Key Insights

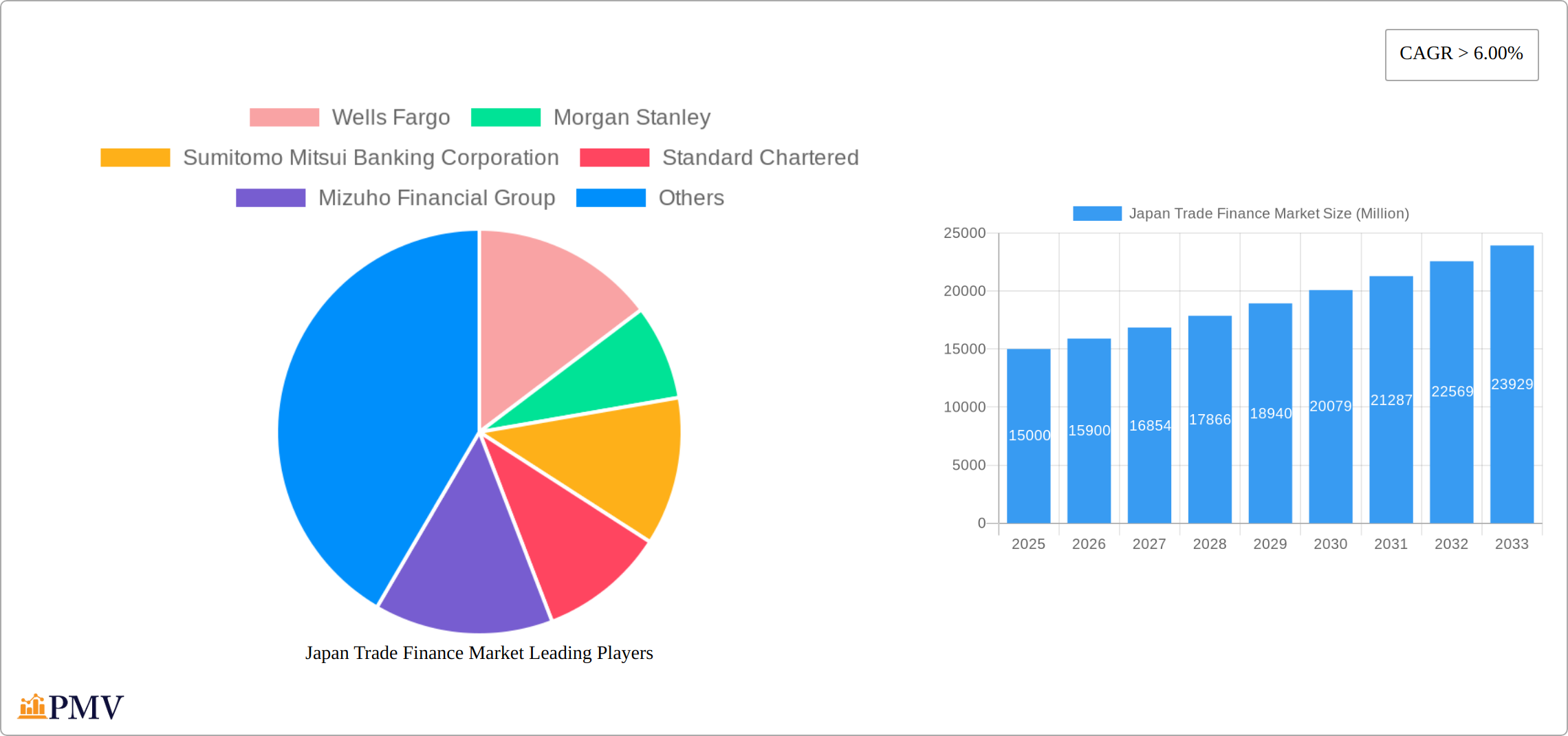

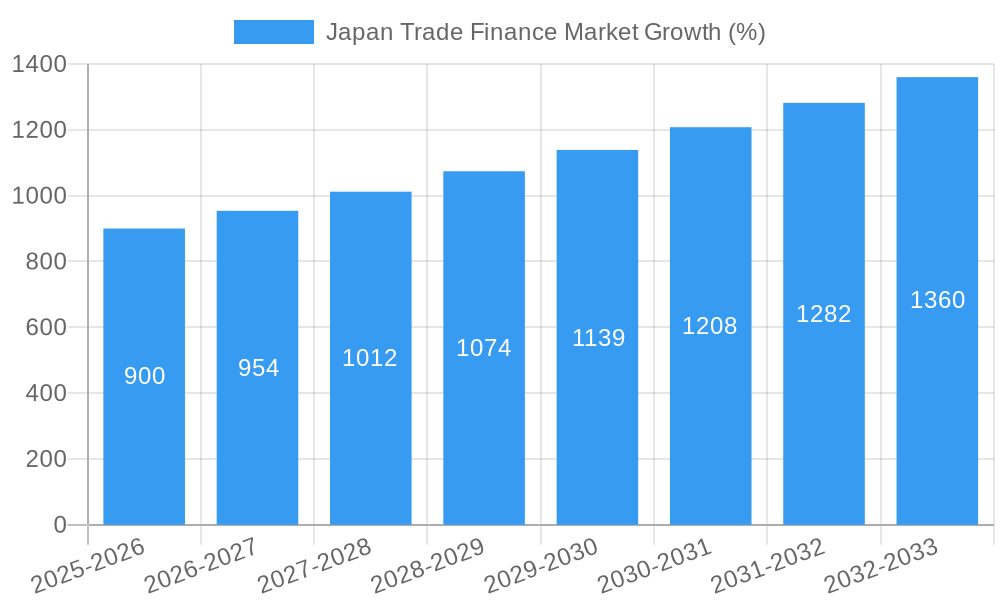

The Japan Trade Finance Market exhibits robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This expansion is fueled by several key drivers. Japan's significant role in global trade, particularly within Asia, creates substantial demand for trade finance solutions. The increasing complexity of international transactions, coupled with a growing preference for digitalization within financial services, further stimulates market growth. Government initiatives promoting exports and foreign direct investment also contribute positively. While the market faces potential restraints such as global economic uncertainties and evolving regulatory landscapes, the overall outlook remains optimistic due to the resilience of Japan's export-oriented economy and ongoing investments in infrastructure projects both domestically and internationally. The competitive landscape is dominated by a mix of global and domestic banking giants, including Wells Fargo, Morgan Stanley, Sumitomo Mitsui Banking Corporation, and others. These institutions offer a comprehensive range of trade finance products and services catering to diverse customer needs, ranging from Letters of Credit and guarantees to supply chain finance solutions. The market segmentation likely includes sectors such as manufacturing, automotive, electronics, and energy, reflecting Japan's diverse export base. Considering the 6%+ CAGR and a base year of 2025, we can project substantial market expansion over the forecast period. The market is expected to consolidate further as banks continue to invest in technology and optimize their offerings to better serve the evolving needs of businesses engaged in international trade.

The projected growth of the Japan Trade Finance Market hinges on effective risk management and innovation within the sector. Banks must continually adapt to emerging risks associated with geopolitical instability and cybersecurity threats, while also embracing technological advancements like blockchain technology to enhance efficiency and transparency. The increasing demand for sustainable trade finance solutions will also play a crucial role in shaping the market's trajectory. A focus on providing environmentally friendly financing options to support eco-conscious businesses will become an increasingly important factor for attracting clients and remaining competitive. Furthermore, collaborations between banks and fintech companies could lead to the development of innovative trade finance solutions. This dynamic interplay between traditional financial institutions and innovative technological approaches will drive the sector's evolution and growth in the coming years.

Japan Trade Finance Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japan Trade Finance Market, encompassing market structure, competitive dynamics, industry trends, leading players, and future growth prospects. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period includes 2019-2024. This report is crucial for businesses, investors, and policymakers seeking to understand and navigate this dynamic market.

Japan Trade Finance Market Market Structure & Competitive Dynamics

The Japan Trade Finance Market exhibits a moderately concentrated structure, with key players like Sumitomo Mitsui Banking Corporation, Mitsubishi UFJ Financial Group Inc, Mizuho Financial Group, and several international banks such as Bank of America, Wells Fargo, Morgan Stanley, Standard Chartered, BNP Paribas, and Royal Bank of Scotland Plc holding significant market share. The market share of these key players is estimated at xx%, with the remaining share distributed among numerous smaller regional and specialized banks. The Asian Development Bank also plays a significant role, though primarily in development-focused financing.

Innovation in the sector is driven by technological advancements, particularly in areas like blockchain technology for secure and efficient trade finance processes. The regulatory framework, largely defined by the Japanese government and the Financial Services Agency (FSA), is relatively stable but continually evolves to address technological changes and international standards. Product substitutes are limited, primarily alternative financing options, such as factoring and invoice discounting. End-user trends show a growing demand for digitalized trade finance solutions and customized financing options tailored to specific industry needs. M&A activity in the sector has been moderate in recent years, with reported deal values averaging xx Million annually. Key examples include:

- Consolidation: Several smaller players have been acquired by larger institutions, aiming for increased market reach and operational efficiency. The value of these deals varied depending on the size of the firms acquired.

- Strategic Partnerships: Banks increasingly form strategic partnerships to leverage each other's expertise and expand their global network.

Japan Trade Finance Market Industry Trends & Insights

The Japan Trade Finance Market is experiencing steady growth, driven by several factors. The projected Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033) is estimated at xx%, with market penetration expected to reach xx% by 2033.

Key growth drivers include increasing international trade, particularly with Asia, technological advancements fostering automation and efficiency in trade finance processes, and supportive government policies aimed at promoting economic growth and international competitiveness. Technological disruptions, such as the adoption of blockchain and AI-powered solutions, are fundamentally changing how trade finance is conducted, increasing transparency and reducing processing times. Consumer preferences increasingly favor digital solutions and streamlined processes, putting pressure on traditional players to modernize their offerings. The competitive dynamics remain intense, with incumbents facing challenges from fintech startups and specialized providers offering innovative solutions.

Dominant Markets & Segments in Japan Trade Finance Market

While precise regional breakdowns are difficult without further data, Tokyo and other major metropolitan areas dominate the market due to high concentration of businesses and trade activity. The leading segment within the market is likely to be related to export/import financing for large corporations, given the scale of Japan's international trade.

- Key Drivers for Dominance:

- Strong Export-Oriented Economy: Japan's robust export sector fuels high demand for trade finance services.

- Well-Developed Infrastructure: Excellent infrastructure, including ports and logistics networks, supports efficient trade operations.

- Supportive Government Policies: Government initiatives promoting international trade and economic growth bolster the market.

The dominance of this segment is primarily due to the scale of transactions and the associated financing needs of large corporations. Smaller businesses and SMEs constitute a significant portion of the market, but their individual transaction values are often smaller. Growth potential lies in increasing financial inclusion and expanding access to finance for SMEs.

Japan Trade Finance Market Product Innovations

Recent product innovations focus on digitalization and efficiency improvements. Blockchain technology offers secure and transparent transaction processing, while AI-powered solutions enhance risk assessment and automate documentation processes. These innovations improve efficiency, reduce costs, and enhance security. The market fit is strong, driven by customer demand for faster, more reliable, and cost-effective trade finance solutions.

Report Segmentation & Scope

This report segments the Japan Trade Finance Market based on several factors including:

- By Transaction Type: Letters of Credit, Documentary Collections, Guarantees, Forfaiting. Growth projections vary across these segments, with digital-friendly transaction types showing higher growth rates.

- By Industry: Manufacturing, Automotive, Electronics, Energy. Market sizes vary significantly across industries, reflecting their reliance on international trade and associated financing needs.

- By Bank Type: Domestic banks, foreign banks, and specialized finance institutions. Competitive dynamics vary according to the bank's reach, expertise, and technology adoption.

Key Drivers of Japan Trade Finance Market Growth

Several factors drive the growth of the Japan Trade Finance Market:

- Technological Advancements: Blockchain, AI, and other technological disruptions streamline processes and enhance efficiency.

- Economic Growth: A growing economy and increasing international trade activity fuel demand for trade finance.

- Government Support: Government initiatives to promote exports and international trade foster market expansion.

Challenges in the Japan Trade Finance Market Sector

The Japan Trade Finance Market faces several challenges:

- Geopolitical Risks: Global uncertainties can impact trade flows and increase risk for lenders.

- Regulatory Complexity: Navigating regulations and compliance requirements poses significant challenges.

- Competition: Intense competition from established players and fintech entrants requires constant innovation.

Leading Players in the Japan Trade Finance Market Market

- Wells Fargo

- Morgan Stanley

- Sumitomo Mitsui Banking Corporation

- Standard Chartered

- Mizuho Financial Group

- Royal Bank Of Scotland Plc

- Bank Of America

- Mitsubishi UFJ Financial Group Inc

- BNP Paribas

- Asian Development Bank (List Not Exhaustive)

Key Developments in Japan Trade Finance Market Sector

- October 2022: Morgan Stanley's commitment to diversity and inclusion through its partnership with OFN signals a shift toward socially responsible investments within the trade finance sector. This could indirectly influence the market by attracting investors with ESG (Environmental, Social, and Governance) considerations.

- August 2022: The MOU between SMBC and Banque Misr accelerates trade digitization, improving efficiency and potentially attracting more businesses to leverage these digital solutions. This demonstrates a significant trend towards digital transformation within the industry.

Strategic Japan Trade Finance Market Market Outlook

The Japan Trade Finance Market exhibits substantial growth potential driven by ongoing digitalization, supportive government policies, and the country's robust export-oriented economy. Strategic opportunities exist for players who can effectively leverage technology to enhance efficiency, offer customized solutions to niche markets, and address the growing demand for sustainable and responsible trade finance practices. The market is expected to witness further consolidation and strategic partnerships as players strive to gain a competitive edge.

Japan Trade Finance Market Segmentation

-

1. Service Provider

- 1.1. Banks

- 1.2. Trade Finance Companies

- 1.3. Insurance Companies

- 1.4. Other Service Providers

-

2. Application

- 2.1. Domestic

- 2.2. International

Japan Trade Finance Market Segmentation By Geography

- 1. Japan

Japan Trade Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Digitization is Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Trade Finance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Provider

- 5.1.1. Banks

- 5.1.2. Trade Finance Companies

- 5.1.3. Insurance Companies

- 5.1.4. Other Service Providers

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Service Provider

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Wells Fargo

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Morgan Stanley

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sumitomo Mitsui Banking Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Standard Chartered

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mizuho Financial Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Bank Of Scotland Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bank Of America

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mitsubishi UFJ Financial Group Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BNP Paribas

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Asian Development Bank**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Wells Fargo

List of Figures

- Figure 1: Japan Trade Finance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Trade Finance Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Trade Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Trade Finance Market Revenue Million Forecast, by Service Provider 2019 & 2032

- Table 3: Japan Trade Finance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Japan Trade Finance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Trade Finance Market Revenue Million Forecast, by Service Provider 2019 & 2032

- Table 6: Japan Trade Finance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Japan Trade Finance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Trade Finance Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Japan Trade Finance Market?

Key companies in the market include Wells Fargo, Morgan Stanley, Sumitomo Mitsui Banking Corporation, Standard Chartered, Mizuho Financial Group, Royal Bank Of Scotland Plc, Bank Of America, Mitsubishi UFJ Financial Group Inc, BNP Paribas, Asian Development Bank**List Not Exhaustive.

3. What are the main segments of the Japan Trade Finance Market?

The market segments include Service Provider, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Digitization is Boosting the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Morgan Stanley Investment Management (MSIM) chose Opportunity Finance Network (OFN) as its diversity and inclusion partner for MSIM's charity donation connected to the recently introduced Impact Class, the firm said today. The OFN is a top national network comprising 370 Community Development Finance Institutions (CDFIs). Its goal is to help underserved areas get cheap, honest financial services and products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Trade Finance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Trade Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Trade Finance Market?

To stay informed about further developments, trends, and reports in the Japan Trade Finance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence