Key Insights

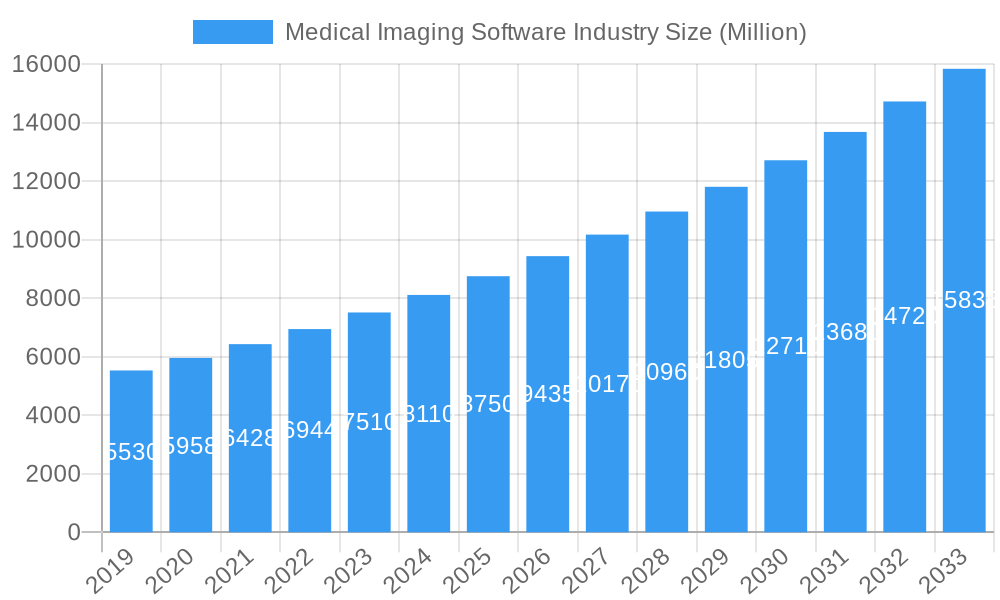

The global Medical Imaging Software market is poised for significant expansion, projected to reach $8.11 Million by 2025, driven by a robust compound annual growth rate (CAGR) of 7.84%. This impressive growth trajectory is fueled by the increasing adoption of advanced imaging modalities like 3D and 4D imaging, which offer superior diagnostic accuracy and patient care across various medical specialties. The rising prevalence of chronic diseases globally, coupled with an aging population, is directly contributing to the escalating demand for sophisticated medical imaging solutions. Furthermore, the continuous advancements in software technologies, including AI and machine learning integration for image analysis and workflow optimization, are empowering healthcare providers to make faster and more informed clinical decisions. Key application areas such as orthopedics, cardiology, and obstetrics and gynecology are leading the adoption curve, benefiting from enhanced visualization and quantitative analysis capabilities. The growing emphasis on early disease detection and personalized medicine further amplifies the need for cutting-edge medical imaging software, cementing its role as a critical component of modern healthcare infrastructure.

Medical Imaging Software Industry Market Size (In Billion)

The market is characterized by dynamic segmentation, with 2D, 3D, and 4D imaging types catering to diverse clinical needs. Dental and orthopedic applications are witnessing substantial growth, attributed to the increasing demand for minimally invasive procedures and reconstructive surgeries. Cardiology and obstetrics/gynecology applications also represent significant segments, leveraging advanced software for precise diagnosis and treatment planning. While the market is experiencing strong growth, certain restraints such as the high cost of advanced software solutions and the need for extensive training for healthcare professionals may pose challenges. However, the ongoing digital transformation in healthcare, coupled with increasing investments in R&D by leading companies like Siemens Healthcare, Philips, and GE Healthcare, is expected to mitigate these challenges. The competitive landscape is marked by strategic collaborations and product innovations, aiming to enhance diagnostic capabilities and improve patient outcomes. The Asia Pacific region, particularly China and India, is emerging as a high-growth market due to increasing healthcare expenditure and a burgeoning patient population.

Medical Imaging Software Industry Company Market Share

Unlocking the Future of Healthcare: Comprehensive Medical Imaging Software Industry Report (2019–2033)

Gain unparalleled insights into the dynamic Medical Imaging Software market. This in-depth report, covering the historical period 2019–2024 and a robust forecast from 2025–2033 with a 2025 base and estimated year, provides a complete market structure, competitive analysis, and future outlook for medical imaging software solutions. Navigate the complex landscape of 2D Imaging, 3D Imaging, and 4D Imaging across critical applications like Dental Applications, Orthopaedic Applications, Cardiology Applications, Obstetrics and Gynaecology Applications, Mammography Applications, and Urology and Nephrology Applications. Discover the strategic initiatives of key players including Esaote SpA, Siemens Healthcare, General Healthcare Company (GE), Koninklijke Philips N.V., Agfa Gevaert HealthCare, Cerner Corporation, MIM Software Inc, Canon Medical Systems Corporation, Fujifilm Holding Company, Carestream Health Inc, Change Healthcare, and Novarad Corporation. With a projected market size of over XX Million USD and a CAGR of XX%, this report is essential for stakeholders seeking to capitalize on the burgeoning medical imaging software solutions and healthcare IT advancements.

Medical Imaging Software Industry Market Structure & Competitive Dynamics

The Medical Imaging Software market exhibits a moderately consolidated structure, characterized by the presence of large, established players alongside niche innovators. Key market participants like Siemens Healthcare, General Healthcare Company (GE), and Koninklijke Philips N.V. hold significant market share, driven by extensive product portfolios, robust R&D investments, and strong global distribution networks. Innovation ecosystems are flourishing, particularly around Artificial Intelligence (AI) in medical imaging, with companies investing heavily in developing AI-powered diagnostic tools and workflow enhancements. Regulatory frameworks, such as HIPAA and GDPR, play a crucial role in shaping market entry and product development, ensuring data privacy and security. Product substitutes are emerging, including advanced visualization techniques and AI-driven analysis platforms, posing a competitive challenge to traditional software. End-user trends indicate a growing demand for integrated Picture Archiving and Communication Systems (PACS) and Vendor Neutral Archives (VNA), alongside a preference for cloud-based solutions and interoperability. Mergers and Acquisitions (M&A) activities are prevalent, with significant deal values in the hundreds of millions of USD, as larger companies seek to acquire specialized technologies and expand their market reach. For instance, the acquisition of smaller AI imaging startups by major healthcare technology providers is a recurring theme.

Medical Imaging Software Industry Industry Trends & Insights

The Medical Imaging Software industry is experiencing substantial growth, fueled by several converging trends. The increasing prevalence of chronic diseases globally drives the demand for advanced diagnostic imaging techniques, consequently boosting the need for sophisticated medical imaging software. Technological advancements, particularly in Artificial Intelligence (AI) and Machine Learning (ML), are revolutionizing the field. AI algorithms are being integrated into imaging software for enhanced image analysis, automated detection of abnormalities, and predictive diagnostics, significantly improving accuracy and efficiency. The expansion of cloud-based solutions is another major trend, offering greater accessibility, scalability, and cost-effectiveness for healthcare providers. This shift to cloud infrastructure facilitates remote access to patient data and images, improving collaboration among medical professionals. Furthermore, the growing adoption of teleradiology services, accelerated by the COVID-19 pandemic, further propels the demand for robust and secure medical imaging software that supports remote interpretation and reporting.

Consumer preferences are evolving, with patients and healthcare providers alike seeking faster, more accurate, and less invasive diagnostic procedures. This demand necessitates software that can optimize imaging workflows, reduce scan times, and provide superior image quality. The push towards value-based healthcare is also influencing the market, with an emphasis on software that can demonstrate improved patient outcomes and reduced healthcare costs. Data analytics and big data capabilities are becoming increasingly important as healthcare organizations aim to leverage imaging data for research, population health management, and personalized medicine. The competitive landscape is intensifying, with both established players and new entrants vying for market share. Strategic partnerships and collaborations are common as companies aim to combine expertise and accelerate innovation. The market penetration of advanced imaging software is steadily increasing across developed and developing economies, driven by government initiatives, increasing healthcare expenditure, and growing awareness of the benefits of modern diagnostic tools. The projected CAGR for the Medical Imaging Software market is estimated to be around XX% over the forecast period, indicating robust growth potential.

Dominant Markets & Segments in Medical Imaging Software Industry

The North America region currently dominates the global Medical Imaging Software market, driven by advanced healthcare infrastructure, high healthcare expenditure, and rapid adoption of new technologies. The United States, in particular, is a significant contributor to this dominance, with a well-established ecosystem of healthcare providers, research institutions, and technology companies.

Imaging Type Dominance:

- 2D Imaging: Remains the foundational imaging type due to its widespread use in various modalities and its established workflow. Its lower cost of implementation and broader compatibility ensure its continued prevalence.

- 3D Imaging: Is experiencing significant growth, driven by its superior visualization capabilities, enabling more precise diagnosis and treatment planning, especially in complex anatomies.

- 4D Imaging: Shows strong potential, particularly in applications requiring dynamic visualization of physiological processes, such as cardiology and obstetrics.

Application Dominance:

- Cardiology Applications: This segment is a major revenue generator due to the high incidence of cardiovascular diseases and the critical role of imaging in diagnosis, monitoring, and intervention. Advanced software for cardiac MRI, CT, and ultrasound is in high demand.

- Orthopaedic Applications: The increasing aging population and rising cases of musculoskeletal disorders contribute to the growth of this segment. Software for orthopedic imaging supports pre-operative planning, post-operative assessment, and the development of personalized treatment strategies.

- Obstetrics and Gynaecology Applications: Driven by the need for accurate fetal monitoring and diagnosis of gynecological conditions, this segment is a consistent performer. The increasing adoption of 3D and 4D ultrasound further fuels its growth.

- Mammography Applications: Essential for breast cancer screening and diagnosis, this segment is critical. Advancements in AI-powered mammography analysis software are enhancing detection rates and reducing false positives, making it a key area of development.

- Dental Applications: Driven by the increasing demand for cosmetic dentistry and the growing adoption of digital radiography and cone-beam CT (CBCT), this segment is expanding rapidly.

- Urology and Nephrology Applications: Software for imaging in these specialties aids in the diagnosis and management of kidney stones, tumors, and other urinary tract disorders.

Key Drivers for Dominance:

- Favorable Economic Policies: Government funding for healthcare research and development, coupled with supportive policies for technology adoption.

- Robust Healthcare Infrastructure: Advanced hospital systems, clinics, and diagnostic centers capable of integrating and utilizing sophisticated imaging software.

- High Disposable Income: Enabling greater patient expenditure on advanced healthcare services.

- Technological Advancements: Continuous innovation in imaging modalities and software solutions, driving demand for upgrades and new implementations.

- Awareness and Screening Programs: Increased public awareness about the importance of early disease detection.

The market penetration of advanced imaging software, including AI-powered solutions, is significantly higher in developed regions like North America and Europe compared to emerging economies, though the latter are rapidly catching up due to increasing investments in healthcare modernization.

Medical Imaging Software Industry Product Innovations

Product innovations in the Medical Imaging Software industry are primarily focused on enhancing diagnostic accuracy, improving workflow efficiency, and enabling personalized medicine. The integration of Artificial Intelligence (AI) and Machine Learning (ML) is a paramount trend, leading to the development of AI-powered tools for image interpretation, anomaly detection, and predictive analytics. For example, new software solutions are emerging that can automatically segment organs, quantify disease progression, and flag critical findings for radiologists. Advanced visualization techniques, including real-time 3D rendering and augmented reality overlays, are transforming surgical planning and interventional procedures. Cloud-based platforms are continuously evolving, offering enhanced data security, scalability, and interoperability, enabling seamless data sharing and collaboration across healthcare networks. These innovations provide competitive advantages by improving diagnostic throughput, reducing errors, and ultimately leading to better patient outcomes.

Report Segmentation & Scope

This comprehensive report segments the Medical Imaging Software market by Imaging Type and Application. The Imaging Type segmentation includes 2D Imaging, 3D Imaging, and 4D Imaging. 2D Imaging represents the largest segment currently, with steady growth projected due to its foundational role. 3D Imaging is expected to witness significant expansion, driven by its enhanced visualization capabilities. 4D Imaging shows promising growth, particularly in dynamic applications. The Application segmentation covers Dental Applications, Orthopaedic Applications, Cardiology Applications, Obstetrics and Gynaecology Applications, Mammography Applications, and Urology and Nephrology Applications, along with Other Applications. The Cardiology Applications segment is a leading revenue generator, expected to maintain strong growth. Orthopaedic Applications and Obstetrics and Gynaecology Applications are also projected for robust expansion. Market sizes and growth projections are detailed for each segment, alongside an analysis of competitive dynamics influencing their respective trajectories.

Key Drivers of Medical Imaging Software Industry Growth

Several key drivers are propelling the growth of the Medical Imaging Software industry. Technologically, the rapid advancements in Artificial Intelligence (AI) and Machine Learning (ML) are paramount, enabling more accurate diagnoses, faster analysis, and personalized treatment planning. The increasing prevalence of chronic diseases globally, such as cardiovascular diseases, cancer, and neurological disorders, necessitates sophisticated diagnostic tools, directly boosting demand for advanced imaging software. Economic factors, including rising healthcare expenditure in both developed and developing nations and favorable government initiatives promoting healthcare digitalization, are significant growth accelerators. Regulatory support for adopting advanced medical technologies and data interoperability standards further facilitates market expansion. The growing demand for minimally invasive procedures and early disease detection also fuels the need for high-resolution imaging and precise software analysis.

Challenges in the Medical Imaging Software Industry Sector

The Medical Imaging Software industry faces several challenges that could impede its growth trajectory. Regulatory hurdles remain significant, with stringent approval processes for new software, especially those incorporating AI, and evolving data privacy regulations like GDPR requiring constant adaptation. Interoperability issues between different imaging modalities, PACS systems, and Electronic Health Records (EHRs) can create workflow inefficiencies and hinder seamless data integration, impacting the adoption of comprehensive solutions. The high cost of implementation for advanced imaging software and hardware can be a barrier for smaller healthcare facilities and those in emerging economies. Furthermore, cybersecurity threats and the need for robust data protection are critical concerns, requiring substantial investment in secure infrastructure and protocols. Intense competition among established players and new entrants also puts pressure on pricing and profit margins, while the ongoing shortage of skilled radiology professionals and IT specialists can impact implementation and support.

Leading Players in the Medical Imaging Software Industry Market

- Esaote SpA

- Siemens Healthcare

- General Healthcare Company (GE)

- Koninklijke Philips N.V.

- Agfa Gevaert HealthCare

- Cerner Corporation

- MIM Software Inc

- Canon Medical Systems Corporation

- Fujifilm Holding Company

- Carestream Health Inc

- Change Healthcare

- Novarad Corporation

Key Developments in Medical Imaging Software Industry Sector

- February 2022: The European Society of Radiology and GE Healthcare renewed their strategic partnership, focusing on the online and onsite European Congress of Radiology (ECR) 2022. GE Healthcare's strategic pillars included digital and artificial intelligence, patient experience, and sustainability & resilience.

- July 2022: At ECR 2022, Canon Medical launched the Vantage Fortian, a new MRI system incorporating innovative workflow solutions, image enhancement, and accelerated scan technologies.

- July 2022: Calyx and Qynapse partnered to expand the use of AI-based neuroimaging techniques in clinical trials for central nervous system (CNS) therapies.

Strategic Medical Imaging Software Industry Market Outlook

The strategic outlook for the Medical Imaging Software industry is exceptionally positive, driven by an accelerating pace of technological innovation and a growing global demand for advanced healthcare solutions. The continued integration of AI and ML into imaging software promises to unlock new levels of diagnostic precision and efficiency, making it an indispensable tool for healthcare providers. The expansion of cloud-based solutions will further democratize access to sophisticated imaging capabilities, particularly in underserved regions. Strategic opportunities lie in developing integrated platforms that offer end-to-end workflow solutions, from image acquisition to AI-driven analysis and reporting. Investments in cybersecurity and data interoperability will be crucial for long-term success. The increasing focus on personalized medicine and predictive diagnostics presents a significant growth avenue for software capable of leveraging complex imaging data. Partnerships and collaborations, especially between software developers and imaging hardware manufacturers, will be key to delivering comprehensive and cutting-edge solutions, ensuring the industry remains at the forefront of medical innovation.

Medical Imaging Software Industry Segmentation

-

1. Imaging Type

- 1.1. 2D Imaging

- 1.2. 3D Imaging

- 1.3. 4D Imaging

-

2. Application

- 2.1. Dental Applications

- 2.2. Orthopaedic Applications

- 2.3. Cardiology Applications

- 2.4. Obstetrics and Gynaecology Applications

- 2.5. Mammography Applications

- 2.6. Urology and Nephrology Applications

- 2.7. Other Applications

Medical Imaging Software Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. United Kingdom

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Latin America

- 4.2. Middle East

Medical Imaging Software Industry Regional Market Share

Geographic Coverage of Medical Imaging Software Industry

Medical Imaging Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Application of Computer-Aided Diagnostic Methods

- 3.3. Market Restrains

- 3.3.1. Dearth of Skilled Professionals and High Set-up Cost of the Equipment

- 3.4. Market Trends

- 3.4.1. Cardiology Applications Segment Holds Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Imaging Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Imaging Type

- 5.1.1. 2D Imaging

- 5.1.2. 3D Imaging

- 5.1.3. 4D Imaging

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dental Applications

- 5.2.2. Orthopaedic Applications

- 5.2.3. Cardiology Applications

- 5.2.4. Obstetrics and Gynaecology Applications

- 5.2.5. Mammography Applications

- 5.2.6. Urology and Nephrology Applications

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Imaging Type

- 6. North America Medical Imaging Software Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Imaging Type

- 6.1.1. 2D Imaging

- 6.1.2. 3D Imaging

- 6.1.3. 4D Imaging

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dental Applications

- 6.2.2. Orthopaedic Applications

- 6.2.3. Cardiology Applications

- 6.2.4. Obstetrics and Gynaecology Applications

- 6.2.5. Mammography Applications

- 6.2.6. Urology and Nephrology Applications

- 6.2.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Imaging Type

- 7. Europe Medical Imaging Software Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Imaging Type

- 7.1.1. 2D Imaging

- 7.1.2. 3D Imaging

- 7.1.3. 4D Imaging

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dental Applications

- 7.2.2. Orthopaedic Applications

- 7.2.3. Cardiology Applications

- 7.2.4. Obstetrics and Gynaecology Applications

- 7.2.5. Mammography Applications

- 7.2.6. Urology and Nephrology Applications

- 7.2.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Imaging Type

- 8. Asia Pacific Medical Imaging Software Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Imaging Type

- 8.1.1. 2D Imaging

- 8.1.2. 3D Imaging

- 8.1.3. 4D Imaging

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dental Applications

- 8.2.2. Orthopaedic Applications

- 8.2.3. Cardiology Applications

- 8.2.4. Obstetrics and Gynaecology Applications

- 8.2.5. Mammography Applications

- 8.2.6. Urology and Nephrology Applications

- 8.2.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Imaging Type

- 9. Rest of the World Medical Imaging Software Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Imaging Type

- 9.1.1. 2D Imaging

- 9.1.2. 3D Imaging

- 9.1.3. 4D Imaging

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dental Applications

- 9.2.2. Orthopaedic Applications

- 9.2.3. Cardiology Applications

- 9.2.4. Obstetrics and Gynaecology Applications

- 9.2.5. Mammography Applications

- 9.2.6. Urology and Nephrology Applications

- 9.2.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Imaging Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Esaote SpA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Siemens Healthcare

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Healthcare Company (GE)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Koninklijke Philips N V

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Agfa Gevaert HealthCare

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cerner Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 MIM Software Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Canon Medical Systems Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Fujifilm Holding Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Carestream Health Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Change Healthcare

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Novarad Corporation

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Esaote SpA

List of Figures

- Figure 1: Global Medical Imaging Software Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Medical Imaging Software Industry Revenue (Million), by Imaging Type 2025 & 2033

- Figure 3: North America Medical Imaging Software Industry Revenue Share (%), by Imaging Type 2025 & 2033

- Figure 4: North America Medical Imaging Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Medical Imaging Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Medical Imaging Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Medical Imaging Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Medical Imaging Software Industry Revenue (Million), by Imaging Type 2025 & 2033

- Figure 9: Europe Medical Imaging Software Industry Revenue Share (%), by Imaging Type 2025 & 2033

- Figure 10: Europe Medical Imaging Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Medical Imaging Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Medical Imaging Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Medical Imaging Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Medical Imaging Software Industry Revenue (Million), by Imaging Type 2025 & 2033

- Figure 15: Asia Pacific Medical Imaging Software Industry Revenue Share (%), by Imaging Type 2025 & 2033

- Figure 16: Asia Pacific Medical Imaging Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Medical Imaging Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Medical Imaging Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Medical Imaging Software Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Medical Imaging Software Industry Revenue (Million), by Imaging Type 2025 & 2033

- Figure 21: Rest of the World Medical Imaging Software Industry Revenue Share (%), by Imaging Type 2025 & 2033

- Figure 22: Rest of the World Medical Imaging Software Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Rest of the World Medical Imaging Software Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Rest of the World Medical Imaging Software Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Medical Imaging Software Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Medical Imaging Software Industry Revenue Million Forecast, by Imaging Type 2020 & 2033

- Table 2: Global Medical Imaging Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Medical Imaging Software Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Medical Imaging Software Industry Revenue Million Forecast, by Imaging Type 2020 & 2033

- Table 5: Global Medical Imaging Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Medical Imaging Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Medical Imaging Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Medical Imaging Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Medical Imaging Software Industry Revenue Million Forecast, by Imaging Type 2020 & 2033

- Table 10: Global Medical Imaging Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Medical Imaging Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Medical Imaging Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Medical Imaging Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Medical Imaging Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Medical Imaging Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Medical Imaging Software Industry Revenue Million Forecast, by Imaging Type 2020 & 2033

- Table 17: Global Medical Imaging Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Medical Imaging Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Medical Imaging Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Medical Imaging Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Medical Imaging Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Medical Imaging Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Medical Imaging Software Industry Revenue Million Forecast, by Imaging Type 2020 & 2033

- Table 24: Global Medical Imaging Software Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 25: Global Medical Imaging Software Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Latin America Medical Imaging Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Middle East Medical Imaging Software Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Imaging Software Industry?

The projected CAGR is approximately 7.84%.

2. Which companies are prominent players in the Medical Imaging Software Industry?

Key companies in the market include Esaote SpA, Siemens Healthcare, General Healthcare Company (GE), Koninklijke Philips N V, Agfa Gevaert HealthCare, Cerner Corporation, MIM Software Inc, Canon Medical Systems Corporation, Fujifilm Holding Company, Carestream Health Inc, Change Healthcare, Novarad Corporation.

3. What are the main segments of the Medical Imaging Software Industry?

The market segments include Imaging Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Application of Computer-Aided Diagnostic Methods.

6. What are the notable trends driving market growth?

Cardiology Applications Segment Holds Major Market Share.

7. Are there any restraints impacting market growth?

Dearth of Skilled Professionals and High Set-up Cost of the Equipment.

8. Can you provide examples of recent developments in the market?

February 2022 - The European Society of Radiology and GE Healthcare have renewed their strategic partnership for the online European Congress of Radiology ECR 2022 on March 2-6, 2022, and onsite ECR 2022 on July 13-17 in Vienna, Austria. GE Healthcare would focus its efforts on three strategic pillars, digital and artificial intelligence, patient experience, and sustainability & resilience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Imaging Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Imaging Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Imaging Software Industry?

To stay informed about further developments, trends, and reports in the Medical Imaging Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence