Key Insights

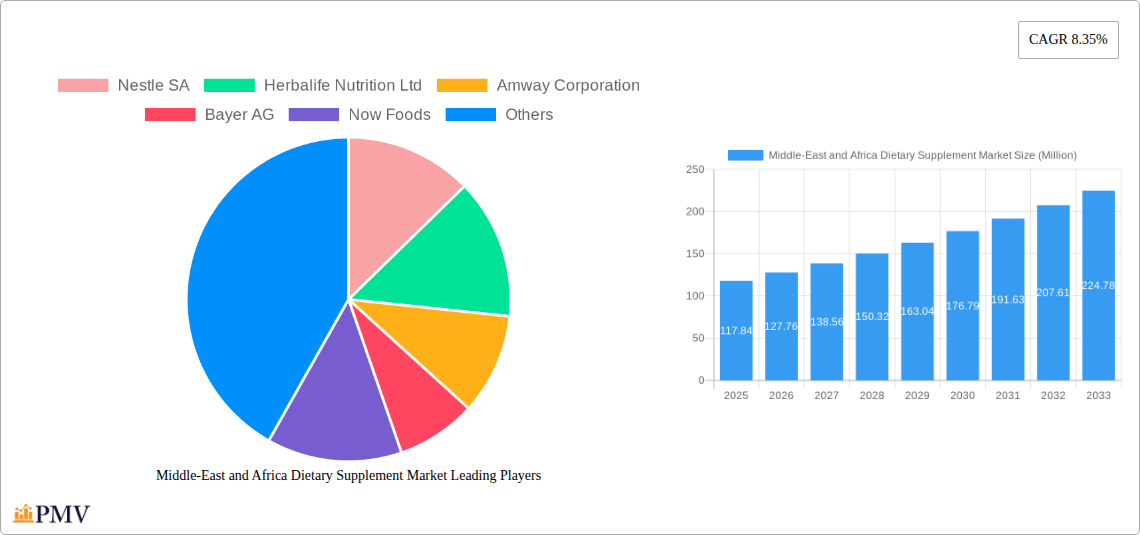

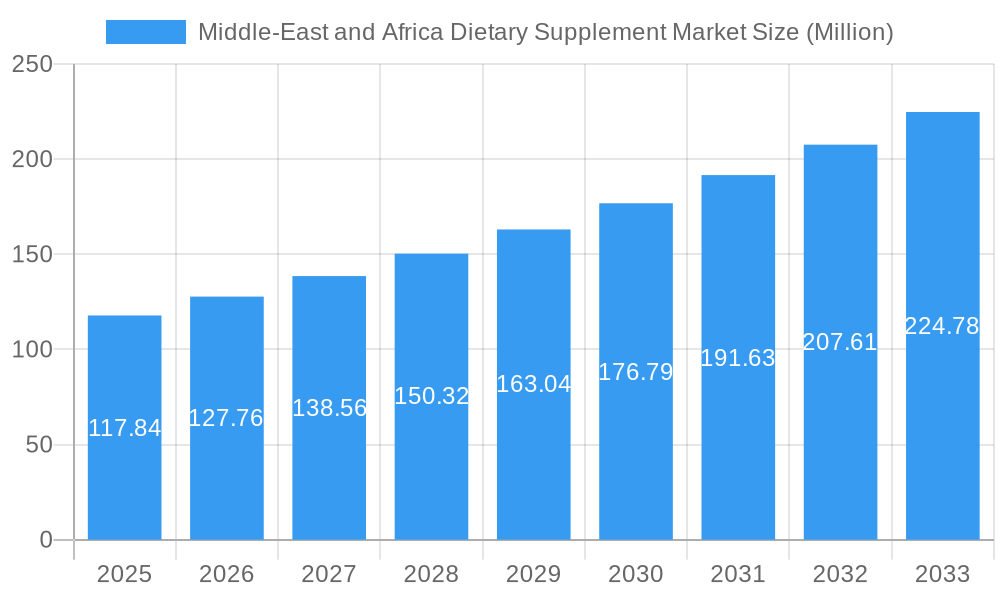

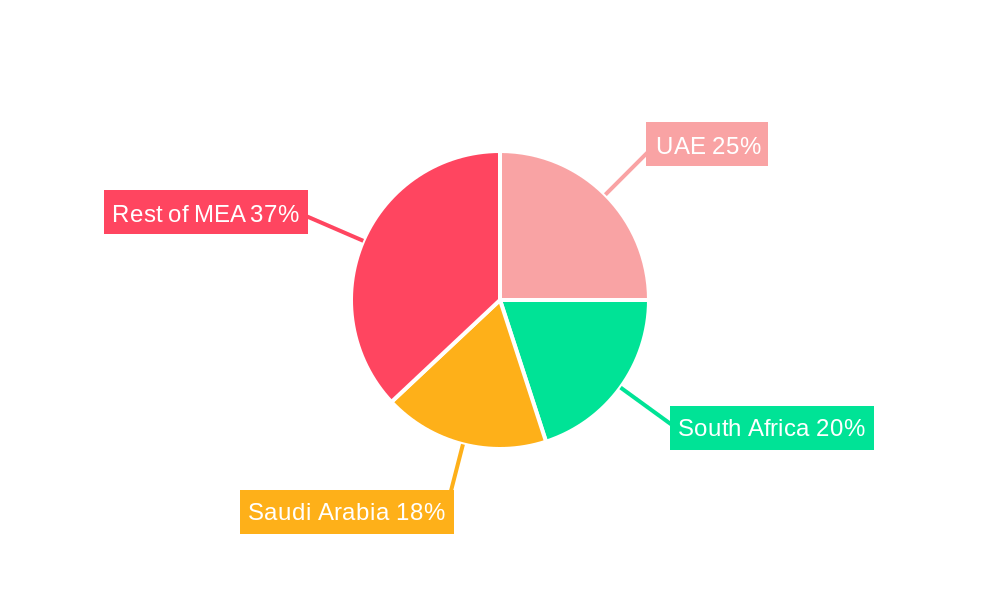

The Middle East and Africa (MEA) dietary supplement market, valued at $117.84 million in 2025, is projected to experience robust growth, driven by increasing health consciousness, rising disposable incomes, and a growing awareness of the benefits of preventative healthcare. The market's Compound Annual Growth Rate (CAGR) of 8.35% from 2025 to 2033 indicates a significant expansion opportunity. Key growth drivers include the increasing prevalence of chronic diseases like diabetes and cardiovascular issues, prompting consumers to seek natural health solutions. Furthermore, the rising popularity of fitness and wellness trends, coupled with increased media attention on the role of supplements in maintaining overall well-being, are significantly fueling market demand. The diverse product segments, encompassing vitamins and minerals, herbal supplements, proteins, probiotics, and fatty acids, cater to a broad range of consumer needs and preferences, contributing to market diversification. Strong distribution channels including supermarkets, pharmacies, and increasingly, online platforms ensure wide product accessibility. Leading players like Nestle SA, Herbalife Nutrition, and Amway are actively investing in product innovation and market penetration, intensifying competition and driving market dynamism. Specific regional variations within MEA, with markets like the UAE and South Africa showing considerable potential, present further growth opportunities for targeted marketing strategies.

Middle-East and Africa Dietary Supplement Market Market Size (In Million)

The market segmentation within MEA reveals valuable insights. The Vitamin and Mineral segment likely holds the largest market share, owing to widespread consumer awareness and their established role in supporting overall health. Herbal supplements are experiencing substantial growth driven by traditional medicine practices and increasing consumer interest in natural remedies. The online distribution channel is showing significant growth potential due to enhanced e-commerce infrastructure and increasing internet penetration, particularly amongst younger demographics. However, challenges remain including regulatory hurdles, varying consumer awareness levels across different regions, and price sensitivity amongst a portion of the consumer base. Overcoming these challenges will be crucial for continued market expansion. Future growth will likely be shaped by innovations in product formulation, targeted marketing initiatives catering to specific regional preferences, and the development of stronger regulatory frameworks.

Middle-East and Africa Dietary Supplement Market Company Market Share

Middle East & Africa Dietary Supplement Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East & Africa dietary supplement market, offering crucial insights for industry stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market trends, competitive dynamics, and growth opportunities within this rapidly evolving sector. The study incorporates data from the historical period (2019-2024) to provide a robust foundation for future projections.

Middle-East and Africa Dietary Supplement Market Market Structure & Competitive Dynamics

This section analyzes the Middle East and Africa dietary supplement market's competitive landscape, encompassing market concentration, innovation, regulatory frameworks, substitute products, end-user trends, and mergers & acquisitions (M&A) activities. The market is moderately concentrated, with key players such as Nestle SA, Herbalife Nutrition Ltd, Amway Corporation, and Bayer AG holding significant market share. However, numerous smaller players and regional brands also contribute to the market's dynamism. Innovation is driven by the demand for specialized supplements catering to specific health needs and preferences. Regulatory frameworks vary across the region, influencing product approvals and labeling requirements. The presence of substitute products, such as functional foods and traditional remedies, poses a competitive challenge. Consumer trends towards health and wellness fuel market growth, while M&A activities consolidate market positions and drive innovation. For example, in 2024, a significant M&A deal valued at approximately $xx Million consolidated two regional players, increasing market concentration by approximately 5%. The average market share of the top 5 players in 2024 was estimated at 40%, indicating opportunities for both expansion by existing players and entry by new ones.

Middle-East and Africa Dietary Supplement Market Industry Trends & Insights

The Middle East and Africa dietary supplement market is experiencing robust growth, driven by factors such as increasing health consciousness, rising disposable incomes, and growing awareness of the benefits of dietary supplements. The market exhibits a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration of dietary supplements is steadily increasing, particularly in urban areas with higher levels of health awareness and access to information. Technological advancements in supplement formulation and delivery systems are driving innovation and expanding product offerings. The growing popularity of online channels for supplement purchases is changing the distribution landscape. Consumer preferences are shifting towards natural and organic supplements, while personalized nutrition solutions are gaining traction. The competitive landscape is characterized by both intense rivalry among established players and the emergence of new entrants, leading to product diversification and price competition. This results in increased product innovation and consumer choice but creates pressure on margins for individual companies.

Dominant Markets & Segments in Middle-East and Africa Dietary Supplement Market

Within the Middle East and Africa region, [Specific Country/Region - e.g., Egypt or South Africa] emerges as a dominant market due to factors such as [Specific reasons - e.g., high population density, favorable economic conditions, and strong consumer demand].

By Type:

- The Vitamin and Mineral segment holds the largest market share, fueled by widespread awareness of their essential role in maintaining overall health.

- The Herbal Supplements segment experiences significant growth due to traditional medicine practices and the increasing popularity of natural remedies.

- Growth in the Protein and Amino Acids segment is driven by the rising fitness and sports nutrition trends, especially in urban centers.

By Distribution Channel:

- Supermarkets and Hypermarkets constitute a major distribution channel owing to their extensive reach and convenience.

- Pharmacies and Drug Stores benefit from the perception of supplements as healthcare products, fostering trust and expertise in product advice.

- Online Channels are experiencing rapid growth, offering convenience, product variety, and competitive pricing.

The growth of each segment is influenced by factors such as economic policies, healthcare infrastructure, and consumer preferences. The dominance of specific segments and channels varies across different countries and regions, reflecting the diversity of the overall market.

Middle-East and Africa Dietary Supplement Market Product Innovations

Recent product innovations focus on advanced delivery systems (e.g., liposomal encapsulation), personalized formulations based on genetic testing, and the incorporation of functional ingredients addressing specific health concerns (e.g., gut health, immune support). These innovations enhance product efficacy, bioavailability, and consumer appeal, allowing companies to differentiate themselves in a competitive market, appealing to health-conscious consumers seeking targeted solutions. The integration of technology in supplement development and marketing is also becoming increasingly prominent.

Report Segmentation & Scope

This report segments the Middle East & Africa dietary supplement market by:

By Type: Vitamin and Mineral, Herbal Supplements, Proteins and Amino Acids, Fatty Acids, Probiotics, Other Types. Each segment's growth trajectory is analyzed, providing market size projections and competitive dynamics.

By Distribution Channel: Supermarkets and Hypermarkets, Pharmacies and Drug Stores, Online Channels, Other Distribution Channels. Market share and growth forecasts for each distribution channel are included, considering emerging online retail trends. The report also examines the competitive intensity within each channel.

Key Drivers of Middle-East and Africa Dietary Supplement Market Growth

Several factors fuel the growth of the Middle East and Africa dietary supplement market. Rising health awareness among consumers, coupled with increasing disposable incomes, particularly in urban centers, fuels demand for health and wellness products. Government initiatives promoting healthy lifestyles and the increasing prevalence of chronic diseases are additional contributing factors. The expansion of e-commerce platforms provides wider access to supplements, further stimulating market expansion. Technological advancements in supplement formulation and delivery systems contribute to innovative product development, attracting health-conscious consumers.

Challenges in the Middle-East and Africa Dietary Supplement Market Sector

The Middle East and Africa dietary supplement market faces challenges, including varying regulatory frameworks across different countries, creating hurdles for manufacturers operating across the region. Supply chain complexities and inconsistencies in product quality due to unregulated manufacturing practices are also significant issues. Intense competition among established players and the emergence of new entrants contribute to pricing pressures. These challenges necessitate careful regulatory compliance, robust quality control, and strong distribution networks to ensure long-term success.

Leading Players in the Middle-East and Africa Dietary Supplement Market Market

- Nestle SA

- Herbalife Nutrition Ltd

- Amway Corporation

- Bayer AG

- Now Foods

- Jamieson Wellness

- Nordiac Naturals Inc

- Vitabiotics Ltd

- SA Natural Products Ltd

- GlaxoSmithKline PLC

Key Developments in Middle-East and Africa Dietary Supplement Market Sector

- October 2024: Nestle SA launched a new line of functional beverages targeting the sports nutrition market.

- June 2024: Herbalife Nutrition Ltd. partnered with a regional distributor to expand its reach in East Africa.

- March 2024: Amway Corporation invested in a new manufacturing facility in [Country] to enhance its production capacity.

- (Further developments can be added here)

Strategic Middle-East and Africa Dietary Supplement Market Market Outlook

The Middle East and Africa dietary supplement market holds significant growth potential, driven by rising health awareness and economic development. Strategic opportunities exist for companies to capitalize on consumer demand for personalized nutrition solutions, natural and organic products, and convenient online purchasing options. Investing in research and development to create innovative products tailored to the unique needs of the regional market will be crucial for success. Focusing on building strong distribution networks and complying with regulatory standards are also critical for long-term sustainability.

Middle-East and Africa Dietary Supplement Market Segmentation

-

1. Type

- 1.1. Vitamin and Mineral

- 1.2. Herbal Supplements

- 1.3. Proteins and Amino Acids

- 1.4. Fatty Acid

- 1.5. Probiotics

- 1.6. Other Types

-

2. Distribution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Pharmacies and Drug Stores

- 2.3. Online Channels

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. South Africa

- 3.4. Rest of Middle-East and Africa

Middle-East and Africa Dietary Supplement Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle-East and Africa Dietary Supplement Market Regional Market Share

Geographic Coverage of Middle-East and Africa Dietary Supplement Market

Middle-East and Africa Dietary Supplement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer Spending on Preventive Healthcare Products; Weight-loss Dietary Supplements Capturing the Market

- 3.3. Market Restrains

- 3.3.1. Escalating Functional Food Consumption; An Environment of Austere Regulations

- 3.4. Market Trends

- 3.4.1. Surging Consumer Healthcare Expenditure

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vitamin and Mineral

- 5.1.2. Herbal Supplements

- 5.1.3. Proteins and Amino Acids

- 5.1.4. Fatty Acid

- 5.1.5. Probiotics

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Pharmacies and Drug Stores

- 5.2.3. Online Channels

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. South Africa

- 5.3.4. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle-East and Africa Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Vitamin and Mineral

- 6.1.2. Herbal Supplements

- 6.1.3. Proteins and Amino Acids

- 6.1.4. Fatty Acid

- 6.1.5. Probiotics

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets and Hypermarkets

- 6.2.2. Pharmacies and Drug Stores

- 6.2.3. Online Channels

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. South Africa

- 6.3.4. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle-East and Africa Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Vitamin and Mineral

- 7.1.2. Herbal Supplements

- 7.1.3. Proteins and Amino Acids

- 7.1.4. Fatty Acid

- 7.1.5. Probiotics

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets and Hypermarkets

- 7.2.2. Pharmacies and Drug Stores

- 7.2.3. Online Channels

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. South Africa

- 7.3.4. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. South Africa Middle-East and Africa Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Vitamin and Mineral

- 8.1.2. Herbal Supplements

- 8.1.3. Proteins and Amino Acids

- 8.1.4. Fatty Acid

- 8.1.5. Probiotics

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets and Hypermarkets

- 8.2.2. Pharmacies and Drug Stores

- 8.2.3. Online Channels

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. South Africa

- 8.3.4. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Middle East and Africa Middle-East and Africa Dietary Supplement Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Vitamin and Mineral

- 9.1.2. Herbal Supplements

- 9.1.3. Proteins and Amino Acids

- 9.1.4. Fatty Acid

- 9.1.5. Probiotics

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets and Hypermarkets

- 9.2.2. Pharmacies and Drug Stores

- 9.2.3. Online Channels

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. South Africa

- 9.3.4. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nestle SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Herbalife Nutrition Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Amway Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Bayer AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Now Foods

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Jamieson Wellness*List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Nordiac Naturals Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Vitabiotics Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 SA Natural Products Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 GlaxoSmithKline PLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Nestle SA

List of Figures

- Figure 1: Middle-East and Africa Dietary Supplement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Dietary Supplement Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 5: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 11: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 13: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 19: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 20: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 21: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 28: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 29: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 33: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 35: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Distribution Channel 2020 & 2033

- Table 37: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Geography 2020 & 2033

- Table 39: Middle-East and Africa Dietary Supplement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Middle-East and Africa Dietary Supplement Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Dietary Supplement Market?

The projected CAGR is approximately 8.35%.

2. Which companies are prominent players in the Middle-East and Africa Dietary Supplement Market?

Key companies in the market include Nestle SA, Herbalife Nutrition Ltd, Amway Corporation, Bayer AG, Now Foods, Jamieson Wellness*List Not Exhaustive, Nordiac Naturals Inc, Vitabiotics Ltd, SA Natural Products Ltd, GlaxoSmithKline PLC.

3. What are the main segments of the Middle-East and Africa Dietary Supplement Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 117.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer Spending on Preventive Healthcare Products; Weight-loss Dietary Supplements Capturing the Market.

6. What are the notable trends driving market growth?

Surging Consumer Healthcare Expenditure.

7. Are there any restraints impacting market growth?

Escalating Functional Food Consumption; An Environment of Austere Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Dietary Supplement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Dietary Supplement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Dietary Supplement Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Dietary Supplement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence