Key Insights

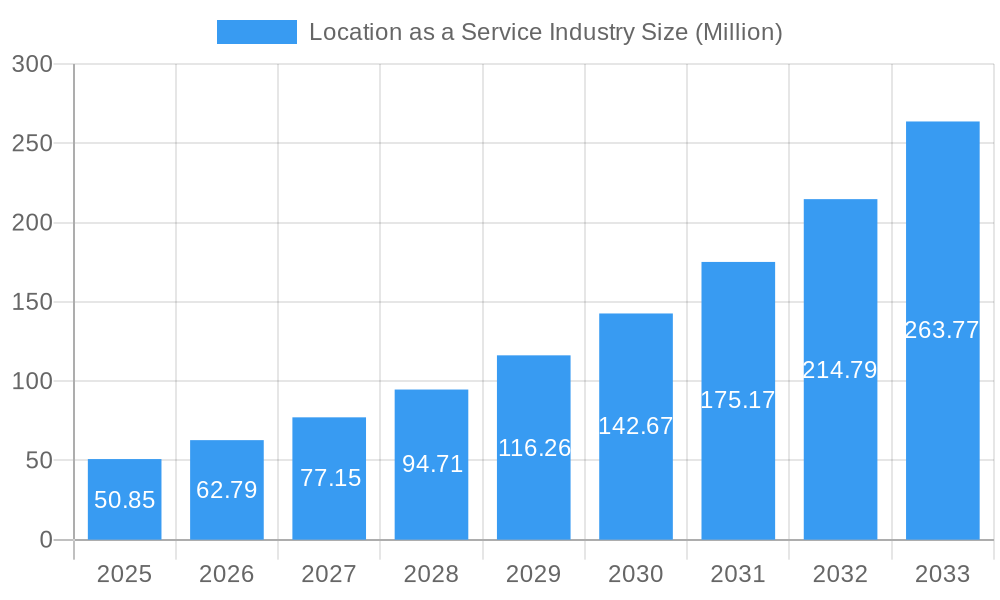

The Location as a Service (LaaS) industry is experiencing explosive growth, with a current market size estimated at 50.85 Million and a projected Compound Annual Growth Rate (CAGR) of 24.11% through 2033. This impressive expansion is fueled by a confluence of factors, primarily the escalating demand for real-time location intelligence across diverse sectors and the increasing adoption of advanced technologies like IoT, AI, and 5G. Businesses are increasingly recognizing the strategic advantage of leveraging precise location data for operational efficiency, enhanced customer experiences, and innovative service development. Key drivers include the need for improved asset tracking and management in supply chains, the burgeoning popularity of indoor navigation for retail and public spaces, and the critical role of location-based services in public safety and emergency response. The industry is also benefiting from the proliferation of connected devices and the continuous refinement of indoor and outdoor positioning technologies, making LaaS solutions more accessible and powerful than ever before. The market is poised for significant transformation, moving beyond basic GPS functionalities to sophisticated, context-aware location intelligence.

Location as a Service Industry Market Size (In Million)

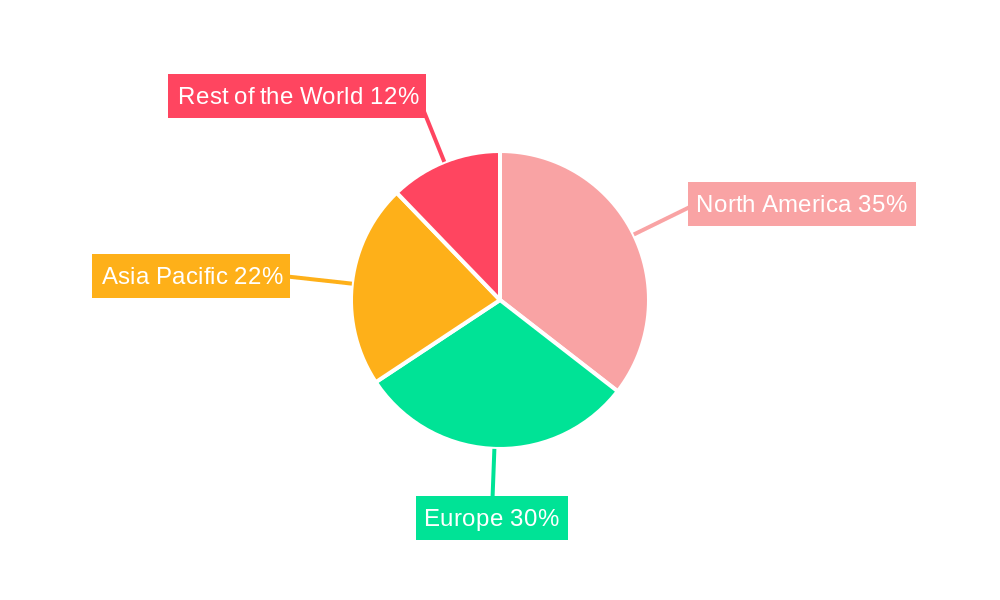

The LaaS market is segmented broadly by location (Indoor and Outdoor), service type (Professional and Managed services), and a wide array of end-user industries, including FMCG and E-commerce, Retail, Healthcare, IT and Telecom, Transportation, and Oil and Gas. The diversification of applications underscores the versatility and pervasive influence of LaaS. For instance, in the retail sector, LaaS is revolutionizing customer engagement through personalized offers and in-store navigation. In healthcare, it's enabling precise patient tracking and asset management. The IT and Telecom sector benefits from network optimization and infrastructure management, while Transportation relies on it for fleet management and route optimization. The presence of major technology giants and specialized LaaS providers like Ubiquicom, HPE Aruba Inc, IBM Corporation, Google LLC, and Zebra Technologies Corporation indicates a highly competitive and innovative landscape. Geographically, North America and Europe are leading markets, with significant growth anticipated in the Asia Pacific region due to rapid digitalization and increasing smart city initiatives. The market is characterized by a trend towards cloud-based LaaS platforms, offering scalability, flexibility, and cost-effectiveness, further accelerating adoption across all segments.

Location as a Service Industry Company Market Share

Here is the SEO-optimized, detailed report description for the Location as a Service Industry, incorporating all your requirements:

This in-depth report provides a definitive analysis of the global Location as a Service (LaaS) industry, a rapidly evolving sector crucial for businesses seeking to leverage geospatial data and services. Covering the Study Period 2019–2033, with a Base Year of 2025 and a Forecast Period of 2025–2033, this report offers unparalleled insights into market structure, competitive dynamics, emerging trends, dominant segments, and strategic outlook. With a focus on actionable intelligence, this research empowers stakeholders to navigate the complexities of the LaaS market, from indoor location tracking to outdoor asset management. The Estimated Year 2025 provides a snapshot of the current market landscape, while the Historical Period 2019–2024 lays the groundwork for understanding growth trajectories. This report is an essential resource for anyone invested in location intelligence, geospatial analytics, and location-based services (LBS).

Location as a Service Industry Market Structure & Competitive Dynamics

The Location as a Service (LaaS) industry is characterized by a dynamic and increasingly competitive market structure, driven by continuous innovation and strategic partnerships. Market concentration varies across different segments, with some areas dominated by a few large players and others fostering a more fragmented ecosystem of specialized providers. The innovation ecosystem is robust, fueled by advancements in AI, IoT, 5G, and edge computing, enabling more precise and real-time location data processing. Regulatory frameworks, particularly concerning data privacy and security (e.g., GDPR, CCPA), play a significant role in shaping market entry and operational strategies. The threat of product substitutes is moderate, as core LaaS functionalities are difficult to replicate without specialized technology, though alternative data sources and analytical tools can offer partial solutions. End-user trends are rapidly shifting towards hyper-personalization, operational efficiency, and enhanced customer experiences, all heavily reliant on accurate location intelligence. Mergers & Acquisitions (M&A) activities are a key feature, with deal values projected to reach several Million in the coming years as larger entities seek to consolidate market share and acquire cutting-edge technologies. For instance, the acquisition of specialized indoor positioning systems or outdoor tracking solutions by established technology giants is a recurring theme, aiming to expand their comprehensive LaaS offerings. Key market share shifts are expected as new applications for real-time location services (RTLS) emerge.

- Market Concentration: Moderate to High in core LBS, fragmented in niche solutions.

- Innovation Ecosystem: Driven by IoT, 5G, AI, Edge Computing, and advanced geospatial analytics.

- Regulatory Frameworks: Significant impact of data privacy and security laws.

- Product Substitutes: Limited for core LaaS, but alternative data analytics exist.

- End-User Trends: Demand for personalization, efficiency, and enhanced customer journeys.

- M&A Activities: High, with projected deal values in the Million range, focusing on technology acquisition and market consolidation.

Location as a Service Industry Industry Trends & Insights

The Location as a Service (LaaS) industry is experiencing exponential growth, propelled by a confluence of technological advancements and expanding market applications. The Compound Annual Growth Rate (CAGR) is projected to be robust, estimated at XX% for the forecast period, driven by increasing demand for sophisticated location intelligence solutions across diverse sectors. Key growth drivers include the proliferation of IoT devices generating vast amounts of location-aware data, the widespread adoption of 5G networks enabling low-latency, high-precision outdoor and indoor tracking, and the growing need for businesses to optimize operations, personalize customer interactions, and enhance safety and security. Technological disruptions such as AI-powered analytics, augmented reality (AR) overlays on location data, and the evolution of geofencing technology are redefining the capabilities of LaaS. Consumer preferences are increasingly leaning towards services that are contextually aware and personalized, directly benefiting from location-based marketing and proximity marketing. Competitive dynamics are intensifying, with a constant race to develop more accurate, scalable, and cost-effective LaaS platforms. Market penetration for advanced real-time location systems (RTLS) is steadily increasing, particularly in sectors like retail, logistics, and healthcare, where precise tracking can lead to significant operational efficiencies and cost savings. The integration of LaaS with other enterprise systems, such as CRM and ERP, is a critical trend, unlocking deeper insights and enabling more informed decision-making. The growing emphasis on asset tracking, fleet management, and supply chain visibility further bolsters market expansion. The ability to derive actionable insights from granular location data is paramount for businesses seeking a competitive edge in today's data-driven economy.

Dominant Markets & Segments in Location as a Service Industry

The Location as a Service (LaaS) industry exhibits significant dominance across various regions and segments, with each contributing uniquely to market growth. North America, particularly the United States, is a leading region due to its mature technological infrastructure, high adoption rates of location-based services (LBS), and a strong presence of key industry players. The IT and Telecom sector stands out as a dominant end-user industry, driven by the demand for network infrastructure management, asset tracking, and location-aware services that enhance customer connectivity. Following closely is the Retail sector, leveraging LaaS for in-store navigation, personalized marketing, inventory management, and customer footfall analysis, significantly improving the omnichannel experience.

The Transportation sector's dominance is fueled by the need for efficient fleet management, real-time vehicle tracking, route optimization, and logistics management, contributing to substantial market value. Within the Location segmentation, Outdoor applications currently hold a larger market share, driven by the widespread use of GPS and cellular triangulation for navigation, asset tracking, and public safety. However, the Indoor location segment is experiencing rapid growth, with advancements in technologies like Wi-Fi triangulation, Bluetooth beacons, and Ultra-Wideband (UWB) enabling precise tracking within complex environments such as warehouses, airports, and hospitals.

In terms of Service Type, Managed services are gaining traction as businesses increasingly outsource their LaaS operations to specialized providers, allowing them to focus on core competencies while benefiting from expert management and cutting-edge technology. Professional services, including consulting, integration, and implementation, remain crucial for customizing and deploying LaaS solutions effectively.

- Leading Region: North America (particularly the USA) - driven by advanced infrastructure and high adoption.

- Dominant End-User Industries:

- IT and Telecom: For network management, asset tracking, and enhanced connectivity services.

- Retail: For in-store navigation, personalized marketing, inventory optimization, and customer analytics.

- Transportation: For fleet management, real-time tracking, route optimization, and logistics efficiency.

- Dominant Location Segments:

- Outdoor: Currently larger share due to widespread GPS adoption for navigation and asset tracking.

- Indoor: Experiencing rapid growth with advancements in UWB, Wi-Fi, and Bluetooth beacon technologies for precise indoor positioning.

- Dominant Service Types:

- Managed Services: Growing preference for outsourced expertise and operational efficiency.

- Professional Services: Essential for customization, integration, and deployment of complex LaaS solutions.

Location as a Service Industry Product Innovations

The Location as a Service (LaaS) industry is witnessing a surge in product innovations, driven by the convergence of technologies like AI, 5G, and IoT. Key developments include the enhanced accuracy and reduced latency of Real-Time Location Systems (RTLS), enabling unprecedented precision in both indoor and outdoor environments. Innovations in geofencing technology allow for more dynamic and responsive zone-based actions. Furthermore, the integration of LaaS with augmented reality (AR) is creating immersive experiences for navigation and information overlay. Companies are focusing on developing platforms that offer sophisticated geospatial analytics and predictive modeling, transforming raw location data into actionable business intelligence. These advancements provide a significant competitive advantage by enabling hyper-personalized customer engagement, optimized logistics, and improved operational efficiency, directly addressing evolving end-user needs for context-aware services.

Report Segmentation & Scope

This comprehensive report segments the Location as a Service (LaaS) market across key dimensions to provide a granular understanding of its dynamics. The Location segmentation includes Indoor and Outdoor services, each with distinct applications and growth trajectories. Service Type is categorized into Professional services, encompassing consulting, integration, and custom development, and Managed services, focusing on ongoing operational support and platform management. The End-user Industry segmentation spans critical sectors such as FMCG and E-commerce, Retail, Healthcare, IT and Telecom, Transportation, and Oil and Gas, alongside a broad category for Other End-user Industries. Each segment is analyzed for its market size, projected growth, and competitive landscape, offering targeted insights into specific industry needs and LaaS adoption trends. The scope of this report is global, covering all major geographical markets and providing a forward-looking analysis of market opportunities and challenges.

Key Drivers of Location as a Service Industry Growth

The Location as a Service (LaaS) industry is experiencing robust growth, propelled by several key factors. The escalating adoption of Internet of Things (IoT) devices, which inherently generate location data, is a primary driver, fueling the need for sophisticated LaaS platforms to process and interpret this information. The ongoing rollout of 5G networks is critical, enabling lower latency and higher precision for real-time location tracking, particularly for outdoor and indoor location applications. Furthermore, the increasing demand for location intelligence across industries, from optimizing supply chains in transportation to personalizing customer experiences in retail and enhancing patient care in healthcare, is a significant accelerator. Government initiatives promoting smart city development and the growing emphasis on operational efficiency and data-driven decision-making across sectors like IT and Telecom and Oil and Gas also contribute substantially to market expansion.

Challenges in the Location as a Service Industry Sector

Despite its strong growth, the Location as a Service (LaaS) industry faces several challenges that can impact its trajectory. Data privacy concerns and evolving regulatory frameworks, such as GDPR and CCPA, create compliance hurdles and necessitate robust security measures, potentially increasing operational costs. The accuracy and reliability of location data can be inconsistent, especially in complex indoor environments or areas with poor GPS signals, impacting the effectiveness of LaaS applications. Integration complexities with existing legacy systems within enterprises can pose significant technical and financial barriers. Furthermore, intense competitive pressures among a growing number of LaaS providers can lead to price wars and margin erosion. Supply chain disruptions affecting hardware components for IoT devices and tracking solutions can also present unforeseen restraints.

Leading Players in the Location as a Service Industry Market

- Ubiquicom

- GL Communications Inc

- HPE Aruba Inc

- IBM Corporation

- Google LLC

- Zebra Technologies Corporation

- Esri Technologies Ltd

- DigitalGlobe Inc (Maxar Technologies)

- Cisco Systems Inc

- Sewio Networks

- IndoorAtlas Ltd

- HID Global (Assa Abloy AB)

- Ericsson Inc

- Creativity Software Ltd

- ALE International

- Teldio Corporation

- HERE Global BV

Key Developments in Location as a Service Industry Sector

- May 2022: AT&T announced the launch of location-based routing with Intrado to improve public safety response for wireless 9-1-1 calls. AT&T can quickly and more accurately identify where a wireless 9-1-1 call is coming from using device GPS and hybrid information to route the call to the correct 9-1-1 call center, also known as the public safety answering point, or PSAP. This development significantly enhances emergency services efficiency through precise location tracking.

- January 2022: Catalina, a shopper intelligence and omnichannel media provider, announced its partnership with PlaceIQ, a data and technology provider, to bring location-driven planning, measurement, and attribution to CPG retailers. It would enable advertisers to reach more precise audiences, optimize offline and online media engagement across channels, and deliver real-world ROI on a brand campaign's performance, highlighting the growing importance of location intelligence in marketing and advertising for FMCG and E-commerce.

Strategic Location as a Service Industry Market Outlook

The strategic outlook for the Location as a Service (LaaS) industry remains exceptionally positive, driven by the increasing commoditization of location data and its integration into core business strategies. Growth accelerators include the expanding use of AI and machine learning to derive deeper insights from geospatial data, enabling predictive analytics and hyper-personalized services. The continued advancement of indoor positioning systems (IPS) and outdoor tracking solutions will unlock new use cases in smart buildings, asset management, and autonomous systems. The ongoing digital transformation across industries, coupled with the imperative for operational efficiency and enhanced customer experiences, will continue to fuel demand for sophisticated LaaS. Emerging markets are poised for significant growth as adoption rates for geospatial analytics and real-time location services (RTLS) accelerate, creating substantial strategic opportunities for LaaS providers.

Location as a Service Industry Segmentation

-

1. Location

- 1.1. Indoor

- 1.2. Outdoor

-

2. Service Type

- 2.1. Professional

- 2.2. Managed

-

3. End-user Industry

- 3.1. FMCG and E-commerce

- 3.2. Retail

- 3.3. Healthcare

- 3.4. IT and Telecom

- 3.5. Transportation

- 3.6. Oil and Gas

- 3.7. Other End-user Industries

Location as a Service Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Rest of Asia Pacific

- 4. Rest of the World

Location as a Service Industry Regional Market Share

Geographic Coverage of Location as a Service Industry

Location as a Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Geo-based Marketing; Technological Advancements Aided by Emergence of BLE and UWB for Indoor Services; Emerging Use-cases for LBS due to High Penetration of Social Media and Location-based App Adoption

- 3.3. Market Restrains

- 3.3.1. Trade-offs Between Privacy/Security and Regulatory Constraints

- 3.4. Market Trends

- 3.4.1. FMCG and E-Commerce Sector Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Location as a Service Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location

- 5.1.1. Indoor

- 5.1.2. Outdoor

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Professional

- 5.2.2. Managed

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. FMCG and E-commerce

- 5.3.2. Retail

- 5.3.3. Healthcare

- 5.3.4. IT and Telecom

- 5.3.5. Transportation

- 5.3.6. Oil and Gas

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Location

- 6. North America Location as a Service Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location

- 6.1.1. Indoor

- 6.1.2. Outdoor

- 6.2. Market Analysis, Insights and Forecast - by Service Type

- 6.2.1. Professional

- 6.2.2. Managed

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. FMCG and E-commerce

- 6.3.2. Retail

- 6.3.3. Healthcare

- 6.3.4. IT and Telecom

- 6.3.5. Transportation

- 6.3.6. Oil and Gas

- 6.3.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Location

- 7. Europe Location as a Service Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location

- 7.1.1. Indoor

- 7.1.2. Outdoor

- 7.2. Market Analysis, Insights and Forecast - by Service Type

- 7.2.1. Professional

- 7.2.2. Managed

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. FMCG and E-commerce

- 7.3.2. Retail

- 7.3.3. Healthcare

- 7.3.4. IT and Telecom

- 7.3.5. Transportation

- 7.3.6. Oil and Gas

- 7.3.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Location

- 8. Asia Pacific Location as a Service Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location

- 8.1.1. Indoor

- 8.1.2. Outdoor

- 8.2. Market Analysis, Insights and Forecast - by Service Type

- 8.2.1. Professional

- 8.2.2. Managed

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. FMCG and E-commerce

- 8.3.2. Retail

- 8.3.3. Healthcare

- 8.3.4. IT and Telecom

- 8.3.5. Transportation

- 8.3.6. Oil and Gas

- 8.3.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Location

- 9. Rest of the World Location as a Service Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location

- 9.1.1. Indoor

- 9.1.2. Outdoor

- 9.2. Market Analysis, Insights and Forecast - by Service Type

- 9.2.1. Professional

- 9.2.2. Managed

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. FMCG and E-commerce

- 9.3.2. Retail

- 9.3.3. Healthcare

- 9.3.4. IT and Telecom

- 9.3.5. Transportation

- 9.3.6. Oil and Gas

- 9.3.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Location

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Ubiquicom

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 GL Communications Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 HPE Aruba Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 IBM Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Google LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Zebra Technologies Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Esri Technologies Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 DigitalGlobe Inc (Maxar Technologies )

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Cisco Systems Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Sewio Networks

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 IndoorAtlas Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 HID Global (Assa Abloy AB)

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Ericsson Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Creativity Software Ltd

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 ALE International

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Teldio Corporation

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 HERE Global BV

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.1 Ubiquicom

List of Figures

- Figure 1: Global Location as a Service Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Location as a Service Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Location as a Service Industry Revenue (Million), by Location 2025 & 2033

- Figure 4: North America Location as a Service Industry Volume (K Unit), by Location 2025 & 2033

- Figure 5: North America Location as a Service Industry Revenue Share (%), by Location 2025 & 2033

- Figure 6: North America Location as a Service Industry Volume Share (%), by Location 2025 & 2033

- Figure 7: North America Location as a Service Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 8: North America Location as a Service Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 9: North America Location as a Service Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: North America Location as a Service Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 11: North America Location as a Service Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 12: North America Location as a Service Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 13: North America Location as a Service Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: North America Location as a Service Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: North America Location as a Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Location as a Service Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Location as a Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Location as a Service Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Location as a Service Industry Revenue (Million), by Location 2025 & 2033

- Figure 20: Europe Location as a Service Industry Volume (K Unit), by Location 2025 & 2033

- Figure 21: Europe Location as a Service Industry Revenue Share (%), by Location 2025 & 2033

- Figure 22: Europe Location as a Service Industry Volume Share (%), by Location 2025 & 2033

- Figure 23: Europe Location as a Service Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 24: Europe Location as a Service Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 25: Europe Location as a Service Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 26: Europe Location as a Service Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 27: Europe Location as a Service Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 28: Europe Location as a Service Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 29: Europe Location as a Service Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Europe Location as a Service Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: Europe Location as a Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Location as a Service Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Location as a Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Location as a Service Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Location as a Service Industry Revenue (Million), by Location 2025 & 2033

- Figure 36: Asia Pacific Location as a Service Industry Volume (K Unit), by Location 2025 & 2033

- Figure 37: Asia Pacific Location as a Service Industry Revenue Share (%), by Location 2025 & 2033

- Figure 38: Asia Pacific Location as a Service Industry Volume Share (%), by Location 2025 & 2033

- Figure 39: Asia Pacific Location as a Service Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 40: Asia Pacific Location as a Service Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 41: Asia Pacific Location as a Service Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 42: Asia Pacific Location as a Service Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 43: Asia Pacific Location as a Service Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 44: Asia Pacific Location as a Service Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Asia Pacific Location as a Service Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Asia Pacific Location as a Service Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Asia Pacific Location as a Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Location as a Service Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Location as a Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Location as a Service Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Location as a Service Industry Revenue (Million), by Location 2025 & 2033

- Figure 52: Rest of the World Location as a Service Industry Volume (K Unit), by Location 2025 & 2033

- Figure 53: Rest of the World Location as a Service Industry Revenue Share (%), by Location 2025 & 2033

- Figure 54: Rest of the World Location as a Service Industry Volume Share (%), by Location 2025 & 2033

- Figure 55: Rest of the World Location as a Service Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 56: Rest of the World Location as a Service Industry Volume (K Unit), by Service Type 2025 & 2033

- Figure 57: Rest of the World Location as a Service Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 58: Rest of the World Location as a Service Industry Volume Share (%), by Service Type 2025 & 2033

- Figure 59: Rest of the World Location as a Service Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 60: Rest of the World Location as a Service Industry Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 61: Rest of the World Location as a Service Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: Rest of the World Location as a Service Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: Rest of the World Location as a Service Industry Revenue (Million), by Country 2025 & 2033

- Figure 64: Rest of the World Location as a Service Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Rest of the World Location as a Service Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World Location as a Service Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Location as a Service Industry Revenue Million Forecast, by Location 2020 & 2033

- Table 2: Global Location as a Service Industry Volume K Unit Forecast, by Location 2020 & 2033

- Table 3: Global Location as a Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global Location as a Service Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 5: Global Location as a Service Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Location as a Service Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Location as a Service Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Location as a Service Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Location as a Service Industry Revenue Million Forecast, by Location 2020 & 2033

- Table 10: Global Location as a Service Industry Volume K Unit Forecast, by Location 2020 & 2033

- Table 11: Global Location as a Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 12: Global Location as a Service Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 13: Global Location as a Service Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Location as a Service Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Location as a Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Location as a Service Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Location as a Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Location as a Service Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Location as a Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Location as a Service Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Global Location as a Service Industry Revenue Million Forecast, by Location 2020 & 2033

- Table 22: Global Location as a Service Industry Volume K Unit Forecast, by Location 2020 & 2033

- Table 23: Global Location as a Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 24: Global Location as a Service Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 25: Global Location as a Service Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Location as a Service Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Location as a Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Global Location as a Service Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Location as a Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Location as a Service Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany Location as a Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Location as a Service Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France Location as a Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: France Location as a Service Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Location as a Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Location as a Service Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Location as a Service Industry Revenue Million Forecast, by Location 2020 & 2033

- Table 38: Global Location as a Service Industry Volume K Unit Forecast, by Location 2020 & 2033

- Table 39: Global Location as a Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 40: Global Location as a Service Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 41: Global Location as a Service Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 42: Global Location as a Service Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 43: Global Location as a Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Location as a Service Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: China Location as a Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: China Location as a Service Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Japan Location as a Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Location as a Service Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: India Location as a Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: India Location as a Service Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Rest of Asia Pacific Location as a Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Location as a Service Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Global Location as a Service Industry Revenue Million Forecast, by Location 2020 & 2033

- Table 54: Global Location as a Service Industry Volume K Unit Forecast, by Location 2020 & 2033

- Table 55: Global Location as a Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 56: Global Location as a Service Industry Volume K Unit Forecast, by Service Type 2020 & 2033

- Table 57: Global Location as a Service Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 58: Global Location as a Service Industry Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 59: Global Location as a Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Location as a Service Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Location as a Service Industry?

The projected CAGR is approximately 24.11%.

2. Which companies are prominent players in the Location as a Service Industry?

Key companies in the market include Ubiquicom, GL Communications Inc, HPE Aruba Inc, IBM Corporation, Google LLC, Zebra Technologies Corporation, Esri Technologies Ltd, DigitalGlobe Inc (Maxar Technologies ), Cisco Systems Inc, Sewio Networks, IndoorAtlas Ltd, HID Global (Assa Abloy AB), Ericsson Inc, Creativity Software Ltd, ALE International, Teldio Corporation, HERE Global BV.

3. What are the main segments of the Location as a Service Industry?

The market segments include Location, Service Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 50.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Geo-based Marketing; Technological Advancements Aided by Emergence of BLE and UWB for Indoor Services; Emerging Use-cases for LBS due to High Penetration of Social Media and Location-based App Adoption.

6. What are the notable trends driving market growth?

FMCG and E-Commerce Sector Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Trade-offs Between Privacy/Security and Regulatory Constraints.

8. Can you provide examples of recent developments in the market?

May 2022: AT&T announced the launch of location-based routing with Intrado to improve public safety response for wireless 9-1-1 calls. AT&T can quickly and more accurately identify where a wireless 9-1-1 call is coming from using device GPS and hybrid information to route the call to the correct 9-1-1 call center, also known as the public safety answering point, or PSAP.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Location as a Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Location as a Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Location as a Service Industry?

To stay informed about further developments, trends, and reports in the Location as a Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence