Key Insights

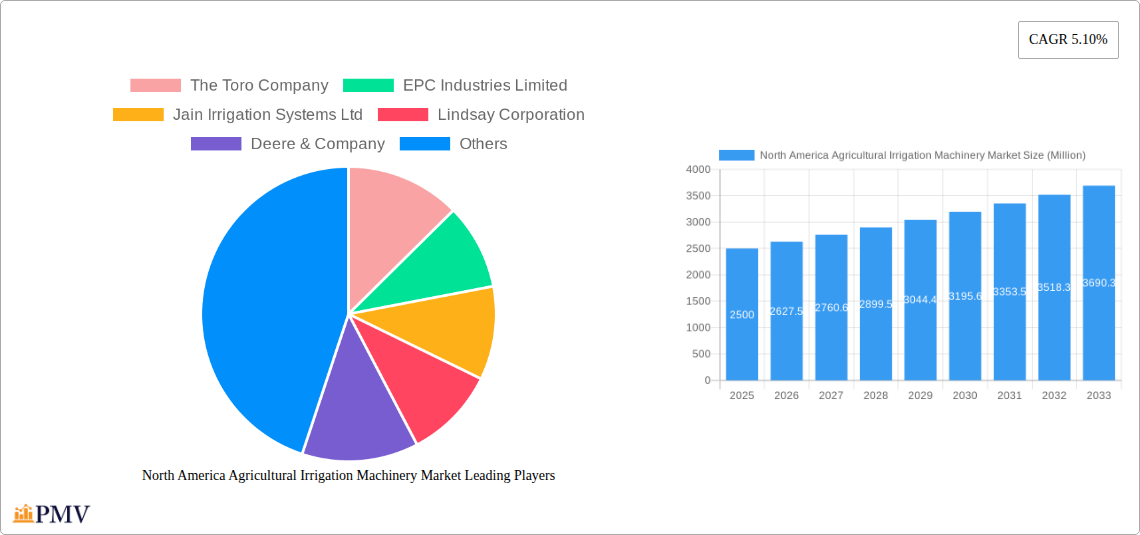

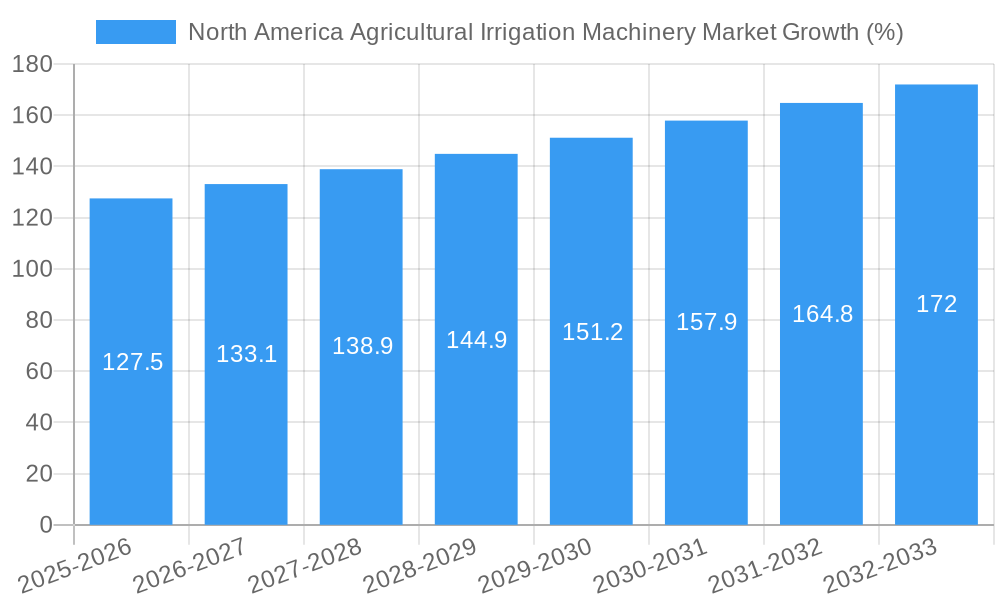

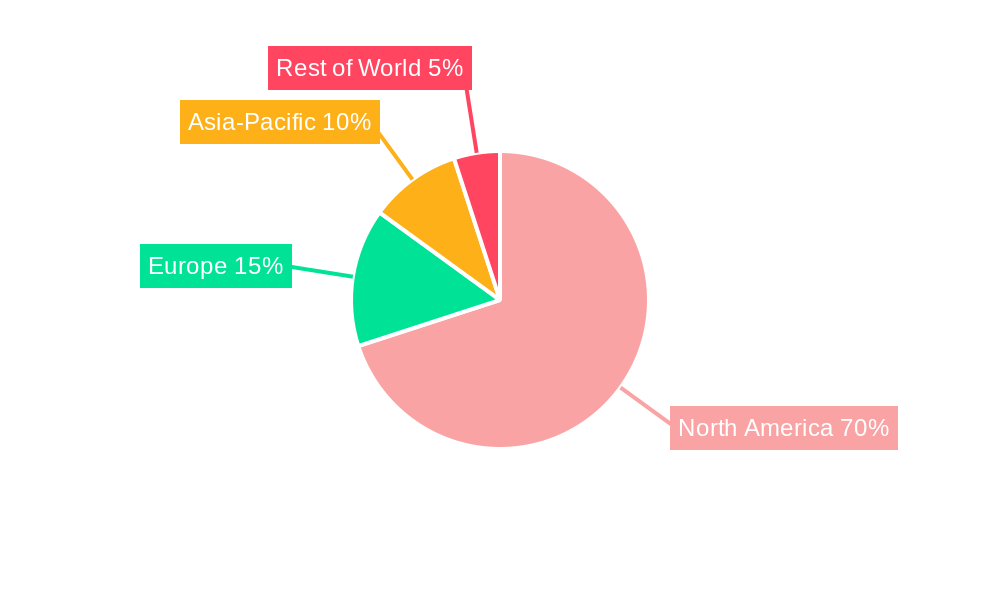

The North America agricultural irrigation machinery market, valued at approximately $X million in 2025 (assuming a logical extrapolation based on the provided 2019-2024 data and 5.10% CAGR), is projected to experience robust growth throughout the forecast period (2025-2033). This expansion is driven primarily by the increasing demand for efficient water management solutions amidst growing concerns over water scarcity and the rising need to enhance agricultural productivity. Favorable government policies promoting sustainable agricultural practices and technological advancements in irrigation systems, such as precision irrigation technologies and smart sensors, further fuel market growth. The market is segmented by irrigation type (sprinkler, drip, and other) and crop type (crop and non-crop), with drip irrigation experiencing significant traction due to its water-saving capabilities. Key players like The Toro Company, Jain Irrigation Systems Ltd, and Rain Bird Corporation are driving innovation and expanding their market share through product diversification and strategic partnerships. The United States, being the largest agricultural producer in North America, dominates the regional market, followed by Canada and Mexico.

Within the North American landscape, the market's growth trajectory is expected to be influenced by several factors. While the adoption of advanced irrigation technologies presents a significant opportunity, challenges remain, including high initial investment costs for sophisticated systems and the need for farmer education and training to effectively utilize these technologies. Furthermore, regional variations in climate and agricultural practices will influence the adoption rate of different irrigation types across the various sub-regions within North America. Nonetheless, the long-term outlook remains positive, driven by the ongoing need to improve water-use efficiency, increase crop yields, and address the challenges of climate change affecting agricultural production in the region. The market is poised for continued expansion, with substantial investment in research and development further contributing to the development of more efficient and sustainable irrigation solutions.

North America Agricultural Irrigation Machinery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Agricultural Irrigation Machinery market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market dynamics, competitive landscapes, and future growth prospects. The study utilizes rigorous research methodologies to provide accurate and actionable intelligence. The total market size in 2025 is estimated at xx Million, with projections extending to 2033.

North America Agricultural Irrigation Machinery Market Structure & Competitive Dynamics

The North American agricultural irrigation machinery market exhibits a moderately concentrated structure, with several key players holding significant market share. The Toro Company, Lindsay Corporation, Deere & Company, and Valmont Industries are among the dominant players, each contributing significantly to the overall market volume. However, the market also features several smaller, specialized companies that cater to niche segments, indicating a presence of both large corporations and smaller niche players.

Market share dynamics are shaped by factors such as product innovation, technological advancements, distribution networks, and brand reputation. Mergers and acquisitions (M&A) play a role in shaping the competitive landscape, with deal values fluctuating based on the size and strategic importance of the acquired entity. For example, in the period between 2019 and 2024, M&A activity in the sector totalled approximately xx Million. The regulatory framework, while generally supportive of agricultural modernization, also influences investment decisions and the adoption of new technologies. The market is witnessing increasing preference for water-efficient irrigation systems driven by environmental concerns and water scarcity in certain regions. Substitutes for traditional irrigation methods, such as rainwater harvesting and drip irrigation are gaining traction.

- Market Concentration: Moderately concentrated, with a few major players dominating.

- Innovation Ecosystems: Active, with continuous development of water-efficient technologies.

- Regulatory Frameworks: Supportive of sustainable agriculture practices.

- Product Substitutes: Growing adoption of water-efficient alternatives.

- End-User Trends: Increasing demand for precision irrigation solutions.

- M&A Activities: Significant activity observed, with deals valued at approximately xx Million between 2019 and 2024.

North America Agricultural Irrigation Machinery Market Industry Trends & Insights

The North American agricultural irrigation machinery market is experiencing robust growth, driven by factors such as increasing agricultural output, rising awareness of water conservation, and technological advancements. The market is witnessing a steady shift towards precision irrigation technologies, offering increased efficiency and reduced water wastage. This trend is further fueled by government initiatives promoting sustainable agricultural practices and water conservation.

Technological disruptions, such as the integration of IoT sensors and data analytics, are revolutionizing irrigation management, enabling farmers to optimize water usage and improve crop yields. Consumer preferences are leaning toward automated, data-driven irrigation systems that minimize labor requirements and enhance operational efficiency. The competitive landscape remains dynamic, with companies investing heavily in R&D to develop innovative products and enhance their market position. The compound annual growth rate (CAGR) for the market during the forecast period (2025-2033) is projected to be xx%. Market penetration of advanced irrigation technologies is expected to increase significantly over the coming years, reaching xx% by 2033.

Dominant Markets & Segments in North America Agricultural Irrigation Machinery Market

Within North America, the Western region demonstrates the strongest growth and market dominance for agricultural irrigation machinery. This dominance stems from several factors:

- California: A major agricultural hub, California's high water demand and large-scale farming operations drive considerable demand for irrigation machinery.

- Economic Policies: Government initiatives promoting sustainable agriculture and water conservation contribute significantly.

- Infrastructure: Existing irrigation infrastructure provides a foundation for further expansion and modernization.

By Irrigation Type:

- Sprinkler Irrigation: Remains a dominant segment due to its wide applicability and cost-effectiveness in various cropping systems. However, drip irrigation is gaining ground due to increased water efficiency.

- Drip Irrigation: Shows robust growth fueled by the increasing focus on water conservation and precision agriculture.

- Other: This segment includes various specialized irrigation systems, and their growth is influenced by specific crop requirements and regional variations.

By Crop Type:

- Crop: This segment constitutes the largest portion of the market and is driven by the need for efficient irrigation to maximize crop yields.

- Non-crop: Includes landscaping and other non-agricultural applications and is a relatively smaller but steadily growing segment.

North America Agricultural Irrigation Machinery Market Product Innovations

Recent product developments focus on enhancing precision, efficiency, and automation. Smart irrigation systems, incorporating IoT sensors and data analytics, enable real-time monitoring and control of irrigation schedules, optimizing water usage and minimizing waste. These systems offer significant competitive advantages through improved crop yields, reduced operational costs, and enhanced sustainability. The market trend is towards user-friendly interfaces and integration with existing farm management systems.

Report Segmentation & Scope

This report segments the North America Agricultural Irrigation Machinery market based on Irrigation type (Sprinkler Irrigation, Drip Irrigation, Other) and Crop Type (Crop, Non-crop). Each segment's growth trajectory, market size, and competitive landscape are analyzed in detail. The report provides insights into market share, growth projections, and key drivers for each segment. For example, the Sprinkler Irrigation segment is expected to witness a steady growth rate, while the Drip Irrigation segment is poised for faster growth due to its water efficiency advantages. Similarly, the Crop segment is significantly larger than the Non-crop segment, but the Non-crop segment is showing strong growth potential.

Key Drivers of North America Agricultural Irrigation Machinery Market Growth

Several factors contribute to the market's growth. Technological advancements, such as the development of smart irrigation systems, are improving efficiency and reducing water waste. Government incentives promoting sustainable agriculture and water conservation are creating favorable market conditions. The increasing adoption of precision farming techniques is also driving demand. Furthermore, rising food demand and the need to enhance crop yields are stimulating the need for advanced irrigation solutions.

Challenges in the North America Agricultural Irrigation Machinery Market Sector

The market faces challenges such as high initial investment costs for advanced irrigation systems. Water scarcity in certain regions and fluctuating energy prices can affect the adoption rate. Furthermore, stringent regulatory compliance requirements and potential supply chain disruptions due to global events may also constrain growth. These factors collectively could negatively impact market growth by approximately xx% in the short term.

Leading Players in the North America Agricultural Irrigation Machinery Market Market

- The Toro Company

- EPC Industries Limited

- Jain Irrigation Systems Ltd

- Lindsay Corporation

- Deere & Company

- T-L Irrigation Co

- Rain Bird Corporation

- Nelson Irrigation Corporation

- Netafim Limited

- Valmont Industries

Key Developments in North America Agricultural Irrigation Machinery Market Sector

- 2023 Q4: Lindsay Corporation launches a new smart irrigation system incorporating advanced sensors and data analytics.

- 2022 Q2: The Toro Company acquires a smaller irrigation technology company, expanding its product portfolio.

- 2021 Q3: Deere & Company invests in research and development of water-efficient irrigation technologies. (Further developments can be added here as available)

Strategic North America Agricultural Irrigation Machinery Market Market Outlook

The North American agricultural irrigation machinery market holds significant growth potential, driven by increasing demand for water-efficient and technologically advanced solutions. Strategic opportunities lie in investing in research and development of innovative irrigation technologies, expanding into emerging markets, and forming strategic partnerships to enhance market penetration. Focus on sustainable practices and addressing environmental concerns will be key to long-term success. The market is expected to witness significant growth in the next decade, offering attractive returns for companies capable of innovating and adapting to evolving market demands.

North America Agricultural Irrigation Machinery Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Agricultural Irrigation Machinery Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Agricultural Irrigation Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Declining Labour Availability and Rising Cost of Farm Labour; Rapid Technological Advancements by Key Players

- 3.3. Market Restrains

- 3.3.1. High Cost of Agricultural Machinery and Repair; Data Privacy Concerns in Modern Farming

- 3.4. Market Trends

- 3.4.1. Increasing Water Scarcity Driving the Adoption of Micro-irrigation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Agricultural Irrigation Machinery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United States North America Agricultural Irrigation Machinery Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Agricultural Irrigation Machinery Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Agricultural Irrigation Machinery Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Agricultural Irrigation Machinery Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 The Toro Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 EPC Industries Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Jain Irrigation Systems Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Lindsay Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Deere & Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 T-L Irrigation Co

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Rain Bird Corporatio

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nelson Irrigation Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Netafim Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Valmont Industries

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 The Toro Company

List of Figures

- Figure 1: North America Agricultural Irrigation Machinery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Agricultural Irrigation Machinery Market Share (%) by Company 2024

List of Tables

- Table 1: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of North America North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 14: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 15: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 16: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 17: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 18: North America Agricultural Irrigation Machinery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico North America Agricultural Irrigation Machinery Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Agricultural Irrigation Machinery Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the North America Agricultural Irrigation Machinery Market?

Key companies in the market include The Toro Company, EPC Industries Limited, Jain Irrigation Systems Ltd, Lindsay Corporation, Deere & Company, T-L Irrigation Co, Rain Bird Corporatio, Nelson Irrigation Corporation, Netafim Limited, Valmont Industries.

3. What are the main segments of the North America Agricultural Irrigation Machinery Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Declining Labour Availability and Rising Cost of Farm Labour; Rapid Technological Advancements by Key Players.

6. What are the notable trends driving market growth?

Increasing Water Scarcity Driving the Adoption of Micro-irrigation.

7. Are there any restraints impacting market growth?

High Cost of Agricultural Machinery and Repair; Data Privacy Concerns in Modern Farming.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Agricultural Irrigation Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Agricultural Irrigation Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Agricultural Irrigation Machinery Market?

To stay informed about further developments, trends, and reports in the North America Agricultural Irrigation Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence