Key Insights

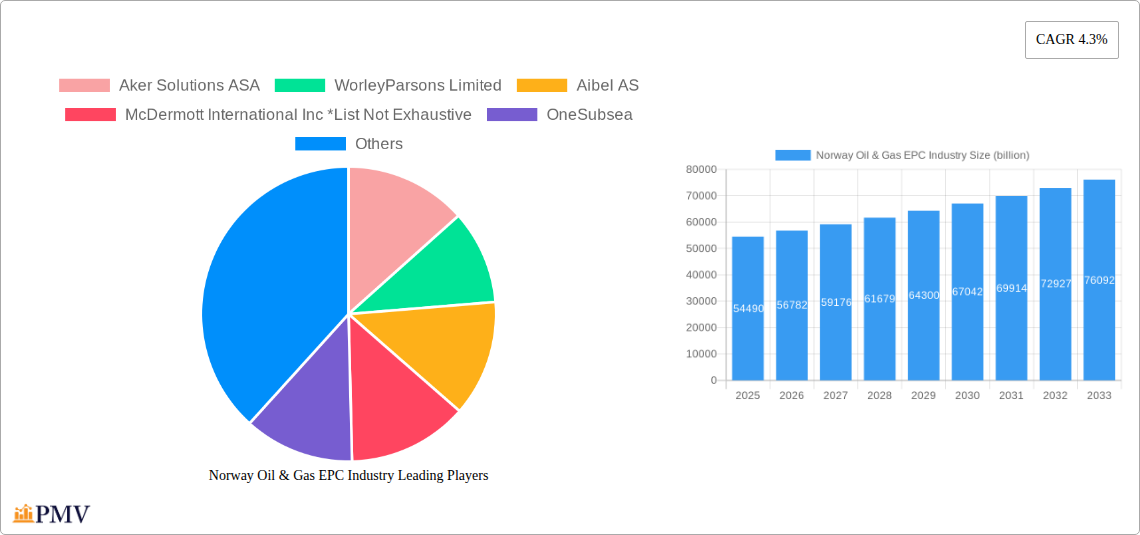

The Norway Oil & Gas EPC (Engineering, Procurement, and Construction) industry is poised for significant growth, driven by the nation's robust offshore exploration and production activities. The market is projected to reach USD 54.49 billion in 2025, expanding at a healthy Compound Annual Growth Rate (CAGR) of 4.3% through 2033. This expansion is fueled by substantial investments in developing new offshore fields, maintaining existing infrastructure, and the ongoing transition towards more sustainable and efficient energy solutions within the oil and gas sector. Key drivers include the demand for advanced technological solutions for complex offshore projects, the need for decommissioning of aging facilities, and the continued exploration of previously untapped hydrocarbon reserves. The upstream segment, encompassing exploration and production, is expected to lead the market, followed by midstream activities like transportation and storage, and downstream operations related to refining and processing.

Norway Oil & Gas EPC Industry Market Size (In Billion)

Despite the strong growth trajectory, the Norway Oil & Gas EPC industry faces certain restraints. These include the increasing scrutiny and regulatory pressures concerning environmental sustainability and carbon emissions, which are driving a shift towards greener technologies and potentially higher project costs. Furthermore, fluctuating global energy prices and geopolitical uncertainties can impact investment decisions and project timelines. However, the industry's adaptability and its focus on innovation, including digital transformation and the integration of renewable energy sources within existing oil and gas infrastructure, are expected to mitigate these challenges. Companies are increasingly adopting advanced technologies like AI, IoT, and data analytics to optimize project execution, enhance safety, and reduce operational costs, positioning the Norwegian market as a leader in technological advancement within the global oil and gas EPC landscape.

Norway Oil & Gas EPC Industry Company Market Share

This in-depth report provides a definitive analysis of the Norway Oil & Gas EPC (Engineering, Procurement, and Construction) industry, offering critical insights into market dynamics, growth drivers, competitive landscape, and future outlook. Covering the study period of 2019–2033, with a base year of 2025 and forecast period of 2025–2033, this comprehensive study empowers stakeholders with data-driven strategies for navigating the evolving Norwegian oil and gas sector. Explore key developments, dominant segments, and actionable intelligence for maximizing investment opportunities within this vital industry.

Norway Oil & Gas EPC Industry Market Structure & Competitive Dynamics

The Norway Oil & Gas EPC market exhibits a moderately concentrated structure, characterized by the presence of globally recognized players alongside specialized domestic firms. Innovation ecosystems are heavily driven by technological advancements in offshore exploration, subsea technologies, and sustainable energy solutions. Regulatory frameworks, primarily dictated by Norwegian authorities and international environmental standards, play a pivotal role in shaping project development and operational practices. Identifying and mitigating risks associated with product substitutes, such as renewable energy integration and energy efficiency measures, is crucial for long-term sustainability. End-user trends are increasingly leaning towards lower-carbon solutions and enhanced operational efficiency, driving demand for advanced EPC services. Merger and acquisition (M&A) activities, while not constant, can significantly impact market concentration, with historical deal values indicating strategic consolidations aimed at expanding service portfolios and geographic reach. Key metrics to monitor include evolving market share dynamics and the strategic rationale behind any reported M&A transactions.

Norway Oil & Gas EPC Industry Industry Trends & Insights

The Norway Oil & Gas EPC industry is experiencing robust growth, propelled by significant investments in both traditional upstream operations and the burgeoning midstream and downstream sectors. A key growth driver is the continuous exploration and development of the Norwegian Continental Shelf (NCS), which holds substantial reserves of oil and natural gas. Technological disruptions are a constant feature, with advancements in digitalization, automation, and artificial intelligence revolutionizing project execution, operational efficiency, and safety standards. The industry is witnessing an increasing adoption of modular construction techniques and advanced subsea technologies, enabling more complex and efficient development of offshore fields. Consumer preferences are shifting towards more sustainable energy sources, influencing the demand for EPC services that can support the transition to lower-carbon operations and the integration of renewable energy alongside traditional oil and gas activities. This also includes a focus on carbon capture, utilization, and storage (CCUS) solutions. Competitive dynamics are intense, with major global EPC providers vying for lucrative contracts. The compound annual growth rate (CAGR) is expected to remain strong, driven by ongoing projects and the need for infrastructure upgrades. Market penetration of advanced technologies and sustainable practices is steadily increasing, reflecting the industry's adaptation to global energy transitions and stringent environmental regulations.

Dominant Markets & Segments in Norway Oil & Gas EPC Industry

The Upstream segment currently dominates the Norway Oil & Gas EPC industry. This dominance is fueled by the continued strategic importance of offshore exploration and production on the Norwegian Continental Shelf. Significant factors contributing to this supremacy include:

- Rich Reserves: The NCS is endowed with substantial reserves of oil and natural gas, attracting continuous investment in new field developments and the optimization of existing ones.

- Technological Expertise: Norway has developed world-leading expertise in offshore engineering, subsea technology, and deepwater operations, making it a hub for complex upstream projects.

- Government Support and Investment: Favorable economic policies and consistent government backing for the oil and gas sector have historically encouraged substantial capital expenditure in upstream activities.

- Infrastructure Development: A well-established network of platforms, pipelines, and processing facilities supports efficient upstream operations and facilitates further development.

While Midstream and Downstream segments are growing, their current market share and influence are relatively smaller compared to the upstream sector. The Midstream segment's growth is linked to the transportation and processing of extracted hydrocarbons, including the expansion and maintenance of pipelines and LNG facilities. The Downstream segment, focusing on refining and petrochemicals, also presents opportunities, particularly in areas of energy transition and the development of specialized chemical products. However, the sheer scale of ongoing and planned upstream projects, such as the Halten East development and Aker BP's extensive field developments, solidifies the upstream segment's leadership within the Norway Oil & Gas EPC landscape.

Norway Oil & Gas EPC Industry Product Innovations

Product innovations in the Norway Oil & Gas EPC industry are primarily focused on enhancing efficiency, sustainability, and safety. This includes the development of advanced subsea processing technologies that reduce the need for surface facilities, thereby lowering operational costs and environmental impact. Digitalization plays a crucial role, with the implementation of AI-driven predictive maintenance, digital twins for operational optimization, and advanced data analytics for reservoir management. Furthermore, there is a significant push towards modular construction techniques, enabling faster and more cost-effective project execution. Innovations in CCUS technologies are also gaining traction, with EPC providers developing solutions for capturing and storing CO2 emissions from offshore operations. These innovations offer competitive advantages by reducing project timelines, minimizing operational expenditures, and aligning with stricter environmental regulations.

Report Segmentation & Scope

This report meticulously segments the Norway Oil & Gas EPC Industry into its core operational areas:

- Upstream: This segment encompasses all activities related to the exploration, extraction, and initial processing of oil and natural gas. It includes the design, procurement, and construction of offshore platforms, subsea pipelines, drilling facilities, and associated infrastructure. Growth projections are robust, driven by ongoing discoveries and the need for efficient production.

- Midstream: This segment focuses on the transportation, storage, and initial processing of crude oil and natural gas after extraction. It includes the development and maintenance of onshore and offshore pipelines, liquefaction plants (LNG), and storage terminals. Growth is anticipated as production volumes increase and export capabilities are enhanced.

- Downstream: This segment involves the refining of crude oil into finished products like gasoline, diesel, and jet fuel, as well as the production of petrochemicals. While currently less dominant in terms of new EPC project focus compared to upstream, there is emerging interest in EPC services related to energy transition, such as biofuel production and advanced chemical recycling.

Key Drivers of Norway Oil & Gas EPC Industry Growth

The Norway Oil & Gas EPC industry's growth is propelled by several potent drivers. Technologically, ongoing advancements in offshore exploration, deepwater capabilities, and digitalization are enabling the development of increasingly complex fields, driving demand for sophisticated EPC solutions. Economically, substantial proven reserves on the Norwegian Continental Shelf continue to attract significant capital investment from major oil and gas operators. Government policies and regulatory frameworks, while stringent on environmental standards, also provide a stable investment climate and often incentivize the development of new fields and infrastructure. Furthermore, the global demand for energy, particularly natural gas as a transition fuel, ensures continued activity in the Norwegian sector. Strategic initiatives like the development of the Halten East gas and condensate discoveries and Aker BP's multi-billion dollar investments underscore the robust pipeline of projects.

Challenges in the Norway Oil & Gas EPC Industry Sector

Despite robust growth, the Norway Oil & Gas EPC industry sector faces significant challenges. Regulatory hurdles, particularly concerning environmental permits and evolving carbon emission standards, can lead to project delays and increased compliance costs. Supply chain disruptions, exacerbated by global events and logistical complexities, can impact project timelines and material costs, leading to cost overruns. Intense competitive pressures from both domestic and international EPC players can affect profit margins. Furthermore, the ongoing global energy transition presents a long-term challenge, requiring the industry to adapt and diversify its service offerings to remain relevant. The reliance on volatile commodity prices also introduces an element of economic uncertainty for future project investments.

Leading Players in the Norway Oil & Gas EPC Industry Market

- Aker Solutions ASA

- WorleyParsons Limited

- Aibel AS

- McDermott International Inc

- OneSubsea

- Subsea 7 SA

- John Wood Group PLC

- TechnipFMC PLC

Key Developments in Norway Oil & Gas EPC Industry Sector

- May 2022: Equinor and partners submitted a plan to develop a cluster of gas and condensate discoveries in the Norwegian Sea for USD 940 million. The Halten East project contains reserves of around 100 million barrels of oil equivalent, with 60% being natural gas, and is anticipated to commence exports to Europe in 2025.

- December 2022: Norwegian oil firm Aker BP and its partners announced an investment exceeding USD 20.5 billion for the development of several oil and gas fields off Norway in the coming years, signaling substantial long-term commitment to the region's upstream sector.

Strategic Norway Oil & Gas EPC Industry Market Outlook

The strategic outlook for the Norway Oil & Gas EPC industry is characterized by significant growth accelerators and a pivotal role in the European energy landscape. The continued development of the Norwegian Continental Shelf, coupled with Europe's increasing reliance on stable gas supplies, presents a sustained demand for EPC services. Innovations in subsea technology and digitalization will further enhance project efficiency and reduce operational costs. The industry is well-positioned to capitalize on opportunities in the energy transition, particularly in areas such as offshore wind infrastructure support, CCUS solutions, and the development of hydrogen production facilities. Investments in projects like Halten East and Aker BP's extensive field developments highlight the robust project pipeline and the long-term strategic importance of the Norwegian oil and gas sector for global energy security.

Norway Oil & Gas EPC Industry Segmentation

- 1. Midstream

- 2. Downstream

- 3. Upstream

Norway Oil & Gas EPC Industry Segmentation By Geography

- 1. Norway

Norway Oil & Gas EPC Industry Regional Market Share

Geographic Coverage of Norway Oil & Gas EPC Industry

Norway Oil & Gas EPC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improved Viability Of Offshore Oil And Gas Projects

- 3.3. Market Restrains

- 3.3.1. Ban On Offshore Exploration And Production Activities In Multiple Regions

- 3.4. Market Trends

- 3.4.1. Upstream Sector to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Oil & Gas EPC Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Midstream

- 5.2. Market Analysis, Insights and Forecast - by Downstream

- 5.3. Market Analysis, Insights and Forecast - by Upstream

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Midstream

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aker Solutions ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WorleyParsons Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aibel AS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 McDermott International Inc *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 OneSubsea

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Subsea 7 SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 John Wood Group PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 TechnipFMC PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Aker Solutions ASA

List of Figures

- Figure 1: Norway Oil & Gas EPC Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Norway Oil & Gas EPC Industry Share (%) by Company 2025

List of Tables

- Table 1: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Midstream 2020 & 2033

- Table 2: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Downstream 2020 & 2033

- Table 3: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Upstream 2020 & 2033

- Table 4: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Midstream 2020 & 2033

- Table 6: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Downstream 2020 & 2033

- Table 7: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Upstream 2020 & 2033

- Table 8: Norway Oil & Gas EPC Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Oil & Gas EPC Industry?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Norway Oil & Gas EPC Industry?

Key companies in the market include Aker Solutions ASA, WorleyParsons Limited, Aibel AS, McDermott International Inc *List Not Exhaustive, OneSubsea, Subsea 7 SA, John Wood Group PLC, TechnipFMC PLC.

3. What are the main segments of the Norway Oil & Gas EPC Industry?

The market segments include Midstream, Downstream, Upstream.

4. Can you provide details about the market size?

The market size is estimated to be USD 54.49 billion as of 2022.

5. What are some drivers contributing to market growth?

Improved Viability Of Offshore Oil And Gas Projects.

6. What are the notable trends driving market growth?

Upstream Sector to Dominate the Market.

7. Are there any restraints impacting market growth?

Ban On Offshore Exploration And Production Activities In Multiple Regions.

8. Can you provide examples of recent developments in the market?

In May 2022, Equinor and partners submitted a plan to develop a cluster of gas and condensate discoveries in the Norwegian Sea for USD 940 million. The Halten East contains reserves of around 100 million barrels of oil equivalent, 60% of which is natural gas, and is expected to begin exporting to Europe in 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Oil & Gas EPC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Oil & Gas EPC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Oil & Gas EPC Industry?

To stay informed about further developments, trends, and reports in the Norway Oil & Gas EPC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence