Key Insights

The global laboratory electronic balance market, currently valued at approximately $0.82 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 4.89% from 2025 to 2033. This expansion is fueled by several key factors. Increased research and development activities across various scientific disciplines, including pharmaceuticals, biotechnology, and environmental science, are significantly boosting demand for precise and reliable weighing instruments. Furthermore, the growing adoption of advanced technologies like automated weighing systems and connectivity features (e.g., data logging and integration with laboratory information management systems) is enhancing the efficiency and accuracy of laboratory workflows, thereby driving market growth. The rising prevalence of quality control and assurance measures across industries also contributes to the increasing demand for high-precision laboratory balances. The market is highly competitive, with major players including Mettler-Toledo, Sartorius, and Ohaus constantly innovating to improve product features and expand their market share.

Laboratory Electronic Balance Market Market Size (In Million)

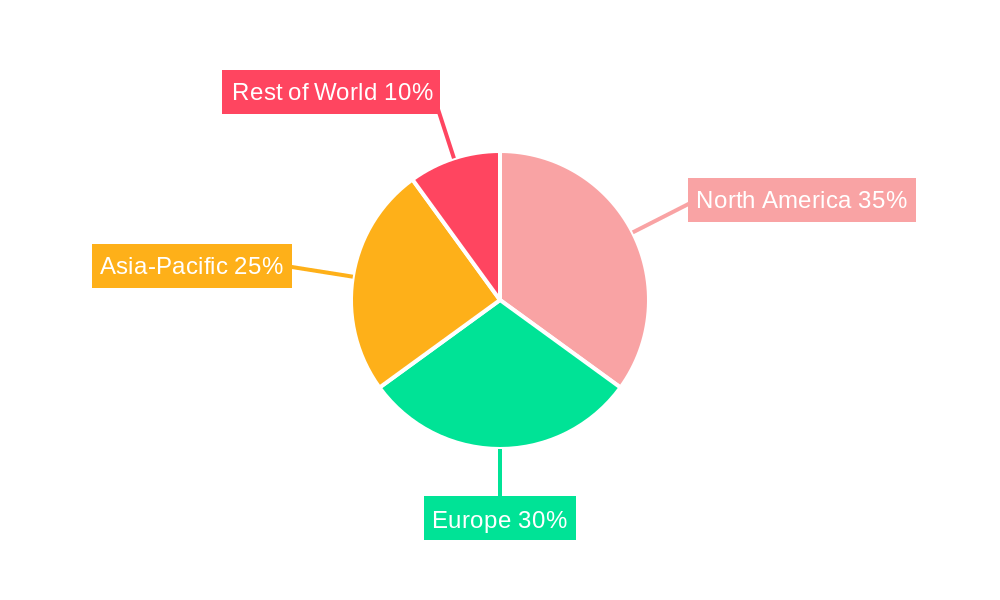

The market segmentation reveals a diverse landscape with various balance types catering to specific needs within different research areas. While specific segment breakdowns are not provided, it can be inferred that segments like analytical balances, precision balances, and microbalances each contribute significantly to the overall market. Geographic variations in market penetration are likely, with developed regions such as North America and Europe showing higher adoption rates due to advanced research infrastructure and stringent regulatory compliance. Emerging economies in Asia-Pacific and other developing regions are expected to witness rapid growth, driven by increasing investments in healthcare and scientific research. Restraints to market growth might include economic downturns affecting research budgets and the potential for technological obsolescence as more advanced weighing technologies emerge. However, the overarching trend points toward continued expansion, fueled by the intrinsic need for accurate weighing in scientific research and quality control.

Laboratory Electronic Balance Market Company Market Share

Deep Dive into the Laboratory Electronic Balance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the global Laboratory Electronic Balance Market, offering invaluable insights for industry stakeholders, investors, and researchers. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report meticulously examines market dynamics, competitive landscapes, technological advancements, and future growth prospects. The global market size is estimated at xx Million in 2025, and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Laboratory Electronic Balance Market Market Structure & Competitive Dynamics

The Laboratory Electronic Balance market is characterized by a moderately concentrated structure, with a few major players holding significant market share. Mettler-Toledo International Inc, Sartorius AG, and A&D Company Limited are among the leading companies, consistently driving innovation and market expansion. Market concentration is further influenced by the presence of several regional players and specialized niche providers.

The competitive landscape is dynamic, shaped by intense R&D efforts, strategic partnerships, mergers and acquisitions (M&A), and aggressive pricing strategies. Recent M&A activities, while not publicly disclosed in terms of specific deal values for all transactions, indicate a trend towards consolidation. For instance, the acquisition of smaller balance manufacturers by larger companies is observed, aimed at expanding product portfolios and enhancing market reach. This competitive pressure necessitates continuous innovation to maintain market leadership. The regulatory landscape, varying across regions, also impacts market structure. Stringent regulations regarding accuracy, safety, and calibration standards in certain jurisdictions influence product development and market entry strategies. Furthermore, the growing adoption of advanced analytical techniques fuels demand for sophisticated electronic balances, impacting market segmentation and driving growth in the high-end segment.

- Market Share: Mettler-Toledo and Sartorius are estimated to hold a combined market share of approximately 40-50% in 2025.

- M&A Activity: While precise deal values are not publicly available for all transactions, the observed trend is towards acquisition of smaller companies by larger players.

- Product Substitutes: While direct substitutes are limited, advancements in other analytical technologies such as spectroscopy can sometimes indirectly reduce reliance on highly precise balances in certain applications.

Laboratory Electronic Balance Market Industry Trends & Insights

The Laboratory Electronic Balance market is experiencing robust growth, fueled by several key factors. The increasing demand for precise measurement in various scientific research, pharmaceutical, food & beverage, and industrial applications drives market expansion. The rising adoption of advanced analytical techniques, coupled with automation in laboratories, fuels the demand for sophisticated and automated electronic balances. Moreover, stringent quality control regulations across numerous industries mandate the use of accurate and reliable weighing instruments, further propelling market growth.

Technological disruptions, such as the incorporation of smart features, improved connectivity, and advanced data management capabilities, are transforming the landscape. The integration of advanced technologies such as AI and IoT into balance systems is anticipated to improve accuracy and efficiency, further impacting market dynamics. Consumer preferences are shifting towards user-friendly, compact, and energy-efficient models with enhanced features such as data logging and connectivity options. The competitive dynamics are intensely competitive, with key players focusing on product innovation, strategic partnerships, and aggressive pricing to secure a larger market share.

The global market is expected to witness a healthy CAGR of approximately xx% during the forecast period, with significant market penetration in developing economies as they adopt more advanced laboratory equipment.

Dominant Markets & Segments in Laboratory Electronic Balance Market

The North American region currently holds a leading position in the Laboratory Electronic Balance market, primarily due to the strong presence of major players and high adoption of advanced technologies in the pharmaceutical and life science sectors. The high investments in R&D and technological advancement coupled with stringent regulatory standards contributes to the significant market dominance.

- Key Drivers in North America:

- Strong presence of major market players.

- High adoption rates in pharmaceutical and life sciences.

- Significant investment in R&D and advanced technologies.

- Stringent regulatory standards.

- Well-developed laboratory infrastructure.

Europe also holds a notable market share due to a robust pharmaceutical and chemical industry along with a strong presence of research institutions. While the Asia-Pacific region exhibits significant growth potential, the North American market maintains its dominance through continuous technological advances and increased regulatory compliance requirements. This is also supported by robust economic performance and government investments.

The analytical balance segment is currently the most dominant due to its widespread use in various research, quality control, and analytical applications, followed by precision balances and microbalances.

Laboratory Electronic Balance Market Product Innovations

Recent years have witnessed remarkable innovation in the Laboratory Electronic Balance market, characterized by the development of highly precise, user-friendly, and technologically advanced instruments. New product launches featuring advanced features such as touchscreen interfaces, automated calibration systems, improved data connectivity, and enhanced weighing capabilities are driving market growth. These innovations directly address the growing demand for increased efficiency, accuracy, and reduced operational costs in laboratories. The integration of smart features and advanced data analysis capabilities is improving measurement accuracy, streamlining workflows, and enhancing data management capabilities. This trend caters to the growing needs of modern laboratories for higher levels of automation and data integrity.

Report Segmentation & Scope

This report segments the Laboratory Electronic Balance Market based on several key parameters:

By Product Type: Analytical Balances, Precision Balances, Microbalances, Semi-Micro Balances, Moisture Balances, and others. Each segment exhibits unique growth projections and competitive dynamics. Analytical balances are the largest segment, driven by a widespread application in various sectors.

By Application: Pharmaceutical & Biotechnology, Food & Beverage, Chemical, Research & Academic Institutions, Industrial Manufacturing, and others. Each application area presents a distinct growth trajectory based on the specific technological and regulatory needs.

By Region: North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Regional variations in market dynamics are determined by the level of technological adoption, economic development, and regulatory environments.

Key Drivers of Laboratory Electronic Balance Market Growth

The Laboratory Electronic Balance market growth is primarily fueled by several key factors: Increasing demand for precise measurements across various industries, technological advancements driving higher accuracy and efficiency, and stringent regulatory standards necessitate the use of high-quality electronic balances. Furthermore, the rising adoption of automated laboratory systems further propels the demand for integrated and automated weighing solutions. The expansion of research and development activities across various scientific and industrial fields provides additional growth impetus.

Challenges in the Laboratory Electronic Balance Market Sector

Despite the robust growth, challenges persist in this market sector. Fluctuations in raw material prices and supply chain disruptions can impact production costs and market stability. Intense competition and the introduction of technologically superior products necessitate continuous innovation to maintain market share. Regulatory compliance requirements vary across regions, which can pose obstacles for manufacturers expanding their operations globally.

Leading Players in the Laboratory Electronic Balance Market Market

- Mettler-Toledo International Inc

- Sartorius AG

- A&D Company Limited

- BEL Engineering SRL

- Changzhou Xingyun Electronic Equipment Co Ltd

- CAS Corporation

- Brecknell scales

- Adam Equipment

- Precisa

- OHAUS Instruments (Shanghai) Co Ltd

- RADWAG Balances and Scales

- Shimadzu Corporation

- KERN & SOHN GmbH

- BONSO Electronics International Inc

- Brecknell Scales (Avery Weigh-Tronix LLC)

- *List Not Exhaustive

Key Developments in Laboratory Electronic Balance Market Sector

- July 2024: Mettler Toledo launched the XPR Essential Analytical Balances and Microbalances, featuring advanced load cell technology and an innovative weighing pan design for enhanced accuracy and efficiency. They also enhanced their existing XPR Analytical and Automatic Balance portfolio.

- April 2024: Sartorius introduced the Quintix Pro laboratory balance, highlighting usability, flexibility, and sustainability with a 7-inch full-touch display and automated leveling system.

Strategic Laboratory Electronic Balance Market Market Outlook

The future of the Laboratory Electronic Balance market looks promising, driven by ongoing technological advancements, increased demand from diverse sectors, and expanding global research activities. Strategic opportunities lie in developing innovative products with enhanced features, expanding into emerging markets, and establishing strong partnerships to strengthen market presence. The increasing focus on automation and data connectivity will shape future product development and market growth.

Laboratory Electronic Balance Market Segmentation

-

1. Type

- 1.1. Analytical Balance

- 1.2. Precision Balance

- 1.3. Compact Balances

- 1.4. Other Types

-

2. End-user Vertical

- 2.1. Pharmaceutical

- 2.2. Food and Beverage

- 2.3. Chemical

- 2.4. Biotechnology

- 2.5. Other End-user Verticals

Laboratory Electronic Balance Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Laboratory Electronic Balance Market Regional Market Share

Geographic Coverage of Laboratory Electronic Balance Market

Laboratory Electronic Balance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Scope of Scientific Research and Industrial Applications; Rising Demand for Accurate and Reliable Measurements

- 3.3. Market Restrains

- 3.3.1. Expanding Scope of Scientific Research and Industrial Applications; Rising Demand for Accurate and Reliable Measurements

- 3.4. Market Trends

- 3.4.1. The Pharmaceutical Research Application Segment is Expected to Hold a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Laboratory Electronic Balance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analytical Balance

- 5.1.2. Precision Balance

- 5.1.3. Compact Balances

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Pharmaceutical

- 5.2.2. Food and Beverage

- 5.2.3. Chemical

- 5.2.4. Biotechnology

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Laboratory Electronic Balance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Analytical Balance

- 6.1.2. Precision Balance

- 6.1.3. Compact Balances

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Pharmaceutical

- 6.2.2. Food and Beverage

- 6.2.3. Chemical

- 6.2.4. Biotechnology

- 6.2.5. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Laboratory Electronic Balance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Analytical Balance

- 7.1.2. Precision Balance

- 7.1.3. Compact Balances

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Pharmaceutical

- 7.2.2. Food and Beverage

- 7.2.3. Chemical

- 7.2.4. Biotechnology

- 7.2.5. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Laboratory Electronic Balance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Analytical Balance

- 8.1.2. Precision Balance

- 8.1.3. Compact Balances

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Pharmaceutical

- 8.2.2. Food and Beverage

- 8.2.3. Chemical

- 8.2.4. Biotechnology

- 8.2.5. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Laboratory Electronic Balance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Analytical Balance

- 9.1.2. Precision Balance

- 9.1.3. Compact Balances

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Pharmaceutical

- 9.2.2. Food and Beverage

- 9.2.3. Chemical

- 9.2.4. Biotechnology

- 9.2.5. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Laboratory Electronic Balance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Analytical Balance

- 10.1.2. Precision Balance

- 10.1.3. Compact Balances

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Pharmaceutical

- 10.2.2. Food and Beverage

- 10.2.3. Chemical

- 10.2.4. Biotechnology

- 10.2.5. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Laboratory Electronic Balance Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Analytical Balance

- 11.1.2. Precision Balance

- 11.1.3. Compact Balances

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.2.1. Pharmaceutical

- 11.2.2. Food and Beverage

- 11.2.3. Chemical

- 11.2.4. Biotechnology

- 11.2.5. Other End-user Verticals

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Mettler-Toledo International Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Sartorius AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 A&D Company Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 BEL Engineering SRL

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Changzhou Xingyun Electronic Equipment Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 CAS Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Brecknell scales

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Adam Equipment

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Precisa

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 OHAUS Instruments (Shanghai) Co Ltd

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 RADWAG Balances and Scales

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Shimadzu Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 KERN & SOHN GmbH

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 BONSO Electronics International Inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Brecknell Scales (Avery Weigh-Tronix LLC)*List Not Exhaustive

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Mettler-Toledo International Inc

List of Figures

- Figure 1: Global Laboratory Electronic Balance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Laboratory Electronic Balance Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Laboratory Electronic Balance Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Laboratory Electronic Balance Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America Laboratory Electronic Balance Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Laboratory Electronic Balance Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Laboratory Electronic Balance Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 8: North America Laboratory Electronic Balance Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 9: North America Laboratory Electronic Balance Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 10: North America Laboratory Electronic Balance Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 11: North America Laboratory Electronic Balance Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Laboratory Electronic Balance Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Laboratory Electronic Balance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Laboratory Electronic Balance Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Laboratory Electronic Balance Market Revenue (Million), by Type 2025 & 2033

- Figure 16: Europe Laboratory Electronic Balance Market Volume (Billion), by Type 2025 & 2033

- Figure 17: Europe Laboratory Electronic Balance Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Laboratory Electronic Balance Market Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Laboratory Electronic Balance Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 20: Europe Laboratory Electronic Balance Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 21: Europe Laboratory Electronic Balance Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 22: Europe Laboratory Electronic Balance Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 23: Europe Laboratory Electronic Balance Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Laboratory Electronic Balance Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Laboratory Electronic Balance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Laboratory Electronic Balance Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Laboratory Electronic Balance Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Asia Laboratory Electronic Balance Market Volume (Billion), by Type 2025 & 2033

- Figure 29: Asia Laboratory Electronic Balance Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Laboratory Electronic Balance Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Laboratory Electronic Balance Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 32: Asia Laboratory Electronic Balance Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 33: Asia Laboratory Electronic Balance Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 34: Asia Laboratory Electronic Balance Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 35: Asia Laboratory Electronic Balance Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Laboratory Electronic Balance Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Laboratory Electronic Balance Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Laboratory Electronic Balance Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Australia and New Zealand Laboratory Electronic Balance Market Revenue (Million), by Type 2025 & 2033

- Figure 40: Australia and New Zealand Laboratory Electronic Balance Market Volume (Billion), by Type 2025 & 2033

- Figure 41: Australia and New Zealand Laboratory Electronic Balance Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Australia and New Zealand Laboratory Electronic Balance Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Australia and New Zealand Laboratory Electronic Balance Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 44: Australia and New Zealand Laboratory Electronic Balance Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 45: Australia and New Zealand Laboratory Electronic Balance Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 46: Australia and New Zealand Laboratory Electronic Balance Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 47: Australia and New Zealand Laboratory Electronic Balance Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Australia and New Zealand Laboratory Electronic Balance Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Australia and New Zealand Laboratory Electronic Balance Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Australia and New Zealand Laboratory Electronic Balance Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Latin America Laboratory Electronic Balance Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Latin America Laboratory Electronic Balance Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Latin America Laboratory Electronic Balance Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Latin America Laboratory Electronic Balance Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Latin America Laboratory Electronic Balance Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 56: Latin America Laboratory Electronic Balance Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 57: Latin America Laboratory Electronic Balance Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 58: Latin America Laboratory Electronic Balance Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 59: Latin America Laboratory Electronic Balance Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Latin America Laboratory Electronic Balance Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Latin America Laboratory Electronic Balance Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Latin America Laboratory Electronic Balance Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Laboratory Electronic Balance Market Revenue (Million), by Type 2025 & 2033

- Figure 64: Middle East and Africa Laboratory Electronic Balance Market Volume (Billion), by Type 2025 & 2033

- Figure 65: Middle East and Africa Laboratory Electronic Balance Market Revenue Share (%), by Type 2025 & 2033

- Figure 66: Middle East and Africa Laboratory Electronic Balance Market Volume Share (%), by Type 2025 & 2033

- Figure 67: Middle East and Africa Laboratory Electronic Balance Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 68: Middle East and Africa Laboratory Electronic Balance Market Volume (Billion), by End-user Vertical 2025 & 2033

- Figure 69: Middle East and Africa Laboratory Electronic Balance Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 70: Middle East and Africa Laboratory Electronic Balance Market Volume Share (%), by End-user Vertical 2025 & 2033

- Figure 71: Middle East and Africa Laboratory Electronic Balance Market Revenue (Million), by Country 2025 & 2033

- Figure 72: Middle East and Africa Laboratory Electronic Balance Market Volume (Billion), by Country 2025 & 2033

- Figure 73: Middle East and Africa Laboratory Electronic Balance Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Middle East and Africa Laboratory Electronic Balance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Laboratory Electronic Balance Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Laboratory Electronic Balance Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 5: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Global Laboratory Electronic Balance Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: Global Laboratory Electronic Balance Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 11: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 15: Global Laboratory Electronic Balance Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 16: Global Laboratory Electronic Balance Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 17: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global Laboratory Electronic Balance Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 22: Global Laboratory Electronic Balance Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 23: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 26: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 27: Global Laboratory Electronic Balance Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 28: Global Laboratory Electronic Balance Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 29: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 33: Global Laboratory Electronic Balance Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 34: Global Laboratory Electronic Balance Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 35: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Country 2020 & 2033

- Table 37: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Type 2020 & 2033

- Table 39: Global Laboratory Electronic Balance Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 40: Global Laboratory Electronic Balance Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 41: Global Laboratory Electronic Balance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Laboratory Electronic Balance Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Laboratory Electronic Balance Market?

The projected CAGR is approximately 4.89%.

2. Which companies are prominent players in the Laboratory Electronic Balance Market?

Key companies in the market include Mettler-Toledo International Inc, Sartorius AG, A&D Company Limited, BEL Engineering SRL, Changzhou Xingyun Electronic Equipment Co Ltd, CAS Corporation, Brecknell scales, Adam Equipment, Precisa, OHAUS Instruments (Shanghai) Co Ltd, RADWAG Balances and Scales, Shimadzu Corporation, KERN & SOHN GmbH, BONSO Electronics International Inc, Brecknell Scales (Avery Weigh-Tronix LLC)*List Not Exhaustive.

3. What are the main segments of the Laboratory Electronic Balance Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Scope of Scientific Research and Industrial Applications; Rising Demand for Accurate and Reliable Measurements.

6. What are the notable trends driving market growth?

The Pharmaceutical Research Application Segment is Expected to Hold a Significant Share in the Market.

7. Are there any restraints impacting market growth?

Expanding Scope of Scientific Research and Industrial Applications; Rising Demand for Accurate and Reliable Measurements.

8. Can you provide examples of recent developments in the market?

July 2024: Mettler Toledo introduced its latest offerings: the XPR Essential Analytical Balances and Microbalances. The XPR Essential Analytical Balances are engineered to provide swift and precise results. Their advanced load cell technology and innovative hanging weighing pan design ensure accurate measurements of small samples, effectively minimizing waste and optimizing costs. In tandem with these launches, Mettler Toledo is enhancing its XPR Analytical and Automatic Balance portfolio with notable upgrades.April 2024: Sartorius introduced its latest innovation: the Quintix Pro laboratory balance. This cutting-edge device redefines standard laboratory weighing. Tailored for the dynamic needs of contemporary labs, the Quintix Pro stands out in usability, flexibility, and sustainability. Leveraging advanced engineering and top-tier features, it promises an unparalleled user experience. Its 7-inch, high-resolution, full-touch graphic display simplifies menu navigation and boosts productivity. Additionally, the series boasts an automated motorized leveling system, streamlining daily tasks and ensuring precise results every time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Laboratory Electronic Balance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Laboratory Electronic Balance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Laboratory Electronic Balance Market?

To stay informed about further developments, trends, and reports in the Laboratory Electronic Balance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence