Key Insights

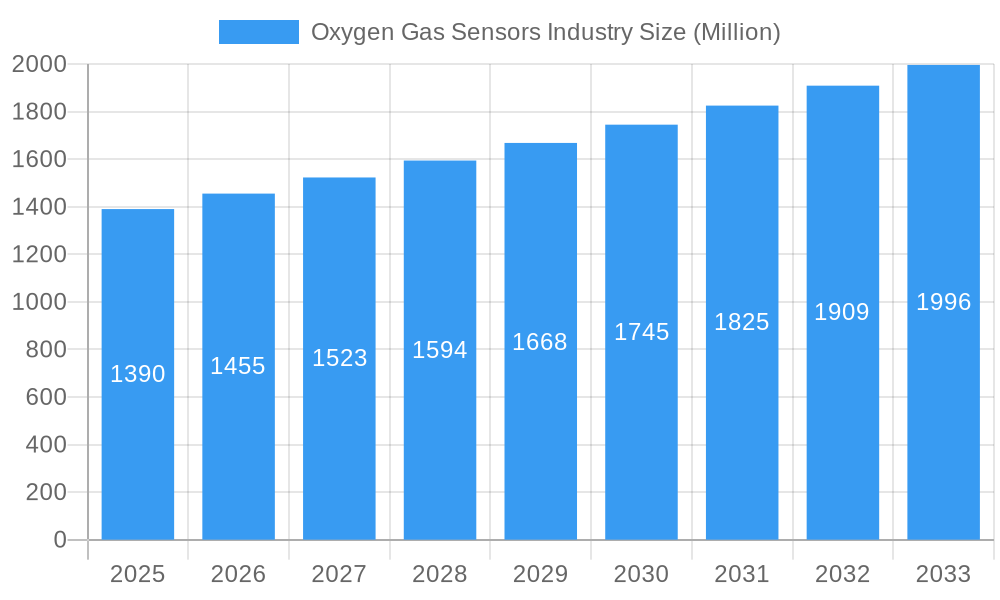

The global Oxygen Gas Sensors market is projected for robust expansion, estimated at USD 1.39 Billion in 2025 and poised for substantial growth at a Compound Annual Growth Rate (CAGR) of 4.76% through 2033. This dynamic growth is fueled by an increasing demand for precise oxygen monitoring across a multitude of critical applications. The chemical and petrochemical industries are leading this charge, requiring highly accurate sensors for process control, safety monitoring, and compliance. Furthermore, the automotive sector's burgeoning need for efficient emission control systems, coupled with the medical and life sciences industry's reliance on oxygen sensors for respiratory monitoring and diagnostic equipment, significantly contributes to market expansion. The industrial sector, including manufacturing and energy, also presents a consistent demand for reliable oxygen sensing solutions. The "Smart Buildings" trend is further accelerating adoption, as these systems increasingly integrate air quality monitoring, including oxygen levels, for enhanced occupant comfort and safety.

Oxygen Gas Sensors Industry Market Size (In Billion)

Technological advancements are playing a pivotal role in shaping the oxygen gas sensor market. The evolution from traditional potentiometric and amperometric sensors to more advanced infrared and catalytic technologies is enhancing performance, accuracy, and longevity. These newer technologies offer improved resistance to interference and broader detection ranges, making them suitable for increasingly demanding environments. While the market exhibits strong growth potential, certain restraints exist, such as the high initial cost of advanced sensor technologies and the need for regular calibration and maintenance in certain applications. However, ongoing research and development efforts are focused on reducing costs and improving ease of use. Key market players like Honeywell International Corporation, Mettler-Toledo International Inc, and Figaro Engineering Inc are actively innovating, launching new products, and expanding their presence across major regions, including North America, Europe, and Asia, to capitalize on this expanding market opportunity.

Oxygen Gas Sensors Industry Company Market Share

This comprehensive report delivers a detailed analysis of the global Oxygen Gas Sensors market, offering critical insights into market dynamics, growth drivers, segmentation, and competitive landscape. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this report provides a strategic roadmap for stakeholders seeking to capitalize on the evolving opportunities within this vital industry. The market is projected to reach a value of over 10 Million USD by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

Oxygen Gas Sensors Industry Market Structure & Competitive Dynamics

The global Oxygen Gas Sensors market exhibits a moderately concentrated structure, characterized by the presence of established global players and emerging regional manufacturers. Innovation plays a pivotal role, with companies consistently investing in research and development to enhance sensor accuracy, miniaturization, and lifespan. The competitive ecosystem is shaped by robust intellectual property protection, stringent quality certifications, and the increasing demand for specialized sensor solutions. Regulatory frameworks, particularly in automotive and medical applications, significantly influence product development and market entry.

Key aspects of market structure and dynamics include:

- Market Concentration: Dominated by a few key players, but with increasing opportunities for niche market specialists.

- Innovation Ecosystems: Driven by advancements in material science, MEMS technology, and signal processing.

- Regulatory Frameworks: Compliance with standards like ISO 13485 for medical devices and stringent automotive emission regulations is crucial.

- Product Substitutes: While direct substitutes are limited for core oxygen sensing functions, alternative monitoring methods and integrated solutions are emerging.

- End-User Trends: Growing demand for real-time monitoring, predictive maintenance, and integration with IoT platforms.

- M&A Activities: Strategic acquisitions and partnerships are observed to expand product portfolios, gain market access, and consolidate technological expertise. Notable M&A deals in the past have ranged from xx Million USD to over xx Million USD, signaling a healthy appetite for consolidation and growth.

Oxygen Gas Sensors Industry Industry Trends & Insights

The Oxygen Gas Sensors industry is experiencing robust growth, propelled by escalating demand across diverse end-user sectors and continuous technological advancements. The increasing emphasis on industrial safety, environmental monitoring, and healthcare diagnostics are significant market growth drivers. The automotive sector's transition towards stricter emission standards and the burgeoning adoption of advanced driver-assistance systems (ADAS) are creating substantial demand for highly accurate and reliable oxygen sensors. In the medical field, the rising prevalence of respiratory diseases and the growing need for patient monitoring in critical care settings are fueling market expansion.

Technological disruptions are at the forefront of this growth. The development of novel sensing technologies, such as advanced electrochemical cells, solid-state sensors, and miniaturized infrared (IR) sensors, is enhancing performance characteristics like sensitivity, response time, and operational lifespan. Furthermore, the integration of AI and machine learning algorithms with oxygen sensor data is enabling more sophisticated analytical capabilities and predictive maintenance solutions. Consumer preferences are shifting towards smaller, more energy-efficient, and cost-effective sensor solutions with seamless connectivity. The competitive dynamics are intensifying, with companies focusing on product differentiation, strategic alliances, and expanding their global distribution networks to capture market share. The market penetration of advanced oxygen sensors is expected to rise significantly, driven by their indispensable role in ensuring safety, efficiency, and compliance across industries. The projected market size is expected to exceed 10 Million USD by 2025.

Dominant Markets & Segments in Oxygen Gas Sensors Industry

The Industrial end-user industry segment is currently the dominant market for oxygen gas sensors, driven by widespread applications in process control, safety monitoring, and environmental compliance across sectors like chemical and petrochemical, manufacturing, and power generation. The Automotive sector is rapidly emerging as a key growth engine, fueled by stringent emission control regulations and the increasing sophistication of internal combustion engines and hybrid/electric vehicle powertrains.

Key Segment Dominance:

Type:

- Amperometric: This type leads due to its high accuracy, sensitivity, and versatility, finding extensive use in industrial and medical applications. Its dominance is projected to continue with an estimated market share of over xx% by 2025.

- Potentiometric: While established, its market share is steadily growing, particularly in applications requiring long-term stability.

- Resistive: Primarily used in lower-cost applications, its growth is more moderate compared to amperometric sensors.

Technology:

- Infrared (IR): Dominates applications requiring non-depleting sensing and long operational life, especially in industrial combustion control and medical anesthesia. Its market share is expected to be around xx% by 2025.

- Catalytic: Remains crucial for flammable gas detection, often used in conjunction with oxygen sensing for safety applications in industrial settings.

- Other Technologies: Including solid-state and advanced electrochemical, these are gaining traction due to their miniaturization and enhanced performance.

End-User Industry:

- Industrial: This segment accounts for the largest market share, estimated at over xx% by 2025, driven by safety and process optimization needs.

- Automotive: Exhibits the highest growth potential, driven by emission regulations and evolving vehicle technologies.

- Medical and Life Sciences: Critical for patient care and diagnostics, this segment shows consistent and significant demand.

- Chemical and Petrochemical: High demand for safety and process control applications.

- Water and Wastewater: Essential for process monitoring and environmental compliance.

- Smart Buildings: Growing adoption for indoor air quality monitoring and energy efficiency.

The dominance of these segments is underpinned by factors such as evolving economic policies favoring industrial automation and environmental protection, substantial infrastructure development in emerging economies, and increasing awareness of health and safety standards globally.

Oxygen Gas Sensors Industry Product Innovations

Product innovation in the Oxygen Gas Sensors industry is driven by the relentless pursuit of enhanced accuracy, miniaturization, and extended operational life. Manufacturers are developing novel sensor materials and designs to improve sensitivity, reduce response times, and increase resistance to interfering gases. Applications are expanding beyond traditional safety and process control to include sophisticated diagnostics in the automotive sector, advanced patient monitoring in healthcare, and integrated environmental sensing for smart cities. The competitive advantage lies in offering integrated solutions, wireless connectivity, and predictive analytics capabilities, alongside robust performance.

Report Segmentation & Scope

This report meticulously segments the Oxygen Gas Sensors market by Type, Technology, and End-User Industry to provide a granular view of market dynamics.

- Type: The market is segmented into Potentiometric, Amperometric, Resistive, and Other Types. The Amperometric segment, projected to reach a market size of over xx Million USD by 2025, is expected to lead due to its superior performance characteristics and broad applicability across industrial and medical sectors.

- Technology: Key technologies include Infrared, Catalytic, and Other Technologies. The Infrared segment is anticipated to dominate, driven by its non-depleting nature and suitability for long-term, stable measurements, with an estimated market share of xx% by 2025.

- End-User Industry: Segmentation encompasses Chemical and Petrochemical, Automotive, Medical and Life Sciences, Industrial, Water and Wastewater, Smart Buildings, and Other End-User Industries. The Industrial segment, projected to exceed xx Million USD in value by 2025, is the largest, while the Automotive segment offers the highest growth trajectory.

Key Drivers of Oxygen Gas Sensors Industry Growth

The growth of the Oxygen Gas Sensors industry is propelled by several key factors:

- Stringent Safety Regulations: Increasing global regulations for industrial safety, emission control in vehicles, and patient monitoring in healthcare mandate the use of reliable oxygen sensors.

- Technological Advancements: Innovations in sensor materials, miniaturization (MEMS), and integration with IoT and AI are enhancing sensor performance, functionality, and cost-effectiveness.

- Industrial Automation & Process Optimization: The drive for greater efficiency and reduced operational costs in manufacturing, chemical processing, and energy sectors necessitates precise oxygen monitoring.

- Growing Healthcare Demands: Rising incidences of respiratory diseases and the expansion of critical care units globally are increasing the demand for medical-grade oxygen sensors.

- Environmental Monitoring Initiatives: Growing concern over air quality and industrial emissions fuels the adoption of oxygen sensors for environmental surveillance.

Challenges in the Oxygen Gas Sensors Industry Sector

Despite robust growth, the Oxygen Gas Sensors industry faces several challenges:

- Sensor Drift and Calibration: Maintaining long-term accuracy and requiring frequent calibration can increase operational costs and complexity for end-users.

- Interference from Other Gases: Certain sensor types can be susceptible to interference from other gases present in the environment, leading to inaccurate readings.

- Cost Sensitivity in Certain Applications: While technology is advancing, the initial cost of high-performance sensors can be a barrier for adoption in price-sensitive markets.

- Supply Chain Volatility: Geopolitical factors and the reliance on specific raw materials can lead to supply chain disruptions and price fluctuations.

- Competition from Alternative Technologies: While direct substitutes are limited, advancements in non-sensor-based monitoring techniques and integrated systems pose indirect competition.

Leading Players in the Oxygen Gas Sensors Industry Market

- Honeywell International Corporation

- Mettler-Toledo International Inc

- Figaro Engineering Inc

- Aeroqual Limited

- Delphi Automotive PLC

- Francisco Albero SAU

- Robert Bosch GmbH

- City Technology Limited

- Control Instruments Corporation

- Hamilton Company

- Yokogawa Electric Corporation

- Sensore Electronic GmbH

- Maxtec LLC

- ABB Limited

- Fujikura Limited

- General Electric Company

- AlphaSense Inc

- Advanced Micro Instruments Inc

- Membrapor AG

- Eaton Corporation

Key Developments in Oxygen Gas Sensors Industry Sector

- May 2023: The DD-Scientific team announced an impressive expansion of their operations, marked by significant growth and a continuous influx of new customers. This sustained success has culminated in the establishment of a state-of-the-art Centre of Excellence dedicated to the production of oxygen sensors. Alongside this milestone, DD-Scientific has made substantial investments in automation and testing, solidifying its position as a leading supplier of world-class sensors. Their remarkable achievements stand tall even amidst competition from larger industry players.

- March 2023: German students from Leibniz University of Hannover selected the EC Sense TB200B-ES1-O2-25% Oxygen Gas Sensor Module for inclusion in a space experiment. This innovative experiment, destined for the International Space Station (ISS), aims to explore the intricate relationship between clover plants and rhizobia bacteria under microgravity conditions. This unique collaboration seeks to unravel the phenomenon of self-fertilization in this context.

- August 2022: Endress+Hauser unveiled a groundbreaking lineup of Liquid Analysis disinfection sensors and accompanying accessories tailored for an expanded range of applications. This release includes the CCS55D Memosens Free amperometric Bromine sensor, the CCS58D Memosens Ozone sensor, and the versatile Flowfit CYA27 assembly. The CYA27 assembly boasts unmatched flexibility, accommodating a variety of sensors, from disinfection and pH to conductivity and dissolved oxygen. In addition, it offers comprehensive flow monitoring and diagnostic indicator options, ensuring precise measurements across a spectrum of disinfection applications.

Strategic Oxygen Gas Sensors Industry Market Outlook

The strategic outlook for the Oxygen Gas Sensors market is highly positive, driven by increasing global adoption across critical sectors. The confluence of tightening environmental regulations, advancements in medical technology, and the pervasive integration of IoT in industrial and smart building applications will continue to fuel demand. Investments in research and development for next-generation sensors, including solid-state and micro-sensors with enhanced capabilities, represent significant future growth accelerators. Companies that focus on providing integrated sensing solutions, robust data analytics, and sustainable sensor technologies will be best positioned to capitalize on the expanding market opportunities and achieve sustained revenue growth in the coming years, with a projected market value exceeding 10 Million USD by 2025.

Oxygen Gas Sensors Industry Segmentation

-

1. Type

- 1.1. Potentiometric

- 1.2. Amperometric

- 1.3. Resistive

- 1.4. Other Types

-

2. Technology

- 2.1. Infrared

- 2.2. Catalytic

- 2.3. Other Technologies

-

3. End-User Industry

- 3.1. Chemical and Petrochemical

- 3.2. Automotive

- 3.3. Medical and Life Sciences

- 3.4. Industrial

- 3.5. Water and Wastewater

- 3.6. Smart Buildings

- 3.7. Other End-User Industries

Oxygen Gas Sensors Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

-

3. Asia

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Australia and New Zealand

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Mexico

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

Oxygen Gas Sensors Industry Regional Market Share

Geographic Coverage of Oxygen Gas Sensors Industry

Oxygen Gas Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Regulations to Ensure Safety in Work Places

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness of Applications and Usage of Oxygen Sensors in SMEs

- 3.4. Market Trends

- 3.4.1. Automotive Sector to Occupy a Significant Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oxygen Gas Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Potentiometric

- 5.1.2. Amperometric

- 5.1.3. Resistive

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Infrared

- 5.2.2. Catalytic

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Chemical and Petrochemical

- 5.3.2. Automotive

- 5.3.3. Medical and Life Sciences

- 5.3.4. Industrial

- 5.3.5. Water and Wastewater

- 5.3.6. Smart Buildings

- 5.3.7. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Oxygen Gas Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Potentiometric

- 6.1.2. Amperometric

- 6.1.3. Resistive

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Infrared

- 6.2.2. Catalytic

- 6.2.3. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End-User Industry

- 6.3.1. Chemical and Petrochemical

- 6.3.2. Automotive

- 6.3.3. Medical and Life Sciences

- 6.3.4. Industrial

- 6.3.5. Water and Wastewater

- 6.3.6. Smart Buildings

- 6.3.7. Other End-User Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Oxygen Gas Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Potentiometric

- 7.1.2. Amperometric

- 7.1.3. Resistive

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Infrared

- 7.2.2. Catalytic

- 7.2.3. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End-User Industry

- 7.3.1. Chemical and Petrochemical

- 7.3.2. Automotive

- 7.3.3. Medical and Life Sciences

- 7.3.4. Industrial

- 7.3.5. Water and Wastewater

- 7.3.6. Smart Buildings

- 7.3.7. Other End-User Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Oxygen Gas Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Potentiometric

- 8.1.2. Amperometric

- 8.1.3. Resistive

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Infrared

- 8.2.2. Catalytic

- 8.2.3. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End-User Industry

- 8.3.1. Chemical and Petrochemical

- 8.3.2. Automotive

- 8.3.3. Medical and Life Sciences

- 8.3.4. Industrial

- 8.3.5. Water and Wastewater

- 8.3.6. Smart Buildings

- 8.3.7. Other End-User Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Oxygen Gas Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Potentiometric

- 9.1.2. Amperometric

- 9.1.3. Resistive

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Infrared

- 9.2.2. Catalytic

- 9.2.3. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by End-User Industry

- 9.3.1. Chemical and Petrochemical

- 9.3.2. Automotive

- 9.3.3. Medical and Life Sciences

- 9.3.4. Industrial

- 9.3.5. Water and Wastewater

- 9.3.6. Smart Buildings

- 9.3.7. Other End-User Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Oxygen Gas Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Potentiometric

- 10.1.2. Amperometric

- 10.1.3. Resistive

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Infrared

- 10.2.2. Catalytic

- 10.2.3. Other Technologies

- 10.3. Market Analysis, Insights and Forecast - by End-User Industry

- 10.3.1. Chemical and Petrochemical

- 10.3.2. Automotive

- 10.3.3. Medical and Life Sciences

- 10.3.4. Industrial

- 10.3.5. Water and Wastewater

- 10.3.6. Smart Buildings

- 10.3.7. Other End-User Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mettler-Toledo International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Figaro Engineering Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aeroqual Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Delphi Automotive PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Francisco Albero SAU

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Robert Bosch GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 City Technology Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Control Instruments Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hamilton Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Yokogawa Electric Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sensore Electronic GmbH

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Maxtec LLC*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ABB Limited

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Fujikura Limited

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 General Electric Company

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 AlphaSense Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Advanced Micro Instruments Inc

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Membrapor AG

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Eaton Corporation

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Corporation

List of Figures

- Figure 1: Global Oxygen Gas Sensors Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Oxygen Gas Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Oxygen Gas Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Oxygen Gas Sensors Industry Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Oxygen Gas Sensors Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Oxygen Gas Sensors Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 7: North America Oxygen Gas Sensors Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 8: North America Oxygen Gas Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Oxygen Gas Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Oxygen Gas Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Oxygen Gas Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Oxygen Gas Sensors Industry Revenue (Million), by Technology 2025 & 2033

- Figure 13: Europe Oxygen Gas Sensors Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Oxygen Gas Sensors Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 15: Europe Oxygen Gas Sensors Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 16: Europe Oxygen Gas Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Oxygen Gas Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Oxygen Gas Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Oxygen Gas Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Oxygen Gas Sensors Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Asia Oxygen Gas Sensors Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Oxygen Gas Sensors Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: Asia Oxygen Gas Sensors Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: Asia Oxygen Gas Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Oxygen Gas Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Oxygen Gas Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Oxygen Gas Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Oxygen Gas Sensors Industry Revenue (Million), by Technology 2025 & 2033

- Figure 29: Latin America Oxygen Gas Sensors Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Latin America Oxygen Gas Sensors Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 31: Latin America Oxygen Gas Sensors Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 32: Latin America Oxygen Gas Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Oxygen Gas Sensors Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Oxygen Gas Sensors Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Oxygen Gas Sensors Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Oxygen Gas Sensors Industry Revenue (Million), by Technology 2025 & 2033

- Figure 37: Middle East and Africa Oxygen Gas Sensors Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Middle East and Africa Oxygen Gas Sensors Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 39: Middle East and Africa Oxygen Gas Sensors Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 40: Middle East and Africa Oxygen Gas Sensors Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Oxygen Gas Sensors Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 13: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Germany Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Russia Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 21: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 22: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Japan Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia and New Zealand Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 30: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 31: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 37: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 38: Global Oxygen Gas Sensors Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 39: United Arab Emirates Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Saudi Arabia Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: South Africa Oxygen Gas Sensors Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oxygen Gas Sensors Industry?

The projected CAGR is approximately 4.76%.

2. Which companies are prominent players in the Oxygen Gas Sensors Industry?

Key companies in the market include Honeywell International Corporation, Mettler-Toledo International Inc, Figaro Engineering Inc, Aeroqual Limited, Delphi Automotive PLC, Francisco Albero SAU, Robert Bosch GmbH, City Technology Limited, Control Instruments Corporation, Hamilton Company, Yokogawa Electric Corporation, Sensore Electronic GmbH, Maxtec LLC*List Not Exhaustive, ABB Limited, Fujikura Limited, General Electric Company, AlphaSense Inc, Advanced Micro Instruments Inc, Membrapor AG, Eaton Corporation.

3. What are the main segments of the Oxygen Gas Sensors Industry?

The market segments include Type, Technology, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Regulations to Ensure Safety in Work Places.

6. What are the notable trends driving market growth?

Automotive Sector to Occupy a Significant Market Demand.

7. Are there any restraints impacting market growth?

Lack of Awareness of Applications and Usage of Oxygen Sensors in SMEs.

8. Can you provide examples of recent developments in the market?

May 2023: The DD-Scientific team announced an impressive expansion of their operations, marked by significant growth and a continuous influx of new customers. This sustained success has culminated in the establishment of a state-of-the-art Centre of Excellence dedicated to the production of oxygen sensors. Alongside this milestone, DD-Scientific has made substantial investments in automation and testing, solidifying its position as a leading supplier of world-class sensors. Their remarkable achievements stand tall even amidst competition from larger industry players.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oxygen Gas Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oxygen Gas Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oxygen Gas Sensors Industry?

To stay informed about further developments, trends, and reports in the Oxygen Gas Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence