Key Insights

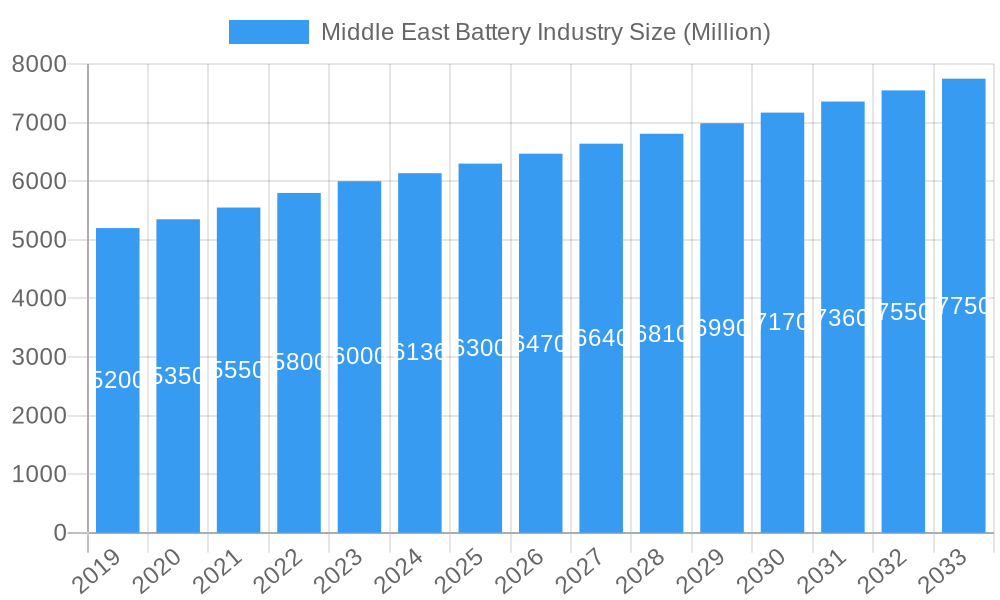

The Middle East battery market is poised for robust growth, projected to reach an estimated USD 6,136 million in 2024. This expansion is fueled by a CAGR of 2.82% expected to persist through 2033. Key drivers for this growth include the escalating demand for reliable energy storage solutions across various sectors, particularly in the automotive industry driven by increasing vehicle sales and the nascent but growing interest in electric vehicles. Furthermore, the industrial sector's continuous development, including infrastructure projects and manufacturing expansion, necessitates advanced battery technologies for uninterrupted operations and power backup. Consumer electronics, a consistent growth area, also contributes significantly to battery consumption. The market is segmented by type into primary and secondary batteries, with secondary batteries, especially Lithium-ion and Lead-acid technologies, dominating due to their reusability and evolving performance characteristics.

Middle East Battery Industry Market Size (In Billion)

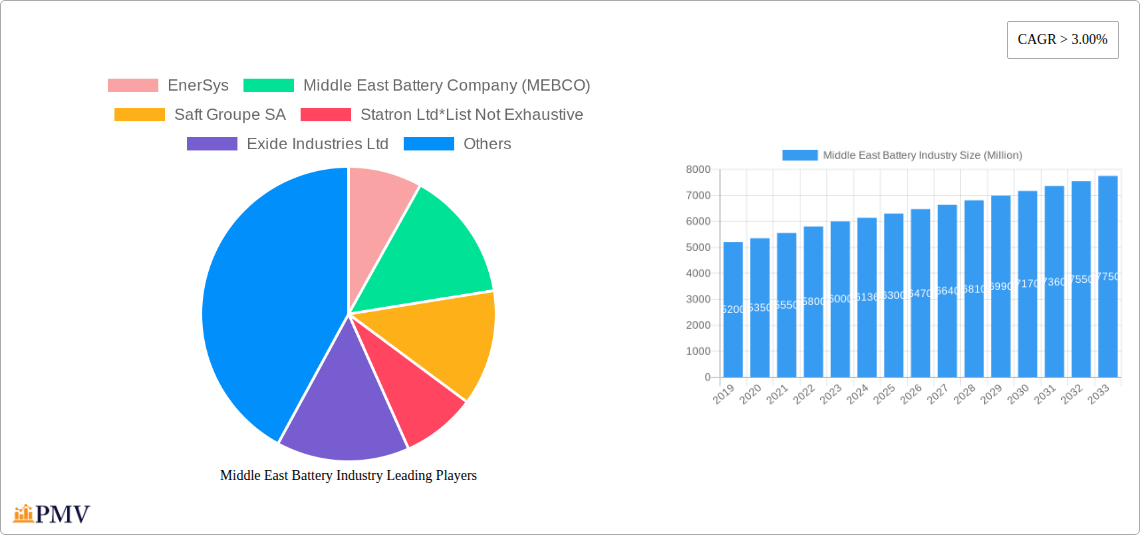

Geographically, the United Arab Emirates and Saudi Arabia are expected to be the leading markets, owing to significant investments in smart city initiatives, renewable energy storage, and industrial diversification. The "Rest of the Middle East" region, while currently smaller, presents substantial untapped potential as countries focus on enhancing their energy infrastructure and adopting modern technologies. While the market benefits from strong demand, it faces restraints such as fluctuating raw material prices, particularly for lithium and cobalt, and the initial high cost of advanced battery technologies, which can slow down adoption in price-sensitive segments. Nevertheless, ongoing research and development, coupled with strategic investments from key players like EnerSys, Middle East Battery Company (MEBCO), and Tesla Inc., are expected to drive innovation and cost-efficiency, further solidifying the market's upward trajectory.

Middle East Battery Industry Company Market Share

This in-depth report provides an exhaustive analysis of the Middle East battery industry, offering critical insights into market dynamics, growth drivers, competitive landscapes, and future outlook. Targeting industry stakeholders, investors, and decision-makers, this report is a definitive guide to navigating the evolving Middle East battery market. Our comprehensive research covers all major segments including primary batteries and secondary batteries, with a detailed focus on lead-acid batteries, lithium-ion batteries, and other battery technologies. We examine diverse applications such as automotive batteries, industrial batteries, consumer electronics batteries, and other battery applications across key geographies including the United Arab Emirates, Saudi Arabia, and the Rest of the Middle East.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

Middle East Battery Industry Market Structure & Competitive Dynamics

The Middle East battery market exhibits a dynamic and evolving competitive structure, characterized by increasing foreign investment and growing local manufacturing capabilities. Market concentration varies across different segments, with established players in traditional lead-acid battery manufacturing and emerging players in the lithium-ion battery sector. Innovation ecosystems are rapidly developing, driven by government initiatives promoting localization and advanced manufacturing. Regulatory frameworks are becoming more supportive, fostering growth in automotive battery, industrial battery, and consumer electronics battery sectors. Product substitutes are being influenced by technological advancements, with lithium-ion batteries increasingly challenging lead-acid batteries in performance-critical applications. End-user trends are leaning towards higher energy density, faster charging, and longer lifespan solutions, especially for electric vehicles and renewable energy storage. Merger and acquisition (M&A) activities are anticipated to increase as companies seek to expand their market reach, technological portfolios, and vertical integration. For instance, strategic investments in the electric vehicle battery metals plant announced by Saudi Arabia in May 2022, with USD 2 billion allocated, signal significant M&A potential.

Middle East Battery Industry Industry Trends & Insights

The Middle East battery industry is experiencing robust growth, propelled by a confluence of technological advancements, supportive government policies, and burgeoning end-user demand. A significant driver is the increasing adoption of electric vehicles (EVs) across the region, which is directly fueling demand for high-performance lithium-ion batteries. This trend is further amplified by aggressive national visions aimed at diversifying economies away from fossil fuels and promoting sustainable transportation. The region's focus on renewable energy projects, such as solar and wind farms, is also a major catalyst for the industrial battery segment, particularly for energy storage solutions. Technological disruptions, including breakthroughs in battery chemistries, charging technologies, and battery management systems, are continuously reshaping the competitive landscape. Consumer preferences are shifting towards smarter, more efficient, and longer-lasting battery solutions for portable electronics and other applications. The competitive dynamics are intensifying, with both established global players and ambitious local manufacturers vying for market share. The CAGR for the Middle East battery market is projected to be substantial in the coming years, driven by these factors. Market penetration of advanced battery technologies is expected to rise significantly, particularly in sectors like renewable energy and grid storage. The development of local manufacturing capabilities, supported by substantial government investments as seen in Saudi Arabia’s initiatives, is crucial for meeting future demand and fostering regional self-sufficiency in battery production.

Dominant Markets & Segments in Middle East Battery Industry

The Middle East battery industry is characterized by distinct dominant markets and segments, each driven by specific factors.

Dominant Geography: Saudi Arabia and the United Arab Emirates are emerging as the leading hubs for battery manufacturing, investment, and consumption. This dominance is underpinned by:

- Economic Policies: Proactive government initiatives and substantial investments in industrial diversification and advanced manufacturing. For example, Saudi Arabia's commitment of USD 6 billion for an electric vehicle battery metals plant and related infrastructure demonstrates a strong policy push.

- Infrastructure Development: Significant investments in industrial zones, logistics networks, and power grids to support large-scale manufacturing and energy storage projects.

- Demand Growth: Rapidly expanding automotive sectors, increasing adoption of EVs, and ambitious renewable energy targets drive demand for various battery types.

Dominant Technology:

- Lithium-ion Battery: This segment is experiencing the most rapid growth, driven by its superior energy density, lifespan, and suitability for demanding applications like EVs and grid storage. The ongoing development of the electric vehicle battery metals plant and integrated battery chemicals complexes signals a strategic focus on this technology.

- Lead-acid Battery: Remains dominant in traditional automotive and industrial backup power applications due to its cost-effectiveness and proven reliability. However, its market share is expected to face pressure from advanced battery technologies in certain segments.

Dominant Application:

- Automotive: The burgeoning automotive sector, particularly the push towards electric mobility, is a primary growth engine. The demand for automotive batteries, both for internal combustion engines and EVs, is substantial.

- Industrial: Applications in renewable energy storage, grid stabilization, uninterruptible power supplies (UPS), and telecommunications are significant contributors to market growth. The expansion of industrial infrastructure and the need for reliable backup power solutions are key drivers.

Dominant Type:

- Secondary Battery: This category, encompassing rechargeable batteries like lithium-ion and lead-acid batteries, dominates the market due to its widespread use in transportation, electronics, and energy storage.

The strategic focus on developing integrated battery value chains, from raw material sourcing to manufacturing of advanced battery components and finished products, is a key trend shaping the dominance of specific segments and geographies. The significant allocation of USD 2 billion for the electric vehicle battery metals plant highlights the strategic importance of securing supply chains for lithium-ion battery production.

Middle East Battery Industry Product Innovations

Product innovation in the Middle East battery industry is primarily focused on enhancing energy density, improving safety, and extending cycle life for lithium-ion batteries. Developments also include advancements in faster charging capabilities and more sustainable manufacturing processes for both lead-acid and lithium-ion chemistries. The emergence of solid-state battery technologies and improved thermal management systems are also key areas of research. These innovations are crucial for meeting the demanding requirements of electric vehicles, grid-scale energy storage, and next-generation portable electronics, offering competitive advantages through superior performance and reliability.

Report Segmentation & Scope

This report meticulously segments the Middle East battery industry to provide a granular understanding of the market. The segmentation covers:

- Battery Type: This includes a detailed analysis of Primary Battery and Secondary Battery markets, with a focus on the growth trajectories and market shares of each. Projections for Secondary Battery are expected to be significantly higher due to rechargeability demands.

- Battery Technology: The report delves into Lead-acid Battery, Lithium-ion Battery, and Other Technologies. The Lithium-ion Battery segment is projected for substantial growth, while Lead-acid Battery will maintain a strong presence in established applications.

- Application: We examine the Automotive, Industrial, Consumer Electronics, and Other Applications segments. The Automotive and Industrial sectors are expected to be the fastest-growing, driven by EV adoption and renewable energy expansion.

- Geography: The market is analyzed across the United Arab Emirates, Saudi Arabia, and the Rest of the Middle East. Saudi Arabia and the UAE are anticipated to lead in terms of market size and growth due to significant investments and policy support.

Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed.

Key Drivers of Middle East Battery Industry Growth

The growth of the Middle East battery industry is propelled by several key factors:

- Electric Vehicle (EV) Adoption: Government initiatives and increasing consumer interest in EVs are driving demand for high-capacity lithium-ion batteries.

- Renewable Energy Expansion: Large-scale solar and wind projects necessitate robust energy storage solutions, boosting the industrial battery segment.

- Government Support & Investment: Strategic investments in battery manufacturing, such as Saudi Arabia's electric vehicle battery metals plant, are fostering local production and technological advancement.

- Infrastructure Development: Ongoing investments in industrial parks and power grids support the expansion of battery production and deployment.

- Technological Advancements: Innovations in battery chemistry and performance are making batteries more efficient and suitable for a wider range of applications.

Challenges in the Middle East Battery Industry Sector

Despite the robust growth, the Middle East battery industry faces several challenges:

- Supply Chain Dependencies: Reliance on imported raw materials and components for advanced battery technologies poses a risk.

- Skilled Workforce Shortage: A lack of specialized talent in battery manufacturing and R&D can hinder rapid expansion.

- High Initial Investment Costs: Establishing advanced battery manufacturing facilities requires significant capital expenditure.

- Recycling Infrastructure: Developing efficient and widespread battery recycling capabilities is crucial for sustainability and resource management.

- Market Volatility: Fluctuations in raw material prices and evolving technological landscapes can impact profitability.

Leading Players in the Middle East Battery Industry Market

- EnerSys

- Middle East Battery Company (MEBCO)

- Saft Groupe SA

- Statron Ltd*List Not Exhaustive

- Exide Industries Ltd

- C&D Technologies Inc

- FIAMM Energy Technology SpA

- Tesla Inc

- Panasonic Corporation

Key Developments in Middle East Battery Industry Sector

- May 2022: Saudi Arabia's Ministry of Industry and Mineral Resources announced that it had secured USD 6 billion for a steel plate mill complex and an electric vehicle battery metals plant. Out of the total amount of USD 6 billion, USD 2 billion will be allocated for the electric vehicle battery metals plant. This development is critical for establishing a localized supply chain for EV battery components.

- January 2023: EV Metals Group (EVM) signed agreements for the allocation of 127 hectares of land from the Royal Commission for Jubail and Yanbu (RCJY) and a gas and power allocation from the Saudi Ministry of Energy. The agreements support EVM's planned USD 899 million integrated Battery Chemicals Complex at Yanbu Industrial City. This move signifies a significant step towards domestic production of battery-grade chemicals, crucial for the entire lithium-ion battery value chain.

Strategic Middle East Battery Industry Market Outlook

The strategic outlook for the Middle East battery industry is exceptionally promising, driven by aggressive government mandates and a strong commitment to diversifying economies through high-tech manufacturing. The region is positioning itself as a global hub for battery production and innovation, particularly in the lithium-ion battery sector, leveraging its strategic location and abundant energy resources. Future growth accelerators include the expansion of domestic EV manufacturing, continued investment in renewable energy storage to support grid stability, and the development of a circular economy for batteries through advanced recycling initiatives. The strategic focus on value chain integration, from raw material processing to battery assembly, will further solidify the region's competitive advantage. Opportunities abound for companies looking to establish manufacturing plants, invest in R&D, and tap into the rapidly growing demand for sustainable energy storage solutions.

Middle East Battery Industry Segmentation

-

1. Type

- 1.1. Primary Battery

- 1.2. Secondary Battery

-

2. Technology

- 2.1. Lead-acid Battery

- 2.2. Lithium-ion Battery

- 2.3. Other Technologies

-

3. Application

- 3.1. Automotive

- 3.2. Industri

- 3.3. Consumer Electronics

- 3.4. Other Applications

-

4. Geography

- 4.1. United Arab Emirates

- 4.2. Saudi Arabia

- 4.3. Rest of the Middle-East

Middle East Battery Industry Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. Rest of the Middle East

Middle East Battery Industry Regional Market Share

Geographic Coverage of Middle East Battery Industry

Middle East Battery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. Lead-acid Batteries to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Battery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Primary Battery

- 5.1.2. Secondary Battery

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Lead-acid Battery

- 5.2.2. Lithium-ion Battery

- 5.2.3. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Automotive

- 5.3.2. Industri

- 5.3.3. Consumer Electronics

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. Rest of the Middle-East

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Arab Emirates

- 5.5.2. Saudi Arabia

- 5.5.3. Rest of the Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Arab Emirates Middle East Battery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Primary Battery

- 6.1.2. Secondary Battery

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Lead-acid Battery

- 6.2.2. Lithium-ion Battery

- 6.2.3. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Automotive

- 6.3.2. Industri

- 6.3.3. Consumer Electronics

- 6.3.4. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United Arab Emirates

- 6.4.2. Saudi Arabia

- 6.4.3. Rest of the Middle-East

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Saudi Arabia Middle East Battery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Primary Battery

- 7.1.2. Secondary Battery

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Lead-acid Battery

- 7.2.2. Lithium-ion Battery

- 7.2.3. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Automotive

- 7.3.2. Industri

- 7.3.3. Consumer Electronics

- 7.3.4. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United Arab Emirates

- 7.4.2. Saudi Arabia

- 7.4.3. Rest of the Middle-East

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of the Middle East Middle East Battery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Primary Battery

- 8.1.2. Secondary Battery

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Lead-acid Battery

- 8.2.2. Lithium-ion Battery

- 8.2.3. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Automotive

- 8.3.2. Industri

- 8.3.3. Consumer Electronics

- 8.3.4. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United Arab Emirates

- 8.4.2. Saudi Arabia

- 8.4.3. Rest of the Middle-East

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 EnerSys

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Middle East Battery Company (MEBCO)

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Saft Groupe SA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Statron Ltd*List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Exide Industries Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 C&D Technologies Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 FIAMM Energy Technology SpA

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Tesla Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Panasonic Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 EnerSys

List of Figures

- Figure 1: Middle East Battery Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Battery Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East Battery Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Middle East Battery Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Middle East Battery Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 4: Middle East Battery Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 5: Middle East Battery Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Middle East Battery Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 7: Middle East Battery Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Middle East Battery Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 9: Middle East Battery Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: Middle East Battery Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 11: Middle East Battery Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 12: Middle East Battery Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 13: Middle East Battery Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 14: Middle East Battery Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 15: Middle East Battery Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Middle East Battery Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 17: Middle East Battery Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: Middle East Battery Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 19: Middle East Battery Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: Middle East Battery Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 21: Middle East Battery Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Middle East Battery Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 23: Middle East Battery Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 24: Middle East Battery Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 25: Middle East Battery Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 26: Middle East Battery Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 27: Middle East Battery Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Middle East Battery Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: Middle East Battery Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Middle East Battery Industry Volume K Units Forecast, by Country 2020 & 2033

- Table 31: Middle East Battery Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 32: Middle East Battery Industry Volume K Units Forecast, by Type 2020 & 2033

- Table 33: Middle East Battery Industry Revenue undefined Forecast, by Technology 2020 & 2033

- Table 34: Middle East Battery Industry Volume K Units Forecast, by Technology 2020 & 2033

- Table 35: Middle East Battery Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Middle East Battery Industry Volume K Units Forecast, by Application 2020 & 2033

- Table 37: Middle East Battery Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: Middle East Battery Industry Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: Middle East Battery Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Middle East Battery Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Battery Industry?

The projected CAGR is approximately 2.82%.

2. Which companies are prominent players in the Middle East Battery Industry?

Key companies in the market include EnerSys, Middle East Battery Company (MEBCO), Saft Groupe SA, Statron Ltd*List Not Exhaustive, Exide Industries Ltd, C&D Technologies Inc, FIAMM Energy Technology SpA, Tesla Inc, Panasonic Corporation.

3. What are the main segments of the Middle East Battery Industry?

The market segments include Type, Technology, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

Lead-acid Batteries to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

May 2022: Saudi Arabia's Ministry of Industry and Mineral Resources announced that it had secured USD 6 billion for a steel plate mill complex and an electric vehicle battery metals plant. Out of the total amount of USD 6 billion, USD 2 billion will be allocated for the electric vehicle battery metals plant.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Battery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Battery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Battery Industry?

To stay informed about further developments, trends, and reports in the Middle East Battery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence