Key Insights

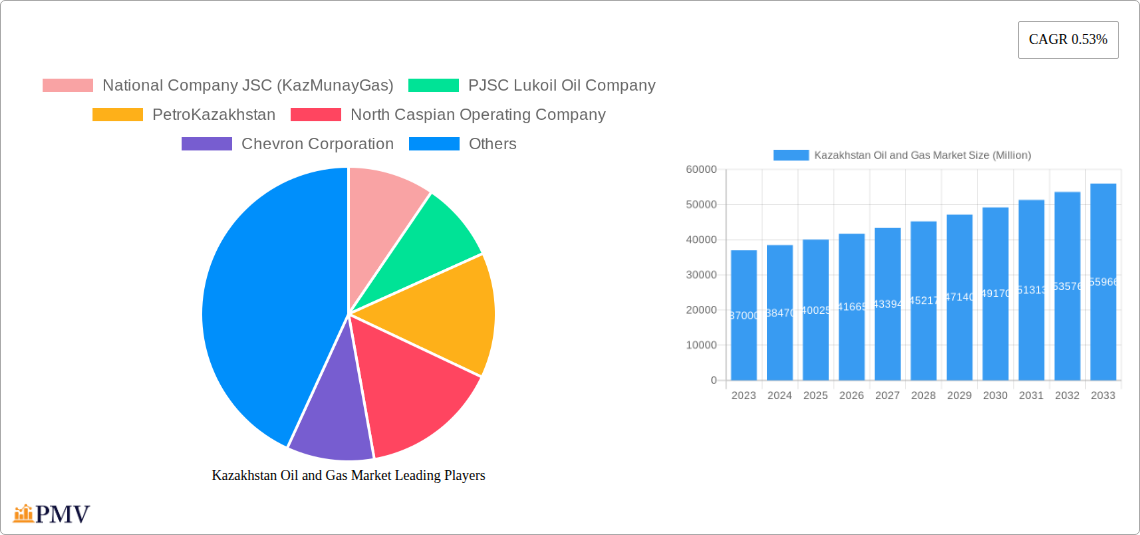

The Kazakhstan Oil and Gas Market is poised for significant growth, with an estimated market size of USD 37 billion in 2023. This expansion is underpinned by a projected Compound Annual Growth Rate (CAGR) of 4.1% from 2023 to 2033, indicating a robust and sustained upward trajectory. The market's value is expressed in billions of USD, reflecting the substantial economic impact of its oil and gas sector. Key drivers for this growth include substantial investments in upstream exploration and production, particularly in onshore fields with ongoing projects and promising developments in the pipeline. Furthermore, the development of critical midstream infrastructure, including transportation networks, storage facilities, and the expansion of LNG terminals, is crucial for enhancing market efficiency and export capabilities. Downstream segments, such as refineries and petrochemical plants, are also experiencing revitalization and expansion, driven by the demand for refined products and value-added petrochemicals, both domestically and internationally.

Kazakhstan Oil and Gas Market Market Size (In Billion)

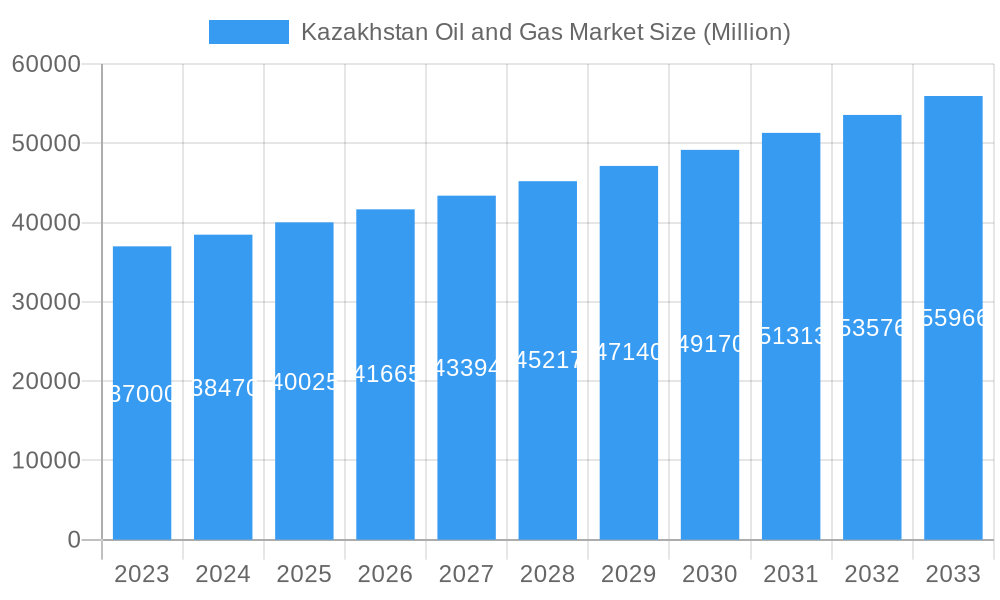

Several factors contribute to the market's dynamism. The strategic location of Kazakhstan, with its vast reserves and access to key export routes, acts as a significant growth enabler. Ongoing modernization of existing infrastructure and the initiation of new projects across the entire value chain, from exploration to refined product delivery, are creating substantial opportunities. However, the market is not without its challenges. Potential restraints may include geopolitical complexities, evolving environmental regulations, and the need for continuous technological upgrades to maintain competitiveness and efficiency. The competitive landscape features major national and international players, including National Company JSC (KazMunayGas), PJSC Lukoil Oil Company, Chevron Corporation, and PJSC Gazprom, all actively involved in shaping the market's future through significant investments and strategic partnerships. These companies are instrumental in driving innovation and ensuring the market's continued development.

Kazakhstan Oil and Gas Market Company Market Share

Here's a detailed SEO-optimized report description for the Kazakhstan Oil and Gas Market, designed for maximum visibility and engagement without requiring further modification:

This comprehensive report provides an in-depth analysis of the Kazakhstan Oil and Gas Market, offering critical insights into market structure, competitive dynamics, industry trends, and growth drivers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report is an essential resource for stakeholders seeking to understand the evolving landscape of Kazakhstan's vital energy sector. We delve into upstream, midstream, and downstream segments, including detailed overviews of Onshore and Offshore Exploration and Production, Oil and Gas Transportation, Storage Facilities, LNG Terminals, Refineries, and Petrochemicals Plants.

The Kazakhstan Oil and Gas Market is a cornerstone of the nation's economy, characterized by significant reserves and strategic geopolitical positioning. This report meticulously examines the market's trajectory, providing actionable intelligence for investors, policymakers, and industry professionals. We highlight the key players driving innovation and market expansion, alongside the critical developments shaping the future of Kazakhstan's energy production and export capabilities.

Key report features include:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

Kazakhstan Oil and Gas Market Market Structure & Competitive Dynamics

The Kazakhstan Oil and Gas Market exhibits a dynamic and evolving structure, influenced by national energy policies, international agreements, and the strategic presence of both state-owned enterprises and global energy giants. Market concentration is notable, with key players like National Company JSC (KazMunayGas), PJSC Lukoil Oil Company, PetroKazakhstan, North Caspian Operating Company, Chevron Corporation, PJSC Gazprom, Karachaganak Petroleum Operating BV, and Nostrum Oil & Gas PLC holding significant upstream and downstream capacities. Innovation ecosystems are fostered through joint ventures and strategic partnerships aimed at enhancing extraction technologies, refining capabilities, and the development of petrochemical value chains. The regulatory framework, guided by the Ministry of Energy, plays a pivotal role in shaping investment, production quotas, and environmental standards. Product substitutes, while present in the broader energy mix, are continuously challenged by the country's vast hydrocarbon resources. End-user trends are increasingly focused on optimizing production efficiency, reducing emissions, and diversifying into higher-value petrochemical products. Merger and Acquisition (M&A) activities are strategic, often involving significant multi-billion dollar deals to consolidate market share, acquire new exploration blocks, or integrate midstream and downstream assets. For instance, recent agreements signaling potential billions in investment for petrochemical complex construction underscore the market's M&A potential. The market's competitive intensity is high, driven by the pursuit of technological advancements and securing long-term export contracts.

Kazakhstan Oil and Gas Market Industry Trends & Insights

The Kazakhstan Oil and Gas Market is experiencing robust growth and transformation, driven by a confluence of factors including significant hydrocarbon reserves, strategic governmental support, and increasing global energy demand. A projected Compound Annual Growth Rate (CAGR) of approximately 4.5% from 2025 to 2033 underscores the market's upward trajectory. Market penetration of advanced exploration and production technologies is steadily increasing, leading to enhanced recovery rates from mature fields and the unlocking of previously inaccessible reserves. Technological disruptions, such as the adoption of AI and IoT for optimizing operations, are becoming more prevalent, promising greater efficiency and cost reduction. Consumer preferences within the domestic and international markets are evolving, with a growing emphasis on cleaner energy sources and higher-value refined products and petrochemicals. This is prompting increased investment in downstream processing and diversification into products like polyethylene and polypropylene. The competitive dynamics are shaped by major international oil companies (IOCs) and national oil companies (NOCs) vying for exploration blocks and production licenses. Furthermore, Kazakhstan's commitment to fulfilling its international production quotas, such as the agreed reduction of 78,000 barrels per day until the end of 2024 in alignment with OPEC+ decisions, highlights the influence of global energy diplomacy on domestic market trends. The nation's ambition to become a regional petrochemical hub is a significant driver, attracting substantial foreign direct investment. Infrastructure development, particularly in transportation and storage, is crucial to support the projected production volumes and export demands, further stimulating market growth. The overall outlook suggests sustained expansion, with innovation and strategic partnerships being key differentiators in this competitive landscape.

Dominant Markets & Segments in Kazakhstan Oil and Gas Market

The Kazakhstan Oil and Gas Market is dominated by its Upstream: Location of Deployment(Onshore) segment, driven by the country's vast terrestrial hydrocarbon reserves. Onshore operations account for the lion's share of production and exploration activities.

- Onshore Production: This segment benefits from extensive existing infrastructure, including wellheads, gathering stations, and processing facilities across major fields like Tengiz, Kashagan (partially onshore interface), and Karachaganak. Projects in the pipeline and upcoming projects, such as enhanced oil recovery (EOR) initiatives and the development of new exploration blocks, are expected to sustain and grow production volumes significantly. Economic policies promoting foreign investment and the stability of exploration licenses are key drivers for onshore dominance. The sheer scale of proven reserves, estimated in the tens of billions of barrels of oil equivalent, solidifies its leading position.

- Midstream: Transportation: The expansion and modernization of oil and gas pipelines remain a critical focus. Existing infrastructure, including the Caspian Pipeline Consortium (CPC) and various domestic pipelines, facilitates the export of a substantial portion of Kazakhstan's production. Projects in the pipeline and upcoming projects aim to enhance capacity and connectivity, ensuring efficient delivery to international markets. Investment in multimodal transportation solutions is also crucial.

- Downstream: Refineries: Kazakhstan's downstream sector is undergoing significant transformation. Existing refineries are being modernized to meet higher quality standards and increase processing capacity. Upcoming projects, such as the construction of new petrochemical complexes, are poised to add substantial value by converting raw hydrocarbons into specialized products. The agreement between Sinopec and KazMunayGaz for a gas-based petrochemical complex in the Atyrau region, with an expected final investment decision in 2024, exemplifies this strategic shift.

- Petrochemicals Plants: This segment represents a high-growth area, driven by government initiatives to diversify the economy and add value to its natural resources. Investment in these plants is crucial for Kazakhstan to move beyond raw material export towards higher-margin finished products.

The dominance of the onshore segment is underpinned by continuous investment in exploration and production, coupled with the strategic development of midstream and downstream capabilities to maximize the value chain.

Kazakhstan Oil and Gas Market Product Innovations

Product innovation in the Kazakhstan Oil and Gas Market is increasingly focused on enhancing the efficiency and environmental sustainability of operations and diversifying the product portfolio. Companies are investing in advanced extraction technologies, such as seismic imaging and horizontal drilling, to optimize yields from existing fields and unlock new reserves. In the downstream sector, innovation is centered on developing advanced refining processes to produce higher-quality fuels and a wider array of petrochemicals, including polymers and fertilizers. The development of modular and efficient petrochemical plants, like the proposed gas-based complex, represents a significant leap in product diversification and value addition. These innovations aim to improve competitive advantage by reducing production costs, minimizing environmental impact, and meeting evolving market demands for specialized chemical products.

Report Segmentation & Scope

This report segments the Kazakhstan Oil and Gas Market across its entire value chain. The Upstream segment covers Location of Deployment, differentiating between Onshore and Offshore operations. Onshore exploration and production is further detailed into Existing Projects, Projects in Pipeline, and Upcoming Projects, reflecting the dynamic nature of reserve development. The Midstream segment examines Transportation, encompassing Existing Infrastructure and Projects in Pipeline and Upcoming Projects, alongside Storage facilities and the development of LNG Terminals. The Downstream segment meticulously analyzes Refineries, including Existing Infrastructure and Projects in Pipeline and Upcoming Projects, and the rapidly growing Petrochemicals Plants sector. Growth projections and competitive dynamics are provided for each segment, offering a granular understanding of market opportunities and challenges.

Key Drivers of Kazakhstan Oil and Gas Market Growth

The Kazakhstan Oil and Gas Market is propelled by several key drivers. Firstly, significant proven hydrocarbon reserves provide a robust foundation for sustained production and export. Secondly, favorable government policies and strategic investments aimed at attracting foreign direct investment and modernizing infrastructure are crucial. Thirdly, growing global energy demand, particularly in Asia, fuels export opportunities. Fourthly, technological advancements in exploration, extraction, and processing are enhancing efficiency and unlocking new resource potential. Finally, the diversification of the economy towards higher-value petrochemical products represents a significant growth accelerator.

Challenges in the Kazakhstan Oil and Gas Market Sector

Despite its strong growth potential, the Kazakhstan Oil and Gas Market faces several challenges. Geopolitical factors and global supply chain volatility can impact export routes and pricing. Environmental regulations and the global push towards decarbonization necessitate significant investment in cleaner technologies and emission reduction strategies. Infrastructure bottlenecks, particularly in transportation and logistics, can constrain export capacity. Furthermore, competition from other energy-producing nations and fluctuations in global commodity prices pose ongoing economic risks. Operational complexities in some of the country's mature fields and the capital-intensive nature of developing new large-scale projects also present significant hurdles.

Leading Players in the Kazakhstan Oil and Gas Market Market

- National Company JSC (KazMunayGas)

- PJSC Lukoil Oil Company

- PetroKazakhstan

- North Caspian Operating Company

- Chevron Corporation

- PJSC Gazprom

- Karachaganak Petroleum Operating BV

- Nostrum Oil & Gas PLC

Key Developments in Kazakhstan Oil and Gas Market Sector

- June 2023: The Ministry of Energy in Kazakhstan announced its decision to maintain a reduction in oil production by 78,000 barrels per day until the end of 2024. This measure aligns with the broader agreement reached by OPEC in June 2022, demonstrating Kazakhstan's commitment to global energy market stability.

- May 2023: Sinopec, the Chinese energy company, finalized significant agreements with KazMunayGaz, Kazakhstan's state-owned oil and gas firm. These agreements are pivotal for the construction of a gas-based petrochemical complex in the Atyrau region of Kazakhstan. A final investment decision for this project is anticipated in 2024, signaling substantial future investment in the country's downstream sector.

Strategic Kazakhstan Oil and Gas Market Market Outlook

The strategic outlook for the Kazakhstan Oil and Gas Market is one of sustained growth and increasing diversification. The nation is strategically positioned to capitalize on its vast reserves and growing global energy needs. Key growth accelerators include the continued development of upstream assets, particularly through the implementation of advanced EOR techniques and the exploration of new frontier areas. Investments in midstream infrastructure, such as pipeline expansions and upgrades, will be crucial to ensure efficient export capabilities to key international markets. The downstream sector presents a significant opportunity for value addition, with a strong focus on developing world-class petrochemical plants to transform raw hydrocarbons into high-demand polymers and chemicals. Government initiatives promoting foreign investment and fostering innovation will be instrumental in unlocking the full potential of these strategic opportunities. The market is poised for continued expansion, driven by a blend of resource advantage, technological adoption, and a clear vision for economic diversification.

Kazakhstan Oil and Gas Market Segmentation

-

1. Upstream

-

1.1. Location of Deployment

-

1.1.1. Onshore

-

1.1.1.1. Overview

- 1.1.1.1.1. Existing Projects

- 1.1.1.1.2. Projects in Pipeline

- 1.1.1.1.3. Upcoming Projects

-

1.1.1.1. Overview

- 1.1.2. Offshore

-

1.1.1. Onshore

-

1.1. Location of Deployment

-

2. Midstream

-

2.1. Transportation

-

2.1.1. Overview

- 2.1.1.1. Existing Infrastructure

- 2.1.1.2. Projects in Pipeline

- 2.1.1.3. Upcoming Projects

-

2.1.1. Overview

- 2.2. Storage

- 2.3. LNG Terminals

-

2.1. Transportation

-

3. Downstream

-

3.1. Refineries

-

3.1.1. Overview

- 3.1.1.1. Existing Infrastructure

- 3.1.1.2. Projects in Pipeline

- 3.1.1.3. Upcoming Projects

-

3.1.1. Overview

- 3.2. Petrochemicals Plants

-

3.1. Refineries

Kazakhstan Oil and Gas Market Segmentation By Geography

- 1. Kazakhstan

Kazakhstan Oil and Gas Market Regional Market Share

Geographic Coverage of Kazakhstan Oil and Gas Market

Kazakhstan Oil and Gas Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Volatility of Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Upstream Sector to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kazakhstan Oil and Gas Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 5.1.1. Location of Deployment

- 5.1.1.1. Onshore

- 5.1.1.1.1. Overview

- 5.1.1.1.1.1. Existing Projects

- 5.1.1.1.1.2. Projects in Pipeline

- 5.1.1.1.1.3. Upcoming Projects

- 5.1.1.1.1. Overview

- 5.1.1.2. Offshore

- 5.1.1.1. Onshore

- 5.1.1. Location of Deployment

- 5.2. Market Analysis, Insights and Forecast - by Midstream

- 5.2.1. Transportation

- 5.2.1.1. Overview

- 5.2.1.1.1. Existing Infrastructure

- 5.2.1.1.2. Projects in Pipeline

- 5.2.1.1.3. Upcoming Projects

- 5.2.1.1. Overview

- 5.2.2. Storage

- 5.2.3. LNG Terminals

- 5.2.1. Transportation

- 5.3. Market Analysis, Insights and Forecast - by Downstream

- 5.3.1. Refineries

- 5.3.1.1. Overview

- 5.3.1.1.1. Existing Infrastructure

- 5.3.1.1.2. Projects in Pipeline

- 5.3.1.1.3. Upcoming Projects

- 5.3.1.1. Overview

- 5.3.2. Petrochemicals Plants

- 5.3.1. Refineries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kazakhstan

- 5.1. Market Analysis, Insights and Forecast - by Upstream

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 National Company JSC (KazMunayGas)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PJSC Lukoil Oil Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PetroKazakhstan

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 North Caspian Operating Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chevron Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PJSC Gazprom

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Karachaganak Petroleum Operating BV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nostrum Oil & Gas PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 National Company JSC (KazMunayGas)

List of Figures

- Figure 1: Kazakhstan Oil and Gas Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Kazakhstan Oil and Gas Market Share (%) by Company 2025

List of Tables

- Table 1: Kazakhstan Oil and Gas Market Revenue undefined Forecast, by Upstream 2020 & 2033

- Table 2: Kazakhstan Oil and Gas Market Volume Million Forecast, by Upstream 2020 & 2033

- Table 3: Kazakhstan Oil and Gas Market Revenue undefined Forecast, by Midstream 2020 & 2033

- Table 4: Kazakhstan Oil and Gas Market Volume Million Forecast, by Midstream 2020 & 2033

- Table 5: Kazakhstan Oil and Gas Market Revenue undefined Forecast, by Downstream 2020 & 2033

- Table 6: Kazakhstan Oil and Gas Market Volume Million Forecast, by Downstream 2020 & 2033

- Table 7: Kazakhstan Oil and Gas Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Kazakhstan Oil and Gas Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Kazakhstan Oil and Gas Market Revenue undefined Forecast, by Upstream 2020 & 2033

- Table 10: Kazakhstan Oil and Gas Market Volume Million Forecast, by Upstream 2020 & 2033

- Table 11: Kazakhstan Oil and Gas Market Revenue undefined Forecast, by Midstream 2020 & 2033

- Table 12: Kazakhstan Oil and Gas Market Volume Million Forecast, by Midstream 2020 & 2033

- Table 13: Kazakhstan Oil and Gas Market Revenue undefined Forecast, by Downstream 2020 & 2033

- Table 14: Kazakhstan Oil and Gas Market Volume Million Forecast, by Downstream 2020 & 2033

- Table 15: Kazakhstan Oil and Gas Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Kazakhstan Oil and Gas Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kazakhstan Oil and Gas Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Kazakhstan Oil and Gas Market?

Key companies in the market include National Company JSC (KazMunayGas), PJSC Lukoil Oil Company, PetroKazakhstan, North Caspian Operating Company, Chevron Corporation, PJSC Gazprom, Karachaganak Petroleum Operating BV, Nostrum Oil & Gas PLC.

3. What are the main segments of the Kazakhstan Oil and Gas Market?

The market segments include Upstream, Midstream, Downstream.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

4.; Abundant Oil and Gas Reserves4.; Favorable Investment in Upstream Sector.

6. What are the notable trends driving market growth?

Upstream Sector to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Volatility of Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

June 2023: The Ministry of Energy in Kazakhstan has announced that the country will maintain its reduction of oil production by 78,000 barrels per day until the end of 2024. This decision aligns with the agreement reached by the Organization of the Petroleum Exporting Countries (OPEC) in June 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kazakhstan Oil and Gas Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kazakhstan Oil and Gas Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kazakhstan Oil and Gas Market?

To stay informed about further developments, trends, and reports in the Kazakhstan Oil and Gas Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence