Key Insights

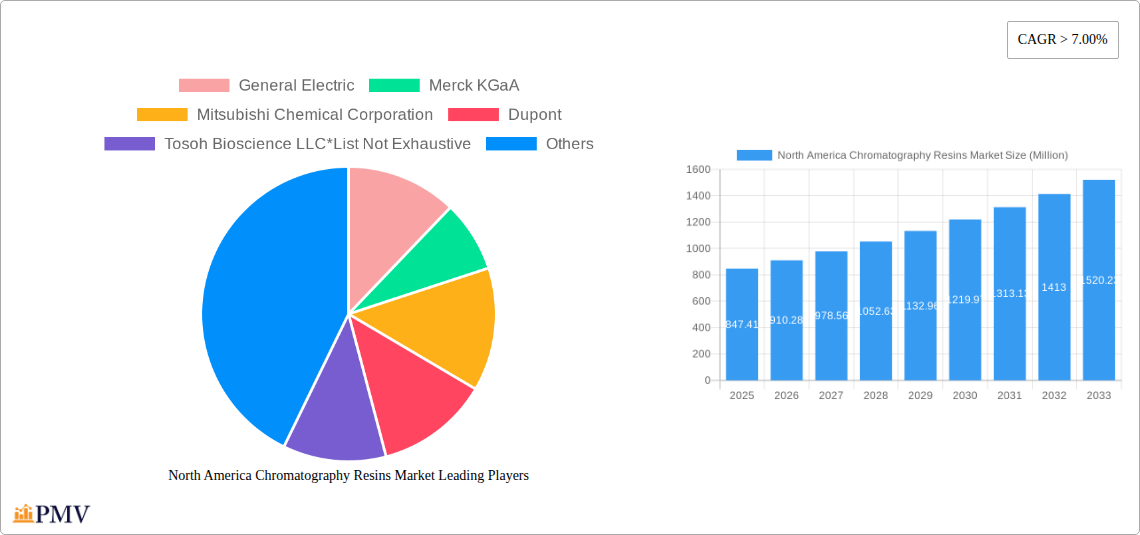

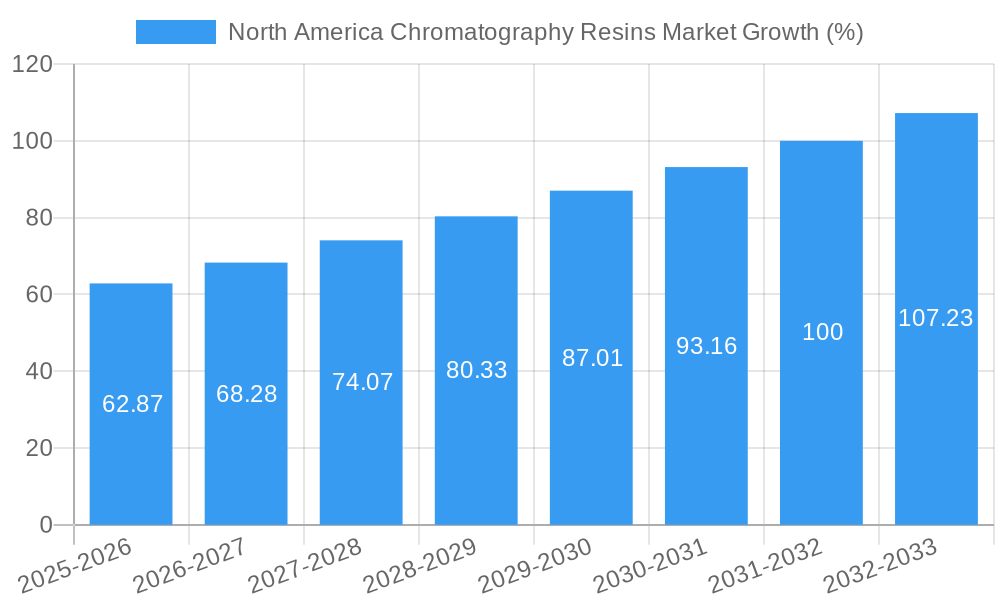

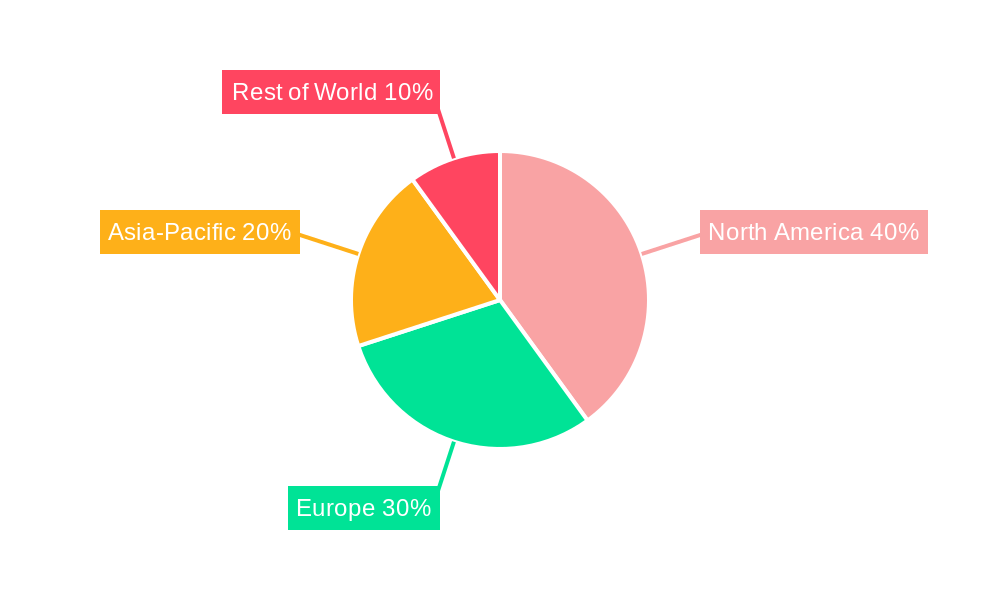

The North America chromatography resins market, valued at approximately $847.41 million in 2025, is projected to experience robust growth, exceeding a 7% Compound Annual Growth Rate (CAGR) from 2025 to 2033. This expansion is driven by several key factors. The pharmaceutical and biopharmaceutical industries' increasing reliance on advanced purification techniques for drug development and production is a major catalyst. Stringent regulatory requirements for drug purity further fuel demand for high-performance chromatography resins. Simultaneously, the food and beverage sector's growing adoption of chromatography for quality control and analysis contributes to market growth. Technological advancements, such as the development of more efficient and selective resins, along with innovative chromatography techniques, enhance separation efficiency and reduce processing times, making them more attractive to various industries. Furthermore, the increasing prevalence of chronic diseases is indirectly boosting the demand for advanced drug therapies, thereby driving the need for sophisticated purification processes that utilize chromatography resins. The market segmentation reflects this diversity, with significant contributions from natural-based and synthetic-based resins, across various chromatography technologies. The established presence of key players like GE Healthcare Life Sciences, Merck KGaA, and others ensures a competitive landscape, fostering innovation and driving market expansion.

Despite its potential, the market faces some challenges. The high initial investment required for advanced chromatography systems might deter smaller companies. Fluctuations in raw material prices and potential supply chain disruptions could also impact market growth. However, the long-term outlook remains positive, fueled by the continuous demand for higher purity products and the persistent need for effective separation techniques across various industrial sectors. The North American region, specifically the United States, is anticipated to remain a major contributor to the overall market size due to its advanced healthcare infrastructure, robust pharmaceutical industry, and presence of leading chromatography resin manufacturers. The market's strong fundamentals and positive growth trajectory suggest a promising future for chromatography resins in North America.

This comprehensive report provides an in-depth analysis of the North America chromatography resins market, offering valuable insights for stakeholders across the pharmaceutical, biotechnology, and environmental sectors. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market size, growth drivers, competitive landscape, and future trends. It includes detailed segmentations by end-user industry (pharmaceuticals, drug production, water & environmental agencies, food & beverages, other), origin (natural-based, synthetic-based), and technology (ion exchange, affinity, size exclusion, hydrophobic interaction, others).

North America Chromatography Resins Market Market Structure & Competitive Dynamics

The North American chromatography resins market exhibits a moderately consolidated structure, with key players holding significant market share. The market is characterized by a dynamic interplay of established multinational corporations and specialized niche players. Competition is fierce, driven by innovation in resin technology, strategic acquisitions, and the continuous pursuit of higher efficiency and selectivity.

Market concentration is influenced by several factors, including the scale of manufacturing facilities, R&D investments, and the breadth of product portfolios. While precise market share figures for individual players are proprietary, the leading companies – including General Electric, Merck KGaA, Mitsubishi Chemical Corporation, DuPont, Tosoh Bioscience LLC, Purolite, Agilent Technologies, Avantor Inc, Thermo Fisher Scientific, and GE Healthcare Life Sciences – collectively account for a substantial portion of the market. The industry is witnessing increasing M&A activity, exemplified by the merger of Purolite and Dow's ion exchange resins business, which significantly reshaped the competitive landscape and deal values are estimated to be in the range of xx Million. Regulatory frameworks, particularly those concerning environmental compliance and product safety, heavily influence market dynamics. The substitution of traditional resins with newer, more efficient technologies is an ongoing trend, leading to continuous product development and refinement. Finally, end-user preferences, especially within the booming pharmaceutical and biotech sectors, are shaping demand for specialized resins with enhanced performance characteristics.

North America Chromatography Resins Market Industry Trends & Insights

The North America chromatography resins market is experiencing robust growth, driven by several key factors. The pharmaceutical and biotechnology industries are major consumers, fueled by the increasing demand for biopharmaceuticals and advanced drug discovery techniques. The CAGR for the period 2025-2033 is projected to be xx%, reflecting the consistent market expansion. Technological advancements, such as the development of high-performance resins with improved selectivity and capacity, are boosting market penetration. Consumer preferences are shifting towards more sustainable and environmentally friendly options, which is influencing the adoption of natural-based resins. However, the market also faces challenges, including fluctuating raw material prices and the emergence of alternative separation technologies. Intense competition among established players and the entry of new entrants necessitate continuous innovation and strategic partnerships to maintain a strong market position. The increasing focus on process optimization and cost reduction within the end-user industries is also a key driver, pushing the demand for more efficient chromatography resins. The market penetration of advanced technologies like affinity chromatography resins continues to grow due to their superior performance in specific applications.

Dominant Markets & Segments in North America Chromatography Resins Market

Dominant End-user Industry: The pharmaceutical industry dominates the North America chromatography resins market, accounting for approximately xx% of the total market value, driven by the increasing demand for biopharmaceuticals and sophisticated purification processes. This is further fuelled by strong economic policies supporting the pharmaceutical industry in key North American regions. The expansion of pharmaceutical manufacturing facilities and investments in R&D are vital drivers for this segment.

Dominant Origin: Synthetic-based resins currently hold a larger market share (approximately xx%) compared to natural-based resins, primarily due to their consistent performance, scalability and ability to meet the demands of high-throughput processes. However, the growing demand for environmentally friendly solutions is boosting the adoption of natural-based resins.

Dominant Technology: Ion exchange chromatography resins remain the dominant technology, commanding approximately xx% of the market due to their versatility and cost-effectiveness. However, affinity chromatography resins are experiencing substantial growth, driven by their high selectivity and application in biopharmaceutical purification.

The United States is the largest market within North America, benefiting from advanced infrastructure, robust regulatory frameworks, and a concentrated presence of major pharmaceutical and biotechnology companies.

North America Chromatography Resins Market Product Innovations

Recent years have witnessed significant product innovations in chromatography resins, including the launch of next-generation affinity resins by Merck KGaA offering enhanced selectivity and binding capacity. These innovations cater to the growing demand for more efficient and targeted purification processes in biopharmaceutical manufacturing. Furthermore, there is a notable trend towards the development of resins with improved chemical stability and longer operational lifetimes, maximizing cost-effectiveness for end-users. The emphasis is on developing resins that meet specific application needs, ranging from large-scale industrial purification to highly specialized analytical applications. This continuous development ensures the market remains dynamic and adaptable to evolving industry requirements.

Report Segmentation & Scope

This report provides a granular segmentation of the North America chromatography resins market, categorized by:

End-user Industry: Pharmaceuticals, Drug Production, Water & Environmental Agencies, Food & Beverages, Other End-user Industries. Each segment's growth projections and market sizes are detailed, highlighting competitive landscapes within each sector.

Origin: Natural-based and Synthetic-based resins. Growth projections and market sizes are provided for each origin type, considering factors such as sustainability and performance characteristics.

Technology: Ion Exchange Chromatography Resins, Affinity Chromatography Resins, Size Exclusion Chromatography Resins, Hydrophobic Interaction Chromatography Resins, and Other Technologies. This section analyzes the market share, growth trajectory, and competitive dynamics for each technology. Each segment's growth is projected based on historical data, current trends, and future market expectations.

Key Drivers of North America Chromatography Resins Market Growth

The growth of the North America chromatography resins market is propelled by several key factors: the burgeoning biopharmaceutical industry, necessitating advanced purification techniques; the increasing demand for high-purity products across various sectors; technological advancements leading to more efficient and selective resins; and supportive regulatory frameworks promoting innovation and market expansion. Government initiatives to improve water quality further stimulate the use of chromatography resins in environmental applications.

Challenges in the North America Chromatography Resins Market Sector

The North America chromatography resins market faces certain challenges, including fluctuating raw material prices impacting production costs; the emergence of competitive separation technologies; and stringent regulatory compliance requirements that necessitate significant investments in quality control and environmental protection measures. Supply chain disruptions can also lead to delays and increased costs, influencing market stability and price fluctuations.

Leading Players in the North America Chromatography Resins Market Market

- General Electric

- Merck KGaA

- Mitsubishi Chemical Corporation

- Dupont

- Tosoh Bioscience LLC

- Purolite

- Agilent Technologies

- Avantor Inc

- Thermo Fisher Scientific

- GE Healthcare Life Sciences

Key Developments in North America Chromatography Resins Market Sector

- 2022: Merger of Purolite and Dow's Ion Exchange Resins Business significantly alters market share and competitive dynamics.

- 2023: Launch of next-generation affinity resins by Merck KGaA enhances market offerings and caters to high-demand applications.

- 2024: Expansion of production facilities by Tosoh Bioscience increases capacity and meets growing market demand.

Strategic North America Chromatography Resins Market Market Outlook

The North America chromatography resins market holds significant growth potential, driven by continued innovation in resin technology, expanding application areas in biopharmaceuticals and environmental monitoring, and supportive regulatory frameworks. Strategic partnerships and collaborations between resin manufacturers and end-users will further shape the market landscape. Companies focused on developing sustainable and high-performance resins are expected to gain a competitive edge. The market is poised for continued expansion, driven by the strong demand from key end-user industries and technological advancements.

North America Chromatography Resins Market Segmentation

-

1. Origin

-

1.1. Natural-based

- 1.1.1. Agarose

- 1.1.2. Dextran

-

1.2. Synthetic-based

- 1.2.1. Silica Gel

- 1.2.2. Aluminum Oxide

- 1.2.3. Polystyrene

- 1.2.4. Other Synthetic-based Resins

-

1.1. Natural-based

-

2. Technology

- 2.1. Ion Exchange Chromatography Resins

- 2.2. Affinity Chromatography Resins

- 2.3. Size Exclusion Chromatography Resins

- 2.4. Hydrophobic Interaction Chromatography Resins

- 2.5. Other Technologies

-

3. End-user Industry

-

3.1. Pharmaceuticals

- 3.1.1. Biotechnology

- 3.1.2. Drug Discovery

- 3.1.3. Drug Production

- 3.2. Water and Environmental Agencies

- 3.3. Food and Beverages

- 3.4. Other End-user Industries

-

3.1. Pharmaceuticals

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America Chromatography Resins Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Chromatography Resins Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Technological Advancements in Chromatography Resins; Increasing Importance of Chromatography Tests in Drug Approvals

- 3.3. Market Restrains

- 3.3.1. ; High Costs vs. Productivity of Chromatography Systems

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Pharmaceutical Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 5.1.1. Natural-based

- 5.1.1.1. Agarose

- 5.1.1.2. Dextran

- 5.1.2. Synthetic-based

- 5.1.2.1. Silica Gel

- 5.1.2.2. Aluminum Oxide

- 5.1.2.3. Polystyrene

- 5.1.2.4. Other Synthetic-based Resins

- 5.1.1. Natural-based

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Ion Exchange Chromatography Resins

- 5.2.2. Affinity Chromatography Resins

- 5.2.3. Size Exclusion Chromatography Resins

- 5.2.4. Hydrophobic Interaction Chromatography Resins

- 5.2.5. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Pharmaceuticals

- 5.3.1.1. Biotechnology

- 5.3.1.2. Drug Discovery

- 5.3.1.3. Drug Production

- 5.3.2. Water and Environmental Agencies

- 5.3.3. Food and Beverages

- 5.3.4. Other End-user Industries

- 5.3.1. Pharmaceuticals

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Origin

- 6. United States North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Origin

- 6.1.1. Natural-based

- 6.1.1.1. Agarose

- 6.1.1.2. Dextran

- 6.1.2. Synthetic-based

- 6.1.2.1. Silica Gel

- 6.1.2.2. Aluminum Oxide

- 6.1.2.3. Polystyrene

- 6.1.2.4. Other Synthetic-based Resins

- 6.1.1. Natural-based

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Ion Exchange Chromatography Resins

- 6.2.2. Affinity Chromatography Resins

- 6.2.3. Size Exclusion Chromatography Resins

- 6.2.4. Hydrophobic Interaction Chromatography Resins

- 6.2.5. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Pharmaceuticals

- 6.3.1.1. Biotechnology

- 6.3.1.2. Drug Discovery

- 6.3.1.3. Drug Production

- 6.3.2. Water and Environmental Agencies

- 6.3.3. Food and Beverages

- 6.3.4. Other End-user Industries

- 6.3.1. Pharmaceuticals

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Origin

- 7. Canada North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Origin

- 7.1.1. Natural-based

- 7.1.1.1. Agarose

- 7.1.1.2. Dextran

- 7.1.2. Synthetic-based

- 7.1.2.1. Silica Gel

- 7.1.2.2. Aluminum Oxide

- 7.1.2.3. Polystyrene

- 7.1.2.4. Other Synthetic-based Resins

- 7.1.1. Natural-based

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Ion Exchange Chromatography Resins

- 7.2.2. Affinity Chromatography Resins

- 7.2.3. Size Exclusion Chromatography Resins

- 7.2.4. Hydrophobic Interaction Chromatography Resins

- 7.2.5. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Pharmaceuticals

- 7.3.1.1. Biotechnology

- 7.3.1.2. Drug Discovery

- 7.3.1.3. Drug Production

- 7.3.2. Water and Environmental Agencies

- 7.3.3. Food and Beverages

- 7.3.4. Other End-user Industries

- 7.3.1. Pharmaceuticals

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Origin

- 8. Mexico North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Origin

- 8.1.1. Natural-based

- 8.1.1.1. Agarose

- 8.1.1.2. Dextran

- 8.1.2. Synthetic-based

- 8.1.2.1. Silica Gel

- 8.1.2.2. Aluminum Oxide

- 8.1.2.3. Polystyrene

- 8.1.2.4. Other Synthetic-based Resins

- 8.1.1. Natural-based

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Ion Exchange Chromatography Resins

- 8.2.2. Affinity Chromatography Resins

- 8.2.3. Size Exclusion Chromatography Resins

- 8.2.4. Hydrophobic Interaction Chromatography Resins

- 8.2.5. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Pharmaceuticals

- 8.3.1.1. Biotechnology

- 8.3.1.2. Drug Discovery

- 8.3.1.3. Drug Production

- 8.3.2. Water and Environmental Agencies

- 8.3.3. Food and Beverages

- 8.3.4. Other End-user Industries

- 8.3.1. Pharmaceuticals

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Origin

- 9. United States North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Chromatography Resins Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 General Electric

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Merck KGaA

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Mitsubishi Chemical Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Dupont

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Tosoh Bioscience LLC*List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Purolite

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Agilient Technologies

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Avantor Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Thermo Fisher Scientific

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 GE Healthcare Life Sciences

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 General Electric

List of Figures

- Figure 1: North America Chromatography Resins Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Chromatography Resins Market Share (%) by Company 2024

List of Tables

- Table 1: North America Chromatography Resins Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Chromatography Resins Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: North America Chromatography Resins Market Revenue Million Forecast, by Origin 2019 & 2032

- Table 4: North America Chromatography Resins Market Volume K Tons Forecast, by Origin 2019 & 2032

- Table 5: North America Chromatography Resins Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: North America Chromatography Resins Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 7: North America Chromatography Resins Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: North America Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 9: North America Chromatography Resins Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: North America Chromatography Resins Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 11: North America Chromatography Resins Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: North America Chromatography Resins Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 13: North America Chromatography Resins Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: North America Chromatography Resins Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 15: United States North America Chromatography Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States North America Chromatography Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Canada North America Chromatography Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada North America Chromatography Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Mexico North America Chromatography Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico North America Chromatography Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Rest of North America North America Chromatography Resins Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of North America North America Chromatography Resins Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: North America Chromatography Resins Market Revenue Million Forecast, by Origin 2019 & 2032

- Table 24: North America Chromatography Resins Market Volume K Tons Forecast, by Origin 2019 & 2032

- Table 25: North America Chromatography Resins Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 26: North America Chromatography Resins Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 27: North America Chromatography Resins Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 28: North America Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 29: North America Chromatography Resins Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: North America Chromatography Resins Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 31: North America Chromatography Resins Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: North America Chromatography Resins Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 33: North America Chromatography Resins Market Revenue Million Forecast, by Origin 2019 & 2032

- Table 34: North America Chromatography Resins Market Volume K Tons Forecast, by Origin 2019 & 2032

- Table 35: North America Chromatography Resins Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 36: North America Chromatography Resins Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 37: North America Chromatography Resins Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 38: North America Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 39: North America Chromatography Resins Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: North America Chromatography Resins Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 41: North America Chromatography Resins Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: North America Chromatography Resins Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 43: North America Chromatography Resins Market Revenue Million Forecast, by Origin 2019 & 2032

- Table 44: North America Chromatography Resins Market Volume K Tons Forecast, by Origin 2019 & 2032

- Table 45: North America Chromatography Resins Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 46: North America Chromatography Resins Market Volume K Tons Forecast, by Technology 2019 & 2032

- Table 47: North America Chromatography Resins Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 48: North America Chromatography Resins Market Volume K Tons Forecast, by End-user Industry 2019 & 2032

- Table 49: North America Chromatography Resins Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 50: North America Chromatography Resins Market Volume K Tons Forecast, by Geography 2019 & 2032

- Table 51: North America Chromatography Resins Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: North America Chromatography Resins Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Chromatography Resins Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the North America Chromatography Resins Market?

Key companies in the market include General Electric, Merck KGaA, Mitsubishi Chemical Corporation, Dupont, Tosoh Bioscience LLC*List Not Exhaustive, Purolite, Agilient Technologies, Avantor Inc, Thermo Fisher Scientific, GE Healthcare Life Sciences.

3. What are the main segments of the North America Chromatography Resins Market?

The market segments include Origin, Technology, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 847.41 Million as of 2022.

5. What are some drivers contributing to market growth?

; Technological Advancements in Chromatography Resins; Increasing Importance of Chromatography Tests in Drug Approvals.

6. What are the notable trends driving market growth?

Increasing Demand from Pharmaceutical Sector.

7. Are there any restraints impacting market growth?

; High Costs vs. Productivity of Chromatography Systems.

8. Can you provide examples of recent developments in the market?

Merger of Purolite and Dow's Ion Exchange Resins Business

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Chromatography Resins Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Chromatography Resins Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Chromatography Resins Market?

To stay informed about further developments, trends, and reports in the North America Chromatography Resins Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence