Key Insights

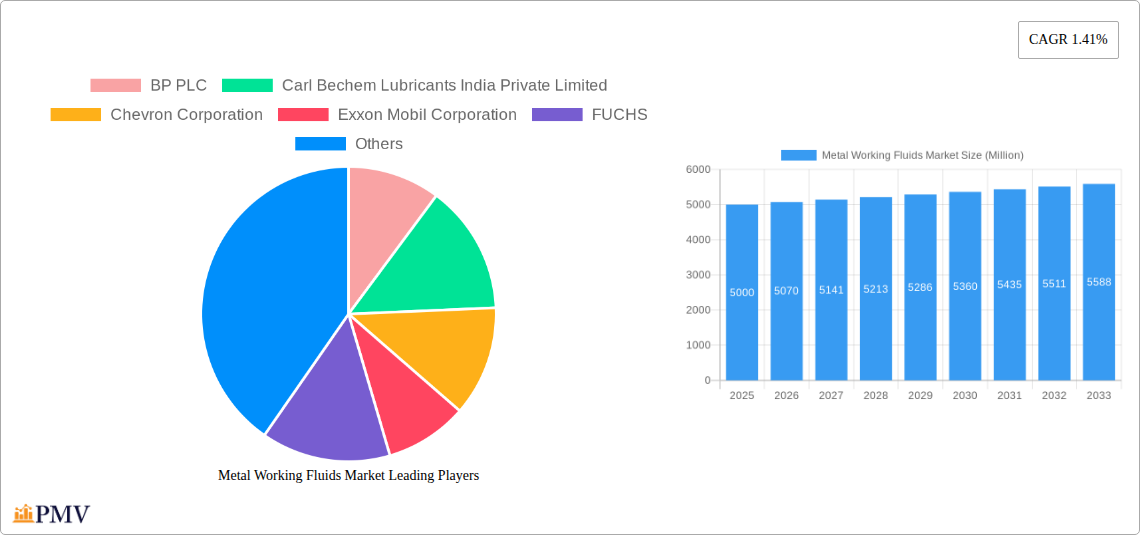

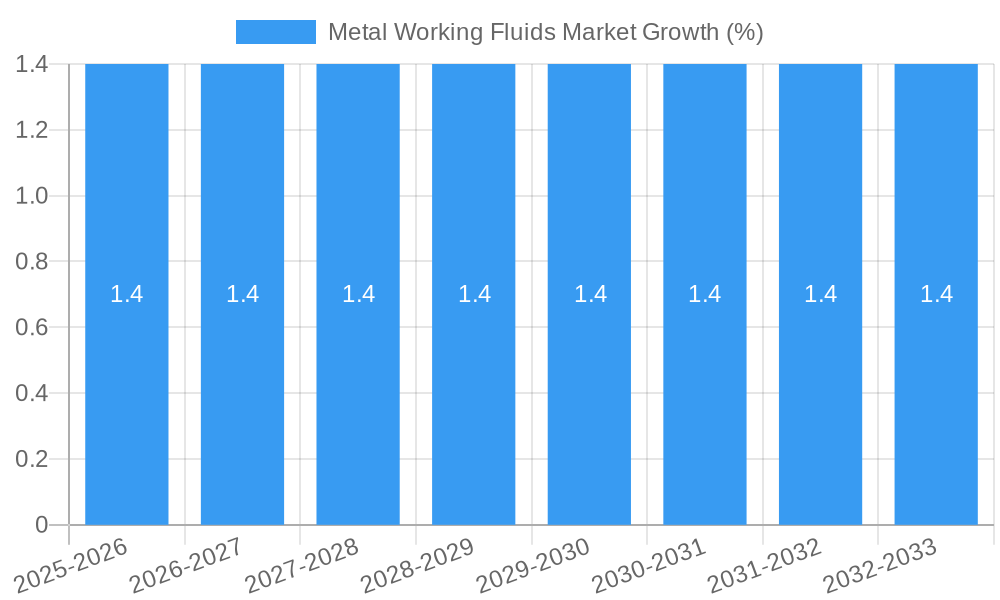

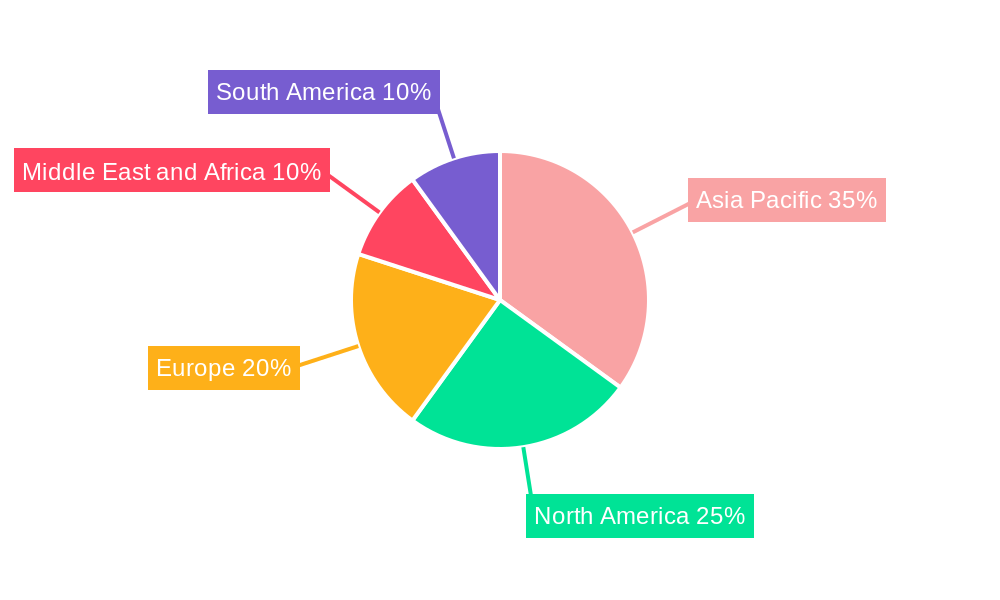

The global Metal Working Fluids market is projected to reach an estimated $XX million in 2025, exhibiting a modest Compound Annual Growth Rate (CAGR) of 1.41% through 2033. This steady growth is primarily driven by the continued demand from manufacturing sectors, particularly automotive, aerospace, and heavy machinery, where metalworking processes are integral. Key drivers include advancements in fluid formulations offering enhanced performance, extended tool life, and improved workpiece finish. Furthermore, the increasing adoption of automation and precision manufacturing techniques necessitates specialized metal working fluids that can meet stringent operational requirements. The market is also influenced by evolving environmental regulations and a growing preference for eco-friendly and sustainable fluid options, pushing manufacturers to innovate towards biodegradable and low-toxicity formulations. The Asia Pacific region, led by China and India, is expected to remain a dominant force due to its robust manufacturing base and increasing industrialization.

Despite the overall positive trajectory, the market faces certain restraints. The fluctuating raw material prices, especially for base oils and additives, can impact production costs and profit margins. Moreover, the stringent disposal regulations for used metal working fluids pose an ongoing challenge for end-users and manufacturers alike, necessitating investment in waste management and recycling technologies. However, emerging trends such as the development of synthetic and semi-synthetic fluids with superior lubrication and cooling properties, along with the integration of smart technologies for fluid monitoring and maintenance, are expected to create new avenues for growth. The market is segmented into Removal Fluids, Forming Fluids, Protection Fluids, and Treating Fluids, each catering to specific stages of the metalworking process and contributing to the overall market dynamics.

This comprehensive Metal Working Fluids Market report delivers an in-depth analysis of the global metalworking lubricant market and its sub-segments. Spanning the study period 2019–2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report provides critical insights into market dynamics, growth drivers, emerging trends, and competitive landscapes. The metalworking fluids industry is a vital component of the manufacturing sector, supporting a wide array of industrial processes. This report will equip stakeholders with actionable intelligence to navigate the evolving metalworking fluid applications and capitalize on future opportunities.

Metal Working Fluids Market Market Structure & Competitive Dynamics

The metal working fluids market exhibits a moderately concentrated structure, with key global players dominating significant market share. Innovation plays a crucial role, driven by continuous research and development in biodegradable metalworking fluids, synthetic metalworking fluids, and high-performance formulations that enhance machining efficiency and tool longevity. Regulatory frameworks, particularly concerning environmental impact and health safety, are increasingly influencing product development and market entry strategies. Product substitutes, such as dry machining techniques, present a competitive challenge, necessitating advancements in fluid performance and sustainability. End-user trends reveal a growing demand for specialized fluids tailored to specific materials and manufacturing processes, including those for advanced composites and additive manufacturing. Mergers and acquisitions (M&A) activity remains a key strategy for market expansion and consolidation. For instance, recent years have seen strategic acquisitions aimed at broadening product portfolios and geographical reach. The metal working fluids market share is influenced by the adoption of advanced manufacturing technologies and the increasing focus on operational efficiency across industries.

- Market Concentration: Dominated by a few multinational corporations, with a growing presence of specialized regional players.

- Innovation Ecosystem: Driven by R&D in eco-friendly formulations, high-performance additives, and application-specific solutions.

- Regulatory Frameworks: Strict environmental and health regulations (e.g., REACH, OSHA) shaping product composition and disposal practices.

- Product Substitutes: Dry machining, minimum quantity lubrication (MQL) systems.

- End-User Trends: Demand for biodegradable, low-VOC, and high-performance fluids for precision engineering and automation.

- M&A Activities: Strategic acquisitions to enhance product portfolios, expand market reach, and gain technological expertise. Anticipated M&A deal values in the coming years are projected to be in the range of several hundred million dollars as companies seek to strengthen their market positions.

Metal Working Fluids Market Industry Trends & Insights

The metal working fluids market is experiencing robust growth, propelled by the resurgence of manufacturing activities globally and the increasing adoption of advanced machining technologies. The CAGR for the metalworking fluid market is estimated to be approximately 4.5% during the forecast period. A significant trend is the escalating demand for eco-friendly metalworking fluids, driven by stringent environmental regulations and growing corporate sustainability initiatives. This has spurred considerable investment in the development and adoption of biodegradable metalworking fluids and water-based formulations that reduce environmental impact and improve worker safety. Technological disruptions, such as the rise of Industry 4.0 and automation, are also reshaping the market. Smart metalworking fluids with enhanced monitoring capabilities and self-healing properties are emerging as key innovations.

Consumer preferences are shifting towards fluids that offer superior performance, extended tool life, and improved surface finish, while minimizing waste and maintenance costs. The automotive, aerospace, and heavy machinery sectors continue to be major consumers of metalworking fluids, with their demand being closely linked to global industrial production output. The competitive dynamics are characterized by a strong emphasis on product differentiation through superior performance, sustainability, and technical support. Companies are investing heavily in R&D to develop next-generation fluids that address specific industry challenges, such as machining difficult-to-cut alloys and high-temperature applications. The market penetration of specialized fluids for additive manufacturing and 3D printing is also on the rise, indicating a diversification of applications. Geographically, emerging economies, particularly in Asia-Pacific, are showcasing significant growth potential due to rapid industrialization and increasing manufacturing investments. The global market size for metal working fluids is projected to reach approximately USD 15 Billion by 2033.

Dominant Markets & Segments in Metal Working Fluids Market

The metal working fluids market is significantly influenced by regional economic policies, infrastructure development, and the strength of its manufacturing base. Asia-Pacific, particularly China, India, and Southeast Asian nations, is emerging as a dominant region due to its robust manufacturing sector, expanding automotive industry, and substantial investments in infrastructure and industrial automation. The country's large manufacturing output directly translates into high demand for a wide range of metalworking lubricant products.

Among the product types, Removal Fluids represent the largest and most dominant segment. These fluids are essential for machining operations like grinding, milling, and turning, where they lubricate, cool, and flush away chips, thereby enhancing tool life and surface quality.

- Key Drivers for Dominance:

- Economic Policies: Government incentives for manufacturing growth and export promotion.

- Infrastructure Development: Significant investment in industrial zones and manufacturing facilities.

- Automotive Sector Growth: A primary driver for removal fluids due to high-volume production of automotive components.

- Aerospace and Defense Industry: Demand for high-precision machining and specialized metalworking fluids.

- Technological Advancements: Adoption of high-speed machining and advanced tooling requiring superior cooling and lubrication.

The dominance of Removal Fluids is further bolstered by their widespread application across diverse industries, including automotive, aerospace, heavy machinery, and general manufacturing. The continuous need for efficient material removal in these sectors ensures sustained demand. While Forming Fluids, Protection Fluids, and Treating Fluids are crucial for their respective applications (e.g., stamping, corrosion prevention, surface finishing), Removal Fluids consistently command a larger market share due to the sheer volume of machining operations performed globally. The market size for Removal Fluids is estimated to be around USD 7 Billion in 2025.

Metal Working Fluids Market Product Innovations

Product innovation in the metal working fluids market is primarily focused on enhancing performance, sustainability, and application specificity. Advancements in synthetic metalworking fluids offer superior cooling and lubrication properties, extending tool life and improving machining accuracy. The development of biodegradable metalworking fluids addresses increasing environmental concerns, with formulations that break down naturally, reducing waste disposal issues. Innovations also include low-mist metalworking fluids and low-VOC (volatile organic compound) options to improve worker safety and air quality in manufacturing environments. Metalworking fluids with enhanced corrosion inhibition and excellent lubricity for challenging materials like titanium and composites are also gaining traction. These innovations provide a competitive advantage by meeting stringent regulatory requirements and evolving end-user demands for efficient, safe, and environmentally responsible solutions.

Report Segmentation & Scope

This report meticulously segments the metal working fluids market by product type, offering granular insights into each category.

- Removal Fluids: This segment encompasses lubricants and coolants used in operations such as cutting, grinding, milling, and drilling. Their market size is projected to reach USD 8 Billion by 2033, driven by extensive use in automotive and general manufacturing.

- Forming Fluids: These fluids are utilized in processes like stamping, drawing, and forging, facilitating material deformation while preventing tool wear. The market for forming fluids is anticipated to grow steadily, reaching approximately USD 3 Billion by 2033.

- Protection Fluids: This category includes rust preventatives and temporary coatings designed to protect metal components from corrosion during storage and transportation. Their market size is estimated to be around USD 2 Billion by 2033.

- Treating Fluids: These fluids are used in surface treatment processes such as passivation and cleaning, enhancing the properties of metal surfaces. Their market is expected to reach USD 1.5 Billion by 2033.

Key Drivers of Metal Working Fluids Market Growth

The metal working fluids market is propelled by several interconnected drivers. The increasing demand for high-precision manufacturing across industries like automotive, aerospace, and electronics necessitates advanced metalworking lubricant solutions that ensure optimal performance and extended tool life. Global industrialization and the subsequent growth in manufacturing output, especially in emerging economies, directly translate into higher consumption of these fluids. Furthermore, stringent environmental regulations are driving the adoption of eco-friendly metalworking fluids, creating a significant market opportunity for biodegradable and low-VOC formulations. Technological advancements in machining, such as the adoption of high-speed machining and automation, also demand fluids with superior cooling and lubrication capabilities.

Challenges in the Metal Working Fluids Market Sector

Despite strong growth, the metal working fluids market faces several challenges. Increasing environmental and health regulations, while driving innovation, also impose higher compliance costs for manufacturers. Fluctuations in raw material prices, particularly for base oils and additives, can impact profit margins and product pricing. The development of advanced dry machining technologies and minimum quantity lubrication (MQL) systems presents a competitive threat, potentially reducing the demand for conventional metalworking lubricants. Additionally, the disposal of spent metalworking fluids poses environmental challenges, necessitating investment in recycling and waste treatment technologies. Supply chain disruptions and geopolitical uncertainties can also affect the availability and cost of raw materials.

Leading Players in the Metal Working Fluids Market Market

- BP PLC

- Carl Bechem Lubricants India Private Limited

- Chevron Corporation

- Exxon Mobil Corporation

- FUCHS

- Hindustan Petroleum Corporation Limited

- Indian Oil Corporation Ltd

- Kemipex

- SKF

- Motul

- PETRONAS Lubricants International

- TotalEnergies

- Saudi Arabian Oil Co

Key Developments in Metal Working Fluids Market Sector

- September 2023: FUCHS Group inaugurated a state-of-the-art facility in Ba Ria-Vung Tau, Vietnam, with an investment of EUR 9 million (USD 9.52 million). The plant's production range includes automotive oils, industrial oils, metalworking fluids, and specialized solutions for the mining sector. This strategic investment positions FUCHS Vietnam to swiftly address the growing lubricant demands in the region.

- February 2023: Univar Solutions Inc. secured exclusive distribution rights for Automate's oil-based dyes and authorized distribution rights for water-based dyes. These agreements cater specifically to customers in lubricants and metalworking fluids across the United States and Canada. This new agreement enhances Univar Solutions' specialty ingredients portfolio, offering products designed for diverse applications in lubricant, oil, grease, and fuel coloration.

Strategic Metal Working Fluids Market Market Outlook

- September 2023: FUCHS Group inaugurated a state-of-the-art facility in Ba Ria-Vung Tau, Vietnam, with an investment of EUR 9 million (USD 9.52 million). The plant's production range includes automotive oils, industrial oils, metalworking fluids, and specialized solutions for the mining sector. This strategic investment positions FUCHS Vietnam to swiftly address the growing lubricant demands in the region.

- February 2023: Univar Solutions Inc. secured exclusive distribution rights for Automate's oil-based dyes and authorized distribution rights for water-based dyes. These agreements cater specifically to customers in lubricants and metalworking fluids across the United States and Canada. This new agreement enhances Univar Solutions' specialty ingredients portfolio, offering products designed for diverse applications in lubricant, oil, grease, and fuel coloration.

Strategic Metal Working Fluids Market Market Outlook

The strategic outlook for the metal working fluids market is characterized by sustained growth and evolving opportunities. The increasing emphasis on sustainability will continue to drive demand for eco-friendly metalworking fluids, presenting a significant avenue for companies investing in biodegradable and bio-based formulations. The integration of Industry 4.0 and smart manufacturing technologies will fuel the need for advanced metalworking lubricants with enhanced monitoring and predictive capabilities. Furthermore, the growing prominence of additive manufacturing will create new niches for specialized metalworking fluids designed for unique material processing requirements. Strategic partnerships and collaborations focused on R&D, distribution networks, and sustainable solutions will be crucial for market players to maintain a competitive edge and capitalize on the projected expansion of the global metalworking fluid market.

Metal Working Fluids Market Segmentation

-

1. Product Type

- 1.1. Removal Fluids

- 1.2. Forming Fluids

- 1.3. Protection Fluids

- 1.4. Treating Fluids

Metal Working Fluids Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Malaysia

- 1.6. Thailand

- 1.7. Indonesia

- 1.8. Vietnam

- 1.9. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. NORDIC Countries

- 3.7. Turkey

- 3.8. Russia

- 3.9. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Colombia

- 4.4. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. Qatar

- 5.3. United Arab Emirates

- 5.4. Nigeria

- 5.5. Egypt

- 5.6. South Africa

- 5.7. Rest of Middle East and Africa

Metal Working Fluids Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.41% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Automotive Sector; Increasing Demand from the Heavy Machinery Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Growing Demand from the Automotive Sector; Increasing Demand from the Heavy Machinery Industry; Other Drivers

- 3.4. Market Trends

- 3.4.1. Growing Demand from the Automotive Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metal Working Fluids Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Removal Fluids

- 5.1.2. Forming Fluids

- 5.1.3. Protection Fluids

- 5.1.4. Treating Fluids

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Metal Working Fluids Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Removal Fluids

- 6.1.2. Forming Fluids

- 6.1.3. Protection Fluids

- 6.1.4. Treating Fluids

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Metal Working Fluids Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Removal Fluids

- 7.1.2. Forming Fluids

- 7.1.3. Protection Fluids

- 7.1.4. Treating Fluids

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Metal Working Fluids Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Removal Fluids

- 8.1.2. Forming Fluids

- 8.1.3. Protection Fluids

- 8.1.4. Treating Fluids

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Metal Working Fluids Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Removal Fluids

- 9.1.2. Forming Fluids

- 9.1.3. Protection Fluids

- 9.1.4. Treating Fluids

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Metal Working Fluids Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Removal Fluids

- 10.1.2. Forming Fluids

- 10.1.3. Protection Fluids

- 10.1.4. Treating Fluids

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BP PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Carl Bechem Lubricants India Private Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Chevron Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Exxon Mobil Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FUCHS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hindustan Petroleum Corporation Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Indian Oil Corporation Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kemipex

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SKF

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Motul

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PETRONAS Lubricants International

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TotalEnergies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Saudi Arabian Oil Co *List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 BP PLC

List of Figures

- Figure 1: Global Metal Working Fluids Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Metal Working Fluids Market Revenue (Million), by Product Type 2024 & 2032

- Figure 3: Asia Pacific Metal Working Fluids Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 4: Asia Pacific Metal Working Fluids Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Asia Pacific Metal Working Fluids Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Metal Working Fluids Market Revenue (Million), by Product Type 2024 & 2032

- Figure 7: North America Metal Working Fluids Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 8: North America Metal Working Fluids Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Metal Working Fluids Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Metal Working Fluids Market Revenue (Million), by Product Type 2024 & 2032

- Figure 11: Europe Metal Working Fluids Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 12: Europe Metal Working Fluids Market Revenue (Million), by Country 2024 & 2032

- Figure 13: Europe Metal Working Fluids Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: South America Metal Working Fluids Market Revenue (Million), by Product Type 2024 & 2032

- Figure 15: South America Metal Working Fluids Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 16: South America Metal Working Fluids Market Revenue (Million), by Country 2024 & 2032

- Figure 17: South America Metal Working Fluids Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Middle East and Africa Metal Working Fluids Market Revenue (Million), by Product Type 2024 & 2032

- Figure 19: Middle East and Africa Metal Working Fluids Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Middle East and Africa Metal Working Fluids Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Middle East and Africa Metal Working Fluids Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Metal Working Fluids Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Metal Working Fluids Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Metal Working Fluids Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Metal Working Fluids Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 5: Global Metal Working Fluids Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: India Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Malaysia Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Thailand Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Indonesia Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Vietnam Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia Pacific Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Metal Working Fluids Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: Global Metal Working Fluids Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Metal Working Fluids Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 21: Global Metal Working Fluids Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Germany Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: United Kingdom Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: NORDIC Countries Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Turkey Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Russia Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Metal Working Fluids Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 32: Global Metal Working Fluids Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Colombia Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Rest of South America Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Metal Working Fluids Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 38: Global Metal Working Fluids Market Revenue Million Forecast, by Country 2019 & 2032

- Table 39: Saudi Arabia Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Qatar Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Arab Emirates Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Nigeria Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Egypt Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Africa Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Middle East and Africa Metal Working Fluids Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal Working Fluids Market?

The projected CAGR is approximately 1.41%.

2. Which companies are prominent players in the Metal Working Fluids Market?

Key companies in the market include BP PLC, Carl Bechem Lubricants India Private Limited, Chevron Corporation, Exxon Mobil Corporation, FUCHS, Hindustan Petroleum Corporation Limited, Indian Oil Corporation Ltd, Kemipex, SKF, Motul, PETRONAS Lubricants International, TotalEnergies, Saudi Arabian Oil Co *List Not Exhaustive.

3. What are the main segments of the Metal Working Fluids Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Automotive Sector; Increasing Demand from the Heavy Machinery Industry; Other Drivers.

6. What are the notable trends driving market growth?

Growing Demand from the Automotive Sector.

7. Are there any restraints impacting market growth?

Growing Demand from the Automotive Sector; Increasing Demand from the Heavy Machinery Industry; Other Drivers.

8. Can you provide examples of recent developments in the market?

September 2023: FUCHS Group inaugurated a state-of-the-art facility in Ba Ria-Vung Tau, Vietnam, with an investment of EUR 9 million (USD 9.52 million). The plant's production range includes automotive oils, industrial oils, metalworking fluids, and specialized solutions for the mining sector. This strategic investment positions FUCHS Vietnam to swiftly address the growing lubricant demands in the region.February 2023: Univar Solutions Inc. secured exclusive distribution rights for Automate's oil-based dyes and authorized distribution rights for water-based dyes. These agreements cater specifically to customers in lubricants and metalworking fluids across the United States and Canada. This new agreement enhances Univar Solutions' specialty ingredients portfolio, offering products designed for diverse applications in lubricant, oil, grease, and fuel coloration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metal Working Fluids Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metal Working Fluids Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metal Working Fluids Market?

To stay informed about further developments, trends, and reports in the Metal Working Fluids Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence