Key Insights

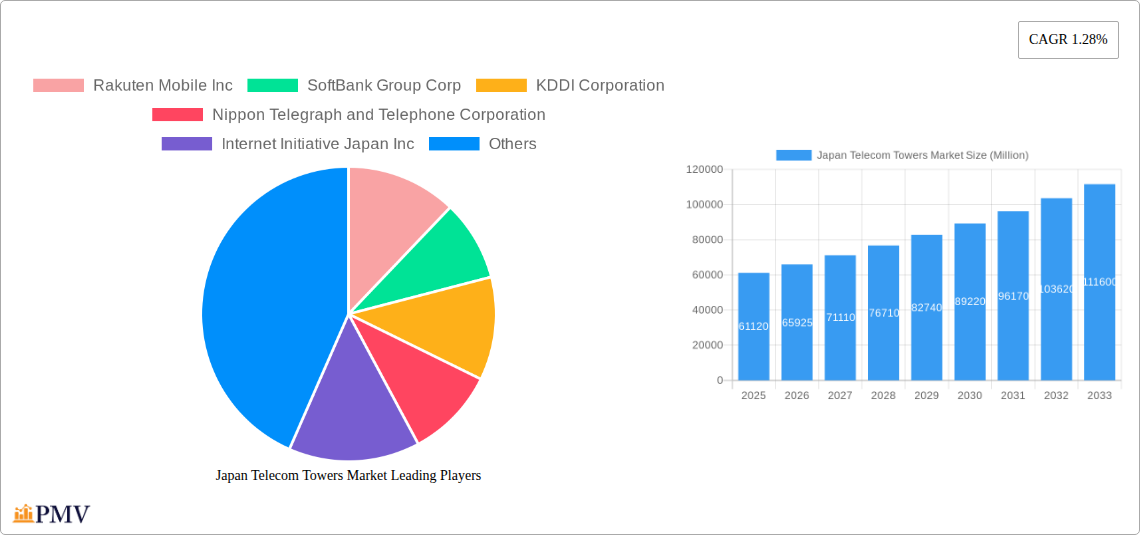

The Japan Telecom Towers Market is poised for significant expansion, projecting a market size of USD 61.12 billion in 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 7.9% from 2019 to 2033. A primary driver for this upward trajectory is the escalating demand for enhanced mobile broadband services, fueled by the widespread adoption of 5G technology and the increasing consumption of data-intensive applications like video streaming, online gaming, and the Internet of Things (IoT). The ongoing network densification efforts by Mobile Network Operators (MNOs) to improve coverage and capacity, especially in urban centers and for new technologies, are also a critical factor. Furthermore, the increasing trend of tower sharing among MNOs and the emergence of independent tower companies (TowerCos) are optimizing infrastructure utilization and reducing operational costs, thereby propelling market growth. Investments in deploying small cells and distributed antenna systems (DAS) to complement macro towers are also contributing to the market's dynamism.

Japan Telecom Towers Market Market Size (In Billion)

The market's evolution is further shaped by several key trends and strategic initiatives. The continuous technological advancements, including the rollout of more sophisticated antenna systems and the integration of artificial intelligence for network management, are enhancing the value proposition of telecom towers. The growing focus on renewable energy sources for powering tower sites, driven by sustainability goals and reducing operational expenses, represents another significant trend. However, the market also faces certain restraints. High initial capital expenditure for new tower construction and the complexities associated with obtaining regulatory approvals and site acquisitions can pose challenges. Additionally, the consolidation within the MNO landscape might lead to fewer potential tenants for tower companies, impacting revenue streams. Despite these challenges, the market is expected to witness a surge in demand for both rooftop and ground-based installations across operator-owned and private-owned structures, with a notable emphasis on accommodating renewable energy integration.

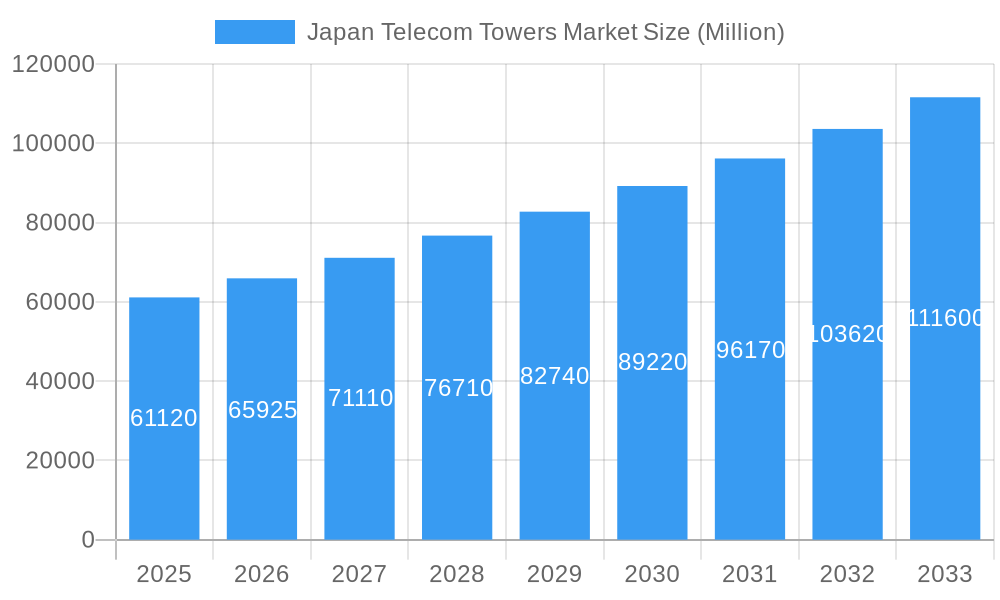

Japan Telecom Towers Market Company Market Share

This in-depth market report provides a detailed analysis of the Japan Telecom Towers Market, encompassing its structure, competitive landscape, industry trends, and future outlook from 2019 to 2033. Leveraging advanced market intelligence and proprietary data, this report offers actionable insights for stakeholders seeking to capitalize on the rapidly evolving Japanese telecommunications infrastructure. The study period covers 2019-2033, with 2025 serving as both the base and estimated year, and the forecast period extending from 2025-2033. Historical data from 2019-2024 is also meticulously analyzed.

This report is crucial for telecom infrastructure providers, mobile network operators (MNOs), tower companies, investment firms, technology vendors, and government regulatory bodies looking to understand the dynamic forces shaping the Japanese 5G infrastructure, telecom tower investments, shared infrastructure, wireless communication, and connectivity solutions market.

Japan Telecom Towers Market Market Structure & Competitive Dynamics

The Japan Telecom Towers Market exhibits a moderately concentrated structure, with key players like Nippon Telegraph and Telephone Corporation, SoftBank Group Corp, and KDDI Corporation holding significant market share in terms of existing infrastructure deployment. Innovation ecosystems are driven by the pursuit of advanced 5G and future 6G technologies, focusing on densification and improved coverage. Regulatory frameworks, primarily overseen by the Ministry of Internal Affairs and Communications (MIC), play a pivotal role in dictating deployment strategies, spectrum allocation, and tower sharing mandates. Product substitutes, while limited in the context of physical tower infrastructure, include advancements in small cell technology and in-building solutions that can sometimes reduce the reliance on macro towers in dense urban environments. End-user trends are strongly influenced by the increasing demand for high-speed mobile data, IoT applications, and immersive digital experiences, all of which necessitate robust and extensive telecom tower networks. Merger and acquisition (M&A) activities are anticipated to increase as companies seek to consolidate assets, expand their footprint, and achieve economies of scale. For instance, recent M&A deals within the broader telecom infrastructure space have seen valuations exceeding $5.0 billion, signaling robust investor confidence.

- Market Share Dynamics: Key MNOs dominate ownership of existing tower assets, though the trend towards independent tower companies is gaining traction.

- Innovation Ecosystem: Focus on small cell integration, energy efficiency, and smart tower solutions.

- Regulatory Influence: MIC policies on infrastructure sharing and 5G deployment significantly impact market entry and expansion.

- M&A Potential: Consolidation opportunities are present for both established players and new entrants seeking to gain market access.

Japan Telecom Towers Market Industry Trends & Insights

The Japan Telecom Towers Market is poised for substantial growth, driven by the ubiquitous rollout of 5G services and the escalating demand for enhanced mobile broadband, low-latency applications, and the burgeoning Internet of Things (IoT). The nation's commitment to digital transformation and its status as a technological leader propel continuous investment in advanced telecommunications infrastructure. The increasing adoption of shared infrastructure models, where multiple operators utilize the same tower, is a critical trend optimizing deployment costs and accelerating network build-out. This trend is further amplified by government initiatives promoting infrastructure sharing to foster competition and improve service accessibility across the archipelago, including remote and rural areas. Technological advancements, such as the development of novel antenna technologies like glass antennas, are also reshaping the landscape, enabling more discreet and integrated deployments within urban environments. The competitive dynamics are intensifying, with established telecom giants like Nippon Telegraph and Telephone Corporation, SoftBank Group Corp, and KDDI Corporation actively investing in their tower portfolios, while newer entrants and specialized tower companies are carving out niche segments. The market penetration for 5G services is projected to reach over 70% by 2028, necessitating a significant expansion of macro and small cell tower deployments. The Compound Annual Growth Rate (CAGR) for the Japan Telecom Towers Market is estimated to be approximately 8.5% during the forecast period (2025-2033). Consumer preferences are shifting towards seamless connectivity for streaming, online gaming, and augmented reality experiences, all of which are heavily reliant on robust cellular networks powered by an extensive tower infrastructure. This sustained demand fuels ongoing investment and innovation within the sector. Furthermore, the exploration of renewable energy sources for powering telecom towers is gaining momentum, driven by sustainability goals and potential cost savings, indicating a shift in fuel type preferences towards more eco-friendly options.

Dominant Markets & Segments in Japan Telecom Towers Market

The Operator-owned segment within the Ownership category is currently dominant in the Japan Telecom Towers Market, reflecting the historical development of the telecommunications industry where major carriers built and managed their own infrastructure. Nippon Telegraph and Telephone Corporation (NTT), SoftBank Group Corp, and KDDI Corporation, as the primary mobile network operators, possess extensive portfolios of self-owned towers that underpin their vast service networks. The key drivers for this segment's dominance include the need for direct control over network performance, security, and the strategic advantage of owning a critical infrastructure asset. Economic policies in Japan have historically supported the development of national telecommunications networks, fostering significant capital expenditure by these operators.

In terms of Installation, Ground-based towers represent the largest segment. This is due to their capacity to support heavier equipment, accommodate a higher number of antennas, and their suitability for widespread rural and suburban coverage. Their robust construction allows for greater flexibility in terms of future upgrades and the addition of new technologies. While rooftop installations are crucial for urban densification and in-building coverage solutions, the sheer scale and widespread deployment of ground-based towers for macro coverage solidify their leading position.

Regarding Fuel Type, the Non-renewable fuel type segment, primarily relying on traditional power grids and backup diesel generators, currently holds the dominant share. This is a consequence of established infrastructure and the historical reliance on conventional energy sources for consistent and reliable power supply to telecom sites. However, significant growth is observed and projected for the Renewable fuel type segment, driven by increasing environmental consciousness, government incentives for green energy adoption, and the long-term cost-effectiveness of renewable solutions like solar and wind power. Several operators are actively exploring and implementing hybrid solutions and investing in renewable energy sources to power their tower infrastructure, aiming to reduce operational expenditures and their carbon footprint.

- Ownership Dominance (Operator-owned):

- Key Drivers: Direct network control, strategic asset ownership, historical infrastructure development.

- Economic Policies: Government support for national network build-out.

- Infrastructure Investment: Significant historical CAPEX by MNOs.

- Installation Dominance (Ground-based):

- Key Drivers: Capacity for extensive equipment, suitability for macro coverage, structural integrity.

- Geographical Factors: Need for widespread coverage across diverse terrain.

- Technological Requirements: Support for multiple antennas and future expansions.

- Fuel Type Dominance (Non-renewable, transitioning to Renewable):

- Key Drivers (Non-renewable): Existing grid infrastructure, historical reliability.

- Key Drivers (Renewable): Environmental sustainability mandates, cost reduction initiatives, government incentives for green energy.

- Technological Advancements: Development of efficient solar and battery storage solutions.

Japan Telecom Towers Market Product Innovations

The Japan Telecom Towers Market is witnessing a wave of product innovations aimed at enhancing network efficiency, expanding coverage, and improving sustainability. A notable development is the emergence of advanced antenna systems, such as JTower's glass antenna, which discreetly integrates 5G base station capabilities into building windows, addressing urban aesthetic concerns and maximizing deployment flexibility in dense areas. This technology, developed in collaboration with NTT DoCoMo and AGC, signifies a paradigm shift in how telecommunication infrastructure can be integrated into the built environment. Furthermore, advancements in smart tower solutions are enabling remote monitoring, predictive maintenance, and dynamic resource allocation, optimizing operational efficiency. The integration of AI and machine learning in network management is also a key trend, allowing for more intelligent power management and fault detection. These innovations offer a significant competitive advantage by reducing deployment costs, minimizing visual impact, and improving overall network performance and reliability, thereby catering to the evolving demands of 5G and beyond.

Report Segmentation & Scope

This report meticulously segments the Japan Telecom Towers Market across key parameters to provide a granular understanding of market dynamics. The Ownership segmentation includes Operator-owned, where carriers maintain direct control over their towers; Private-owned, encompassing towers held by independent tower companies; and MNO Captive, referring to towers built by MNOs but potentially managed by a separate internal entity. The Installation segmentation categorizes towers into Rooftop, ideal for urban density and in-building coverage, and Ground-based, suitable for broader coverage and capacity. The Fuel Type segmentation differentiates between Renewable sources like solar and wind, emphasizing sustainability, and Non-renewable sources, including traditional grid power and backup generators. Each segment is analyzed for its current market size, projected growth rates, and competitive landscape, offering insights into specific investment opportunities and market penetration strategies.

Key Drivers of Japan Telecom Towers Market Growth

The Japan Telecom Towers Market is experiencing robust growth propelled by several key factors. The nationwide deployment of 5G networks is a primary accelerator, necessitating a significant expansion of macro and small cell infrastructure to support higher bandwidth and lower latency. The increasing adoption of IoT devices across various industries, from manufacturing to healthcare, further amplifies the demand for ubiquitous and reliable connectivity. Government initiatives promoting digital transformation and smart city development also play a crucial role by encouraging investment in advanced telecommunications infrastructure. Furthermore, the trend towards tower sharing and infrastructure consolidation optimizes deployment costs and accelerates network build-out, making it an attractive proposition for operators. Finally, the continuous evolution towards 6G technologies is already prompting research and development, laying the groundwork for future infrastructure requirements.

Challenges in the Japan Telecom Towers Market Sector

Despite the positive growth trajectory, the Japan Telecom Towers Market faces several challenges. Regulatory hurdles and complex permitting processes can lead to delays in site acquisition and deployment. The high cost of land acquisition and leasing in densely populated urban areas presents a significant financial constraint. Supply chain disruptions for critical components and specialized equipment can impact project timelines and costs. Furthermore, intense competition among tower operators and MNOs for prime locations and market share can put pressure on pricing and profitability. The environmental impact of tower construction and operation, along with the increasing need for sustainable energy solutions, also presents an ongoing challenge requiring strategic adaptation and investment in green technologies.

Leading Players in the Japan Telecom Towers Market Market

- Nippon Telegraph and Telephone Corporation

- SoftBank Group Corp

- KDDI Corporation

- Rakuten Mobile Inc

- Internet Initiative Japan Inc

- JSAT Corporation

- TOKAI Communications Corporation

- Wowow Inc

- Okinawa Cellular Telephone Company

- Mitsui & Co Lt

- JTower Inc

Key Developments in Japan Telecom Towers Market Sector

- August 2024: JTower, a Japanese tower operator, announced a glass antenna, asserting its capability to "transform windows into base stations" for 5G services in Tokyo. In an official statement, JTower revealed its collaboration with fellow Japanese carrier NTT DoCoMo and glass producer AGC. Together, they installed the innovative glass antenna at the Shinjuku 3Chome East Building in Tokyo, linking it to JTower's 5G carrier-neutral network infrastructure. This development signifies a leap in integrated urban infrastructure solutions.

- February 2024: NTT Docomo, a telecom operator in Japan, is partnering with NEC to establish a joint venture. The goal is to expand the 5G open RAN networking gear business in international markets, with a focus on Southeast Asia and the Middle East. This move aims to challenge the long-standing dominance of industry giants like Huawei and Ericsson, showcasing strategic international expansion and technological competition.

Strategic Japan Telecom Towers Market Market Outlook

The strategic outlook for the Japan Telecom Towers Market is exceptionally promising, driven by the relentless demand for enhanced digital connectivity and the nation's forward-thinking approach to technological advancement. The continued build-out of 5G networks, coupled with the impending development of 6G, ensures a sustained need for robust and scalable tower infrastructure. Opportunities lie in the development of smart towers equipped with IoT capabilities, the expansion of rural connectivity initiatives, and the integration of renewable energy solutions to power these sites sustainably. Furthermore, the ongoing consolidation and M&A activities present avenues for strategic partnerships and market expansion. The increasing commoditization of passive tower infrastructure is also opening doors for new business models focused on value-added services and end-to-end connectivity solutions, positioning the market for significant long-term growth and innovation.

Japan Telecom Towers Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

Japan Telecom Towers Market Segmentation By Geography

- 1. Japan

Japan Telecom Towers Market Regional Market Share

Geographic Coverage of Japan Telecom Towers Market

Japan Telecom Towers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs

- 3.3. Market Restrains

- 3.3.1. Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs

- 3.4. Market Trends

- 3.4.1. 5G is Expected to be a Catalyst for the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Telecom Towers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rakuten Mobile Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SoftBank Group Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KDDI Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Telegraph and Telephone Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Internet Initiative Japan Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 JSAT Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TOKAI Communications Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wowow Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Okinawa Cellular Telephone Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mitsui & Co Lt

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rakuten Mobile Inc

List of Figures

- Figure 1: Japan Telecom Towers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Japan Telecom Towers Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Telecom Towers Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 2: Japan Telecom Towers Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 3: Japan Telecom Towers Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 4: Japan Telecom Towers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Japan Telecom Towers Market Revenue undefined Forecast, by Ownership 2020 & 2033

- Table 6: Japan Telecom Towers Market Revenue undefined Forecast, by Installation 2020 & 2033

- Table 7: Japan Telecom Towers Market Revenue undefined Forecast, by Fuel Type 2020 & 2033

- Table 8: Japan Telecom Towers Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Telecom Towers Market?

The projected CAGR is approximately 7.9%.

2. Which companies are prominent players in the Japan Telecom Towers Market?

Key companies in the market include Rakuten Mobile Inc, SoftBank Group Corp, KDDI Corporation, Nippon Telegraph and Telephone Corporation, Internet Initiative Japan Inc, JSAT Corporation, TOKAI Communications Corporation, Wowow Inc, Okinawa Cellular Telephone Company, Mitsui & Co Lt.

3. What are the main segments of the Japan Telecom Towers Market?

The market segments include Ownership, Installation, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs.

6. What are the notable trends driving market growth?

5G is Expected to be a Catalyst for the Market's Growth.

7. Are there any restraints impacting market growth?

Improving Connectivity to Rural Areas5.1.2 5G Deployments are a Major Catalyst for Growth in the Cell Tower Leasing Environment; Improving and Catering to Increasing Data Needs.

8. Can you provide examples of recent developments in the market?

August 2024: JTower, a Japanese tower operator, announced a glass antenna, asserting its capability to "transform windows into base stations" for 5G services in Tokyo. In an official statement, JTower revealed its collaboration with fellow Japanese carrier NTT DoCoMo and glass producer AGC. Together, they installed the innovative glass antenna at the Shinjuku 3Chome East Building in Tokyo, linking it to JTower's 5G carrier-neutral network infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Telecom Towers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Telecom Towers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Telecom Towers Market?

To stay informed about further developments, trends, and reports in the Japan Telecom Towers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence