Key Insights

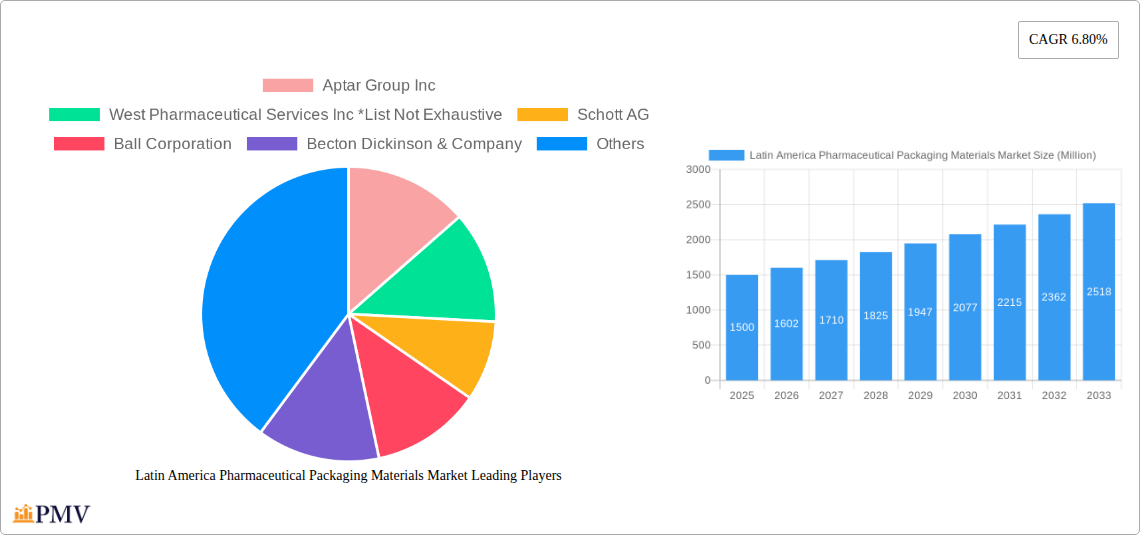

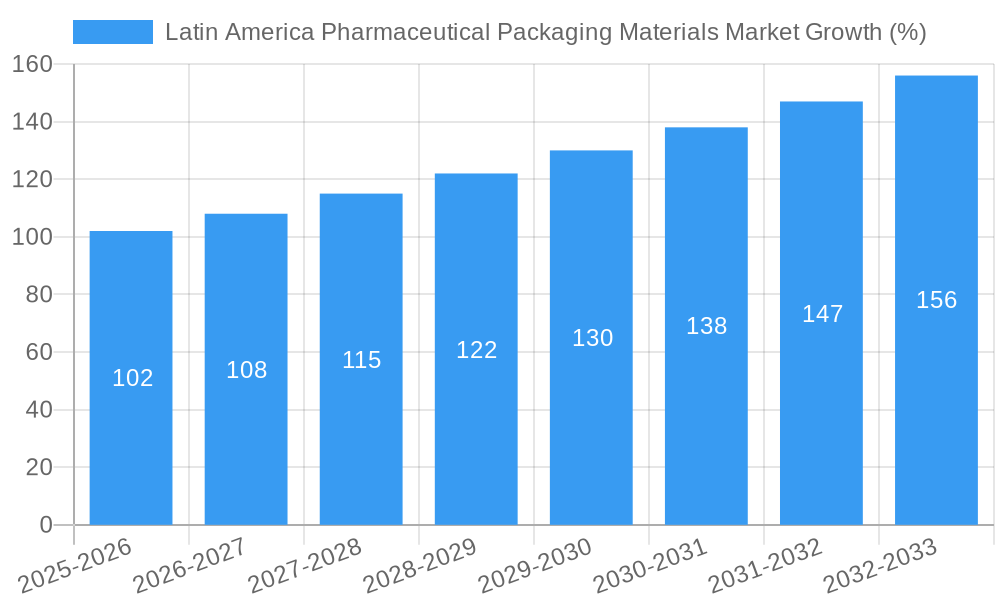

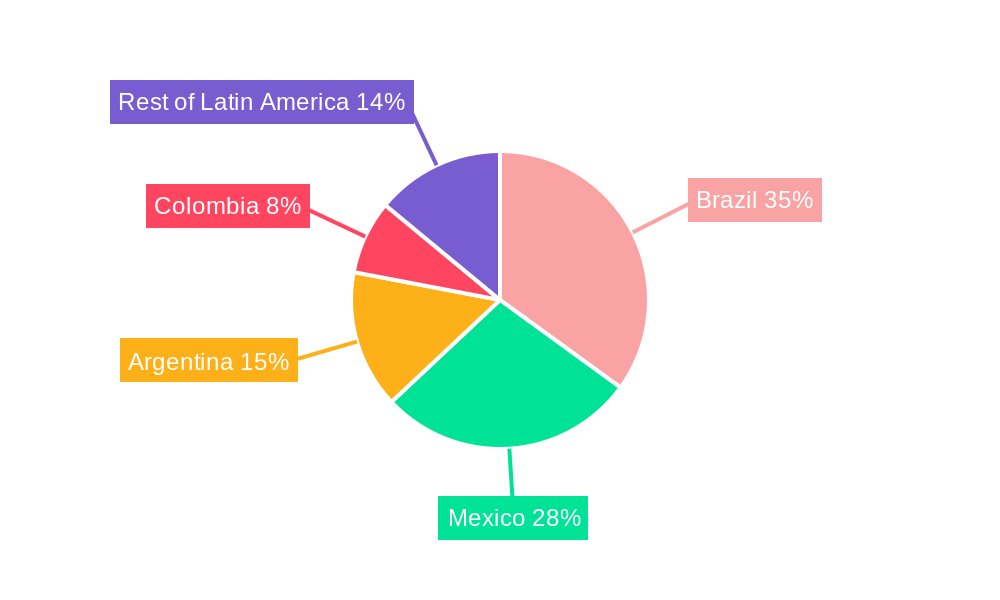

The Latin American pharmaceutical packaging materials market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.80% from 2025 to 2033. This expansion is fueled by several key factors. The increasing prevalence of chronic diseases and a rising elderly population across the region are significantly boosting demand for pharmaceutical products, consequently driving the need for effective and safe packaging solutions. Furthermore, stringent regulatory requirements regarding drug safety and efficacy are pushing manufacturers to adopt advanced packaging technologies, such as tamper-evident closures and prefillable syringes, which contribute to market growth. Brazil, Mexico, and Argentina represent the largest national markets, contributing significantly to the overall regional market size. The market is segmented by packaging material (plastic, paper & paperboard, glass, metal) and product type (blister packs, bottles, syringes, vials, ampoules, closures, containers, and other products). The dominance of plastic packaging is expected to continue, driven by its cost-effectiveness and versatility. However, growing environmental concerns are promoting the adoption of sustainable alternatives, like paper-based packaging, creating opportunities for innovation and market diversification.

The competitive landscape is marked by the presence of both multinational corporations like Aptar Group, West Pharmaceutical Services, Schott AG, and Amcor Limited, and regional players. These companies are focusing on strategic partnerships, acquisitions, and product innovation to gain a competitive edge. While the market faces some restraints, such as economic fluctuations in certain Latin American countries and potential supply chain disruptions, the overall growth trajectory remains positive, propelled by the fundamental drivers mentioned above. The market is poised for considerable expansion in the coming years, spurred by a confluence of factors contributing to a strong demand for pharmaceutical packaging materials in this dynamic region. Growth will be uneven across segments, with innovative packaging solutions for injectable drugs and those addressing increasing counterfeiting concerns likely experiencing above-average growth.

Latin America Pharmaceutical Packaging Materials Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Latin America Pharmaceutical Packaging Materials Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, competitive landscapes, and future growth trajectories. The market is segmented by packaging material (Plastic, Paper and Paperboard, Glass, Metal), product type (Blister Packs, Plastic Bottles, Prefillable Syringes, Vials and Ampuls, Closures, Containers, Other Products), and country (Brazil, Mexico, Colombia, Argentina, Rest of Latin America). Key players like Aptar Group Inc, West Pharmaceutical Services Inc, Schott AG, Ball Corporation, Becton Dickinson & Company, Intrapac Group, CCL Industries Inc, Amcor Limited, Sealed Air Corporation, and Gerresheimer AG are analyzed, though this list is not exhaustive. The report’s total market value in 2025 is estimated at xx Million.

Latin America Pharmaceutical Packaging Materials Market Structure & Competitive Dynamics

The Latin American pharmaceutical packaging materials market exhibits a moderately concentrated structure, with several multinational corporations holding significant market share. The market's competitive dynamics are shaped by factors such as innovation in packaging technologies, stringent regulatory frameworks across different Latin American countries, and the availability of substitute materials. End-user trends, particularly the increasing demand for convenient and tamper-evident packaging, are also significant drivers. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with deal values totaling approximately xx Million in the past five years. Key players are focusing on strategic partnerships and organic growth through product diversification. For example, market share for plastic packaging materials is estimated at xx%, while glass packaging holds approximately xx%. The regulatory landscape, though, varies across countries, creating both opportunities and challenges for companies operating regionally. The level of innovation varies by segment, with companies investing heavily in advanced barrier technologies and sustainable materials, responding to pressure from environmental regulations and increasing sustainability expectations.

Latin America Pharmaceutical Packaging Materials Market Industry Trends & Insights

The Latin America pharmaceutical packaging materials market is projected to experience robust growth with a CAGR of xx% during the forecast period (2025-2033). This growth is driven by several factors, including the rising prevalence of chronic diseases, expanding healthcare infrastructure, and increasing pharmaceutical production within the region. Technological advancements in packaging materials, such as the adoption of modified atmosphere packaging (MAP) and blister packs with enhanced security features, are significantly shaping market trends. Furthermore, changing consumer preferences towards convenience and safety are driving demand for innovative packaging solutions. The market penetration of eco-friendly and sustainable packaging materials is gradually increasing, with a projected xx% market share by 2033. Competitive dynamics remain intense, with key players focusing on product differentiation, capacity expansion, and strategic partnerships to gain a competitive edge. The rising adoption of sophisticated packaging technology is expected to accelerate market expansion, particularly for specialized products that require high levels of containment and protection.

Dominant Markets & Segments in Latin America Pharmaceutical Packaging Materials Market

Brazil and Mexico represent the largest national markets within the Latin America pharmaceutical packaging materials sector, accounting for approximately xx% and xx% of the total market value in 2025 respectively. This dominance stems from a combination of factors including:

- Larger populations: These countries have considerably larger populations than other nations in the region, creating a higher demand for pharmaceutical products and, consequently, packaging materials.

- Stronger economies: Brazil and Mexico boast relatively stronger economies compared to other Latin American countries, contributing to higher healthcare spending and pharmaceutical investment.

- Established healthcare infrastructure: Both countries possess relatively advanced healthcare systems, including a robust network of hospitals and pharmacies.

Within the product segment, plastic packaging materials dominate, holding approximately xx% market share in 2025 due to their cost-effectiveness, versatility, and suitability for various packaging formats. However, growth in the glass and paper/paperboard segments is anticipated due to an increasing focus on sustainability. The blister pack segment accounts for a significant portion of total market value due to its widespread use in packaging tablets and capsules. This segment demonstrates exceptional growth potential, projected to grow at xx% CAGR.

Latin America Pharmaceutical Packaging Materials Market Product Innovations

Recent innovations focus on sustainable and eco-friendly materials, such as biodegradable plastics and recycled paperboard. The development of advanced barrier technologies improves product shelf life and prevents contamination. Active and intelligent packaging solutions are gaining traction, providing features such as temperature indicators and tamper evidence. These innovations enhance product safety and security while addressing consumer concerns around environmental impact and product integrity, thereby improving market fit and competitive advantage.

Report Segmentation & Scope

This report segments the Latin America pharmaceutical packaging materials market by packaging material (Plastic, Paper and Paperboard, Glass, Metal), product type (Blister Packs, Plastic Bottles, Prefillable Syringes, Vials and Ampuls, Closures, Containers, Other Products), and country (Brazil, Mexico, Colombia, Argentina, Rest of Latin America). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. The Plastic segment is expected to grow at xx% CAGR, while the Blister Packs segment is projected to grow at xx% CAGR. The Brazilian market is predicted to reach xx Million by 2033. The competitive landscape varies across different segments, with some experiencing higher concentration than others.

Key Drivers of Latin America Pharmaceutical Packaging Materials Market Growth

Several factors drive market growth, including: the growing prevalence of chronic diseases requiring long-term medication, increasing disposable incomes leading to increased healthcare spending, the expanding pharmaceutical manufacturing sector in Latin America, and favorable government regulations promoting the growth of the healthcare sector. Technological advancements in packaging materials, particularly in areas of sustainability and security, further fuel market expansion. The increasing demand for convenient and tamper-evident packaging also contributes significantly to market growth.

Challenges in the Latin America Pharmaceutical Packaging Materials Market Sector

The Latin American pharmaceutical packaging materials market faces challenges, including economic volatility in some countries, the prevalence of counterfeit drugs requiring robust packaging solutions, and the need for infrastructure improvement to support efficient supply chains. Regulatory inconsistencies across different Latin American countries pose hurdles to market penetration for multinational corporations. The competitive intensity also creates pressure on margins and requires companies to focus on differentiating their offerings and innovating. These challenges result in xx% of products failing to meet quality standards annually.

Leading Players in the Latin America Pharmaceutical Packaging Materials Market Market

- Aptar Group Inc

- West Pharmaceutical Services Inc

- Schott AG

- Ball Corporation

- Becton Dickinson & Company

- Intrapac Group

- CCL Industries Inc

- Amcor Limited

- Sealed Air Corporation

- Gerresheimer AG

Key Developments in Latin America Pharmaceutical Packaging Materials Market Sector

- January 2023: Amcor launches a new range of sustainable packaging solutions for the pharmaceutical industry in Brazil.

- June 2022: Aptar Group Inc. announces a strategic partnership with a leading Latin American pharmaceutical company to develop innovative drug delivery systems.

- October 2021: West Pharmaceutical Services Inc. invests in expanding its manufacturing facility in Mexico to meet growing demand. (Note: This is a sample; a full report would contain many more specific examples)

Strategic Latin America Pharmaceutical Packaging Materials Market Outlook

The Latin America pharmaceutical packaging materials market presents significant growth opportunities, driven by increasing healthcare spending, technological innovation, and a growing focus on sustainability. Companies should focus on strategic partnerships, product diversification, and investment in advanced technologies to remain competitive. The increasing demand for specialized packaging solutions, such as those for biologics and injectables, presents a particularly lucrative avenue for growth. Exploring sustainable and eco-friendly packaging options will be crucial for attracting environmentally conscious consumers and complying with stricter regulations. The market's future potential is considerable, making strategic investment and proactive adaptation essential for capturing market share.

Latin America Pharmaceutical Packaging Materials Market Segmentation

-

1. Packaging Material

- 1.1. Plastic

- 1.2. Paper and Paperboard

- 1.3. Glass

- 1.4. Metal

-

2. Product

- 2.1. Blister Packs

- 2.2. Plastic Bottles

- 2.3. Prefillable Syringes

- 2.4. Vials and Ampuls

- 2.5. Closures

- 2.6. Containers

- 2.7. Other Products

Latin America Pharmaceutical Packaging Materials Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Pharmaceutical Packaging Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Domestic Pharmaceuticals Production; Growing FDI In regional pharmaceutical and packaging sector

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Processes such as Aseptic Food Packaging

- 3.4. Market Trends

- 3.4.1. Increasing Domestic Pharmaceuticals Production

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Pharmaceutical Packaging Materials Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material

- 5.1.1. Plastic

- 5.1.2. Paper and Paperboard

- 5.1.3. Glass

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Blister Packs

- 5.2.2. Plastic Bottles

- 5.2.3. Prefillable Syringes

- 5.2.4. Vials and Ampuls

- 5.2.5. Closures

- 5.2.6. Containers

- 5.2.7. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Packaging Material

- 6. Brazil Latin America Pharmaceutical Packaging Materials Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Pharmaceutical Packaging Materials Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Pharmaceutical Packaging Materials Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Pharmaceutical Packaging Materials Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Pharmaceutical Packaging Materials Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Pharmaceutical Packaging Materials Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Aptar Group Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 West Pharmaceutical Services Inc *List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Schott AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Ball Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Becton Dickinson & Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Intrapac Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 CCL Industries Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Amcor Limited

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sealed Air Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Gerresheimer AG

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Aptar Group Inc

List of Figures

- Figure 1: Latin America Pharmaceutical Packaging Materials Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Pharmaceutical Packaging Materials Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Pharmaceutical Packaging Materials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Pharmaceutical Packaging Materials Market Revenue Million Forecast, by Packaging Material 2019 & 2032

- Table 3: Latin America Pharmaceutical Packaging Materials Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Latin America Pharmaceutical Packaging Materials Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Pharmaceutical Packaging Materials Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Pharmaceutical Packaging Materials Market Revenue Million Forecast, by Packaging Material 2019 & 2032

- Table 13: Latin America Pharmaceutical Packaging Materials Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Latin America Pharmaceutical Packaging Materials Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Chile Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Venezuela Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ecuador Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Bolivia Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Paraguay Latin America Pharmaceutical Packaging Materials Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Pharmaceutical Packaging Materials Market?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Latin America Pharmaceutical Packaging Materials Market?

Key companies in the market include Aptar Group Inc, West Pharmaceutical Services Inc *List Not Exhaustive, Schott AG, Ball Corporation, Becton Dickinson & Company, Intrapac Group, CCL Industries Inc, Amcor Limited, Sealed Air Corporation, Gerresheimer AG.

3. What are the main segments of the Latin America Pharmaceutical Packaging Materials Market?

The market segments include Packaging Material, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Domestic Pharmaceuticals Production; Growing FDI In regional pharmaceutical and packaging sector.

6. What are the notable trends driving market growth?

Increasing Domestic Pharmaceuticals Production.

7. Are there any restraints impacting market growth?

Growing Demand for Processes such as Aseptic Food Packaging.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Pharmaceutical Packaging Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Pharmaceutical Packaging Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Pharmaceutical Packaging Materials Market?

To stay informed about further developments, trends, and reports in the Latin America Pharmaceutical Packaging Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence