Key Insights

The Middle East chocolate market is poised for significant expansion, driven by a growing consumer base with an increasing disposable income and a burgeoning demand for premium and artisanal chocolate products. The market is projected to reach USD 2.84 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.89% expected through 2033. This growth is fueled by several factors, including the increasing popularity of dark chocolate, a segment that aligns with health-conscious consumer trends, and the growing appeal of milk and white chocolate varieties catering to broader preferences. The distribution landscape is evolving, with online retail stores emerging as a critical channel, complementing traditional outlets like convenience stores and supermarkets/hypermarkets, offering consumers greater accessibility and variety. Key players such as Nestlé SA, Mars Incorporated, and The Hershey Company are actively investing in product innovation and expanding their presence across the region, further stimulating market dynamism.

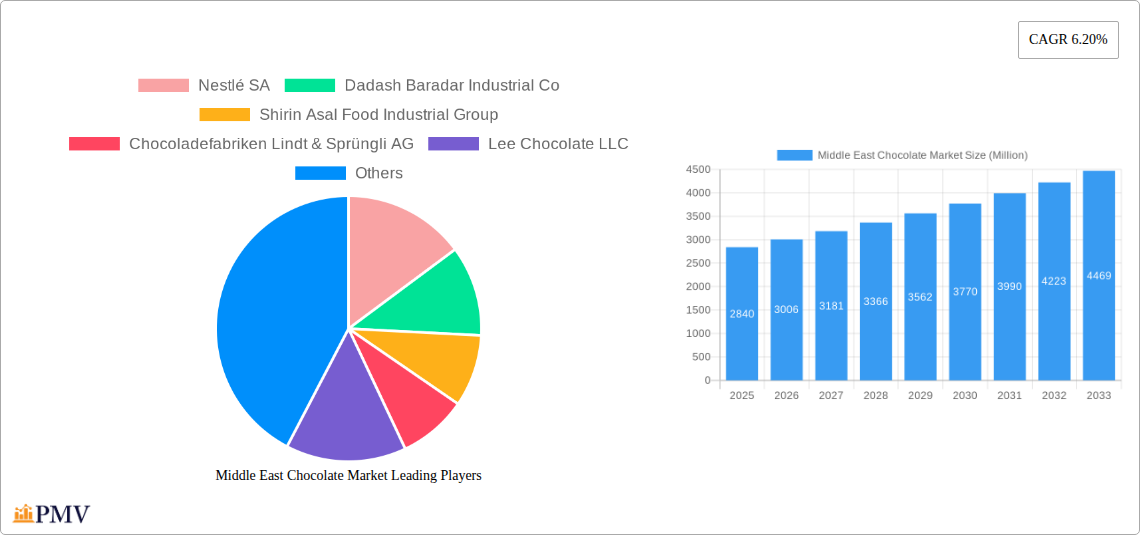

Middle East Chocolate Market Market Size (In Billion)

The market’s trajectory is further supported by emerging trends such as the rise of personalized chocolate experiences and the increasing availability of ethically sourced and sustainable cocoa products, appealing to a more discerning Middle Eastern consumer. While the market enjoys strong growth drivers, potential restraints such as fluctuating raw material prices and geopolitical instabilities in certain sub-regions could pose challenges. Nevertheless, the overall outlook remains highly positive, with the Middle East's growing appreciation for confectionery, coupled with a youthful demographic, presenting a fertile ground for continued market penetration and revenue generation. The region's focus on luxury goods and gifting culture also contributes to the sustained demand for high-quality chocolates, making it an attractive market for both established and emerging chocolate brands.

Middle East Chocolate Market Company Market Share

Middle East Chocolate Market Report: In-Depth Analysis and Future Outlook (2019–2033)

This comprehensive report delves into the dynamic Middle East chocolate market, offering a detailed analysis of its current landscape and future trajectory. Spanning a study period from 2019 to 2033, with a base year of 2025, this report provides actionable insights for stakeholders seeking to capitalize on the region's burgeoning demand for confectionery. Leveraging extensive data and expert analysis, we examine key market segments, growth drivers, challenges, and the competitive strategies of leading players. The report is structured to provide a clear and actionable understanding of the GCC chocolate market, MENA confectionery trends, and the impact of premium chocolate in the Middle East.

Middle East Chocolate Market Market Structure & Competitive Dynamics

The Middle East chocolate market exhibits a moderately concentrated structure, with a few multinational giants and a growing number of regional players vying for market share. Innovation ecosystems are flourishing, driven by evolving consumer preferences for healthier options, premium ingredients, and unique flavor profiles. Regulatory frameworks, while generally supportive of trade, can vary across countries, impacting import duties and food safety standards. Product substitutes, including traditional sweets and other snack categories, present a constant competitive challenge. End-user trends indicate a strong inclination towards indulgence, convenience, and increasingly, ethical sourcing and plant-based alternatives. Mergers and acquisitions (M&A) are expected to play a significant role in market consolidation and expansion. For instance, strategic investments in manufacturing capabilities, such as Nestlé's SAR 7 billion commitment in Saudi Arabia, signal a move towards strengthening local production and market penetration. The total market value is estimated to reach xx billion USD by 2025, with M&A deal values anticipated to increase by xx% during the forecast period. Key market share players in 2025 are projected to be:

- Nestlé SA: xx%

- Mars Incorporated: xx%

- Mondelēz International Inc: xx%

- Ferrero International SA: xx%

- Berry Callebaut: xx%

Middle East Chocolate Market Industry Trends & Insights

The Middle East chocolate market is experiencing robust growth, fueled by a confluence of socio-economic and demographic factors. A rising disposable income across key nations within the GCC and MENA region is directly translating into increased consumer spending on premium and indulgence products, including high-quality chocolates. The young and growing population demographic further propels demand, with a significant portion of consumers being millennials and Gen Z, who are increasingly influenced by global trends and digital marketing. Technological disruptions are reshaping the industry, from advanced manufacturing processes ensuring product quality and consistency to sophisticated online retail platforms that enhance accessibility. The surge in e-commerce penetration, particularly post-pandemic, has created new avenues for chocolate brands to reach consumers directly. Consumer preferences are evolving beyond basic indulgence; there's a discernible shift towards healthier options, such as dark chocolate with higher cocoa content, reduced sugar variants, and those fortified with functional ingredients. The demand for plant-based and vegan chocolates is also gaining significant traction, aligning with global wellness movements and ethical consumption trends. This presents a substantial opportunity for manufacturers to innovate and cater to this niche yet rapidly expanding segment. Competitive dynamics are intensifying, with both established global players and ambitious regional brands actively expanding their product portfolios and distribution networks. Strategic partnerships and local manufacturing initiatives are becoming crucial for long-term success. The projected Compound Annual Growth Rate (CAGR) for the Middle East chocolate market is approximately xx% from 2025 to 2033. Market penetration of premium chocolate is expected to reach xx% by 2025.

Dominant Markets & Segments in Middle East Chocolate Market

The Middle East chocolate market is characterized by distinct dominant regions and segments, driven by economic prosperity, cultural influences, and evolving consumer behaviors.

Leading Region: United Arab Emirates (UAE) The UAE consistently emerges as a dominant market due to its status as a global hub for tourism, trade, and its affluent consumer base. High disposable incomes, a large expatriate population with diverse palates, and a strong retail infrastructure contribute to its leading position.

- Economic Policies: Favorable business environments and government initiatives promoting foreign investment encourage market expansion by major chocolate manufacturers.

- Infrastructure: World-class retail outlets, including luxury malls and sophisticated supermarkets, ensure wide product availability and accessibility.

- Consumer Sophistication: The discerning consumer base in the UAE actively seeks premium, artisanal, and innovative chocolate products.

Dominant Segment: Milk and White Chocolate While dark chocolate is gaining traction, Milk and White Chocolate variants continue to hold the largest market share within the Middle East chocolate market. This dominance is attributed to their broad appeal, perceived sweetness, and versatility in various confectionery applications. They are widely consumed across all age groups and are staples in both everyday treats and gifting occasions.

Dominant Distribution Channel: Supermarket/Hypermarket Supermarkets/Hypermarkets remain the primary distribution channel for chocolate products across the Middle East. Their extensive reach, diverse product offerings, and ability to cater to bulk purchases make them the preferred shopping destination for the majority of consumers.

- Convenience: Consumers can purchase chocolates alongside other grocery items, making shopping efficient.

- Visibility: Prominent shelf placement and in-store promotions within these large retail formats drive impulse purchases.

- Product Variety: Supermarkets and hypermarkets offer a wide selection of brands and product types, satisfying varied consumer needs.

However, the Online Retail Store segment is experiencing rapid growth, driven by increasing internet penetration, smartphone usage, and the demand for convenience. This channel is particularly effective for niche products, premium offerings, and direct-to-consumer sales, and is projected to capture significant market share in the coming years.

Middle East Chocolate Market Product Innovations

Product innovation in the Middle East chocolate market is increasingly focused on health and wellness, premiumization, and unique sensory experiences. Brands are actively developing sugar-free, low-sugar, and plant-based chocolate alternatives to cater to the growing health-conscious consumer base. The incorporation of exotic ingredients, local flavors, and functional benefits, such as added vitamins or antioxidants, are also key trends. For instance, Barry Callebaut's recent launch of 100% dairy-free and plant-based chocolate NXT in Saudi Arabia and their whole-fruit chocolates under the Cacao Barry brand in the UAE exemplify this trend towards healthier and more sustainable chocolate options, offering competitive advantages in a market seeking both indulgence and mindful consumption.

Report Segmentation & Scope

This report meticulously segments the Middle East chocolate market to provide a granular view of its dynamics. The key segmentation includes:

- Confectionery Variant: The market is analyzed across Dark Chocolate, Milk and White Chocolate. Milk and White Chocolate are projected to maintain their dominance in market share, while Dark Chocolate is expected to witness a higher CAGR driven by health consciousness.

- Distribution Channel: The report scrutinizes the market through Convenience Store, Online Retail Store, Supermarket/Hypermarket, and Others. Supermarkets/Hypermarkets are expected to hold the largest market share in 2025, valued at approximately xx billion USD, while Online Retail Stores are forecast to grow at a CAGR of xx% during the forecast period, signifying a significant shift in consumer purchasing habits.

Key Drivers of Middle East Chocolate Market Growth

Several factors are propelling the growth of the Middle East chocolate market. Rising disposable incomes and a growing young population with a penchant for premium and indulgent products are primary demand drivers. Increased urbanization and the expansion of modern retail formats, including supermarkets and online platforms, are enhancing accessibility. Furthermore, a growing awareness of health and wellness is fueling demand for darker, sugar-free, and plant-based chocolate variants. Government initiatives promoting local manufacturing and tourism also contribute to market expansion, creating a favorable environment for both domestic and international players.

Challenges in the Middle East Chocolate Market Sector

Despite robust growth, the Middle East chocolate market faces several challenges. Fluctuations in raw material prices, particularly cocoa, can impact profit margins. Navigating diverse regulatory landscapes across different countries requires careful attention to compliance and labeling standards. Intense competition from both global brands and local manufacturers necessitates continuous innovation and effective marketing strategies. Supply chain disruptions, exacerbated by geopolitical events or logistical complexities, can also pose a risk. Moreover, maintaining consistent product quality and meeting evolving consumer demands for ethical sourcing and sustainability require substantial investment and operational agility.

Leading Players in the Middle East Chocolate Market Market

- Nestlé SA

- Dadash Baradar Industrial Co

- Shirin Asal Food Industrial Group

- Chocoladefabriken Lindt & Sprüngli AG

- Lee Chocolate LLC

- Berry Callebaut

- Makaw Chocolate LLC

- Ferrero International SA

- Mars Incorporated

- Yıldız Holding A

- IFFCO

- Patchi LLC

- Parand Chocolate Co

- Strauss Group Ltd

- Mondelēz International Inc

- Bostani Chocolatier Inc

- The Hershey Company

Key Developments in Middle East Chocolate Market Sector

- November 2022: Nestlé announced plans to invest SAR 7 billion in the Kingdom of Saudi Arabia over the next ten years, including an initial investment of up to USD 99.6 million to establish a cutting-edge manufacturing plant set to open in 2025, signaling a significant commitment to expanding its presence and production capabilities in the region.

- November 2022: Barry Callebaut launched 100% dairy-free and plant-based chocolate NXT in Saudi Arabia. This innovative product is allergen-free, vegan, and caters to the surging demand for plant-based food options across the country.

- September 2022: Barry Callebaut, under its Cacao Barry brand, launched its line of whole-fruit chocolates in the United Arab Emirates. These chocolates are made from pure cacao fruit and contain less sugar than conventional dark chocolate, aligning with health-conscious consumer preferences.

Strategic Middle East Chocolate Market Market Outlook

The strategic outlook for the Middle East chocolate market remains exceptionally positive, driven by sustained economic growth, a young and aspirational consumer base, and increasing urbanization. Key growth accelerators include the continued premiumization trend, with consumers willing to spend more on high-quality, artisanal, and ethically sourced chocolates. The burgeoning demand for healthier alternatives, such as dark and plant-based chocolates, presents a significant opportunity for product diversification and innovation. Expansion of online retail channels will further enhance market reach and accessibility, particularly for niche and direct-to-consumer brands. Strategic investments in local manufacturing and supply chain optimization will be crucial for major players to capture market share and mitigate potential disruptions. Overall, the region offers substantial untapped potential for confectionery manufacturers focused on delivering value, innovation, and sustainable products.

Middle East Chocolate Market Segmentation

-

1. Confectionery Variant

- 1.1. Dark Chocolate

- 1.2. Milk and White Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Middle East Chocolate Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Chocolate Market Regional Market Share

Geographic Coverage of Middle East Chocolate Market

Middle East Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Chocolate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Dark Chocolate

- 5.1.2. Milk and White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestlé SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dadash Baradar Industrial Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shirin Asal Food Industrial Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chocoladefabriken Lindt & Sprüngli AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lee Chocolate LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Berry Callebaut

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Makaw Chocolate LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ferrero International SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mars Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yıldız Holding A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 IFFCO

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Patchi LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Parand Chocolate Co

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Strauss Group Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Mondelēz International Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Bostani Chocolatier Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 The Hershey Company

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Nestlé SA

List of Figures

- Figure 1: Middle East Chocolate Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Chocolate Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Chocolate Market Revenue undefined Forecast, by Confectionery Variant 2020 & 2033

- Table 2: Middle East Chocolate Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 3: Middle East Chocolate Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Middle East Chocolate Market Revenue undefined Forecast, by Confectionery Variant 2020 & 2033

- Table 5: Middle East Chocolate Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Middle East Chocolate Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East Chocolate Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Chocolate Market?

The projected CAGR is approximately 5.89%.

2. Which companies are prominent players in the Middle East Chocolate Market?

Key companies in the market include Nestlé SA, Dadash Baradar Industrial Co, Shirin Asal Food Industrial Group, Chocoladefabriken Lindt & Sprüngli AG, Lee Chocolate LLC, Berry Callebaut, Makaw Chocolate LLC, Ferrero International SA, Mars Incorporated, Yıldız Holding A, IFFCO, Patchi LLC, Parand Chocolate Co, Strauss Group Ltd, Mondelēz International Inc, Bostani Chocolatier Inc, The Hershey Company.

3. What are the main segments of the Middle East Chocolate Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

November 2022: Nestlé announced plans to invest SAR 7 billion in the Kingdom of Saudi Arabia in the coming ten years in a strategic move to grow its longstanding business in the country, beginning with up to USD 99.6 million to establish a cutting-edge manufacturing plant – which is set to open in 2025.November 2022: Barry Callebaut launched 100% dairy-free and plant-based chocolate NXT in Saudi Arabia. NXT is the first-of-its-kind dairy-free, lactose-free, nut-free, allergen-free, 100% plant-based, and vegan dark and milk chocolate to respond to the growing demand for plant-based foods across the country.September 2022: Barry Callebaut launched its line of whole-fruit chocolates under the Cacao Barry brand in the United Arab Emirates. The product has less sugar than conventional dark chocolate and is made from pure cacao fruit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Chocolate Market?

To stay informed about further developments, trends, and reports in the Middle East Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence