Key Insights

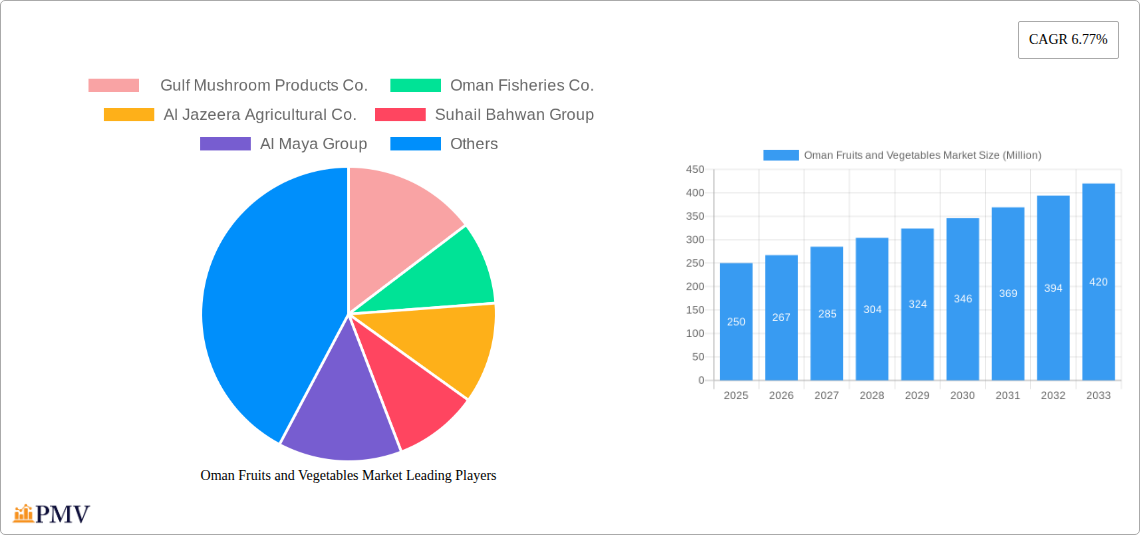

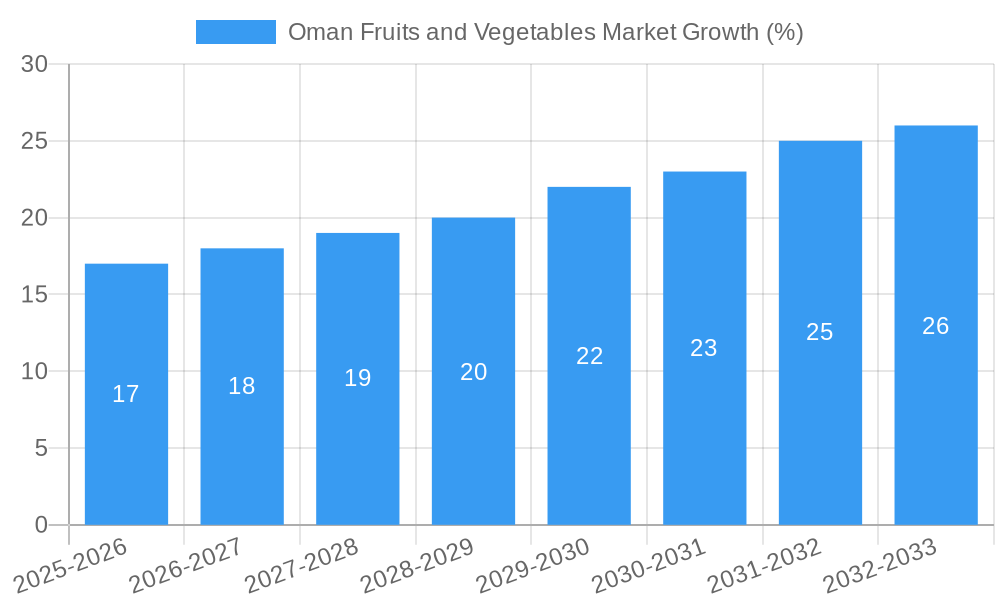

The Oman fruits and vegetables market, valued at approximately $250 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.77% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes within Oman are increasing consumer spending on fresh produce, contributing significantly to market growth. Furthermore, a growing awareness of health and wellness, coupled with increasing preference for nutritious diets, is bolstering demand for fruits and vegetables. Government initiatives promoting sustainable agriculture and food security are also playing a crucial role in supporting the sector's development. The market is further segmented into fruits and vegetables, each witnessing significant consumption. Importantly, the local production of fruits and vegetables is gradually increasing to meet the growing demand. However, challenges such as water scarcity and fluctuating global prices pose potential restraints on market expansion. Key players such as Gulf Mushroom Products Co., Oman Fisheries Co., and Al Maya Group are actively shaping the market dynamics through investments in technology, improved farming practices, and distribution networks.

The forecast period of 2025-2033 anticipates continuous expansion driven by these factors, particularly given ongoing efforts to enhance agricultural infrastructure and supply chain efficiency. While import dependency remains a factor, domestic production is steadily increasing, potentially reducing reliance on imports and creating greater market stability. The competitive landscape is characterized by a mix of both large multinational corporations and smaller local businesses, leading to a dynamic market with opportunities for both established players and new entrants. Future growth hinges on addressing challenges related to sustainable agricultural practices and efficient supply chains to ensure long-term market sustainability and accessibility.

This comprehensive report provides an in-depth analysis of the Oman fruits and vegetables market, offering valuable insights for businesses, investors, and stakeholders. The study period covers 2019-2033, with a focus on 2025 as the base and estimated year. The report forecasts market trends from 2025 to 2033, leveraging data from the historical period of 2019-2024. Key segments analyzed include fruits and vegetables, encompassing production, consumption, import, export, and price trend analysis. Leading companies like Gulf Mushroom Products Co., Oman Fisheries Co., Al Jazeera Agricultural Co., Suhail Bahwan Group, Al Maya Group, Oman India Fertiliser Company, Oman Agro Industries, Al Khonji Group, and Oman Food Investment Holding Company are profiled, offering a holistic view of the market landscape.

Oman Fruits and Vegetables Market Structure & Competitive Dynamics

The Oman fruits and vegetables market exhibits a moderately concentrated structure, with a few large players dominating specific segments. The market is characterized by a dynamic interplay of established players and emerging companies, driven by innovation in farming techniques and distribution networks. Regulatory frameworks, including food safety standards and agricultural policies, significantly influence market dynamics. Product substitutes, such as imported produce, pose a competitive challenge, particularly for locally grown products. End-user preferences, shifting towards healthier and organic options, are shaping market trends.

- Market Concentration: The top five players hold approximately xx% of the market share.

- Innovation Ecosystems: Technological advancements in irrigation, precision farming, and post-harvest technologies are fostering innovation.

- Regulatory Frameworks: Government initiatives promoting sustainable agriculture and food security are key factors.

- M&A Activities: The market has witnessed xx M&A deals in the past five years, with a total estimated value of xx Million. These deals have primarily focused on expanding market reach and consolidating supply chains.

- Product Substitutes: Imported fruits and vegetables, often at lower prices, pose a competitive challenge to local producers.

- End-User Trends: Growing awareness of health and wellness is boosting demand for organic and locally sourced produce.

Oman Fruits and Vegetables Market Industry Trends & Insights

The Oman fruits and vegetables market is experiencing steady growth, driven by factors like rising population, increasing disposable incomes, and a growing preference for fresh produce. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, including advancements in hydroponics and vertical farming, are enhancing productivity and efficiency. Consumer preferences are increasingly focusing on quality, safety, and traceability, pushing producers to adopt better farming practices. Competitive dynamics are characterized by both price competition and differentiation strategies based on product quality and branding. Market penetration of organic and specialty produce is steadily increasing. The report analyses these trends with granular detail, providing insights into future opportunities and challenges.

Dominant Markets & Segments in Oman Fruits and Vegetables Market

The dominant segment within the Oman fruits and vegetables market is currently xx (e.g., vegetables). This dominance is primarily attributed to:

- Higher Consumption: Demand for vegetables is significantly higher than that for fruits, driven by dietary habits and culinary traditions.

- Local Production: A larger portion of vegetable production occurs domestically, reducing reliance on imports.

- Government Support: Government policies often prioritize vegetable production due to their importance in food security.

The leading region in terms of both production and consumption is typically the xx region, benefiting from favorable climatic conditions and efficient infrastructure. Key drivers for this regional dominance include:

Favorable Climate: Suitable weather conditions for a variety of fruits and vegetables.

Infrastructure Development: Investment in irrigation systems and transportation networks.

Government Policies: Targeted support for agricultural development in the region.

Detailed analysis of each segment—production, consumption, import, export, and price trends—for both fruits and vegetables is provided in the full report.

Oman Fruits and Vegetables Market Product Innovations

Recent product innovations in the Oman fruits and vegetables market focus on improving quality, shelf life, and convenience. Technological advancements in packaging and processing are enhancing the appeal and usability of fresh produce. The market is also seeing increased adoption of organic farming practices and the introduction of novel varieties better suited to the local climate. These innovations are strengthening the competitive landscape and catering to evolving consumer preferences.

Report Segmentation & Scope

This report provides a comprehensive segmentation of the Oman fruits and vegetables market based on Type:

Fruits: This segment covers production, consumption, import, export, and price trend analysis for various fruit varieties cultivated and consumed in Oman. The market is projected to grow at a CAGR of xx% during the forecast period. Competitive dynamics within this segment are shaped by factors such as pricing, product quality, and brand recognition.

Vegetables: This segment mirrors the structure of the Fruits segment, providing detailed insights into the vegetable market. The growth projection for vegetables is similar to fruits, expected at a CAGR of xx% during the forecast period. Competitive dynamics are influenced by similar factors to those in the fruit segment.

Each segment's analysis includes market size, growth projections, and competitive landscape assessments.

Key Drivers of Oman Fruits and Vegetables Market Growth

Several key factors are driving the growth of the Oman fruits and vegetables market:

- Rising Population: The increasing population fuels demand for fresh produce.

- Growing Disposable Incomes: Higher purchasing power leads to increased spending on food.

- Government Initiatives: Policies promoting sustainable agriculture and food security contribute to growth.

- Tourism: The tourism sector stimulates demand, particularly for high-quality fruits and vegetables.

Challenges in the Oman Fruits and Vegetables Market Sector

The Oman fruits and vegetables market faces certain challenges:

- Water Scarcity: Limited water resources pose a significant challenge to agricultural production.

- Climate Change: Extreme weather events negatively impact crop yields.

- Supply Chain Inefficiencies: Inefficient logistics and storage facilities lead to post-harvest losses.

- Competition from Imports: Imported produce, sometimes at lower prices, creates competitive pressure. These factors influence market profitability and sustainability.

Leading Players in the Oman Fruits and Vegetables Market Market

- Gulf Mushroom Products Co.

- Oman Fisheries Co.

- Al Jazeera Agricultural Co.

- Suhail Bahwan Group

- Al Maya Group

- Oman India Fertiliser Company

- Oman Agro Industries

- Al Khonji Group

- Oman Food Investment Holding Company

Key Developments in Oman Fruits and Vegetables Market Sector

November 2020: The Oman Investment Authority launched a project under Oman Food Investment Holding Company to market and produce high-quality fruits and vegetables. This initiative aimed to enhance the local supply chain and improve product quality.

January 2022: A financial agreement was signed between Sohar Islamic Bank and Khazaen Fruit and Vegetable Central Market SAOC for the development of a new central market. This project will significantly improve infrastructure and logistics, benefiting the entire industry.

Strategic Oman Fruits and Vegetables Market Market Outlook

The future of the Oman fruits and vegetables market looks promising, with significant opportunities for growth. Continued investments in infrastructure, technological advancements in farming and processing, and supportive government policies are key growth accelerators. Companies focused on sustainable practices, product quality, and value-added offerings are well-positioned to capitalize on market expansion. The increasing demand for healthy and convenient food options presents a significant opportunity for innovation and market leadership.

Oman Fruits and Vegetables Market Segmentation

-

1. Type (Pr

- 1.1. Vegetables

- 1.2. Fruits

-

2. Type (Pr

- 2.1. Vegetables

- 2.2. Fruits

Oman Fruits and Vegetables Market Segmentation By Geography

- 1. Oman

Oman Fruits and Vegetables Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.77% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production

- 3.3. Market Restrains

- 3.3.1. Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis

- 3.4. Market Trends

- 3.4.1. Growing Preference for Organic Produce

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Fruits and Vegetables Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 5.1.1. Vegetables

- 5.1.2. Fruits

- 5.2. Market Analysis, Insights and Forecast - by Type (Pr

- 5.2.1. Vegetables

- 5.2.2. Fruits

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Type (Pr

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Gulf Mushroom Products Co.

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Oman Fisheries Co.

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Jazeera Agricultural Co.

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Suhail Bahwan Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Al Maya Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oman India Fertiliser Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oman Agro Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Al Khonji Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oman Food Investment Holding Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Gulf Mushroom Products Co.

List of Figures

- Figure 1: Oman Fruits and Vegetables Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Fruits and Vegetables Market Share (%) by Company 2024

List of Tables

- Table 1: Oman Fruits and Vegetables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Fruits and Vegetables Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 3: Oman Fruits and Vegetables Market Revenue Million Forecast, by Type (Pr 2019 & 2032

- Table 4: Oman Fruits and Vegetables Market Volume Kiloton Forecast, by Type (Pr 2019 & 2032

- Table 5: Oman Fruits and Vegetables Market Revenue Million Forecast, by Type (Pr 2019 & 2032

- Table 6: Oman Fruits and Vegetables Market Volume Kiloton Forecast, by Type (Pr 2019 & 2032

- Table 7: Oman Fruits and Vegetables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Oman Fruits and Vegetables Market Volume Kiloton Forecast, by Region 2019 & 2032

- Table 9: Oman Fruits and Vegetables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Oman Fruits and Vegetables Market Volume Kiloton Forecast, by Country 2019 & 2032

- Table 11: Oman Fruits and Vegetables Market Revenue Million Forecast, by Type (Pr 2019 & 2032

- Table 12: Oman Fruits and Vegetables Market Volume Kiloton Forecast, by Type (Pr 2019 & 2032

- Table 13: Oman Fruits and Vegetables Market Revenue Million Forecast, by Type (Pr 2019 & 2032

- Table 14: Oman Fruits and Vegetables Market Volume Kiloton Forecast, by Type (Pr 2019 & 2032

- Table 15: Oman Fruits and Vegetables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Oman Fruits and Vegetables Market Volume Kiloton Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Fruits and Vegetables Market?

The projected CAGR is approximately 6.77%.

2. Which companies are prominent players in the Oman Fruits and Vegetables Market?

Key companies in the market include Gulf Mushroom Products Co. , Oman Fisheries Co. , Al Jazeera Agricultural Co. , Suhail Bahwan Group, Al Maya Group , Oman India Fertiliser Company, Oman Agro Industries, Al Khonji Group, Oman Food Investment Holding Company .

3. What are the main segments of the Oman Fruits and Vegetables Market?

The market segments include Type (Pr, Type (Pr.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Milled and Broken Rice; Growing Preference for Speciality Rice Variety; Government Initiatives Supports Rice Production.

6. What are the notable trends driving market growth?

Growing Preference for Organic Produce.

7. Are there any restraints impacting market growth?

Lack of Supply Chain for Rice; Growing Agricultural Labor Crisis.

8. Can you provide examples of recent developments in the market?

January 2022: Financial agreement for the Khazaen Fruits and Vegetables Central Market was signed between Sohar Islamic Bank and Khazaen Fruit and Vegetable Central Market SAOC to provide financing facilities for the new market project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Kiloton.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Fruits and Vegetables Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Fruits and Vegetables Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Fruits and Vegetables Market?

To stay informed about further developments, trends, and reports in the Oman Fruits and Vegetables Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence