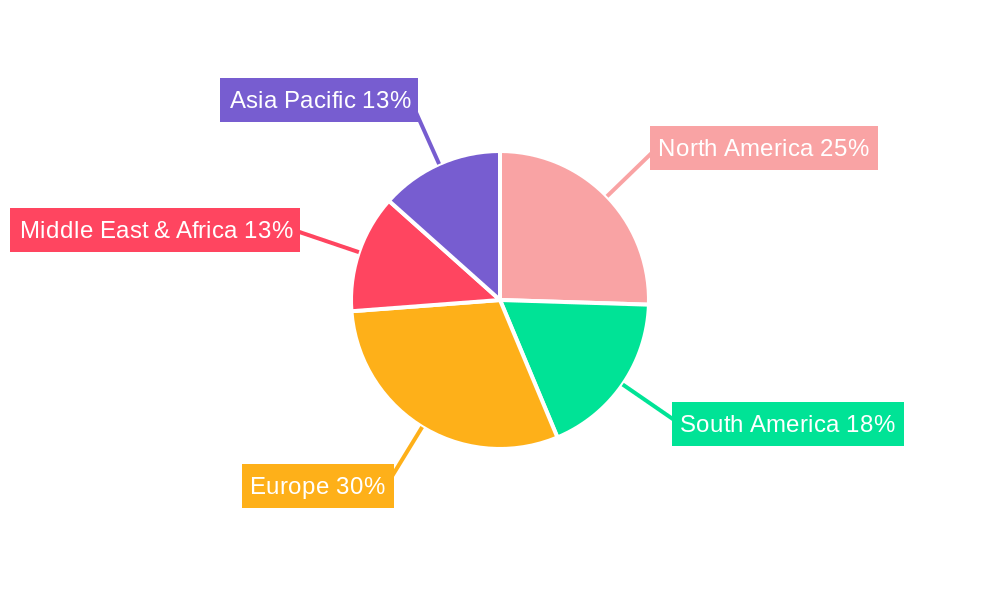

RTD Coffee Market in Africa Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

RTD Coffee Market in Africa Regional Market Share

Geographic Coverage of RTD Coffee Market in Africa

RTD Coffee Market in Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global RTD Coffee Market in Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Cold Brew Coffee

- 5.1.2. Iced coffee

- 5.1.3. Other RTD Coffee

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Glass Bottles

- 5.2.3. Metal Can

- 5.2.4. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Specialty Stores

- 5.3.1.4. Supermarket/Hypermarket

- 5.3.1.5. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. North America RTD Coffee Market in Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6.1.1. Cold Brew Coffee

- 6.1.2. Iced coffee

- 6.1.3. Other RTD Coffee

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Aseptic packages

- 6.2.2. Glass Bottles

- 6.2.3. Metal Can

- 6.2.4. PET Bottles

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Off-trade

- 6.3.1.1. Convenience Stores

- 6.3.1.2. Online Retail

- 6.3.1.3. Specialty Stores

- 6.3.1.4. Supermarket/Hypermarket

- 6.3.1.5. Others

- 6.3.2. On-trade

- 6.3.1. Off-trade

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7. South America RTD Coffee Market in Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7.1.1. Cold Brew Coffee

- 7.1.2. Iced coffee

- 7.1.3. Other RTD Coffee

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Aseptic packages

- 7.2.2. Glass Bottles

- 7.2.3. Metal Can

- 7.2.4. PET Bottles

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Off-trade

- 7.3.1.1. Convenience Stores

- 7.3.1.2. Online Retail

- 7.3.1.3. Specialty Stores

- 7.3.1.4. Supermarket/Hypermarket

- 7.3.1.5. Others

- 7.3.2. On-trade

- 7.3.1. Off-trade

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8. Europe RTD Coffee Market in Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8.1.1. Cold Brew Coffee

- 8.1.2. Iced coffee

- 8.1.3. Other RTD Coffee

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Aseptic packages

- 8.2.2. Glass Bottles

- 8.2.3. Metal Can

- 8.2.4. PET Bottles

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Off-trade

- 8.3.1.1. Convenience Stores

- 8.3.1.2. Online Retail

- 8.3.1.3. Specialty Stores

- 8.3.1.4. Supermarket/Hypermarket

- 8.3.1.5. Others

- 8.3.2. On-trade

- 8.3.1. Off-trade

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9. Middle East & Africa RTD Coffee Market in Africa Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9.1.1. Cold Brew Coffee

- 9.1.2. Iced coffee

- 9.1.3. Other RTD Coffee

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Aseptic packages

- 9.2.2. Glass Bottles

- 9.2.3. Metal Can

- 9.2.4. PET Bottles

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Off-trade

- 9.3.1.1. Convenience Stores

- 9.3.1.2. Online Retail

- 9.3.1.3. Specialty Stores

- 9.3.1.4. Supermarket/Hypermarket

- 9.3.1.5. Others

- 9.3.2. On-trade

- 9.3.1. Off-trade

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10. Asia Pacific RTD Coffee Market in Africa Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10.1.1. Cold Brew Coffee

- 10.1.2. Iced coffee

- 10.1.3. Other RTD Coffee

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Aseptic packages

- 10.2.2. Glass Bottles

- 10.2.3. Metal Can

- 10.2.4. PET Bottles

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Off-trade

- 10.3.1.1. Convenience Stores

- 10.3.1.2. Online Retail

- 10.3.1.3. Specialty Stores

- 10.3.1.4. Supermarket/Hypermarket

- 10.3.1.5. Others

- 10.3.2. On-trade

- 10.3.1. Off-trade

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Arla Foods amba

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nestle S A

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Java House Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Coca-Cola Compan

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Keurig Dr Pepper Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 King Car Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Arla Foods amba

List of Figures

- Figure 1: Global RTD Coffee Market in Africa Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America RTD Coffee Market in Africa Revenue (undefined), by Soft Drink Type 2025 & 2033

- Figure 3: North America RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 4: North America RTD Coffee Market in Africa Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 5: North America RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 6: North America RTD Coffee Market in Africa Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 7: North America RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America RTD Coffee Market in Africa Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America RTD Coffee Market in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America RTD Coffee Market in Africa Revenue (undefined), by Soft Drink Type 2025 & 2033

- Figure 11: South America RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 12: South America RTD Coffee Market in Africa Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 13: South America RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 14: South America RTD Coffee Market in Africa Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 15: South America RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America RTD Coffee Market in Africa Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America RTD Coffee Market in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe RTD Coffee Market in Africa Revenue (undefined), by Soft Drink Type 2025 & 2033

- Figure 19: Europe RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 20: Europe RTD Coffee Market in Africa Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 21: Europe RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 22: Europe RTD Coffee Market in Africa Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 23: Europe RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe RTD Coffee Market in Africa Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe RTD Coffee Market in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa RTD Coffee Market in Africa Revenue (undefined), by Soft Drink Type 2025 & 2033

- Figure 27: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 28: Middle East & Africa RTD Coffee Market in Africa Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 29: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 30: Middle East & Africa RTD Coffee Market in Africa Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa RTD Coffee Market in Africa Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa RTD Coffee Market in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific RTD Coffee Market in Africa Revenue (undefined), by Soft Drink Type 2025 & 2033

- Figure 35: Asia Pacific RTD Coffee Market in Africa Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 36: Asia Pacific RTD Coffee Market in Africa Revenue (undefined), by Packaging Type 2025 & 2033

- Figure 37: Asia Pacific RTD Coffee Market in Africa Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 38: Asia Pacific RTD Coffee Market in Africa Revenue (undefined), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific RTD Coffee Market in Africa Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific RTD Coffee Market in Africa Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific RTD Coffee Market in Africa Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Soft Drink Type 2020 & 2033

- Table 2: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 3: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Soft Drink Type 2020 & 2033

- Table 6: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 7: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Soft Drink Type 2020 & 2033

- Table 13: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 14: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Soft Drink Type 2020 & 2033

- Table 20: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 21: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Soft Drink Type 2020 & 2033

- Table 33: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 34: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Soft Drink Type 2020 & 2033

- Table 43: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Packaging Type 2020 & 2033

- Table 44: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global RTD Coffee Market in Africa Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific RTD Coffee Market in Africa Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the RTD Coffee Market in Africa?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the RTD Coffee Market in Africa?

Key companies in the market include Arla Foods amba, Nestle S A, Java House Group, The Coca-Cola Compan, Keurig Dr Pepper Inc, King Car Group.

3. What are the main segments of the RTD Coffee Market in Africa?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

December 2023: Costa Coffee’s Moroccan franchisee Goldex Morocco has planned to launch five new outlets in Morocco by the end of Q3 2023 at a cost of USD m. Two will be in Casablanca, two in Rabat and the final outlet will be opened in Bouskoura.August 2023: Java House has launched its latest innovation, cold brew coffee, a ready-to-drink made from 100% Kenyan Arabica coffee beans.The innovation was a collaboration between Java House; KEVIAN, manufacturer of Afia and Pick n Peel fruit juices, and dairy processor Bio Food Products Ltd.January 2023: Goldex Morocco, part of UK-based Goldex Investments Group, opened a second Costa Coffee store in Casablanca in May 2023. Goldex Investments Group further plans to open six or seven more outlets in 2024, probably in Casablanca, Rabat, Tangier, and Agadir. It aims to have opened 30 to 40 cafes within the next five years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "RTD Coffee Market in Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the RTD Coffee Market in Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the RTD Coffee Market in Africa?

To stay informed about further developments, trends, and reports in the RTD Coffee Market in Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence