Key Insights

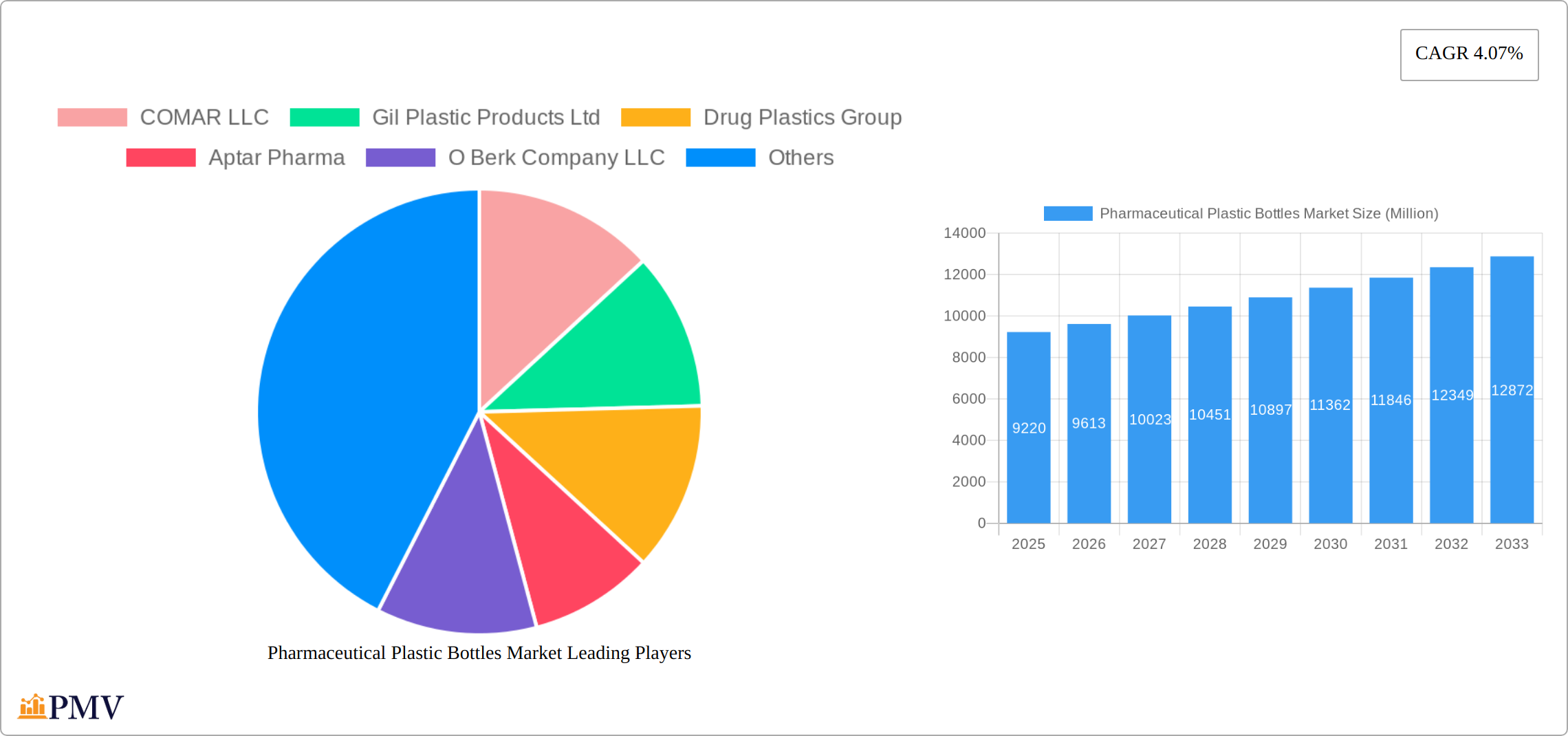

The pharmaceutical plastic bottles market, valued at $9.22 billion in 2025, is projected to experience robust growth, driven by the increasing demand for pharmaceutical products globally and the inherent advantages of plastic bottles in terms of cost-effectiveness, lightweight nature, and ease of sterilization. The market's Compound Annual Growth Rate (CAGR) of 4.07% from 2019 to 2024 suggests a consistent upward trajectory, expected to continue throughout the forecast period (2025-2033). Key growth drivers include the rising prevalence of chronic diseases necessitating long-term medication, the expanding pharmaceutical industry in emerging economies, and the growing adoption of single-dose and multi-dose packaging solutions for improved patient convenience and medication adherence. Market segmentation reveals significant contributions from PET and HDPE materials, reflecting their widespread use due to their barrier properties and suitability for various pharmaceutical applications. Solid containers and dropper bottles currently dominate the type segment, although nasal spray and liquid bottles are anticipated to witness faster growth, fueled by innovation in drug delivery systems. Major players like Amcor Limited, Gerresheimer AG, and Berry Group Inc. are actively shaping the market through strategic expansions, product innovation, and acquisitions, thereby driving market consolidation.

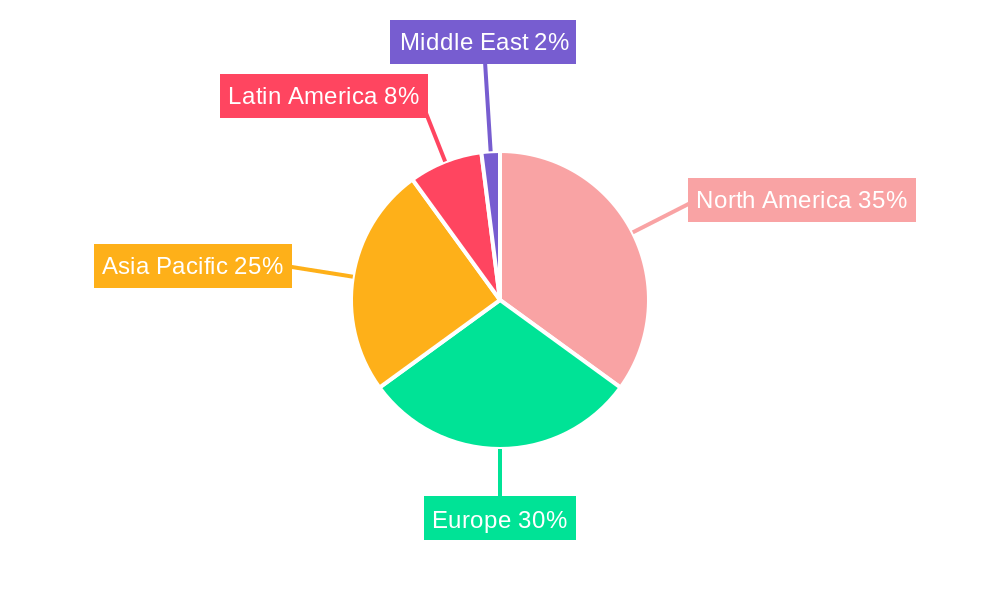

The geographic landscape indicates a strong presence across North America and Europe, with significant growth potential in the Asia-Pacific region, driven by expanding healthcare infrastructure and increasing disposable incomes. While regulatory hurdles related to plastic waste management present a restraint, the industry's increasing adoption of sustainable practices, such as the use of recycled materials and biodegradable alternatives, is mitigating this concern. Furthermore, advancements in bottle design, including tamper-evident closures and child-resistant packaging, are enhancing product safety and further fueling market growth. The competitive landscape is characterized by both large multinational corporations and specialized regional players, each contributing to innovation and diversification within the pharmaceutical plastic bottles market. The forecast period promises sustained expansion, driven by the interplay of technological advancements, evolving regulatory landscapes, and the ever-growing need for effective and safe pharmaceutical packaging.

Pharmaceutical Plastic Bottles Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the global Pharmaceutical Plastic Bottles Market, covering market size, growth projections, competitive landscape, and key industry trends from 2019 to 2033. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024. This report is crucial for stakeholders seeking actionable insights into this dynamic market, identifying lucrative opportunities, and navigating the competitive landscape.

Pharmaceutical Plastic Bottles Market Structure & Competitive Dynamics

The Pharmaceutical Plastic Bottles Market is characterized by a moderately concentrated competitive landscape with both large multinational corporations and specialized regional players. The market share is distributed among several key players, with the top five companies accounting for approximately xx% of the global market in 2025. This concentration is partially driven by significant capital investments required for manufacturing and stringent regulatory compliance. Innovation is a key differentiator, with companies investing heavily in R&D to develop sustainable and high-performance materials and designs. The regulatory framework varies across regions, influencing material choices and manufacturing processes. Product substitutes, such as glass bottles, exist, but plastic offers advantages in terms of cost, weight, and shatter resistance. End-user trends towards sustainable packaging and increasing demand for specialized drug delivery systems are reshaping market dynamics. Mergers and acquisitions (M&A) activity is relatively frequent, with deal values averaging xx Million in recent years, reflecting the consolidation trend and the pursuit of market expansion.

- Market Concentration: Moderately concentrated, with top 5 companies holding approximately xx% market share in 2025.

- Innovation Ecosystems: Significant R&D investment in sustainable materials and advanced designs.

- Regulatory Frameworks: Vary across regions, impacting material selection and manufacturing.

- Product Substitutes: Glass bottles offer limited competition due to cost and fragility.

- End-User Trends: Growing demand for sustainable packaging and specialized delivery systems.

- M&A Activities: Frequent M&A activity, with average deal values around xx Million.

Pharmaceutical Plastic Bottles Market Industry Trends & Insights

The Pharmaceutical Plastic Bottles Market is poised for significant expansion throughout the forecast period (2025-2033), projected to achieve a robust CAGR of [Insert Projected CAGR Here]%. This growth trajectory is fueled by a confluence of factors. The escalating global burden of chronic illnesses necessitates a corresponding increase in pharmaceutical production and packaging, thereby driving market demand. Simultaneously, the pharmaceutical industry's ongoing technological transformation, encompassing the development of innovative drug delivery systems such as inhalers and injectables, necessitates specialized plastic bottles with enhanced functionalities, further accelerating market expansion. Consumer preferences are demonstrably shifting towards convenience and enhanced safety features, creating a strong demand for tamper-evident closures and child-resistant packaging. The competitive landscape is characterized by intense activity, including product innovation, strategic alliances, and mergers & acquisitions, compelling companies to continuously improve their offerings and broaden their market reach. Furthermore, the adoption of sustainable and eco-friendly plastic materials, such as bio-based polymers, is steadily gaining traction.

Dominant Markets & Segments in Pharmaceutical Plastic Bottles Market

The North American region currently dominates the Pharmaceutical Plastic Bottles Market, driven by a robust pharmaceutical industry and high per capita healthcare expenditure. Within the segment breakdown:

By Raw Material:

- Polyethylene Terephthalate (PET): This segment holds the largest market share due to its lightweight, transparency, and barrier properties.

- Polypropylene (PP): Strong demand for PP bottles in oral care and other applications.

- Low-density Polyethylene (LDPE): Widely used for flexible packaging solutions.

- High-density Polyethylene (HDPE): Popular choice for its durability and chemical resistance.

By Type:

- Liquid Bottles: This segment dominates the market due to the high volume of liquid pharmaceuticals.

- Dropper Bottles: High demand in ophthalmic and other specialized applications.

- Nasal Spray Bottles: Steady growth fueled by the rising prevalence of respiratory ailments.

- Solid Containers: Significant use for solid dosage forms like tablets and capsules.

- Oral Care: Growing demand due to the popularity of oral hygiene products.

- Other Types: This category includes specialized containers for various pharmaceutical applications.

Key Drivers (Regional Dominance):

- Strong pharmaceutical industry presence.

- High healthcare expenditure.

- Advanced healthcare infrastructure.

- Favorable regulatory environment.

The European market shows significant growth potential, while emerging economies in Asia-Pacific present attractive long-term prospects.

Pharmaceutical Plastic Bottles Market Product Innovations

Recent innovations within the sector have centered on enhancing the sustainability, safety, and overall functionality of pharmaceutical plastic bottles. Key advancements include the development and implementation of bio-based plastics, the improvement of barrier properties to ensure optimal drug efficacy, and the integration of sophisticated smart packaging technologies to bolster security and traceability. The overarching focus remains on creating eco-friendly, tamper-evident, and user-friendly designs that cater to the evolving needs of both pharmaceutical manufacturers and end-consumers. These innovations are strategically designed to provide a competitive advantage through superior product performance, reduced environmental impact, and elevated consumer experiences.

Report Segmentation & Scope

This report segments the Pharmaceutical Plastic Bottles Market by raw material (PET, PP, LDPE, HDPE) and by type (Solid Containers, Dropper Bottles, Nasal Spray Bottles, Liquid Bottles, Oral Care, Other Types). Each segment is analyzed in detail, providing market size, growth projections, and competitive dynamics. For instance, the PET segment is projected to maintain its dominant position due to its cost-effectiveness and performance attributes, while the Dropper Bottles segment is anticipated to experience significant growth due to the increasing demand for ophthalmic and other specialized drug delivery systems. The report further provides regional breakdowns, offering a granular understanding of market opportunities across different geographic areas.

Key Drivers of Pharmaceutical Plastic Bottles Market Growth

The growth of the Pharmaceutical Plastic Bottles Market is driven by several key factors: the rising global prevalence of chronic diseases, increasing demand for convenient and safe drug packaging, technological advancements in drug delivery systems, and the growing adoption of sustainable packaging solutions. Government regulations promoting the use of eco-friendly materials also contribute to market expansion. The rising disposable incomes and increasing healthcare awareness in developing economies are further boosting market demand.

Challenges in the Pharmaceutical Plastic Bottles Market Sector

The Pharmaceutical Plastic Bottles Market faces a number of substantial challenges, including the stringent regulatory landscape, concerns surrounding plastic waste and environmental sustainability, volatility in raw material pricing, and the fiercely competitive nature of the manufacturing sector. Supply chain disruptions, particularly those stemming from global crises, can significantly impact production volumes and delivery timelines. Meeting the growing demand for sustainable yet high-performing plastic packaging solutions represents a critical challenge that mandates continuous innovation and substantial investment.

Leading Players in the Pharmaceutical Plastic Bottles Market Market

- COMAR LLC

- Gil Plastic Products Ltd

- Drug Plastics Group

- Aptar Pharma

- O Berk Company LLC

- Alpha Packaging

- Frapak Packagin

- Pro-Pac Packaging Ltd

- Amcor Limited

- Gerresheimer AG

- Berry Group Inc

Key Developments in Pharmaceutical Plastic Bottles Market Sector

- May 2022: Gerresheimer AG expands manufacturing capabilities in India, enhancing local supply for pharma and healthcare.

- November 2021: Santen Pharmaceutical Co. Ltd. plans to launch the first bio-based plastic eye drop bottle in EMEA, furthering its zero-carbon commitment.

Strategic Pharmaceutical Plastic Bottles Market Market Outlook

The future of the Pharmaceutical Plastic Bottles Market appears bright, with significant growth potential driven by ongoing technological advancements, increasing demand for sustainable packaging, and the growing prevalence of chronic diseases globally. Strategic opportunities lie in developing innovative, eco-friendly packaging solutions that meet the evolving needs of pharmaceutical companies and consumers. Companies focusing on sustainability, enhanced product safety, and efficient supply chain management are poised to gain a competitive edge in this dynamic market.

Pharmaceutical Plastic Bottles Market Segmentation

-

1. Raw Material

- 1.1. Polyethylene Terephthalate (PET)

- 1.2. Poly Propylene (PP)

- 1.3. Low-density Poly Ethylene (LDPE)

- 1.4. High-density Poly Ethylene (HDPE)

-

2. Type

- 2.1. Solid Containers

- 2.2. Dropper Bottles

- 2.3. Nasal Spray Bottles

- 2.4. Liquid Bottles

- 2.5. Oral Care

- 2.6. Other Types

Pharmaceutical Plastic Bottles Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Mexico

-

6. Middle East and Africa

- 6.1. Saudi Arabia

- 6.2. United Arab Emirates

- 6.3. South Africa

Pharmaceutical Plastic Bottles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Need for Lightweight Pharma Bottles by Consumers; Increasing Spending on Healthcare and Pharmaceutical to Augment the Market Growth

- 3.3. Market Restrains

- 3.3.1. Increasing Raw Material Costs; Environmental Concerns over Usage of Plastics

- 3.4. Market Trends

- 3.4.1. HDPE Segment to Report the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polyethylene Terephthalate (PET)

- 5.1.2. Poly Propylene (PP)

- 5.1.3. Low-density Poly Ethylene (LDPE)

- 5.1.4. High-density Poly Ethylene (HDPE)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Solid Containers

- 5.2.2. Dropper Bottles

- 5.2.3. Nasal Spray Bottles

- 5.2.4. Liquid Bottles

- 5.2.5. Oral Care

- 5.2.6. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. North America Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. Polyethylene Terephthalate (PET)

- 6.1.2. Poly Propylene (PP)

- 6.1.3. Low-density Poly Ethylene (LDPE)

- 6.1.4. High-density Poly Ethylene (HDPE)

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Solid Containers

- 6.2.2. Dropper Bottles

- 6.2.3. Nasal Spray Bottles

- 6.2.4. Liquid Bottles

- 6.2.5. Oral Care

- 6.2.6. Other Types

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. Europe Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. Polyethylene Terephthalate (PET)

- 7.1.2. Poly Propylene (PP)

- 7.1.3. Low-density Poly Ethylene (LDPE)

- 7.1.4. High-density Poly Ethylene (HDPE)

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Solid Containers

- 7.2.2. Dropper Bottles

- 7.2.3. Nasal Spray Bottles

- 7.2.4. Liquid Bottles

- 7.2.5. Oral Care

- 7.2.6. Other Types

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Asia Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. Polyethylene Terephthalate (PET)

- 8.1.2. Poly Propylene (PP)

- 8.1.3. Low-density Poly Ethylene (LDPE)

- 8.1.4. High-density Poly Ethylene (HDPE)

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Solid Containers

- 8.2.2. Dropper Bottles

- 8.2.3. Nasal Spray Bottles

- 8.2.4. Liquid Bottles

- 8.2.5. Oral Care

- 8.2.6. Other Types

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. Australia and New Zealand Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. Polyethylene Terephthalate (PET)

- 9.1.2. Poly Propylene (PP)

- 9.1.3. Low-density Poly Ethylene (LDPE)

- 9.1.4. High-density Poly Ethylene (HDPE)

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Solid Containers

- 9.2.2. Dropper Bottles

- 9.2.3. Nasal Spray Bottles

- 9.2.4. Liquid Bottles

- 9.2.5. Oral Care

- 9.2.6. Other Types

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. Latin America Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. Polyethylene Terephthalate (PET)

- 10.1.2. Poly Propylene (PP)

- 10.1.3. Low-density Poly Ethylene (LDPE)

- 10.1.4. High-density Poly Ethylene (HDPE)

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Solid Containers

- 10.2.2. Dropper Bottles

- 10.2.3. Nasal Spray Bottles

- 10.2.4. Liquid Bottles

- 10.2.5. Oral Care

- 10.2.6. Other Types

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. Middle East and Africa Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Raw Material

- 11.1.1. Polyethylene Terephthalate (PET)

- 11.1.2. Poly Propylene (PP)

- 11.1.3. Low-density Poly Ethylene (LDPE)

- 11.1.4. High-density Poly Ethylene (HDPE)

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Solid Containers

- 11.2.2. Dropper Bottles

- 11.2.3. Nasal Spray Bottles

- 11.2.4. Liquid Bottles

- 11.2.5. Oral Care

- 11.2.6. Other Types

- 11.1. Market Analysis, Insights and Forecast - by Raw Material

- 12. North America Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 13. Europe Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 Germany

- 13.1.3 France

- 13.1.4 Rest of Europe

- 14. Asia Pacific Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 India

- 14.1.3 Japan

- 14.1.4 Rest of Asia Pacific

- 15. Latin America Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Mexico

- 15.1.4 Rest of Latin America

- 16. Middle East Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Saudi Arabia Pharmaceutical Plastic Bottles Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1 United Arab Emirates

- 17.1.2 South Africa

- 17.1.3 Rest of Middle East

- 18. Competitive Analysis

- 18.1. Global Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 COMAR LLC

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Gil Plastic Products Ltd

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Drug Plastics Group

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Aptar Pharma

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 O Berk Company LLC

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Alpha Packaging

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Frapak Packagin

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Pro-Pac Packaging Ltd

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Amcor Limited

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Gerresheimer AG

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.11 Berry Group Inc

- 18.2.11.1. Overview

- 18.2.11.2. Products

- 18.2.11.3. SWOT Analysis

- 18.2.11.4. Recent Developments

- 18.2.11.5. Financials (Based on Availability)

- 18.2.1 COMAR LLC

List of Figures

- Figure 1: Global Pharmaceutical Plastic Bottles Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: Saudi Arabia Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Saudi Arabia Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Pharmaceutical Plastic Bottles Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 15: North America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 16: North America Pharmaceutical Plastic Bottles Market Revenue (Million), by Type 2024 & 2032

- Figure 17: North America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: North America Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Pharmaceutical Plastic Bottles Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 21: Europe Pharmaceutical Plastic Bottles Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 22: Europe Pharmaceutical Plastic Bottles Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Pharmaceutical Plastic Bottles Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pharmaceutical Plastic Bottles Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 27: Asia Pharmaceutical Plastic Bottles Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 28: Asia Pharmaceutical Plastic Bottles Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pharmaceutical Plastic Bottles Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Australia and New Zealand Pharmaceutical Plastic Bottles Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 33: Australia and New Zealand Pharmaceutical Plastic Bottles Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 34: Australia and New Zealand Pharmaceutical Plastic Bottles Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Australia and New Zealand Pharmaceutical Plastic Bottles Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Australia and New Zealand Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Australia and New Zealand Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Latin America Pharmaceutical Plastic Bottles Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 39: Latin America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 40: Latin America Pharmaceutical Plastic Bottles Market Revenue (Million), by Type 2024 & 2032

- Figure 41: Latin America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Type 2024 & 2032

- Figure 42: Latin America Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Pharmaceutical Plastic Bottles Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 45: Middle East and Africa Pharmaceutical Plastic Bottles Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 46: Middle East and Africa Pharmaceutical Plastic Bottles Market Revenue (Million), by Type 2024 & 2032

- Figure 47: Middle East and Africa Pharmaceutical Plastic Bottles Market Revenue Share (%), by Type 2024 & 2032

- Figure 48: Middle East and Africa Pharmaceutical Plastic Bottles Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Middle East and Africa Pharmaceutical Plastic Bottles Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 3: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Brazil Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Argentina Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Latin America Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Arab Emirates Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: South Africa Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 30: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 35: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: United Kingdom Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Germany Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 41: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 42: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 43: China Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: India Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Japan Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 47: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 48: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 50: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 51: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: Brazil Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Argentina Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Mexico Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 56: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Type 2019 & 2032

- Table 57: Global Pharmaceutical Plastic Bottles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Saudi Arabia Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: United Arab Emirates Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: South Africa Pharmaceutical Plastic Bottles Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Plastic Bottles Market?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the Pharmaceutical Plastic Bottles Market?

Key companies in the market include COMAR LLC, Gil Plastic Products Ltd, Drug Plastics Group, Aptar Pharma, O Berk Company LLC, Alpha Packaging, Frapak Packagin, Pro-Pac Packaging Ltd, Amcor Limited, Gerresheimer AG, Berry Group Inc.

3. What are the main segments of the Pharmaceutical Plastic Bottles Market?

The market segments include Raw Material, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Need for Lightweight Pharma Bottles by Consumers; Increasing Spending on Healthcare and Pharmaceutical to Augment the Market Growth.

6. What are the notable trends driving market growth?

HDPE Segment to Report the Highest Growth Rate.

7. Are there any restraints impacting market growth?

Increasing Raw Material Costs; Environmental Concerns over Usage of Plastics.

8. Can you provide examples of recent developments in the market?

May 2022 - Gerresheimer AG has enhanced its manufacturing capabilities in India to ensure consistent local supply for pharma and healthcare operations. The company has opened a new plant to produce plastic containers and closures at its Kosamba manufacturing site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Plastic Bottles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Plastic Bottles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Plastic Bottles Market?

To stay informed about further developments, trends, and reports in the Pharmaceutical Plastic Bottles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence