Key Insights

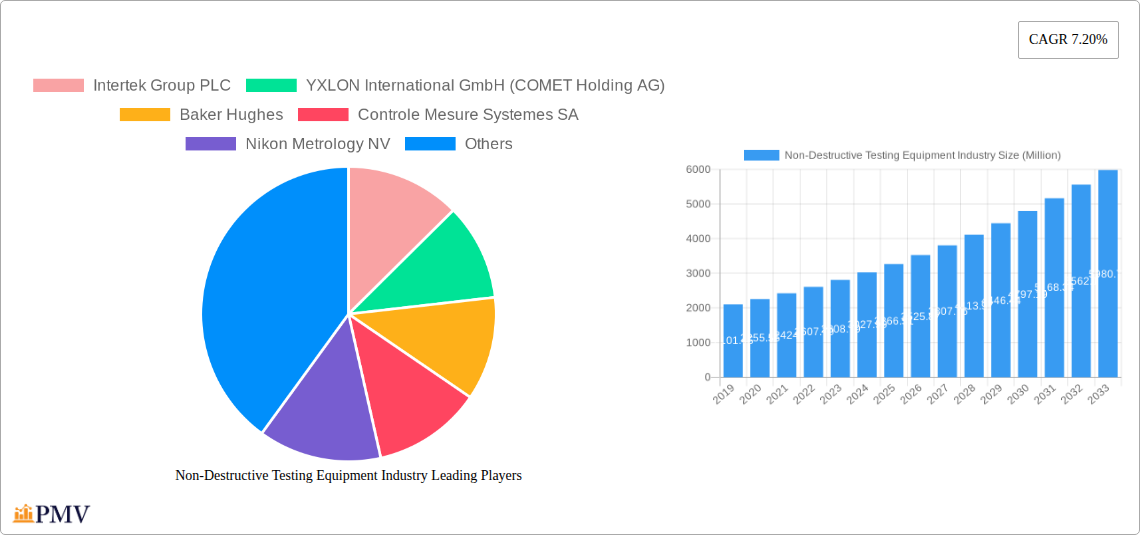

The global Non-Destructive Testing (NDT) Equipment market is poised for significant expansion, projected to reach a substantial valuation of USD 3.02 billion. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 7.20% over the forecast period of 2025-2033. This upward trajectory is primarily driven by an escalating demand for stringent quality control and safety assurance across a multitude of critical industries. The increasing complexity and precision required in sectors like aerospace, automotive, and oil and gas necessitate advanced NDT solutions to detect flaws without compromising component integrity. Furthermore, the growing emphasis on extending the lifespan of existing infrastructure and assets, coupled with the development of new, high-performance materials, fuels the adoption of sophisticated NDT technologies. Emerging economies, with their burgeoning industrial bases and increased investments in infrastructure development, are also contributing significantly to this market's dynamism.

Non-Destructive Testing Equipment Industry Market Size (In Billion)

Technological advancements and increasing market penetration are key trends shaping the NDT equipment landscape. Innovations in radiography testing, ultrasonic testing, and eddy current equipment are leading to enhanced accuracy, portability, and data analysis capabilities. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into NDT systems promises more efficient defect detection and predictive maintenance. While the market is characterized by strong growth drivers, certain restraints exist. High initial investment costs for advanced NDT equipment and the need for skilled personnel to operate and interpret results can pose challenges, particularly for smaller enterprises. Nevertheless, the clear benefits of improved safety, reduced downtime, and enhanced product reliability are expected to outweigh these hurdles, ensuring sustained market development and innovation. The market's segmentation by technology, with Radiography Testing Equipment and Ultrasonic Testing Equipment leading the charge, and by end-user industry, dominated by Oil & Gas and Power & Energy, highlights the areas of greatest current and future demand.

Non-Destructive Testing Equipment Industry Company Market Share

Unlock critical insights into the dynamic Non-Destructive Testing (NDT) Equipment market with this in-depth report. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this analysis provides an unparalleled understanding of market structure, key trends, leading players, and future growth trajectories. Discover how advanced technologies like Radiography Testing Equipment, Ultrasonic Testing Equipment, Eddy Current Equipment, and Liquid Penetrant Testing Equipment are revolutionizing sectors such as Oil and Gas, Aerospace and Defense, and Power and Energy. With a projected market size in the billions of dollars, this report is essential for stakeholders seeking to capitalize on the expanding demand for safety, quality assurance, and asset integrity solutions worldwide.

Non-Destructive Testing Equipment Industry Market Structure & Competitive Dynamics

The global Non-Destructive Testing (NDT) Equipment market is characterized by a moderately concentrated structure, with a significant presence of both multinational corporations and specialized regional players. Innovation ecosystems are robust, driven by continuous advancements in sensor technology, data analytics, and miniaturization of equipment. Regulatory frameworks, such as those established by the American Petroleum Institute (API) and the American Society for Non-Destructive Testing (ASNT), play a crucial role in shaping market standards and product development, emphasizing safety and reliability. While direct product substitutes are limited due to the specialized nature of NDT, advancements in predictive maintenance software and data interpretation can indirectly impact the demand for certain equipment. End-user trends are strongly influenced by increasing safety regulations, aging infrastructure, and the growing need for efficient asset management across industries like Oil and Gas, Aerospace, and Construction. Mergers and acquisitions (M&A) activities are notable, with deal values often reaching tens to hundreds of Millions, aimed at expanding market reach, acquiring new technologies, and consolidating market share. For instance, the acquisition of smaller technology providers by larger conglomerates is a common strategy to enhance product portfolios. Key market players are continuously investing in research and development (R&D) to offer more sophisticated and user-friendly NDT solutions.

Non-Destructive Testing Equipment Industry Industry Trends & Insights

The Non-Destructive Testing (NDT) Equipment industry is poised for significant expansion, driven by a confluence of technological advancements, stringent safety regulations, and the ever-increasing need for asset integrity management across diverse end-user sectors. The global market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6-8% over the forecast period (2025-2033), reaching a market valuation in the tens of billions of dollars by 2033. This growth is propelled by several key factors. Firstly, the burgeoning Oil and Gas sector, particularly in offshore exploration and production, demands robust NDT solutions for pipeline inspection, pressure vessel integrity, and facility maintenance, representing a substantial portion of market share, estimated to be over 30% in 2025. Secondly, the Aerospace and Defense industry's stringent safety standards and the continuous development of new aircraft and defense systems necessitate highly accurate and reliable NDT methods for component inspection, contributing an estimated 20% market share. Furthermore, the Power and Energy sector, encompassing nuclear, renewable, and conventional power plants, relies heavily on NDT for the safe operation and longevity of critical infrastructure, with its market share projected around 15%.

Technological disruptions are a primary growth catalyst. The integration of Artificial Intelligence (AI) and Machine Learning (ML) into NDT equipment is revolutionizing data analysis, enabling faster defect detection and more accurate assessments. advancements in miniaturization and wireless connectivity are leading to the development of portable and remotely operated NDT devices, enhancing operational efficiency and safety. The adoption of phased array ultrasonic testing (PAUT) and digital radiography is rapidly increasing due to their superior imaging capabilities and reduced inspection times compared to traditional methods. Consumer preferences are shifting towards NDT solutions that offer real-time data, cloud connectivity for data storage and analysis, and user-friendly interfaces. This is pushing manufacturers to invest in digital transformation and develop smart NDT equipment. Competitive dynamics are intensifying, with established players like Olympus Corporation and Baker Hughes investing heavily in R&D and strategic partnerships to maintain their market leadership. The entry of new players, particularly from Asia, is also shaping the competitive landscape. Market penetration of advanced NDT technologies is steadily increasing as industries recognize the long-term cost savings and safety benefits associated with early detection of flaws and defects.

Dominant Markets & Segments in Non-Destructive Testing Equipment Industry

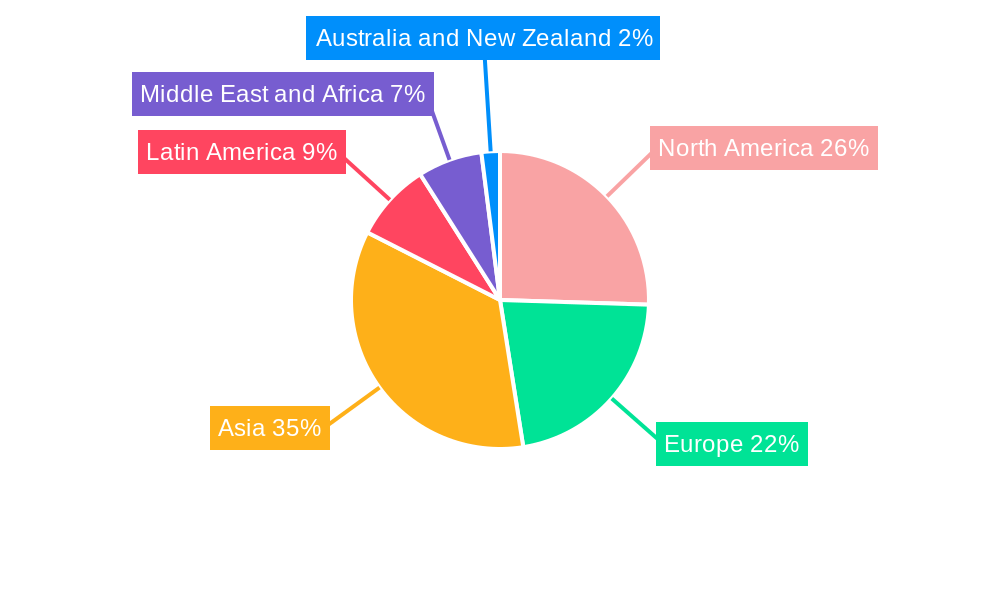

The Non-Destructive Testing (NDT) Equipment market exhibits distinct regional and segment-specific dominance. Geographically, North America and Asia Pacific are emerging as the leading markets, driven by significant investments in infrastructure development, a strong presence of key end-user industries like Oil and Gas and Aerospace, and robust regulatory frameworks mandating safety and quality assurance.

- Leading Region: North America, particularly the United States, holds a substantial market share, estimated to be around 30-35% in 2025. This dominance is fueled by extensive operations in the Oil and Gas sector, a mature Aerospace industry, and significant government spending on defense and infrastructure. Economic policies supporting industrial growth and technological adoption further bolster this position.

- Dominant Technology Segment:

- Ultrasonic Testing Equipment: This segment is anticipated to command the largest market share, projected at over 25% in 2025. Its versatility, accuracy, and applicability across a wide range of materials and defect types make it indispensable for industries like Oil and Gas, Power and Energy, and Manufacturing. Advancements in phased array and guided wave ultrasonic technologies are further enhancing its market penetration.

- Radiography Testing Equipment: Holding a significant market share of approximately 20-25%, radiography remains a critical NDT method, especially for inspecting welds, castings, and complex geometries. The development of digital radiography and computed radiography (CR) systems has improved image quality and reduced inspection times, maintaining its relevance.

- Dominant End-User Industry Segment:

- Oil and Gas: This industry segment is expected to be the largest consumer of NDT equipment, accounting for an estimated 30-35% of the market in 2025. The continuous need for pipeline integrity, facility maintenance, and offshore exploration safety drives the demand for a wide array of NDT solutions, including ultrasonic, radiographic, and eddy current testing.

- Aerospace and Defense: With a market share of approximately 20-25%, this sector demands the highest levels of accuracy and reliability. NDT equipment is crucial for inspecting aircraft components, engines, and defense systems for structural integrity, ensuring passenger safety and mission readiness.

Non-Destructive Testing Equipment Industry Product Innovations

Product innovations in the Non-Destructive Testing (NDT) Equipment market are focused on enhancing accuracy, portability, automation, and data analysis capabilities. Manufacturers are developing advanced ultrasonic phased array systems with improved beam steering and imaging resolution, alongside portable digital X-ray systems that offer faster inspection times and superior image quality. The integration of AI and machine learning algorithms into eddy current and magnetic particle testing equipment is enabling automated defect detection and classification. Furthermore, the development of specialized probes and sensors for inspecting composite materials and harsh environments is expanding the application scope of NDT technologies. These innovations provide competitive advantages by enabling more efficient, reliable, and cost-effective inspections, meeting the evolving demands of end-user industries.

Report Segmentation & Scope

This comprehensive report segments the Non-Destructive Testing (NDT) Equipment market across key technology and end-user industry verticals. The scope includes a detailed analysis of:

Technology Segmentation:

- Radiography Testing Equipment: This segment encompasses X-ray and gamma-ray based inspection systems, crucial for volumetric defect detection. Growth is projected to be moderate, with market size estimated in the hundreds of Millions.

- Ultrasonic Testing Equipment: Including conventional, phased array, and guided wave systems, this segment is expected to exhibit strong growth, with market size projected to reach billions of dollars.

- Magnetic Particle Testing Equipment: Essential for surface and near-surface crack detection in ferromagnetic materials, this segment is projected to maintain steady growth.

- Liquid Penetrant Testing Equipment: Utilized for surface-breaking defects in non-porous materials, this segment offers reliable and cost-effective solutions.

- Visual Inspection Equipment: Encompassing borescopes, videoscopes, and advanced imaging systems, this segment is vital for preliminary inspections.

- Eddy Current Equipment: Applied for surface and subsurface flaw detection, material characterization, and coating thickness measurement, this segment is experiencing robust growth.

- Other Technologies Equipment: This includes acoustic emission testing, thermal imaging, and laser-based inspection systems, catering to specialized applications.

End-user Industry Segmentation:

- Oil and Gas: Projected to be the largest segment, with market size in the billions, driven by exploration, production, and refining operations.

- Power and Energy: Significant demand from nuclear, renewable, and conventional power generation facilities, with market size in the hundreds of Millions.

- Aerospace and Defense: High-value applications requiring precision and reliability, with market size in the hundreds of Millions.

- Automotive and Transportation: Growing adoption for quality control in manufacturing and maintenance, with market size in the hundreds of Millions.

- Construction: Increasing use for structural integrity assessment and quality assurance, with market size in the hundreds of Millions.

- Other End-user Industries: Including general manufacturing, healthcare, and research institutions, contributing to the overall market growth.

Key Drivers of Non-Destructive Testing Equipment Industry Growth

The Non-Destructive Testing (NDT) Equipment industry's growth is propelled by a robust combination of technological advancements, stringent regulatory mandates, and increasing industrial safety consciousness. The escalating demand for enhanced safety and quality assurance across critical sectors such as Oil and Gas, Aerospace, and Power & Energy directly fuels the adoption of NDT solutions. For instance, stringent API regulations in the oil and gas industry necessitate regular inspections, driving demand for advanced NDT equipment. Technological innovations, particularly in digitalization, AI integration for data analysis, and the miniaturization of portable devices, are making NDT more efficient, accurate, and accessible. The increasing focus on predictive maintenance and asset integrity management, aiming to prevent catastrophic failures and extend the lifespan of critical infrastructure, further accelerates market expansion. Government initiatives promoting industrial safety and quality standards also play a significant role in driving market growth.

Challenges in the Non-Destructive Testing Equipment Industry Sector

Despite robust growth prospects, the Non-Destructive Testing (NDT) Equipment industry faces several challenges. The high initial cost of advanced NDT equipment can be a barrier for small and medium-sized enterprises (SMEs), impacting market penetration in certain segments. A shortage of skilled NDT technicians and inspectors poses a significant operational constraint, leading to delays and increased labor costs, estimated to impact project timelines by up to 10-15%. Evolving regulatory landscapes, while driving demand, can also create compliance challenges for manufacturers who need to continuously adapt their products. Intense competition, particularly from emerging economies offering lower-cost alternatives, puts pressure on profit margins for established players. Furthermore, the need for continuous R&D to keep pace with technological advancements requires substantial investment, and the integration of new technologies into existing infrastructure can be complex for end-users.

Leading Players in the Non-Destructive Testing Equipment Industry Market

- Intertek Group PLC

- YXLON International GmbH (COMET Holding AG)

- Baker Hughes

- Controle Mesure Systemes SA

- Nikon Metrology NV

- Fujifilm Corporation

- Mistras Group Inc

- OkoNDT Group

- Innospection Limited

- Applus+ Laboratories

- Bureau Veritas SA

- Olympus Corporation

- Magnaflux Corp

Key Developments in Non-Destructive Testing Equipment Industry Sector

- May 2023: MP Machinery and Testing announced the release of proprietary material testing equipment that non-destructively determines the material properties of structures and in-service components. MPM provides advanced material testing products and services for the steel, nuclear power & energy, aerospace, pipe, defense, and transportation industries. This development enhances the capability for real-time material analysis, impacting asset management strategies.

- May 2023: The American Petroleum Institute (API) announced the signing of two separate memorandums of understanding (MoU) with the American Society for Non-Destructive Testing (ASNT) and the Non-Destructive Testing Management Association (NDTMA). These agreements support the industry's overall goal of promoting high-quality, non-destructive testing NDT and auditing and improving safety in the gas and oil industry. This initiative is expected to lead to standardized best practices and increased adoption of certified NDT services.

Strategic Non-Destructive Testing Equipment Industry Market Outlook

The strategic outlook for the Non-Destructive Testing (NDT) Equipment market remains exceptionally promising, driven by an accelerating global emphasis on safety, reliability, and asset lifecycle management. Future growth will be significantly shaped by the continued integration of Industry 4.0 technologies, including AI, IoT, and advanced data analytics, leading to smarter, more automated, and predictive NDT solutions. The expanding exploration and production activities in emerging economies, coupled with stringent regulatory enforcement in established markets like Oil and Gas and Aerospace, will provide sustained demand. Opportunities lie in developing specialized NDT equipment for new materials, such as composites and advanced alloys, and for rapidly growing sectors like renewable energy infrastructure (wind turbines, solar panels) and electric vehicle manufacturing. Strategic collaborations between NDT equipment manufacturers, software providers, and end-users will be crucial for developing integrated solutions that enhance inspection efficiency, reduce downtime, and improve overall operational safety and performance. The market is set for continued expansion, reaching multi-billion dollar valuations by 2033.

Non-Destructive Testing Equipment Industry Segmentation

-

1. Technology

- 1.1. Radiography Testing Equipment

- 1.2. Ultrasonic Testing Equipment

- 1.3. Magnetic Particle Testing Equipment

- 1.4. Liquid Penetrant Testing Equipment

- 1.5. Visual Inspection Equipment

- 1.6. Eddy Current Equipment

- 1.7. Other Technologies Equipment

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Power and Energy

- 2.3. Aerospace and Defense

- 2.4. Automotive and Transportation

- 2.5. Construction

- 2.6. Other End-user Industries

Non-Destructive Testing Equipment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Italy

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. South Korea

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Mexico

- 5.2. Brazil

- 5.3. Argentina

-

6. Middle East and Africa

- 6.1. Saudi Arabia

- 6.2. United Arab Emirates

- 6.3. Qatar

Non-Destructive Testing Equipment Industry Regional Market Share

Geographic Coverage of Non-Destructive Testing Equipment Industry

Non-Destructive Testing Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Regulations Mandating Safety; Aging Infrastructure and Increasing Need for Maintenance

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Personnel and Training Facilities

- 3.4. Market Trends

- 3.4.1. Oil and Gas Holds Highest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Non-Destructive Testing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Radiography Testing Equipment

- 5.1.2. Ultrasonic Testing Equipment

- 5.1.3. Magnetic Particle Testing Equipment

- 5.1.4. Liquid Penetrant Testing Equipment

- 5.1.5. Visual Inspection Equipment

- 5.1.6. Eddy Current Equipment

- 5.1.7. Other Technologies Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Power and Energy

- 5.2.3. Aerospace and Defense

- 5.2.4. Automotive and Transportation

- 5.2.5. Construction

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Non-Destructive Testing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Radiography Testing Equipment

- 6.1.2. Ultrasonic Testing Equipment

- 6.1.3. Magnetic Particle Testing Equipment

- 6.1.4. Liquid Penetrant Testing Equipment

- 6.1.5. Visual Inspection Equipment

- 6.1.6. Eddy Current Equipment

- 6.1.7. Other Technologies Equipment

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas

- 6.2.2. Power and Energy

- 6.2.3. Aerospace and Defense

- 6.2.4. Automotive and Transportation

- 6.2.5. Construction

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Non-Destructive Testing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Radiography Testing Equipment

- 7.1.2. Ultrasonic Testing Equipment

- 7.1.3. Magnetic Particle Testing Equipment

- 7.1.4. Liquid Penetrant Testing Equipment

- 7.1.5. Visual Inspection Equipment

- 7.1.6. Eddy Current Equipment

- 7.1.7. Other Technologies Equipment

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas

- 7.2.2. Power and Energy

- 7.2.3. Aerospace and Defense

- 7.2.4. Automotive and Transportation

- 7.2.5. Construction

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Non-Destructive Testing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Radiography Testing Equipment

- 8.1.2. Ultrasonic Testing Equipment

- 8.1.3. Magnetic Particle Testing Equipment

- 8.1.4. Liquid Penetrant Testing Equipment

- 8.1.5. Visual Inspection Equipment

- 8.1.6. Eddy Current Equipment

- 8.1.7. Other Technologies Equipment

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas

- 8.2.2. Power and Energy

- 8.2.3. Aerospace and Defense

- 8.2.4. Automotive and Transportation

- 8.2.5. Construction

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Australia and New Zealand Non-Destructive Testing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Radiography Testing Equipment

- 9.1.2. Ultrasonic Testing Equipment

- 9.1.3. Magnetic Particle Testing Equipment

- 9.1.4. Liquid Penetrant Testing Equipment

- 9.1.5. Visual Inspection Equipment

- 9.1.6. Eddy Current Equipment

- 9.1.7. Other Technologies Equipment

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas

- 9.2.2. Power and Energy

- 9.2.3. Aerospace and Defense

- 9.2.4. Automotive and Transportation

- 9.2.5. Construction

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Latin America Non-Destructive Testing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Radiography Testing Equipment

- 10.1.2. Ultrasonic Testing Equipment

- 10.1.3. Magnetic Particle Testing Equipment

- 10.1.4. Liquid Penetrant Testing Equipment

- 10.1.5. Visual Inspection Equipment

- 10.1.6. Eddy Current Equipment

- 10.1.7. Other Technologies Equipment

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas

- 10.2.2. Power and Energy

- 10.2.3. Aerospace and Defense

- 10.2.4. Automotive and Transportation

- 10.2.5. Construction

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Middle East and Africa Non-Destructive Testing Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Radiography Testing Equipment

- 11.1.2. Ultrasonic Testing Equipment

- 11.1.3. Magnetic Particle Testing Equipment

- 11.1.4. Liquid Penetrant Testing Equipment

- 11.1.5. Visual Inspection Equipment

- 11.1.6. Eddy Current Equipment

- 11.1.7. Other Technologies Equipment

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Oil and Gas

- 11.2.2. Power and Energy

- 11.2.3. Aerospace and Defense

- 11.2.4. Automotive and Transportation

- 11.2.5. Construction

- 11.2.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Intertek Group PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 YXLON International GmbH (COMET Holding AG)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Baker Hughes

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Controle Mesure Systemes SA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Nikon Metrology NV

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Fujifilm Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mistras Group Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 OkoNDT Group

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Innospection Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Applus+ Laboratories

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Bureau Veritas SA

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Olympus Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Magnaflux Corp

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Intertek Group PLC

List of Figures

- Figure 1: Global Non-Destructive Testing Equipment Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Non-Destructive Testing Equipment Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Non-Destructive Testing Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Non-Destructive Testing Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Non-Destructive Testing Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Non-Destructive Testing Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Non-Destructive Testing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Non-Destructive Testing Equipment Industry Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Non-Destructive Testing Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Non-Destructive Testing Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Non-Destructive Testing Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Non-Destructive Testing Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Non-Destructive Testing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Non-Destructive Testing Equipment Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Non-Destructive Testing Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Non-Destructive Testing Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Non-Destructive Testing Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Non-Destructive Testing Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Non-Destructive Testing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Non-Destructive Testing Equipment Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Australia and New Zealand Non-Destructive Testing Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Australia and New Zealand Non-Destructive Testing Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Australia and New Zealand Non-Destructive Testing Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Australia and New Zealand Non-Destructive Testing Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Non-Destructive Testing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Non-Destructive Testing Equipment Industry Revenue (Million), by Technology 2025 & 2033

- Figure 27: Latin America Non-Destructive Testing Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Latin America Non-Destructive Testing Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Latin America Non-Destructive Testing Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Latin America Non-Destructive Testing Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Non-Destructive Testing Equipment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Non-Destructive Testing Equipment Industry Revenue (Million), by Technology 2025 & 2033

- Figure 33: Middle East and Africa Non-Destructive Testing Equipment Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 34: Middle East and Africa Non-Destructive Testing Equipment Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 35: Middle East and Africa Non-Destructive Testing Equipment Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Middle East and Africa Non-Destructive Testing Equipment Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Non-Destructive Testing Equipment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 10: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Russia Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 18: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 24: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 27: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Mexico Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Brazil Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Argentina Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 33: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Non-Destructive Testing Equipment Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: United Arab Emirates Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Qatar Non-Destructive Testing Equipment Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Non-Destructive Testing Equipment Industry?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the Non-Destructive Testing Equipment Industry?

Key companies in the market include Intertek Group PLC, YXLON International GmbH (COMET Holding AG), Baker Hughes, Controle Mesure Systemes SA, Nikon Metrology NV, Fujifilm Corporation, Mistras Group Inc, OkoNDT Group, Innospection Limited, Applus+ Laboratories, Bureau Veritas SA, Olympus Corporation, Magnaflux Corp.

3. What are the main segments of the Non-Destructive Testing Equipment Industry?

The market segments include Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Regulations Mandating Safety; Aging Infrastructure and Increasing Need for Maintenance.

6. What are the notable trends driving market growth?

Oil and Gas Holds Highest Market Share.

7. Are there any restraints impacting market growth?

Lack of Skilled Personnel and Training Facilities.

8. Can you provide examples of recent developments in the market?

May 2023: MP Machinery and Testing announced the release of proprietary material testing equipment that non-destructively determines the material properties of structures and in-service components. MPM provides advanced material testing products and services for the steel, nuclear power & energy, aerospace, pipe, defense, and transportation industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Non-Destructive Testing Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Non-Destructive Testing Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Non-Destructive Testing Equipment Industry?

To stay informed about further developments, trends, and reports in the Non-Destructive Testing Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence