Key Insights

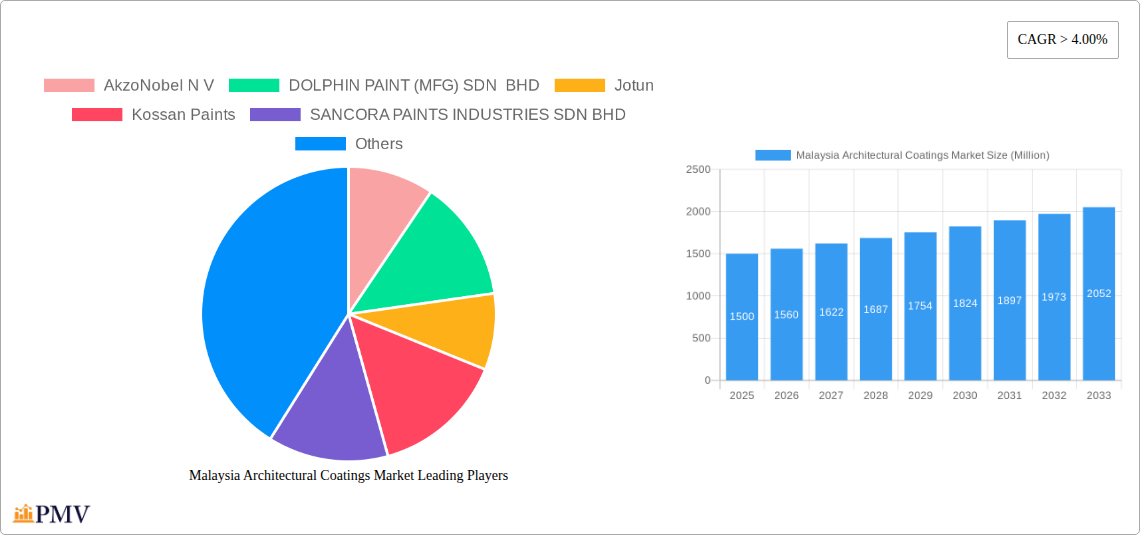

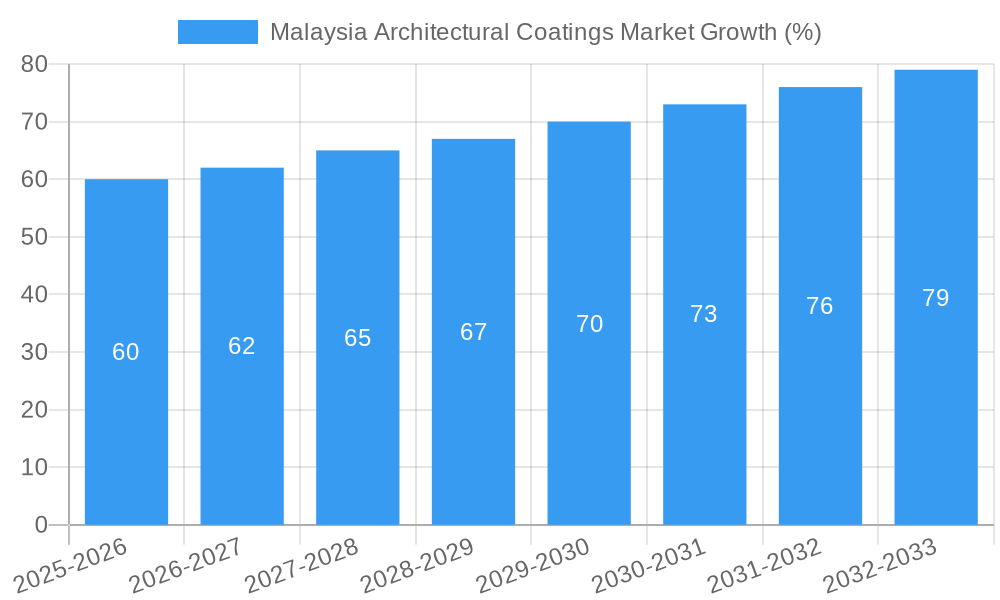

The Malaysian architectural coatings market, valued at approximately RM 1.5 billion (estimated based on typical market sizes with similar CAGRs) in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) exceeding 4% through 2033. This positive trajectory is fueled by several key factors. Firstly, sustained growth in the Malaysian construction sector, driven by both residential and commercial building projects, is a significant driver. The increasing urbanization and rising disposable incomes within the population are fueling demand for aesthetically pleasing and durable coatings. Secondly, evolving architectural trends toward sustainable and eco-friendly building materials are boosting the demand for waterborne coatings, a segment anticipated to witness significant growth within the forecast period. Furthermore, technological advancements in coating formulations, leading to enhanced durability, improved aesthetics, and reduced environmental impact, are contributing to market expansion. Increased awareness of the importance of building protection against harsh weather conditions also plays a crucial role. However, price volatility of raw materials and fluctuations in the overall economic climate represent potential restraints on market growth.

The market segmentation reveals a significant contribution from the commercial sector, reflecting the large-scale construction activities in urban areas. Solventborne coatings currently hold a larger market share but are expected to witness a gradual decline due to stricter environmental regulations favoring waterborne alternatives. Among resin types, acrylic and alkyd resins dominate, although the adoption of polyurethane and other specialized resins is gaining traction due to their superior performance characteristics. Key players like AkzoNobel, Jotun, Nippon Paint, and Kansai Paint hold significant market share, engaging in intense competition through product innovation, strategic partnerships, and expansion initiatives. The Malaysian market's future prospects are positive, underpinned by ongoing infrastructure development, rising construction activities, and a growing focus on sustainable building practices. The increasing adoption of technologically advanced coatings will further propel the market's growth trajectory.

This detailed report provides a comprehensive analysis of the Malaysia Architectural Coatings Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period 2019-2033, with 2025 as the base year and forecast extending to 2033. The report meticulously examines market structure, competitive dynamics, industry trends, dominant segments, product innovations, and key challenges, offering actionable intelligence for navigating this dynamic market. The Malaysian architectural coatings market size is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Malaysia Architectural Coatings Market Market Structure & Competitive Dynamics

The Malaysian architectural coatings market exhibits a moderately concentrated structure, with several key players holding significant market share. The market is characterized by intense competition, driven by factors such as product innovation, pricing strategies, and brand reputation. The regulatory framework, while generally supportive of industry growth, also includes environmental regulations impacting product formulations. Innovation in the sector focuses primarily on developing sustainable, high-performance coatings, catering to increasing consumer demand for eco-friendly and durable products. Mergers and acquisitions (M&A) activities play a pivotal role in shaping the market landscape. Recent M&A deals, while not publicly disclosed for all transactions, have resulted in significant shifts in market share and influence. For instance, one key player's acquisition of CMI Construction Material Industry and CMI Marketing in March 2022 significantly broadened their portfolio. The total value of M&A deals in the period 2019-2024 is estimated at xx Million.

- Market Concentration: Moderately Concentrated

- Innovation Ecosystem: Focused on sustainable and high-performance coatings

- Regulatory Framework: Supportive, with environmental regulations

- Product Substitutes: Limited, but increasing interest in bio-based alternatives

- End-User Trends: Growing demand for eco-friendly and durable coatings

- M&A Activities: Significant impact on market share and competitive dynamics

Malaysia Architectural Coatings Market Industry Trends & Insights

The Malaysian architectural coatings market is experiencing robust growth, propelled by several key factors. The country's robust construction sector, driven by infrastructure development and urbanization, is a primary driver of market expansion. Increasing disposable incomes and rising consumer awareness of aesthetics and home improvement have also fueled demand for high-quality coatings. Technological advancements, particularly in waterborne and low-VOC coatings, are further shaping the market landscape, with a growing preference for environmentally friendly solutions. The shift towards sustainable practices is impacting resin choices, with an increasing adoption of acrylic and polyurethane resins over traditional alkyd formulations. The market penetration of waterborne coatings is increasing steadily, exceeding xx% in 2024, driven by stricter environmental regulations and health concerns. Competitive dynamics, characterized by both price competition and innovation-driven differentiation, further contribute to the dynamic nature of this market. The market is estimated to have recorded a CAGR of xx% between 2019 and 2024.

Dominant Markets & Segments in Malaysia Architectural Coatings Market

The residential segment currently dominates the Malaysian architectural coatings market, driven by a large housing market and increasing consumer spending on home improvement. However, the commercial segment is exhibiting strong growth potential, fueled by infrastructural projects and commercial construction activities. Within the technology segment, waterborne coatings are experiencing rapid growth due to their eco-friendly nature and compliance with environmental regulations. Acrylic and polyurethane resins are leading in terms of market share owing to their superior performance and versatility.

- Key Drivers for Residential Segment: Rising disposable incomes, home improvement trends, and urbanization.

- Key Drivers for Commercial Segment: Infrastructure development, commercial construction boom, and government initiatives.

- Key Drivers for Waterborne Coatings: Environmental regulations, health concerns, and superior performance.

- Key Drivers for Acrylic and Polyurethane Resins: Superior performance characteristics, durability, and aesthetic appeal.

Malaysia Architectural Coatings Market Product Innovations

Recent innovations in the Malaysian architectural coatings market focus on developing environmentally friendly, high-performance coatings with enhanced durability and aesthetic appeal. This includes the introduction of low-VOC (Volatile Organic Compound) formulations, water-based coatings, and self-cleaning technologies. Companies are also investing in developing coatings with superior resistance to weathering, UV degradation, and microbial growth. These innovations are improving product performance, extending lifespan, and addressing growing consumer concerns regarding sustainability and health.

Report Segmentation & Scope

This report segments the Malaysian architectural coatings market based on sub-end users (residential and commercial), technology (solventborne and waterborne), and resin type (acrylic, alkyd, epoxy, polyester, polyurethane, and other resin types). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The residential segment is projected to maintain dominance, with a xx Million market size in 2025, while the commercial segment is anticipated to experience substantial growth. Waterborne coatings are expected to capture a larger market share due to growing environmental concerns, projected to reach xx Million by 2033. Similarly, acrylic and polyurethane resins are projected to maintain their leadership positions due to their performance advantages.

Key Drivers of Malaysia Architectural Coatings Market Growth

Several factors contribute to the growth of the Malaysian architectural coatings market. The burgeoning construction industry, fueled by government infrastructure projects and urbanization, is a key driver. Rising disposable incomes and increased consumer spending on home improvements further stimulate demand. Stringent environmental regulations promote the adoption of eco-friendly coatings, while technological advancements in resin chemistry and coating formulations continue to enhance product performance and expand application possibilities.

Challenges in the Malaysia Architectural Coatings Market Sector

Despite strong growth potential, the Malaysian architectural coatings market faces several challenges. Fluctuations in raw material prices, supply chain disruptions, and intense competition impact profitability. Stringent environmental regulations require continuous innovation in product formulations to meet compliance standards, adding to development costs. Moreover, consumer awareness regarding the long-term benefits of premium coatings needs further cultivation to drive adoption of higher-priced, high-performance products. This is further complicated by the presence of counterfeit products in the market, eroding trust and potentially impacting market growth by xx% in the long term.

Leading Players in the Malaysia Architectural Coatings Market Market

- AkzoNobel N V

- DOLPHIN PAINT (MFG) SDN BHD

- Jotun

- Kossan Paints

- SANCORA PAINTS INDUSTRIES SDN BHD

- SKK(S) Pte Ltd

- DAI NIPPON TORYO CO LTD

- Nippon Paint Holdings Co Ltd

- KCC PAINTS SDN BHD

- TOA Paint Public Company Limited

- Kansai Paint Co Ltd

- TRUE COLOR PAINTING SOLUTIONS SDN BH

- Seamaster Paint (Singapore) Pte Ltd

Key Developments in Malaysia Architectural Coatings Market Sector

- August 2020: Acquisition of Asian JV Stake and Indonesia Business by a major player to establish dominance in Asia. This significantly impacted the competitive landscape.

- January 2021: Introduction of the Dulux Promise Guarantee program, enhancing consumer trust and potentially increasing market share.

- March 2022: Acquisition of CMI Construction Material Industry Sdn. Bhd. (CMI) and CMI Marketing Sdn. Bhd. (CMIM), diversifying product portfolio and expanding market reach.

Strategic Malaysia Architectural Coatings Market Market Outlook

The Malaysian architectural coatings market presents significant growth opportunities, driven by continued infrastructure development, urbanization, and rising consumer spending. Strategic investments in research and development, focusing on sustainable and high-performance coatings, are crucial for success. Companies that successfully navigate environmental regulations and adopt innovative marketing strategies to build brand loyalty and increase consumer awareness will be best positioned to capitalize on this expanding market. The focus should be on offering value-added services and developing strong distribution networks to maintain a competitive edge.

Malaysia Architectural Coatings Market Segmentation

-

1. Sub End User

- 1.1. Commercial

- 1.2. Residential

-

2. Technology

- 2.1. Solventborne

- 2.2. Waterborne

-

3. Resin

- 3.1. Acrylic

- 3.2. Alkyd

- 3.3. Epoxy

- 3.4. Polyester

- 3.5. Polyurethane

- 3.6. Other Resin Types

Malaysia Architectural Coatings Market Segmentation By Geography

- 1. Malaysia

Malaysia Architectural Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Soaring Demand for Water based Coatings; Rising Building & Construction Industry in Emerging Economies; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Impact of COVID-19 Pandemic; Other Restraints

- 3.4. Market Trends

- 3.4.1. Residential is the largest segment by Sub End User.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Architectural Coatings Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Solventborne

- 5.2.2. Waterborne

- 5.3. Market Analysis, Insights and Forecast - by Resin

- 5.3.1. Acrylic

- 5.3.2. Alkyd

- 5.3.3. Epoxy

- 5.3.4. Polyester

- 5.3.5. Polyurethane

- 5.3.6. Other Resin Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Sub End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 AkzoNobel N V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DOLPHIN PAINT (MFG) SDN BHD

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jotun

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kossan Paints

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SANCORA PAINTS INDUSTRIES SDN BHD

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SKK(S) Pte Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DAI NIPPON TORYO CO LTD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nippon Paint Holdings Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 KCC PAINTS SDN BHD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TOA Paint Public Company Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kansai Paint Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 TRUE COLOR PAINTING SOLUTIONS SDN BH

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Seamaster Paint (Singapore) Pte Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 AkzoNobel N V

List of Figures

- Figure 1: Malaysia Architectural Coatings Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Architectural Coatings Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Architectural Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Architectural Coatings Market Volume liter Forecast, by Region 2019 & 2032

- Table 3: Malaysia Architectural Coatings Market Revenue Million Forecast, by Sub End User 2019 & 2032

- Table 4: Malaysia Architectural Coatings Market Volume liter Forecast, by Sub End User 2019 & 2032

- Table 5: Malaysia Architectural Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 6: Malaysia Architectural Coatings Market Volume liter Forecast, by Technology 2019 & 2032

- Table 7: Malaysia Architectural Coatings Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 8: Malaysia Architectural Coatings Market Volume liter Forecast, by Resin 2019 & 2032

- Table 9: Malaysia Architectural Coatings Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Malaysia Architectural Coatings Market Volume liter Forecast, by Region 2019 & 2032

- Table 11: Malaysia Architectural Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Malaysia Architectural Coatings Market Volume liter Forecast, by Country 2019 & 2032

- Table 13: Malaysia Architectural Coatings Market Revenue Million Forecast, by Sub End User 2019 & 2032

- Table 14: Malaysia Architectural Coatings Market Volume liter Forecast, by Sub End User 2019 & 2032

- Table 15: Malaysia Architectural Coatings Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 16: Malaysia Architectural Coatings Market Volume liter Forecast, by Technology 2019 & 2032

- Table 17: Malaysia Architectural Coatings Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 18: Malaysia Architectural Coatings Market Volume liter Forecast, by Resin 2019 & 2032

- Table 19: Malaysia Architectural Coatings Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Malaysia Architectural Coatings Market Volume liter Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Architectural Coatings Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Malaysia Architectural Coatings Market?

Key companies in the market include AkzoNobel N V, DOLPHIN PAINT (MFG) SDN BHD, Jotun, Kossan Paints, SANCORA PAINTS INDUSTRIES SDN BHD, SKK(S) Pte Ltd, DAI NIPPON TORYO CO LTD, Nippon Paint Holdings Co Ltd, KCC PAINTS SDN BHD, TOA Paint Public Company Limited, Kansai Paint Co Ltd, TRUE COLOR PAINTING SOLUTIONS SDN BH, Seamaster Paint (Singapore) Pte Ltd.

3. What are the main segments of the Malaysia Architectural Coatings Market?

The market segments include Sub End User, Technology, Resin.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Soaring Demand for Water based Coatings; Rising Building & Construction Industry in Emerging Economies; Other Drivers.

6. What are the notable trends driving market growth?

Residential is the largest segment by Sub End User..

7. Are there any restraints impacting market growth?

; Impact of COVID-19 Pandemic; Other Restraints.

8. Can you provide examples of recent developments in the market?

March 2022: The company acquired CMI Construction Material Industry Sdn. Bhd. (CMI) and CMI Marketing Sdn. Bhd. (CMIM) to diversify its product portfolio in waterproofing and other segments.January 2021: The company introduced Dulux Promise Guarantee program which ensures easy replacement of dulux products.August 2020: The company acquired Asian JV Stake and Indonesia Business to establish dominance in Asia to pursue global growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Architectural Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Architectural Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Architectural Coatings Market?

To stay informed about further developments, trends, and reports in the Malaysia Architectural Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence