Key Insights

The North American amusement park market is experiencing significant expansion, driven by increasing disposable incomes and a strong consumer preference for leisure and entertainment. Innovations in ride technology and immersive experiences, including VR and AR, are attracting a wider demographic. Strategic partnerships with hospitality providers further bolster the sector's growth. Despite potential economic headwinds and seasonality, the market is projected for robust development. Key revenue streams include ticket sales, food and beverage, merchandise, and accommodations. While the United States leads, Canada and Mexico present emerging growth opportunities.

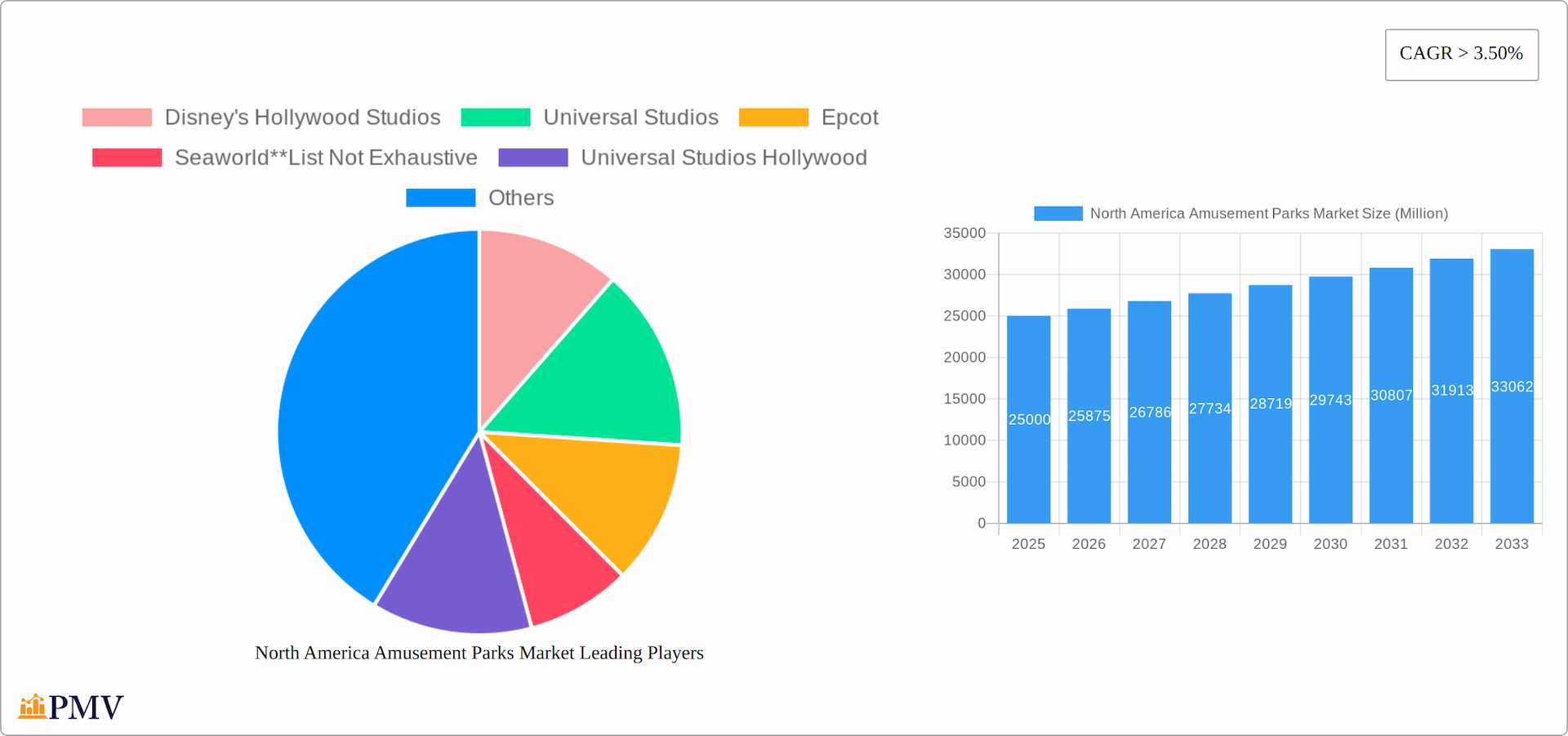

North America Amusement Parks Market Market Size (In Billion)

Major investments in new attractions by industry leaders like Disney and Universal underscore the market's upward trajectory. Intense competition fosters continuous improvement in offerings and customer experience. The integration of technology and data analytics is enhancing operational efficiency and personalization. However, the industry must address rising operational costs, sustainability concerns, and evolving consumer preferences. Future growth will likely focus on creating unique, memorable experiences that cater to diverse interests while prioritizing safety and responsible tourism.

North America Amusement Parks Market Company Market Share

This comprehensive analysis of the North America amusement parks market, covering 2019-2033, offers critical insights for stakeholders. The market size in 2025 is estimated at $33.3 billion, with a projected Compound Annual Growth Rate (CAGR) of 29.8% through 2033. This report uses 2025 as the base year for its analysis.

North America Amusement Parks Market Structure & Competitive Dynamics

The North American amusement park market is characterized by a moderately concentrated structure, dominated by major players like Disney, Universal Studios, and SeaWorld. However, a significant number of smaller, regional parks contribute to the overall market size. Innovation ecosystems within the industry are vibrant, with continuous development in ride technology, immersive experiences, and themed attractions. Regulatory frameworks vary across different states and provinces, impacting operational costs and expansion strategies. Product substitutes, such as home entertainment options and other leisure activities, exert competitive pressure. End-user trends increasingly favor immersive and interactive experiences, driving the need for innovation and technological advancements.

The market witnessed several significant M&A activities in recent years. For instance, the acquisition of the Best Western Premier Grand Canyon Squire Inn by Delaware North in January 2023 showcases the ongoing expansion in the parks and lodging sector. Deal values for such acquisitions range from $XX Million to $XX Million depending on asset size and location. The competitive landscape is further shaped by the continuous evolution of consumer preferences, requiring amusement parks to adapt their offerings and enhance the guest experience. Market share is heavily influenced by brand recognition, location, and the quality of attractions. Disney and Universal Studios hold significant market share in the theme park segment, while regional parks compete based on local appeal and unique offerings.

North America Amusement Parks Market Industry Trends & Insights

The North America amusement parks market is experiencing a dynamic phase of growth, propelled by increasing consumer spending power, a surge in domestic and international tourism, and a pronounced shift towards unique, engaging entertainment experiences. The Compound Annual Growth Rate (CAGR) for the forecast period of 2025-2033 is anticipated to be robust, indicating substantial market expansion. Key innovations are emerging through the integration of cutting-edge technologies like virtual reality (VR) and augmented reality (AR), which are revolutionizing the guest experience and fostering a culture of continuous innovation. Consumers are increasingly seeking out parks that offer deeply immersive narratives, highly personalized interactions, and a commitment to environmentally responsible practices. The competitive landscape is characterized by fierce rivalry among prominent industry leaders, necessitating ongoing investments in new attractions, technological advancements, and operational excellence. While market saturation is evident in major metropolitan hubs, significant opportunities for expansion exist within secondary and tertiary markets, offering untapped potential for growth.

Dominant Markets & Segments in North America Amusement Parks Market

The United States continues to be the undisputed leader in the North American amusement parks market, followed by Canada and Mexico. The market is comprehensively segmented to understand its diverse components, including: Rides (categorized into mechanical, water, and other types), Age Demographics (spanning up to 18 years, 19-35 years, 36-50 years, 51-65 years, and over 65 years), Revenue Streams (encompassing ticket sales, food & beverages, merchandise, hotels/resorts, and ancillary revenues), and Geographical Location.

-

By Rides: Mechanical rides remain the top revenue generators, consistently attracting a broad spectrum of visitors due to their widespread appeal and diverse offerings.

-

By Age: The 19-35 years age demographic constitutes a particularly influential consumer base, demonstrating a strong demand for high-thrill attractions and deeply engaging, immersive experiences.

-

By Revenue: Ticket sales are the cornerstone of revenue generation. However, food and beverage sales are increasingly contributing significant profits, often boasting higher profit margins.

-

By Country: The United States commands the largest market share, characterized by a high concentration of world-renowned theme parks and a substantial influx of tourists, thereby driving considerable revenue.

The sustained dominance of key regions is underpinned by robust tourism infrastructure, supportive economic policies, and the strategic presence of major entertainment conglomerates. Florida and California, in particular, stand out as prime locations due to the flagship parks operated by industry giants such as Disney and Universal Studios.

North America Amusement Parks Market Product Innovations

Recent product innovations in the North American amusement park market revolve around enhancing the guest experience through technological integration. The introduction of VR and AR technologies provides immersive experiences, and advancements in ride design focus on increased thrill levels and interactive elements. These innovations improve guest engagement and satisfaction, bolstering competitive advantages. The market fit for these advancements is strong, supported by the growing demand for immersive entertainment.

Report Segmentation & Scope

This comprehensive report meticulously analyzes the North American amusement parks market across several critical dimensions:

-

By Rides:

- Mechanical Rides: Market Size in 2025 estimated at $XX Million, with a projected CAGR of XX%.

- Water Rides: Market Size in 2025 estimated at $XX Million, with a projected CAGR of XX%.

- Other Rides: Market Size in 2025 estimated at $XX Million, with a projected CAGR of XX%.

-

By Age: Each age demographic presents distinct preferences, directly influencing ride development and the overall park offerings. The 19-35 year old segment represents a significant portion of the market share.

-

By Revenue: While ticket sales remain the primary revenue driver, food & beverages, merchandise, and integrated hotel/resort offerings play crucial roles in bolstering overall profitability and enhancing guest experience.

-

By Country: The United States leads the market, followed by Canada and Mexico, with each nation exhibiting unique market characteristics and distinct growth potentials.

Key Drivers of North America Amusement Parks Market Growth

Several factors contribute to the market's growth. Strong economic growth boosts disposable incomes, leading to increased spending on leisure activities. Technological advancements enhance guest experiences, attracting a wider audience. Favorable government policies and infrastructure development support the growth of tourism and related industries. The increasing popularity of experiential entertainment drives the demand for unique and immersive attractions.

Challenges in the North America Amusement Parks Market Sector

The market faces challenges including seasonality, which impacts revenue streams, and increasing operational costs due to rising labor and maintenance expenses. Intense competition forces constant investment in innovation to retain market share. Regulatory compliance and obtaining necessary permits can present hurdles, particularly during expansion projects. Supply chain disruptions can impact the procurement of materials and equipment.

Leading Players in the North America Amusement Parks Market

- Disney's Hollywood Studios

- Universal Studios

- Epcot

- SeaWorld

- Universal Studios Hollywood

- Magic Kingdom

- Disney's Animal Kingdom

- Disney's California Adventure

- Islands of Adventure

- Disneyland

Key Developments in North America Amusement Parks Market Sector

-

July 2022: Five Star Parks & Attractions strategically expanded its operational footprint with the acquisition of three Malibu Jack's Indoor Theme Parks. This move highlights a trend of consolidation and growth within the smaller, specialized park segment.

-

January 2023: Delaware North's acquisition of the Best Western Premier Grand Canyon Squire Inn demonstrates an ambitious expansion into the hospitality sector by a major industry player. This strategic move aims to enhance the integrated guest experience, offering a more seamless and comprehensive vacation package.

Strategic North America Amusement Parks Market Outlook

The North American amusement parks market exhibits a positive outlook, driven by sustained growth in tourism, technological innovation, and the continuous demand for immersive experiences. Strategic opportunities lie in developing personalized experiences, embracing sustainable practices, and expanding into underserved markets. Investment in technology and creating unique attractions will be crucial for maintaining competitiveness in this dynamic sector. The market's future growth will be fueled by advancements in technology and the continued focus on delivering exceptional guest experiences.

North America Amusement Parks Market Segmentation

-

1. Rides

- 1.1. Mechanical Rides

- 1.2. Water Rides

- 1.3. Other Rides

-

2. Age

- 2.1. Upto 18 years

- 2.2. 19 to 35 years

- 2.3. 36 to 50 years

- 2.4. 51 to 65 years

- 2.5. More than 65 years

-

3. Revenue

- 3.1. Tickets

- 3.2. Food & Beverages

- 3.3. Merchandise

- 3.4. Hotels/Resorts

- 3.5. Other Revenues

North America Amusement Parks Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Amusement Parks Market Regional Market Share

Geographic Coverage of North America Amusement Parks Market

North America Amusement Parks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 29.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Number of Visitors to Museums is Driving the Market; Digitalization is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Maintenance and Preservation Costs; Changing Visitor Preferences

- 3.4. Market Trends

- 3.4.1. Mechanical Rides Powering North America's Amusement Park Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Amusement Parks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Rides

- 5.1.1. Mechanical Rides

- 5.1.2. Water Rides

- 5.1.3. Other Rides

- 5.2. Market Analysis, Insights and Forecast - by Age

- 5.2.1. Upto 18 years

- 5.2.2. 19 to 35 years

- 5.2.3. 36 to 50 years

- 5.2.4. 51 to 65 years

- 5.2.5. More than 65 years

- 5.3. Market Analysis, Insights and Forecast - by Revenue

- 5.3.1. Tickets

- 5.3.2. Food & Beverages

- 5.3.3. Merchandise

- 5.3.4. Hotels/Resorts

- 5.3.5. Other Revenues

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Rides

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Disney's Hollywood Studios

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Universal Studios

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Epcot

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Seaworld**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Universal Studios Hollywood

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Magic Kingdom

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Disney's Animal Kingdom

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Disney's California Adventure

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Islands of Adventure

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Disneyland

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Disney's Hollywood Studios

List of Figures

- Figure 1: North America Amusement Parks Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Amusement Parks Market Share (%) by Company 2025

List of Tables

- Table 1: North America Amusement Parks Market Revenue billion Forecast, by Rides 2020 & 2033

- Table 2: North America Amusement Parks Market Revenue billion Forecast, by Age 2020 & 2033

- Table 3: North America Amusement Parks Market Revenue billion Forecast, by Revenue 2020 & 2033

- Table 4: North America Amusement Parks Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Amusement Parks Market Revenue billion Forecast, by Rides 2020 & 2033

- Table 6: North America Amusement Parks Market Revenue billion Forecast, by Age 2020 & 2033

- Table 7: North America Amusement Parks Market Revenue billion Forecast, by Revenue 2020 & 2033

- Table 8: North America Amusement Parks Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States North America Amusement Parks Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Amusement Parks Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Amusement Parks Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Amusement Parks Market?

The projected CAGR is approximately 29.8%.

2. Which companies are prominent players in the North America Amusement Parks Market?

Key companies in the market include Disney's Hollywood Studios, Universal Studios, Epcot, Seaworld**List Not Exhaustive, Universal Studios Hollywood, Magic Kingdom, Disney's Animal Kingdom, Disney's California Adventure, Islands of Adventure, Disneyland.

3. What are the main segments of the North America Amusement Parks Market?

The market segments include Rides, Age, Revenue.

4. Can you provide details about the market size?

The market size is estimated to be USD 33.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Number of Visitors to Museums is Driving the Market; Digitalization is Driving the Market.

6. What are the notable trends driving market growth?

Mechanical Rides Powering North America's Amusement Park Industry.

7. Are there any restraints impacting market growth?

Maintenance and Preservation Costs; Changing Visitor Preferences.

8. Can you provide examples of recent developments in the market?

January 2023: Global hospitality and entertainment company Delaware North announced its continued expansion in the parks and lodging sector through the acquisition of the Best Western Premier Grand Canyon Squire Inn.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Amusement Parks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Amusement Parks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Amusement Parks Market?

To stay informed about further developments, trends, and reports in the North America Amusement Parks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence