Key Insights

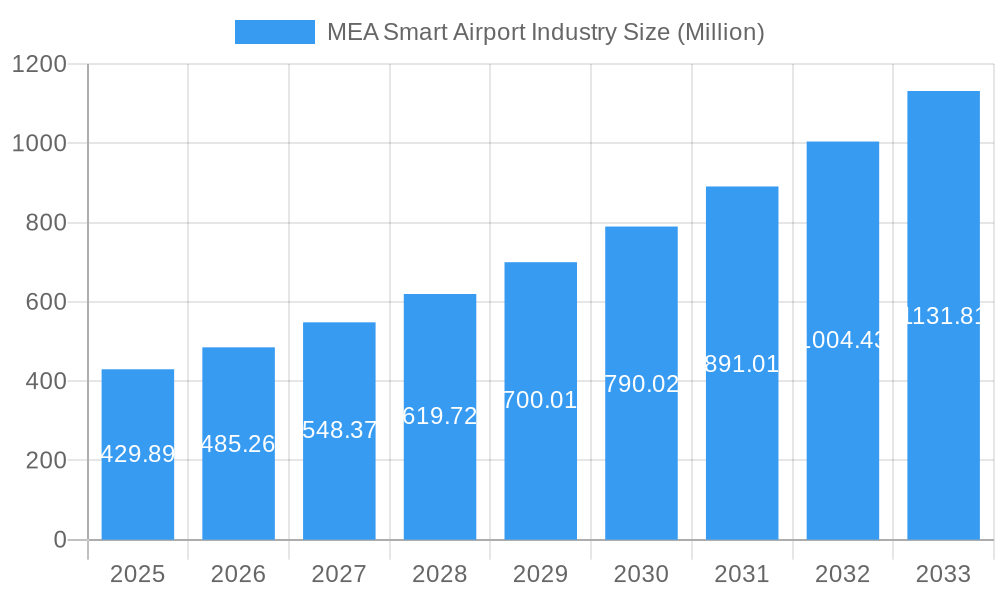

The Middle East and Africa (MEA) smart airport market is experiencing robust growth, projected to reach \$429.89 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.99% from 2025 to 2033. This expansion is fueled by several key factors. Increased passenger traffic across the region, coupled with a rising demand for enhanced security and operational efficiency, is driving the adoption of smart technologies. Governments across the MEA are investing heavily in modernizing their airport infrastructure to improve passenger experience and competitiveness on the global stage. Furthermore, the increasing focus on optimizing airport operations through automation, data analytics, and intelligent systems contributes significantly to market growth. Technological advancements in areas like security systems (biometric screening, intelligent surveillance), communication systems (high-speed internet, seamless connectivity), and air/ground traffic control are creating numerous opportunities for market players. The integration of these technologies improves safety, security, and efficiency, leading to cost savings and enhanced passenger satisfaction.

MEA Smart Airport Industry Market Size (In Million)

Significant growth is expected across various segments, including passenger and baggage control systems, ground handling systems, and communication and security systems. Saudi Arabia, the United Arab Emirates, and Turkey are expected to be key contributors to market growth due to significant investments in infrastructure development and ongoing expansion of existing airports. However, challenges remain. High implementation costs associated with smart airport technologies can be a barrier to entry for some smaller airports. Furthermore, ensuring interoperability between different systems and maintaining cybersecurity are crucial considerations for sustained growth. Despite these challenges, the long-term outlook for the MEA smart airport market remains positive, driven by sustained investment in infrastructure modernization and a commitment to enhancing passenger experience and operational efficiency.

MEA Smart Airport Industry Company Market Share

MEA Smart Airport Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa (MEA) smart airport industry, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this study meticulously examines market structure, competitive dynamics, technological advancements, and growth drivers, enabling informed strategic decision-making. The report projects a market valuation exceeding $XX Million by 2033, presenting substantial opportunities for investment and expansion.

MEA Smart Airport Industry Market Structure & Competitive Dynamics

The MEA smart airport industry presents a moderately concentrated market structure, dominated by key players such as L3Harris Technologies Inc, Amadeus IT Group S.A, Honeywell International Inc, and Collins Aerospace (RTX Corporation), who collectively hold a substantial market share. However, a dynamic competitive landscape exists, fueled by the presence of numerous regional and specialized firms. This competition is further intensified by significant mergers and acquisitions (M&A) activity, with deal values exceeding $XX Million in the last five years, leading to a constantly shifting market share. The regulatory environment, while evolving, presents both opportunities and challenges for market participants. A rapidly developing innovation ecosystem, fostered by government initiatives and private sector investments, is primarily focused on enhancing airport security and operational efficiency. The specialized nature of airport technologies limits the availability of direct product substitutes. Crucially, end-user demand strongly favors enhanced passenger experiences, streamlined operations, and robust security measures.

- Market Concentration: Moderately concentrated, with the top five players holding approximately XX% of the market share. This concentration is, however, challenged by the increasing number of agile and specialized players entering the market.

- M&A Activity: High levels of M&A activity, with deal values exceeding $XX Million annually in recent years, significantly impacting market consolidation and competitive dynamics.

- Regulatory Framework: A constantly evolving regulatory framework focused on establishing industry standards and stringent security protocols, creating both opportunities and challenges for businesses operating within the sector.

- Innovation Ecosystems: A thriving innovation ecosystem fueled by substantial government and private investment, driving technological advancements and the development of cutting-edge solutions.

MEA Smart Airport Industry Industry Trends & Insights

The MEA smart airport industry is experiencing robust growth, driven by increasing passenger traffic, government initiatives promoting infrastructure development, and the adoption of advanced technologies. The Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at XX%, exceeding the global average. Technological disruptions such as AI, IoT, and big data analytics are transforming airport operations, enhancing efficiency, security, and passenger experience. Market penetration of smart technologies is increasing significantly, with a projected XX% penetration rate by 2033. Consumer preferences are shifting towards seamless travel experiences, personalized services, and improved connectivity. Competitive dynamics are intensifying, with companies investing heavily in R&D and strategic partnerships to maintain market leadership.

Dominant Markets & Segments in MEA Smart Airport Industry

The UAE and Saudi Arabia represent the most dominant markets within the MEA region, driven by substantial investments in airport infrastructure and expansion projects. Within segments, Air/Ground Traffic Control, Security Systems, and Passenger Control systems show the highest growth potential.

Key Drivers in Dominant Markets:

- UAE: Significant government investments, strong tourism sector, and strategic location.

- Saudi Arabia: Vision 2030 initiatives, expanding tourism sector, and increasing air travel.

Dominant Segments:

- Air/Ground Traffic Control: Driven by increased air traffic and the need for improved efficiency.

- Security Systems: High demand for enhanced security measures due to rising terrorism threats.

- Passenger Control: Focus on improving passenger experience and reducing bottlenecks.

Detailed Dominance Analysis: The UAE and Saudi Arabia benefit from significant government investment in airport infrastructure upgrades and expansion. This investment is largely influenced by the importance of aviation to national economic strategies, coupled with high passenger traffic growth in these regions. The dominance of certain segments stems from regulatory requirements related to security and the desire to create seamless passenger journeys.

MEA Smart Airport Industry Product Innovations

Recent product innovations within the MEA smart airport industry are characterized by a focus on integrated security systems leveraging advanced technologies like AI and machine learning, AI-powered passenger flow management systems designed to optimize passenger throughput and reduce congestion, and modernized baggage handling systems that enhance efficiency and reduce delays. These advancements not only improve operational efficiency and the overall passenger experience but also strengthen security measures, thereby significantly contributing to market growth. A key trend is the development of modular, scalable, and interoperable solutions readily adaptable to existing airport infrastructure. The primary benefit of these innovative solutions is the ability to drastically enhance efficiency while simultaneously reducing operational costs.

Report Segmentation & Scope

This report segments the MEA smart airport market by technology: Security Systems, Communication Systems, Air/Ground Traffic Control, Passenger, Cargo, and Baggage Control, Ground Handling Systems, and Other Technologies. Each segment's growth trajectory, market size, and competitive dynamics are analyzed in detail. For instance, the Security Systems segment is projected to witness significant growth, driven by the demand for advanced security measures. The Air/Ground Traffic Control segment is projected to be the largest segment with a market size exceeding $XX Million by 2033. Similarly, detailed analysis for other segments like Passenger, Cargo, and Baggage control is included to showcase the overall market segmentation. Competitive analysis encompasses both established players and emerging companies.

Key Drivers of MEA Smart Airport Industry Growth

The growth of the MEA smart airport industry is propelled by several key factors: a marked increase in passenger traffic, substantial government investments in modernizing airport infrastructure, rapid technological advancements, and a strong emphasis on optimizing both passenger experience and operational efficiency. The adoption of smart technologies is largely driven by the urgent need to mitigate challenges such as congestion, security threats, and sustainability concerns. Government regulations and policies play a crucial role in incentivizing the adoption and implementation of these advanced technologies.

Challenges in the MEA Smart Airport Industry Sector

Challenges include high initial investment costs for implementing smart technologies, cybersecurity risks, integration complexities, and the need for skilled workforce. Regulatory uncertainties, supply chain disruptions, and intense competition also pose challenges to market growth. These factors can result in project delays and increased operational costs which impact the market significantly.

Leading Players in the MEA Smart Airport Industry Market

- L3Harris Technologies Inc

- Amadeus IT Group S.A

- Honeywell International Inc

- Collins Aerospace (RTX Corporation)

- THALES

- Sabre GLBL Inc

- Cisco Systems Inc

- Siemens AG

- International Business Machines Corporation (IBM)

- NATS Holdings Limited

- SITA

- Indra Sistemas S.A

Key Developments in MEA Smart Airport Industry Sector

- 2022 Q4: Amadeus IT Group S.A successfully launched a new AI-powered passenger flow management system at Dubai International Airport, demonstrating the practical application of advanced technologies within the region.

- 2023 Q1: Honeywell forged a strategic partnership with a major regional airport operator to implement a comprehensive, state-of-the-art security system, highlighting the collaborative approach to integrating smart solutions.

- 2023 Q3: L3Harris Technologies Inc expanded its MEA portfolio through the acquisition of a smaller technology provider. (Further details on this and other developments will be included in the full report.)

Strategic MEA Smart Airport Industry Market Outlook

The MEA smart airport industry possesses significant future growth potential, driven by ongoing infrastructure development projects, consistently rising passenger numbers, and the accelerating adoption of advanced technologies. Strategic opportunities abound in areas such as AI-driven airport operations, enhanced passenger services and amenities, and sophisticated security systems designed to meet evolving threats. Businesses that prioritize innovation, strategic partnerships, and a customer-centric approach are optimally positioned to capitalize on this robust growth trajectory. The market is projected to maintain a steady growth rate in the coming years, fueled by continuous investment in and integration of technology across existing and newly planned airport facilities.

MEA Smart Airport Industry Segmentation

-

1. Technology

- 1.1. Security Systems

- 1.2. Communication Systems

- 1.3. Air/Ground Traffic Control

- 1.4. Passenger, Cargo, and Baggage Control

- 1.5. Ground Handling Systems

- 1.6. Other Technologies

-

2. Geography

-

2.1. Middle-East and Africa

- 2.1.1. Saudi Arabia

- 2.1.2. United Arab Emirates

- 2.1.3. Turkey

- 2.1.4. Egypt

- 2.1.5. South Africa

- 2.1.6. Rest of Middle-East and Africa

-

2.1. Middle-East and Africa

MEA Smart Airport Industry Segmentation By Geography

-

1. Middle East and Africa

- 1.1. Saudi

- 2. United

-

3. Turkey

- 3.1. Egypt

- 3.2. South

- 4. Rest

MEA Smart Airport Industry Regional Market Share

Geographic Coverage of MEA Smart Airport Industry

MEA Smart Airport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Security Systems to Dominate Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Security Systems

- 5.1.2. Communication Systems

- 5.1.3. Air/Ground Traffic Control

- 5.1.4. Passenger, Cargo, and Baggage Control

- 5.1.5. Ground Handling Systems

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Middle-East and Africa

- 5.2.1.1. Saudi Arabia

- 5.2.1.2. United Arab Emirates

- 5.2.1.3. Turkey

- 5.2.1.4. Egypt

- 5.2.1.5. South Africa

- 5.2.1.6. Rest of Middle-East and Africa

- 5.2.1. Middle-East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East and Africa

- 5.3.2. United

- 5.3.3. Turkey

- 5.3.4. Rest

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Middle East and Africa MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Security Systems

- 6.1.2. Communication Systems

- 6.1.3. Air/Ground Traffic Control

- 6.1.4. Passenger, Cargo, and Baggage Control

- 6.1.5. Ground Handling Systems

- 6.1.6. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Middle-East and Africa

- 6.2.1.1. Saudi Arabia

- 6.2.1.2. United Arab Emirates

- 6.2.1.3. Turkey

- 6.2.1.4. Egypt

- 6.2.1.5. South Africa

- 6.2.1.6. Rest of Middle-East and Africa

- 6.2.1. Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. United MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Security Systems

- 7.1.2. Communication Systems

- 7.1.3. Air/Ground Traffic Control

- 7.1.4. Passenger, Cargo, and Baggage Control

- 7.1.5. Ground Handling Systems

- 7.1.6. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Middle-East and Africa

- 7.2.1.1. Saudi Arabia

- 7.2.1.2. United Arab Emirates

- 7.2.1.3. Turkey

- 7.2.1.4. Egypt

- 7.2.1.5. South Africa

- 7.2.1.6. Rest of Middle-East and Africa

- 7.2.1. Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Turkey MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Security Systems

- 8.1.2. Communication Systems

- 8.1.3. Air/Ground Traffic Control

- 8.1.4. Passenger, Cargo, and Baggage Control

- 8.1.5. Ground Handling Systems

- 8.1.6. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Middle-East and Africa

- 8.2.1.1. Saudi Arabia

- 8.2.1.2. United Arab Emirates

- 8.2.1.3. Turkey

- 8.2.1.4. Egypt

- 8.2.1.5. South Africa

- 8.2.1.6. Rest of Middle-East and Africa

- 8.2.1. Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest MEA Smart Airport Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Security Systems

- 9.1.2. Communication Systems

- 9.1.3. Air/Ground Traffic Control

- 9.1.4. Passenger, Cargo, and Baggage Control

- 9.1.5. Ground Handling Systems

- 9.1.6. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Middle-East and Africa

- 9.2.1.1. Saudi Arabia

- 9.2.1.2. United Arab Emirates

- 9.2.1.3. Turkey

- 9.2.1.4. Egypt

- 9.2.1.5. South Africa

- 9.2.1.6. Rest of Middle-East and Africa

- 9.2.1. Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 L3Harris Technologies Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Amadeus IT Group S A

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Honeywell International Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Collins Aerospace (RTX Corporation)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 THALES

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sabre GLBL Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cisco Systems Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Siemens AG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 International Business Machines Corporation (IBM)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 NATS Holdings Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 SITA

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Indra Sistemas S A

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global MEA Smart Airport Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Middle East and Africa MEA Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: Middle East and Africa MEA Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: Middle East and Africa MEA Smart Airport Industry Revenue (Million), by Geography 2025 & 2033

- Figure 5: Middle East and Africa MEA Smart Airport Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 6: Middle East and Africa MEA Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Middle East and Africa MEA Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: United MEA Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 9: United MEA Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: United MEA Smart Airport Industry Revenue (Million), by Geography 2025 & 2033

- Figure 11: United MEA Smart Airport Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 12: United MEA Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: United MEA Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Turkey MEA Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Turkey MEA Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Turkey MEA Smart Airport Industry Revenue (Million), by Geography 2025 & 2033

- Figure 17: Turkey MEA Smart Airport Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 18: Turkey MEA Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Turkey MEA Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest MEA Smart Airport Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Rest MEA Smart Airport Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Rest MEA Smart Airport Industry Revenue (Million), by Geography 2025 & 2033

- Figure 23: Rest MEA Smart Airport Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Rest MEA Smart Airport Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest MEA Smart Airport Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Global MEA Smart Airport Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global MEA Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Saudi MEA Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 9: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global MEA Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 13: Global MEA Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Egypt MEA Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: South MEA Smart Airport Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global MEA Smart Airport Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 17: Global MEA Smart Airport Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Global MEA Smart Airport Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Smart Airport Industry?

The projected CAGR is approximately 12.99%.

2. Which companies are prominent players in the MEA Smart Airport Industry?

Key companies in the market include L3Harris Technologies Inc, Amadeus IT Group S A, Honeywell International Inc, Collins Aerospace (RTX Corporation), THALES, Sabre GLBL Inc, Cisco Systems Inc, Siemens AG, International Business Machines Corporation (IBM), NATS Holdings Limited, SITA, Indra Sistemas S A.

3. What are the main segments of the MEA Smart Airport Industry?

The market segments include Technology, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 429.89 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Security Systems to Dominate Market Share.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Smart Airport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Smart Airport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Smart Airport Industry?

To stay informed about further developments, trends, and reports in the MEA Smart Airport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence