Key Insights

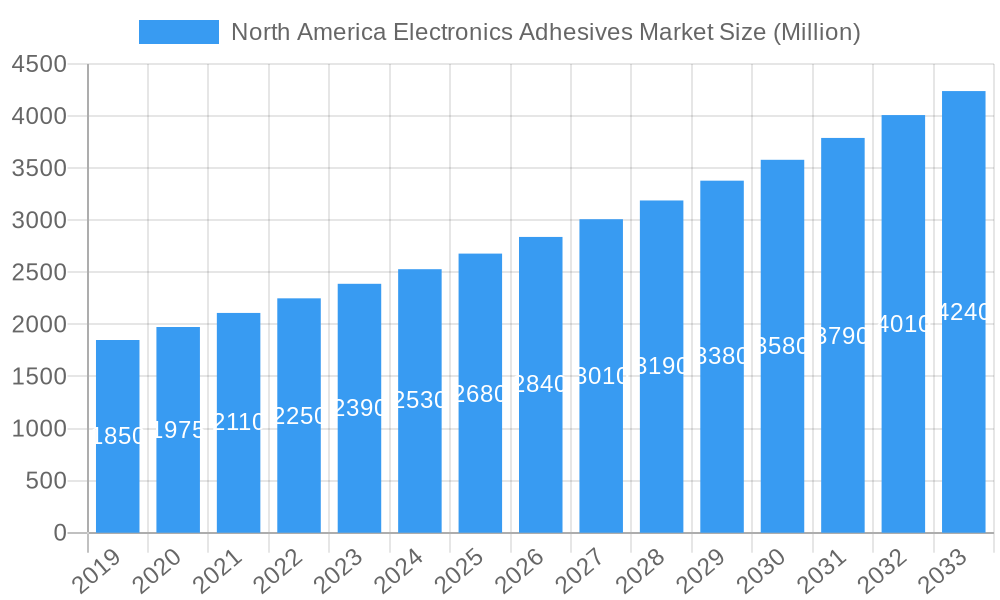

The North America Electronics Adhesives Market is projected for substantial growth, expected to reach $14.72 billion by 2025, with a CAGR of 7.89%. This expansion is driven by escalating demand for advanced electronic devices across consumer, industrial, and automotive segments. Key factors include component miniaturization, increased adoption of surface mounting and other advanced packaging techniques, and the need for protective solutions like conformal coatings and encapsulation to improve device durability and performance. The rollout of 5G infrastructure and the proliferation of Internet of Things (IoT) devices are further stimulating the demand for high-performance electronic adhesives. Manufacturers are prioritizing the development of innovative formulations offering enhanced thermal conductivity, superior electrical insulation, and robust adhesion to diverse substrates, addressing the evolving needs of electronics manufacturing.

North America Electronics Adhesives Market Market Size (In Billion)

While promising, the market faces certain challenges. Fluctuations in raw material prices for resins such as epoxy and polyurethane can affect manufacturing costs and profitability. Stringent environmental regulations on volatile organic compounds (VOCs) necessitate investment in low-VOC and eco-friendly formulations, presenting development hurdles and initial costs. However, the strategic significance of electronics manufacturing in North America, coupled with substantial R&D investments from leading companies including Henkel, 3M, Arkema, and H.B. Fuller, is anticipated to mitigate these challenges. The market is characterized by vigorous competition and a continuous pursuit of technological innovation, with a strong focus on specialized adhesives for emerging applications like wearable technology and advanced driver-assistance systems (ADAS).

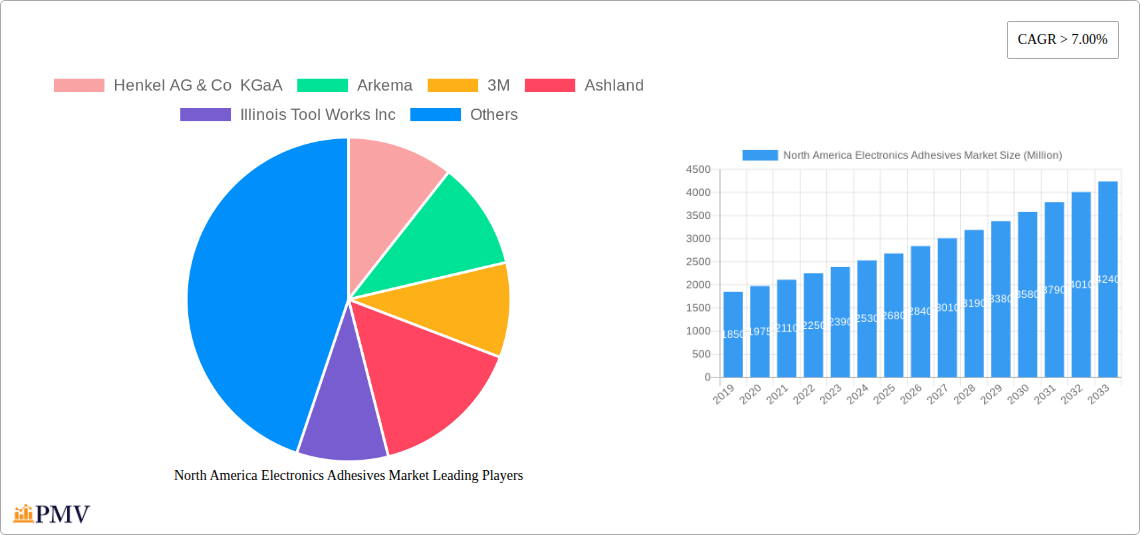

North America Electronics Adhesives Market Company Market Share

This comprehensive market research report offers in-depth analysis of the North America electronics adhesives market, a vital sector for electronic device functionality and reliability. The report covers the period from 2019 to 2033, with 2025 as the base year and forecasts extending to 2033, providing critical insights into market dynamics, growth drivers, technological advancements, and competitive landscapes. It examines key segments including epoxy, acrylic, and polyurethane adhesives, as well as applications such as conformal coatings, surface mounting, and encapsulation. With detailed regional segmentation for the United States, Canada, and Mexico, this report is an essential resource for stakeholders looking to understand and leverage opportunities in this dynamic market.

North America Electronics Adhesives Market Market Structure & Competitive Dynamics

The North America electronics adhesives market is characterized by a moderately concentrated structure, with a few dominant players holding significant market share. Leading companies such as Henkel AG & Co KGaA, Arkema, 3M, Ashland, Illinois Tool Works Inc, BASF SE, H B Fuller Company, Dow, and Sika AG are at the forefront of innovation and market penetration. These players actively engage in research and development to introduce high-performance adhesives catering to the evolving demands of the electronics industry. The innovation ecosystem thrives on collaborations between adhesive manufacturers, electronics OEMs, and research institutions, fostering the development of advanced bonding solutions. Regulatory frameworks, particularly concerning environmental compliance and material safety, play a crucial role in shaping product development and market entry strategies. While product substitutes exist, the unique performance characteristics of specialized electronics adhesives, such as their thermal conductivity, electrical insulation, and mechanical strength, limit widespread substitution. End-user trends are heavily influenced by the miniaturization of electronic devices, the increasing demand for flexible electronics, and the growing adoption of electric vehicles, all of which necessitate advanced adhesive technologies. Mergers and acquisitions (M&A) activities are a significant feature of the market's competitive dynamics, with strategic acquisitions aimed at expanding product portfolios, market reach, and technological capabilities. For instance, recent M&A deals have seen major players acquiring smaller, specialized adhesive companies to gain access to niche technologies and customer bases, thereby consolidating market leadership.

North America Electronics Adhesives Market Industry Trends & Insights

The North America electronics adhesives market is experiencing robust growth, driven by several interconnected trends. The escalating demand for consumer electronics, including smartphones, tablets, and wearable devices, directly fuels the consumption of various electronic adhesives for assembly and protection. The burgeoning automotive sector, particularly the shift towards electric vehicles (EVs), represents a significant growth catalyst. EVs require advanced adhesives for battery pack assembly, thermal management, and component bonding, driving substantial demand for high-performance epoxy adhesives and polyurethane adhesives with superior thermal conductivity and durability. Furthermore, the increasing adoption of IoT devices across industries, from smart homes to industrial automation, necessitates sophisticated adhesive solutions for miniaturized and interconnected electronic components. Technological disruptions are at the core of market evolution. Innovations in adhesive formulations, such as the development of UV-curable adhesives, conductive adhesives, and thermally conductive adhesives, are enabling manufacturers to achieve faster production cycles, enhance device performance, and overcome design challenges. The trend towards miniaturization in electronics necessitates adhesives with precise application capabilities and excellent adhesion to diverse substrate materials. Consumer preferences are increasingly focused on product durability, longevity, and enhanced functionality, pushing adhesive manufacturers to develop solutions that contribute to these attributes. Competitive dynamics are intensifying, with a strong emphasis on product differentiation through performance, sustainability, and cost-effectiveness. Companies are investing heavily in R&D to develop adhesives that meet stringent environmental regulations and offer improved recyclability. The market penetration of advanced adhesive technologies is steadily increasing as manufacturers recognize their critical role in achieving higher manufacturing yields and product reliability. The projected Compound Annual Growth Rate (CAGR) for the North America electronics adhesives market is robust, driven by these powerful industry trends and an expanding application landscape.

Dominant Markets & Segments in North America Electronics Adhesives Market

Within the North America electronics adhesives market, the United States stands out as the dominant geographic region, driven by its massive electronics manufacturing base, significant R&D investments, and the presence of major global electronics companies. The economic policies supporting technological innovation and manufacturing in the U.S., coupled with substantial government funding for research in areas like advanced materials and semiconductor manufacturing, further solidify its leading position. Canada and Mexico, while smaller in market size, are also crucial players, with Mexico benefiting from its proximity to the U.S. and its role in electronics assembly and manufacturing.

In terms of Resin Type, Epoxy adhesives hold a significant share due to their excellent mechanical strength, chemical resistance, and adhesive properties, making them indispensable for structural bonding, encapsulation, and underfill applications. Acrylics are gaining traction due to their fast curing times and versatility, particularly in applications requiring flexibility and impact resistance. Polyurethane adhesives offer a good balance of flexibility, toughness, and adhesion to a wide range of substrates, finding use in demanding applications like automotive electronics and industrial automation.

For Application, Surface Mounting is a substantial segment, as adhesives are critical for securing components onto printed circuit boards (PCBs) during automated assembly processes. Encapsulation is another vital application, providing protection to sensitive electronic components from environmental factors like moisture, dust, and thermal stress, thereby enhancing device reliability and lifespan. Conformal Coatings are essential for protecting PCBs from environmental contaminants and ensuring electrical insulation, particularly in harsh operating conditions. Wire Tacking applications, while smaller, are important for securing wires and cables in place, preventing strain and ensuring the integrity of electrical connections.

The dominance of specific segments is influenced by evolving industry needs. For example, the increasing complexity and density of PCBs in consumer electronics and automotive applications are driving demand for high-performance adhesives in surface mounting and encapsulation. The growing emphasis on device longevity and reliability in harsh environments is boosting the demand for advanced conformal coatings and encapsulation solutions. Economic policies encouraging domestic manufacturing and R&D investment further fuel the growth of these dominant segments within the United States.

North America Electronics Adhesives Market Product Innovations

Product innovation in the North America electronics adhesives market is predominantly focused on enhancing performance and addressing emerging industry demands. Key developments include the introduction of ultra-low outgassing adhesives for sensitive optics and display applications, crucial for the miniaturization and improved performance of electronic devices. Advancements in thermally conductive adhesives are enabling more efficient heat dissipation in power electronics and high-performance computing, a critical factor for device longevity and operational stability. Furthermore, the development of flexible and stretchable adhesives caters to the growing market for wearable electronics and flexible displays, offering enhanced durability and design freedom. The competitive advantage lies in offering adhesives with superior adhesion to novel substrate materials, faster curing times, and improved environmental sustainability, meeting the stringent requirements of modern electronic manufacturing.

Report Segmentation & Scope

This report segments the North America electronics adhesives market by Resin Type, encompassing Epoxy, Acrylics, Polyurethane, and Other Resin Types. By Application, the market is analyzed across Conformal Coatings, Surface Mounting, Encapsulation, Wire Tacking, and Other Applications. Geographically, the report covers the United States, Canada, and Mexico. The United States is projected to maintain its leading market share, driven by its robust manufacturing capabilities and R&D investments, with an estimated market size of over $1 Billion in 2025, growing at a significant CAGR. Canada and Mexico represent growing markets, with Mexico benefiting from its role in the electronics supply chain. Within Resin Types, Epoxy is expected to dominate, followed by Acrylics and Polyurethane, with their respective market sizes and growth rates detailed. Similarly, the applications segment shows strong growth in Surface Mounting and Encapsulation, reflecting current industry demands.

Key Drivers of North America Electronics Adhesives Market Growth

Several key factors are propelling the growth of the North America electronics adhesives market. The relentless miniaturization of electronic devices, driven by consumer demand for smaller, more powerful gadgets, necessitates the use of advanced adhesives for precise component placement and secure bonding. The rapid expansion of the electric vehicle (EV) market is a major growth accelerator, requiring specialized adhesives for battery assembly, thermal management, and structural integrity. Government initiatives promoting domestic manufacturing and technological innovation, particularly in semiconductors and advanced electronics, further stimulate demand. Furthermore, the increasing adoption of IoT devices across various sectors, from smart homes to industrial automation, creates a sustained need for reliable and high-performance adhesives to connect and protect intricate electronic components.

Challenges in the North America Electronics Adhesives Market Sector

Despite the promising growth trajectory, the North America electronics adhesives market faces certain challenges. Stringent environmental regulations regarding volatile organic compounds (VOCs) and hazardous materials can increase compliance costs and necessitate reformulation efforts. Supply chain disruptions, as witnessed in recent years, can impact raw material availability and pricing, affecting production schedules and profitability. Competitive pressures from both established players and emerging niche manufacturers also pose a challenge, requiring continuous innovation and cost optimization. The need for specialized training and expertise for handling and applying advanced adhesives can also create a barrier for some smaller manufacturers.

Leading Players in the North America Electronics Adhesives Market Market

- Henkel AG & Co KGaA

- Arkema

- 3M

- Ashland

- Illinois Tool Works Inc

- BASF SE

- Beardow Adams

- Dow

- H B Fuller Company

- Sika AG

- Covestro AG

- AVERY DENNISON CORPORATION

- Huntsman International LLC

- CHEMENCE

Key Developments in North America Electronics Adhesives Market Sector

- 2024 (Q1): Henkel AG & Co KGaA launched a new line of high-thermal-conductivity adhesives for advanced EV battery thermal management systems, addressing critical cooling needs in next-generation electric vehicles.

- 2023 (Q4): 3M announced significant advancements in their conductive adhesive portfolio, enabling finer pitch interconnects for next-generation semiconductor packaging, supporting the trend of miniaturization.

- 2023 (Q3): Arkema acquired a specialized manufacturer of high-performance adhesives for flexible electronics, bolstering its offering for the wearable and foldable device markets.

- 2023 (Q2): H B Fuller Company introduced a sustainable adhesive solution with reduced environmental impact, aligning with growing industry demand for eco-friendly materials.

Strategic North America Electronics Adhesives Market Market Outlook

The strategic outlook for the North America electronics adhesives market remains highly positive, fueled by persistent technological advancements and burgeoning end-use industries. Growth accelerators include the continued evolution of 5G technology, the expansion of artificial intelligence (AI) and machine learning applications requiring high-performance computing, and the increasing penetration of smart devices in homes and workplaces. Furthermore, the ongoing transition to sustainable energy solutions, including solar power and advanced battery technologies, will drive demand for specialized adhesives with enhanced durability and performance. Strategic opportunities lie in developing bio-based and recyclable adhesives, catering to the growing sustainability consciousness, and in expanding capabilities for servicing emerging sectors like advanced medical electronics and aerospace.

North America Electronics Adhesives Market Segmentation

-

1. Resin Type

- 1.1. Epoxy

- 1.2. Acrylics

- 1.3. Polyurethane

- 1.4. Other Resin Types

-

2. Application

- 2.1. Conformal Coatings

- 2.2. Surface Mounting

- 2.3. Encapsulation

- 2.4. Wire Tacking

- 2.5. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Electronics Adhesives Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Electronics Adhesives Market Regional Market Share

Geographic Coverage of North America Electronics Adhesives Market

North America Electronics Adhesives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Electronics Manufacturing in Mexico; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulations Related to the VOCs; Globalization and Growing Operating Costs; Other Restraints

- 3.4. Market Trends

- 3.4.1. Epoxy Resin Type to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Electronics Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Epoxy

- 5.1.2. Acrylics

- 5.1.3. Polyurethane

- 5.1.4. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Conformal Coatings

- 5.2.2. Surface Mounting

- 5.2.3. Encapsulation

- 5.2.4. Wire Tacking

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. United States North America Electronics Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Epoxy

- 6.1.2. Acrylics

- 6.1.3. Polyurethane

- 6.1.4. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Conformal Coatings

- 6.2.2. Surface Mounting

- 6.2.3. Encapsulation

- 6.2.4. Wire Tacking

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. Canada North America Electronics Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Epoxy

- 7.1.2. Acrylics

- 7.1.3. Polyurethane

- 7.1.4. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Conformal Coatings

- 7.2.2. Surface Mounting

- 7.2.3. Encapsulation

- 7.2.4. Wire Tacking

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Mexico North America Electronics Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Epoxy

- 8.1.2. Acrylics

- 8.1.3. Polyurethane

- 8.1.4. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Conformal Coatings

- 8.2.2. Surface Mounting

- 8.2.3. Encapsulation

- 8.2.4. Wire Tacking

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Henkel AG & Co KGaA

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Arkema

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 3M

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Ashland

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Illinois Tool Works Inc

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 BASF SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Beardow Adams

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Dow

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 H B Fuller Company

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Sika AG

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Covestro AG

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 AVERY DENNISON CORPORATION

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Huntsman International LLC

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 CHEMENCE

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: North America Electronics Adhesives Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Electronics Adhesives Market Share (%) by Company 2025

List of Tables

- Table 1: North America Electronics Adhesives Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 2: North America Electronics Adhesives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: North America Electronics Adhesives Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Electronics Adhesives Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Electronics Adhesives Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 6: North America Electronics Adhesives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: North America Electronics Adhesives Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Electronics Adhesives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Electronics Adhesives Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 10: North America Electronics Adhesives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: North America Electronics Adhesives Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Electronics Adhesives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Electronics Adhesives Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 14: North America Electronics Adhesives Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: North America Electronics Adhesives Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Electronics Adhesives Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Electronics Adhesives Market?

The projected CAGR is approximately 7.89%.

2. Which companies are prominent players in the North America Electronics Adhesives Market?

Key companies in the market include Henkel AG & Co KGaA, Arkema, 3M, Ashland, Illinois Tool Works Inc, BASF SE, Beardow Adams, Dow, H B Fuller Company, Sika AG, Covestro AG, AVERY DENNISON CORPORATION, Huntsman International LLC , CHEMENCE.

3. What are the main segments of the North America Electronics Adhesives Market?

The market segments include Resin Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.72 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Electronics Manufacturing in Mexico; Other Drivers.

6. What are the notable trends driving market growth?

Epoxy Resin Type to Dominate the Market.

7. Are there any restraints impacting market growth?

; Stringent Regulations Related to the VOCs; Globalization and Growing Operating Costs; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Electronics Adhesives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Electronics Adhesives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Electronics Adhesives Market?

To stay informed about further developments, trends, and reports in the North America Electronics Adhesives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence