Key Insights

The North American flowerpots market is poised for significant expansion, projected to reach $8.31 billion by 2033, driven by a compelling compound annual growth rate (CAGR) of 14.3% from the base year of 2025. This robust growth is underpinned by several key market dynamics. The burgeoning popularity of home gardening and urban agriculture, spurred by heightened environmental consciousness and a demand for homegrown produce, is a primary demand driver. Concurrently, the escalating trend in home décor and landscape enhancement, particularly among millennial and Gen Z consumers, is fueling increased flowerpot sales. Market segmentation highlights a diverse offering, with plastic flowerpots leading due to their cost-effectiveness and adaptability. However, segments such as ceramic and wooden flowerpots are gaining traction, driven by their superior aesthetic appeal and perceived premium quality. The residential sector remains a dominant force, while the commercial sector, encompassing hospitality, dining, and corporate environments, is experiencing notable growth, reflecting the increasing integration of plants for interior aesthetics and environmental enhancement. The United States commands the largest market share in North America, with Canada following, and Mexico and the Rest of North America presenting substantial future growth potential.

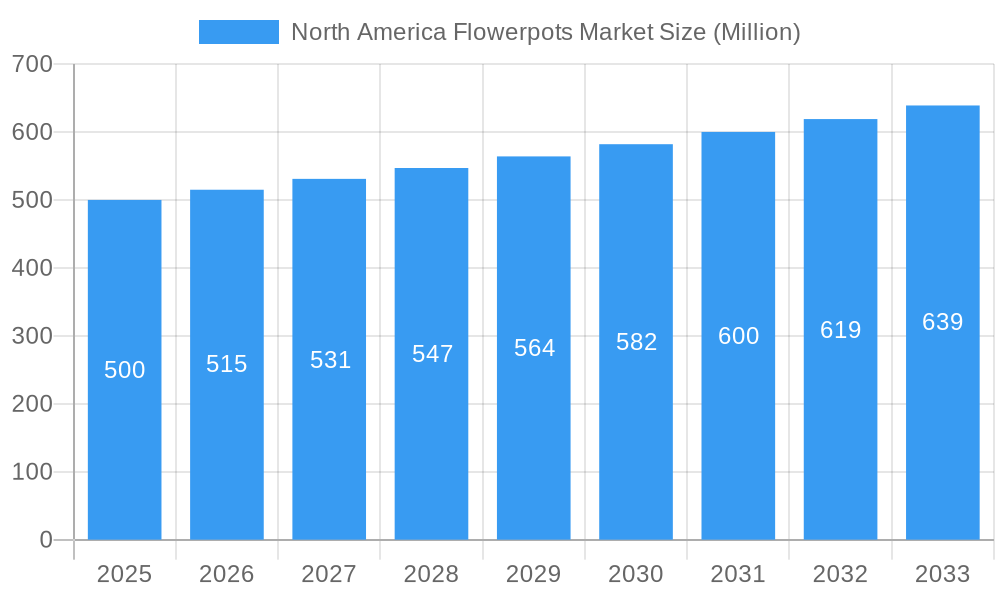

North America Flowerpots Market Market Size (In Billion)

The competitive arena features a blend of established corporations and agile new entrants. Leading companies such as Brown Wood Inc. and The Clay Room specialize in specific product categories, such as wooden and ceramic flowerpots, respectively. Conversely, emerging businesses are effectively utilizing digital platforms to expand their market reach. Strategic imperatives for success include product portfolio diversification, encompassing a broad range of materials, dimensions, and designs, alongside the development of innovative, eco-friendly solutions, such as those made from recycled materials or incorporating self-watering mechanisms, to resonate with environmentally aware consumers. Key challenges for market participants involve navigating raw material price volatility and intense competition, necessitating strategic marketing initiatives and optimized supply chain management. The market trajectory is expected to remain upward, propelled by evolving consumer preferences for attractive and functional flowerpots, the expansion of urban gardening initiatives, and sustained investment in home improvement and landscaping projects.

North America Flowerpots Market Company Market Share

North America Flowerpots Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America flowerpots market, covering the period 2019-2033. It offers actionable insights into market dynamics, competitive landscapes, and future growth potential, equipping businesses with the knowledge necessary to navigate this dynamic sector. The report leverages extensive research and data analysis to deliver a detailed understanding of the market, including market sizing, segmentation, and key trends. With a base year of 2025 and an estimated year of 2025, the report projects market trends through 2033, providing a robust forecast for informed decision-making.

North America Flowerpots Market Structure & Competitive Dynamics

The North America flowerpots market exhibits a moderately concentrated structure with a few dominant players and numerous smaller niche competitors. Market share is largely driven by brand recognition, product innovation, and distribution networks. Innovation ecosystems are vibrant, particularly in sustainable and smart-growing solutions. Regulatory frameworks concerning material safety and environmental impact influence market dynamics. Product substitutes, such as fabric pots and self-watering systems, pose competitive challenges. End-user trends toward eco-friendly and aesthetically pleasing flowerpots are shaping market demand. Mergers and acquisitions (M&A) activity has been moderate, with deal values averaging around xx Million USD in recent years. Key M&A activities include:

- The acquisition of BrightFarms by Cox Enterprises in August 2021, solidifying BrightFarms' position in the indoor agriculture space (though not directly in flowerpots, it impacts the broader market for indoor plant growth).

- Bowery Farming's USD 300 Million Series C funding round in May 2021, demonstrating significant investment in vertical farming technology which indirectly influences the demand for suitable containers.

Market leaders currently hold approximately xx% of the total market share, while smaller players occupy the remaining share. The market's competitive intensity is moderate, driven by price competition and product differentiation.

North America Flowerpots Market Industry Trends & Insights

The North American flowerpots market exhibits robust growth, fueled by several interconnected factors. The burgeoning popularity of home gardening and urban farming significantly boosts demand. Advancements in materials science and manufacturing techniques are resulting in flowerpots that are not only more durable and lightweight but also aesthetically superior. A notable shift in consumer preferences towards eco-friendly and sustainable options is driving strong growth within the wood, ceramic, and recycled plastic flowerpot segments. Furthermore, the market is witnessing a surge in demand for smart flowerpots incorporating advanced sensor technology and automation features. Market projections indicate a compound annual growth rate (CAGR) of xx% over the forecast period (2025-2033), with market penetration expanding from xx% in 2025 to xx% in 2033. The competitive landscape is defined by both price competition and product differentiation, with leading players prioritizing innovation and strategic branding to maintain their market share and establish a strong brand identity.

Dominant Markets & Segments in North America Flowerpots Market

The United States commands the largest share of the North American flowerpots market, attributable to its extensive gardening culture and higher disposable incomes. Canada holds the second-largest market position.

Key Drivers of Market Dominance:

- United States: A deeply entrenched gardening culture, higher disposable incomes, readily accessible retail channels, and a well-established infrastructure for gardening supplies contribute to the strong market presence.

- Canada: A burgeoning interest in home gardening, favorable climatic conditions in certain regions, and increasing urbanization, driving demand for space-saving balcony and patio gardening options, are key factors.

Segment Dominance:

- Type: Plastic flowerpots maintain market dominance due to their affordability and versatility. However, the ceramic and wood segments are experiencing robust growth, driven by their aesthetic appeal and perception of higher quality. This trend reflects the increasing consumer focus on both practicality and visual appeal.

- Application: Residential applications constitute the largest portion of the market, reflecting the rise in home gardening. The commercial segment displays steady growth, fueled by landscaping projects and urban beautification initiatives. This suggests a diverse market with opportunities across both residential and commercial sectors.

- Region: The United States remains the dominant regional market, a consequence of its larger population, higher disposable incomes, and strong consumer preference for home gardening. This dominance is expected to continue throughout the forecast period.

North America Flowerpots Market Product Innovations

Recent product innovations in the North America flowerpots market focus on improved materials, sustainable designs, and smart technology integration. Self-watering flowerpots, utilizing advanced water management systems, are gaining popularity. The use of recycled plastics and other sustainable materials is increasing in response to growing environmental concerns. Smart flowerpots with embedded sensors for monitoring soil moisture and nutrients are becoming more prevalent, appealing to technologically savvy consumers. These innovations enhance convenience, improve plant health, and cater to the evolving demands of consumers.

Report Segmentation & Scope

The report provides a comprehensive segmentation of the North America flowerpots market based on type (Plastic, Ceramics, Wood, Fiber Glass, Others), application (Commercial, Residential, Others), and region (United States, Canada, Rest of North America). A detailed analysis of each segment's market size, growth projections, and competitive dynamics is included. The Plastic segment is projected to maintain its dominance, exhibiting a CAGR of xx% during the forecast period. The Ceramic segment will demonstrate moderate growth, while the Wood segment, although experiencing slower growth currently, shows significant potential for expansion among environmentally conscious consumers. The Residential application segment will remain a key driver of overall market growth. The United States is expected to retain its position as the largest regional market, holding a substantial market share throughout the forecast period.

Key Drivers of North America Flowerpots Market Growth

Several factors drive the growth of the North America flowerpots market: the increasing popularity of home gardening and urban farming fuelled by the COVID-19 pandemic and the millennial generation's enthusiasm for plant ownership. Technological advancements leading to innovative and sustainable products, such as self-watering systems and recycled materials, also boost growth. Favorable government initiatives and supportive policies promoting green spaces and urban gardening further contribute to market expansion.

Challenges in the North America Flowerpots Market Sector

The North America flowerpots market faces challenges such as fluctuating raw material prices, especially for plastics and ceramics, impacting manufacturing costs. Increased competition from international manufacturers, coupled with stringent environmental regulations and import/export restrictions, create hurdles for market players. Supply chain disruptions and logistics challenges can also impact the availability and timely delivery of products.

Leading Players in the North America Flowerpots Market Market

- Brown Wood Inc

- Bowery Farming

- BrightFarms

- Classilk Design

- Potluck Color

- The Clay Room

- Crosea Inc

- USA Planter

Key Developments in North America Flowerpots Market Sector

- August 2021: Cox Enterprises' acquisition of BrightFarms underscores increased investment in the indoor agriculture sector, indirectly boosting demand for associated products, including flowerpots and related growing systems.

- May 2021: Bowery Farming's USD 300 Million Series C funding round highlights significant investment in vertical farming technology, which is anticipated to stimulate demand for specialized flowerpots and advanced growing systems. This further points towards the potential for innovation and growth within the sector.

Strategic North America Flowerpots Market Outlook

The North America flowerpots market is poised for continued growth, driven by sustained interest in home gardening, urban farming, and innovative product development. Strategic opportunities exist for companies focusing on sustainability, smart technology integration, and premium product offerings. Expansion into new market segments, such as specialized flowerpots for vertical farming and hydroponics, presents further growth potential. The market's future success will depend on companies' ability to adapt to changing consumer preferences, embrace sustainable practices, and leverage technological advancements.

North America Flowerpots Market Segmentation

-

1. Type

- 1.1. Plastic

- 1.2. Ceramics

- 1.3. Wood

- 1.4. Fiber Glass

- 1.5. Others

-

2. Application

- 2.1. Commercial

- 2.2. Residential

- 2.3. Others

North America Flowerpots Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Flowerpots Market Regional Market Share

Geographic Coverage of North America Flowerpots Market

North America Flowerpots Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Real Estate Sector Drives the Market; Increasing Urbanization and Infrastructural Development Drives the Market

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives; More Expensive than Traditional Fixtures

- 3.4. Market Trends

- 3.4.1. Growth of Nurseries is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Flowerpots Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Plastic

- 5.1.2. Ceramics

- 5.1.3. Wood

- 5.1.4. Fiber Glass

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Commercial

- 5.2.2. Residential

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Brown Wood Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bowery Gradens

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bright Frams

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Classilk Design

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Potluck Color

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Clay Room

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Crosea Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 USA Planter

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Brown Wood Inc

List of Figures

- Figure 1: North America Flowerpots Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Flowerpots Market Share (%) by Company 2025

List of Tables

- Table 1: North America Flowerpots Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Flowerpots Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: North America Flowerpots Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: North America Flowerpots Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: North America Flowerpots Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Flowerpots Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: North America Flowerpots Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: North America Flowerpots Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: North America Flowerpots Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: North America Flowerpots Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: North America Flowerpots Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: North America Flowerpots Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States North America Flowerpots Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States North America Flowerpots Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Flowerpots Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Flowerpots Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Flowerpots Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Flowerpots Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Flowerpots Market?

The projected CAGR is approximately 14.3%.

2. Which companies are prominent players in the North America Flowerpots Market?

Key companies in the market include Brown Wood Inc, Bowery Gradens, Bright Frams, Classilk Design, Potluck Color, The Clay Room, Crosea Inc, USA Planter.

3. What are the main segments of the North America Flowerpots Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.31 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Real Estate Sector Drives the Market; Increasing Urbanization and Infrastructural Development Drives the Market.

6. What are the notable trends driving market growth?

Growth of Nurseries is Driving the Market.

7. Are there any restraints impacting market growth?

Availability of Alternatives; More Expensive than Traditional Fixtures.

8. Can you provide examples of recent developments in the market?

On August 17, 2021, Cox Enterprises announced the acquisition of BrightFarms, an indoor farming company and provider of locally grown packaged salads. The move solidifies BrightFarms' leadership in the indoor agriculture space and provides a strong, stable foundation committed to accelerating growth with partner retailers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Flowerpots Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Flowerpots Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Flowerpots Market?

To stay informed about further developments, trends, and reports in the North America Flowerpots Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence