Key Insights

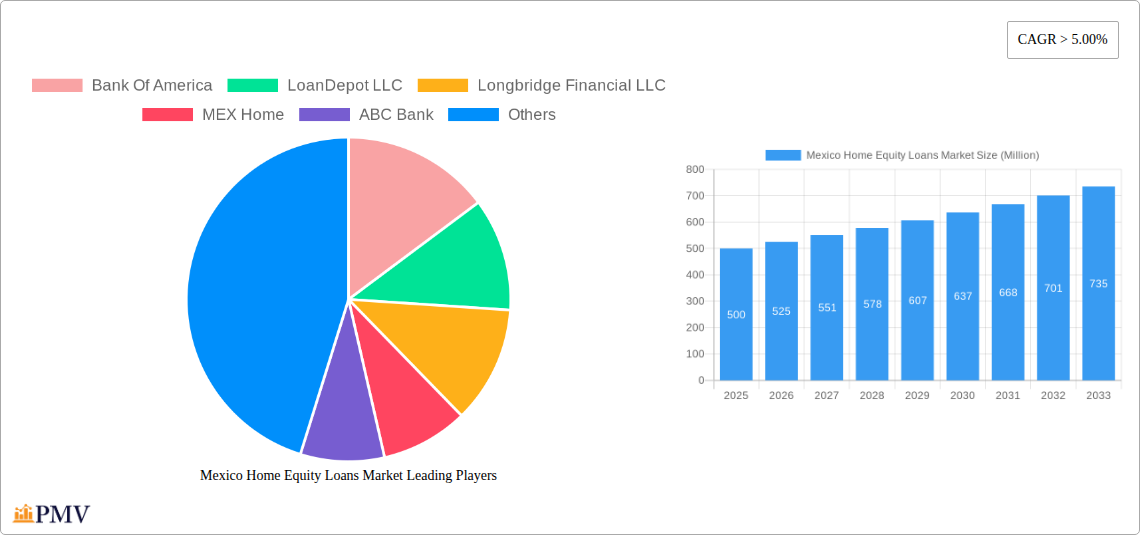

The Mexico home equity loan market is poised for significant expansion, projected at a 4.56% CAGR from 2024 to 2033. This robust growth is underpinned by increasing home values, rising disposable incomes, and a greater understanding of home equity as a flexible credit source. Competitive financing options from national and regional institutions are further stimulating market development. Key market segments include loan type, loan amount, and borrower demographics, enabling lenders to offer targeted financial solutions. The market is anticipated to reach 747.9 million by 2033.

Mexico Home Equity Loans Market Market Size (In Million)

The competitive environment is dynamic, with established national lenders such as Bank of America and LoanDepot LLC alongside regional banks and specialized entities like Mexlend. These players offer diverse product portfolios and cater to various market niches. The forecast period is expected to witness sustained growth, influenced by Mexico's ongoing economic development and increasing homeownership rates.

Mexico Home Equity Loans Market Company Market Share

Mexico Home Equity Loans Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Mexico Home Equity Loans Market, covering the period from 2019 to 2033. The study meticulously examines market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key growth drivers, offering valuable insights for investors, lenders, and industry stakeholders. With a base year of 2025 and a forecast period extending to 2033, this report presents a detailed view of the market's historical performance, current state, and future trajectory. The total market size is predicted to reach xx Million by 2033.

Mexico Home Equity Loans Market Market Structure & Competitive Dynamics

The Mexico Home Equity Loans Market exhibits a moderately consolidated structure, with a handful of major players commanding significant market share. The market's competitive landscape is characterized by intense rivalry, fueled by ongoing product innovations and strategic mergers and acquisitions (M&A). Regulatory frameworks, while evolving, generally support market growth. However, the presence of substitute financial products (e.g., personal loans) poses a challenge to market expansion. End-user trends toward digitalization and streamlined borrowing processes are reshaping market dynamics.

Key Market Structure Metrics:

- Market Concentration: Moderately Consolidated (xx% held by top 5 players in 2024).

- M&A Activity (2019-2024): xx deals with an estimated total value of xx Million. Notable examples include Guild Mortgage's acquisition of Legacy Mortgage in February 2023.

- Innovation Ecosystem: Moderate level of innovation driven by technological advancements in digital lending platforms and risk assessment models.

- Regulatory Framework: Generally supportive, with ongoing adjustments to consumer protection regulations.

Mexico Home Equity Loans Market Industry Trends & Insights

The Mexico Home Equity Loans Market is witnessing robust growth, driven primarily by rising homeownership rates, increasing disposable incomes, and favorable government policies. Technological disruptions, particularly in the form of fintech solutions, are streamlining the loan application and disbursement process, enhancing customer experience and market accessibility. Shifting consumer preferences towards digital platforms and personalized financial solutions are reshaping the market landscape. Competitive dynamics are marked by a focus on product differentiation, pricing strategies, and customer service excellence.

Key Metrics:

- CAGR (2019-2024): xx%

- Market Penetration: xx% (estimated for 2024)

- Growth Drivers: Rising homeownership rates, increasing disposable incomes, favorable government policies, and technological advancements.

- Challenges: Competition from substitute financial products, macroeconomic uncertainties, and regulatory changes.

Dominant Markets & Segments in Mexico Home Equity Loans Market

While detailed regional segmentation data is unavailable at this time, preliminary analysis suggests that urban areas with higher homeownership rates are likely the dominant markets within Mexico. Further research is required to precisely define the most dominant segment.

Key Drivers of Dominance:

- Higher homeownership rates in urban areas.

- Greater financial literacy and awareness of home equity loans.

- Concentrated presence of key lenders in urban centers.

Dominance Analysis: Further research is required to provide a concrete analysis on the dominant market segments, as data is limited. The report will further investigate this aspect with detailed regional and demographic segmentation to offer a clearer picture.

Mexico Home Equity Loans Market Product Innovations

Recent innovations in the Mexico Home Equity Loans Market revolve around technology-driven enhancements to the customer experience. Digital platforms are enabling faster loan applications, improved transparency, and personalized offerings. These innovations enhance the speed and efficiency of the lending process, improving customer satisfaction and attracting a broader range of borrowers. The increased use of AI and machine learning in credit scoring and risk assessment is also improving efficiency and reducing costs.

Report Segmentation & Scope

This report segments the Mexico Home Equity Loans Market based on several factors, including loan type (fixed-rate, adjustable-rate), loan amount, borrower demographics (age, income, credit score), and geographic location. Growth projections and market size estimates are provided for each segment, alongside a detailed analysis of the competitive dynamics within each. Further research will refine the segment projections and clarify the competitive landscape.

Key Drivers of Mexico Home Equity Loans Market Growth

Several factors contribute to the growth of the Mexico Home Equity Loans Market. Increasing homeownership rates, rising household incomes, and favorable government policies encouraging homeownership are key contributors. Technological advancements such as digital lending platforms and improved credit scoring models also play a significant role. The increasing adoption of online lending platforms contributes to faster processing times and improved customer experiences.

Challenges in the Mexico Home Equity Loans Market Sector

The Mexico Home Equity Loans Market faces several challenges. These include competition from alternative financial products, macroeconomic uncertainties affecting consumer spending and creditworthiness, and the risk of regulatory changes impacting lending practices. Moreover, the need for continuous adaptation to evolving consumer preferences and technological advancements poses an ongoing challenge to market participants.

Leading Players in the Mexico Home Equity Loans Market Market

- Bank Of America

- LoanDepot LLC

- Longbridge Financial LLC

- MEX Home

- ABC Bank

- WaFd Bank

- Bank of Albuquerque

- Mexlend

- Pinnacle Bank

- New Mexico Bank And Trust

- List Not Exhaustive

Key Developments in Mexico Home Equity Loans Market Sector

- August 2022: Rocket Mortgage, a leading mortgage lender in Mexico, launched a new home equity loan product, aiming to address rising consumer debt. This signifies a significant market expansion and increased competition within the sector.

- February 2023: Guild Mortgage's acquisition of Legacy Mortgage in New Mexico expanded its market reach and product offerings in the Southwest region. This consolidation within the market could lead to increased efficiency and market share.

Strategic Mexico Home Equity Loans Market Market Outlook

The Mexico Home Equity Loans Market holds significant growth potential. Further expansion will likely be driven by ongoing technological innovations, increasing financial inclusion, and supportive government policies. Strategic opportunities lie in expanding digital lending capabilities, providing tailored products to specific customer segments, and leveraging partnerships to enhance market reach. The market is poised for sustained growth, particularly with further advancements in financial technology and enhanced consumer awareness.

Mexico Home Equity Loans Market Segmentation

-

1. Types

- 1.1. Fixed Rate Loans

- 1.2. Home Equity Line of Credit

-

2. Service Provider

- 2.1. Commercial Banks

- 2.2. Financial Institutions

- 2.3. Credit Unions

- 2.4. Other Creditors

-

3. Mode

- 3.1. Online

- 3.2. Offline

Mexico Home Equity Loans Market Segmentation By Geography

- 1. Mexico

Mexico Home Equity Loans Market Regional Market Share

Geographic Coverage of Mexico Home Equity Loans Market

Mexico Home Equity Loans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk

- 3.3. Market Restrains

- 3.3.1. Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk

- 3.4. Market Trends

- 3.4.1. Financial And Socioeconomic Factors Favouring The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Home Equity Loans Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Fixed Rate Loans

- 5.1.2. Home Equity Line of Credit

- 5.2. Market Analysis, Insights and Forecast - by Service Provider

- 5.2.1. Commercial Banks

- 5.2.2. Financial Institutions

- 5.2.3. Credit Unions

- 5.2.4. Other Creditors

- 5.3. Market Analysis, Insights and Forecast - by Mode

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bank Of America

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LoanDepot LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Longbridge Financial LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MEX Home

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ABC Bank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 WaFd Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bank of Albuquerque

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mexlend

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pinnacle Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 New Mexico Bank And Trust**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bank Of America

List of Figures

- Figure 1: Mexico Home Equity Loans Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Mexico Home Equity Loans Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Home Equity Loans Market Revenue million Forecast, by Types 2020 & 2033

- Table 2: Mexico Home Equity Loans Market Revenue million Forecast, by Service Provider 2020 & 2033

- Table 3: Mexico Home Equity Loans Market Revenue million Forecast, by Mode 2020 & 2033

- Table 4: Mexico Home Equity Loans Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Mexico Home Equity Loans Market Revenue million Forecast, by Types 2020 & 2033

- Table 6: Mexico Home Equity Loans Market Revenue million Forecast, by Service Provider 2020 & 2033

- Table 7: Mexico Home Equity Loans Market Revenue million Forecast, by Mode 2020 & 2033

- Table 8: Mexico Home Equity Loans Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Home Equity Loans Market?

The projected CAGR is approximately 4.56%.

2. Which companies are prominent players in the Mexico Home Equity Loans Market?

Key companies in the market include Bank Of America, LoanDepot LLC, Longbridge Financial LLC, MEX Home, ABC Bank, WaFd Bank, Bank of Albuquerque, Mexlend, Pinnacle Bank, New Mexico Bank And Trust**List Not Exhaustive.

3. What are the main segments of the Mexico Home Equity Loans Market?

The market segments include Types, Service Provider, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 747.9 million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk.

6. What are the notable trends driving market growth?

Financial And Socioeconomic Factors Favouring The Market.

7. Are there any restraints impacting market growth?

Rise in the price of Housing Units increasing Home Equity loan demand by borrower; Decline in Inflation and lending interest rate reducing lender risk.

8. Can you provide examples of recent developments in the market?

On August 2022, Rocket Mortgage, Mexico's largest mortgage lender and a part of Rocket Companies introduced a home equity loan to give Americans one more way to pay off debt that has risen along with inflation. Detroit-based Rocket Mortgage is enabling the American Dream of homeownership and financial freedom through its obsession with an industry-leading, digital-driven client experience

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Home Equity Loans Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Home Equity Loans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Home Equity Loans Market?

To stay informed about further developments, trends, and reports in the Mexico Home Equity Loans Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence