Key Insights

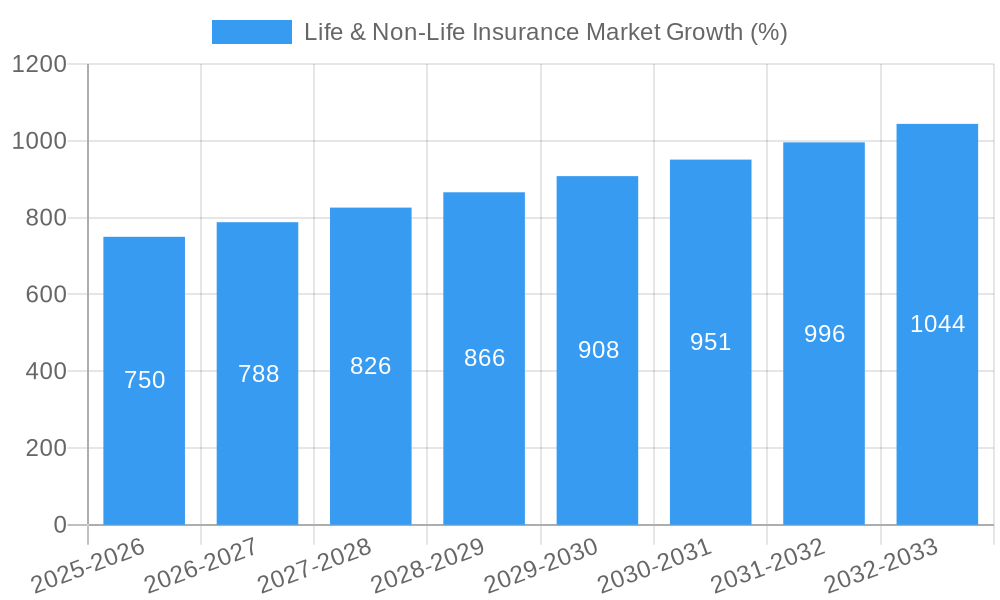

The Life & Non-Life Insurance market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing awareness of risk, and the expanding reach of digital insurance platforms. The period from 2019 to 2024 showed significant expansion, laying the foundation for continued growth in the forecast period (2025-2033). While precise market size figures for previous years are unavailable, a conservative estimate based on typical industry growth patterns suggests a substantial market in 2019, gradually increasing to a significant size by 2024. The base year of 2025 provides a crucial benchmark. Considering a typical CAGR of 5-7% for this sector (a range considered reasonable considering global economic trends and insurance penetration rates), we can project a steady increase in market size throughout the forecast period. Factors influencing growth include favorable government regulations, increased insurance penetration in emerging markets, and the adoption of innovative insurance products tailored to specific consumer needs.

The market's segmentation reveals key trends. The life insurance segment is likely to be driven by increasing demand for retirement planning and wealth management solutions. Meanwhile, the non-life insurance sector will likely see strong growth, propelled by the rising adoption of motor insurance and the need for property and casualty coverage in an increasingly volatile world. Technological advancements, including AI and big data analytics, are playing a significant role in improving risk assessment, customer service, and fraud detection, thereby boosting market efficiency and profitability. The continued expansion of digital distribution channels further enhances accessibility and convenience for consumers, driving market penetration. Regional variations in market size and growth will be influenced by factors such as economic development, regulatory frameworks, and demographic trends.

Life & Non-Life Insurance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Life & Non-Life Insurance market, offering invaluable insights into market structure, competitive dynamics, industry trends, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and an estimated year of 2025, this report is an essential resource for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic sector. The report analyzes key segments, identifies leading players, and forecasts future market trends, enabling informed strategic planning and investment decisions.

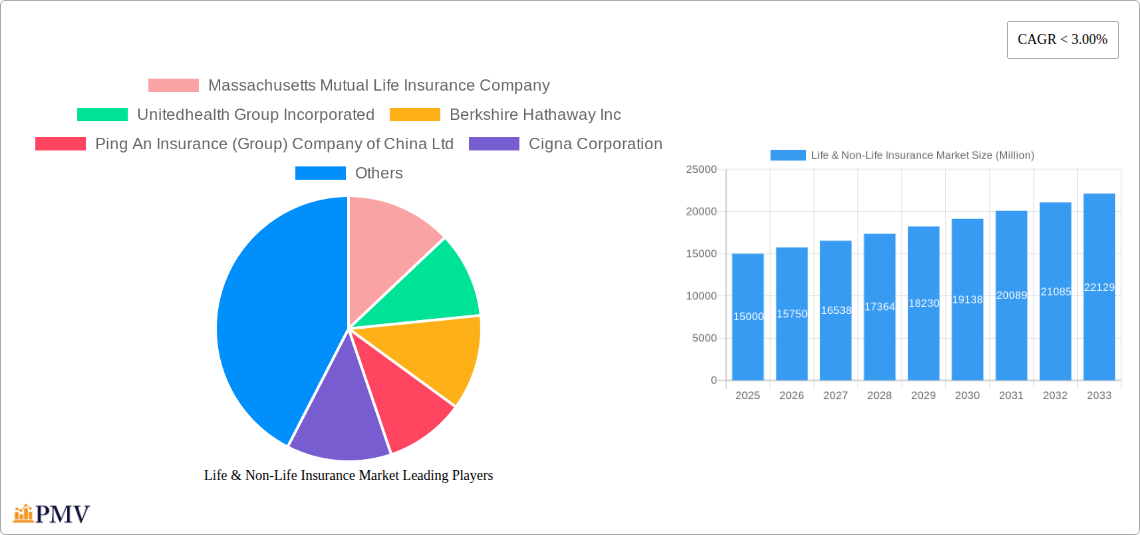

Life & Non-Life Insurance Market Structure & Competitive Dynamics

The global Life & Non-Life insurance market is characterized by a complex interplay of established players and emerging entrants. Market concentration is moderate, with a few dominant players commanding significant market share. However, the market is increasingly fragmented due to the entry of numerous niche players and the expansion of InsurTech companies. Innovation ecosystems are vibrant, driven by advancements in data analytics, AI, and digital technologies. Regulatory frameworks vary significantly across regions, influencing market dynamics and competitive landscapes. Product substitutes, such as crowdfunding and peer-to-peer insurance platforms, are gaining traction, albeit still representing a relatively small market share. End-user trends towards personalized and digital insurance solutions are driving market transformation. M&A activities are frequent, with deal values reaching into the Billions. For instance, in 2024, the market witnessed xx Billion in M&A activity.

- Market Share: Top 5 players account for approximately xx% of the global market.

- M&A Activity: Increased consolidation through mergers and acquisitions driven by expansion strategies and technological integration.

- Regulatory Landscape: Stringent regulations in developed markets, creating a barrier to entry for some players but ensuring consumer protection.

Life & Non-Life Insurance Market Industry Trends & Insights

The Life & Non-Life insurance market is experiencing significant transformation fueled by several key trends. Market growth is primarily driven by increasing health consciousness, rising disposable incomes, especially in emerging economies, and growing awareness of the need for financial security. Technological disruptions, particularly the rise of InsurTech, are revolutionizing the industry, introducing innovative products, distribution channels, and customer service models. Consumer preferences are shifting toward personalized, digital-first solutions with seamless online interactions. Competitive dynamics are intensifying, with companies vying for market share through product innovation, technological advancements, and strategic partnerships. The compound annual growth rate (CAGR) is projected at xx% during the forecast period (2025-2033), with market penetration increasing significantly across various segments. The growing adoption of telematics and wearable technology is contributing to the growth of the market.

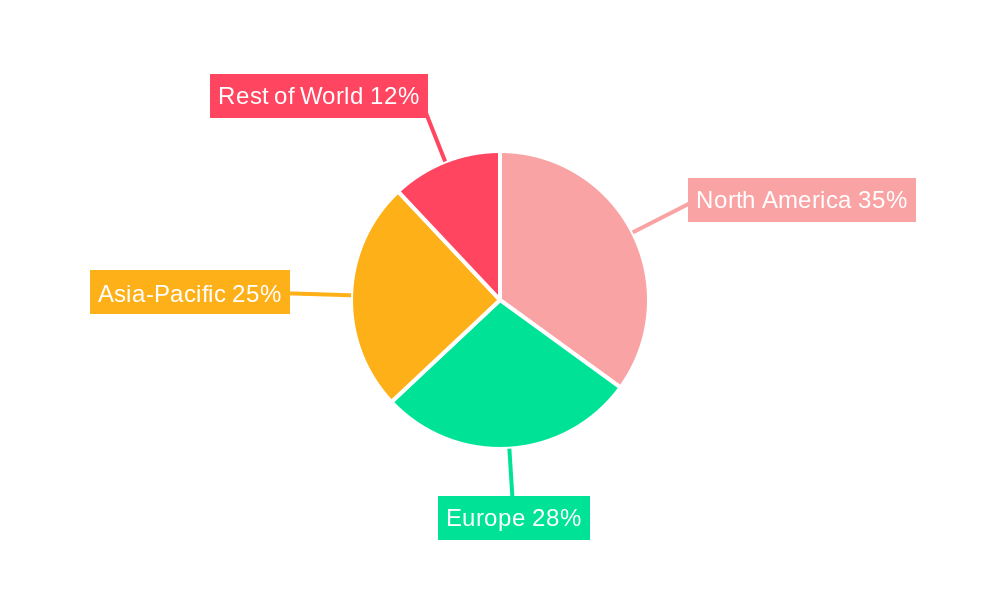

Dominant Markets & Segments in Life & Non-Life Insurance Market

The Asia-Pacific region currently holds the largest share of the Life & Non-Life Insurance market, driven by its massive population base, rapidly expanding middle class, and increasing penetration of insurance products. Within this region, China and India stand out as key markets with significant growth potential.

- Key Drivers for Asia-Pacific Dominance:

- Rapid Economic Growth: Rising disposable incomes and increasing awareness of insurance benefits.

- Favorable Government Policies: Supportive regulatory frameworks promoting insurance penetration.

- Expanding Infrastructure: Improved access to insurance services through enhanced digital infrastructure.

- Growing Middle Class: A larger consumer base with greater financial resources and insurance needs.

Detailed analysis reveals China's dominance within Asia-Pacific is attributed to its vast population, accelerating urbanization, and the expansion of the middle class. The country's robust economic growth fuels demand for various insurance products. India represents a strong secondary market experiencing rapid growth driven by increased financial inclusion and government initiatives.

Life & Non-Life Insurance Market Product Innovations

Recent years have witnessed significant product innovations in the Life & Non-Life insurance sector, particularly driven by technological advancements. AI-powered risk assessment tools, personalized insurance plans based on individual health data, and embedded insurance solutions integrated into various platforms are reshaping the landscape. These innovations are enhancing customer experience, improving risk management, and creating new revenue streams for insurance providers. The focus is on developing more accessible and affordable insurance products that cater to diverse consumer needs.

Report Segmentation & Scope

This report segments the Life & Non-Life insurance market based on product type (Life Insurance, Non-Life Insurance), distribution channel (online, offline), and geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed. The report provides detailed insights into the life insurance segment, covering term life, whole life, and universal life insurance, along with an examination of the non-life insurance segment focusing on health, auto, property, and liability insurance. Further, it includes market size projections for each segment during the forecast period and discusses the competitive landscape within each sector.

Key Drivers of Life & Non-Life Insurance Market Growth

Several factors contribute to the growth of the Life & Non-Life Insurance market. Technological advancements, like AI and big data analytics, enable better risk assessment and personalized product offerings. Economic growth and rising disposable incomes boost consumer spending on insurance products. Furthermore, favorable regulatory environments in certain regions incentivize insurance adoption. Increased awareness of health risks and a growing preference for financial security also play key roles.

Challenges in the Life & Non-Life Insurance Market Sector

Despite growth prospects, the Life & Non-Life Insurance market faces several challenges. Stringent regulatory compliance can increase operational costs. Supply chain disruptions, particularly evident in recent years, impact the availability of insurance services. Intense competition, both from established players and emerging InsurTech startups, exerts pressure on pricing and profit margins. These factors contribute to a complex and constantly evolving market landscape. The impact of these challenges is estimated to reduce the overall market growth by approximately xx% during the forecast period.

Leading Players in the Life & Non-Life Insurance Market Market

- Massachusetts Mutual Life Insurance Company

- Unitedhealth Group Incorporated

- Berkshire Hathaway Inc

- Ping An Insurance (Group) Company of China Ltd

- Cigna Corporation

- CHINA LIFE INSURANCE COMPANY LIMITED

- Anthem Inc

- AETNA HEALTH INSURANCE (THAILAND) PUBLIC COMPANY LIMITED

- The People's Insurance Company (Group) of China Limited

- NIPPON LIFE INSURANCE COMPANY

*List Not Exhaustive

Key Developments in Life & Non-Life Insurance Market Sector

- Jan 2023: Company X launches a new AI-powered claims processing system.

- Mar 2024: Company Y acquires Company Z for xx Million, expanding its market reach.

- Oct 2024: New regulations implemented in Region A impact insurance pricing strategies.

Strategic Life & Non-Life Insurance Market Market Outlook

The Life & Non-Life Insurance market presents significant opportunities for growth and innovation. The increasing adoption of digital technologies, expansion into emerging markets, and development of customized insurance products will drive market expansion. Strategic partnerships, mergers and acquisitions, and investment in technological advancements are crucial for success in this dynamic market. The potential for growth is particularly strong in emerging economies with rapidly expanding middle classes and underdeveloped insurance sectors. The continued integration of InsurTech will contribute significantly to the market's evolution and expansion.

Life & Non-Life Insurance Market Segmentation

-

1. Insurance Type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Others

-

1.1. Life Insurance

-

2. channel of distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Others

Life & Non-Life Insurance Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of NA

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of NA

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of AP

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

-

5. Middle East

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. Rest

Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Global M&A Activity in Insurance Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Others

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by channel of distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. North America Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6.1.1. Life Insurance

- 6.1.1.1. Individual

- 6.1.1.2. Group

- 6.1.2. Non-Life Insurance

- 6.1.2.1. Home

- 6.1.2.2. Motor

- 6.1.2.3. Others

- 6.1.1. Life Insurance

- 6.2. Market Analysis, Insights and Forecast - by channel of distribution

- 6.2.1. Direct

- 6.2.2. Agency

- 6.2.3. Banks

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7. Europe Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 7.1.1. Life Insurance

- 7.1.1.1. Individual

- 7.1.1.2. Group

- 7.1.2. Non-Life Insurance

- 7.1.2.1. Home

- 7.1.2.2. Motor

- 7.1.2.3. Others

- 7.1.1. Life Insurance

- 7.2. Market Analysis, Insights and Forecast - by channel of distribution

- 7.2.1. Direct

- 7.2.2. Agency

- 7.2.3. Banks

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8. Asia Pacific Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 8.1.1. Life Insurance

- 8.1.1.1. Individual

- 8.1.1.2. Group

- 8.1.2. Non-Life Insurance

- 8.1.2.1. Home

- 8.1.2.2. Motor

- 8.1.2.3. Others

- 8.1.1. Life Insurance

- 8.2. Market Analysis, Insights and Forecast - by channel of distribution

- 8.2.1. Direct

- 8.2.2. Agency

- 8.2.3. Banks

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9. South America Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 9.1.1. Life Insurance

- 9.1.1.1. Individual

- 9.1.1.2. Group

- 9.1.2. Non-Life Insurance

- 9.1.2.1. Home

- 9.1.2.2. Motor

- 9.1.2.3. Others

- 9.1.1. Life Insurance

- 9.2. Market Analysis, Insights and Forecast - by channel of distribution

- 9.2.1. Direct

- 9.2.2. Agency

- 9.2.3. Banks

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10. Middle East Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 10.1.1. Life Insurance

- 10.1.1.1. Individual

- 10.1.1.2. Group

- 10.1.2. Non-Life Insurance

- 10.1.2.1. Home

- 10.1.2.2. Motor

- 10.1.2.3. Others

- 10.1.1. Life Insurance

- 10.2. Market Analysis, Insights and Forecast - by channel of distribution

- 10.2.1. Direct

- 10.2.2. Agency

- 10.2.3. Banks

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Insurance Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Massachusetts Mutual Life Insurance Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Unitedhealth Group Incorporated

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Berkshire Hathaway Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ping An Insurance (Group) Company of China Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cigna Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CHINA LIFE INSURANCE COMPANY LIMITED

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Anthem Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AETNA HEALTH INSURANCE (THAILAND) PUBLIC COMPANY LIMITED

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The People's Insurance Company (Group) of China Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NIPPON LIFE INSURANCE COMPANY*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Massachusetts Mutual Life Insurance Company

List of Figures

- Figure 1: Life & Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Life & Non-Life Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 3: Life & Non-Life Insurance Market Revenue Million Forecast, by channel of distribution 2019 & 2032

- Table 4: Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 6: Life & Non-Life Insurance Market Revenue Million Forecast, by channel of distribution 2019 & 2032

- Table 7: Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: US Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of NA Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 13: Life & Non-Life Insurance Market Revenue Million Forecast, by channel of distribution 2019 & 2032

- Table 14: Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Germany Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: UK Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: France Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Russia Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Spain Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of NA Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 22: Life & Non-Life Insurance Market Revenue Million Forecast, by channel of distribution 2019 & 2032

- Table 23: Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: India Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: China Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Japan Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of AP Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 29: Life & Non-Life Insurance Market Revenue Million Forecast, by channel of distribution 2019 & 2032

- Table 30: Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Brazil Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Argentina Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 34: Life & Non-Life Insurance Market Revenue Million Forecast, by channel of distribution 2019 & 2032

- Table 35: Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: UAE Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Saudi Arabia Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest Life & Non-Life Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Life & Non-Life Insurance Market?

The projected CAGR is approximately < 3.00%.

2. Which companies are prominent players in the Life & Non-Life Insurance Market?

Key companies in the market include Massachusetts Mutual Life Insurance Company, Unitedhealth Group Incorporated, Berkshire Hathaway Inc, Ping An Insurance (Group) Company of China Ltd, Cigna Corporation, CHINA LIFE INSURANCE COMPANY LIMITED, Anthem Inc, AETNA HEALTH INSURANCE (THAILAND) PUBLIC COMPANY LIMITED, The People's Insurance Company (Group) of China Limited, NIPPON LIFE INSURANCE COMPANY*List Not Exhaustive.

3. What are the main segments of the Life & Non-Life Insurance Market?

The market segments include Insurance Type, channel of distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Global M&A Activity in Insurance Industry:.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence