Key Insights

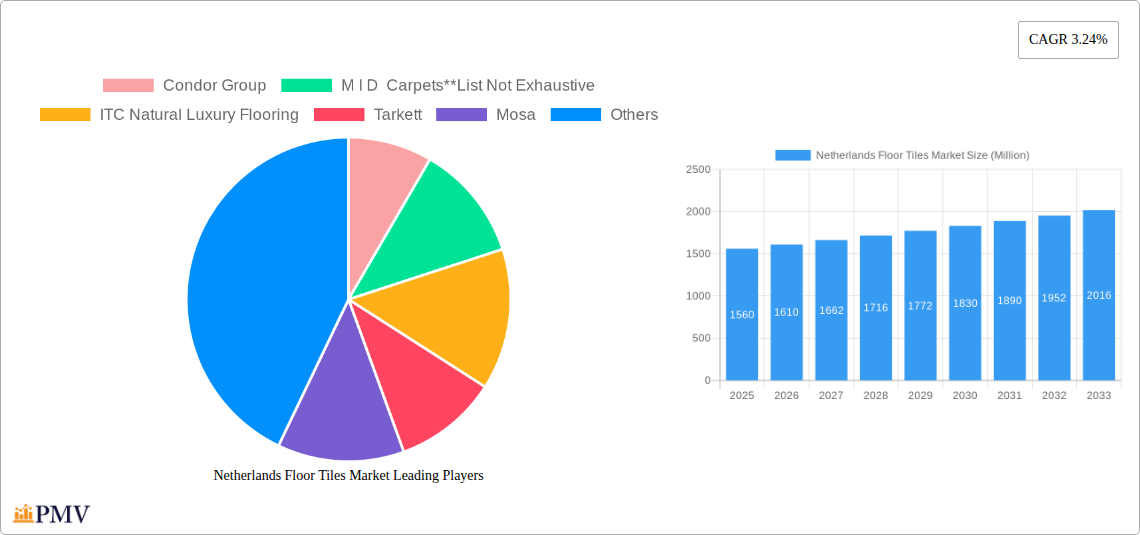

The Netherlands floor tiles market, valued at €1.56 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.24% from 2025 to 2033. This growth is driven by several key factors. Firstly, a burgeoning construction sector, fueled by both residential and commercial building projects, creates significant demand for floor tiles. Secondly, increasing consumer preference for aesthetically pleasing and durable flooring solutions, coupled with rising disposable incomes, is boosting sales of high-quality tiles. Furthermore, innovative product developments, such as eco-friendly and resilient flooring options, are expanding market appeal. However, the market faces some challenges. Fluctuations in raw material prices and potential economic downturns could impact growth. Competition from alternative flooring materials, such as wood and laminate, also presents a restraint. Market segmentation reveals that the residential sector currently dominates, but the commercial segment is showing promising growth potential, driven by renovation and new construction projects in the hospitality and retail sectors. Key players like Condor Group, M I D Carpets, ITC Natural Luxury Flooring, and Tarkett are actively shaping the market through product innovation and strategic partnerships. The distribution channels are diversified, with contractors, specialty stores, and home centers playing significant roles.

Netherlands Floor Tiles Market Market Size (In Billion)

The forecast period (2025-2033) suggests a consistent upward trajectory for the Netherlands floor tiles market. While the current dominance of carpet and area rugs is expected to continue, the resilient flooring segment, encompassing options like vinyl and ceramic, is anticipated to experience above-average growth due to its durability and cost-effectiveness. The increasing focus on sustainability and eco-friendly products will likely influence consumer choices, driving demand for tiles made from recycled materials or with lower environmental impact. Therefore, manufacturers and distributors should focus on enhancing product offerings, leveraging digital marketing strategies, and establishing strong partnerships to capitalize on emerging trends and maintain a competitive edge. Expansion into specialized niches, such as large-format tiles and designer collections, could also provide avenues for substantial growth.

Netherlands Floor Tiles Market Company Market Share

Netherlands Floor Tiles Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Netherlands floor tiles market, covering market size, segmentation, competitive landscape, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers invaluable insights for industry stakeholders, including manufacturers, distributors, investors, and market researchers. The total market value in 2025 is estimated at xx Million and is projected to reach xx Million by 2033.

Netherlands Floor Tiles Market Market Structure & Competitive Dynamics

The Netherlands floor tiles market exhibits a moderately concentrated structure, with a few major players holding significant market share. Key companies include Condor Group, M I D Carpets, ITC Natural Luxury Flooring, Tarkett, Mosa, Johnson Tiles, The Harlinger Pottery and Tiles Factory, Carpet Bonanza, and Interface. However, the presence of numerous smaller, specialized firms contributes to a dynamic competitive landscape.

Innovation plays a crucial role, with companies continuously introducing new products and technologies to cater to evolving consumer preferences and sustainability concerns. The regulatory framework, encompassing building codes and environmental standards, significantly influences market dynamics. The market also experiences pressure from product substitutes, such as alternative flooring materials. M&A activities remain relatively infrequent but have the potential to reshape market dynamics. Recent deal values have been estimated at xx Million.

- Market Concentration: Moderately concentrated, with some dominant players.

- Innovation: High level of innovation in product design, materials, and sustainability.

- Regulatory Framework: Significant impact from building codes and environmental regulations.

- Product Substitutes: Competition from alternative flooring materials.

- M&A Activity: Relatively infrequent, but impactful when they occur.

Netherlands Floor Tiles Market Industry Trends & Insights

The Netherlands floor tiles market is experiencing steady growth, driven by factors such as rising construction activity, increasing disposable incomes, and a growing preference for aesthetically pleasing and durable flooring solutions. Technological advancements, including the introduction of sustainable materials and innovative manufacturing processes, are reshaping the market. Consumer preferences are shifting towards eco-friendly, low-maintenance, and high-performance flooring options. The market is witnessing a growing demand for resilient flooring options alongside non-resilient choices.

The market's CAGR during the forecast period (2025-2033) is projected to be xx%, reflecting the ongoing positive trends. Market penetration of specific product types varies significantly, with resilient flooring showing robust growth compared to other segments. Competitive dynamics are characterized by intense competition, particularly amongst major players. This necessitates continuous innovation and effective marketing strategies for market success.

Dominant Markets & Segments in Netherlands Floor Tiles Market

The residential segment currently dominates the Netherlands floor tiles market, driven by rising homeownership rates and renovation projects. However, the commercial segment is also experiencing substantial growth, fueled by increasing investments in infrastructure and commercial real estate development. Within product types, resilient flooring holds the largest market share, reflecting its durability and versatility. Contractors are the primary distribution channel, followed by specialty stores and home centers.

- By Product:

- Resilient flooring leads in market share, owing to its durability and practicality.

- Carpet and area rugs maintain a sizable segment.

- Other resilient and non-resilient flooring cater to niche markets.

- By End User:

- Residential sector is the dominant end-user, driven by renovation and new construction.

- Commercial sector shows promising growth, fueled by rising construction activity.

- By Distribution Channel:

- Contractors are the leading distribution channel.

- Specialty stores and home centers contribute significantly.

- Other channels including online retailers occupy a niche segment.

Geographic dominance is primarily concentrated in densely populated urban areas and regions with high construction activity. Economic policies promoting sustainable construction practices and investments in infrastructure development serve as key drivers for market growth.

Netherlands Floor Tiles Market Product Innovations

Recent innovations include the development of 100% recyclable carpet systems (Condor Cartex) and new core collections of tiles with unique shapes (Mosa). These innovations focus on sustainability and design flexibility, appealing to environmentally conscious consumers and architects seeking unique aesthetics. Technological trends point towards greater use of recycled materials and smart technologies that enhance flooring performance. The market fit for these innovations appears strong, given the increasing demand for sustainable and aesthetically diverse flooring options.

Report Segmentation & Scope

This report segments the Netherlands floor tiles market by product type (carpet and area rugs, resilient flooring, other resilient flooring, non-resilient flooring), end-user (residential, commercial), and distribution channel (contractors, specialty stores, home centers, other distribution channels). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. Growth projections vary across segments, with resilient flooring and the residential sector expected to show strong performance. Competitive intensity also differs across segments, reflecting the level of product differentiation and market concentration.

Key Drivers of Netherlands Floor Tiles Market Growth

Several factors contribute to the growth of the Netherlands floor tiles market. These include:

- Rising construction activity: A surge in residential and commercial construction projects.

- Increased disposable incomes: Higher purchasing power allows consumers to invest in higher-quality flooring.

- Emphasis on aesthetics and durability: Consumers prefer flooring that enhances the look and feel of their spaces while lasting long.

- Technological advancements: Innovations in materials and manufacturing lead to better-performing, sustainable options.

- Government initiatives: Policies promoting sustainable construction and energy efficiency stimulate market demand.

Challenges in the Netherlands Floor Tiles Market Sector

The Netherlands floor tiles market faces several challenges:

- Fluctuations in raw material prices: Price volatility impacts production costs and profitability.

- Stringent environmental regulations: Compliance with sustainability standards can be costly for manufacturers.

- Intense competition: The presence of numerous players creates competitive pressure.

- Supply chain disruptions: Global events can disrupt the availability of raw materials and components.

- Economic downturns: Recessions can significantly reduce demand for flooring products.

Leading Players in the Netherlands Floor Tiles Market Market

- Condor Group

- M I D Carpets

- ITC Natural Luxury Flooring

- Tarkett

- Mosa

- Johnson Tiles

- The Harlinger Pottery and Tiles Factory

- Carpet Bonanza

- Interface

Key Developments in Netherlands Floor Tiles Market Sector

- 2022: Condor Group initiates construction of a new VEBE production facility in Genemuiden, expanding its production capacity by over 56,400 m2.

- 2021: Condor ALLOA launches Condor Cartex, the world's first 100% recyclable automotive polyester carpet system.

- 2021: Mosa introduces a new core collection of uniquely shaped tiles, enhancing design possibilities.

Strategic Netherlands Floor Tiles Market Market Outlook

The Netherlands floor tiles market presents significant growth opportunities, driven by sustained construction activity, increasing consumer spending, and the rising adoption of sustainable flooring solutions. Strategic initiatives should focus on developing innovative and eco-friendly products, strengthening distribution networks, and expanding into new market segments. Companies that effectively adapt to changing consumer preferences and technological advancements will be best positioned to capitalize on the market's future potential. Focus on sustainability and circular economy principles will be crucial for long-term success.

Netherlands Floor Tiles Market Segmentation

-

1. Product

- 1.1. Carpet and Area Rugs

-

1.2. Resilent Flooring

- 1.2.1. Vinyl Flooring

- 1.2.2. Other Resilient Flooring

-

1.3. Non-resilent Flooring

- 1.3.1. Wood Flooring

- 1.3.2. Ceramic Flooring

- 1.3.3. Laminate Flooring

- 1.3.4. Stone Flooring

-

2. End User

- 2.1. Residential

- 2.2. Commercial

-

3. Distribution Channel

- 3.1. Contractors

- 3.2. Specialty Stores

- 3.3. Home Centers

- 3.4. Other Distribution Channels

Netherlands Floor Tiles Market Segmentation By Geography

- 1. Netherlands

Netherlands Floor Tiles Market Regional Market Share

Geographic Coverage of Netherlands Floor Tiles Market

Netherlands Floor Tiles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Real-Estate Industry Is Driving The Market; Export of Furniture From UK Is Driving The Market

- 3.3. Market Restrains

- 3.3.1. Fluctuating Price of Raw Materials; Limitations in Supply Chain Restraints The Market Growth

- 3.4. Market Trends

- 3.4.1. Belgium is the Largest Exporter of Floor Covering Products to the Netherlands

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands Floor Tiles Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Carpet and Area Rugs

- 5.1.2. Resilent Flooring

- 5.1.2.1. Vinyl Flooring

- 5.1.2.2. Other Resilient Flooring

- 5.1.3. Non-resilent Flooring

- 5.1.3.1. Wood Flooring

- 5.1.3.2. Ceramic Flooring

- 5.1.3.3. Laminate Flooring

- 5.1.3.4. Stone Flooring

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Contractors

- 5.3.2. Specialty Stores

- 5.3.3. Home Centers

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Condor Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 M I D Carpets**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ITC Natural Luxury Flooring

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tarkett

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mosa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Johnson Tiles

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Harlinger Pottery and Tiles Factory

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Carpet Bonanza

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Interface

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Condor Group

List of Figures

- Figure 1: Netherlands Floor Tiles Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Netherlands Floor Tiles Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands Floor Tiles Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Netherlands Floor Tiles Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Netherlands Floor Tiles Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Netherlands Floor Tiles Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Netherlands Floor Tiles Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Netherlands Floor Tiles Market Revenue Million Forecast, by End User 2020 & 2033

- Table 7: Netherlands Floor Tiles Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Netherlands Floor Tiles Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands Floor Tiles Market?

The projected CAGR is approximately 3.24%.

2. Which companies are prominent players in the Netherlands Floor Tiles Market?

Key companies in the market include Condor Group, M I D Carpets**List Not Exhaustive, ITC Natural Luxury Flooring, Tarkett, Mosa, Johnson Tiles, The Harlinger Pottery and Tiles Factory, Carpet Bonanza, Interface.

3. What are the main segments of the Netherlands Floor Tiles Market?

The market segments include Product, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Real-Estate Industry Is Driving The Market; Export of Furniture From UK Is Driving The Market.

6. What are the notable trends driving market growth?

Belgium is the Largest Exporter of Floor Covering Products to the Netherlands.

7. Are there any restraints impacting market growth?

Fluctuating Price of Raw Materials; Limitations in Supply Chain Restraints The Market Growth.

8. Can you provide examples of recent developments in the market?

In 2022, at the Zevenhond Zuid industrial estate in Genemuiden, Condor Group is preparing for the new VEBE production facility, including office spaces. This new plant will have over 56,400 m2 for production areas and 2,800 m2 of office space.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands Floor Tiles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands Floor Tiles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands Floor Tiles Market?

To stay informed about further developments, trends, and reports in the Netherlands Floor Tiles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence