Key Insights

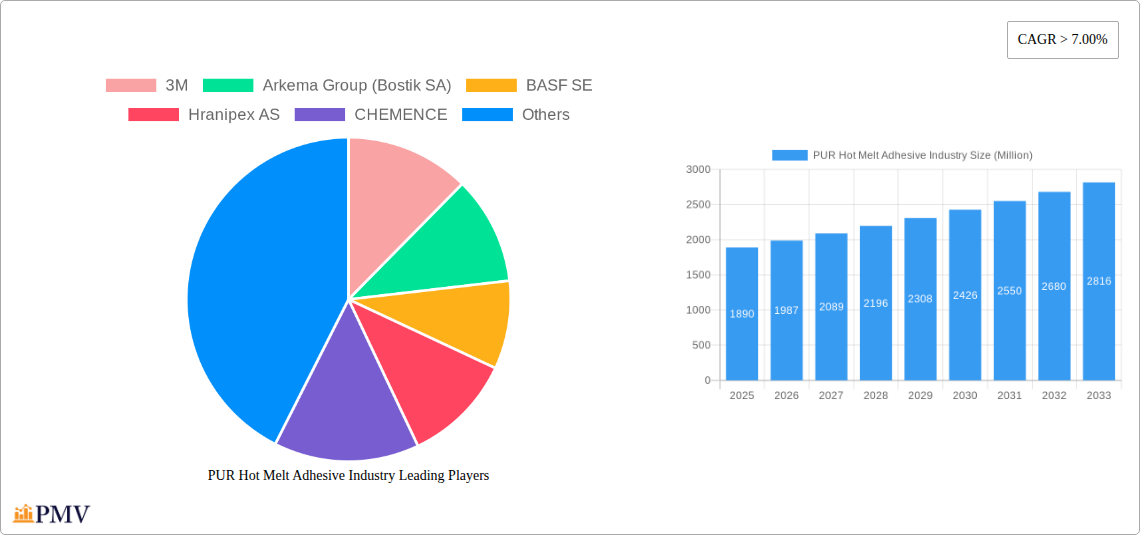

The global PUR Hot Melt Adhesive market is poised for robust expansion, projected to reach an estimated $1.89 billion by 2025. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 5.2% expected throughout the forecast period of 2019-2033. Key drivers fueling this upward trajectory include the escalating demand for sustainable and eco-friendly bonding solutions across various industries, coupled with advancements in adhesive technology that offer superior performance characteristics. The inherent properties of PUR hot melt adhesives, such as their high bond strength, excellent flexibility, and rapid curing times, make them increasingly indispensable in sectors like packaging, automotive, and furniture manufacturing where efficiency and durability are paramount. The growing emphasis on lightweighting in automotive and aerospace, alongside the expansion of e-commerce driving packaging demand, further bolsters market prospects.

PUR Hot Melt Adhesive Industry Market Size (In Billion)

The market's growth is further supported by a diverse application landscape, encompassing paper, board, and packaging, healthcare, automotive, furniture (woodworking), footwear, textiles, and electrical and electronics. While the market benefits from strong demand, certain restraints may influence its pace. These could include fluctuating raw material prices, particularly for isocyanates, and the stringent regulatory landscape surrounding chemical usage in some regions. However, continuous innovation by leading players such as 3M, Arkema Group (Bostik SA), BASF SE, and H B Fuller Company, is likely to mitigate these challenges. The strategic focus on developing advanced formulations with enhanced environmental profiles and performance capabilities will be crucial for capitalizing on emerging opportunities and maintaining competitive advantage in this dynamic market.

PUR Hot Melt Adhesive Industry Company Market Share

This in-depth market research report provides a detailed analysis of the global PUR Hot Melt Adhesive industry, offering critical insights into market dynamics, key trends, dominant segments, product innovations, and future growth prospects. Leveraging a comprehensive study period from 2019 to 2033, with 2025 as the base and estimated year, this report is essential for stakeholders seeking to understand and capitalize on the evolving landscape of PUR hot melt adhesives. The study delves into both Non-reactive and Reactive PUR hot melt adhesive types, examining their applications across diverse sectors including Paper, Board, and Packaging, Healthcare, Automotive, Furniture (Woodworking), Footwear, Textiles, Electrical and Electronics, Bookbinding, and Other Applications. Market projections are meticulously crafted for the forecast period of 2025–2033, building upon historical data from 2019–2024.

PUR Hot Melt Adhesive Industry Market Structure & Competitive Dynamics

The PUR Hot Melt Adhesive market is characterized by a moderately concentrated structure, with major global players holding significant market share. Innovation ecosystems are driven by continuous R&D investments focused on enhanced performance, sustainability, and application-specific solutions. Regulatory frameworks, particularly concerning environmental impact and safety standards, play a crucial role in shaping product development and market entry. Product substitutes, while present in certain applications, face challenges in matching the superior bonding strength, flexibility, and durability offered by PUR hot melt adhesives. End-user trends highlight a growing demand for high-performance adhesives that contribute to lighter, stronger, and more sustainable end products. Mergers and acquisitions (M&A) activities are strategic tools for market expansion and technology acquisition, with estimated M&A deal values reaching several billion dollars annually in recent years. Key companies like Henkel AG & Co KGaA, H B Fuller Company, and Arkema Group (Bostik SA) are prominent in driving these dynamics.

- Market Concentration: Dominated by a few key global players, but with growing regional and specialized manufacturers.

- Innovation Ecosystems: Focus on bio-based formulations, low-VOC (Volatile Organic Compound) adhesives, and smart adhesive technologies.

- Regulatory Frameworks: Stringent regulations on chemical composition, emissions, and end-of-life disposal influencing product development.

- Product Substitutes: Traditional adhesives (e.g., epoxy, silicone) and mechanical fastening methods, but often inferior in performance.

- End-User Trends: Demand for solvent-free, energy-efficient bonding solutions across all application segments.

- M&A Activities: Strategic consolidations aimed at expanding product portfolios, geographical reach, and technological capabilities, with significant billion-dollar deals.

PUR Hot Melt Adhesive Industry Industry Trends & Insights

The PUR Hot Melt Adhesive industry is poised for robust growth, driven by an increasing demand for high-performance bonding solutions across a multitude of applications. The market is experiencing a significant surge, with a projected Compound Annual Growth Rate (CAGR) of approximately 7.5% over the forecast period. This expansion is fueled by several key trends. Firstly, the escalating adoption of PUR hot melt adhesives in the Paper, Board, and Packaging sector, driven by the need for stronger, more sustainable, and faster packaging solutions, is a major growth propeller. The trend towards e-commerce has amplified this demand, requiring durable packaging that can withstand transit. Secondly, the Automotive industry's push for lightweighting and improved fuel efficiency is leading to increased utilization of PUR hot melts for structural bonding and interior assembly, replacing traditional mechanical fasteners. This trend is further supported by stringent automotive safety regulations.

In the Healthcare sector, the demand for sterile, biocompatible, and reliable adhesives in medical device manufacturing and wound care is also on the rise. The ability of PUR hot melts to form strong, durable bonds with diverse substrates makes them ideal for such critical applications. Furthermore, the Furniture (Woodworking) industry is witnessing a paradigm shift towards modern manufacturing techniques, where PUR hot melt adhesives offer advantages in terms of faster assembly times, improved joint strength, and enhanced aesthetics compared to conventional glues. The Textiles and Footwear industries are also significant contributors, utilizing these adhesives for seam sealing, lamination, and structural bonding, enhancing product durability and comfort. Technological advancements in formulation chemistry, leading to faster curing times, improved flexibility, and enhanced resistance to environmental factors, are continuously expanding the application scope of PUR hot melts. Consumer preferences are increasingly leaning towards environmentally friendly and sustainable products, which aligns well with the solvent-free nature of PUR hot melt adhesives. The competitive landscape is dynamic, with continuous innovation and strategic partnerships shaping market dominance. The overall market penetration of PUR hot melt adhesives is expected to increase substantially as awareness of their benefits grows across emerging economies. The market is projected to reach well over fifty billion dollars in value by 2033.

Dominant Markets & Segments in PUR Hot Melt Adhesive Industry

The Paper, Board, and Packaging segment is the dominant force in the global PUR Hot Melt Adhesive industry, driven by the massive scale of packaging operations worldwide, particularly with the surge in e-commerce. This segment's growth is further propelled by the demand for sustainable packaging solutions, where PUR hot melts offer strong, reliable bonds without contributing to harmful VOC emissions. The economic policies supporting trade and manufacturing, coupled with the infrastructure development for logistics and distribution, directly bolster the demand for effective packaging adhesives.

- Paper, Board, and Packaging: This segment is projected to hold a market share exceeding thirty-five percent of the total market value.

- Key Drivers: Growth of e-commerce, demand for high-strength and tamper-evident packaging, increasing use of recycled materials, and regulatory push for sustainable packaging.

- Dominance Analysis: The sheer volume of manufactured goods requiring robust and efficient packaging makes this segment the largest consumer of PUR hot melt adhesives. The ability to achieve rapid bonding cycles on high-speed packaging lines is a critical advantage.

The Automotive segment is another significant contributor, driven by the automotive industry's relentless pursuit of lightweighting, improved fuel efficiency, and enhanced vehicle safety. PUR hot melts are increasingly employed in structural bonding, interior trim assembly, and the manufacturing of composite parts, replacing traditional welding and mechanical fastening methods.

- Automotive: Expected to account for over twenty percent of the market revenue.

- Key Drivers: Lightweighting initiatives for fuel economy, stringent safety regulations requiring stronger vehicle structures, growth in electric vehicle (EV) production, and the need for durable interior components.

- Dominance Analysis: The automotive industry's high-volume production and continuous innovation in vehicle design and materials necessitate advanced bonding solutions like PUR hot melts. Their ability to bond dissimilar materials effectively is a major advantage.

The Furniture (Woodworking) segment also showcases strong growth, driven by modern furniture manufacturing techniques that prioritize speed, precision, and aesthetic appeal. PUR hot melts offer superior bond strength and durability for various wood-based products.

- Furniture (Woodworking): Projected to capture a market share of over fifteen percent.

- Key Drivers: Rise in demand for customized and modular furniture, efficiency gains in manufacturing processes, and the need for durable and aesthetically pleasing wood joints.

- Dominance Analysis: PUR hot melts provide furniture manufacturers with the capability to create strong, flexible, and invisible joints, enhancing the overall quality and longevity of furniture.

Other segments like Healthcare, Footwear, and Textiles are also experiencing substantial growth due to their specific performance requirements, contributing to the overall market expansion. The Electrical and Electronics sector, driven by the miniaturization of devices and the need for thermal management, is also emerging as a significant application area.

PUR Hot Melt Adhesive Industry Product Innovations

Product innovations in the PUR Hot Melt Adhesive industry are primarily focused on enhancing performance characteristics such as faster curing times, improved flexibility, greater thermal stability, and increased adhesion to a wider range of substrates. There is a significant push towards developing bio-based and sustainable PUR formulations to meet growing environmental regulations and consumer demand. These innovations lead to competitive advantages by enabling more efficient manufacturing processes, reducing energy consumption, and creating more durable and reliable end products. Applications are expanding into novel areas such as advanced composites, 3D printing, and specialized industrial assembly, pushing the boundaries of what is possible with hot melt technology.

Report Segmentation & Scope

This report meticulously segments the PUR Hot Melt Adhesive market based on type and application. The Type segmentation includes Non-reactive PUR hot melt adhesives, known for their fast set times and ease of use in various assembly applications, and Reactive PUR hot melt adhesives, which undergo a secondary curing process through moisture, resulting in exceptionally strong and durable bonds.

The Application segmentation provides a granular view of market dynamics across several key industries. This includes Paper, Board, and Packaging, where PUR hot melts are essential for carton sealing, labeling, and bookbinding; Healthcare, for medical device assembly and wound care; Automotive, for structural bonding, interior trim, and component assembly; Furniture (Woodworking), for edge banding, profile wrapping, and cabinet assembly; Footwear, for sole attachment and upper assembly; Textiles, for laminating and seam sealing; Electrical and Electronics, for component potting and encapsulation; Bookbinding, for spine gluing and cover attachment; and Other Applications, encompassing a broad spectrum of industrial and consumer uses. Each segment is analyzed for its market size, growth projections, and competitive landscape.

Key Drivers of PUR Hot Melt Adhesive Industry Growth

Several key drivers are propelling the growth of the PUR Hot Melt Adhesive industry. Technological advancements, particularly in formulation chemistry and application technologies, are leading to adhesives with superior performance characteristics, such as faster curing times, enhanced bond strength, and improved flexibility. The increasing demand for sustainable and eco-friendly manufacturing processes favors solvent-free PUR hot melts over traditional solvent-based adhesives. Economic growth and industrialization, especially in emerging economies, are expanding the end-use industries, thereby boosting the demand for adhesives. Stringent regulations mandating higher product quality, durability, and safety across sectors like automotive and healthcare are also contributing to the adoption of high-performance PUR hot melts.

Challenges in the PUR Hot Melt Adhesive Industry Sector

Despite its strong growth trajectory, the PUR Hot Melt Adhesive industry faces several challenges. Fluctuations in raw material prices, particularly those derived from petrochemicals, can impact manufacturing costs and profit margins. Stringent regulatory compliance regarding chemical composition and environmental impact requires continuous investment in R&D and product reformulation. Intense competition from alternative adhesive technologies and mechanical fastening methods can limit market penetration in certain applications. Supply chain disruptions, exacerbated by geopolitical factors and global economic volatility, can affect the availability and cost of raw materials and finished products, potentially impacting market stability.

Leading Players in the PUR Hot Melt Adhesive Industry Market

- 3M

- Arkema Group (Bostik SA)

- BASF SE

- Hranipex AS

- CHEMENCE

- Collano Adhesives AG

- DIC CORPORATION

- Franklin International Inc

- H B Fuller Company

- Henkel AG & Co KGaA

- BC Adhesives

- Jowat SE

- KLEBCHEMIE GmbH & Co KG

- Master Bond Inc

- Sika AG

Key Developments in PUR Hot Melt Adhesive Industry Sector

- 2023/2024: Henkel AG & Co KGaA launched a new range of low-temperature PUR hot melt adhesives for improved energy efficiency in packaging applications.

- 2023/2024: H B Fuller Company acquired a leading bio-based adhesive manufacturer, expanding its sustainable product portfolio in PUR hot melts.

- 2023/2024: Arkema Group (Bostik SA) introduced advanced PUR hot melts for the automotive sector, focusing on lightweighting and enhanced structural integrity.

- 2023/2024: 3M expanded its research and development efforts in developing PUR hot melts with enhanced UV resistance for outdoor applications.

- 2023/2024: BASF SE announced strategic partnerships to develop innovative PUR formulations for the electronics industry, addressing thermal management challenges.

- 2023/2024: Jowat SE introduced high-performance PUR hot melts for the woodworking industry, emphasizing faster processing speeds and stronger bonds.

Strategic PUR Hot Melt Adhesive Industry Market Outlook

The strategic outlook for the PUR Hot Melt Adhesive industry is highly promising, driven by continued technological innovation and the expanding demand for high-performance, sustainable bonding solutions. The increasing focus on lightweighting in the automotive sector, the growing e-commerce landscape driving packaging demand, and the rising need for durable and aesthetically pleasing furniture will act as significant growth accelerators. Investments in R&D for bio-based and recyclable PUR formulations will unlock new market opportunities and enhance competitive positioning. Furthermore, the expansion of manufacturing capabilities in emerging economies presents substantial untapped market potential. Strategic partnerships, mergers, and acquisitions will continue to play a vital role in consolidating market share and gaining access to new technologies and geographies, ensuring sustained industry growth well into the future.

PUR Hot Melt Adhesive Industry Segmentation

-

1. Type

- 1.1. Non-reactive

- 1.2. Reactive

-

2. Application

- 2.1. Paper, Board, and Packaging

- 2.2. Healthcare

- 2.3. Automotive

- 2.4. Furniture (Woodworking)

- 2.5. Footwear

- 2.6. Textiles

- 2.7. Electrical and Electronics

- 2.8. Bookbinding

- 2.9. Other Applications

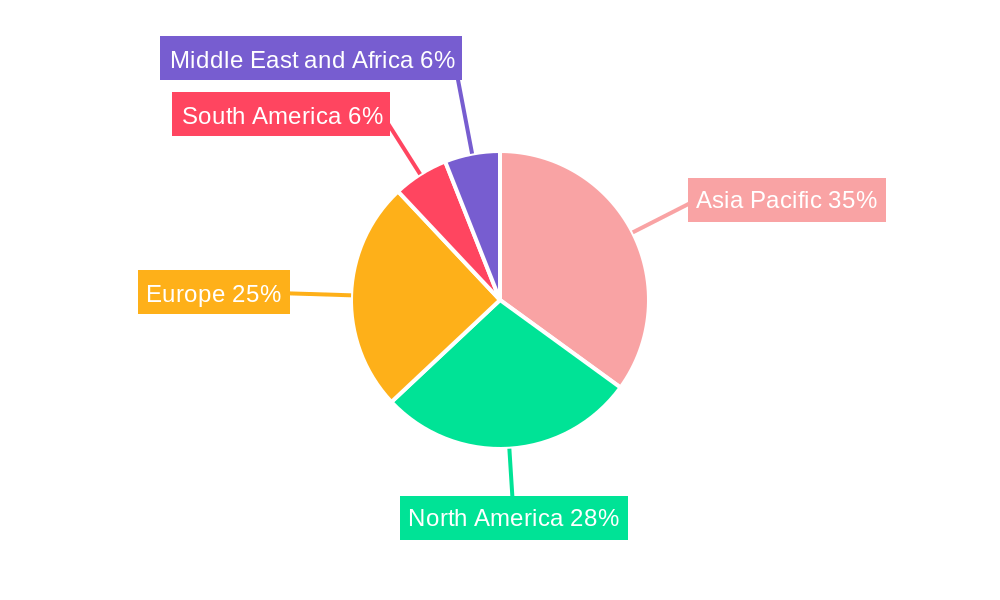

PUR Hot Melt Adhesive Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

PUR Hot Melt Adhesive Industry Regional Market Share

Geographic Coverage of PUR Hot Melt Adhesive Industry

PUR Hot Melt Adhesive Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Packaging and Electronics Industries; Rising Environmental Concerns Regarding Solvent-borne Adhesives

- 3.3. Market Restrains

- 3.3.1. Increasing Demand from the Packaging and Electronics Industries; Rising Environmental Concerns Regarding Solvent-borne Adhesives

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Packaging and Electronics Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PUR Hot Melt Adhesive Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Non-reactive

- 5.1.2. Reactive

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Paper, Board, and Packaging

- 5.2.2. Healthcare

- 5.2.3. Automotive

- 5.2.4. Furniture (Woodworking)

- 5.2.5. Footwear

- 5.2.6. Textiles

- 5.2.7. Electrical and Electronics

- 5.2.8. Bookbinding

- 5.2.9. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific PUR Hot Melt Adhesive Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Non-reactive

- 6.1.2. Reactive

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Paper, Board, and Packaging

- 6.2.2. Healthcare

- 6.2.3. Automotive

- 6.2.4. Furniture (Woodworking)

- 6.2.5. Footwear

- 6.2.6. Textiles

- 6.2.7. Electrical and Electronics

- 6.2.8. Bookbinding

- 6.2.9. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America PUR Hot Melt Adhesive Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Non-reactive

- 7.1.2. Reactive

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Paper, Board, and Packaging

- 7.2.2. Healthcare

- 7.2.3. Automotive

- 7.2.4. Furniture (Woodworking)

- 7.2.5. Footwear

- 7.2.6. Textiles

- 7.2.7. Electrical and Electronics

- 7.2.8. Bookbinding

- 7.2.9. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe PUR Hot Melt Adhesive Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Non-reactive

- 8.1.2. Reactive

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Paper, Board, and Packaging

- 8.2.2. Healthcare

- 8.2.3. Automotive

- 8.2.4. Furniture (Woodworking)

- 8.2.5. Footwear

- 8.2.6. Textiles

- 8.2.7. Electrical and Electronics

- 8.2.8. Bookbinding

- 8.2.9. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America PUR Hot Melt Adhesive Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Non-reactive

- 9.1.2. Reactive

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Paper, Board, and Packaging

- 9.2.2. Healthcare

- 9.2.3. Automotive

- 9.2.4. Furniture (Woodworking)

- 9.2.5. Footwear

- 9.2.6. Textiles

- 9.2.7. Electrical and Electronics

- 9.2.8. Bookbinding

- 9.2.9. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa PUR Hot Melt Adhesive Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Non-reactive

- 10.1.2. Reactive

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Paper, Board, and Packaging

- 10.2.2. Healthcare

- 10.2.3. Automotive

- 10.2.4. Furniture (Woodworking)

- 10.2.5. Footwear

- 10.2.6. Textiles

- 10.2.7. Electrical and Electronics

- 10.2.8. Bookbinding

- 10.2.9. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 3M

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arkema Group (Bostik SA)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BASF SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hranipex AS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CHEMENCE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Collano Adhesives AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 DIC CORPORATION

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Franklin International Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 H B Fuller Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Henkel AG & Co KGaA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BC Adhesives

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Jowat SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 KLEBCHEMIE GmbH & Co KG

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Master Bond Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sika A

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 3M

List of Figures

- Figure 1: Global PUR Hot Melt Adhesive Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific PUR Hot Melt Adhesive Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: Asia Pacific PUR Hot Melt Adhesive Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific PUR Hot Melt Adhesive Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: Asia Pacific PUR Hot Melt Adhesive Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific PUR Hot Melt Adhesive Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific PUR Hot Melt Adhesive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America PUR Hot Melt Adhesive Industry Revenue (undefined), by Type 2025 & 2033

- Figure 9: North America PUR Hot Melt Adhesive Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America PUR Hot Melt Adhesive Industry Revenue (undefined), by Application 2025 & 2033

- Figure 11: North America PUR Hot Melt Adhesive Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America PUR Hot Melt Adhesive Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America PUR Hot Melt Adhesive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe PUR Hot Melt Adhesive Industry Revenue (undefined), by Type 2025 & 2033

- Figure 15: Europe PUR Hot Melt Adhesive Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe PUR Hot Melt Adhesive Industry Revenue (undefined), by Application 2025 & 2033

- Figure 17: Europe PUR Hot Melt Adhesive Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe PUR Hot Melt Adhesive Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe PUR Hot Melt Adhesive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America PUR Hot Melt Adhesive Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: South America PUR Hot Melt Adhesive Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America PUR Hot Melt Adhesive Industry Revenue (undefined), by Application 2025 & 2033

- Figure 23: South America PUR Hot Melt Adhesive Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America PUR Hot Melt Adhesive Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America PUR Hot Melt Adhesive Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa PUR Hot Melt Adhesive Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: Middle East and Africa PUR Hot Melt Adhesive Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa PUR Hot Melt Adhesive Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa PUR Hot Melt Adhesive Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa PUR Hot Melt Adhesive Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa PUR Hot Melt Adhesive Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 14: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United States PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Mexico PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 19: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Germany PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 27: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Brazil PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Argentina PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global PUR Hot Melt Adhesive Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa PUR Hot Melt Adhesive Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PUR Hot Melt Adhesive Industry?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the PUR Hot Melt Adhesive Industry?

Key companies in the market include 3M, Arkema Group (Bostik SA), BASF SE, Hranipex AS, CHEMENCE, Collano Adhesives AG, DIC CORPORATION, Franklin International Inc, H B Fuller Company, Henkel AG & Co KGaA, BC Adhesives, Jowat SE, KLEBCHEMIE GmbH & Co KG, Master Bond Inc, Sika A.

3. What are the main segments of the PUR Hot Melt Adhesive Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Packaging and Electronics Industries; Rising Environmental Concerns Regarding Solvent-borne Adhesives.

6. What are the notable trends driving market growth?

Increasing Demand from the Packaging and Electronics Industries.

7. Are there any restraints impacting market growth?

Increasing Demand from the Packaging and Electronics Industries; Rising Environmental Concerns Regarding Solvent-borne Adhesives.

8. Can you provide examples of recent developments in the market?

The recent developments pertaining to the major players in the market are being covered in the complete study

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PUR Hot Melt Adhesive Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PUR Hot Melt Adhesive Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PUR Hot Melt Adhesive Industry?

To stay informed about further developments, trends, and reports in the PUR Hot Melt Adhesive Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence