Key Insights

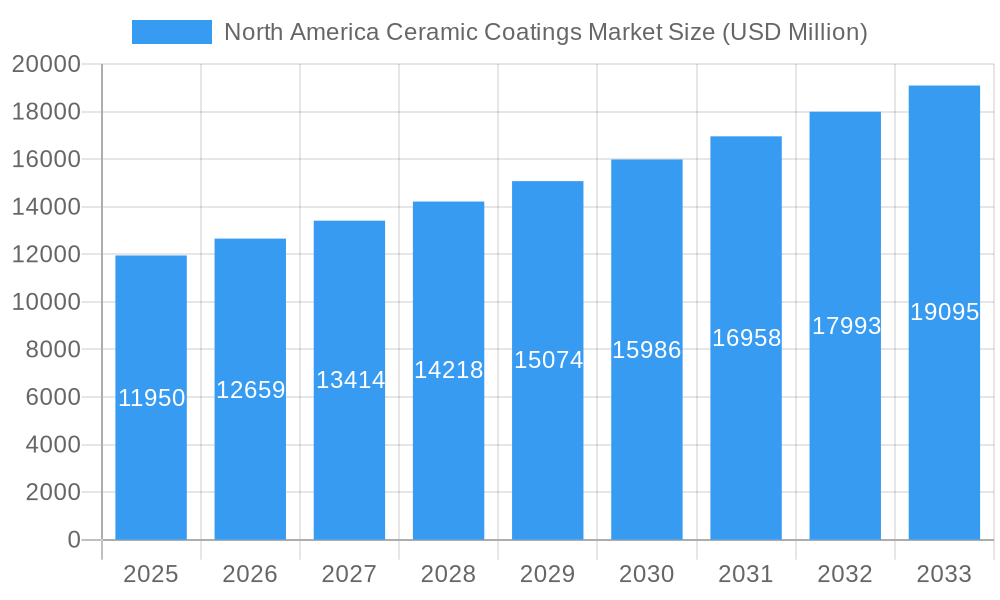

The North America ceramic coatings market is poised for significant expansion, projected to reach an estimated $11.95 billion in 2025. Driven by the inherent superior properties of ceramic coatings, such as exceptional thermal resistance, wear resistance, and corrosion protection, the market is set to experience a robust CAGR of 5.9% during the forecast period of 2025-2033. Key growth enablers include increasing demand from the aerospace and defense sector for high-performance components, the transportation industry's adoption of these coatings for enhanced durability and fuel efficiency, and the burgeoning healthcare industry's reliance on biocompatible ceramic coatings for medical implants and devices. Advancements in deposition technologies like Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) are further stimulating market growth by enabling more precise and cost-effective application of these advanced materials. The industrial sector, particularly in applications requiring extreme temperature and wear resistance, also represents a substantial contributor to this market's upward trajectory.

North America Ceramic Coatings Market Market Size (In Billion)

Emerging trends such as the development of novel ceramic materials with tailored properties and the increasing focus on sustainable manufacturing processes are shaping the future of the North America ceramic coatings market. While the market enjoys strong growth, certain restraints, such as the high initial cost of advanced application technologies and the specialized expertise required for implementation, could moderate the pace of adoption in some segments. However, the long-term benefits of enhanced product lifespan and reduced maintenance costs associated with ceramic coatings are expected to outweigh these challenges. The United States is anticipated to be the dominant geographical region, fueled by its strong industrial base and significant investments in research and development. Other North American countries are also expected to witness steady growth, driven by their respective industrial needs and technological advancements in coating applications.

North America Ceramic Coatings Market Company Market Share

Here's the detailed SEO-optimized report description for the North America Ceramic Coatings Market, designed for maximum search visibility and reader engagement, with no placeholder text and ready for immediate use.

This comprehensive report provides an in-depth analysis of the North America Ceramic Coatings Market, a critical sector driven by innovation and increasing demand across diverse industries. The ceramic coatings market size in North America is projected to reach approximately $18.5 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.2% during the forecast period of 2025-2033. The study delves into market dynamics, segmentation, key players, and future outlook, offering actionable insights for stakeholders. The base year for estimation is 2025, with historical data spanning from 2019 to 2024, and the forecast period extending to 2033.

North America Ceramic Coatings Market Market Structure & Competitive Dynamics

The North America Ceramic Coatings Market is characterized by a moderately concentrated structure, with a few major players holding significant market share, alongside a growing number of specialized and emerging companies. Innovation is a key differentiator, fueled by substantial R&D investments in developing advanced materials and application technologies. Regulatory frameworks, particularly concerning environmental impact and material safety, are becoming increasingly stringent, influencing product development and market entry. The threat of product substitutes, such as advanced polymer coatings and metallic coatings, exists but is often mitigated by the superior thermal resistance, hardness, and chemical inertness offered by ceramic coatings. End-user trends are strongly influenced by the pursuit of enhanced performance, durability, and cost-efficiency, driving adoption in demanding applications. Merger and Acquisition (M&A) activities are a significant aspect of the competitive landscape, with strategic consolidations aimed at expanding product portfolios, geographical reach, and technological capabilities. Notable M&A deals in the historical period (2019-2024) indicate a market consolidation trend, with deal values estimated to be in the hundreds of millions of dollars, aimed at synergizing expertise and market access. The market's competitive intensity is further shaped by proprietary technologies and patents held by leading firms.

North America Ceramic Coatings Market Industry Trends & Insights

The North America Ceramic Coatings Market is experiencing robust growth, propelled by several key trends and insights. A significant driver is the escalating demand for high-performance materials in aerospace and defense, where ceramic coatings are crucial for protecting components from extreme temperatures, wear, and corrosion, contributing to enhanced aircraft safety and efficiency. Similarly, the transportation sector, particularly the automotive and aerospace industries, is witnessing a surge in adoption for fuel efficiency and durability improvements, including applications in engine components and exhaust systems. In the healthcare industry, biocompatible ceramic coatings are gaining traction for medical implants and devices due to their inertness and resistance to biological degradation. The energy and power sector, encompassing oil and gas exploration and renewable energy technologies like wind turbines and solar panels, relies on ceramic coatings to withstand harsh operating conditions and extend equipment lifespan. The industrial sector, a broad category, continuously benefits from ceramic coatings in machinery, manufacturing equipment, and infrastructure for wear resistance and protection.

Technological disruptions are shaping the market, with advancements in thermal spray technologies like plasma spray and HVOF (High-Velocity Oxygen Fuel) offering improved coating densities and adhesion. Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) technologies are enabling the creation of ultra-thin, highly uniform, and exceptionally hard ceramic films for specialized applications. The market penetration of ceramic coatings is steadily increasing as their benefits become more widely understood and their cost-effectiveness in the long term is recognized. Consumer preferences are shifting towards sustainable and long-lasting solutions, aligning perfectly with the inherent durability of ceramic coatings. The competitive dynamics are intensifying, with companies focusing on product differentiation through superior performance, customization, and cost-effective solutions. Market penetration in emerging applications within the "Other End-user Industries" segment is also a notable trend, indicating the versatile applicability of ceramic coatings. The CAGR of 7.2% signifies a healthy and expanding market, underscoring the positive industry outlook.

Dominant Markets & Segments in North America Ceramic Coatings Market

The United States stands as the dominant geographical market within North America, driven by its advanced industrial base, significant investments in aerospace and defense, and strong presence of R&D institutions. Economic policies and robust infrastructure development further bolster its leading position.

- Leading Country: United States (estimated market share of over 65% of the North American market in 2025)

- Key Drivers: High spending in aerospace and defense, extensive automotive manufacturing, stringent environmental regulations demanding durable and efficient solutions, and a thriving healthcare sector.

- Dominance Analysis: The US possesses a mature market with high adoption rates across all major end-user industries. Continuous innovation and the presence of major manufacturing hubs contribute to its sustained leadership.

Among the Type segments, Oxide coatings currently hold the largest market share, owing to their widespread use, cost-effectiveness, and excellent corrosion and thermal resistance. However, Carbide coatings and Nitride coatings are experiencing rapid growth due to their exceptional hardness and wear resistance, making them indispensable in demanding industrial and transportation applications.

- Dominant Type Segment: Oxide Coatings (e.g., Alumina, Zirconia)

- Key Drivers: Versatility, cost-effectiveness, excellent thermal insulation and corrosion resistance.

- Dominance Analysis: Oxide coatings are foundational in numerous applications, providing reliable performance across a broad spectrum of industries, from industrial equipment to consumer goods.

In terms of Technology, Thermal Spray remains the dominant method for applying ceramic coatings due to its versatility, scalability, and ability to coat large and complex parts. However, Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD) are rapidly gaining prominence for specialized applications requiring ultra-high precision, thin films, and superior surface properties.

- Dominant Technology: Thermal Spray (Plasma Spray, HVOF)

- Key Drivers: High deposition rates, ability to coat diverse substrates, cost-effectiveness for bulk applications.

- Dominance Analysis: Thermal spray techniques are the workhorse of the industry, offering robust and efficient coating solutions for a wide range of industrial needs.

The Aerospace and Defense and Industrial end-user industries are the primary contributors to the North America Ceramic Coatings Market's dominance, followed closely by Transportation. These sectors continually push the boundaries of material performance, requiring the extreme properties offered by ceramic coatings.

- Dominant End-user Industry: Aerospace and Defense

- Key Drivers: Extreme operating conditions, requirement for lightweight and durable components, safety regulations, advanced material needs.

- Dominance Analysis: This sector demands the highest levels of performance from coatings, making ceramic coatings essential for critical aircraft and defense system components.

North America Ceramic Coatings Market Product Innovations

Product innovations in the North America Ceramic Coatings Market are largely focused on enhancing specific properties like wear resistance, thermal insulation, and biocompatibility. Companies are developing novel ceramic formulations, such as advanced alumina-titania and zirconia-based coatings, offering superior performance in high-temperature applications and abrasive environments. Advancements in nanostructured ceramic coatings and composite ceramic materials are providing enhanced mechanical properties and functional benefits. These innovations are expanding the applicability of ceramic coatings into newer sectors like advanced electronics and renewable energy systems, offering competitive advantages through extended product lifecycles and improved operational efficiency.

Report Segmentation & Scope

This report meticulously segments the North America Ceramic Coatings Market across several key dimensions to provide a granular understanding of market dynamics. Type: The market is analyzed by Ceramic Coating Type, including Carbide, Nitride, Oxide, and Other Types. This segmentation highlights the distinct properties and applications of each material category, with projections for their respective market sizes and growth rates. Technology: Key application technologies such as Thermal Spray, Physical Vapor Deposition (PVD), Chemical Vapor Deposition (CVD), Atmospheric Outer Spray, and Other Technologies are examined. This analysis details the advantages and market penetration of each technology, along with future adoption trends. End-user Industry: The report provides in-depth analysis for major end-user industries including Aerospace and Defense, Transportation, Healthcare, Energy and Power, Industrial, and Other End-user Industries. Growth projections and competitive dynamics within each of these vital sectors are presented. Geography: The market is segmented geographically into the United States, Canada, Mexico, and the Rest of North America. This regional analysis details market sizes, growth trends, and key influencing factors specific to each area.

Key Drivers of North America Ceramic Coatings Market Growth

The growth of the North America Ceramic Coatings Market is significantly propelled by the escalating demand for enhanced durability and performance across various industries. The aerospace and defense sector's continuous need for materials that can withstand extreme temperatures and wear is a primary driver. In the transportation industry, a focus on fuel efficiency and component longevity fuels the adoption of lightweight, high-performance coatings. Stringent environmental regulations are also pushing industries towards more sustainable and durable solutions, where ceramic coatings excel. Furthermore, advancements in material science and application technologies, such as improved thermal spray techniques and PVD/CVD processes, are making ceramic coatings more accessible and effective, thereby expanding their application scope into new markets.

Challenges in the North America Ceramic Coatings Market Sector

Despite the robust growth, the North America Ceramic Coatings Market faces several challenges. The high initial cost of application technologies and specialized equipment can be a barrier to entry for smaller companies and in price-sensitive applications. Regulatory hurdles, particularly concerning the disposal of spent materials and emissions during the coating process, require significant compliance efforts and investment. Supply chain complexities for raw materials, especially specialized ceramic powders, can sometimes lead to price volatility and availability issues. Moreover, the market faces competitive pressures from alternative coating technologies, such as advanced polymers and metallic alloys, which may offer comparable performance in certain applications at a lower cost. Continuous R&D is crucial to maintain a competitive edge and address these challenges.

Leading Players in the North America Ceramic Coatings Market Market

- APS Materials Inc

- A&A Thermal Spray Coatings

- Aremco

- Praxair S T Technology Inc (Linde Plc)

- Saint-Gobain

- Fosbel Inc

- OC Oerlikon Management AG

- Kurt J Lesker Company

- Swain Tech Coatings Inc

- Bodycote

- Waipolon International Co Ltd

Key Developments in North America Ceramic Coatings Market Sector

- 2023/Q4: Saint-Gobain launched a new line of advanced ceramic coatings for industrial wear resistance, enhancing operational efficiency for manufacturing clients.

- 2023/Q3: OC Oerlikon Management AG expanded its thermal spray capabilities with new state-of-the-art equipment, increasing production capacity for high-demand aerospace components.

- 2022/Q2: A&A Thermal Spray Coatings acquired a specialized R&D firm to bolster its expertise in novel ceramic material development for extreme environments.

- 2022/Q1: Praxair S T Technology Inc (Linde Plc) announced significant investment in its North American manufacturing facilities to meet growing demand in the energy sector.

- 2021/Q4: Bodycote partnered with a leading aerospace manufacturer to develop customized ceramic coating solutions for next-generation aircraft engines.

Strategic North America Ceramic Coatings Market Market Outlook

The strategic outlook for the North America Ceramic Coatings Market is overwhelmingly positive, driven by sustained demand for high-performance solutions and ongoing technological advancements. The increasing focus on lightweighting and efficiency in the aerospace, defense, and transportation sectors will continue to be a significant growth accelerator. Innovations in PVD and CVD technologies are expected to unlock new market opportunities in electronics and medical devices. The growing emphasis on sustainable manufacturing and extended product lifecycles also favors the adoption of durable ceramic coatings. Strategic opportunities lie in developing cost-effective application methods, expanding into emerging end-user industries, and forming strategic alliances to leverage synergistic expertise. The market is poised for continued robust growth, with ample potential for innovation and expansion.

North America Ceramic Coatings Market Segmentation

-

1. Type

- 1.1. Carbide

- 1.2. Nitride

- 1.3. Oxide

- 1.4. Other Types

-

2. Technology

- 2.1. Thermal Spray

- 2.2. Physical Vapor Deposition

- 2.3. Chemical Vapor Deposition

- 2.4. Atmospheric Outer Spray

- 2.5. Other Technologies

-

3. End-user Industry

- 3.1. Aerospace and Defense

- 3.2. Transportation

- 3.3. Healthcare

- 3.4. Energy and Power

- 3.5. Industrial

- 3.6. Other End-user Industries

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

North America Ceramic Coatings Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Ceramic Coatings Market Regional Market Share

Geographic Coverage of North America Ceramic Coatings Market

North America Ceramic Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Aerospace Thermal Applications; Increasing Usage in Medical Devices

- 3.3. Market Restrains

- 3.3.1. ; Higher Costs of Ceramic Coatings; Capital Intensive Production Setup; Issues Regarding Thermal Spray Process Reliability and Consistency

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense Segment to Dominate the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Ceramic Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carbide

- 5.1.2. Nitride

- 5.1.3. Oxide

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Thermal Spray

- 5.2.2. Physical Vapor Deposition

- 5.2.3. Chemical Vapor Deposition

- 5.2.4. Atmospheric Outer Spray

- 5.2.5. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Aerospace and Defense

- 5.3.2. Transportation

- 5.3.3. Healthcare

- 5.3.4. Energy and Power

- 5.3.5. Industrial

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Ceramic Coatings Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Carbide

- 6.1.2. Nitride

- 6.1.3. Oxide

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Thermal Spray

- 6.2.2. Physical Vapor Deposition

- 6.2.3. Chemical Vapor Deposition

- 6.2.4. Atmospheric Outer Spray

- 6.2.5. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Aerospace and Defense

- 6.3.2. Transportation

- 6.3.3. Healthcare

- 6.3.4. Energy and Power

- 6.3.5. Industrial

- 6.3.6. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Ceramic Coatings Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Carbide

- 7.1.2. Nitride

- 7.1.3. Oxide

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Thermal Spray

- 7.2.2. Physical Vapor Deposition

- 7.2.3. Chemical Vapor Deposition

- 7.2.4. Atmospheric Outer Spray

- 7.2.5. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Aerospace and Defense

- 7.3.2. Transportation

- 7.3.3. Healthcare

- 7.3.4. Energy and Power

- 7.3.5. Industrial

- 7.3.6. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Ceramic Coatings Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Carbide

- 8.1.2. Nitride

- 8.1.3. Oxide

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Thermal Spray

- 8.2.2. Physical Vapor Deposition

- 8.2.3. Chemical Vapor Deposition

- 8.2.4. Atmospheric Outer Spray

- 8.2.5. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Aerospace and Defense

- 8.3.2. Transportation

- 8.3.3. Healthcare

- 8.3.4. Energy and Power

- 8.3.5. Industrial

- 8.3.6. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of North America North America Ceramic Coatings Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Carbide

- 9.1.2. Nitride

- 9.1.3. Oxide

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Thermal Spray

- 9.2.2. Physical Vapor Deposition

- 9.2.3. Chemical Vapor Deposition

- 9.2.4. Atmospheric Outer Spray

- 9.2.5. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Aerospace and Defense

- 9.3.2. Transportation

- 9.3.3. Healthcare

- 9.3.4. Energy and Power

- 9.3.5. Industrial

- 9.3.6. Other End-user Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 APS Materials Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 A&A Thermal Spray Coatings

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aremco

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Praxair S T Technology Inc (Linde Plc)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Saint-Gobain

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Fosbel Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 OC Oerlikon Management AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Kurt J Lesker Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Swain Tech Coatings Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bodycote

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Waipolon International Co Ltd*List Not Exhaustive

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 APS Materials Inc

List of Figures

- Figure 1: North America Ceramic Coatings Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Ceramic Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: North America Ceramic Coatings Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: North America Ceramic Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 3: North America Ceramic Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Ceramic Coatings Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 5: North America Ceramic Coatings Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: North America Ceramic Coatings Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: North America Ceramic Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 8: North America Ceramic Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 9: North America Ceramic Coatings Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: North America Ceramic Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: North America Ceramic Coatings Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: North America Ceramic Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 13: North America Ceramic Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: North America Ceramic Coatings Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 15: North America Ceramic Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: North America Ceramic Coatings Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: North America Ceramic Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 18: North America Ceramic Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 19: North America Ceramic Coatings Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: North America Ceramic Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: North America Ceramic Coatings Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: North America Ceramic Coatings Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 23: North America Ceramic Coatings Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 24: North America Ceramic Coatings Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 25: North America Ceramic Coatings Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Ceramic Coatings Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the North America Ceramic Coatings Market?

Key companies in the market include APS Materials Inc, A&A Thermal Spray Coatings, Aremco, Praxair S T Technology Inc (Linde Plc), Saint-Gobain, Fosbel Inc, OC Oerlikon Management AG, Kurt J Lesker Company, Swain Tech Coatings Inc, Bodycote, Waipolon International Co Ltd*List Not Exhaustive.

3. What are the main segments of the North America Ceramic Coatings Market?

The market segments include Type, Technology, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Aerospace Thermal Applications; Increasing Usage in Medical Devices.

6. What are the notable trends driving market growth?

Aerospace and Defense Segment to Dominate the Market Demand.

7. Are there any restraints impacting market growth?

; Higher Costs of Ceramic Coatings; Capital Intensive Production Setup; Issues Regarding Thermal Spray Process Reliability and Consistency.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Ceramic Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Ceramic Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Ceramic Coatings Market?

To stay informed about further developments, trends, and reports in the North America Ceramic Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence