Key Insights

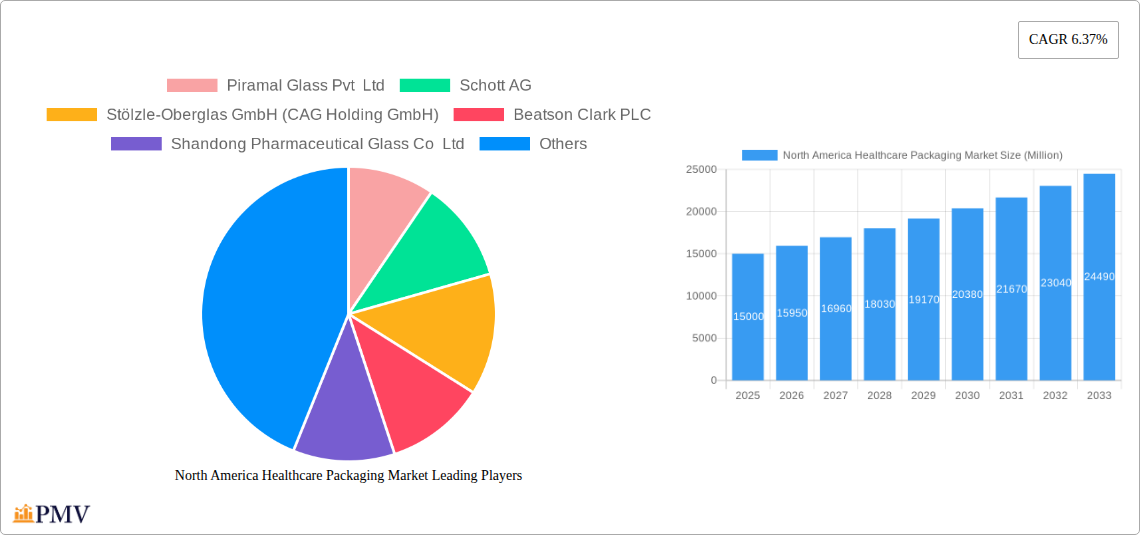

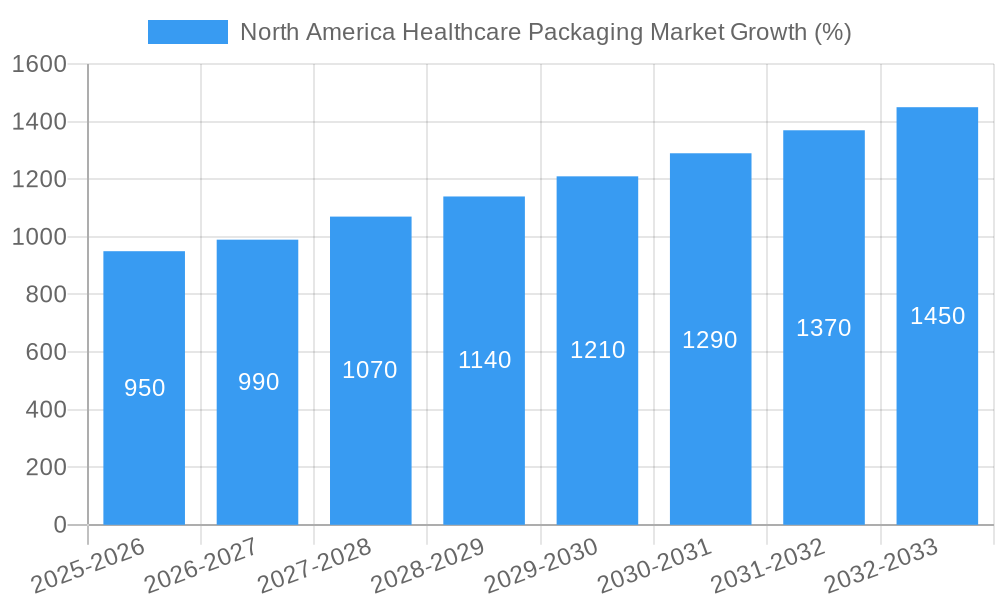

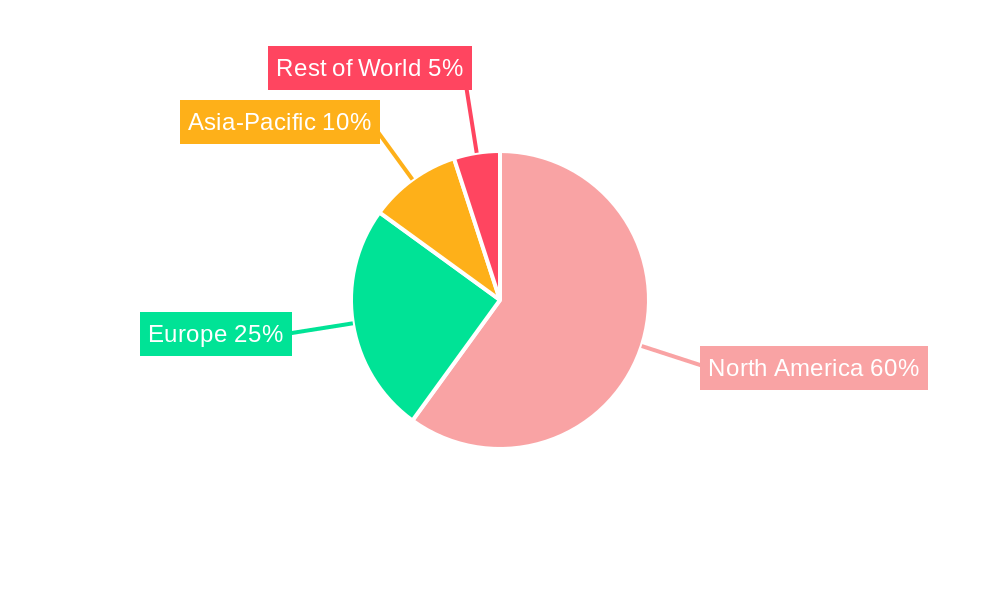

The North America healthcare packaging market, encompassing products like bottles, vials, syringes, and blister packs, is experiencing robust growth, driven by factors such as the increasing prevalence of chronic diseases, the rising demand for pharmaceuticals, and the growing adoption of advanced drug delivery systems. A compound annual growth rate (CAGR) of 6.37% from 2019 to 2024 suggests a significant market expansion. This growth is further fueled by technological advancements in packaging materials, leading to improved drug stability, enhanced patient safety, and reduced environmental impact. The pharmaceutical segment is a major driver, accounting for a substantial portion of market demand, with medical devices representing a considerable secondary sector. The preference for convenient and tamper-evident packaging formats is also a key trend, pushing manufacturers to invest in innovative solutions. While the market faces challenges such as stringent regulatory requirements and concerns about supply chain disruptions, the overall outlook remains positive. The dominance of materials like glass and plastic is expected to continue, although biodegradable and sustainable alternatives are gaining traction.

Within North America, the United States and Canada constitute the largest markets, reflecting their advanced healthcare infrastructure and high pharmaceutical consumption. The market segmentation by product type and material highlights the diversity of packaging solutions. The dominance of glass and plastic is likely to continue due to established infrastructure and regulatory compliance, with niche applications driving growth in other materials. The competitive landscape is characterized by both established players with extensive manufacturing capabilities and emerging companies offering innovative packaging solutions. While precise market size figures for 2025 and beyond are not explicitly provided, estimations based on the given CAGR of 6.37% from 2019-2024, and considering typical market dynamics, suggest a continued upward trajectory. Analyzing the growth trajectory further, we can anticipate increasing demand for specialized packaging, particularly for biologics and personalized medicines, leading to a diversified product portfolio across the market.

North America Healthcare Packaging Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the North America healthcare packaging market, offering invaluable insights for stakeholders across the pharmaceutical, medical device, and packaging industries. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report meticulously analyzes market trends, competitive dynamics, and growth opportunities, presenting a robust forecast for 2025-2033. Key market segments, including product type, material, country (United States and Canada), and end-user vertical are examined to reveal dominant players and emerging opportunities. The report values are expressed in Millions.

North America Healthcare Packaging Market Structure & Competitive Dynamics

The North America healthcare packaging market is characterized by a moderately concentrated structure, with several large multinational corporations and regional players vying for market share. The market's competitive landscape is shaped by factors such as ongoing innovation in packaging materials and technologies, stringent regulatory frameworks (FDA guidelines, etc.), and the increasing demand for sustainable and eco-friendly packaging solutions. Product substitution, particularly the shift from glass to plastic in certain applications, significantly impacts market dynamics. Furthermore, the market witnesses consistent mergers and acquisitions (M&A) activity, driving consolidation and influencing pricing strategies.

Based on our analysis, the top five companies control approximately xx% of the market in 2025. M&A activities in the historical period (2019-2024) resulted in a total deal value of approximately $xx Million, primarily driven by strategic expansions and the consolidation of smaller players.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share (2025).

- Innovation Ecosystems: Strong focus on sustainable packaging, advanced barrier materials, and smart packaging technologies.

- Regulatory Frameworks: Stringent FDA regulations drive compliance costs and influence material choices.

- Product Substitutes: Plastic increasingly substitutes glass in certain segments due to cost and weight advantages.

- End-User Trends: Growing demand for tamper-evident packaging and patient convenience features.

- M&A Activities: Significant consolidation activity with a total deal value of approximately $xx Million (2019-2024).

North America Healthcare Packaging Market Industry Trends & Insights

The North America healthcare packaging market is experiencing robust growth, driven by several key factors. The aging population and increasing prevalence of chronic diseases fuel the demand for pharmaceuticals and medical devices, consequently boosting the need for packaging solutions. Technological advancements, particularly in materials science and automation, are leading to innovations in barrier properties, sterility assurance, and packaging efficiency. Consumer preferences are shifting towards convenient, user-friendly, and sustainable packaging options, influencing design and material choices. Furthermore, the competitive landscape is dynamic, with companies constantly striving to differentiate their offerings through innovation and cost optimization. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), with a market penetration of xx% by 2033.

Dominant Markets & Segments in North America Healthcare Packaging Market

The United States dominates the North America healthcare packaging market, accounting for a larger share of overall revenue compared to Canada. Within product types, Bottles and Containers and Vials and Ampoules represent significant market segments due to their widespread use in pharmaceutical packaging. Plastic remains the dominant material due to cost-effectiveness and versatility. The pharmaceutical end-user vertical contributes the largest share of revenue.

- Key Drivers for US Market Dominance:

- Large pharmaceutical and medical device industry.

- Advanced healthcare infrastructure.

- High per capita healthcare spending.

- Key Drivers for Canada Market Growth:

- Increasing healthcare expenditure.

- Growing pharmaceutical market.

- Government initiatives supporting healthcare innovation.

- Dominant Product Types: Bottles and Containers, Vials and Ampoules due to high demand in pharmaceuticals.

- Dominant Material: Plastic due to cost-effectiveness and versatility.

- Dominant End-user Vertical: Pharmaceutical industry due to high volume drug packaging requirements.

North America Healthcare Packaging Market Product Innovations

Recent innovations focus on enhanced barrier properties to maintain product sterility and extend shelf life, improved tamper-evident features for security, and the increasing adoption of sustainable and recyclable materials like bioplastics. Smart packaging solutions incorporating RFID technology and other digital features are also gaining traction for tracking and tracing pharmaceuticals throughout the supply chain. These innovations improve product safety, enhance supply chain efficiency, and address growing environmental concerns.

Report Segmentation & Scope

This report segments the North America healthcare packaging market based on product type (Bottles and Containers, Vials and Ampoules, Cartridges and Syringes, Pouch and Bags, Blister Packs, Tubes, Paper Board Boxes, Caps and Closures, Labels, Other Product Types), material (Glass, Plastic, Other Materials), country (United States, Canada), and end-user vertical (Pharmaceutical, Medical Devices). Each segment's growth projection, market size, and competitive dynamics are analyzed in detail, providing a granular understanding of market opportunities. For example, the Vials and Ampoules segment is expected to witness significant growth driven by the increasing demand for injectable drugs. The plastic material segment dominates due to its cost-effectiveness and versatility, while the pharmaceutical end-user vertical accounts for the majority of market share.

Key Drivers of North America Healthcare Packaging Market Growth

The market's growth is propelled by several factors: rising demand for pharmaceuticals and medical devices due to an aging population and increased prevalence of chronic diseases; increasing adoption of advanced packaging technologies to enhance product stability, safety, and convenience; the shift towards sustainable and eco-friendly packaging solutions due to increasing environmental concerns; and stringent regulatory requirements mandating improved packaging standards for safety and traceability.

Challenges in the North America Healthcare Packaging Market Sector

The market faces challenges such as the rising cost of raw materials, particularly plastic resins; stringent regulatory compliance requirements, increasing the cost of product development and approval; supply chain disruptions impacting raw material availability and timely delivery; and intense competition, necessitating continuous innovation and cost optimization to maintain market share. These challenges contribute to fluctuations in pricing and potentially limit market growth.

Leading Players in the North America Healthcare Packaging Market Market

- Piramal Glass Pvt Ltd

- Schott AG

- Stölzle-Oberglas GmbH (CAG Holding GmbH)

- Beatson Clark PLC

- Shandong Pharmaceutical Glass Co Ltd

- Nipro Corporation

- Arab Pharmaceutical Glass Co

- Şişecam Group

- Bormioli Pharma AG

- SGD SA (SGD Pharma)

- Gerresheimer AG

- Corning Incorporated

Key Developments in North America Healthcare Packaging Market Sector

- 2022 Q4: Gerresheimer AG launched a new sustainable glass vial for injectable drugs.

- 2023 Q1: SGD Pharma announced a significant investment in its North American manufacturing facility.

- 2023 Q2: A major merger between two regional packaging companies reshaped the competitive landscape.

- 2024 Q3: Schott AG introduced a new line of high-barrier plastic containers for sensitive pharmaceuticals. (Further developments would be added for each year up to the current date).

Strategic North America Healthcare Packaging Market Outlook

The North America healthcare packaging market presents significant growth potential driven by ongoing technological advancements, increasing demand for innovative packaging solutions, and the growing focus on sustainability. Strategic opportunities exist for companies to capitalize on the rising demand for sustainable materials, smart packaging, and customized packaging solutions tailored to specific therapeutic areas and patient needs. Companies that invest in research and development, enhance their supply chain efficiency, and prioritize regulatory compliance will be well-positioned for future success.

North America Healthcare Packaging Market Segmentation

-

1. End-user Vertical

- 1.1. Pharmaceutical

- 1.2. Medical Devices

-

2. Product Type

- 2.1. Bottles and Containers

- 2.2. Vials and Ampoules

- 2.3. Cartridges and Syringes

- 2.4. Pouch and Bags

- 2.5. Blister Packs

- 2.6. Tubes

- 2.7. Paper Board Boxes

- 2.8. Caps and Closures

- 2.9. Labels

- 2.10. Other Pr

-

3. Material

- 3.1. Glass

- 3.2. Plastic

- 3.3. Other Materials (Paper and Metal)

North America Healthcare Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Healthcare Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.37% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increased Emphasis on Convenience and Environmental Issues; Rise in Medicine Counterfeiting Leading to Advanced Packaging and Labeling

- 3.3. Market Restrains

- 3.3.1. ; Environmental Concerns Related to Raw Materials for Packaging and Price Competition

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Industry has Witnessed Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Healthcare Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Pharmaceutical

- 5.1.2. Medical Devices

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles and Containers

- 5.2.2. Vials and Ampoules

- 5.2.3. Cartridges and Syringes

- 5.2.4. Pouch and Bags

- 5.2.5. Blister Packs

- 5.2.6. Tubes

- 5.2.7. Paper Board Boxes

- 5.2.8. Caps and Closures

- 5.2.9. Labels

- 5.2.10. Other Pr

- 5.3. Market Analysis, Insights and Forecast - by Material

- 5.3.1. Glass

- 5.3.2. Plastic

- 5.3.3. Other Materials (Paper and Metal)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. United States North America Healthcare Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Healthcare Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Healthcare Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Healthcare Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Piramal Glass Pvt Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Schott AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Stölzle-Oberglas GmbH (CAG Holding GmbH)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Beatson Clark PLC

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Shandong Pharmaceutical Glass Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nipro Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Arab Pharmaceutical Glass Co

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Şişecam Grou

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bormioli Pharma AG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 SGD SA (SGD Pharma)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Gerresheimer AG

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Corning Incorporated

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Piramal Glass Pvt Ltd

List of Figures

- Figure 1: North America Healthcare Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Healthcare Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: North America Healthcare Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Healthcare Packaging Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 3: North America Healthcare Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: North America Healthcare Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 5: North America Healthcare Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Healthcare Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Healthcare Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Healthcare Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Healthcare Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Healthcare Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Healthcare Packaging Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 12: North America Healthcare Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: North America Healthcare Packaging Market Revenue Million Forecast, by Material 2019 & 2032

- Table 14: North America Healthcare Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Healthcare Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Healthcare Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Healthcare Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Healthcare Packaging Market?

The projected CAGR is approximately 6.37%.

2. Which companies are prominent players in the North America Healthcare Packaging Market?

Key companies in the market include Piramal Glass Pvt Ltd, Schott AG, Stölzle-Oberglas GmbH (CAG Holding GmbH), Beatson Clark PLC, Shandong Pharmaceutical Glass Co Ltd, Nipro Corporation, Arab Pharmaceutical Glass Co, Şişecam Grou, Bormioli Pharma AG, SGD SA (SGD Pharma), Gerresheimer AG, Corning Incorporated.

3. What are the main segments of the North America Healthcare Packaging Market?

The market segments include End-user Vertical, Product Type, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increased Emphasis on Convenience and Environmental Issues; Rise in Medicine Counterfeiting Leading to Advanced Packaging and Labeling.

6. What are the notable trends driving market growth?

Pharmaceutical Industry has Witnessed Significant Growth.

7. Are there any restraints impacting market growth?

; Environmental Concerns Related to Raw Materials for Packaging and Price Competition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Healthcare Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Healthcare Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Healthcare Packaging Market?

To stay informed about further developments, trends, and reports in the North America Healthcare Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence