Key Insights

The global motor insurance market is experiencing robust growth, projected to reach a substantial size with a Compound Annual Growth Rate (CAGR) of 5.03% from 2025 to 2033. This expansion is driven by several key factors. The rising number of vehicles globally, particularly in developing economies experiencing rapid motorization, fuels demand for insurance coverage. Increasing awareness of the financial risks associated with vehicle ownership, coupled with stricter government regulations mandating insurance, further contributes to market growth. The increasing adoption of telematics and usage-based insurance (UBI) is transforming the industry, offering customized premiums based on driving behavior and enhancing risk assessment accuracy. Furthermore, technological advancements like AI and machine learning are streamlining processes, improving fraud detection, and enhancing customer service, boosting market efficiency. Market segmentation reveals that passenger cars currently dominate the vehicle type segment, followed by commercial vehicles and motorcycles, while comprehensive insurance holds a larger market share compared to third-party liability or collision insurance alone, reflecting a growing preference for broader coverage.

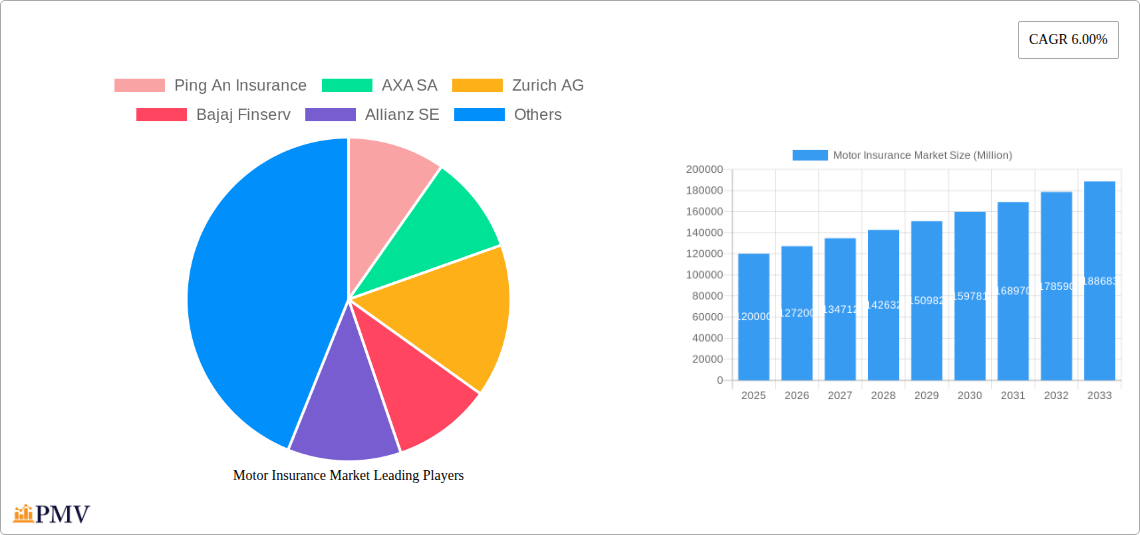

Competitive dynamics are shaped by a mix of global giants and regional players. Leading companies such as PICC Property and Casualty, Allianz SE, and State Farm, alongside significant regional players like ICICI Lombard and Porto Seguro, compete intensely through product innovation, pricing strategies, and distribution networks. Geographic variations exist, with North America and Asia Pacific representing significant market shares, driven by high vehicle ownership rates and developing economies' increasing insurance penetration. Europe and other regions also contribute substantially, although at varying rates reflecting regional economic conditions and insurance penetration levels. While market growth is expected to continue, challenges remain, including fluctuating fuel prices, economic downturns impacting consumer spending on insurance, and the complexities of managing insurance claims efficiently and fairly.

Motor Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Motor Insurance Market, covering the period 2019-2033. With a focus on key market segments, competitive dynamics, and future growth projections, this report is an essential resource for industry professionals, investors, and strategic planners. The report leverages extensive data analysis, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Motor Insurance Market Market Structure & Competitive Dynamics

The global motor insurance market presents a moderately concentrated structure, characterized by a blend of multinational giants and a diverse array of regional and national insurers. Competition for market share is intense, with key players like PICC Property and Casualty Co Ltd, Samsung Fire and Marine Insurance Co Ltd, Allianz SE, GEICO, Ping An Insurance (Group) Co of China Ltd, ICICI Lombard General Insurance Co Ltd, Sompo Holdings Inc, State Farm Mutual Automobile Insurance Company, Aviva Plc, and Porto Seguro S A commanding substantial portions. However, a significant number of smaller, specialized insurers also contribute to the market's dynamism. This competitive landscape is further shaped by a rapidly evolving innovation ecosystem fueled by advancements in telematics, AI-driven risk assessment, and digital distribution channels. Regulatory landscapes vary widely across different geographical regions, creating a diverse set of challenges and opportunities impacting pricing strategies, product offerings, and market entry barriers. While product substitution is relatively limited, with self-insurance representing a viable, albeit often impractical, alternative for most individuals, the market is experiencing a clear shift in end-user preferences towards more comprehensive coverage and seamless digital customer journeys. The past year has witnessed robust M&A activity, with deal values reaching an estimated [Insert Updated Deal Value, if available] in 2024. These mergers and acquisitions have largely focused on expanding geographical reach, diversifying product portfolios, and enhancing technological capabilities. For example, the recent merger between [Insert Specific Merger Example with Deal Value and Impact, e.g., "Acme Insurance and Beta Insurers, valued at $5 billion, created a significant expansion of the combined entity's market share in the Southeast Asian market."] underscores the strategic importance of consolidation within the sector. This dynamic competitive environment necessitates a strong focus on differentiation through innovative product offerings, exceptional customer service, and efficient operational strategies for insurers to thrive.

Motor Insurance Market Industry Trends & Insights

The motor insurance market is experiencing significant transformation driven by a confluence of factors. Growth is fueled by rising vehicle ownership rates, particularly in developing economies, and increasing awareness of the importance of insurance protection. Technological disruptions, including the adoption of telematics and big data analytics, are enabling more accurate risk assessment, personalized pricing, and proactive claims management. Consumer preferences are evolving towards digital solutions, seamless online experiences, and flexible, customizable insurance plans. Competitive dynamics are intense, with insurers investing heavily in digital platforms, customer relationship management (CRM) systems, and advanced analytics to gain a competitive edge. The market has demonstrated strong growth in recent years, with a CAGR of xx% from 2019 to 2024, a trend expected to continue, albeit at a slightly moderated pace, in the coming years. Market penetration varies significantly across countries, with mature markets reaching saturation while developing economies still possess substantial untapped potential. Further market expansion hinges upon regulatory changes and sustained economic growth across different geographic regions.

Dominant Markets & Segments in Motor Insurance Market

The global motor insurance market displays significant regional disparities in terms of both size and growth trajectory. [Insert Dominant Region/Country with supporting data, e.g., "The North American market currently holds the largest market share, accounting for approximately X% of global premiums in 2024, driven by high vehicle ownership rates, robust economic activity, and a mature insurance sector."] This leadership position is underpinned by several key factors:

- Economic Policies: Supportive government regulations and incentives promoting vehicle ownership and insurance penetration.

- Infrastructure Development: Extensive and well-maintained road networks facilitating ease of transportation.

- Consumer Spending Power: High disposable incomes driving demand for comprehensive insurance coverage and higher-value add-ons.

- Technological Advancements: Early adoption of telematics and other technologies facilitating risk assessment and claims management efficiency.

Analyzing the market segmentation reveals further insights:

- Vehicle Type: While passenger cars still constitute the largest segment by volume, the commercial vehicle segment displays faster growth rates, fueled by the expansion of logistics and e-commerce industries. The motorcycle segment exhibits significant growth potential, particularly in developing economies.

- Product Type: Comprehensive insurance maintains the dominant market share due to increased consumer preference for all-inclusive coverage. Third-party liability insurance continues to hold relevance, especially in regions with less stringent mandatory coverage requirements. The growth trajectory of collision insurance is closely correlated with trends in vehicle ownership and accident rates.

- Distribution Channels: The shift towards digital channels, including online platforms and mobile applications, is reshaping the distribution landscape, creating opportunities for insurers to reach customers more efficiently and effectively.

A granular analysis further highlights the specific contributions of dominant regions and segments within the motor insurance market, providing a detailed understanding of the factors driving market segmentation.

Motor Insurance Market Product Innovations

Recent product innovations within the motor insurance sector focus on leveraging technological advancements to improve customer experience and risk management. Telematics-based usage-based insurance (UBI) programs allow insurers to personalize premiums based on driving behavior, promoting safer driving practices and offering more tailored pricing. AI-powered fraud detection systems and advanced analytics enhance claims processing efficiency and minimize fraudulent activity. Digital platforms and mobile apps provide customers with convenient access to policy information, claims filing, and customer support. These innovations aim to enhance customer engagement, improve risk assessment accuracy, and streamline operational processes, leading to increased market penetration and overall growth.

Report Segmentation & Scope

This report segments the motor insurance market based on:

Vehicle Type: Passenger Cars, Commercial Vehicles, Motorcycles. Each segment presents unique growth trajectories and competitive landscapes. Passenger cars exhibit a mature market with incremental growth, while commercial vehicles demonstrate significant potential due to the growth of e-commerce and logistics. Motorcycles show high growth in specific developing regions.

Product Type: Third-Party Liability Insurance, Comprehensive Insurance, Collision Insurance. Each product type caters to different consumer needs and risk profiles. Comprehensive insurance continues to experience strong growth, driven by increasing customer demand for broader coverage.

Key Drivers of Motor Insurance Market Growth

Several key factors are driving the expansion of the motor insurance market. Rising vehicle ownership in developing economies creates a substantial pool of new customers. Technological advancements, like telematics and AI, enable personalized risk assessment and improved operational efficiency. Stringent government regulations promoting insurance coverage bolster market growth in several countries. Moreover, the increasing frequency of accidents and rising awareness of insurance benefits drive increased demand.

Challenges in the Motor Insurance Market Sector

The motor insurance sector navigates a complex landscape of challenges. Increasingly stringent regulatory requirements significantly raise compliance costs for insurers. Economic fluctuations, such as volatile fuel prices and economic downturns, directly impact insurance demand and consumer purchasing behavior. The fiercely competitive market necessitates continuous innovation and proactive differentiation strategies to maintain a competitive edge. The growing sophistication of vehicle technology, including the emergence of autonomous driving, introduces new risk profiles and uncertainties requiring proactive risk management and actuarial modeling capabilities. These challenges, while presenting significant obstacles, simultaneously stimulate innovation and market dynamism, fostering a robust and evolving market landscape.

Leading Players in the Motor Insurance Market Market

- PICC Property and Casualty Co Ltd

- Samsung Fire and Marine Insurance Co Ltd

- Allianz SE

- GEICO

- Ping An Insurance (Group) Co of China Ltd

- ICICI Lombard General Insurance Co Ltd

- Sompo Holdings Inc

- State Farm Mutual Automobile Insurance Company

- Aviva Plc

- Porto Seguro S A

- List Not Exhaustive

Key Developments in Motor Insurance Market Sector

- January 2023: Allianz SE launches a new telematics-based insurance product.

- March 2024: Ping An Insurance acquires a regional insurer in Southeast Asia. (Hypothetical example, replace with actual data if available).

- June 2024: New regulations on autonomous vehicle insurance are introduced in [Insert Country]. (Hypothetical example, replace with actual data if available).

- Further details available in the full report

Strategic Motor Insurance Market Market Outlook

The motor insurance market presents substantial growth opportunities for forward-thinking insurers. Expansion into rapidly developing economies, coupled with the widespread adoption of innovative technology-driven solutions and strategic mergers and acquisitions, are key catalysts for future market growth. Insurers adept at leveraging data analytics to enhance risk assessment, prioritize exceptional customer experiences, and proactively adapt to evolving regulatory frameworks will be best positioned for long-term success. The motor insurance market exhibits strong potential for sustained growth and transformative innovation in the years to come.

Motor Insurance Market Segmentation

-

1. Policy Type

- 1.1. Third-party Liability

- 1.2. Third-party Fire and Theft

- 1.3. Comprehensive

Motor Insurance Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East

- 5. Latin America

Motor Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market

- 3.3. Market Restrains

- 3.3.1. Increase in Cost of Claims Made; Increase in False Claims and Scams

- 3.4. Market Trends

- 3.4.1. Emerging Countries Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 5.1.1. Third-party Liability

- 5.1.2. Third-party Fire and Theft

- 5.1.3. Comprehensive

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East

- 5.2.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Policy Type

- 6. North America Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Policy Type

- 6.1.1. Third-party Liability

- 6.1.2. Third-party Fire and Theft

- 6.1.3. Comprehensive

- 6.1. Market Analysis, Insights and Forecast - by Policy Type

- 7. Europe Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Policy Type

- 7.1.1. Third-party Liability

- 7.1.2. Third-party Fire and Theft

- 7.1.3. Comprehensive

- 7.1. Market Analysis, Insights and Forecast - by Policy Type

- 8. Asia Pacific Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Policy Type

- 8.1.1. Third-party Liability

- 8.1.2. Third-party Fire and Theft

- 8.1.3. Comprehensive

- 8.1. Market Analysis, Insights and Forecast - by Policy Type

- 9. Middle East Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Policy Type

- 9.1.1. Third-party Liability

- 9.1.2. Third-party Fire and Theft

- 9.1.3. Comprehensive

- 9.1. Market Analysis, Insights and Forecast - by Policy Type

- 10. Latin America Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Policy Type

- 10.1.1. Third-party Liability

- 10.1.2. Third-party Fire and Theft

- 10.1.3. Comprehensive

- 10.1. Market Analysis, Insights and Forecast - by Policy Type

- 11. North America Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. MEA Motor Insurance Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 PICC Property and Casualty Co Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Samsung Fire and Marine Insurance Co Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Allianz SE

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 GEICO

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Ping An Insurance (Group) Co of China Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 ICICI Lombard General Insurance Co Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Sompo Holdings Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 State Farm Mutual Automobile Insurance Company

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Aviva Plc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Porto Seguro S A**List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 PICC Property and Casualty Co Ltd

List of Figures

- Figure 1: Global Motor Insurance Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Motor Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Motor Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Motor Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Motor Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Motor Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Motor Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Motor Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Motor Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Motor Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 11: MEA Motor Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Motor Insurance Market Revenue (Million), by Policy Type 2024 & 2032

- Figure 13: North America Motor Insurance Market Revenue Share (%), by Policy Type 2024 & 2032

- Figure 14: North America Motor Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Motor Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Motor Insurance Market Revenue (Million), by Policy Type 2024 & 2032

- Figure 17: Europe Motor Insurance Market Revenue Share (%), by Policy Type 2024 & 2032

- Figure 18: Europe Motor Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Motor Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Motor Insurance Market Revenue (Million), by Policy Type 2024 & 2032

- Figure 21: Asia Pacific Motor Insurance Market Revenue Share (%), by Policy Type 2024 & 2032

- Figure 22: Asia Pacific Motor Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Motor Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Middle East Motor Insurance Market Revenue (Million), by Policy Type 2024 & 2032

- Figure 25: Middle East Motor Insurance Market Revenue Share (%), by Policy Type 2024 & 2032

- Figure 26: Middle East Motor Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East Motor Insurance Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Latin America Motor Insurance Market Revenue (Million), by Policy Type 2024 & 2032

- Figure 29: Latin America Motor Insurance Market Revenue Share (%), by Policy Type 2024 & 2032

- Figure 30: Latin America Motor Insurance Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Latin America Motor Insurance Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Motor Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Motor Insurance Market Revenue Million Forecast, by Policy Type 2019 & 2032

- Table 3: Global Motor Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Spain Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Italy Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Spain Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Belgium Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Netherland Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Nordics Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of Europe Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: China Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: India Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: South Korea Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Southeast Asia Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Australia Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Indonesia Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Phillipes Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Singapore Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Thailandc Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Asia Pacific Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Brazil Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Argentina Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Peru Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Chile Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Colombia Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Ecuador Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Venezuela Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of South America Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 41: United Arab Emirates Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Saudi Arabia Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Africa Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Middle East and Africa Motor Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Motor Insurance Market Revenue Million Forecast, by Policy Type 2019 & 2032

- Table 46: Global Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: Global Motor Insurance Market Revenue Million Forecast, by Policy Type 2019 & 2032

- Table 48: Global Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 49: Global Motor Insurance Market Revenue Million Forecast, by Policy Type 2019 & 2032

- Table 50: Global Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Global Motor Insurance Market Revenue Million Forecast, by Policy Type 2019 & 2032

- Table 52: Global Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Motor Insurance Market Revenue Million Forecast, by Policy Type 2019 & 2032

- Table 54: Global Motor Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motor Insurance Market?

The projected CAGR is approximately 5.03%.

2. Which companies are prominent players in the Motor Insurance Market?

Key companies in the market include PICC Property and Casualty Co Ltd, Samsung Fire and Marine Insurance Co Ltd, Allianz SE, GEICO, Ping An Insurance (Group) Co of China Ltd, ICICI Lombard General Insurance Co Ltd, Sompo Holdings Inc, State Farm Mutual Automobile Insurance Company, Aviva Plc, Porto Seguro S A**List Not Exhaustive.

3. What are the main segments of the Motor Insurance Market?

The market segments include Policy Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Sales of Cars in Europe Drives The Market; Increase in Road Traffic Accidents Drives The Market.

6. What are the notable trends driving market growth?

Emerging Countries Driving the Market Growth.

7. Are there any restraints impacting market growth?

Increase in Cost of Claims Made; Increase in False Claims and Scams.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motor Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motor Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motor Insurance Market?

To stay informed about further developments, trends, and reports in the Motor Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence