Key Insights

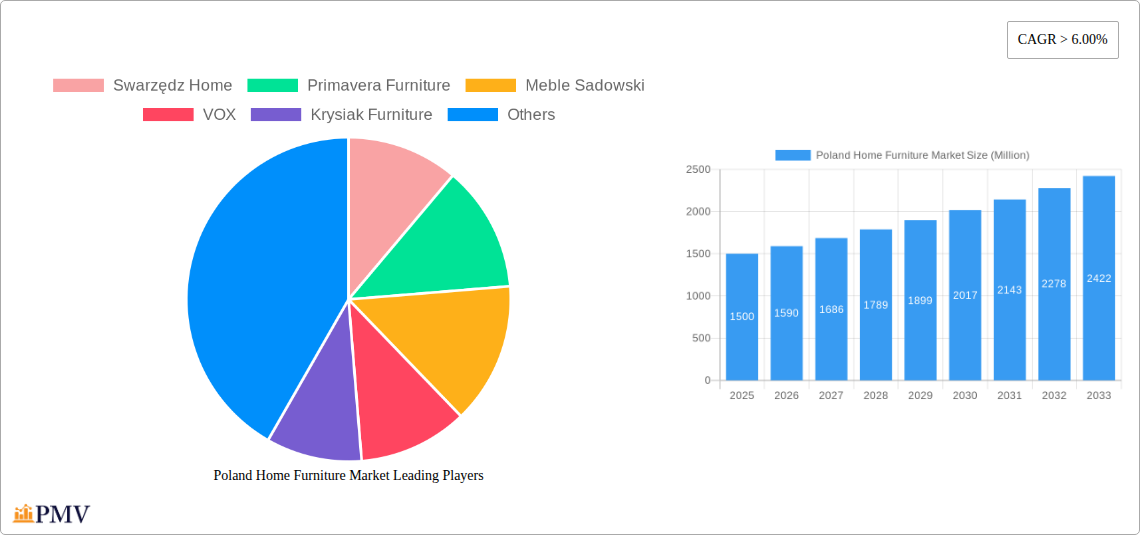

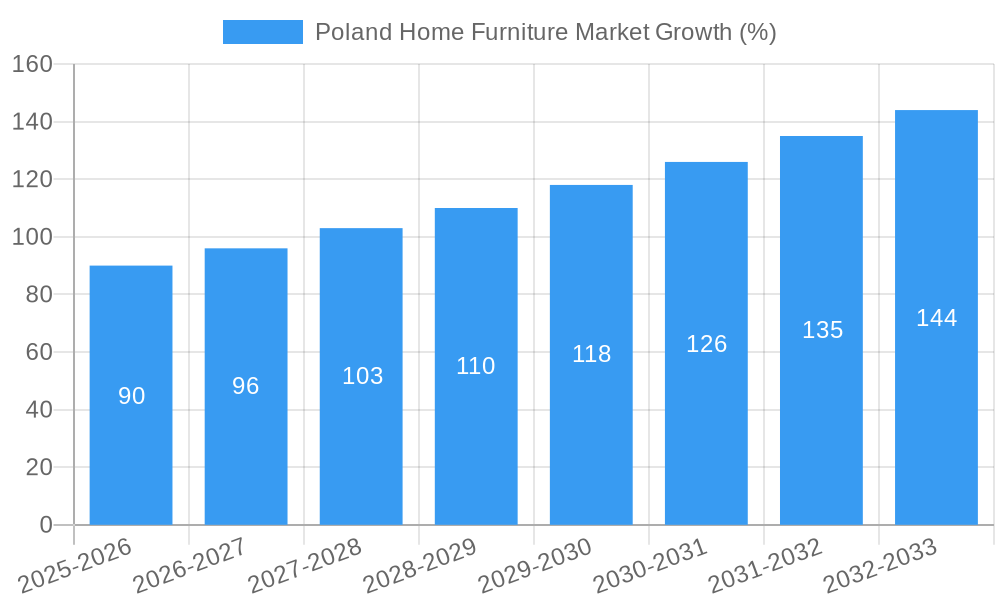

The Polish home furniture market, valued at approximately €1.5 billion in 2025, exhibits robust growth potential, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 6% through 2033. This positive trajectory is fueled by several key factors. Firstly, a rising middle class with increased disposable incomes is driving demand for higher-quality and aesthetically pleasing furniture. Secondly, ongoing urbanization and the construction of new housing units contribute significantly to market expansion. Thirdly, the increasing popularity of online shopping channels, alongside the growth of e-commerce platforms specializing in home furnishings, provides greater accessibility and convenience for consumers. Finally, the evolving design preferences of Polish consumers, mirroring global trends toward minimalist and modern aesthetics, further stimulate demand for new furniture.

However, the market also faces challenges. Fluctuations in raw material prices, particularly wood and metal, pose a risk to production costs and profitability. Competition from established international brands like IKEA and emerging domestic players necessitates continuous innovation and strategic pricing. Furthermore, potential economic downturns could dampen consumer spending on non-essential items like home furniture, creating a period of slower growth. The market is segmented by material (wood, metal, plastic, and others), furniture type (kitchen, living room, bedroom, and others), and distribution channels (supermarkets, specialty stores, online, and others). Dominant players include Swarzędz Home, Primavera Furniture, Meble Sadowski, VOX, and IKEA, each leveraging its strengths in design, distribution, and branding to compete effectively. The market's future success will depend on manufacturers' ability to adapt to shifting consumer preferences, manage supply chain risks, and capitalize on the growing e-commerce segment.

This detailed report provides a comprehensive analysis of the Poland home furniture market, offering invaluable insights for businesses, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market structure, competitive dynamics, industry trends, and future growth potential. The report incorporates extensive data, including market sizing (in Millions), CAGR, and segment-specific growth projections, to deliver actionable intelligence.

Poland Home Furniture Market Market Structure & Competitive Dynamics

The Polish home furniture market is characterized by a mix of large multinational players like IKEA and smaller, domestically-focused companies such as Swarzędz Home and Meble Sadowski. Market concentration is moderate, with the top five players holding an estimated xx% market share in 2025. The market exhibits a dynamic innovation ecosystem, with companies continuously introducing new designs, materials, and manufacturing processes. The regulatory framework is largely supportive of the industry, although compliance requirements can pose challenges for smaller businesses. Product substitution is a notable factor, with increasing consumer interest in sustainable and eco-friendly alternatives. End-user trends show a preference for modern, functional designs, incorporating smart home technologies. M&A activity in the sector has been relatively low in recent years, with a total deal value estimated at xx Million in the 2019-2024 period. Future M&A activity is predicted to increase, driven by consolidation efforts among smaller players and expansion initiatives by larger companies.

- Market Concentration: Moderate, Top 5 players holding xx% market share (2025).

- Innovation Ecosystem: Active, with ongoing development of new designs and materials.

- Regulatory Framework: Supportive, but with compliance complexities.

- Product Substitution: Growing interest in sustainable and eco-friendly options.

- End-User Trends: Preference for modern, functional designs.

- M&A Activity (2019-2024): Estimated value: xx Million.

Poland Home Furniture Market Industry Trends & Insights

The Polish home furniture market is poised for steady growth throughout the forecast period (2025-2033). Key growth drivers include rising disposable incomes, increasing urbanization, and a growing preference for upgrading home furnishings. Technological advancements, such as 3D printing and automated manufacturing, are reshaping the industry, enhancing efficiency and allowing for greater customization. Consumer preferences are evolving towards sustainable and eco-friendly products, creating new opportunities for companies that prioritize environmental responsibility. The competitive landscape is dynamic, with established players facing challenges from emerging competitors and e-commerce platforms. The market is anticipated to achieve a CAGR of xx% during the forecast period, with market penetration of xx% by 2033. The growing popularity of online shopping also contributes to growth.

Dominant Markets & Segments in Poland Home Furniture Market

The largest segment in the Polish home furniture market is living room and dining room furniture, driven by strong consumer demand for aesthetically pleasing and functional pieces. The wood material segment dominates, reflecting traditional preferences and the readily available resource base. Specialty stores remain the primary distribution channel, but online sales are experiencing rapid growth. Key drivers for the dominance of these segments include:

- Living Room & Dining Room Furniture: High consumer demand for stylish and functional pieces.

- Wood Material: Traditional preferences and domestic resource availability.

- Specialty Stores: Established retail infrastructure and customer preference for in-person shopping experience.

Regional dominance is primarily concentrated in urban centers due to higher population density and disposable incomes.

Poland Home Furniture Market Product Innovations

Recent innovations in the Polish home furniture market include the integration of smart home technology into furniture pieces, the use of sustainable and recycled materials, and the rise of customizable furniture options. These advancements cater to consumer demand for functional, environmentally responsible, and personalized furniture. Companies are leveraging advanced manufacturing techniques such as 3D printing to enhance production efficiency and offer tailored solutions. This focus on innovation is contributing to a more competitive and dynamic market.

Report Segmentation & Scope

This report segments the Polish home furniture market based on material (wood, metal, plastic, other), furniture type (kitchen, living room & dining room, bedroom, other), and distribution channel (supermarkets & hypermarkets, specialty stores, online, other). Each segment is analyzed in detail, providing market size estimates, growth projections, and competitive dynamics for the historical period (2019-2024), base year (2025), and forecast period (2025-2033). For example, the wood segment is projected to maintain its dominance, while online sales are expected to witness significant growth throughout the forecast period.

Key Drivers of Poland Home Furniture Market Growth

The Polish home furniture market's growth is driven by several key factors. Rising disposable incomes among the Polish population are fueling increased spending on home furnishings. Urbanization is creating greater demand for modern and stylish furniture. Government initiatives promoting sustainable development and eco-friendly products are also driving the market. The rise of e-commerce further contributes to market growth.

Challenges in the Poland Home Furniture Market Sector

Challenges include fluctuating raw material prices, supply chain disruptions, and intense competition from both domestic and international players. The increasing cost of labor and transportation also pose significant hurdles. Environmental regulations and consumer preference for sustainable products introduce further complexities for manufacturers. Meeting consumer demand for customized products with efficient production presents a notable challenge.

Leading Players in the Poland Home Furniture Market Market

- Swarzędz Home

- Primavera Furniture

- Meble Sadowski

- VOX

- Krysiak Furniture

- IKEA

- Art Mebel

- Mebin Furniture

- BoConcept

- GiB MEBLE

- Meblomir

- MotivHome

- Halupczok

- DFM Sp zoo

Key Developments in Poland Home Furniture Market Sector

- 2021: BoConcept launched a new store model, enhancing the customer experience with consultations and 3D renderings.

- 2021: IKEA Poland and Norway implemented successful circular economy initiatives, reusing spare parts.

Strategic Poland Home Furniture Market Market Outlook

The Polish home furniture market presents significant growth opportunities for companies that can adapt to evolving consumer preferences and technological advancements. Focusing on sustainable materials, offering customized solutions, and leveraging digital platforms will be crucial for success. Strategic partnerships and investments in innovative manufacturing technologies are also expected to play a key role in shaping the market's future. The market is expected to experience sustained growth, driven by consumer spending, infrastructural development, and increasing adoption of eco-friendly products.

Poland Home Furniture Market Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Materials

-

2. Type

- 2.1. Kitchen Furniture

- 2.2. Living Room and Dining Room Furniture

- 2.3. Bedroom Furniture

- 2.4. Other Furniture

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

Poland Home Furniture Market Segmentation By Geography

- 1. Poland

Poland Home Furniture Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Technological Advancement of Smokeless Grilling

- 3.2.2 Infrared heating

- 3.2.3 others driving the market; Rising E-commerce driving sales of smokeless indoor grills

- 3.3. Market Restrains

- 3.3.1. Coal based grills having a significant share in the market; Rising price of electronic appliances with supply chain disruptions in market

- 3.4. Market Trends

- 3.4.1. Increasing Disposable Income is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Home Furniture Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Kitchen Furniture

- 5.2.2. Living Room and Dining Room Furniture

- 5.2.3. Bedroom Furniture

- 5.2.4. Other Furniture

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Swarzędz Home

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Primavera Furniture

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Meble Sadowski

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 VOX

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Krysiak Furniture

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IKEA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Art Mebel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mebin Furniture

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BoConcept

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GiB MEBLE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Meblomir

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 MotivHome

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Halupczok

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 DFM Sp zoo

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Swarzędz Home

List of Figures

- Figure 1: Poland Home Furniture Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland Home Furniture Market Share (%) by Company 2024

List of Tables

- Table 1: Poland Home Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland Home Furniture Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Poland Home Furniture Market Revenue Million Forecast, by Material 2019 & 2032

- Table 4: Poland Home Furniture Market Volume K Unit Forecast, by Material 2019 & 2032

- Table 5: Poland Home Furniture Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Poland Home Furniture Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 7: Poland Home Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Poland Home Furniture Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 9: Poland Home Furniture Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Poland Home Furniture Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Poland Home Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Poland Home Furniture Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Poland Home Furniture Market Revenue Million Forecast, by Material 2019 & 2032

- Table 14: Poland Home Furniture Market Volume K Unit Forecast, by Material 2019 & 2032

- Table 15: Poland Home Furniture Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Poland Home Furniture Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 17: Poland Home Furniture Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Poland Home Furniture Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 19: Poland Home Furniture Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Poland Home Furniture Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Home Furniture Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Poland Home Furniture Market?

Key companies in the market include Swarzędz Home, Primavera Furniture, Meble Sadowski, VOX, Krysiak Furniture, IKEA, Art Mebel, Mebin Furniture, BoConcept, GiB MEBLE, Meblomir, MotivHome, Halupczok, DFM Sp zoo.

3. What are the main segments of the Poland Home Furniture Market?

The market segments include Material, Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancement of Smokeless Grilling. Infrared heating. others driving the market; Rising E-commerce driving sales of smokeless indoor grills.

6. What are the notable trends driving market growth?

Increasing Disposable Income is Driving the Market.

7. Are there any restraints impacting market growth?

Coal based grills having a significant share in the market; Rising price of electronic appliances with supply chain disruptions in market.

8. Can you provide examples of recent developments in the market?

In 2021, BoConcept opened a new store model. The store featured a refreshed, evolved store concept that offers customers an elevated take on the shopping experience, including consultations and the ability to create a 3D rendering of the space the customer would like to design.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Home Furniture Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Home Furniture Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Home Furniture Market?

To stay informed about further developments, trends, and reports in the Poland Home Furniture Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence