Key Insights

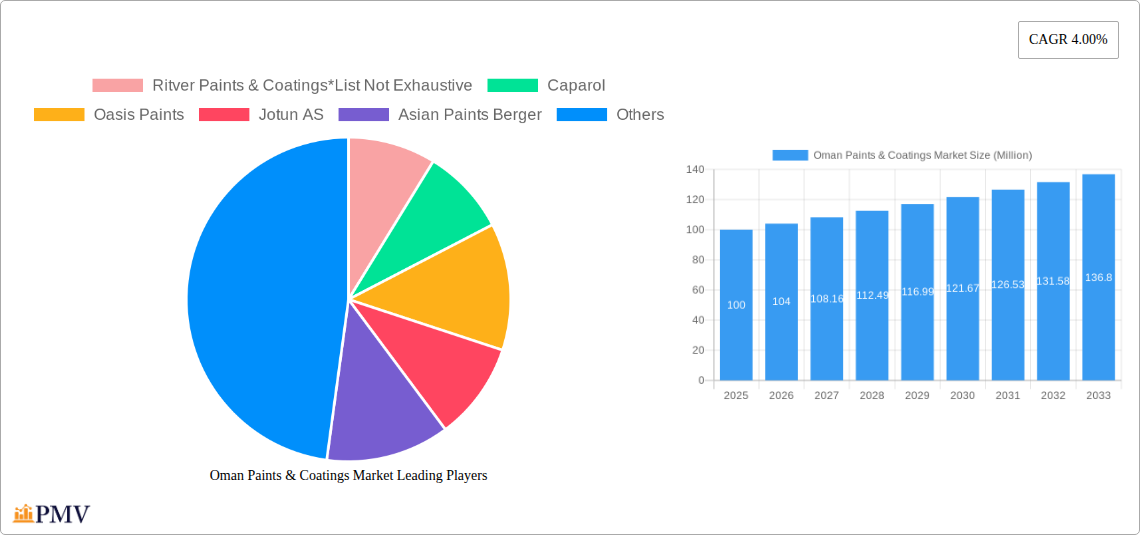

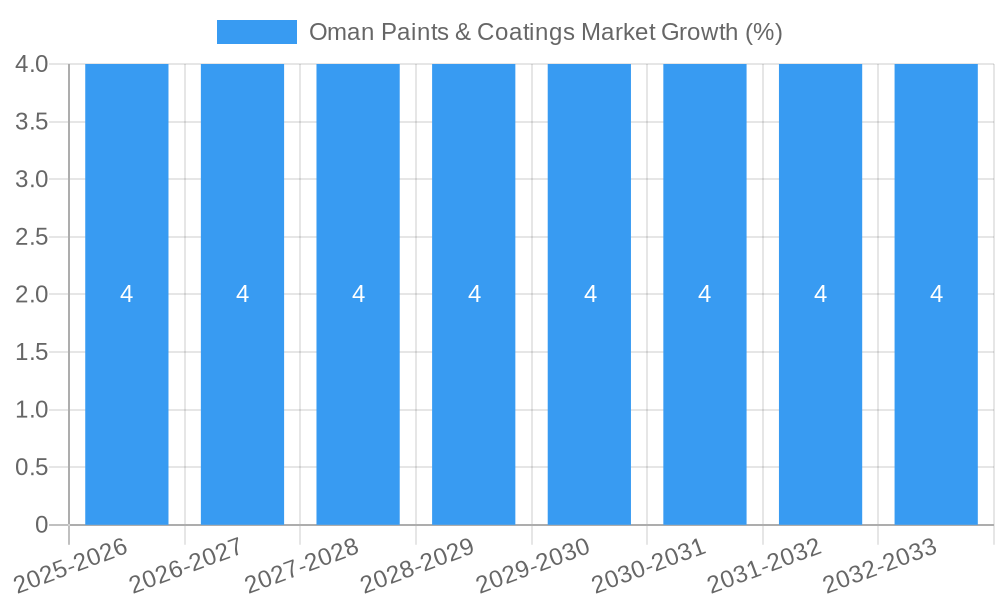

The Oman paints and coatings market, valued at approximately $XX million in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 4.00% from 2025 to 2033. This growth is fueled by several key factors. The burgeoning construction sector in Oman, driven by government initiatives and investments in infrastructure development, significantly boosts demand for architectural coatings. Furthermore, the automotive industry's expansion and the increasing popularity of aesthetically pleasing and protective coatings for vehicles contribute to market expansion. Growth is also propelled by rising disposable incomes, leading to increased spending on home improvement and renovation projects. The preference for high-performance, durable coatings, particularly water-borne options that align with environmental sustainability concerns, further shapes market trends. However, fluctuating oil prices and potential economic slowdowns represent challenges that could influence market growth. Competition among established players like Asian Paints Berger, Jotun AS, and BASF SE, alongside local manufacturers, intensifies market dynamics. Segmentation analysis reveals strong demand across various resin types, including acrylics and alkyds, catering to different applications in construction, automotive, and industrial sectors.

The market's segmentation offers valuable insights into specific growth opportunities. The water-borne coatings segment is expected to witness faster growth compared to solvent-borne coatings, driven by stricter environmental regulations and health concerns regarding volatile organic compounds (VOCs). Within the end-user industry segment, the architectural coatings sector holds a significant market share, mirroring the robust construction activity in Oman. However, the industrial coatings segment also demonstrates promising growth potential, linked to the ongoing industrialization and manufacturing expansion within the country. Future market growth will depend on government policies promoting sustainable building practices, investments in infrastructure, and technological advancements in coating formulations enhancing durability, aesthetics, and environmental friendliness. The competitive landscape necessitates strategic approaches for manufacturers to effectively penetrate and capture market share.

Oman Paints & Coatings Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Oman paints and coatings market, offering invaluable insights for industry stakeholders. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report covers market sizing, segmentation, competitive dynamics, and future growth projections, empowering informed decision-making. With a focus on key players like Jotun AS, Asian Paints Berger, and Nippon Paint Holdings Co Ltd, this report is an essential resource for understanding this dynamic market.

Oman Paints & Coatings Market Market Structure & Competitive Dynamics

The Oman paints and coatings market exhibits a moderately concentrated structure, with several multinational and regional players vying for market share. The market's competitive landscape is shaped by factors such as innovation ecosystems, evolving regulatory frameworks, the availability of product substitutes (e.g., powder coatings), and fluctuating end-user demands across diverse sectors. Mergers and acquisitions (M&A) have played a significant role, exemplified by Hempel A/S's acquisition of Khimji Paints LLC in 2022. This deal, valued at xx Million, underscores the strategic importance of the Omani market and the consolidation trend within the industry. Market share data indicates that Jotun AS holds approximately xx% market share, while Asian Paints Berger commands around xx%. Other key players, such as Nippon Paint Holdings Co Ltd and AkzoNobel NV, also contribute significantly to the market's overall volume. Further analysis reveals that the average deal value for M&A activities within this sector in Oman over the past five years has been approximately xx Million.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Ecosystems: Moderate level of innovation driven by both local and international players.

- Regulatory Framework: Influences product formulations and environmental standards.

- Product Substitutes: Powder coatings and other specialized coatings present competitive pressure.

- End-User Trends: Growing demand from construction, automotive, and industrial sectors.

- M&A Activity: Significant activity indicating consolidation and expansion strategies.

Oman Paints & Coatings Market Industry Trends & Insights

The Oman paints and coatings market is experiencing robust growth, driven by factors such as rising construction activity fueled by government infrastructure projects and a burgeoning automotive sector. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and is projected to reach xx% during the forecast period (2025-2033). This growth is also influenced by increasing consumer preference for high-quality, durable, and aesthetically pleasing coatings. Technological disruptions, such as the adoption of water-borne coatings due to environmental concerns, are reshaping the market. The market penetration of water-borne coatings has increased from xx% in 2019 to an estimated xx% in 2025. Competitive dynamics remain intense, with companies investing in R&D and strategic partnerships to enhance their market positions. The increasing adoption of advanced technologies, like UV-curable coatings, along with changing consumer preferences for eco-friendly products, will continue to propel the market in the years to come.

Dominant Markets & Segments in Oman Paints & Coatings Market

The architectural coatings segment dominates the Oman paints and coatings market, driven by strong growth in the construction sector. Within resin types, acrylic coatings hold the largest market share due to their versatility, cost-effectiveness, and superior performance characteristics. Water-borne technologies are also gaining prominence due to their environmentally friendly nature. The key drivers contributing to the dominance of these segments include:

- Architectural Coatings: Robust construction activity, government investments in infrastructure, and rising urbanization.

- Acrylic Resin Type: Versatility, cost-effectiveness, and performance benefits.

- Water-borne Technology: Growing environmental consciousness and stricter regulations.

The industrial coatings segment is also witnessing significant growth, driven by the expansion of various manufacturing industries in the region. The automotive sector is another significant end-user industry for paints and coatings. Economic policies that encourage infrastructure development and industrialization are significant contributors to the market’s growth in these dominant segments.

Oman Paints & Coatings Market Product Innovations

Recent product innovations focus on enhancing durability, performance, and eco-friendliness. Manufacturers are increasingly developing water-borne, low-VOC coatings that meet stringent environmental regulations. Innovations in UV-curable coatings provide faster drying times and improved resistance to chemicals. These advancements are driving market growth by catering to the increasing demand for sustainable and high-performance coatings. The competitive advantage lies in offering superior quality, specialized applications, and customized solutions to specific customer needs.

Report Segmentation & Scope

The report comprehensively segments the Oman paints and coatings market based on resin type (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Other Resin Types), technology (Water-borne, Solvent-borne), and end-user industry (Architectural, Automotive, Wood, Industrial Coatings, Transportation, Packaging, Other End-user Industries). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail, providing a complete picture of the market landscape. For instance, the Architectural segment is projected to grow at xx% CAGR over the forecast period, while the Automotive segment is expected to witness growth at xx% CAGR. The competitive landscape varies across these segments, with some dominated by multinational corporations while others see stronger participation from regional players.

Key Drivers of Oman Paints & Coatings Market Growth

The Oman paints and coatings market is propelled by several key factors, including robust economic growth, government initiatives promoting infrastructure development, and a thriving construction sector. The increasing urbanization and rising disposable incomes are driving demand for aesthetically pleasing and high-quality coatings. Additionally, technological advancements leading to the development of eco-friendly and high-performance coatings further fuel market expansion. Government regulations promoting sustainable building practices and environmental protection also influence market dynamics.

Challenges in the Oman Paints & Coatings Market Sector

The Oman paints and coatings market faces certain challenges, including fluctuating raw material prices, which directly impact production costs. Stringent environmental regulations require manufacturers to adapt their product formulations, adding to the cost burden. Intense competition from established and emerging players also necessitates continuous innovation and strategic partnerships to maintain profitability. Moreover, supply chain disruptions and logistics complexities can impact market stability. These factors create hurdles that manufacturers must navigate effectively.

Leading Players in the Oman Paints & Coatings Market Market

- Ritver Paints & Coatings

- Caparol

- Oasis Paints

- Jotun AS

- Asian Paints Berger

- Nippon Paint Holdings Co Ltd

- BASF SE

- Novacolor

- Hempel A/S

- National Paints Factories Co Ltd

- AkzoNobel NV

Key Developments in Oman Paints & Coatings Market Sector

- February 2022: Hempel A/S acquired Khimji Paints LLC, expanding its Middle East presence.

- January 2022: Nippon Paints partnered with Karwa Motors, securing exclusive paint solutions provision.

Strategic Oman Paints & Coatings Market Market Outlook

The Oman paints and coatings market presents significant growth opportunities, particularly in the architectural, industrial, and automotive sectors. Strategic partnerships, investments in R&D, and the development of sustainable and innovative products will be crucial for success. Companies focusing on eco-friendly solutions and catering to the growing demand for specialized coatings will gain a competitive edge. The market's long-term growth potential is substantial, driven by ongoing infrastructure projects and a rising middle class.

Oman Paints & Coatings Market Segmentation

-

1. Resin Type

- 1.1. Acrylic

- 1.2. Alkyd

- 1.3. Polyurethane

- 1.4. Epoxy

- 1.5. Polyester

- 1.6. Other Resin Types

- 1.7. Mining

- 1.8. Rubber Processing

- 1.9. Agrochemicals

- 1.10. Other Applications

-

2. Technology

- 2.1. Water-borne

- 2.2. Solvent-borne

-

3. End-user Industry

- 3.1. Architectural

- 3.2. Automotive

- 3.3. Wood

- 3.4. Industrial Coatings

- 3.5. Transportation

- 3.6. Packaging

- 3.7. Other End-user Industries

Oman Paints & Coatings Market Segmentation By Geography

- 1. Oman

Oman Paints & Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Decorative and Architectural Coatings; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Crude Oil Prices; Slowdown in Automotive Industry

- 3.4. Market Trends

- 3.4.1. Expansion of the Oil and Gas Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Paints & Coatings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Acrylic

- 5.1.2. Alkyd

- 5.1.3. Polyurethane

- 5.1.4. Epoxy

- 5.1.5. Polyester

- 5.1.6. Other Resin Types

- 5.1.7. Mining

- 5.1.8. Rubber Processing

- 5.1.9. Agrochemicals

- 5.1.10. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne

- 5.2.2. Solvent-borne

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Architectural

- 5.3.2. Automotive

- 5.3.3. Wood

- 5.3.4. Industrial Coatings

- 5.3.5. Transportation

- 5.3.6. Packaging

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ritver Paints & Coatings*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Caparol

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Oasis Paints

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jotun AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Asian Paints Berger

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nippon Paint Holdings Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BASF SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Novacolor

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hempel A/S

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 National Paints Factories Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 AkzoNobel NV

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Ritver Paints & Coatings*List Not Exhaustive

List of Figures

- Figure 1: Oman Paints & Coatings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Paints & Coatings Market Share (%) by Company 2024

List of Tables

- Table 1: Oman Paints & Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Paints & Coatings Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Oman Paints & Coatings Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 4: Oman Paints & Coatings Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 5: Oman Paints & Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Oman Paints & Coatings Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 7: Oman Paints & Coatings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Oman Paints & Coatings Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 9: Oman Paints & Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Oman Paints & Coatings Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 11: Oman Paints & Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Oman Paints & Coatings Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 13: Oman Paints & Coatings Market Revenue Million Forecast, by Resin Type 2019 & 2032

- Table 14: Oman Paints & Coatings Market Volume K Tons Forecast, by Resin Type 2019 & 2032

- Table 15: Oman Paints & Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Oman Paints & Coatings Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 17: Oman Paints & Coatings Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 18: Oman Paints & Coatings Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 19: Oman Paints & Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Oman Paints & Coatings Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Paints & Coatings Market?

The projected CAGR is approximately 4.00%.

2. Which companies are prominent players in the Oman Paints & Coatings Market?

Key companies in the market include Ritver Paints & Coatings*List Not Exhaustive, Caparol, Oasis Paints, Jotun AS, Asian Paints Berger, Nippon Paint Holdings Co Ltd, BASF SE, Novacolor, Hempel A/S, National Paints Factories Co Ltd, AkzoNobel NV.

3. What are the main segments of the Oman Paints & Coatings Market?

The market segments include Resin Type, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Decorative and Architectural Coatings; Other Drivers.

6. What are the notable trends driving market growth?

Expansion of the Oil and Gas Industry.

7. Are there any restraints impacting market growth?

Fluctuations in Crude Oil Prices; Slowdown in Automotive Industry.

8. Can you provide examples of recent developments in the market?

February 2022: Hempel A/S announced the acquisition of Khimji Paints LLC, one of the leading paint and coatings manufacturers in Oman, in a bid to expand its presence in the Middle East through acquisitions and organic growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950, USD 4950, and USD 6950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Paints & Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Paints & Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Paints & Coatings Market?

To stay informed about further developments, trends, and reports in the Oman Paints & Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence