Key Insights

The North American Cafes & Bars market is poised for steady expansion, with a projected market size of $68.8 billion in 2024. This growth is fueled by a confluence of evolving consumer preferences and innovative business models. The market is expected to witness a Compound Annual Growth Rate (CAGR) of 4.36% during the forecast period of 2025-2033. Key growth drivers include the increasing demand for premium and specialty coffee and tea beverages, the rising popularity of grab-and-go options, and the integration of technology to enhance customer experience, such as mobile ordering and loyalty programs. Furthermore, the social aspect of cafes and bars as gathering spaces, coupled with a growing appreciation for artisanal food and beverage offerings, continues to underpin market vitality. The segment of Specialist Coffee & Tea Shops is anticipated to be a significant contributor to this growth, reflecting a consumer desire for unique flavor profiles and high-quality ingredients.

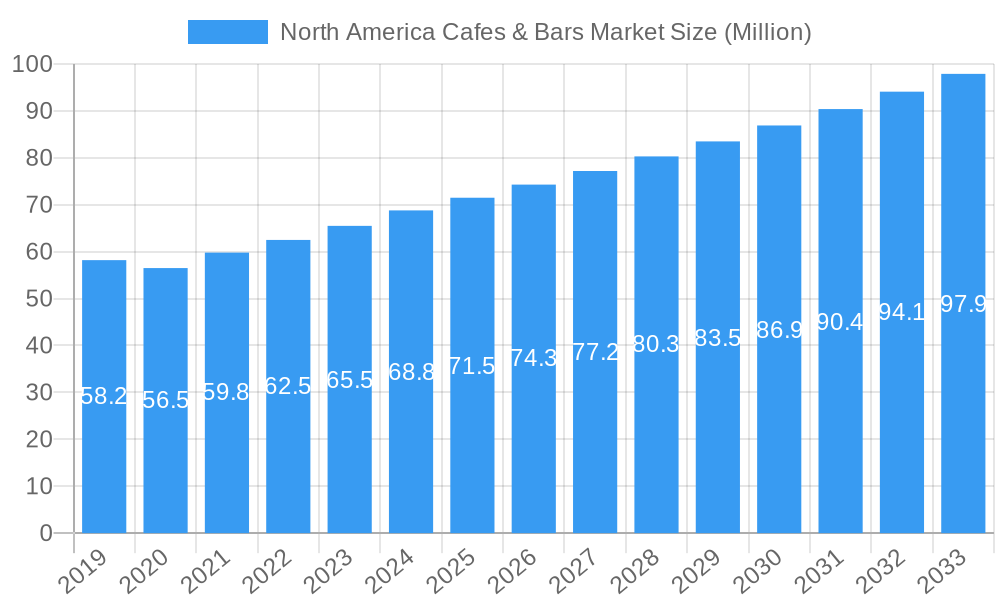

North America Cafes & Bars Market Market Size (In Million)

The competitive landscape is characterized by a dynamic interplay between established giants and agile independent players. Chained outlets continue to dominate, leveraging economies of scale and strong brand recognition, while independent outlets carve out niches by offering distinct experiences and catering to local tastes. The "Retail" and "Leisure" location segments are expected to see substantial activity, driven by foot traffic in commercial hubs and entertainment districts. While the market benefits from strong consumer spending and a culture that embraces cafe and bar patronage, certain restraints, such as rising operational costs (including labor and ingredient prices) and intense competition, could temper the pace of growth in specific sub-segments. Nevertheless, the overall outlook remains positive, with continuous innovation in product offerings and service delivery expected to sustain momentum.

North America Cafes & Bars Market Company Market Share

This in-depth market research report provides a detailed analysis of the North America Cafes & Bars Market, offering crucial insights into market dynamics, trends, and future growth opportunities. Covering the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025–2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving landscape of specialty coffee shops, bars, pubs, juice bars, smoothie bars, and dessert cafes across the region. The North American coffee and bar industry is a multi-billion dollar sector driven by evolving consumer lifestyles, a demand for convenience, and innovative product offerings.

The report delves into key market segments including Cuisine (Bars & Pubs, Cafes, Juice/Smoothie/Desserts Bars, Specialist Coffee & Tea Shops), Outlet Type (Chained Outlets, Independent Outlets), and Location (Leisure, Lodging, Retail, Standalone, Travel). It analyzes the impact of industry developments, consumer preferences, technological advancements, and competitive strategies of leading players like Starbucks Corporation, Inspire Brands Inc, Dutch Bros Inc, McDonald's Corporation, and Jab Holding Company SÀRL. This comprehensive report is designed for industry professionals, investors, and market strategists looking for actionable intelligence and data-driven forecasts within the North American cafe and bar market.

North America Cafes & Bars Market Market Structure & Competitive Dynamics

The North America Cafes & Bars Market is characterized by a moderate to high level of market concentration, with a few dominant players holding significant market share, especially within the chained outlets segment. Starbucks Corporation consistently leads the market in terms of brand recognition and global presence. However, the independent outlets segment fosters a diverse ecosystem of innovation and niche offerings, particularly in the specialist coffee & tea shops and bars & pubs categories. The regulatory framework, encompassing health and safety standards, licensing, and employment laws, plays a crucial role in shaping market entry and operational costs. Product substitutes are abundant, ranging from home-brewed beverages to alternative dining options, necessitating continuous product differentiation and value-added services. End-user trends are heavily influenced by convenience, premiumization, health-consciousness, and the desire for unique experiences. Mergers and acquisitions (M&A) activities are prevalent as larger entities seek to expand their portfolios, acquire innovative concepts, or gain market share. Recent M&A deals have valued in the hundreds of millions to billions of dollars, reflecting the significant investment in this sector. The market's competitive intensity is driven by aggressive pricing strategies, extensive menu diversification, and strategic location selection.

North America Cafes & Bars Market Industry Trends & Insights

The North America Cafes & Bars Market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period. This expansion is fueled by a confluence of evolving consumer lifestyles, an increasing demand for on-the-go convenience, and a growing appreciation for premium and artisanal beverage experiences. The rise of remote work and hybrid work models has also influenced consumer behavior, leading to a greater demand for accessible coffee shops and casual dining spaces that offer both work-friendly environments and quality refreshments. Technological disruptions are rapidly reshaping the industry, with mobile ordering and payment systems becoming standard, enhancing customer convenience and operational efficiency. AI-powered personalization of offers and loyalty programs are increasingly being adopted to foster customer retention.

Consumer preferences are shifting towards healthier options, with a significant rise in demand for plant-based milk alternatives, low-sugar beverages, and fresh, locally-sourced ingredients, particularly within the juice/smoothie/desserts bars segment. The "experience economy" continues to be a major driver, with consumers seeking unique ambiances, curated menus, and a sense of community within cafes and bars. This is evident in the growing popularity of themed bars, specialty coffee tasting events, and cafes designed for social gatherings. Sustainability is also emerging as a key purchasing factor, with consumers increasingly favoring brands that demonstrate ethical sourcing, eco-friendly packaging, and reduced waste.

The competitive dynamics within the market are intensifying. While large chains like Starbucks Corporation and Inspire Brands Inc leverage their scale and brand recognition, independent establishments are differentiating themselves through unique offerings, personalized service, and strong local community ties. The specialist coffee & tea shops segment, in particular, thrives on this artisanal approach. The bars & pubs segment is witnessing a resurgence with a focus on craft beers, artisanal cocktails, and elevated pub fare. The market penetration of chained outlets remains high, but independent operators are finding success by catering to specific niche demands and offering a more intimate customer experience. The overall market size is estimated to reach over $150 billion by 2025.

Dominant Markets & Segments in North America Cafes & Bars Market

The United States continues to be the dominant market within the North America Cafes & Bars sector, contributing significantly to the overall market value due to its large population, high disposable income, and deeply ingrained cafe and bar culture. Within the US, major metropolitan areas like New York, Los Angeles, and Chicago represent hubs of consumption and innovation. Canada also presents a substantial and growing market, with cities such as Toronto, Vancouver, and Montreal showing increasing demand for diverse cafe and bar offerings.

Cuisine Dominance:

- Cafes: This segment, encompassing both general cafes and specialist coffee & tea shops, holds the largest market share, driven by the daily coffee ritual, the demand for comfortable co-working spaces, and the growing appreciation for specialty coffee and artisanal teas. Starbucks Corporation and Dutch Bros Inc are key players in this segment. The trend towards premiumization and unique flavor profiles further bolsters its dominance.

- Bars & Pubs: While a mature segment, bars and pubs are experiencing a revival driven by an increased demand for craft beverages, unique social experiences, and elevated food menus. Their dominance is particularly strong in urban and entertainment districts.

- Juice/Smoothie/Desserts Bars: This segment is exhibiting the highest growth rate, fueled by increasing health consciousness, demand for convenient and nutritious options, and the popularity of customizable beverages. Smoothie King Franchises Inc and Tropical Smoothie Cafe LLC are significant contributors.

Outlet Type Dominance:

- Chained Outlets: These outlets command the largest market share due to their extensive reach, standardized offerings, strong brand recognition, and efficient operational models. Companies like Starbucks Corporation, McDonald's Corporation (with its McCafe offerings), and Inspire Brands Inc lead this segment. Their ability to leverage economies of scale and sophisticated marketing campaigns contributes to their dominance.

- Independent Outlets: While smaller in overall market share, independent outlets are crucial for market diversity and innovation, often catering to niche markets and offering unique experiences. Their dominance is felt in specific local communities and within segments like specialty coffee and artisanal bars.

Location Dominance:

- Retail: Cafes and bars located within retail environments, such as shopping malls and strip centers, benefit from high foot traffic and impulse purchasing. This location type is consistently a major contributor to market revenue.

- Standalone: Standalone outlets, especially those offering unique ambiances or drive-thru services, continue to be significant, providing dedicated spaces for customers seeking a specific experience.

- Travel: Airports and travel hubs represent a lucrative location segment, driven by the constant flow of travelers seeking convenience and familiar brands. Starbucks Corporation has a particularly strong presence in this location.

Economic policies favoring consumer spending, robust infrastructure supporting business development, and a cultural predisposition towards socializing and casual dining are key drivers for the dominance observed in these segments and regions.

North America Cafes & Bars Market Product Innovations

Product innovation is a critical differentiator in the competitive North America Cafes & Bars market. Companies are consistently introducing new beverages, food pairings, and service formats to attract and retain customers. Key innovations include the expansion of plant-based milk options, the development of low-sugar and functional beverages, and the introduction of unique flavor combinations such as Dutch Bros Inc's White Chocolate Lavender. Advances in cold brew technology and nitro infusions offer enhanced texture and flavor profiles. Furthermore, the integration of subscription models and loyalty programs provides customers with recurring value and encourages repeat business. The focus on sustainable sourcing and eco-friendly packaging is also gaining traction, aligning with growing consumer environmental consciousness. These innovations not only drive sales but also enhance brand perception and customer engagement.

Report Segmentation & Scope

This report segments the North America Cafes & Bars Market by Cuisine, Outlet Type, and Location.

- Cuisine: This includes Bars & Pubs, Cafes, Juice/Smoothie/Desserts Bars, and Specialist Coffee & Tea Shops. The Cafes segment, encompassing general cafes and specialty coffee shops, is projected to hold the largest market share, driven by daily consumption and evolving preferences for premium coffee. The Juice/Smoothie/Desserts Bars segment is anticipated to witness the fastest growth, fueled by health and wellness trends.

- Outlet Type: The segmentation covers Chained Outlets and Independent Outlets. Chained Outlets are expected to continue their market dominance due to their widespread presence and brand recognition. However, Independent Outlets will remain vital for niche markets and unique customer experiences, showing steady growth.

- Location: This analysis includes Leisure, Lodging, Retail, Standalone, and Travel locations. The Retail and Standalone segments are projected to represent significant market sizes due to high foot traffic and dedicated customer bases, respectively. The Travel segment, particularly in airports and transportation hubs, offers consistent revenue streams.

Key Drivers of North America Cafes & Bars Market Growth

The growth of the North America Cafes & Bars Market is propelled by several key factors. Evolving consumer lifestyles, characterized by increased demand for convenience and on-the-go options, significantly drive market expansion. The growing appreciation for premiumization and unique sensory experiences, especially in specialty coffee and craft beverages, attracts a wider customer base. Technological advancements, such as mobile ordering and payment systems, enhance customer convenience and operational efficiency for businesses. Furthermore, the rising health consciousness among consumers has led to an increased demand for healthier beverage options, including juices, smoothies, and plant-based alternatives. Economic stability and increasing disposable incomes in key North American countries also contribute to robust consumer spending in this sector.

Challenges in the North America Cafes & Bars Market Sector

Despite its growth, the North America Cafes & Bars Market faces several challenges. Intense competitive pressures from both large chains and emerging independent players can lead to price wars and margin erosion. Rising operational costs, including labor, rent, and ingredient prices, can impact profitability. Supply chain disruptions, exacerbated by global events, can affect the availability and cost of key ingredients. Regulatory hurdles related to food safety, licensing, and employment can also pose challenges for businesses. Furthermore, the increasing consumer demand for sustainable practices requires significant investment in eco-friendly operations and sourcing, which can be a barrier for smaller businesses. Adapting to rapidly changing consumer preferences and staying ahead of flavor trends also requires continuous innovation and marketing efforts.

Leading Players in the North America Cafes & Bars Market Market

- Dutch Bros Inc

- Inspire Brands Inc

- Jab Holding Company SÀRL

- Starbucks Corporation

- Focus Brands LLC

- Restaurant Brands International Inc

- McDonald's Corporation

- Smoothie King Franchises Inc

- MTY Food Group Inc

- Tropical Smoothie Cafe LL

- International Dairy Queen Inc

Key Developments in North America Cafes & Bars Market Sector

- August 2023: Baskin-Robbins entered a franchise development agreement with real estate and franchise operator McMaster Group Holdings to further expand the ice cream brand in Canada. The agreement was done with plans to open 25 new shops in the Vancouver and Calgary markets.

- January 2023: Dutch Bros launched White Chocolate Lavender in over 650 locations, which can be ordered as a cold brew, breve, or Dutch Freeze.

- December 2022: Dutch Bros launched eight classic drinks with sugar-free options as well.

Strategic North America Cafes & Bars Market Market Outlook

The strategic outlook for the North America Cafes & Bars Market remains highly optimistic, driven by sustained consumer demand and ongoing innovation. Growth accelerators include the continued expansion of specialty coffee culture, the burgeoning health and wellness beverage market, and the increasing adoption of technology for enhanced customer experience. Strategic opportunities lie in catering to evolving dietary needs, expanding into underserved geographical areas, and focusing on sustainable business practices. The integration of digital platforms for personalized marketing and loyalty programs will be crucial for customer retention. Furthermore, M&A activities are expected to continue as companies seek to diversify their portfolios and gain competitive advantages in this dynamic multi-billion dollar industry.

North America Cafes & Bars Market Segmentation

-

1. Cuisine

- 1.1. Bars & Pubs

- 1.2. Cafes

- 1.3. Juice/Smoothie/Desserts Bars

- 1.4. Specialist Coffee & Tea Shops

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

North America Cafes & Bars Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Cafes & Bars Market Regional Market Share

Geographic Coverage of North America Cafes & Bars Market

North America Cafes & Bars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cafes & Bars Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bars & Pubs

- 5.1.2. Cafes

- 5.1.3. Juice/Smoothie/Desserts Bars

- 5.1.4. Specialist Coffee & Tea Shops

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dutch Bros Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Inspire Brands Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jab Holding Company SÀRL

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Starbucks Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Focus Brands LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Restaurant Brands International Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 McDonald's Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Smoothie King Franchises Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MTY Food Group Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tropical Smoothie Cafe LL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 International Dairy Queen Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Dutch Bros Inc

List of Figures

- Figure 1: North America Cafes & Bars Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Cafes & Bars Market Share (%) by Company 2025

List of Tables

- Table 1: North America Cafes & Bars Market Revenue undefined Forecast, by Cuisine 2020 & 2033

- Table 2: North America Cafes & Bars Market Revenue undefined Forecast, by Outlet 2020 & 2033

- Table 3: North America Cafes & Bars Market Revenue undefined Forecast, by Location 2020 & 2033

- Table 4: North America Cafes & Bars Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Cafes & Bars Market Revenue undefined Forecast, by Cuisine 2020 & 2033

- Table 6: North America Cafes & Bars Market Revenue undefined Forecast, by Outlet 2020 & 2033

- Table 7: North America Cafes & Bars Market Revenue undefined Forecast, by Location 2020 & 2033

- Table 8: North America Cafes & Bars Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States North America Cafes & Bars Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Cafes & Bars Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Cafes & Bars Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cafes & Bars Market?

The projected CAGR is approximately 4.36%.

2. Which companies are prominent players in the North America Cafes & Bars Market?

Key companies in the market include Dutch Bros Inc, Inspire Brands Inc, Jab Holding Company SÀRL, Starbucks Corporation, Focus Brands LLC, Restaurant Brands International Inc, McDonald's Corporation, Smoothie King Franchises Inc, MTY Food Group Inc, Tropical Smoothie Cafe LL, International Dairy Queen Inc.

3. What are the main segments of the North America Cafes & Bars Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

August 2023: Baskin-Robbins entered a franchise development agreement with real estate and franchise operator McMaster Group Holdings to further expand the ice cream brand in Canada. The agreement was done with plans to open 25 new shops in the Vancouver and Calgary markets.January 2023: Dutch Bros launched White Chocolate Lavender in over 650 locations, which can be ordered as a cold brew, breve, or Dutch Freeze.December 2022: Dutch Bros launched eight classic drinks with sugar-free options as well.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cafes & Bars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cafes & Bars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cafes & Bars Market?

To stay informed about further developments, trends, and reports in the North America Cafes & Bars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence