Key Insights

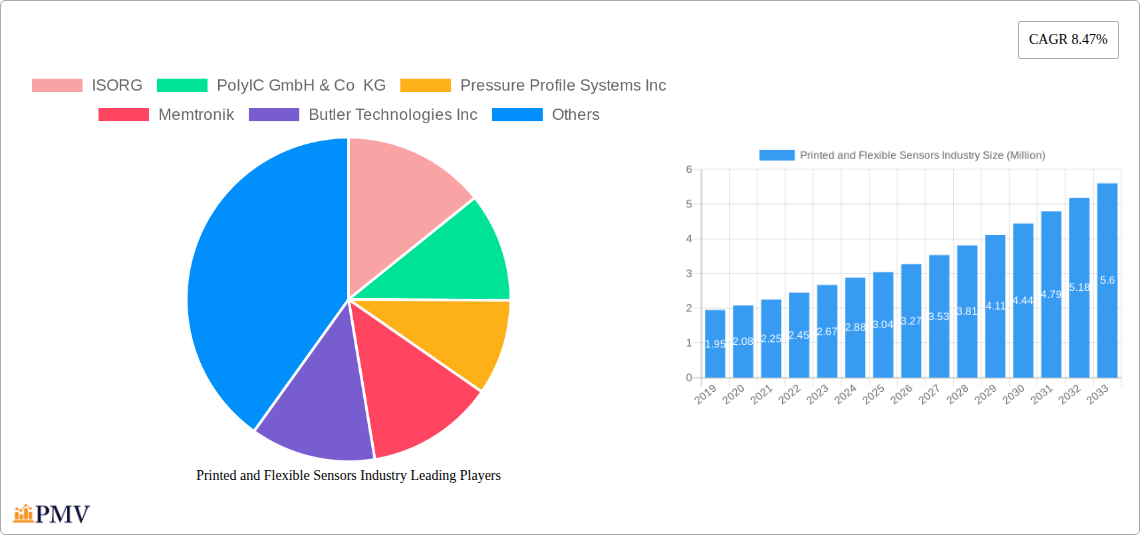

The global Printed and Flexible Sensors market is poised for significant expansion, projected to reach a substantial 3.04 million value unit by 2025. Driven by a compelling CAGR of 8.47%, this burgeoning industry is set to witness robust growth throughout the forecast period of 2025-2033. Key growth catalysts include the increasing demand for miniaturized and integrated sensing solutions across diverse sectors. The automotive industry is a major driver, adopting these sensors for advanced driver-assistance systems (ADAS), in-cabin monitoring, and enhanced vehicle diagnostics. Consumer electronics, with its relentless pursuit of innovative and wearable devices, is another significant contributor, integrating flexible sensors into smartwatches, fitness trackers, and other personal gadgets for health monitoring and user interaction. The medical and healthcare sector is increasingly leveraging these sensors for point-of-care diagnostics, wearable health monitors, and minimally invasive medical devices, offering greater patient comfort and real-time data acquisition. Furthermore, the defense and aerospace industries are exploring the potential of printed and flexible sensors for their lightweight, conformable, and durable characteristics in advanced surveillance, navigation, and structural health monitoring systems.

Printed and Flexible Sensors Industry Market Size (In Million)

The market is segmented into various sensor types, with biosensors and touch sensors anticipated to lead the adoption due to their widespread application in health-tech and user interface design, respectively. Photodetectors and temperature sensors also hold significant market share, driven by their critical roles in imaging, environmental monitoring, and industrial process control. The burgeoning adoption of these technologies is further fueled by continuous innovation in material science, printing techniques, and sensor design, leading to improved performance, reduced manufacturing costs, and enhanced functionalities. While the growth trajectory is strong, potential restraints may emerge from the need for standardization, complex manufacturing processes for certain advanced sensors, and initial integration challenges in legacy systems. However, ongoing research and development are actively addressing these hurdles, paving the way for wider market penetration and the realization of a truly connected and intelligent world powered by advanced printed and flexible sensing technologies.

Printed and Flexible Sensors Industry Company Market Share

Here's the SEO-optimized, detailed report description for the Printed and Flexible Sensors Industry:

Printed and Flexible Sensors Industry Market Structure & Competitive Dynamics

The Printed and Flexible Sensors Industry is characterized by a dynamic market structure with an evolving competitive landscape. Market concentration varies across specialized segments, with a growing presence of innovative startups and established players investing heavily in R&D. The innovation ecosystem is thriving, fueled by advancements in materials science, printing technologies, and miniaturization, leading to the development of novel biosensors, touch sensors, and pressure sensors. Regulatory frameworks are gradually adapting to accommodate the unique manufacturing processes and applications of flexible electronics, particularly in sensitive sectors like medical and healthcare. Product substitutes, while present, often fall short in offering the unique form factors, cost-effectiveness, or integrated functionality of printed and flexible sensors. End-user trends are heavily influenced by the demand for wearable devices, the Internet of Things (IoT), and advanced human-machine interfaces, driving significant adoption in consumer electronics and automotive applications. Mergers and acquisitions (M&A) are a strategic tool for market consolidation and technology acquisition, with estimated deal values in the tens to hundreds of Million indicative of the industry's growth potential. Key players are actively pursuing partnerships and collaborations to expand their technological capabilities and market reach.

Printed and Flexible Sensors Industry Industry Trends & Insights

The Printed and Flexible Sensors Industry is poised for substantial growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 15-20% over the forecast period of 2025–2033. This robust expansion is driven by a confluence of technological advancements, escalating demand from diverse end-user industries, and the inherent advantages offered by flexible and printed sensor technologies. The continuous evolution of printing techniques, including inkjet, screen, and gravure printing, is enabling the cost-effective mass production of high-performance sensors with intricate designs. Material innovation, particularly in conductive inks and substrates, is crucial for enhancing sensor sensitivity, durability, and functionality, paving the way for next-generation devices.

The burgeoning market for wearable technology represents a significant growth driver, with flexible sensors being integral to smartwatches, fitness trackers, and advanced healthcare monitoring devices. The increasing adoption of IoT solutions across various sectors, from smart homes to industrial automation, is further fueling the demand for unobtrusive, integrated, and low-power sensors. In the automotive sector, flexible sensors are transforming vehicle interiors and exteriors, enabling features like advanced driver-assistance systems (ADAS), touch-sensitive surfaces, and integrated lighting. The medical and healthcare industry is a major beneficiary, utilizing printed and flexible sensors for disposable diagnostic devices, patient monitoring patches, and implantable sensors. The miniaturization trend, coupled with the inherent flexibility of these sensors, allows for seamless integration into existing products and the creation of entirely new form factors.

Consumer preferences are increasingly leaning towards personalized and connected experiences, which printed and flexible sensors directly enable through enhanced user interfaces and data-driven insights. The competitive dynamics within the industry are characterized by fierce innovation and strategic partnerships. Companies are focused on developing proprietary printing processes, novel materials, and specialized sensor functionalities to gain a competitive edge. Market penetration is expected to deepen as the cost of production decreases and the reliability and performance of printed and flexible sensors improve, making them a viable alternative to traditional rigid sensors in an expanding range of applications.

Dominant Markets & Segments in Printed and Flexible Sensors Industry

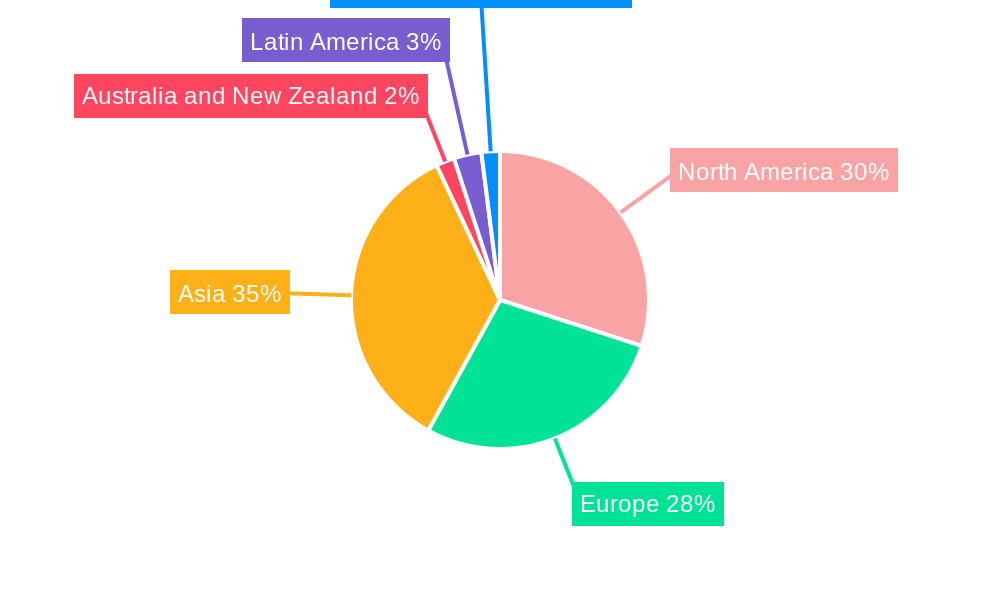

The Printed and Flexible Sensors Industry is experiencing significant growth across various regions and segments, with specific areas demonstrating remarkable dominance.

Leading Region: Asia Pacific is emerging as a dominant region, driven by strong manufacturing capabilities, a rapidly growing consumer electronics market, and significant government investment in advanced technologies. Countries like China, South Korea, and Japan are at the forefront of adopting and manufacturing printed and flexible sensors, contributing significantly to market expansion. Economic policies supporting innovation and R&D, coupled with extensive infrastructure development, are key drivers in this region.

Dominant Type Segment:

- Touch Sensors: These sensors are experiencing substantial market penetration due to their ubiquitous application in smartphones, tablets, smart displays, and automotive infotainment systems. The demand for interactive and intuitive user interfaces continues to propel the growth of printed and flexible touch sensors, offering cost-effectiveness and design flexibility over traditional capacitive touch technologies.

- Biosensors: The Medical and Healthcare segment, in particular, is witnessing an unprecedented surge in demand for printed and flexible biosensors. These sensors are crucial for developing disposable diagnostic tools, continuous glucose monitors, wearable health trackers, and advanced wound care devices. The ability to integrate these sensors into flexible substrates allows for non-invasive and patient-friendly monitoring solutions, driving market dominance.

Dominant End-user Industry:

- Consumer Electronics: This sector remains the largest consumer of printed and flexible sensors. The relentless innovation in smartphones, wearables, and smart home devices necessitates advanced sensing capabilities that are compact, flexible, and cost-efficient. The demand for enhanced user experiences, personalized functionalities, and seamless connectivity directly fuels the adoption of these sensors.

- Medical and Healthcare: As mentioned, the medical sector is a rapidly growing dominant end-user industry. The increasing focus on preventative healthcare, remote patient monitoring, and the development of advanced medical devices are creating immense opportunities for printed and flexible sensors. Their biocompatibility, disposability, and ability to conform to the body make them ideal for numerous healthcare applications.

The dominance of these segments is further reinforced by ongoing technological advancements, favorable regulatory environments in key application areas, and the continuous drive for miniaturization and integration in product design. Economic policies that incentivize the development and adoption of advanced manufacturing techniques also play a crucial role in solidifying the market positions of these dominant segments.

Printed and Flexible Sensors Industry Product Innovations

Product innovations in the Printed and Flexible Sensors Industry are centered around enhancing performance, expanding application scope, and improving manufacturability. Companies are developing ultra-thin, highly sensitive biosensors for point-of-care diagnostics, robust touch sensors with enhanced haptic feedback for automotive interiors, and photodetectors optimized for flexible displays and solar cells. The integration of multiple sensing modalities onto a single flexible substrate is a key trend, offering synergistic functionalities and reducing system complexity. Competitive advantages are being carved out through proprietary material formulations, advanced printing techniques that allow for finer resolution and higher conductivity, and the development of durable, stretchable, and biocompatible sensor designs. These innovations are critical for unlocking new market opportunities and meeting the evolving demands of the consumer electronics, medical and healthcare, and automotive sectors.

Report Segmentation & Scope

This comprehensive report segments the Printed and Flexible Sensors Industry across key categories to provide granular insights. Type segmentation includes:

- Biosensor: Focused on applications in healthcare diagnostics, environmental monitoring, and food safety, with projected market sizes in the billions and significant CAGR due to increasing health awareness and POC testing demand.

- Touch Sensor: Encompassing applications in consumer electronics and automotive interfaces, with substantial market share driven by the proliferation of touch-enabled devices.

- Photodetector: Serving markets like displays, imaging, and solar energy harvesting, with growth tied to advancements in flexible electronics and renewable energy.

- Temperature Sensor: Vital for industrial monitoring, consumer wearables, and medical devices, with steady growth driven by IoT expansion.

- Pressure Sensor: Crucial for automotive, industrial, and medical applications, including smart surfaces and human-machine interfaces, exhibiting strong growth potential.

- Other Types: Including strain sensors, gas sensors, and more, catering to niche but growing applications.

End-user Industry segmentation covers:

- Automotive: Driven by ADAS, infotainment, and smart cabin features, with significant market volume and ongoing innovation.

- Consumer Electronics: The largest segment, encompassing smartphones, wearables, and smart home devices, characterized by high volume and rapid product cycles.

- Medical and Healthcare: A high-growth segment fueled by wearable health monitors, disposable diagnostics, and remote patient care solutions.

- Defense and Aerospace: Utilizing sensors for advanced monitoring, surveillance, and lightweight structural health assessment, with specialized application demands.

- Other End-user Industries: Including industrial automation, energy, and sporting goods, representing diverse and emerging market opportunities.

Key Drivers of Printed and Flexible Sensors Industry Growth

The growth of the Printed and Flexible Sensors Industry is propelled by several key factors. Advancements in printing technologies, such as inkjet and screen printing, are significantly reducing manufacturing costs and enabling high-volume production of complex sensor designs. The burgeoning demand for wearable devices and the Internet of Things (IoT) is a major catalyst, as flexible sensors offer the ideal form factor for integration into these compact and often conformal applications. Miniaturization trends across all electronic devices necessitate sensors that are not only small but also flexible and lightweight. Furthermore, the increasing adoption of printed and flexible sensors in the medical and healthcare sector, for applications like disposable diagnostics and continuous monitoring, is a significant growth accelerator, driven by the need for cost-effective, patient-friendly solutions.

Challenges in the Printed and Flexible Sensors Industry Sector

Despite its promising growth, the Printed and Flexible Sensors Industry faces several challenges. Ensuring consistent performance and reliability across large-scale production runs can be difficult due to variations in printing processes and material properties. The development of robust and long-lasting flexible materials that can withstand harsh environmental conditions or extensive wear and tear remains an ongoing challenge. Regulatory hurdles, especially in sensitive industries like medical and healthcare, can slow down product adoption and require extensive validation processes. Additionally, the initial capital investment required for advanced printing equipment can be a barrier for smaller companies. Supply chain complexities for specialized inks and substrates, as well as intense competition from established sensor technologies, also present significant restraints.

Leading Players in the Printed and Flexible Sensors Industry Market

- ISORG

- PolyIC GmbH & Co KG

- Pressure Profile Systems Inc

- Memtronik

- Butler Technologies Inc

- E2IP Technologies

- Linepro Controls Pvt Ltd

- PST Sensors

- Tekscan Inc

- Forciot

- Quad Industries

- Brewer Science

- Nissha Co Lt

- Canatu Oy

Key Developments in Printed and Flexible Sensors Industry Sector

- March 2023: Tekscan officially announced the launch of the High-Speed TireScan system. Through this, tire makers can precisely, repeatedly, and effectively monitor dynamic contact patch pressure (DCPP) data from a tire rolling on a belt at speeds up to 165 mph (265 km/h) due to the development of this lightweight, durable device.

- February 2023: Quad Industries announced that it will introduce its newest developments in capacitive touch controls, medical electrode patches, printed flexible circuits, pressure sensors, PTC, and non-PTC stretchable film heaters at the LOPEC 2023 trade fair, which will be held in Germany.

Strategic Printed and Flexible Sensors Industry Market Outlook

The strategic outlook for the Printed and Flexible Sensors Industry is exceptionally bright, driven by continuous innovation and expanding application horizons. The market is expected to witness accelerated growth fueled by advancements in printed electronics, enabling the creation of highly integrated and intelligent devices. Strategic opportunities lie in the further development of ultra-low-cost disposable sensors for mass healthcare screening, the integration of flexible sensors into advanced automotive safety systems and personalized mobility solutions, and the development of novel user interfaces for the next generation of consumer electronics. Collaboration between material scientists, printing technology experts, and end-user application developers will be crucial for unlocking new market potential and solidifying the industry's position as a cornerstone of future technological advancements. The increasing demand for IoT devices and smart infrastructure will continue to be a significant growth accelerator.

Printed and Flexible Sensors Industry Segmentation

-

1. Type

- 1.1. Biosensor

- 1.2. Touch Sensor

- 1.3. Photodetectors

- 1.4. Temperature Sensor

- 1.5. Pressure Sensor

- 1.6. Other Types

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Consumer Electronics

- 2.3. Medical and Healthcare

- 2.4. Defense and Aerospace

- 2.5. Other End-user Industries

Printed and Flexible Sensors Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Printed and Flexible Sensors Industry Regional Market Share

Geographic Coverage of Printed and Flexible Sensors Industry

Printed and Flexible Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Progression in Demand for Energy-efficient

- 3.2.2 Thin

- 3.2.3 and Flexible Consumer Electronics Products; Rising Integration of Printed Sensors in Medical Wearable Devices

- 3.3. Market Restrains

- 3.3.1. Requirement of Technological Improvements for Wider Adoption

- 3.4. Market Trends

- 3.4.1. Medical and Healthcare to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Printed and Flexible Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Biosensor

- 5.1.2. Touch Sensor

- 5.1.3. Photodetectors

- 5.1.4. Temperature Sensor

- 5.1.5. Pressure Sensor

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Consumer Electronics

- 5.2.3. Medical and Healthcare

- 5.2.4. Defense and Aerospace

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Printed and Flexible Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Biosensor

- 6.1.2. Touch Sensor

- 6.1.3. Photodetectors

- 6.1.4. Temperature Sensor

- 6.1.5. Pressure Sensor

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Consumer Electronics

- 6.2.3. Medical and Healthcare

- 6.2.4. Defense and Aerospace

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Printed and Flexible Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Biosensor

- 7.1.2. Touch Sensor

- 7.1.3. Photodetectors

- 7.1.4. Temperature Sensor

- 7.1.5. Pressure Sensor

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Consumer Electronics

- 7.2.3. Medical and Healthcare

- 7.2.4. Defense and Aerospace

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Printed and Flexible Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Biosensor

- 8.1.2. Touch Sensor

- 8.1.3. Photodetectors

- 8.1.4. Temperature Sensor

- 8.1.5. Pressure Sensor

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Consumer Electronics

- 8.2.3. Medical and Healthcare

- 8.2.4. Defense and Aerospace

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Printed and Flexible Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Biosensor

- 9.1.2. Touch Sensor

- 9.1.3. Photodetectors

- 9.1.4. Temperature Sensor

- 9.1.5. Pressure Sensor

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Consumer Electronics

- 9.2.3. Medical and Healthcare

- 9.2.4. Defense and Aerospace

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Printed and Flexible Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Biosensor

- 10.1.2. Touch Sensor

- 10.1.3. Photodetectors

- 10.1.4. Temperature Sensor

- 10.1.5. Pressure Sensor

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Automotive

- 10.2.2. Consumer Electronics

- 10.2.3. Medical and Healthcare

- 10.2.4. Defense and Aerospace

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Printed and Flexible Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Biosensor

- 11.1.2. Touch Sensor

- 11.1.3. Photodetectors

- 11.1.4. Temperature Sensor

- 11.1.5. Pressure Sensor

- 11.1.6. Other Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Automotive

- 11.2.2. Consumer Electronics

- 11.2.3. Medical and Healthcare

- 11.2.4. Defense and Aerospace

- 11.2.5. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 ISORG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 PolyIC GmbH & Co KG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Pressure Profile Systems Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Memtronik

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Butler Technologies Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 E2IP Technologies

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Linepro Controls Pvt Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 PST Sensors

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Tekscan Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Forciot

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Quad Industries

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Brewer Science

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Nissha Co Lt

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Canatu Oy

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 ISORG

List of Figures

- Figure 1: Global Printed and Flexible Sensors Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Printed and Flexible Sensors Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Printed and Flexible Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Printed and Flexible Sensors Industry Volume (K Unit), by Type 2025 & 2033

- Figure 5: North America Printed and Flexible Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Printed and Flexible Sensors Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Printed and Flexible Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 8: North America Printed and Flexible Sensors Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 9: North America Printed and Flexible Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: North America Printed and Flexible Sensors Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: North America Printed and Flexible Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Printed and Flexible Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Printed and Flexible Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Printed and Flexible Sensors Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Printed and Flexible Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe Printed and Flexible Sensors Industry Volume (K Unit), by Type 2025 & 2033

- Figure 17: Europe Printed and Flexible Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Printed and Flexible Sensors Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Printed and Flexible Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 20: Europe Printed and Flexible Sensors Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 21: Europe Printed and Flexible Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Printed and Flexible Sensors Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: Europe Printed and Flexible Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Printed and Flexible Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Printed and Flexible Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Printed and Flexible Sensors Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Printed and Flexible Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 28: Asia Printed and Flexible Sensors Industry Volume (K Unit), by Type 2025 & 2033

- Figure 29: Asia Printed and Flexible Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Printed and Flexible Sensors Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Printed and Flexible Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 32: Asia Printed and Flexible Sensors Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 33: Asia Printed and Flexible Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Asia Printed and Flexible Sensors Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: Asia Printed and Flexible Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Printed and Flexible Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Printed and Flexible Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Printed and Flexible Sensors Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Printed and Flexible Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 40: Australia and New Zealand Printed and Flexible Sensors Industry Volume (K Unit), by Type 2025 & 2033

- Figure 41: Australia and New Zealand Printed and Flexible Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: Australia and New Zealand Printed and Flexible Sensors Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: Australia and New Zealand Printed and Flexible Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: Australia and New Zealand Printed and Flexible Sensors Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Australia and New Zealand Printed and Flexible Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Australia and New Zealand Printed and Flexible Sensors Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Australia and New Zealand Printed and Flexible Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Printed and Flexible Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Printed and Flexible Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Printed and Flexible Sensors Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Printed and Flexible Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 52: Latin America Printed and Flexible Sensors Industry Volume (K Unit), by Type 2025 & 2033

- Figure 53: Latin America Printed and Flexible Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: Latin America Printed and Flexible Sensors Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: Latin America Printed and Flexible Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 56: Latin America Printed and Flexible Sensors Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 57: Latin America Printed and Flexible Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: Latin America Printed and Flexible Sensors Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: Latin America Printed and Flexible Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Printed and Flexible Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Latin America Printed and Flexible Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Printed and Flexible Sensors Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Printed and Flexible Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 64: Middle East and Africa Printed and Flexible Sensors Industry Volume (K Unit), by Type 2025 & 2033

- Figure 65: Middle East and Africa Printed and Flexible Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 66: Middle East and Africa Printed and Flexible Sensors Industry Volume Share (%), by Type 2025 & 2033

- Figure 67: Middle East and Africa Printed and Flexible Sensors Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 68: Middle East and Africa Printed and Flexible Sensors Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 69: Middle East and Africa Printed and Flexible Sensors Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 70: Middle East and Africa Printed and Flexible Sensors Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 71: Middle East and Africa Printed and Flexible Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 72: Middle East and Africa Printed and Flexible Sensors Industry Volume (K Unit), by Country 2025 & 2033

- Figure 73: Middle East and Africa Printed and Flexible Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Printed and Flexible Sensors Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 33: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Type 2020 & 2033

- Table 39: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 41: Global Printed and Flexible Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Printed and Flexible Sensors Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Printed and Flexible Sensors Industry?

The projected CAGR is approximately 8.47%.

2. Which companies are prominent players in the Printed and Flexible Sensors Industry?

Key companies in the market include ISORG, PolyIC GmbH & Co KG, Pressure Profile Systems Inc, Memtronik, Butler Technologies Inc, E2IP Technologies, Linepro Controls Pvt Ltd, PST Sensors, Tekscan Inc, Forciot, Quad Industries, Brewer Science, Nissha Co Lt, Canatu Oy.

3. What are the main segments of the Printed and Flexible Sensors Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Progression in Demand for Energy-efficient. Thin. and Flexible Consumer Electronics Products; Rising Integration of Printed Sensors in Medical Wearable Devices.

6. What are the notable trends driving market growth?

Medical and Healthcare to Witness the Growth.

7. Are there any restraints impacting market growth?

Requirement of Technological Improvements for Wider Adoption.

8. Can you provide examples of recent developments in the market?

March 2023 - Tekscanofficially announced the launch of the High-Speed TireScansystem. Through this, tire makers can precisely, repeatedly, and effectively monitor dynamic contact patch pressure (DCPP) data from a tire rolling on a belt at speeds up to 165 mph (265 km/h) due to the development of this lightweight, durable device.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Printed and Flexible Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Printed and Flexible Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Printed and Flexible Sensors Industry?

To stay informed about further developments, trends, and reports in the Printed and Flexible Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence