Key Insights

The neodymium market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 15% from 2025 to 2033. This expansion is primarily driven by the burgeoning demand for neodymium magnets in various high-tech applications, particularly within the automotive, wind energy, and electronics sectors. The increasing adoption of electric vehicles (EVs) and hybrid electric vehicles (HEVs), which heavily rely on neodymium magnets for their motors, is a significant catalyst. Furthermore, the growing renewable energy sector, particularly wind turbines, necessitates a higher volume of powerful and efficient neodymium magnets. Technological advancements in electronics, leading to smaller, more powerful devices, also contribute to market growth. While supply chain constraints and price volatility associated with rare earth elements pose challenges, the overall market outlook remains positive, fueled by sustained investments in renewable energy infrastructure and technological innovations.

However, several factors could potentially moderate market growth. Geopolitical factors influencing the sourcing of rare earth elements, particularly from China, present significant supply-side risks. Environmental concerns surrounding rare earth mining and processing necessitate sustainable practices, adding to production costs. Competition from alternative materials, although currently limited, warrants consideration as research into substitutes for neodymium magnets progresses. Successfully navigating these challenges will require strategic collaborations across the value chain, fostering greater transparency, and investing in responsible sourcing and recycling initiatives. The focus on optimizing magnet efficiency and exploring potential substitutes will play an increasingly crucial role in shaping the market's trajectory over the forecast period.

Neodymium Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global neodymium market, covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033). It offers invaluable insights into market dynamics, competitive landscapes, technological advancements, and future growth prospects, making it an essential resource for industry stakeholders, investors, and researchers. The report meticulously examines various segments, including applications (magnets, catalysts, glass and ceramics, and other applications) and end-user industries (automotive, electrical and electronics, wind energy, and other end-user industries). Key players like Lynas Rare Earths Ltd, China Rare Earth Holdings Limited, and MP Materials are thoroughly analyzed, providing a granular understanding of the competitive landscape. With detailed market sizing (in Millions) and projected CAGR, this report is designed to equip you with actionable intelligence to navigate the complexities of the neodymium market.

Neodymium Market Market Structure & Competitive Dynamics

The neodymium market displays a moderately concentrated structure, with a few dominant players holding a substantial market share. Competition is fierce, driven by continuous technological innovation, product differentiation strategies, and strategic partnerships. Robust innovation ecosystems are vital, with companies heavily investing in R&D to enhance production efficiency and create advanced neodymium-based products. The regulatory environment, particularly concerning rare earth element mining and processing, significantly influences market dynamics. While limited, substitute materials represent a potential challenge, primarily from alternative magnet technologies. The market's expansion is significantly fueled by end-user trends, largely shaped by the booming electric vehicle (EV) and renewable energy sectors. The frequency of mergers and acquisitions (M&A) activity reflects the strategic importance of securing reliable neodymium supply chains and expanding market access.

- Market Concentration: While precise figures are proprietary, the top 5 players control a significant portion of the market, indicating a moderately concentrated landscape. Further research is needed to quantify this with specific percentage data.

- M&A Activity: Recent years have witnessed considerable M&A activity, with deal values reaching substantial figures. These transactions primarily focus on securing crucial raw material sources and expanding market reach. Detailed financial data is often kept private and would require independent verification.

- Key Innovation Areas: Ongoing innovations focus on improved extraction techniques, the development of high-performance magnets with enhanced properties, and the creation of sustainable recycling solutions to minimize environmental impact and resource depletion.

- Regulatory Landscape: A complex and variable regulatory landscape exists across different countries, impacting mining regulations, environmental compliance costs, and trade policies, significantly affecting market players' operational strategies.

Neodymium Market Industry Trends & Insights

The neodymium market is experiencing robust growth, driven primarily by the increasing demand from the electric vehicle (EV) sector, wind energy industry, and electronics manufacturing. The compound annual growth rate (CAGR) is projected to be xx% during the forecast period (2025-2033). This growth is further fueled by technological disruptions, particularly advancements in magnet technology and the development of more efficient rare-earth extraction processes. Consumer preference for environmentally friendly products and the rising adoption of renewable energy sources are additional positive influences. However, the market faces challenges from fluctuating raw material prices and geopolitical uncertainties impacting the supply chain. Market penetration in emerging economies is expected to significantly contribute to overall growth in the coming years. The increasing use of neodymium in permanent magnets for electric motors is a key market driver. Technological innovations in the magnet industry are driving the adoption of neodymium-based products.

Dominant Markets & Segments in Neodymium Market

The Magnets segment holds the dominant position in the neodymium market application, representing approximately xx% of the total market value in 2025. This segment's growth is propelled by the escalating demand for high-performance magnets in various applications.

- Key Drivers for Magnets Segment:

- Rise of electric vehicles and hybrid electric vehicles (HEVs).

- Growing wind energy sector requiring high-power density magnets.

- Expansion of industrial automation and robotics.

The Automotive sector is the leading end-user industry, accounting for roughly xx% of the overall neodymium demand in 2025. This significant share is primarily attributed to the rapid growth of the electric vehicle market.

- Key Drivers for Automotive Segment:

- Increasing global production of electric vehicles.

- Government incentives and regulations promoting electric mobility.

- Advancements in hybrid and plug-in hybrid vehicle technologies.

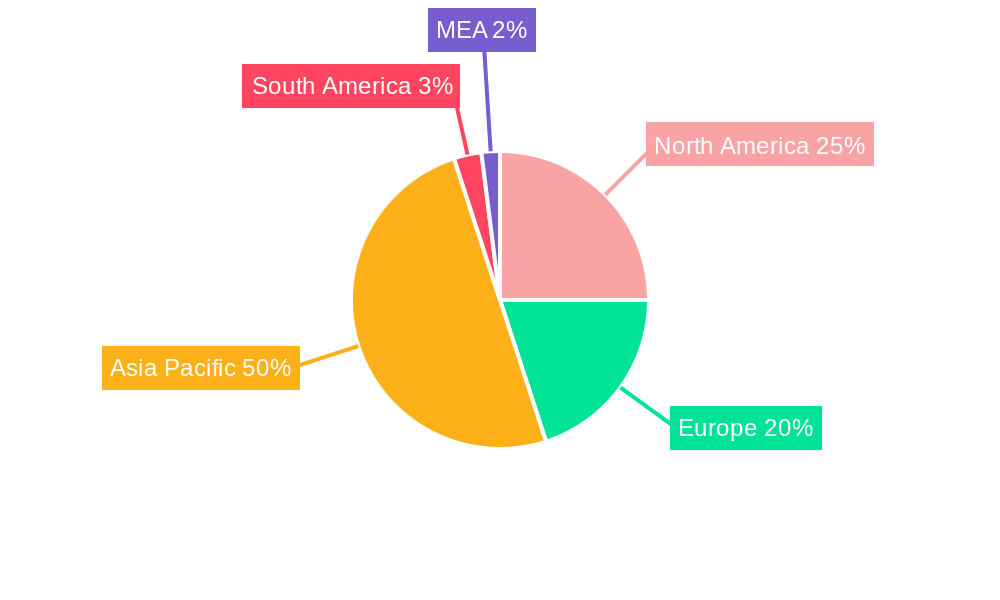

China is currently the dominant market for neodymium, driven by robust domestic demand and a well-established rare-earth mining and processing industry. However, the market landscape is expected to change with the development of sustainable neodymium sources in countries like Australia and the US. Significant growth is anticipated in other regions as well, particularly in North America and Europe, due to increasing EV adoption and investment in renewable energy infrastructure.

Neodymium Market Product Innovations

Recent advancements in neodymium magnet technology center on enhancing performance characteristics such as increased magnetic strength, improved temperature stability, and enhanced durability. New manufacturing processes are continuously developed to reduce production costs and minimize environmental impact. These innovations directly cater to the requirements of high-performance applications across diverse sectors, notably electric vehicles, wind turbines, and advanced consumer electronics. The development of neodymium-based alloys with superior magnetic properties is also a major focus, driving the creation of lighter, more efficient motors with improved performance and extended range for EVs and other applications.

Report Segmentation & Scope

This report segments the neodymium market by application (Magnets, Catalysts, Glass and Ceramics, Other Applications) and end-user industry (Automotive, Electrical and Electronics, Wind Energy, Other End-user Industries). A thorough analysis is provided for each segment, encompassing market size estimations, growth projections, and competitive landscape assessments. The Magnets segment is predicted to show the highest Compound Annual Growth Rate (CAGR), driven by the rapid growth of the EV and renewable energy sectors. The Automotive segment is expected to dominate the end-user market due to the widespread adoption of EVs and hybrid vehicles. The report includes a detailed analysis of each segment's market dynamics and key players, providing valuable insights for strategic decision-making.

Key Drivers of Neodymium Market Growth

Several key factors are driving the growth of the neodymium market, including the burgeoning electric vehicle industry, the expanding renewable energy sector (particularly wind energy), and increasing demand for high-performance magnets in various applications. Government policies promoting green technologies and infrastructure development also contribute significantly to market expansion. Furthermore, advancements in magnet technology and rare-earth extraction techniques are enhancing the performance and affordability of neodymium-based products.

Challenges in the Neodymium Market Sector

The neodymium market faces several challenges, including price volatility of raw materials, geographical concentration of production, and environmental concerns associated with rare-earth mining. Supply chain disruptions, geopolitical factors, and the potential for trade restrictions can also create significant uncertainty. Furthermore, competition from alternative magnet materials and technological breakthroughs in other sectors could potentially impact the market growth. The fluctuating prices of neodymium, heavily influenced by geopolitical factors and supply chain dynamics, remain a significant barrier to market growth. The environmental impact of neodymium extraction, particularly its potential effect on the environment, is a key concern to sustainability initiatives.

Leading Players in the Neodymium Market Market

- Lynas Rare Earths Ltd

- China Rare Earth Holdings Limited

- METALL RARE EARTH LIMITED

- MP MATERIALS

- NEO

- Australian Strategic Materials Ltd

- HEFA Rare Earth Canada Co Ltd

- Arafura Resources

- Peak Rare Earths

- Rainbow Rare Earths Limited

Key Developments in Neodymium Market Sector

- July 2022: Arafura Resources Limited and GE Renewable Energy signed a non-binding memorandum of understanding (MoU) to collaborate on establishing a sustainable supply chain for neodymium and praseodymium (NdPr), supporting the global transition to renewable energy.

- August 2022: Lynas Rare Earths Ltd significantly expanded its capacity at the Mt Weld mine in Western Australia, boosting neodymium and praseodymium production to meet growing global demand.

- November 2022: Arafura Resources Limited secured a substantial supply deal with Hyundai Motor Co. and Kia Corp., agreeing to supply up to 1,500 metric tons of neodymium-praseodymium (NdPr) oxide annually for seven years, highlighting the automotive sector's increasing reliance on these materials.

- February 2023: MP Materials and Sumitomo Corporation formed a strategic partnership to enhance and diversify rare earth supplies in Japan, with Sumitomo becoming the exclusive distributor of MP Materials' neodymium and praseodymium (NdPr) oxide production. This underscores the importance of secure and reliable neodymium supply chains.

- [Add more recent developments here with dates and brief descriptions]

Strategic Neodymium Market Market Outlook

The neodymium market is poised for continued growth, driven by the increasing adoption of electric vehicles, the expansion of renewable energy infrastructure, and advancements in magnet technology. Strategic opportunities exist in developing sustainable and ethically sourced neodymium, improving recycling processes, and exploring new applications for this critical material. Companies that invest in technological innovation, secure stable supply chains, and focus on sustainable practices are expected to be best positioned for success in the years to come. The long-term outlook for the neodymium market is positive, with substantial growth potential across various segments and geographies.

Neodymium Market Segmentation

-

1. Application

- 1.1. Magnets

- 1.2. Catalysts

- 1.3. Glass and Ceramics

- 1.4. Other Applications

-

2. End-User Industry

- 2.1. Automotive

- 2.2. Electrical and Electronics

- 2.3. Wind Energy

- 2.4. Other End-user Industries

Neodymium Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Neodymium Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Neodymium Magnets from Wind Energy and Electric Vehicle Industries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Availability of Less-Expensive Substitutes; Other Restraints

- 3.4. Market Trends

- 3.4.1. Automotive Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Neodymium Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Magnets

- 5.1.2. Catalysts

- 5.1.3. Glass and Ceramics

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Automotive

- 5.2.2. Electrical and Electronics

- 5.2.3. Wind Energy

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific Neodymium Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Magnets

- 6.1.2. Catalysts

- 6.1.3. Glass and Ceramics

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Automotive

- 6.2.2. Electrical and Electronics

- 6.2.3. Wind Energy

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America Neodymium Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Magnets

- 7.1.2. Catalysts

- 7.1.3. Glass and Ceramics

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Automotive

- 7.2.2. Electrical and Electronics

- 7.2.3. Wind Energy

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Neodymium Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Magnets

- 8.1.2. Catalysts

- 8.1.3. Glass and Ceramics

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Automotive

- 8.2.2. Electrical and Electronics

- 8.2.3. Wind Energy

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Neodymium Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Magnets

- 9.1.2. Catalysts

- 9.1.3. Glass and Ceramics

- 9.1.4. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Automotive

- 9.2.2. Electrical and Electronics

- 9.2.3. Wind Energy

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East Neodymium Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Magnets

- 10.1.2. Catalysts

- 10.1.3. Glass and Ceramics

- 10.1.4. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Automotive

- 10.2.2. Electrical and Electronics

- 10.2.3. Wind Energy

- 10.2.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Saudi Arabia Neodymium Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Magnets

- 11.1.2. Catalysts

- 11.1.3. Glass and Ceramics

- 11.1.4. Other Applications

- 11.2. Market Analysis, Insights and Forecast - by End-User Industry

- 11.2.1. Automotive

- 11.2.2. Electrical and Electronics

- 11.2.3. Wind Energy

- 11.2.4. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. North America Neodymium Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. Europe Neodymium Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Germany

- 13.1.2 France

- 13.1.3 Italy

- 13.1.4 United Kingdom

- 13.1.5 Netherlands

- 13.1.6 Rest of Europe

- 14. Asia Pacific Neodymium Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Taiwan

- 14.1.6 Australia

- 14.1.7 Rest of Asia-Pacific

- 15. South America Neodymium Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. MEA Neodymium Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 Middle East

- 16.1.2 Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Lynas Rare Earths Ltd

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 China Rare Earth Holdings Limited

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 METALL RARE EARTH LIMITED

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 MP MATERIALS

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 NEO

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Australian Strategic Materials Ltd

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 HEFA Rare Earth Canada Co Ltd

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Arafura Resources

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Peak Rare Earths

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Rainbow Rare Earths Limited

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Lynas Rare Earths Ltd

List of Figures

- Figure 1: Global Neodymium Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Neodymium Market Volume Breakdown (K Tons, %) by Region 2024 & 2032

- Figure 3: North America Neodymium Market Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Neodymium Market Volume (K Tons), by Country 2024 & 2032

- Figure 5: North America Neodymium Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Neodymium Market Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Neodymium Market Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Neodymium Market Volume (K Tons), by Country 2024 & 2032

- Figure 9: Europe Neodymium Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Neodymium Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Neodymium Market Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Neodymium Market Volume (K Tons), by Country 2024 & 2032

- Figure 13: Asia Pacific Neodymium Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Neodymium Market Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Neodymium Market Revenue (Million), by Country 2024 & 2032

- Figure 16: South America Neodymium Market Volume (K Tons), by Country 2024 & 2032

- Figure 17: South America Neodymium Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Neodymium Market Volume Share (%), by Country 2024 & 2032

- Figure 19: MEA Neodymium Market Revenue (Million), by Country 2024 & 2032

- Figure 20: MEA Neodymium Market Volume (K Tons), by Country 2024 & 2032

- Figure 21: MEA Neodymium Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: MEA Neodymium Market Volume Share (%), by Country 2024 & 2032

- Figure 23: Asia Pacific Neodymium Market Revenue (Million), by Application 2024 & 2032

- Figure 24: Asia Pacific Neodymium Market Volume (K Tons), by Application 2024 & 2032

- Figure 25: Asia Pacific Neodymium Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Neodymium Market Volume Share (%), by Application 2024 & 2032

- Figure 27: Asia Pacific Neodymium Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 28: Asia Pacific Neodymium Market Volume (K Tons), by End-User Industry 2024 & 2032

- Figure 29: Asia Pacific Neodymium Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 30: Asia Pacific Neodymium Market Volume Share (%), by End-User Industry 2024 & 2032

- Figure 31: Asia Pacific Neodymium Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Asia Pacific Neodymium Market Volume (K Tons), by Country 2024 & 2032

- Figure 33: Asia Pacific Neodymium Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Asia Pacific Neodymium Market Volume Share (%), by Country 2024 & 2032

- Figure 35: North America Neodymium Market Revenue (Million), by Application 2024 & 2032

- Figure 36: North America Neodymium Market Volume (K Tons), by Application 2024 & 2032

- Figure 37: North America Neodymium Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: North America Neodymium Market Volume Share (%), by Application 2024 & 2032

- Figure 39: North America Neodymium Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 40: North America Neodymium Market Volume (K Tons), by End-User Industry 2024 & 2032

- Figure 41: North America Neodymium Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 42: North America Neodymium Market Volume Share (%), by End-User Industry 2024 & 2032

- Figure 43: North America Neodymium Market Revenue (Million), by Country 2024 & 2032

- Figure 44: North America Neodymium Market Volume (K Tons), by Country 2024 & 2032

- Figure 45: North America Neodymium Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: North America Neodymium Market Volume Share (%), by Country 2024 & 2032

- Figure 47: Europe Neodymium Market Revenue (Million), by Application 2024 & 2032

- Figure 48: Europe Neodymium Market Volume (K Tons), by Application 2024 & 2032

- Figure 49: Europe Neodymium Market Revenue Share (%), by Application 2024 & 2032

- Figure 50: Europe Neodymium Market Volume Share (%), by Application 2024 & 2032

- Figure 51: Europe Neodymium Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 52: Europe Neodymium Market Volume (K Tons), by End-User Industry 2024 & 2032

- Figure 53: Europe Neodymium Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 54: Europe Neodymium Market Volume Share (%), by End-User Industry 2024 & 2032

- Figure 55: Europe Neodymium Market Revenue (Million), by Country 2024 & 2032

- Figure 56: Europe Neodymium Market Volume (K Tons), by Country 2024 & 2032

- Figure 57: Europe Neodymium Market Revenue Share (%), by Country 2024 & 2032

- Figure 58: Europe Neodymium Market Volume Share (%), by Country 2024 & 2032

- Figure 59: South America Neodymium Market Revenue (Million), by Application 2024 & 2032

- Figure 60: South America Neodymium Market Volume (K Tons), by Application 2024 & 2032

- Figure 61: South America Neodymium Market Revenue Share (%), by Application 2024 & 2032

- Figure 62: South America Neodymium Market Volume Share (%), by Application 2024 & 2032

- Figure 63: South America Neodymium Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 64: South America Neodymium Market Volume (K Tons), by End-User Industry 2024 & 2032

- Figure 65: South America Neodymium Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 66: South America Neodymium Market Volume Share (%), by End-User Industry 2024 & 2032

- Figure 67: South America Neodymium Market Revenue (Million), by Country 2024 & 2032

- Figure 68: South America Neodymium Market Volume (K Tons), by Country 2024 & 2032

- Figure 69: South America Neodymium Market Revenue Share (%), by Country 2024 & 2032

- Figure 70: South America Neodymium Market Volume Share (%), by Country 2024 & 2032

- Figure 71: Middle East Neodymium Market Revenue (Million), by Application 2024 & 2032

- Figure 72: Middle East Neodymium Market Volume (K Tons), by Application 2024 & 2032

- Figure 73: Middle East Neodymium Market Revenue Share (%), by Application 2024 & 2032

- Figure 74: Middle East Neodymium Market Volume Share (%), by Application 2024 & 2032

- Figure 75: Middle East Neodymium Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 76: Middle East Neodymium Market Volume (K Tons), by End-User Industry 2024 & 2032

- Figure 77: Middle East Neodymium Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 78: Middle East Neodymium Market Volume Share (%), by End-User Industry 2024 & 2032

- Figure 79: Middle East Neodymium Market Revenue (Million), by Country 2024 & 2032

- Figure 80: Middle East Neodymium Market Volume (K Tons), by Country 2024 & 2032

- Figure 81: Middle East Neodymium Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: Middle East Neodymium Market Volume Share (%), by Country 2024 & 2032

- Figure 83: Saudi Arabia Neodymium Market Revenue (Million), by Application 2024 & 2032

- Figure 84: Saudi Arabia Neodymium Market Volume (K Tons), by Application 2024 & 2032

- Figure 85: Saudi Arabia Neodymium Market Revenue Share (%), by Application 2024 & 2032

- Figure 86: Saudi Arabia Neodymium Market Volume Share (%), by Application 2024 & 2032

- Figure 87: Saudi Arabia Neodymium Market Revenue (Million), by End-User Industry 2024 & 2032

- Figure 88: Saudi Arabia Neodymium Market Volume (K Tons), by End-User Industry 2024 & 2032

- Figure 89: Saudi Arabia Neodymium Market Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 90: Saudi Arabia Neodymium Market Volume Share (%), by End-User Industry 2024 & 2032

- Figure 91: Saudi Arabia Neodymium Market Revenue (Million), by Country 2024 & 2032

- Figure 92: Saudi Arabia Neodymium Market Volume (K Tons), by Country 2024 & 2032

- Figure 93: Saudi Arabia Neodymium Market Revenue Share (%), by Country 2024 & 2032

- Figure 94: Saudi Arabia Neodymium Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Neodymium Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Neodymium Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Global Neodymium Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Neodymium Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 5: Global Neodymium Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: Global Neodymium Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 7: Global Neodymium Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Neodymium Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Global Neodymium Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Neodymium Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: United States Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Canada Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Mexico Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Global Neodymium Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Neodymium Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 19: Germany Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Germany Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: France Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Italy Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: United Kingdom Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United Kingdom Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: Netherlands Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Netherlands Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Global Neodymium Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Neodymium Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 33: China Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: China Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: Japan Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Japan Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: India Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: South Korea Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: South Korea Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Taiwan Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Taiwan Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Australia Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Australia Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Rest of Asia-Pacific Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Asia-Pacific Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Global Neodymium Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Global Neodymium Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 49: Brazil Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Brazil Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Argentina Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Argentina Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 53: Rest of South America Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of South America Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 55: Global Neodymium Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Neodymium Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 57: Middle East Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Middle East Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 59: Africa Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Africa Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 61: Global Neodymium Market Revenue Million Forecast, by Application 2019 & 2032

- Table 62: Global Neodymium Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 63: Global Neodymium Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 64: Global Neodymium Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 65: Global Neodymium Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Global Neodymium Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 67: China Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: China Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 69: India Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: India Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 71: Japan Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Japan Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 73: South Korea Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: South Korea Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 75: Rest of Asia Pacific Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Rest of Asia Pacific Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 77: Global Neodymium Market Revenue Million Forecast, by Application 2019 & 2032

- Table 78: Global Neodymium Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 79: Global Neodymium Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 80: Global Neodymium Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 81: Global Neodymium Market Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Global Neodymium Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 83: United States Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: United States Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 85: Canada Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: Canada Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 87: Mexico Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Mexico Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 89: Global Neodymium Market Revenue Million Forecast, by Application 2019 & 2032

- Table 90: Global Neodymium Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 91: Global Neodymium Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 92: Global Neodymium Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 93: Global Neodymium Market Revenue Million Forecast, by Country 2019 & 2032

- Table 94: Global Neodymium Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 95: Germany Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Germany Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 97: United Kingdom Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: United Kingdom Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 99: Italy Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: Italy Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 101: France Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: France Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 103: Rest of Europe Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 104: Rest of Europe Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 105: Global Neodymium Market Revenue Million Forecast, by Application 2019 & 2032

- Table 106: Global Neodymium Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 107: Global Neodymium Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 108: Global Neodymium Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 109: Global Neodymium Market Revenue Million Forecast, by Country 2019 & 2032

- Table 110: Global Neodymium Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 111: Brazil Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 112: Brazil Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 113: Argentina Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 114: Argentina Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 115: Rest of South America Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 116: Rest of South America Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 117: Global Neodymium Market Revenue Million Forecast, by Application 2019 & 2032

- Table 118: Global Neodymium Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 119: Global Neodymium Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 120: Global Neodymium Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 121: Global Neodymium Market Revenue Million Forecast, by Country 2019 & 2032

- Table 122: Global Neodymium Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 123: Global Neodymium Market Revenue Million Forecast, by Application 2019 & 2032

- Table 124: Global Neodymium Market Volume K Tons Forecast, by Application 2019 & 2032

- Table 125: Global Neodymium Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 126: Global Neodymium Market Volume K Tons Forecast, by End-User Industry 2019 & 2032

- Table 127: Global Neodymium Market Revenue Million Forecast, by Country 2019 & 2032

- Table 128: Global Neodymium Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 129: South Africa Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 130: South Africa Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 131: Rest of Middle East Neodymium Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 132: Rest of Middle East Neodymium Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Neodymium Market?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the Neodymium Market?

Key companies in the market include Lynas Rare Earths Ltd, China Rare Earth Holdings Limited, METALL RARE EARTH LIMITED, MP MATERIALS, NEO, Australian Strategic Materials Ltd, HEFA Rare Earth Canada Co Ltd, Arafura Resources, Peak Rare Earths, Rainbow Rare Earths Limited.

3. What are the main segments of the Neodymium Market?

The market segments include Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Neodymium Magnets from Wind Energy and Electric Vehicle Industries; Other Drivers.

6. What are the notable trends driving market growth?

Automotive Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Availability of Less-Expensive Substitutes; Other Restraints.

8. Can you provide examples of recent developments in the market?

February 2023: MP Materials and Sumitomo Corporation entered into an agreement to diversify and strengthen rare earth supplies in Japan. Under the agreement, Sumitomo Corporation becomes the exclusive distributor of neodymium and praseodymium (NdPr) oxide produced by MP Materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Neodymium Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Neodymium Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Neodymium Market?

To stay informed about further developments, trends, and reports in the Neodymium Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence