Key Insights

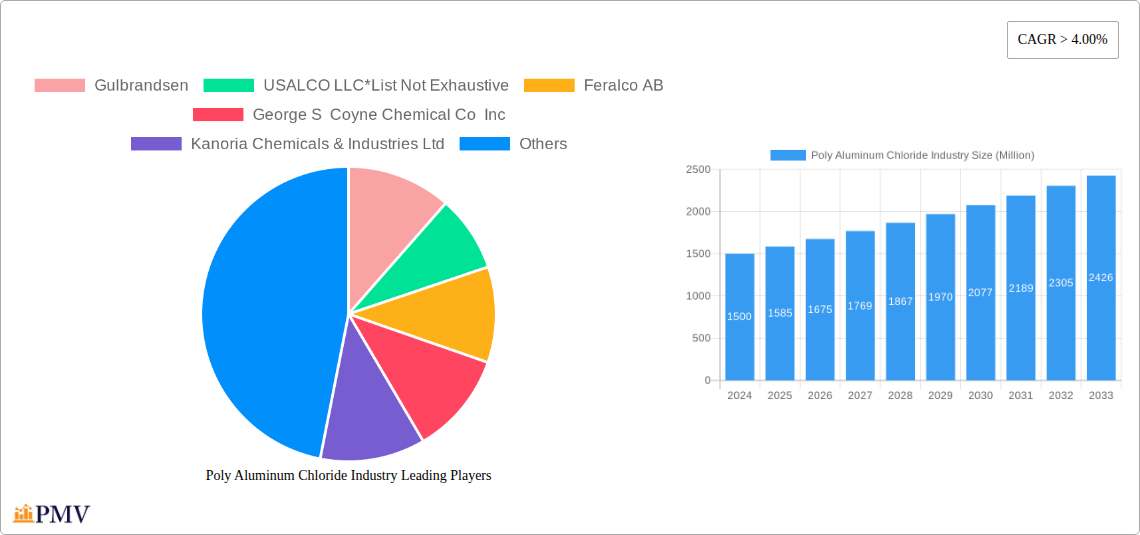

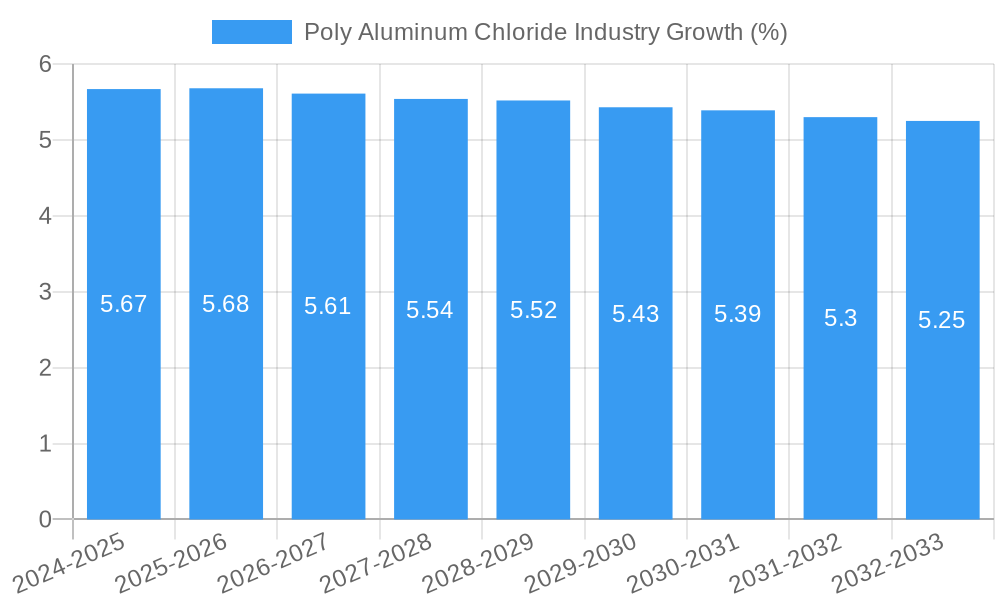

The Poly Aluminum Chloride (PAC) market is poised for robust growth, projecting a market size of approximately $1.5 billion in 2024, with an estimated Compound Annual Growth Rate (CAGR) of 5.7% from 2025 to 2033. This expansion is primarily driven by the escalating demand for effective water treatment solutions across municipal and industrial sectors, fueled by increasing regulatory mandates for clean water and growing environmental consciousness. The paper industry also presents a significant avenue for PAC consumption, where its coagulating and flocculating properties are vital for dewatering and impurity removal, leading to improved paper quality and process efficiency. Furthermore, the burgeoning cosmetics and personal care sector, along with the critical applications in the oil and gas industry for wastewater management and processing, contribute to the sustained market uplift. The solid form of PAC is expected to lead in market share due to its ease of handling and storage, though liquid formulations will also witness steady adoption.

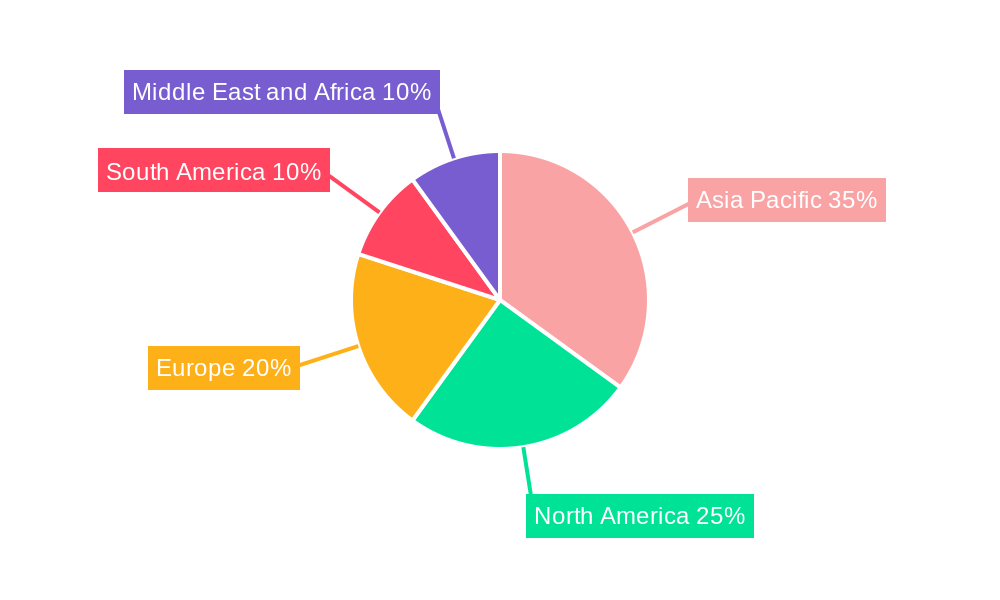

The market's trajectory is further supported by ongoing technological advancements in PAC production, leading to enhanced product purity and performance, thereby broadening its application spectrum. Emerging economies, particularly in the Asia Pacific region, are anticipated to be key growth engines, owing to rapid industrialization, urbanization, and increasing investments in water infrastructure. While the market exhibits strong growth prospects, potential restraints could emerge from fluctuating raw material prices and intense competition among key players like Gulbrandsen, USALCO LLC, Kemira, and GEO Specialty Chemicals Inc. However, strategic collaborations, product innovation, and a focus on sustainable production methods are expected to enable market participants to navigate these challenges and capitalize on the expanding global demand for Poly Aluminum Chloride.

Poly Aluminum Chloride Industry Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This detailed report provides an in-depth analysis of the global Poly Aluminum Chloride (PAC) industry, encompassing market structure, competitive dynamics, key trends, dominant segments, product innovations, growth drivers, challenges, leading players, and a strategic market outlook. Our comprehensive study covers the period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period of 2025-2033, including a historical analysis from 2019-2024. This report is designed to equip industry stakeholders with actionable insights for strategic decision-making in the rapidly evolving PAC market.

Poly Aluminum Chloride Industry Market Structure & Competitive Dynamics

The Poly Aluminum Chloride (PAC) industry exhibits a moderately concentrated market structure, characterized by the presence of both large, established multinational corporations and smaller, regional manufacturers. Key players, including Gulbrandsen, USALCO LLC, Feralco AB, George S Coyne Chemical Co Inc, Kanoria Chemicals & Industries Ltd, Airedale Chemical, Kemira, GEO Specialty Chemicals Inc, Summit Chemical Specialty Products LLC, Synergy Multichem Pvt Ltd, HOLLAND COMPANY, and Aditya Birla Chemicals (India) Limited, collectively hold a significant portion of the market share. Innovation ecosystems are driven by continuous research and development aimed at improving PAC efficacy, purity, and cost-effectiveness for diverse applications. Regulatory frameworks, particularly concerning environmental impact and water quality standards, play a crucial role in shaping product development and market access. Product substitutes, while present in some niche applications, often struggle to match the comprehensive performance and cost-efficiency of PAC, especially in large-scale water treatment. End-user trends indicate a growing demand for advanced coagulants with higher efficiency and reduced sludge production. Merger and acquisition (M&A) activities have been observed as companies seek to expand their geographic reach, product portfolios, and technological capabilities. For instance, M&A deal values in the PAC sector have reached billions in recent years, reflecting the industry's consolidation efforts and strategic growth initiatives.

Poly Aluminum Chloride Industry Industry Trends & Insights

The Poly Aluminum Chloride (PAC) industry is experiencing robust growth, driven by a confluence of factors including increasing global demand for clean water, stricter environmental regulations, and the expanding applications of PAC beyond traditional water treatment. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period. Growing urbanization and industrialization worldwide necessitate enhanced wastewater and potable water treatment capabilities, directly boosting the demand for PAC as a highly effective coagulant and flocculant. Its ability to efficiently remove turbidity, color, and suspended solids at a wider pH range and lower dosage compared to traditional coagulants like aluminum sulfate makes it a preferred choice. Technological disruptions are emerging in the form of enhanced PAC formulations, such as high-basicity PAC and customized PAC grades for specific industrial needs. These advancements aim to optimize performance, reduce chemical consumption, and minimize sludge generation, aligning with sustainability goals and cost-efficiency objectives. Consumer preferences are shifting towards eco-friendly and sustainable solutions. PAC's relatively lower environmental footprint and its role in facilitating cleaner water discharge are increasingly valued. The competitive dynamics are intensifying, with a focus on product quality, price competitiveness, and customer service. Companies are investing in R&D to develop innovative PAC products with improved shelf-life and ease of handling. Furthermore, the increasing penetration of PAC in emerging economies, particularly in Asia-Pacific and Latin America, is a significant growth accelerator. The oil and gas sector's utilization of PAC for produced water treatment and drilling fluid applications, alongside the paper industry's use in sizing and retention, contributes to the overall market expansion.

Dominant Markets & Segments in Poly Aluminum Chloride Industry

The Water Treatment end-user industry stands as the dominant segment within the Poly Aluminum Chloride (PAC) market, driven by escalating global concerns over water scarcity and pollution. This segment accounts for over 70% of the total PAC market value. Within this, both Liquid and Solid forms of PAC witness significant demand, with liquid PAC often preferred for its ease of handling and dosing in large-scale operations, while solid PAC offers advantages in transportation and storage. The Asia-Pacific region, particularly China and India, emerges as the leading geographical market due to rapid industrialization, a large population base, and substantial investments in water infrastructure development. Economic policies supporting environmental protection and stringent water quality standards in these nations further bolster PAC consumption.

- Water Treatment Dominance:

- Drivers: Growing population, increasing industrial water usage, stringent environmental regulations for wastewater discharge, and the universal need for safe drinking water.

- Key Metrics: Billions in market value, billions in projected investment in water infrastructure.

- Liquid PAC Preference:

- Drivers: Ease of automated dosing, reduced manual handling, consistent product quality in solution form, and suitability for large industrial facilities.

- Market Penetration: High in municipal water treatment plants and large industrial complexes.

- Solid PAC Utility:

- Drivers: Cost-effective transportation over long distances, longer shelf-life, and suitability for remote locations or smaller treatment facilities.

- Demand: Significant in regions with developing logistics infrastructure.

- Asia-Pacific Market Leadership:

- Drivers: Rapid industrial growth, substantial urbanization, significant investments in wastewater treatment, and supportive government initiatives for environmental protection.

- Country-Specific Trends: China's massive water treatment projects and India's focus on improving sanitation and water quality are key contributors.

The Paper Industry represents another significant segment, utilizing PAC for enhanced sizing, retention, and drainage. The Cosmetics and Personal Care industry, though smaller, is a growing niche where PAC's astringent properties are leveraged. The Oil and Gas sector employs PAC in drilling fluids and for the treatment of produced water, contributing to its demand. Other End-user Industries, including textiles and mining, also contribute to the diversified application base.

Poly Aluminum Chloride Industry Product Innovations

Product innovation in the Poly Aluminum Chloride (PAC) industry is primarily focused on enhancing performance and sustainability. Manufacturers are developing high-purity PAC grades with advanced basicity and tailored molecular structures to optimize coagulation and flocculation efficiency across diverse water conditions. Innovations include encapsulated solid PAC for controlled release, liquid PAC formulations with extended shelf-life and reduced corrosivity, and specialized PAC products designed for specific industrial applications like textile effluent treatment or oil and gas exploration. These advancements provide competitive advantages by offering superior contaminant removal, reduced sludge generation, and improved cost-effectiveness for end-users, aligning with market demands for more efficient and environmentally responsible chemical solutions.

Report Segmentation & Scope

This comprehensive report segments the Poly Aluminum Chloride (PAC) industry across key parameters to provide granular insights.

- Form: The market is segmented into Solid PAC and Liquid PAC. Solid PAC, often in powder or granular form, offers advantages in storage and transportation logistics, with an estimated market size of billions. Liquid PAC, readily soluble, is preferred for its ease of dosing and immediate application, projected to reach billions in market value.

- End-user Industry: The report delves into the Water Treatment sector, the largest consumer, projected to command billions in market value. The Paper Industry utilizes PAC for various processes, with an estimated market of billions. The Cosmetics and Personal Care industry, a niche but growing segment, is estimated to contribute billions. The Oil and Gas sector's demand for PAC is also significant, with market projections in the billions. Finally, Other End-user Industries, encompassing textiles, mining, and construction, are collectively analyzed with an estimated market size of billions.

Key Drivers of Poly Aluminum Chloride Industry Growth

The growth of the Poly Aluminum Chloride (PAC) industry is propelled by several critical factors. Foremost is the ever-increasing global demand for clean and safe water, driven by population growth, urbanization, and industrial expansion. Stricter environmental regulations worldwide mandating improved wastewater treatment and drinking water quality are a significant catalyst. Technological advancements leading to more efficient, cost-effective, and environmentally friendly PAC formulations are also driving adoption. Furthermore, the expanding applications of PAC in sectors like paper manufacturing, oil and gas, and cosmetics contribute to its market expansion. Government initiatives promoting water infrastructure development and environmental protection further bolster the demand for PAC.

Challenges in the Poly Aluminum Chloride Industry Sector

Despite its robust growth, the Poly Aluminum Chloride (PAC) industry faces several challenges. Fluctuations in the cost of raw materials, particularly aluminum hydroxide and hydrochloric acid, can impact profit margins. Stringent regulatory hurdles regarding the safe handling, transportation, and disposal of PAC, especially in certain regions, can increase operational costs. Intense competition among manufacturers, leading to price pressures, is another significant concern. Additionally, the availability of alternative coagulants and flocculants, although often less effective or more costly for specific applications, poses a competitive threat. Supply chain disruptions, exacerbated by geopolitical events or logistical issues, can also affect the timely availability of PAC to end-users.

Leading Players in the Poly Aluminum Chloride Industry Market

- Gulbrandsen

- USALCO LLC

- Feralco AB

- George S Coyne Chemical Co Inc

- Kanoria Chemicals & Industries Ltd

- Airedale Chemical

- Kemira

- GEO Specialty Chemicals Inc

- Summit Chemical Specialty Products LLC

- Synergy Multichem Pvt Ltd

- HOLLAND COMPANY

- Aditya Birla Chemicals (India) Limited

Key Developments in Poly Aluminum Chloride Industry Sector

- 2023 March: Kemira launched a new high-performance PAC product for advanced wastewater treatment, enhancing sludge dewatering efficiency.

- 2023 February: USALCO LLC announced a significant expansion of its production capacity for liquid PAC to meet growing North American demand.

- 2022 December: Feralco AB acquired a regional PAC producer in Europe, strengthening its market presence and product portfolio.

- 2022 October: Aditya Birla Chemicals (India) Limited introduced a customized PAC grade for the paper industry, improving paper brightness and strength.

- 2022 July: GEO Specialty Chemicals Inc. unveiled an innovative solid PAC formulation with improved handling characteristics and longer shelf-life.

Strategic Poly Aluminum Chloride Industry Market Outlook

The strategic outlook for the Poly Aluminum Chloride (PAC) industry remains highly positive, driven by sustained global demand for effective water treatment solutions and expanding industrial applications. Growth accelerators include ongoing investments in water infrastructure, particularly in emerging economies, and the increasing adoption of PAC due to its superior performance and environmental benefits compared to traditional coagulants. Future market potential lies in the development of niche PAC formulations tailored for specific industrial challenges, such as micro-pollutant removal or enhanced resource recovery from wastewater. Companies that focus on innovation, cost optimization, and sustainable production practices are poised to capture significant market share. Strategic opportunities also exist in forming partnerships for market penetration in underserved regions and in leveraging digital technologies for enhanced supply chain management and customer service. The industry is expected to witness continued consolidation through strategic M&A activities, further shaping its competitive landscape.

Poly Aluminum Chloride Industry Segmentation

-

1. Form

- 1.1. Solid

- 1.2. Liquid

-

2. End-user Industry

- 2.1. Water Treatment

- 2.2. Paper Industry

- 2.3. Cosmetics and Personal Care

- 2.4. Oil and Gas

- 2.5. Other End-user Industries

Poly Aluminum Chloride Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Poly Aluminum Chloride Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from Large-scale Water Treatment Industries; Increasing Demand in Paper and Pulp Industry

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Conditions Arising Due to COVID-19; Other Restraints

- 3.4. Market Trends

- 3.4.1. Large Scale Water Treatment to Boost Poly Aluminum Chloride Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Poly Aluminum Chloride Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Solid

- 5.1.2. Liquid

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Water Treatment

- 5.2.2. Paper Industry

- 5.2.3. Cosmetics and Personal Care

- 5.2.4. Oil and Gas

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Asia Pacific Poly Aluminum Chloride Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Solid

- 6.1.2. Liquid

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Water Treatment

- 6.2.2. Paper Industry

- 6.2.3. Cosmetics and Personal Care

- 6.2.4. Oil and Gas

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. North America Poly Aluminum Chloride Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Solid

- 7.1.2. Liquid

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Water Treatment

- 7.2.2. Paper Industry

- 7.2.3. Cosmetics and Personal Care

- 7.2.4. Oil and Gas

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Europe Poly Aluminum Chloride Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Solid

- 8.1.2. Liquid

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Water Treatment

- 8.2.2. Paper Industry

- 8.2.3. Cosmetics and Personal Care

- 8.2.4. Oil and Gas

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. South America Poly Aluminum Chloride Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Solid

- 9.1.2. Liquid

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Water Treatment

- 9.2.2. Paper Industry

- 9.2.3. Cosmetics and Personal Care

- 9.2.4. Oil and Gas

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Middle East and Africa Poly Aluminum Chloride Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Solid

- 10.1.2. Liquid

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Water Treatment

- 10.2.2. Paper Industry

- 10.2.3. Cosmetics and Personal Care

- 10.2.4. Oil and Gas

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Asia Pacific Poly Aluminum Chloride Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 China

- 11.1.2 India

- 11.1.3 Japan

- 11.1.4 South Korea

- 11.1.5 Rest of Asia Pacific

- 12. North America Poly Aluminum Chloride Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Poly Aluminum Chloride Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 United Kingdom

- 13.1.3 France

- 13.1.4 Italy

- 13.1.5 Rest of Europe

- 14. South America Poly Aluminum Chloride Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Poly Aluminum Chloride Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 South Africa

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Gulbrandsen

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 USALCO LLC*List Not Exhaustive

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Feralco AB

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 George S Coyne Chemical Co Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Kanoria Chemicals & Industries Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Airedale Chemical

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Kemira

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 GEO Specialty Chemicals Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Summit Chemical Specialty Products LLC

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Synergy Multichem Pvt Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 HOLLAND COMPANY

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Aditya Birla Chemicals (India) Limited

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Gulbrandsen

List of Figures

- Figure 1: Global Poly Aluminum Chloride Industry Revenue Breakdown (undefined, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Poly Aluminum Chloride Industry Revenue (undefined), by Country 2024 & 2032

- Figure 3: Asia Pacific Poly Aluminum Chloride Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Poly Aluminum Chloride Industry Revenue (undefined), by Country 2024 & 2032

- Figure 5: North America Poly Aluminum Chloride Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe Poly Aluminum Chloride Industry Revenue (undefined), by Country 2024 & 2032

- Figure 7: Europe Poly Aluminum Chloride Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Poly Aluminum Chloride Industry Revenue (undefined), by Country 2024 & 2032

- Figure 9: South America Poly Aluminum Chloride Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Poly Aluminum Chloride Industry Revenue (undefined), by Country 2024 & 2032

- Figure 11: Middle East and Africa Poly Aluminum Chloride Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Asia Pacific Poly Aluminum Chloride Industry Revenue (undefined), by Form 2024 & 2032

- Figure 13: Asia Pacific Poly Aluminum Chloride Industry Revenue Share (%), by Form 2024 & 2032

- Figure 14: Asia Pacific Poly Aluminum Chloride Industry Revenue (undefined), by End-user Industry 2024 & 2032

- Figure 15: Asia Pacific Poly Aluminum Chloride Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: Asia Pacific Poly Aluminum Chloride Industry Revenue (undefined), by Country 2024 & 2032

- Figure 17: Asia Pacific Poly Aluminum Chloride Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Poly Aluminum Chloride Industry Revenue (undefined), by Form 2024 & 2032

- Figure 19: North America Poly Aluminum Chloride Industry Revenue Share (%), by Form 2024 & 2032

- Figure 20: North America Poly Aluminum Chloride Industry Revenue (undefined), by End-user Industry 2024 & 2032

- Figure 21: North America Poly Aluminum Chloride Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: North America Poly Aluminum Chloride Industry Revenue (undefined), by Country 2024 & 2032

- Figure 23: North America Poly Aluminum Chloride Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Poly Aluminum Chloride Industry Revenue (undefined), by Form 2024 & 2032

- Figure 25: Europe Poly Aluminum Chloride Industry Revenue Share (%), by Form 2024 & 2032

- Figure 26: Europe Poly Aluminum Chloride Industry Revenue (undefined), by End-user Industry 2024 & 2032

- Figure 27: Europe Poly Aluminum Chloride Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Europe Poly Aluminum Chloride Industry Revenue (undefined), by Country 2024 & 2032

- Figure 29: Europe Poly Aluminum Chloride Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Poly Aluminum Chloride Industry Revenue (undefined), by Form 2024 & 2032

- Figure 31: South America Poly Aluminum Chloride Industry Revenue Share (%), by Form 2024 & 2032

- Figure 32: South America Poly Aluminum Chloride Industry Revenue (undefined), by End-user Industry 2024 & 2032

- Figure 33: South America Poly Aluminum Chloride Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: South America Poly Aluminum Chloride Industry Revenue (undefined), by Country 2024 & 2032

- Figure 35: South America Poly Aluminum Chloride Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Poly Aluminum Chloride Industry Revenue (undefined), by Form 2024 & 2032

- Figure 37: Middle East and Africa Poly Aluminum Chloride Industry Revenue Share (%), by Form 2024 & 2032

- Figure 38: Middle East and Africa Poly Aluminum Chloride Industry Revenue (undefined), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa Poly Aluminum Chloride Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa Poly Aluminum Chloride Industry Revenue (undefined), by Country 2024 & 2032

- Figure 41: Middle East and Africa Poly Aluminum Chloride Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Region 2019 & 2032

- Table 2: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Form 2019 & 2032

- Table 3: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Region 2019 & 2032

- Table 5: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 6: China Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 7: India Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 8: Japan Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 9: South Korea Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 10: Rest of Asia Pacific Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 11: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 12: United States Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 13: Canada Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 14: Mexico Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 15: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 16: Germany Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 18: France Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 19: Italy Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 21: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 22: Brazil Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 23: Argentina Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 24: Rest of South America Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 25: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 26: Saudi Arabia Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 27: South Africa Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 29: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Form 2019 & 2032

- Table 30: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by End-user Industry 2019 & 2032

- Table 31: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 32: China Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 33: India Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 34: Japan Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 35: South Korea Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 36: Rest of Asia Pacific Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 37: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Form 2019 & 2032

- Table 38: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by End-user Industry 2019 & 2032

- Table 39: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 40: United States Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 41: Canada Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 42: Mexico Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 43: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Form 2019 & 2032

- Table 44: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by End-user Industry 2019 & 2032

- Table 45: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 46: Germany Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 47: United Kingdom Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 48: France Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 49: Italy Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 50: Rest of Europe Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 51: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Form 2019 & 2032

- Table 52: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by End-user Industry 2019 & 2032

- Table 53: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 54: Brazil Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 55: Argentina Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 56: Rest of South America Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 57: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Form 2019 & 2032

- Table 58: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by End-user Industry 2019 & 2032

- Table 59: Global Poly Aluminum Chloride Industry Revenue undefined Forecast, by Country 2019 & 2032

- Table 60: Saudi Arabia Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 61: South Africa Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East and Africa Poly Aluminum Chloride Industry Revenue (undefined) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poly Aluminum Chloride Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Poly Aluminum Chloride Industry?

Key companies in the market include Gulbrandsen, USALCO LLC*List Not Exhaustive, Feralco AB, George S Coyne Chemical Co Inc, Kanoria Chemicals & Industries Ltd, Airedale Chemical, Kemira, GEO Specialty Chemicals Inc, Summit Chemical Specialty Products LLC, Synergy Multichem Pvt Ltd, HOLLAND COMPANY, Aditya Birla Chemicals (India) Limited.

3. What are the main segments of the Poly Aluminum Chloride Industry?

The market segments include Form, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from Large-scale Water Treatment Industries; Increasing Demand in Paper and Pulp Industry.

6. What are the notable trends driving market growth?

Large Scale Water Treatment to Boost Poly Aluminum Chloride Market.

7. Are there any restraints impacting market growth?

; Unfavorable Conditions Arising Due to COVID-19; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poly Aluminum Chloride Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poly Aluminum Chloride Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poly Aluminum Chloride Industry?

To stay informed about further developments, trends, and reports in the Poly Aluminum Chloride Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence