Key Insights

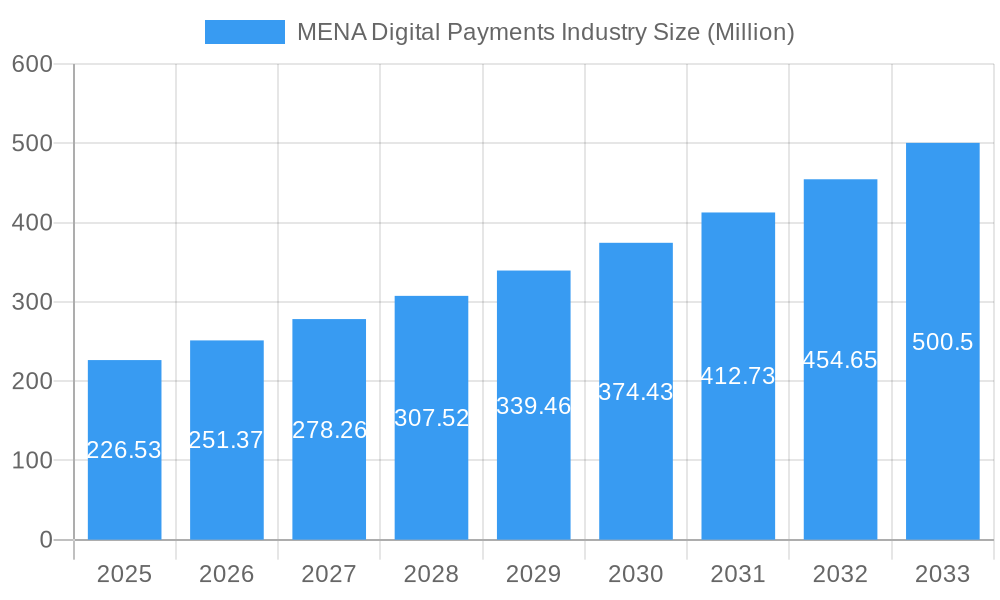

The Middle East and North Africa (MENA) digital payments industry is experiencing robust growth, driven by increasing smartphone penetration, rising e-commerce adoption, and government initiatives promoting financial inclusion. The market, valued at $226.53 million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 10.95% from 2025 to 2033. This expansion is fueled by a young and tech-savvy population readily embracing digital solutions for transactions. Factors such as the increasing popularity of mobile wallets, the expansion of fintech companies offering innovative payment solutions, and the growing reliance on online services are key contributors to this surge. The UAE, Saudi Arabia, and Egypt represent significant market segments, showcasing high adoption rates and robust infrastructure development. However, challenges remain, including concerns around data security and the need for further infrastructure development in some less-developed regions within the MENA area. Competition is fierce, with both established players like Mastercard and PayPal alongside rapidly expanding regional fintechs vying for market share. The impact of the COVID-19 pandemic accelerated the shift towards digital payments, creating a lasting impact on consumer behavior and further bolstering market growth.

MENA Digital Payments Industry Market Size (In Million)

The forecast period (2025-2033) anticipates continued expansion, particularly in countries actively promoting digital financial services. The industry's future hinges on addressing challenges like cybersecurity, regulatory frameworks, and ensuring seamless cross-border transactions. Successful navigation of these factors will further accelerate growth and solidify the MENA region's position as a dynamic hub for digital payments innovation. Continued investment in infrastructure, coupled with the development of user-friendly and secure platforms, will be crucial in maximizing the market's potential. The growing adoption of open banking technologies also presents exciting opportunities for the industry, fostering greater competition and innovation.

MENA Digital Payments Industry Company Market Share

MENA Digital Payments Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Middle East and North Africa (MENA) digital payments industry, covering market size, growth drivers, competitive landscape, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for businesses, investors, and policymakers seeking to understand this rapidly evolving market. The report leverages data from the historical period (2019-2024) to project future trends and provides actionable insights into the opportunities and challenges within the MENA digital payments ecosystem. The total market value is estimated at xx Million in 2025.

MENA Digital Payments Industry Market Structure & Competitive Dynamics

This section analyzes the competitive intensity and structure of the MENA digital payments market. We delve into market concentration, examining the market share held by key players like Alphabet Inc (Google Pay), Mastercard (MasterPass), Paypal Holdings Inc, and others. We also assess the innovation ecosystems, regulatory frameworks (including licensing and compliance requirements), and the prevalence of product substitutes (e.g., cash, checks). Further, we analyze end-user trends, such as the shift towards mobile payments and the adoption of digital wallets, and quantify the impact of mergers and acquisitions (M&A) activities. The estimated value of M&A deals in the sector from 2019 to 2024 totaled xx Million. Key aspects include:

- Market Concentration: Analysis of market share distribution among major players.

- Innovation Ecosystems: Assessment of fintech startups, accelerators, and incubators.

- Regulatory Landscape: Examination of national and regional regulations impacting digital payments.

- Product Substitutes: Evaluation of the competitive pressure from traditional payment methods.

- End-User Trends: Analysis of consumer behavior and adoption of digital payment technologies.

- M&A Activity: Review of significant mergers, acquisitions, and their impact on market dynamics.

MENA Digital Payments Industry Industry Trends & Insights

This section provides a detailed overview of the key trends shaping the MENA digital payments landscape. We examine market growth drivers, including the increasing smartphone penetration, rising internet usage, and government initiatives promoting financial inclusion. The Compound Annual Growth Rate (CAGR) for the MENA digital payments market is projected to be xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of blockchain technology and the expansion of open banking, are also analyzed. Furthermore, this section explores consumer preferences for different payment methods and analyzes competitive dynamics, including pricing strategies and service differentiation. Market penetration rates for various payment methods are presented, showcasing the growth potential in the region.

Dominant Markets & Segments in MENA Digital Payments Industry

This section identifies and analyzes the dominant markets and segments within the MENA digital payments industry.

- Saudi Arabia: High economic growth, government support for digital transformation, and a young, tech-savvy population are key drivers. The market is characterized by a high level of competition among both international and domestic players. Market size in 2025 is estimated at xx Million.

- United Arab Emirates (UAE): The UAE is a leader in digital payment adoption, driven by a well-developed infrastructure and supportive regulatory environment. The impact of COVID-19 on the UAE's payment infrastructure accelerated digital adoption. Market size in 2025 is estimated at xx Million.

- Egypt: Egypt's large population and increasing mobile phone penetration present significant growth opportunities. Initiatives like Mastercard's partnership with AAIB are driving digital transformation. Market size in 2025 is estimated at xx Million.

- Morocco: Steady economic growth and government investments in digital infrastructure contribute to the growth of the digital payments market. Market size in 2025 is estimated at xx Million.

- Turkey: Turkey's robust digital economy and high mobile penetration contribute to the growth of the digital payments market. Market size in 2025 is estimated at xx Million.

- Rest of MENA (Iran, Bahrain, Qatar, Oman): These markets present varying levels of development and adoption, influenced by unique economic and regulatory factors. Market size in 2025 is estimated at xx Million.

MENA Digital Payments Industry Product Innovations

Recent product innovations are driving market transformation. New mobile payment apps, advanced digital wallets, and innovative solutions leveraging biometric authentication are gaining traction. The focus is on enhanced security features, seamless user experiences, and the integration of various payment methods to cater to diverse consumer needs. This innovation creates competitive advantages for players who can effectively adapt to evolving technological trends and meet the growing demands of the market.

Report Segmentation & Scope

This report segments the MENA digital payments market by country (Saudi Arabia, UAE, Egypt, Morocco, Turkey, and Rest of MENA), payment type (mobile payments, online payments, cards, etc.), and user type (consumers, businesses). Each segment's growth projections, market sizes, and competitive dynamics are analyzed. Detailed market size estimates and growth forecasts are provided for each segment for the forecast period (2025-2033).

Key Drivers of MENA Digital Payments Industry Growth

Several factors fuel the growth of the MENA digital payments industry. These include:

- Rising Smartphone Penetration and Internet Usage: Widespread mobile phone and internet access are fundamental to digital payment adoption.

- Government Initiatives: Government support for financial inclusion and digital transformation is accelerating market growth.

- Technological Advancements: Innovations like mobile wallets and biometric authentication enhance convenience and security.

- Increasing E-commerce Activity: The growing online retail sector drives demand for digital payment solutions.

Challenges in the MENA Digital Payments Industry Sector

Despite significant growth potential, the MENA digital payments market faces certain challenges. These include:

- Regulatory Hurdles: Varying regulations across countries can create complexities for businesses operating regionally.

- Cybersecurity Concerns: The risk of fraud and data breaches remains a significant concern for both consumers and businesses.

- Financial Literacy: Limited financial literacy among certain segments of the population can hinder adoption.

- Infrastructure Gaps: Uneven internet and mobile network access in some areas can limit digital payment penetration.

Leading Players in the MENA Digital Payments Industry Market

- Alphabet Inc (Google Pay)

- Saudi Digital Payment Company

- First Data

- ACI Worldwide Inc

- Fawry

- Mastercard (MasterPass)

- CIB Bank

- Paypal Holdings Inc

- Samsung Corporation

- Apple Inc

- Denarii Cas

Key Developments in MENA Digital Payments Industry Sector

- November 2022: Mastercard's strategic partnership with Arab African International Bank (AAIB) to accelerate Egypt's digital transformation. This signifies a major push towards expanding digital payment solutions in Egypt.

- May 2022: Visa's partnership with Fundbox to provide small business-focused digital payment solutions. This highlights the expansion of digital payment services to the SME sector.

Strategic MENA Digital Payments Industry Market Outlook

The MENA digital payments market holds substantial long-term potential. Continued growth in smartphone penetration, increased government support for digital transformation, and ongoing technological advancements will drive market expansion. Strategic opportunities exist for companies that can offer innovative, secure, and user-friendly payment solutions tailored to the specific needs of the MENA region. Focus on expanding financial inclusion and addressing cybersecurity concerns will be crucial for long-term success in this dynamic market.

MENA Digital Payments Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

MENA Digital Payments Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MENA Digital Payments Industry Regional Market Share

Geographic Coverage of MENA Digital Payments Industry

MENA Digital Payments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Proliferation of Smartphones & Social Interactions; Enablement Programs by Key Retailers to Bridge the Gap Between Physical and Digital World; Launch of Real-time Payment Systems in Key GCC and North African Countries; Increasing Emphasis on Customer Satisfaction and Convergence of Global Trends in the Region

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulations in the Payments Industry

- 3.4. Market Trends

- 3.4.1. High Proliferation of Smartphones and Social Interactions to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MENA Digital Payments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America MENA Digital Payments Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America MENA Digital Payments Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe MENA Digital Payments Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa MENA Digital Payments Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific MENA Digital Payments Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Alphabet Inc (Google Pay)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Saudi Digital Payment Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 First Data

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ACI Worldwide?

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fawry

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mastercard (MasterPass)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CIB Bank

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ACI Worldwide Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Paypal Holdings Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Samsung Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Apple Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Denarii Cas

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Alphabet Inc (Google Pay)

List of Figures

- Figure 1: Global MENA Digital Payments Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America MENA Digital Payments Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America MENA Digital Payments Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America MENA Digital Payments Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America MENA Digital Payments Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America MENA Digital Payments Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America MENA Digital Payments Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America MENA Digital Payments Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America MENA Digital Payments Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America MENA Digital Payments Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America MENA Digital Payments Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America MENA Digital Payments Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America MENA Digital Payments Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America MENA Digital Payments Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America MENA Digital Payments Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America MENA Digital Payments Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America MENA Digital Payments Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America MENA Digital Payments Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America MENA Digital Payments Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America MENA Digital Payments Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America MENA Digital Payments Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America MENA Digital Payments Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America MENA Digital Payments Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America MENA Digital Payments Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America MENA Digital Payments Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe MENA Digital Payments Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe MENA Digital Payments Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe MENA Digital Payments Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe MENA Digital Payments Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe MENA Digital Payments Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe MENA Digital Payments Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe MENA Digital Payments Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe MENA Digital Payments Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe MENA Digital Payments Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe MENA Digital Payments Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe MENA Digital Payments Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe MENA Digital Payments Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa MENA Digital Payments Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa MENA Digital Payments Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa MENA Digital Payments Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa MENA Digital Payments Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa MENA Digital Payments Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa MENA Digital Payments Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa MENA Digital Payments Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa MENA Digital Payments Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa MENA Digital Payments Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa MENA Digital Payments Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa MENA Digital Payments Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa MENA Digital Payments Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific MENA Digital Payments Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific MENA Digital Payments Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific MENA Digital Payments Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific MENA Digital Payments Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific MENA Digital Payments Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific MENA Digital Payments Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific MENA Digital Payments Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific MENA Digital Payments Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific MENA Digital Payments Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific MENA Digital Payments Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific MENA Digital Payments Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific MENA Digital Payments Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MENA Digital Payments Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global MENA Digital Payments Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global MENA Digital Payments Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global MENA Digital Payments Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global MENA Digital Payments Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global MENA Digital Payments Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global MENA Digital Payments Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global MENA Digital Payments Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global MENA Digital Payments Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global MENA Digital Payments Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global MENA Digital Payments Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global MENA Digital Payments Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global MENA Digital Payments Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global MENA Digital Payments Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global MENA Digital Payments Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global MENA Digital Payments Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global MENA Digital Payments Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global MENA Digital Payments Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global MENA Digital Payments Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global MENA Digital Payments Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global MENA Digital Payments Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global MENA Digital Payments Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global MENA Digital Payments Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global MENA Digital Payments Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global MENA Digital Payments Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global MENA Digital Payments Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global MENA Digital Payments Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global MENA Digital Payments Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global MENA Digital Payments Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global MENA Digital Payments Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global MENA Digital Payments Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global MENA Digital Payments Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global MENA Digital Payments Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global MENA Digital Payments Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global MENA Digital Payments Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global MENA Digital Payments Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific MENA Digital Payments Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MENA Digital Payments Industry?

The projected CAGR is approximately 10.95%.

2. Which companies are prominent players in the MENA Digital Payments Industry?

Key companies in the market include Alphabet Inc (Google Pay), Saudi Digital Payment Company, First Data, ACI Worldwide?, Fawry, Mastercard (MasterPass), CIB Bank, ACI Worldwide Inc, Paypal Holdings Inc, Samsung Corporation, Apple Inc, Denarii Cas.

3. What are the main segments of the MENA Digital Payments Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 226.53 Million as of 2022.

5. What are some drivers contributing to market growth?

High Proliferation of Smartphones & Social Interactions; Enablement Programs by Key Retailers to Bridge the Gap Between Physical and Digital World; Launch of Real-time Payment Systems in Key GCC and North African Countries; Increasing Emphasis on Customer Satisfaction and Convergence of Global Trends in the Region.

6. What are the notable trends driving market growth?

High Proliferation of Smartphones and Social Interactions to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Stringent Regulations in the Payments Industry.

8. Can you provide examples of recent developments in the market?

November 2022: As part of its initiative to speed up the digital transformation of Egypt's financial ecosystem, Mastercard has announced a long-term strategic partnership with the Arab African International Bank (AAIB). Through this partnership, Mastercard and AAIB will concentrate on planning and executing AAIB's digital transformation strategy and delivering cutting-edge payment solutions that satisfy the growing consumer demand for simple and secure digital payment methods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MENA Digital Payments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MENA Digital Payments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MENA Digital Payments Industry?

To stay informed about further developments, trends, and reports in the MENA Digital Payments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence