Key Insights

The Middle East and Africa frozen food packaging market is experiencing robust growth, driven by rising disposable incomes, increasing urbanization, and a growing preference for convenient and ready-to-eat meals. The burgeoning food service industry, particularly in rapidly developing urban centers, fuels demand for efficient and safe frozen food packaging solutions. A shift towards healthier eating habits and the increasing popularity of frozen fruits and vegetables are also contributing factors. While the market is segmented by primary material (glass, paper, metal, plastic, others), packaging type (bags, boxes, trays, etc.), food type (ready-made meals, fruits, meat, etc.), and country, plastic packaging currently dominates due to its cost-effectiveness and versatility. However, growing environmental concerns are driving a transition towards sustainable packaging options, such as biodegradable and recyclable materials, presenting both opportunities and challenges for market players. The region's diverse demographic and climate conditions influence packaging material selection; for example, certain regions might necessitate packaging that offers enhanced insulation to maintain product quality during transportation and storage.

Despite the market’s growth trajectory, certain restraints exist. Fluctuating raw material prices and the complexity of logistics infrastructure in certain African countries can hinder growth. Furthermore, the adoption of advanced packaging technologies, like modified atmosphere packaging (MAP) and active packaging, remains comparatively lower compared to developed markets. Nevertheless, ongoing infrastructure development and increasing investment in food processing and distribution channels across the Middle East and Africa are expected to significantly mitigate these constraints and unlock further market potential. The forecast period, 2025-2033, promises significant expansion, particularly in countries witnessing rapid economic progress and a surge in the adoption of modern food retail formats. Key players are focusing on innovation, strategic partnerships, and expanding their product portfolios to cater to the diverse needs of the market.

Middle East & Africa Frozen Food Packaging Market: A Comprehensive Report (2019-2033)

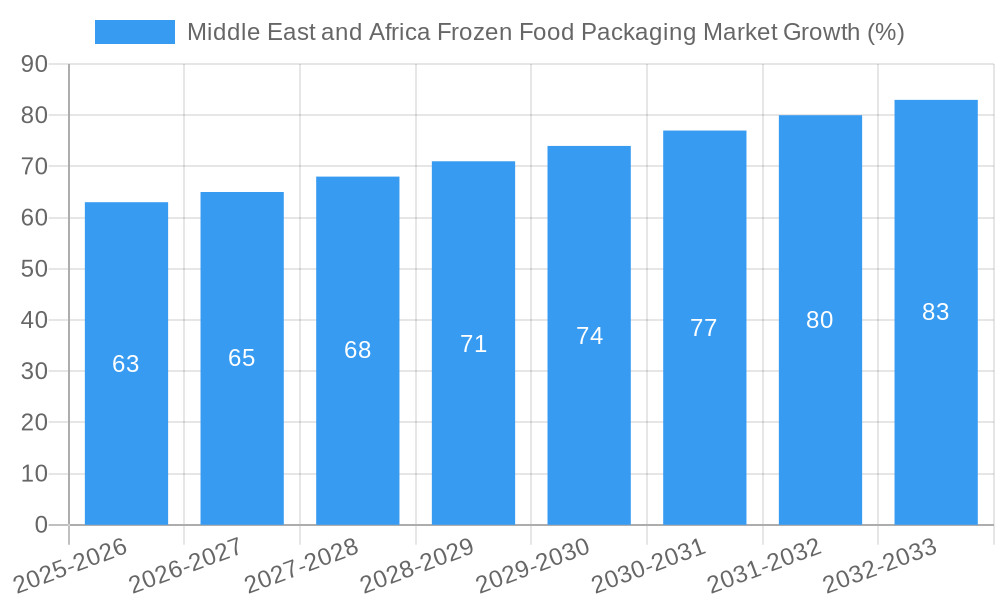

This in-depth report provides a comprehensive analysis of the Middle East and Africa frozen food packaging market, offering invaluable insights for businesses operating within this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year, and the forecast period spanning 2025-2033. The historical period analyzed is 2019-2024. The report values are expressed in Millions.

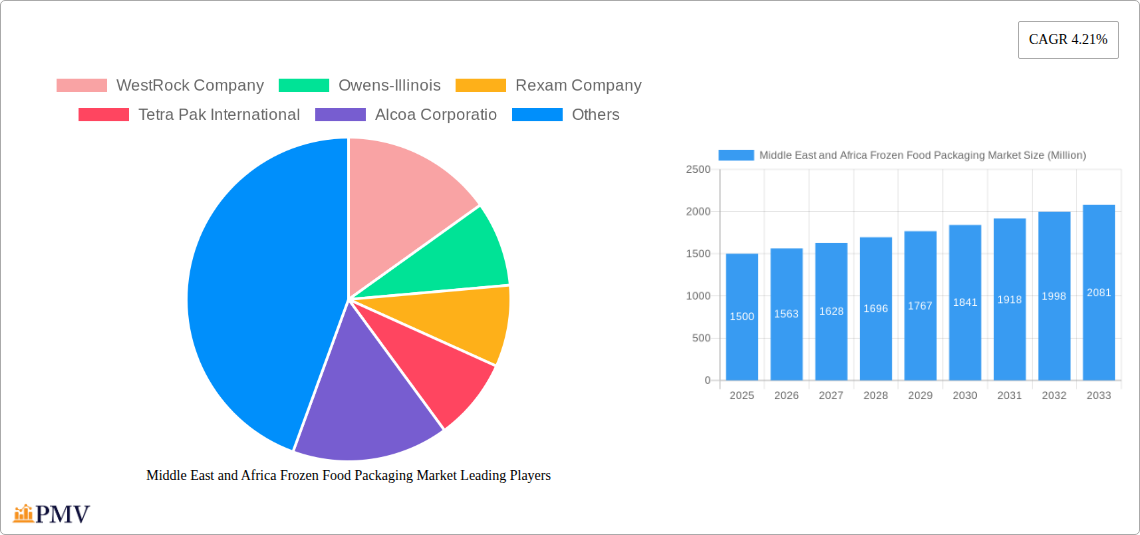

Middle East and Africa Frozen Food Packaging Market Market Structure & Competitive Dynamics

This section analyzes the competitive landscape of the Middle East and Africa frozen food packaging market. We delve into market concentration, examining the market share held by key players like WestRock Company, Owens-Illinois, Rexam Company, Tetra Pak International, and Amcor Ltd. The report explores innovation ecosystems, highlighting emerging technologies and their impact on packaging solutions. Regulatory frameworks impacting the industry, including food safety standards and environmental regulations, are also scrutinized. A detailed analysis of product substitutes, such as biodegradable packaging alternatives, and their market penetration is included. The report also examines end-user trends, focusing on the evolving preferences of frozen food manufacturers and consumers. Finally, the report includes an assessment of recent mergers and acquisitions (M&A) activities, analyzing their impact on market dynamics and providing an overview of deal values (e.g., a xx Million deal in 2023). The competitive landscape is further dissected through metrics such as the Herfindahl-Hirschman Index (HHI) to illustrate market concentration. The report also identifies emerging players and analyzes their growth strategies, considering factors such as their technological capabilities, market penetration, and overall financial performance. Furthermore, it analyzes the impact of geopolitical factors, such as trade agreements and political stability within the MEA region, on the market's competitive dynamics.

Middle East and Africa Frozen Food Packaging Market Industry Trends & Insights

This section provides a detailed analysis of the key trends shaping the Middle East and Africa frozen food packaging market. We examine the market's growth drivers, including the rising demand for convenience foods, the expansion of the retail sector, and the increasing adoption of frozen food products. We quantify this growth with precise CAGR figures, projecting market expansion over the forecast period. Technological disruptions, such as advancements in sustainable packaging materials and automation in packaging processes, are discussed, along with their impact on market dynamics and efficiency. An in-depth exploration of consumer preferences regarding packaging aesthetics, functionality (e.g., resealability), and sustainability considerations is presented. The analysis includes a thorough evaluation of the competitive dynamics, with a focus on pricing strategies, product differentiation, and brand positioning adopted by key market players. Market penetration rates for various packaging types (plastic, paper, etc.) are provided to illustrate consumer and producer preferences. The report examines the influence of macroeconomic factors such as economic growth, disposable incomes, and urbanization on market growth, and forecasts the impact of changing consumption patterns.

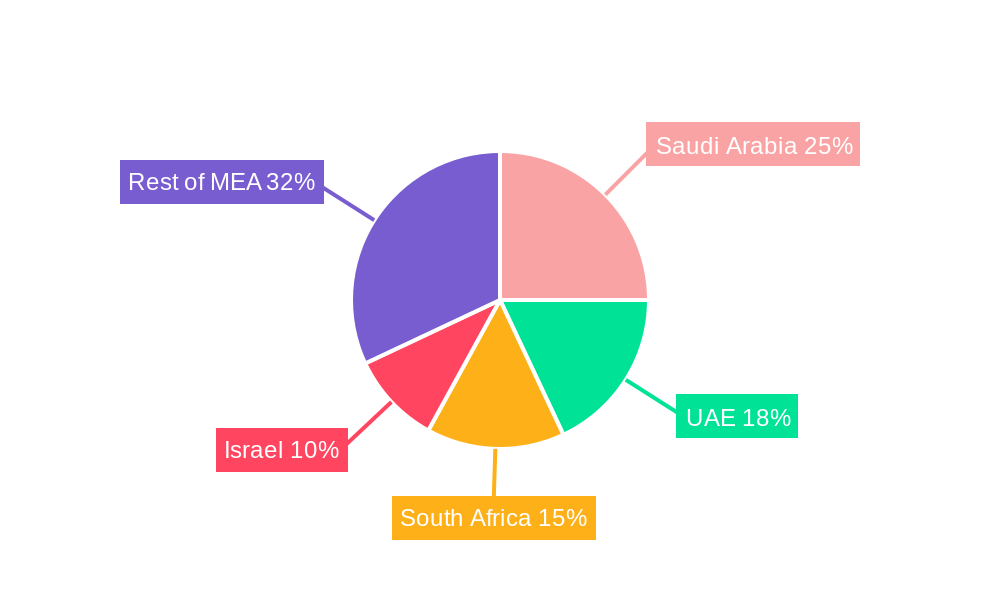

Dominant Markets & Segments in Middle East and Africa Frozen Food Packaging Market

This section identifies the dominant regions, countries, and segments within the Middle East and Africa frozen food packaging market.

By Primary Material: The report analyzes the market share of glass, paper, metal, plastic, and other materials, identifying the dominant material based on factors such as cost-effectiveness, sustainability, and barrier properties. Plastic packaging likely dominates due to its versatility and cost-effectiveness, though the market is increasingly sensitive to environmental concerns, creating growth opportunities for sustainable alternatives.

By Type of Packaging Product: The report analyzes the market shares of bags, boxes, tubs and cups, trays, wrappers, pouches, and other packaging types, pinpointing the dominant types based on food type, preservation requirements, and consumer preferences. Boxes and pouches may dominate due to their suitability for various frozen food products.

By Type of Food Product: The report examines the market share of packaging for readymade meals, fruits and vegetables, meat, seafood, baked goods, and others. This section will highlight the fastest-growing segments in terms of packaging demand. Ready-made meals and fruits and vegetables are likely to be high-growth sectors driven by convenience and health-consciousness.

By Country: The report analyzes the market size and growth prospects for Saudi Arabia, the United Arab Emirates, South Africa, Israel, and the rest of the Middle East and Africa. The Saudi Arabia market is likely to be dominant due to its large population and strong economic growth. Key drivers for each country are analyzed, including economic policies, infrastructure development, and consumer behavior. Growth projections for each country are provided.

Middle East and Africa Frozen Food Packaging Market Product Innovations

The Middle East and Africa frozen food packaging market is witnessing significant product innovations driven by the demand for sustainable and efficient packaging solutions. This includes the introduction of biodegradable and compostable packaging materials, as well as advancements in modified atmosphere packaging (MAP) to extend the shelf life of frozen food products. Innovative designs, such as resealable pouches and easy-open containers, are enhancing consumer convenience. These innovations are aimed at addressing consumer concerns about sustainability and improving the overall user experience while enhancing the supply chain efficiency for manufacturers.

Report Segmentation & Scope

This report segments the Middle East and Africa frozen food packaging market across several dimensions:

By Primary Material: Glass, Paper, Metal, Plastic, Others. Growth projections and market size are provided for each material type, emphasizing competitive dynamics based on cost, sustainability, and performance.

By Type of Packaging Product: Bags, Boxes, Tubs and Cups, Trays, Wrappers, Pouches, Other Types of Packaging. Market size and growth projections are provided for each packaging type, highlighting the dominant segments and their respective competitive landscapes.

By Type of Food Product: Readymade Meals, Fruits and Vegetables, Meat, Sea Food, Baked Goods, Others. This analysis includes market size estimations and growth forecasts, focusing on the competitive dynamics of each food category.

By Country: Saudi Arabia, United Arab Emirates, South Africa, Israel, Rest of Middle East and Africa. Each country's market size, growth potential, and key drivers are detailed.

Key Drivers of Middle East and Africa Frozen Food Packaging Market Growth

The growth of the Middle East and Africa frozen food packaging market is driven by several key factors. The rising demand for convenient and ready-to-eat meals is a primary driver, particularly in urban areas with busy lifestyles. Technological advancements in packaging materials, offering improved barrier properties and sustainability, are also contributing to market growth. Economic growth in several countries within the region is fueling higher disposable incomes, increasing spending on convenient food options and consequently driving up demand for frozen food packaging. Furthermore, favorable government regulations supporting food safety and infrastructure development are also propelling market expansion. The increasing awareness of food safety and hygiene is also a strong contributor, with consumers increasingly opting for frozen foods, which are perceived as safer and longer-lasting.

Challenges in the Middle East and Africa Frozen Food Packaging Market Sector

The Middle East and Africa frozen food packaging market faces several challenges. Fluctuations in raw material prices, particularly for plastics and other key materials, can impact profitability. Supply chain disruptions, including logistical hurdles and infrastructure limitations, can affect the timely delivery of packaging materials. Intense competition among established and emerging players exerts pressure on pricing and profit margins. Stringent regulatory compliance requirements regarding food safety and environmental sustainability pose a challenge for many companies. Furthermore, the relatively low levels of cold chain infrastructure in some parts of the region affect the quality and shelf life of frozen food products. The overall cost of compliance and maintaining consistent supply chain operations can be significant, particularly for smaller players in the market.

Leading Players in the Middle East and Africa Frozen Food Packaging Market Market

- WestRock Company

- Owens-Illinois

- Rexam Company

- Tetra Pak International

- Alcoa Corporation

- Nuconic Packaging

- The Scoular Company

- Toyo Seikan Group Holdings Ltd

- Graham Packaging Company Inc

- Ball Corporation Inc

- Crown Holdings

- Placon Corporation

- Genpak LLC

- Pactiv Evergreen

- Amcor Ltd

Key Developments in Middle East and Africa Frozen Food Packaging Market Sector

- June 2022: Siwar Foods, a new FMCG company in Saudi Arabia, launched a new line of ready-to-eat frozen meals and sweets, significantly boosting demand for convenient packaging solutions.

- August 2022: GEA Food Solutions secured a USD 4 Million contract with Wafrah for Industry and Development Co. in Saudi Arabia to supply automated lines for processing and packaging frozen and cooked meats, indicating investment in advanced packaging technologies within the region.

Strategic Middle East and Africa Frozen Food Packaging Market Market Outlook

The Middle East and Africa frozen food packaging market presents significant growth opportunities. Continued urbanization and rising disposable incomes will fuel demand for convenient frozen food products. The increasing focus on sustainability will drive the adoption of eco-friendly packaging materials. Strategic investments in cold chain infrastructure will enhance the market's efficiency and reduce product spoilage. Companies focusing on innovation, sustainability, and efficient supply chains are well-positioned to capitalize on this expanding market. The development of more sophisticated packaging technologies, coupled with expanding retail infrastructure and consumer preference shifts, presents a compelling long-term growth outlook for market players.

Middle East and Africa Frozen Food Packaging Market Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Metal

- 1.4. Plastic

- 1.5. Others

-

2. Type of Packaging Product

- 2.1. Bags

- 2.2. Boxes

- 2.3. Tubs and Cups

- 2.4. Trays

- 2.5. Wrappers

- 2.6. Pouches

- 2.7. Other Types of Packaging

-

3. Type of Food Product

- 3.1. Readymade Meals

- 3.2. Fruits and Vegetables

- 3.3. Meat

- 3.4. Sea Food

- 3.5. Baked Goods

- 3.6. Others

Middle East and Africa Frozen Food Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Frozen Food Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenience by Consumers; Increase in Disposable Income and Changing Consumer Behavior

- 3.3. Market Restrains

- 3.3.1. Government Regulations and Interventions

- 3.4. Market Trends

- 3.4.1. Plastic Packaging to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Frozen Food Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Metal

- 5.1.4. Plastic

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type of Packaging Product

- 5.2.1. Bags

- 5.2.2. Boxes

- 5.2.3. Tubs and Cups

- 5.2.4. Trays

- 5.2.5. Wrappers

- 5.2.6. Pouches

- 5.2.7. Other Types of Packaging

- 5.3. Market Analysis, Insights and Forecast - by Type of Food Product

- 5.3.1. Readymade Meals

- 5.3.2. Fruits and Vegetables

- 5.3.3. Meat

- 5.3.4. Sea Food

- 5.3.5. Baked Goods

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. South Africa Middle East and Africa Frozen Food Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East and Africa Frozen Food Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East and Africa Frozen Food Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East and Africa Frozen Food Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East and Africa Frozen Food Packaging Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East and Africa Frozen Food Packaging Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 WestRock Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Owens-Illinois

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Rexam Company

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Tetra Pak International

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Alcoa Corporatio

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Nuconic Packaging

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 The Scoular Company

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Toyo Seikan Group Holdings Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Graham Packaging Company Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Ball Corporation Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Crown Holdings

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Placon Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Genpak LLC

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Pactiv Evergreen

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Amcor Ltd

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 WestRock Company

List of Figures

- Figure 1: Middle East and Africa Frozen Food Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Frozen Food Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Frozen Food Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Frozen Food Packaging Market Revenue Million Forecast, by Primary Material 2019 & 2032

- Table 3: Middle East and Africa Frozen Food Packaging Market Revenue Million Forecast, by Type of Packaging Product 2019 & 2032

- Table 4: Middle East and Africa Frozen Food Packaging Market Revenue Million Forecast, by Type of Food Product 2019 & 2032

- Table 5: Middle East and Africa Frozen Food Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East and Africa Frozen Food Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East and Africa Frozen Food Packaging Market Revenue Million Forecast, by Primary Material 2019 & 2032

- Table 14: Middle East and Africa Frozen Food Packaging Market Revenue Million Forecast, by Type of Packaging Product 2019 & 2032

- Table 15: Middle East and Africa Frozen Food Packaging Market Revenue Million Forecast, by Type of Food Product 2019 & 2032

- Table 16: Middle East and Africa Frozen Food Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Saudi Arabia Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Arab Emirates Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Israel Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Qatar Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Kuwait Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Oman Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bahrain Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Jordan Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Lebanon Middle East and Africa Frozen Food Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Frozen Food Packaging Market?

The projected CAGR is approximately 4.21%.

2. Which companies are prominent players in the Middle East and Africa Frozen Food Packaging Market?

Key companies in the market include WestRock Company, Owens-Illinois, Rexam Company, Tetra Pak International, Alcoa Corporatio, Nuconic Packaging, The Scoular Company, Toyo Seikan Group Holdings Ltd, Graham Packaging Company Inc, Ball Corporation Inc, Crown Holdings, Placon Corporation, Genpak LLC, Pactiv Evergreen, Amcor Ltd.

3. What are the main segments of the Middle East and Africa Frozen Food Packaging Market?

The market segments include Primary Material, Type of Packaging Product, Type of Food Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenience by Consumers; Increase in Disposable Income and Changing Consumer Behavior.

6. What are the notable trends driving market growth?

Plastic Packaging to Dominate the Market.

7. Are there any restraints impacting market growth?

Government Regulations and Interventions.

8. Can you provide examples of recent developments in the market?

August 2022: One of the biggest producers of food lines and plants worldwide, German GEA Food Solutions, inked a contract with the Saudi food company Wafrah for Industry and Development Co. GEA Food Solutions would produce and provide Wafrah with highly automated lines for processing and packaging frozen and cooked meats under the USD 4 million deal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Frozen Food Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Frozen Food Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Frozen Food Packaging Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Frozen Food Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence