Key Insights

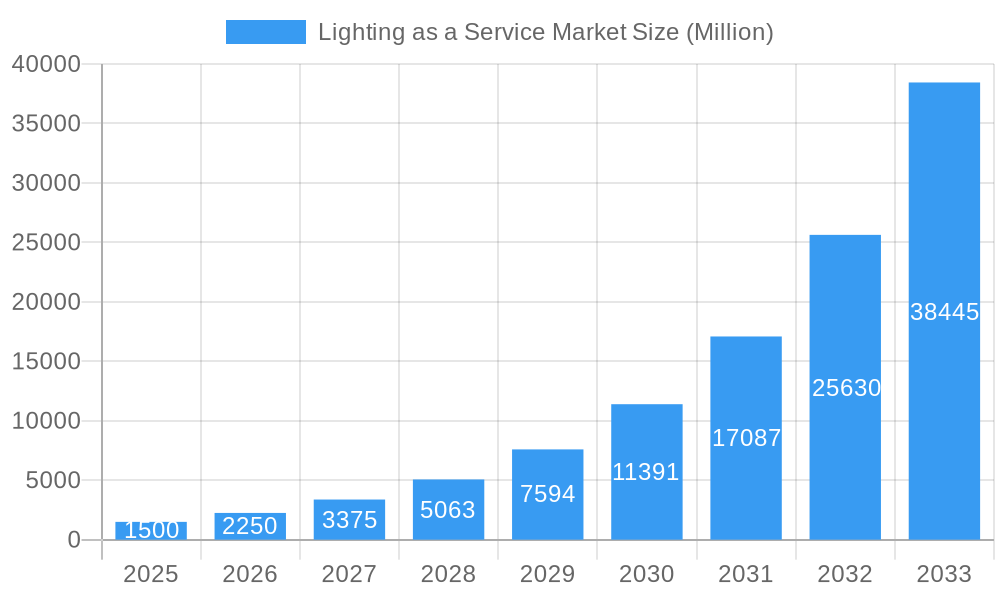

The Lighting as a Service (LaaS) market is poised for significant expansion, driven by the widespread adoption of energy-efficient LED technology and the increasing preference for subscription-based service models. This burgeoning market is projected to reach $3.5 billion by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 34.8%. Key growth catalysts include the financial advantages of operational expenditure (OPEX) models over capital expenditure (CAPEX), enabling businesses to manage budgets more effectively by avoiding substantial upfront investments. Furthermore, the inherent energy savings and enhanced operational efficiency derived from LED lighting and smart management systems, featuring remote monitoring and predictive maintenance, are substantial drivers. The expansion of smart city initiatives and the escalating demand for energy-efficient solutions across commercial, industrial, and outdoor applications are also fueling market growth. The commercial and industrial sectors are leading adoption, with outdoor applications also showing strong demand.

Lighting as a Service Market Market Size (In Billion)

While the market presents immense opportunity, certain restraints exist. Initial infrastructure investment and potential concerns regarding data security and vendor lock-in pose challenges for LaaS providers. Additionally, market penetration in developing economies is hindered by factors such as limited awareness and infrastructure limitations compared to developed regions. Nevertheless, the long-term outlook for the LaaS market remains highly optimistic. Continuous technological advancements, rising energy costs, and a heightened focus on sustainability are expected to propel market growth through the forecast period (2025-2033). Leading industry players, including Electricity Supply Board (ESB) Group and Signify Holdings, are strategically positioning themselves through innovative solutions and partnerships to capitalize on this dynamic market. Geographic expansion into emerging markets represents a significant opportunity for future growth.

Lighting as a Service Market Company Market Share

Lighting as a Service (LaaS) Market Report: A Comprehensive Analysis (2019-2033)

This in-depth report provides a comprehensive analysis of the global Lighting as a Service (LaaS) market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, competitive landscapes, technological advancements, and future growth projections, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report includes detailed segmentation by end-user (Commercial, Outdoor, Industrial) and incorporates data from the base year 2025, with estimations for 2025 and forecasts extending to 2033. The historical period analyzed is 2019-2024. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Lighting as a Service Market Market Structure & Competitive Dynamics

The LaaS market exhibits a moderately concentrated structure, with a few dominant players and numerous smaller niche players. Market share is largely influenced by technological innovation, brand reputation, and the ability to provide comprehensive service packages. The report analyzes the competitive dynamics, highlighting key M&A activities, with some deals exceeding xx Million in value. Regulatory frameworks, varying across regions, significantly impact market entry and operational costs. Product substitution, primarily from traditional lighting solutions, poses a challenge, though the LaaS model's energy efficiency and cost-effectiveness are driving adoption. End-user trends show a growing preference for integrated and smart lighting solutions.

- Market Concentration: Moderately concentrated.

- Innovation Ecosystem: Active, with significant R&D investment.

- Regulatory Frameworks: Varying across regions, impacting market access.

- Product Substitutes: Traditional lighting solutions, but LaaS offers benefits.

- M&A Activity: Significant, with some deals exceeding xx Million. Examples include [Specific Examples of M&A Activities if Available, with deal values].

- End-User Trends: Increasing demand for smart and integrated lighting solutions.

Lighting as a Service Market Industry Trends & Insights

The LaaS market is experiencing robust growth, fueled by several key trends. The increasing adoption of energy-efficient LED technology, coupled with the rising awareness of sustainability, is a major driver. Technological advancements in areas like smart lighting controls, IoT integration, and data analytics are transforming the industry. The shift towards subscription-based business models aligns with consumer preferences for predictable operational costs and minimized upfront capital investment. Competitive pressures are intense, leading to continuous innovation and service enhancements. The market penetration of LaaS is growing steadily, especially in the commercial and industrial segments.

- Market Growth Drivers: Rising energy costs, increasing sustainability concerns, technological advancements (IoT, AI).

- Technological Disruptions: Smart lighting controls, data analytics, energy harvesting technologies.

- Consumer Preferences: Preference for predictable operational expenditure, remote management capabilities.

- Competitive Dynamics: Intense competition driving innovation and service enhancement.

- CAGR: xx% (2025-2033)

- Market Penetration: xx% (2025), projected to reach xx% by 2033.

Dominant Markets & Segments in Lighting as a Service Market

The Commercial segment currently dominates the LaaS market, driven by the high concentration of businesses seeking cost-effective and energy-efficient lighting solutions. North America and Europe are leading regions, benefiting from robust infrastructure, advanced technological adoption, and supportive government policies. Key drivers for dominance include:

Commercial:

- Key Drivers: High demand for energy efficiency, smart building technologies, and reduced operational costs.

- Dominance Analysis: Largest segment due to high adoption rates among businesses.

Outdoor:

- Key Drivers: Smart city initiatives, improved safety and security features, reduced energy consumption in public spaces.

- Dominance Analysis: Growing steadily, driven by smart city projects and governmental initiatives.

Industrial:

- Key Drivers: Enhanced productivity, improved workplace safety, and reduced maintenance costs.

- Dominance Analysis: Shows significant potential due to cost-saving opportunities and efficiency gains in industrial settings.

Lighting as a Service Market Product Innovations

Recent product innovations focus on enhanced energy efficiency, smart controls, data analytics capabilities, and seamless integration with existing building management systems. These advancements provide competitive advantages by offering tailored solutions that improve operational efficiency, reduce energy consumption, and enhance user experience. The market is witnessing a shift towards modular and customizable lighting systems that adapt to diverse applications and specific customer requirements.

Report Segmentation & Scope

This report segments the LaaS market by end-user:

Commercial: This segment includes offices, retail spaces, hospitality, and other commercial buildings. It is projected to exhibit substantial growth due to the increasing adoption of smart building technologies and the focus on energy efficiency. Competitive dynamics are intense with numerous providers offering tailored solutions.

Outdoor: This segment encompasses street lighting, parking areas, and other outdoor applications. Growth is driven by smart city initiatives and the need for energy-efficient and sustainable lighting solutions. Competition is moderate, with a mix of established players and emerging companies.

Industrial: This segment focuses on lighting solutions for factories, warehouses, and other industrial settings. Growth is driven by the increasing demand for enhanced productivity, improved safety, and reduced maintenance costs. The competitive landscape is relatively fragmented, with players offering specialized solutions.

Key Drivers of Lighting as a Service Market Growth

Technological advancements in LED technology, IoT integration, and data analytics are key drivers. Government initiatives promoting energy efficiency and sustainable practices also contribute. The increasing demand for smart lighting solutions, coupled with the economic benefits of reducing energy consumption and maintenance costs, further fuels market growth.

Challenges in the Lighting as a Service Market Sector

High initial investment costs for LaaS infrastructure can be a barrier to adoption. Cybersecurity concerns related to interconnected lighting systems and data privacy are also significant. Competition from traditional lighting solutions and the need to manage complex service agreements add to the challenges. Supply chain disruptions and variations in regulatory frameworks across regions can further impact market growth.

Leading Players in the Lighting as a Service Market Market

- Electricity Supply Board (ESB) Group

- Signify Holdings

- Lumenix

- Enlighted Inc

- LEDVANCE GmbH

- Lighthouse*List Not Exhaustive

- Stouch Lighting

- Every Watt Matters

- General Electric Company

- LumenServe Inc

Key Developments in Lighting as a Service Market Sector

- 2022 Q4: Signify launches a new smart lighting system for commercial buildings.

- 2023 Q1: A major M&A deal takes place between two LaaS providers, resulting in increased market concentration. [Specific Example if Available]

- 2023 Q3: Several municipalities adopt LaaS solutions for public street lighting.

Strategic Lighting as a Service Market Market Outlook

The LaaS market is poised for continued growth, driven by technological innovation, increasing sustainability awareness, and favorable government policies. Strategic opportunities exist in expanding into emerging markets, developing innovative lighting solutions for specific applications, and forging strategic partnerships to strengthen market presence and broaden service offerings. The focus on data-driven insights and personalized lighting experiences will be crucial for success in the years to come.

Lighting as a Service Market Segmentation

-

1. End User

- 1.1. Commercial

- 1.2. Outdoor

- 1.3. Industrial

Lighting as a Service Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Lighting as a Service Market Regional Market Share

Geographic Coverage of Lighting as a Service Market

Lighting as a Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 34.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems

- 3.3. Market Restrains

- 3.3.1. 4.; The global shift toward renewable sources for electricity generation

- 3.4. Market Trends

- 3.4.1. Commercial Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lighting as a Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Commercial

- 5.1.2. Outdoor

- 5.1.3. Industrial

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. North America Lighting as a Service Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Commercial

- 6.1.2. Outdoor

- 6.1.3. Industrial

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Europe Lighting as a Service Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Commercial

- 7.1.2. Outdoor

- 7.1.3. Industrial

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Asia Pacific Lighting as a Service Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Commercial

- 8.1.2. Outdoor

- 8.1.3. Industrial

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Latin America Lighting as a Service Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Commercial

- 9.1.2. Outdoor

- 9.1.3. Industrial

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Middle East Lighting as a Service Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End User

- 10.1.1. Commercial

- 10.1.2. Outdoor

- 10.1.3. Industrial

- 10.1. Market Analysis, Insights and Forecast - by End User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Electricity Supply Board (ESB) Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Signify Holdings

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Lumenix

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Enlighted Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LEDVANCE GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lighthouse*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Stouch Lighting

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Every Watt Matters

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 General Electric Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LumenServe Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Electricity Supply Board (ESB) Group

List of Figures

- Figure 1: Global Lighting as a Service Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Lighting as a Service Market Revenue (billion), by End User 2025 & 2033

- Figure 3: North America Lighting as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 4: North America Lighting as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Lighting as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Lighting as a Service Market Revenue (billion), by End User 2025 & 2033

- Figure 7: Europe Lighting as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: Europe Lighting as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Lighting as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Lighting as a Service Market Revenue (billion), by End User 2025 & 2033

- Figure 11: Asia Pacific Lighting as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Asia Pacific Lighting as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Lighting as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Lighting as a Service Market Revenue (billion), by End User 2025 & 2033

- Figure 15: Latin America Lighting as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Latin America Lighting as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America Lighting as a Service Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East Lighting as a Service Market Revenue (billion), by End User 2025 & 2033

- Figure 19: Middle East Lighting as a Service Market Revenue Share (%), by End User 2025 & 2033

- Figure 20: Middle East Lighting as a Service Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East Lighting as a Service Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Lighting as a Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 2: Global Lighting as a Service Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Lighting as a Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Lighting as a Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Lighting as a Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Lighting as a Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Lighting as a Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global Lighting as a Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Lighting as a Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 10: Global Lighting as a Service Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global Lighting as a Service Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Lighting as a Service Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lighting as a Service Market?

The projected CAGR is approximately 34.8%.

2. Which companies are prominent players in the Lighting as a Service Market?

Key companies in the market include Electricity Supply Board (ESB) Group, Signify Holdings, Lumenix, Enlighted Inc, LEDVANCE GmbH, Lighthouse*List Not Exhaustive, Stouch Lighting, Every Watt Matters, General Electric Company, LumenServe Inc.

3. What are the main segments of the Lighting as a Service Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.5 billion as of 2022.

5. What are some drivers contributing to market growth?

; Government Policies for the Adoption of Energy-efficient Lighting Systems; Adoption of IoT with Lighting Systems.

6. What are the notable trends driving market growth?

Commercial Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The global shift toward renewable sources for electricity generation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lighting as a Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lighting as a Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lighting as a Service Market?

To stay informed about further developments, trends, and reports in the Lighting as a Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence