Key Insights

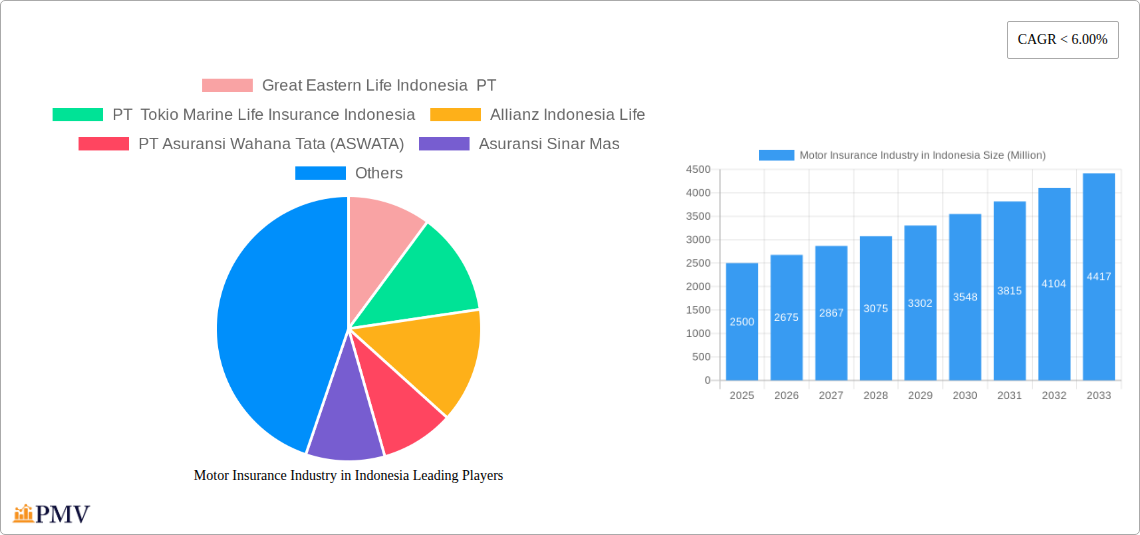

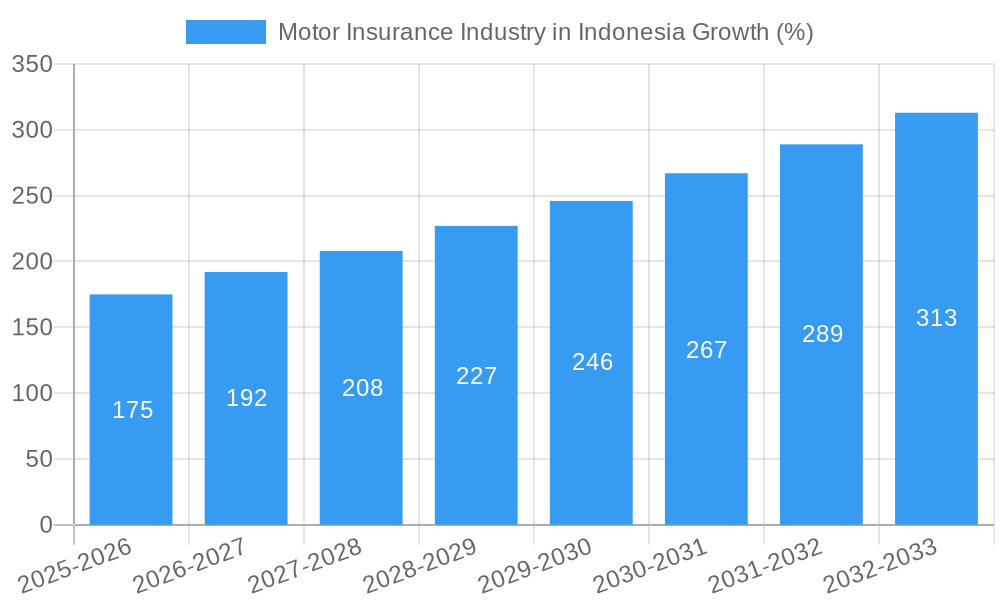

The Indonesian motor insurance market presents a compelling investment opportunity, fueled by a burgeoning middle class, rising vehicle ownership, and increasing awareness of insurance benefits. While precise market size data for 2019-2024 is unavailable, we can extrapolate reasonable estimates based on industry reports and Indonesia's economic growth trajectory. Considering Indonesia's rapid economic development and expanding automotive sector, we estimate the market size in 2025 to be approximately $2.5 billion USD. This figure reflects a steady growth pattern, mirroring the country's overall economic expansion and increasing penetration of insurance products within the population. The forecast period of 2025-2033 anticipates continued expansion, driven by government initiatives promoting financial inclusion and the increasing availability of online insurance platforms. The CAGR (Compound Annual Growth Rate) will likely remain robust, estimated in the range of 7-9%, reflecting a healthy market driven by both organic growth and increased insurance penetration among previously uninsured segments. This growth will be supported by favourable government regulations and a rising demand for comprehensive motor insurance policies that cater to the needs of a diversifying consumer base.

Competition in the Indonesian motor insurance market is intense, with both domestic and international players vying for market share. Digitalization is a key trend, with Insurtech companies disrupting the traditional model and offering more affordable, accessible, and customer-centric solutions. The government's push for financial inclusion will play a critical role in expanding insurance penetration, especially in underserved rural areas. The market's future success hinges on adapting to technological advancements, catering to evolving consumer needs, and effectively managing risks associated with the country’s dynamic economic landscape. Sustainable growth will also rely on enhancing transparency and trust within the insurance sector to increase consumer confidence and drive broader adoption of motor insurance policies.

Motor Insurance Industry in Indonesia: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the Indonesian motor insurance market, offering invaluable insights for industry stakeholders, investors, and strategic planners. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. This report utilizes data to provide actionable insights and projections for this dynamic market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

Motor Insurance Industry in Indonesia Market Structure & Competitive Dynamics

The Indonesian motor insurance market exhibits a moderately concentrated structure, with several major players vying for market share. Market concentration is approximately xx%, with the top five players holding approximately xx% of the market. Innovation in this sector is driven primarily by InsurTech companies and digital adoption by traditional insurers. The regulatory framework, overseen by the Otoritas Jasa Keuangan (OJK), is constantly evolving, influencing product offerings and operational strategies. While limited, product substitution exists in the form of alternative risk management strategies, impacting the market’s overall growth. End-user trends reveal a growing preference for digital insurance solutions and value-added services. M&A activity has been moderate, with recent deals valued at approximately xx Million in the last five years. Key metrics include:

- Market Share: Top 5 players – xx%

- M&A Deal Value (2019-2024): Approximately xx Million

Motor Insurance Industry in Indonesia Industry Trends & Insights

The Indonesian motor insurance market demonstrates robust growth, driven by factors such as increasing vehicle ownership, rising middle-class incomes, and government initiatives promoting financial inclusion. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and it is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Technological disruptions, specifically the rise of InsurTech, are significantly altering the landscape, leading to greater efficiency and accessibility. Consumer preferences are shifting towards digital platforms, personalized products, and bundled services. Intense competition among established players and new entrants fuels innovation and drives down prices, ultimately benefiting consumers. Market penetration remains relatively low, providing substantial room for growth.

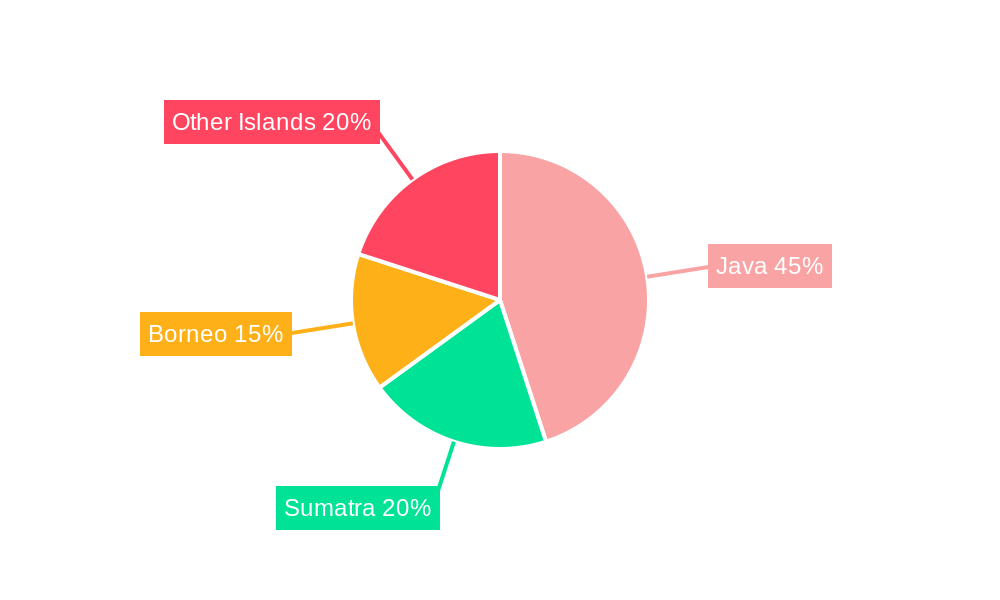

Dominant Markets & Segments in Motor Insurance Industry in Indonesia

The Jakarta metropolitan area currently dominates the Indonesian motor insurance market, accounting for approximately xx% of the total market value. This dominance is attributed to several key drivers:

- High Vehicle Density: Jakarta has the highest concentration of vehicles in Indonesia.

- Strong Economic Activity: The region's robust economy fuels higher demand for motor insurance.

- Developed Infrastructure: Well-established distribution networks facilitate efficient insurance sales.

Beyond Jakarta, other major cities like Surabaya, Bandung, and Medan also contribute significantly to overall market growth. However, significant untapped potential lies in rural areas, offering opportunities for expansion.

Motor Insurance Industry in Indonesia Product Innovations

Recent product innovations focus on leveraging technology to offer personalized, on-demand, and digitally accessible insurance solutions. Telematics-based insurance, allowing for customized premiums based on driving behavior, is gaining traction. Embedded insurance, integrated within various platforms, provides seamless access to insurance products, aligning with changing customer preferences. These innovative offerings enhance the customer experience while offering insurers new revenue streams.

Report Segmentation & Scope

This report segments the Indonesian motor insurance market by various parameters:

- Vehicle Type: Two-wheelers, four-wheelers, commercial vehicles. The four-wheeler segment is projected to experience the fastest growth, driven by increasing sales.

- Distribution Channel: Direct sales, brokers, banks, and online platforms. Online platforms are expected to witness significant expansion.

- Coverage Type: Third-party liability, comprehensive coverage, add-on coverages. Comprehensive insurance is gaining popularity as consumer awareness increases.

- Geographic Region: Jakarta, other major cities and rural areas. Market penetration in rural regions is expected to increase significantly.

Key Drivers of Motor Insurance Industry in Indonesia Growth

Several factors are propelling the growth of the Indonesian motor insurance market:

- Rising Vehicle Ownership: The increasing number of vehicles on the road significantly contributes to the market expansion.

- Expanding Middle Class: The growing middle class has increased disposable income, leading to greater demand for insurance products.

- Government Initiatives: Government policies promoting financial inclusion have a positive impact on the market's growth.

- Technological Advancements: Insurtech innovations are enhancing accessibility and efficiency.

Challenges in the Motor Insurance Industry in Indonesia Sector

Despite significant growth potential, several factors pose challenges to the Indonesian motor insurance market:

- Low Insurance Penetration: Many Indonesians lack insurance coverage, presenting a challenge to market penetration.

- Fraudulent Claims: Fraudulent claims inflate operational costs and impact profitability.

- Competition: Intense competition among insurers necessitates strategic differentiation and operational efficiency.

Leading Players in the Motor Insurance Industry in Indonesia Market

- Great Eastern Life Indonesia PT

- PT Tokio Marine Life Insurance Indonesia

- Allianz Indonesia Life

- PT Asuransi Wahana Tata (ASWATA)

- Asuransi Sinar Mas

- PT Asuransi Astra Buana

- AXA Mandiri

- PT Zurich Insurance Indonesia

- PT AIA Financial

- AIG Insurance Indonesia

- PT Tugu Pratama Indonesia

*List Not Exhaustive

Key Developments in Motor Insurance Industry in Indonesia Sector

- November 2022: PasarPolis launches TAP Insure, a direct-to-consumer insurance platform, leveraging technology to improve accessibility and user experience. This development significantly impacts market dynamics by increasing consumer access to insurance solutions.

- January 2022: The Indonesian government announces the continuation of PPnBM automobile sales tax benefits, impacting the automotive sector and subsequently motor insurance demand. The potential shift to a value-added tax (PPN) system introduces uncertainty regarding future pricing.

Strategic Motor Insurance Industry in Indonesia Market Outlook

The Indonesian motor insurance market presents significant long-term growth potential. Continued economic expansion, rising vehicle ownership, and technological advancements are expected to propel market expansion. Strategic opportunities exist for insurers to leverage digital technologies, expand into underserved markets, and offer innovative, customer-centric products. Focus on building strong distribution networks, managing fraudulent claims effectively, and addressing challenges related to low insurance penetration will be crucial for success in this dynamic market.

Motor Insurance Industry in Indonesia Segmentation

-

1. Insurance Type

- 1.1. Third Party Liability

- 1.2. Comprehensive

-

2. Distribution Channel

- 2.1. Agents

- 2.2. Brokers

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Motor Insurance Industry in Indonesia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Motor Insurance Industry in Indonesia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Potential Growth in the Insurance Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Motor Insurance Industry in Indonesia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Third Party Liability

- 5.1.2. Comprehensive

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Agents

- 5.2.2. Brokers

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. North America Motor Insurance Industry in Indonesia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6.1.1. Third Party Liability

- 6.1.2. Comprehensive

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Agents

- 6.2.2. Brokers

- 6.2.3. Banks

- 6.2.4. Online

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7. South America Motor Insurance Industry in Indonesia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7.1.1. Third Party Liability

- 7.1.2. Comprehensive

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Agents

- 7.2.2. Brokers

- 7.2.3. Banks

- 7.2.4. Online

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8. Europe Motor Insurance Industry in Indonesia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8.1.1. Third Party Liability

- 8.1.2. Comprehensive

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Agents

- 8.2.2. Brokers

- 8.2.3. Banks

- 8.2.4. Online

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9. Middle East & Africa Motor Insurance Industry in Indonesia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9.1.1. Third Party Liability

- 9.1.2. Comprehensive

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Agents

- 9.2.2. Brokers

- 9.2.3. Banks

- 9.2.4. Online

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10. Asia Pacific Motor Insurance Industry in Indonesia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10.1.1. Third Party Liability

- 10.1.2. Comprehensive

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Agents

- 10.2.2. Brokers

- 10.2.3. Banks

- 10.2.4. Online

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Great Eastern Life Indonesia PT

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PT Tokio Marine Life Insurance Indonesia

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Allianz Indonesia Life

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PT Asuransi Wahana Tata (ASWATA)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Asuransi Sinar Mas

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 PT Asuransi Astra Buana

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AXA Mandiri

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PT Zurich Insurance Indonesia

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PT AIA Financial & AIG Insurance Indonesia

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 PT Tugu Pratama Indonesia*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Great Eastern Life Indonesia PT

List of Figures

- Figure 1: Global Motor Insurance Industry in Indonesia Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Motor Insurance Industry in Indonesia Revenue (Million), by Insurance Type 2024 & 2032

- Figure 3: North America Motor Insurance Industry in Indonesia Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 4: North America Motor Insurance Industry in Indonesia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 5: North America Motor Insurance Industry in Indonesia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 6: North America Motor Insurance Industry in Indonesia Revenue (Million), by Country 2024 & 2032

- Figure 7: North America Motor Insurance Industry in Indonesia Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Motor Insurance Industry in Indonesia Revenue (Million), by Insurance Type 2024 & 2032

- Figure 9: South America Motor Insurance Industry in Indonesia Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 10: South America Motor Insurance Industry in Indonesia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 11: South America Motor Insurance Industry in Indonesia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 12: South America Motor Insurance Industry in Indonesia Revenue (Million), by Country 2024 & 2032

- Figure 13: South America Motor Insurance Industry in Indonesia Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Motor Insurance Industry in Indonesia Revenue (Million), by Insurance Type 2024 & 2032

- Figure 15: Europe Motor Insurance Industry in Indonesia Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 16: Europe Motor Insurance Industry in Indonesia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: Europe Motor Insurance Industry in Indonesia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: Europe Motor Insurance Industry in Indonesia Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Motor Insurance Industry in Indonesia Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Motor Insurance Industry in Indonesia Revenue (Million), by Insurance Type 2024 & 2032

- Figure 21: Middle East & Africa Motor Insurance Industry in Indonesia Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 22: Middle East & Africa Motor Insurance Industry in Indonesia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 23: Middle East & Africa Motor Insurance Industry in Indonesia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 24: Middle East & Africa Motor Insurance Industry in Indonesia Revenue (Million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Motor Insurance Industry in Indonesia Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Motor Insurance Industry in Indonesia Revenue (Million), by Insurance Type 2024 & 2032

- Figure 27: Asia Pacific Motor Insurance Industry in Indonesia Revenue Share (%), by Insurance Type 2024 & 2032

- Figure 28: Asia Pacific Motor Insurance Industry in Indonesia Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 29: Asia Pacific Motor Insurance Industry in Indonesia Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 30: Asia Pacific Motor Insurance Industry in Indonesia Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Motor Insurance Industry in Indonesia Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 3: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 6: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 12: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 18: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Germany Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: France Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Italy Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Spain Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Russia Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 30: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 31: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Turkey Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Israel Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: GCC Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 39: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Global Motor Insurance Industry in Indonesia Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Motor Insurance Industry in Indonesia Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Motor Insurance Industry in Indonesia?

The projected CAGR is approximately < 6.00%.

2. Which companies are prominent players in the Motor Insurance Industry in Indonesia?

Key companies in the market include Great Eastern Life Indonesia PT, PT Tokio Marine Life Insurance Indonesia, Allianz Indonesia Life, PT Asuransi Wahana Tata (ASWATA), Asuransi Sinar Mas, PT Asuransi Astra Buana, AXA Mandiri, PT Zurich Insurance Indonesia, PT AIA Financial & AIG Insurance Indonesia, PT Tugu Pratama Indonesia*List Not Exhaustive.

3. What are the main segments of the Motor Insurance Industry in Indonesia?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Potential Growth in the Insurance Sector.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: To increase consumer access to insurance, PasarPolis, an Indonesian insurtech firm, introduced TAP Insure, a direct-to-consumer vertical. The company leverages cutting-edge technology to deliver a seamless user experience from purchase to claim in an effort to democratize insurance by enabling all consumers to readily obtain reasonable insurance solutions. Customers can access embedded insurance products directly from the TAP Insure app, which can be downloaded from the AppStore and Playstore, thanks to PasarPolis' focus on end users.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Motor Insurance Industry in Indonesia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Motor Insurance Industry in Indonesia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Motor Insurance Industry in Indonesia?

To stay informed about further developments, trends, and reports in the Motor Insurance Industry in Indonesia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence