Key Insights

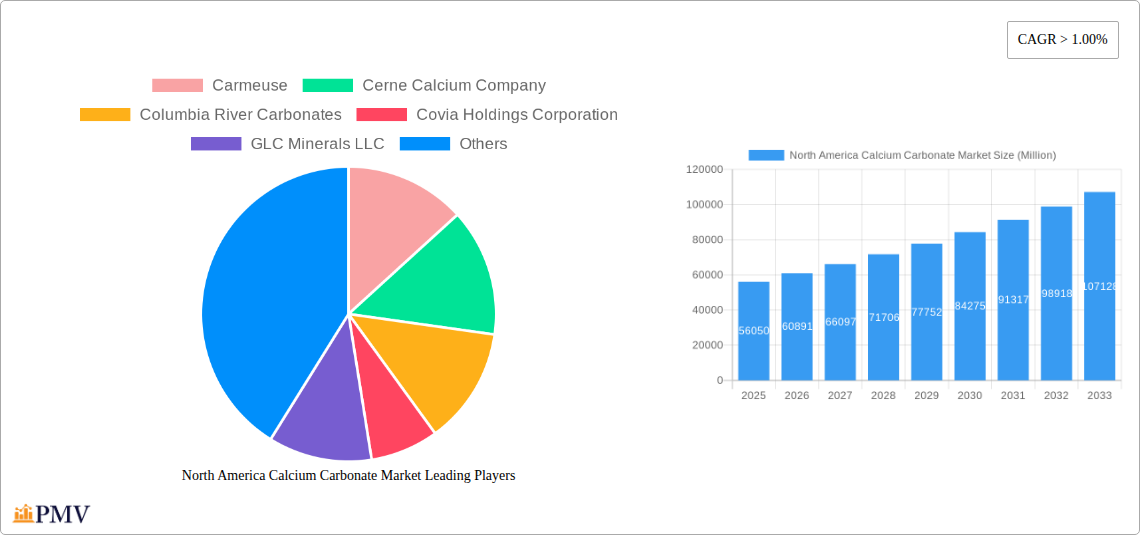

The North America Calcium Carbonate Market is poised for substantial growth, projected to reach an estimated $56.05 billion in 2025. This expansion is driven by a robust CAGR of 8.6%, indicating a dynamic and expanding market throughout the forecast period of 2019-2033. Key drivers underpinning this growth include the increasing demand from the paper industry for brightness and opacity enhancement, the widespread use of calcium carbonate as a filler and extender in plastics for improved mechanical properties and cost reduction, and its essential role in adhesives and sealants for viscosity control and reinforcement. Furthermore, the paints and coatings sector continues to rely on calcium carbonate for its opacifying and rheological benefits, contributing significantly to market expansion. Emerging applications and technological advancements in processing are also expected to fuel sustained demand.

North America Calcium Carbonate Market Market Size (In Billion)

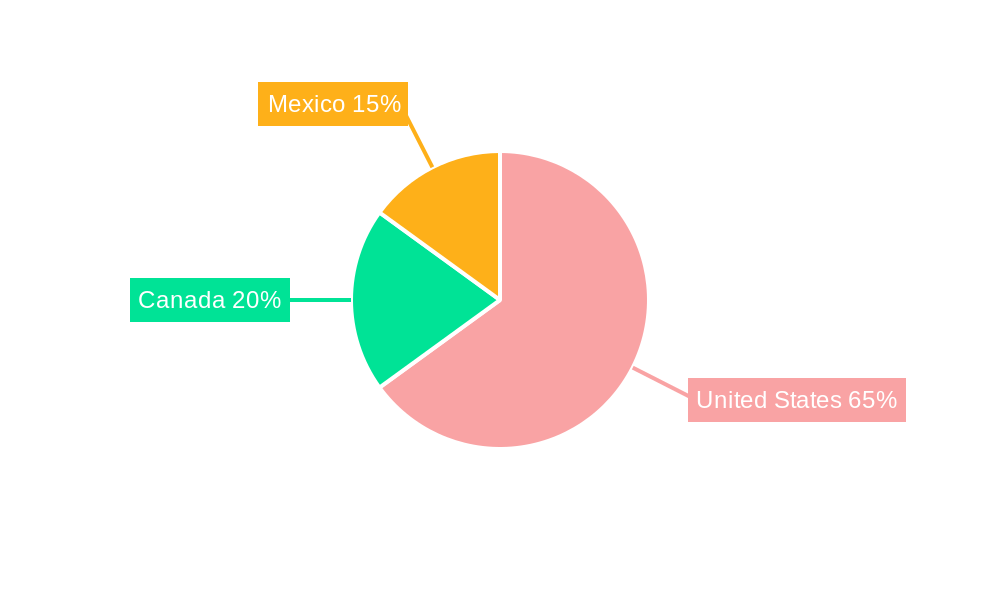

Despite the optimistic outlook, the market faces certain restraints. Fluctuations in raw material prices, particularly for high-purity calcium carbonate, can impact profitability. Stringent environmental regulations concerning mining and processing operations may also pose challenges, necessitating investment in sustainable practices. However, the inherent versatility and cost-effectiveness of calcium carbonate across a multitude of industries, coupled with ongoing innovation in product development and application techniques, are expected to largely offset these limitations. The market is characterized by segmentation into Ground Calcium Carbonate (GCC) and Precipitated Calcium Carbonate (PCC) types, with the paper and plastics industries emerging as dominant end-user segments. Geographically, the United States is expected to maintain its leading position, followed by Canada and Mexico, owing to their developed industrial bases and substantial manufacturing activities.

North America Calcium Carbonate Market Company Market Share

Here's the detailed, SEO-optimized report description for the North America Calcium Carbonate Market:

This in-depth report provides a granular analysis of the North America Calcium Carbonate Market, a critical industrial mineral with widespread applications. Covering the period from 2019 to 2033, with a base year of 2025, this research delves into market dynamics, key trends, dominant segments, and strategic outlook. We explore the intricate competitive landscape, technological innovations, and growth drivers shaping this vital sector. This report is essential for stakeholders seeking to understand current market positions, forecast future trajectories, and identify lucrative opportunities within the North America calcium carbonate market, calcium carbonate applications, ground calcium carbonate market, and precipitated calcium carbonate market.

North America Calcium Carbonate Market Market Structure & Competitive Dynamics

The North America Calcium Carbonate Market exhibits a moderate to high market concentration, with several large, established players dominating a significant portion of the market share. Key companies like Omya AG, Imerys, and Minerals Technologies Inc. leverage extensive operational footprints, advanced processing capabilities, and robust distribution networks. Innovation ecosystems are driven by continuous research into enhanced product functionalities, such as improved particle size distribution, surface treatments for better compatibility with polymers and resins, and development of specialized grades for high-performance applications. Regulatory frameworks, particularly concerning environmental impact and product safety in industries like food and pharmaceuticals, play a crucial role in shaping market entry and operational standards. Product substitutes, while present in some niche applications, generally struggle to match the cost-effectiveness and performance characteristics of calcium carbonate in its primary markets. End-user trends reveal a growing demand for sustainable and recycled content in plastics and paper, influencing the type and sourcing of calcium carbonate utilized. Merger and acquisition (M&A) activities, valued in the hundreds of millions of dollars, are strategically aimed at consolidating market share, expanding product portfolios, and gaining access to new geographies or technologies. For instance, strategic acquisitions of smaller, specialized producers by larger entities are common, aiming to bolster their offerings in areas like high-purity precipitated calcium carbonate.

North America Calcium Carbonate Market Industry Trends & Insights

The North America Calcium Carbonate Market is poised for sustained growth, driven by a confluence of factors. A projected Compound Annual Growth Rate (CAGR) of approximately 4.5% to 5.5% is anticipated from 2025 to 2033, fueled by increasing demand across core end-user industries. Technological disruptions are at the forefront, with advancements in grinding and precipitation technologies leading to the production of ultrafine and surface-modified calcium carbonate grades. These innovations enhance performance characteristics, enabling wider adoption in high-value applications. For example, advancements in micronization techniques allow for the creation of calcium carbonate with particle sizes in the sub-micron range, offering superior opacity and brightness in paints and coatings, and improved impact strength in plastics. Consumer preferences are also evolving, with a heightened emphasis on sustainability and eco-friendly materials. This is driving demand for calcium carbonate as a natural filler and extender, capable of reducing reliance on more resource-intensive materials and contributing to lighter-weight products, particularly in the automotive and construction sectors. The market penetration of calcium carbonate in emerging applications like bioplastics and 3D printing materials is also on the rise. Competitive dynamics are characterized by fierce price competition, particularly in commodity grades, alongside a focus on product differentiation and value-added services for specialized applications. Strategic partnerships between raw material suppliers and end-product manufacturers are becoming increasingly prevalent, fostering innovation and ensuring supply chain stability. The overall market size is projected to reach over $6.5 billion by 2033.

Dominant Markets & Segments in North America Calcium Carbonate Market

The United States firmly holds its position as the dominant market within the North America Calcium Carbonate Market, accounting for over 70% of the total market value. This dominance is attributable to its large industrial base, robust manufacturing sector, and significant consumption across key end-user industries. Economic policies supporting manufacturing growth, coupled with substantial investments in infrastructure development, further bolster the demand for calcium carbonate as a vital industrial filler and additive.

Ground Calcium Carbonate (GCC): GCC represents the larger segment by volume and value, driven by its widespread use as a cost-effective filler and extender in diverse applications.

- Key Drivers: High availability of natural reserves, lower production costs compared to PCC, and its established role in bulk applications like paper, plastics, and construction materials.

- Dominance in Paper Industry: Historically, GCC has been a staple in the paper industry for improving brightness, opacity, and printability. While the digital shift has impacted overall paper demand, the need for high-quality paper products continues to support GCC consumption.

- Dominance in Plastics Industry: GCC is extensively used in plastics to enhance stiffness, impact resistance, and processability, while also reducing material costs. Its application spans from PVC pipes and profiles to automotive components and packaging.

- Dominance in Paints and Coatings: GCC serves as a vital extender pigment, contributing to opacity, whiteness, and rheological properties in a wide range of paints and coatings.

Precipitated Calcium Carbonate (PCC): PCC, with its controlled particle size and morphology, holds a significant share, particularly in high-performance applications.

- Key Drivers: Superior brightness, finer particle size, and customizable surface properties that offer enhanced performance in specific applications like high-gloss coatings, specialty plastics, and pharmaceuticals.

- Dominance in Adhesives and Sealants: PCC's fine particle size and controlled structure provide excellent rheological properties, reinforcement, and cost reduction in adhesives and sealants, crucial for their performance and application ease.

- Emerging Applications: PCC is increasingly finding favor in pharmaceuticals as an excipient, in food products as a calcium supplement, and in advanced polymer formulations.

Geography Breakdown:

- United States: Continues to be the largest consumer, driven by its extensive manufacturing base in plastics, paper, paints, and construction.

- Canada: A significant market, with demand primarily from the pulp and paper, plastics, and mining industries.

- Mexico: An emerging market with growing manufacturing capabilities, particularly in the automotive and plastics sectors, driving increasing demand for calcium carbonate.

North America Calcium Carbonate Market Product Innovations

Product innovation in the North America Calcium Carbonate Market centers on enhancing performance and expanding application potential. Surface-modified calcium carbonate grades are gaining traction, offering improved compatibility with various polymer matrices, leading to better mechanical properties and processing in plastics. Developments in ultrafine and nano-calcium carbonate are enabling superior optical properties and enhanced reinforcement in paints, coatings, and advanced composite materials. The focus is on tailoring particle size distribution, morphology, and surface chemistry to meet the specific demands of high-performance applications, thereby providing a competitive advantage to producers and end-users alike.

Report Segmentation & Scope

This comprehensive report segments the North America Calcium Carbonate Market into key categories. The Type segmentation includes Ground Calcium Carbonate (GCC) and Precipitated Calcium Carbonate (PCC). GCC, characterized by its natural origin and diverse particle sizes, is expected to maintain its dominant market share due to its cost-effectiveness and broad applicability. PCC, with its engineered particle sizes and superior purity, is anticipated to witness higher growth rates, driven by its use in premium applications. The End-user Industry segmentation covers Paper, Plastic, Adhesives and Sealants, Paints and Coatings, and Other End-user Industries. The paper and plastics segments are projected to remain the largest consumers, while adhesives and sealants, and paints and coatings will show robust growth. The Geography segmentation analyzes the market in the United States, Canada, and Mexico. The United States is expected to lead the market, followed by Canada and Mexico, with the latter demonstrating significant growth potential.

Key Drivers of North America Calcium Carbonate Market Growth

Several key drivers are propelling the North America Calcium Carbonate Market. The robust growth in the plastics industry, driven by demand for packaging, automotive components, and construction materials, is a primary contributor. The paper industry's continued need for fillers and coating pigments to enhance paper quality remains a significant driver. Furthermore, increasing investments in infrastructure and construction projects across North America are boosting demand for calcium carbonate in cement, concrete, and asphalt applications. Technological advancements in processing, leading to the development of specialized and high-performance grades, are also expanding the market's reach into niche and high-value sectors. The growing emphasis on sustainable and natural materials as alternatives to synthetic additives further supports market expansion.

Challenges in the North America Calcium Carbonate Market Sector

Despite robust growth, the North America Calcium Carbonate Market faces several challenges. Fluctuations in raw material costs, particularly energy prices impacting mining and processing, can affect profitability. Increasing environmental regulations concerning mining operations and particulate emissions necessitate significant investment in compliance technologies. Intense price competition, especially for commodity grades of Ground Calcium Carbonate, can squeeze profit margins. Supply chain disruptions, as witnessed in recent global events, can impact the availability and cost of both raw materials and finished products. Furthermore, the development and adoption of alternative filler materials in certain specialized applications pose a competitive threat.

Leading Players in the North America Calcium Carbonate Market Market

- Carmeuse

- Cerne Calcium Company

- Columbia River Carbonates

- Covia Holdings Corporation

- GLC Minerals LLC

- Imerys

- JM Huber Corporation

- Lhoist Group

- Minerals Technologies Inc

- Mississippi Lime Company

- Newpark Resources Inc

- Omya AG

- Sibelco

- The Cary Company

- List Not Exhaustive

Key Developments in North America Calcium Carbonate Market Sector

- 2023/05: Imerys completes acquisition of a specialty calcium carbonate producer, expanding its portfolio in high-purity grades for demanding applications.

- 2022/11: Minerals Technologies Inc. launches a new line of surface-modified GCC designed for enhanced performance in flexible packaging.

- 2022/08: Lhoist Group invests in upgrading its grinding facilities to improve energy efficiency and product consistency.

- 2021/04: Omya AG announces expansion of its precipitated calcium carbonate production capacity to meet growing demand in North America.

- 2020/09: Covia Holdings Corporation consolidates its operations, streamlining production and distribution networks for greater efficiency.

Strategic North America Calcium Carbonate Market Market Outlook

The strategic outlook for the North America Calcium Carbonate Market remains highly positive. Growth accelerators include the continued innovation in surface-treated and ultrafine grades, opening doors to advanced material science applications. The increasing demand for sustainable building materials and lightweight plastics will further fuel market expansion. Strategic opportunities lie in the development of bio-based calcium carbonate and the expansion into emerging applications like advanced composites and battery materials. Companies focusing on vertical integration, technological advancements in processing, and strategic M&A will be well-positioned to capitalize on future market growth and maintain a competitive edge in this dynamic sector.

North America Calcium Carbonate Market Segmentation

-

1. Type

- 1.1. Ground Calcium Carbonate

- 1.2. Precipitated Calcium Carbonate

-

2. End-user Industry

- 2.1. Paper

- 2.2. Plastic

- 2.3. Adhesives and Sealants

- 2.4. Paints and Coatings

- 2.5. Other End-user Industries

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Calcium Carbonate Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Calcium Carbonate Market Regional Market Share

Geographic Coverage of North America Calcium Carbonate Market

North America Calcium Carbonate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Paints and Coatings from the Construction Industry

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand for Paints and Coatings from the Construction Industry

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Paints and Coatings Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global North America Calcium Carbonate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ground Calcium Carbonate

- 5.1.2. Precipitated Calcium Carbonate

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Paper

- 5.2.2. Plastic

- 5.2.3. Adhesives and Sealants

- 5.2.4. Paints and Coatings

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Calcium Carbonate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Ground Calcium Carbonate

- 6.1.2. Precipitated Calcium Carbonate

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Paper

- 6.2.2. Plastic

- 6.2.3. Adhesives and Sealants

- 6.2.4. Paints and Coatings

- 6.2.5. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Calcium Carbonate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Ground Calcium Carbonate

- 7.1.2. Precipitated Calcium Carbonate

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Paper

- 7.2.2. Plastic

- 7.2.3. Adhesives and Sealants

- 7.2.4. Paints and Coatings

- 7.2.5. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Calcium Carbonate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Ground Calcium Carbonate

- 8.1.2. Precipitated Calcium Carbonate

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Paper

- 8.2.2. Plastic

- 8.2.3. Adhesives and Sealants

- 8.2.4. Paints and Coatings

- 8.2.5. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Global Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Carmeuse

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Cerne Calcium Company

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Columbia River Carbonates

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Covia Holdings Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 GLC Minerals LLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Imerys

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 JM Huber Corporation

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Lhoist Group

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Minerals Technologies Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Mississippi Lime Company

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Newpark Resources Inc

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Omya AG

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Sibelco

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 The Cary Company*List Not Exhaustive

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.1 Carmeuse

List of Figures

- Figure 1: Global North America Calcium Carbonate Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: United States North America Calcium Carbonate Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: United States North America Calcium Carbonate Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: United States North America Calcium Carbonate Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: United States North America Calcium Carbonate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: United States North America Calcium Carbonate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: United States North America Calcium Carbonate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: United States North America Calcium Carbonate Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: United States North America Calcium Carbonate Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Canada North America Calcium Carbonate Market Revenue (undefined), by Type 2025 & 2033

- Figure 11: Canada North America Calcium Carbonate Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Canada North America Calcium Carbonate Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 13: Canada North America Calcium Carbonate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Canada North America Calcium Carbonate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 15: Canada North America Calcium Carbonate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Canada North America Calcium Carbonate Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Canada North America Calcium Carbonate Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Mexico North America Calcium Carbonate Market Revenue (undefined), by Type 2025 & 2033

- Figure 19: Mexico North America Calcium Carbonate Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Mexico North America Calcium Carbonate Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 21: Mexico North America Calcium Carbonate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Mexico North America Calcium Carbonate Market Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Mexico North America Calcium Carbonate Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Mexico North America Calcium Carbonate Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Mexico North America Calcium Carbonate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global North America Calcium Carbonate Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global North America Calcium Carbonate Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global North America Calcium Carbonate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global North America Calcium Carbonate Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global North America Calcium Carbonate Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global North America Calcium Carbonate Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 7: Global North America Calcium Carbonate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global North America Calcium Carbonate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global North America Calcium Carbonate Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global North America Calcium Carbonate Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 11: Global North America Calcium Carbonate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global North America Calcium Carbonate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global North America Calcium Carbonate Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global North America Calcium Carbonate Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global North America Calcium Carbonate Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global North America Calcium Carbonate Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Calcium Carbonate Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the North America Calcium Carbonate Market?

Key companies in the market include Carmeuse, Cerne Calcium Company, Columbia River Carbonates, Covia Holdings Corporation, GLC Minerals LLC, Imerys, JM Huber Corporation, Lhoist Group, Minerals Technologies Inc, Mississippi Lime Company, Newpark Resources Inc, Omya AG, Sibelco, The Cary Company*List Not Exhaustive.

3. What are the main segments of the North America Calcium Carbonate Market?

The market segments include Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Paints and Coatings from the Construction Industry.

6. What are the notable trends driving market growth?

Increasing Demand from Paints and Coatings Industry.

7. Are there any restraints impacting market growth?

; Increasing Demand for Paints and Coatings from the Construction Industry.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Calcium Carbonate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Calcium Carbonate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Calcium Carbonate Market?

To stay informed about further developments, trends, and reports in the North America Calcium Carbonate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence