Key Insights

The North America fixed income assets market exhibits steady growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 1.50% from 2025 to 2033. This reflects a continued investor preference for relatively safe, income-generating assets, particularly within a backdrop of potential economic uncertainty and fluctuating equity markets. Major drivers include increasing institutional investor participation, a growing demand for diversification within investment portfolios, and the ongoing search for yield in a low-interest-rate environment. Key market trends include the rise of exchange-traded funds (ETFs) and index funds offering broad exposure to the fixed income sector, the growing sophistication of actively managed fixed income strategies targeting specific market segments, and the increasing importance of environmental, social, and governance (ESG) considerations in investment decisions. While regulatory changes and potential interest rate fluctuations pose challenges, the overall outlook remains positive, fueled by the fundamental need for stable, income-producing assets within balanced portfolios.

North America Fixed Income Assets Market Market Size (In Billion)

Despite the steady growth, the market faces certain restraints. Increased competition amongst established players like The Vanguard Group, Pimco Funds, and Fidelity Distributors Corp, necessitates continuous innovation and efficient cost management to maintain market share. Furthermore, shifts in macroeconomic conditions, including inflation and central bank policies, can significantly impact investor sentiment and asset allocation decisions within the fixed income space. The market segmentation reveals a strong presence of various asset classes including government bonds, corporate bonds, and mortgage-backed securities, with differing growth trajectories based on prevailing economic factors and investor risk appetite. The geographical concentration within North America suggests a strong domestic market focus, although opportunities exist for international expansion, particularly through the use of innovative investment vehicles that cater to specific regional preferences.

North America Fixed Income Assets Market Company Market Share

North America Fixed Income Assets Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America fixed income assets market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on the base year 2025 and forecast period 2025-2033, this report meticulously examines market size, growth drivers, competitive dynamics, and future outlook. The study leverages extensive primary and secondary research to deliver actionable intelligence, empowering businesses to navigate the complexities of this dynamic market.

North America Fixed Income Assets Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the North American fixed income assets market, examining market concentration, innovation ecosystems, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a high degree of competition among numerous players, with the top players holding significant market share, but a sizable fragmented market also exists.

The market concentration is moderately high, with the top five players—The Vanguard Group, Pimco Funds, Franklin Distributors Inc., Fidelity Distributors Corp., and American Funds Investment Co.—holding an estimated xx% of the market share in 2025. However, numerous smaller firms contribute significantly to market volume. Innovation within the sector is driven by technological advancements in portfolio management, risk assessment, and data analytics. Stringent regulatory frameworks, such as those enforced by the Securities and Exchange Commission (SEC), significantly impact market operations.

- Market Share (2025): The Vanguard Group (xx%), Pimco Funds (xx%), Franklin Distributors Inc. (xx%), Fidelity Distributors Corp. (xx%), American Funds Investment Co. (xx%), Others (xx%).

- M&A Activity (2019-2024): A total of xx M&A deals were recorded, with a cumulative value of $xx Million. These deals reflect a trend toward consolidation and expansion within the sector.

- Product Substitutes: Alternative investment options, such as real estate and private equity, pose competitive threats to fixed-income assets.

- End-User Trends: Increasing demand for low-risk, stable-return investments from institutional and retail investors fuels market growth.

North America Fixed Income Assets Market Industry Trends & Insights

The North American fixed income assets market exhibits robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Market penetration remains high within institutional investor segments, but there's potential for expansion in the retail investor segment through accessible online platforms.

Technological disruptions, particularly advancements in artificial intelligence (AI) and machine learning (ML), are reshaping investment strategies and risk management. Consumer preferences are shifting towards diversified portfolios including ESG (Environmental, Social, and Governance) focused fixed income products and the demand for personalized investment solutions is growing. The increasing volatility in the equity market also drives investment towards the relatively safer fixed income market. Competitive dynamics are influenced by factors including pricing strategies, service offerings, and technological capabilities.

Dominant Markets & Segments in North America Fixed Income Assets Market

The United States represents the dominant market within North America, driven by its large and sophisticated financial markets, robust regulatory environment, and high concentration of institutional investors.

- Key Drivers for U.S. Dominance:

- Strong Economic Fundamentals: Stable economic growth and relatively low inflation contribute to investor confidence.

- Developed Financial Infrastructure: Well-established financial institutions and regulatory frameworks provide a conducive environment for fixed-income investments.

- High Institutional Investor Concentration: A large pool of institutional investors actively participate in the market.

- Government Debt Market: A substantial and liquid government debt market provides a foundation for fixed-income products.

Canada also represents a significant market, though smaller than the U.S., fueled by factors such as stable political and economic environments and growing institutional investor base. The market is further segmented by asset class (government bonds, corporate bonds, mortgage-backed securities, etc.), investor type (institutional, retail), and investment strategy (active, passive). Each segment exhibits unique growth dynamics and competitive characteristics.

North America Fixed Income Assets Market Product Innovations

Recent product innovations include the development of exchange-traded funds (ETFs) focused on specific fixed-income sectors, as well as the rise of actively managed funds employing sophisticated quantitative models to enhance risk-adjusted returns. These innovations cater to diversified investor needs and enhance market efficiency. The increasing use of fintech solutions promises to streamline operations and broaden market access. The integration of ESG criteria into fixed income products is gaining traction, reflecting evolving investor preferences.

Report Segmentation & Scope

This report segments the North America fixed income assets market based on several key factors: by asset class (Government Bonds, Corporate Bonds, Mortgage-Backed Securities, Municipal Bonds, Others); by investor type (Institutional Investors, Retail Investors); and by investment strategy (Active Management, Passive Management). Each segment's size, growth projections, and competitive dynamics are analyzed in detail. The report also provides regional breakdowns, focusing primarily on the United States and Canada, with detailed analysis of their respective market sizes and growth trajectories.

Key Drivers of North America Fixed Income Assets Market Growth

Several key factors drive the growth of the North American fixed income assets market. These include: (1) Favorable macroeconomic conditions, including low interest rates and stable economic growth, particularly in the U.S.; (2) Increasing demand for low-risk, stable-return investment options from both institutional and retail investors; (3) Growing adoption of technology in portfolio management and risk assessment; and (4) the rise of ESG investing influencing product development.

Challenges in the North America Fixed Income Assets Market Sector

The North America fixed-income assets market faces certain challenges: (1) Interest rate volatility can significantly affect the value of fixed-income securities; (2) Regulatory changes and compliance costs can impact market operations; (3) Increased competition from alternative investment options can constrain market growth; and (4) Geopolitical uncertainties pose risks to market stability, potentially impacting investor confidence.

Leading Players in the North America Fixed Income Assets Market Market

- The Vanguard Group

- Pimco Funds

- Franklin Distributors Inc

- Fidelity Distributors Corp

- American Funds Investment Co

- Putnam Investments LLC

- Oppenheimer Funds Inc

- Scudder Investments

- Evergreen Investments

- Dreyfus Corp

- Federated Investors Inc

- T Rowe Price Group

Key Developments in North America Fixed Income Assets Market Sector

- Q1 2023: Increased adoption of ESG-focused fixed-income products by institutional investors.

- Q3 2022: Launch of several new fixed-income ETFs offering diversified exposure to specific sectors.

- 2021: Significant M&A activity, reflecting consolidation within the market.

Strategic North America Fixed Income Assets Market Outlook

The North American fixed income assets market holds substantial future potential, driven by sustained demand for stable-return investments, ongoing technological advancements, and evolving investor preferences toward ESG-focused products. Strategic opportunities exist for firms to leverage technology to enhance efficiency and offer personalized investment solutions. The focus on sustainable and responsible investments is likely to continue shaping the market landscape, creating both opportunities and challenges for existing players and new entrants alike. The market is expected to witness further consolidation through mergers and acquisitions, leading to a more concentrated but also more innovative market landscape.

North America Fixed Income Assets Market Segmentation

-

1. Source of Funds

- 1.1. Pension Funds and Insurance Companies

- 1.2. Retail Investors

- 1.3. Institutional Investors

- 1.4. Government/Sovereign Wealth Fund

- 1.5. Others

-

2. Fixed Income Type

- 2.1. Core Fixed Income

- 2.2. Alternative Credit

-

3. Type of Asset Management Firms

- 3.1. Large financial institutions/Bulge bracket banks

- 3.2. Mutual Funds ETFs

- 3.3. Private Equity and Venture Capital

- 3.4. Fixed Income Funds

- 3.5. Managed Pension Funds

- 3.6. Others

North America Fixed Income Assets Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

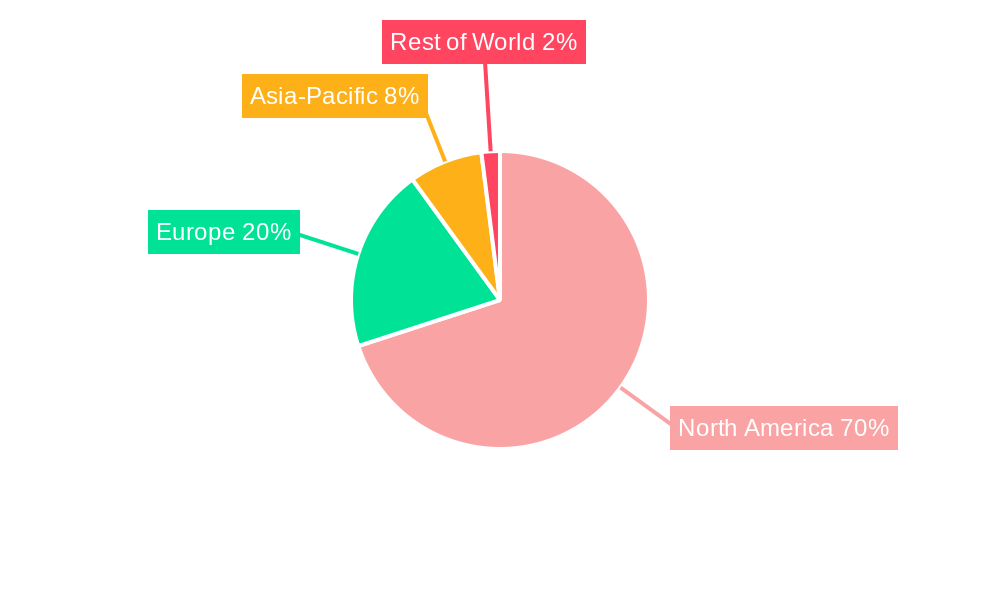

North America Fixed Income Assets Market Regional Market Share

Geographic Coverage of North America Fixed Income Assets Market

North America Fixed Income Assets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Prominence of HNWIs in Fixed Income Investments in North America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Fixed Income Assets Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Source of Funds

- 5.1.1. Pension Funds and Insurance Companies

- 5.1.2. Retail Investors

- 5.1.3. Institutional Investors

- 5.1.4. Government/Sovereign Wealth Fund

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Fixed Income Type

- 5.2.1. Core Fixed Income

- 5.2.2. Alternative Credit

- 5.3. Market Analysis, Insights and Forecast - by Type of Asset Management Firms

- 5.3.1. Large financial institutions/Bulge bracket banks

- 5.3.2. Mutual Funds ETFs

- 5.3.3. Private Equity and Venture Capital

- 5.3.4. Fixed Income Funds

- 5.3.5. Managed Pension Funds

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Source of Funds

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Vanguard Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pimco Funds

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Franklin Distributors Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fidelity Distributors Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 American Funds Investment Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Putnam Investments LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oppenheimer Funds Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Scudder Investments

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Evergreen Investments

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dreyfus Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Federated Investors Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 T Rowe Price Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 The Vanguard Group

List of Figures

- Figure 1: North America Fixed Income Assets Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Fixed Income Assets Market Share (%) by Company 2025

List of Tables

- Table 1: North America Fixed Income Assets Market Revenue Million Forecast, by Source of Funds 2020 & 2033

- Table 2: North America Fixed Income Assets Market Revenue Million Forecast, by Fixed Income Type 2020 & 2033

- Table 3: North America Fixed Income Assets Market Revenue Million Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 4: North America Fixed Income Assets Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Fixed Income Assets Market Revenue Million Forecast, by Source of Funds 2020 & 2033

- Table 6: North America Fixed Income Assets Market Revenue Million Forecast, by Fixed Income Type 2020 & 2033

- Table 7: North America Fixed Income Assets Market Revenue Million Forecast, by Type of Asset Management Firms 2020 & 2033

- Table 8: North America Fixed Income Assets Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Fixed Income Assets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Fixed Income Assets Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Fixed Income Assets Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Fixed Income Assets Market?

The projected CAGR is approximately 1.50%.

2. Which companies are prominent players in the North America Fixed Income Assets Market?

Key companies in the market include The Vanguard Group, Pimco Funds, Franklin Distributors Inc, Fidelity Distributors Corp, American Funds Investment Co, Putnam Investments LLC, Oppenheimer Funds Inc, Scudder Investments, Evergreen Investments, Dreyfus Corp, Federated Investors Inc, T Rowe Price Group.

3. What are the main segments of the North America Fixed Income Assets Market?

The market segments include Source of Funds, Fixed Income Type, Type of Asset Management Firms.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Prominence of HNWIs in Fixed Income Investments in North America.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Fixed Income Assets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Fixed Income Assets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Fixed Income Assets Market?

To stay informed about further developments, trends, and reports in the North America Fixed Income Assets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence