Key Insights

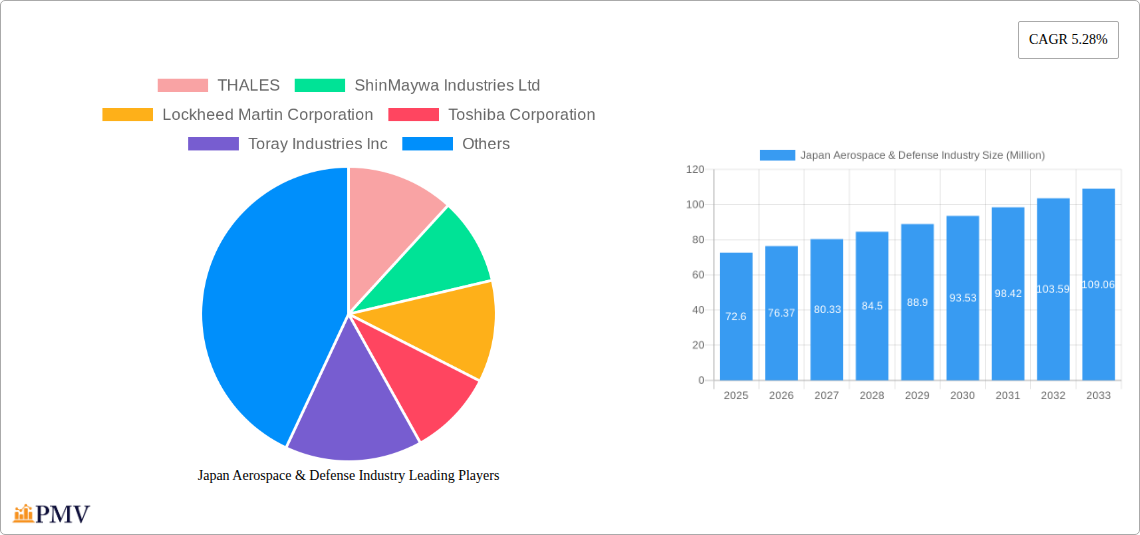

The Japan Aerospace & Defense Industry is poised for robust expansion, with an estimated market size of $72.60 Million in 2025, projected to grow at a Compound Annual Growth Rate (CAGR) of 5.28%. This growth trajectory is propelled by several key drivers. A significant factor is the increasing government investment in national security and defense modernization initiatives, aimed at addressing evolving geopolitical landscapes and regional threats. Furthermore, advancements in aerospace technology, including the development of next-generation aircraft and unmanned aerial systems (UAS), are stimulating demand across both defense and commercial sectors. The industry is also benefiting from strong domestic manufacturing capabilities, particularly in areas like advanced materials, precision engineering, and electronics, which support both indigenous production and international collaborations. The MRO (Maintenance, Repair, and Overhaul) segment is expected to witness substantial growth due to the aging global aircraft fleet and stringent safety regulations, requiring continuous upkeep and upgrades.

Japan Aerospace & Defense Industry Market Size (In Million)

The market segmentation reveals a dynamic landscape. The Aerospace and Defense sectors are the primary domains, with Manufacturing and MRO service types representing key growth areas. Platforms are diverse, encompassing Terrestrial, Aerial, and Naval applications, highlighting the industry's broad reach. Leading companies such as THALES, Lockheed Martin Corporation, RTX Corporation, BAE Systems plc, Northrop Grumman Corporation, and The Boeing Company are actively involved, alongside prominent Japanese players like ShinMaywa Industries Ltd, Toshiba Corporation, Toray Industries Inc, Japan Steel Works Ltd, Komatsu Ltd, Kawasaki Heavy Industries Ltd, and Mitsubishi Heavy Industries Ltd. These collaborations and competitive dynamics are shaping innovation and market expansion. Emerging trends include a focus on sustainable aviation solutions, the integration of artificial intelligence and cyber security in defense systems, and a growing emphasis on domestic supply chain resilience. However, challenges such as high research and development costs and stringent regulatory compliance need to be carefully navigated to sustain this positive growth.

Japan Aerospace & Defense Industry Company Market Share

Japan Aerospace & Defense Industry Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the dynamic Japan Aerospace & Defense Industry market. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period of 2025-2033, it offers critical insights into market structure, trends, dominant segments, product innovations, and growth drivers. The report meticulously examines the competitive landscape, including key players such as THALES, ShinMaywa Industries Ltd, Lockheed Martin Corporation, Toshiba Corporation, Toray Industries Inc, Japan Steel Works Ltd, RTX Corporation, Komatsu Ltd, BAE Systems plc, Kawasaki Heavy Industries Ltd, Northrop Grumman Corporation, The Boeing Company, and Mitsubishi Heavy Industries Ltd. It dissects the market across the Aerospace and Defense sectors, focusing on Manufacturing and MRO service types, and Terrestrial, Aerial, and Naval platforms.

Japan Aerospace & Defense Industry Market Structure & Competitive Dynamics

The Japan Aerospace & Defense Industry market is characterized by a moderate to high concentration, driven by the significant R&D investments and stringent regulatory approvals required for entry. Key players like Mitsubishi Heavy Industries Ltd and Kawasaki Heavy Industries Ltd hold substantial market share, estimated at over 30% combined in specific defense platform manufacturing. Innovation ecosystems thrive through collaborations between major prime contractors and specialized component suppliers, fostering advancements in areas like advanced materials and AI-driven defense systems. The regulatory framework, governed by agencies such as the Ministry of Defense, prioritizes national security and technological sovereignty, influencing import/export policies and domestic production mandates. Product substitutes are limited, particularly in high-specification defense systems, but advancements in civilian aerospace technology can sometimes find dual-use applications. End-user trends are heavily influenced by geopolitical developments, necessitating modernization of aging fleets and development of next-generation platforms, projected to drive demand by 8% annually. Mergers and acquisitions (M&A) activities, while less frequent than in other global markets, are strategic, focusing on acquiring specialized technological capabilities or consolidating market positions. Recent M&A deal values have ranged from tens of millions to several hundred million dollars, aimed at enhancing capabilities in areas like unmanned aerial systems and cybersecurity.

Japan Aerospace & Defense Industry Industry Trends & Insights

The Japan Aerospace & Defense Industry is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period. This expansion is primarily fueled by increasing defense budgets driven by regional security concerns and Japan's evolving security posture. Technological disruptions are a significant trend, with a rapid adoption of artificial intelligence (AI), advanced robotics, and next-generation sensor technologies across both aerospace and defense applications. The integration of AI in autonomous systems, including unmanned aerial vehicles (UAVs) and robotic ground vehicles, is a key differentiator. Consumer preferences, particularly in the aerospace sector, are shifting towards more sustainable aviation solutions and advanced passenger experiences, influencing the development of fuel-efficient aircraft and innovative cabin technologies. The defense sector is witnessing a strong demand for advanced cybersecurity solutions, electronic warfare capabilities, and networked combat systems to counter emerging threats. Competitive dynamics are intense, with both domestic players like Mitsubishi Heavy Industries Ltd and international giants like Lockheed Martin Corporation and BAE Systems plc vying for lucrative contracts. The market penetration of advanced manufacturing techniques, such as additive manufacturing (3D printing) for critical aerospace components, is steadily increasing, promising to reduce lead times and manufacturing costs. Furthermore, the growing emphasis on MRO services is creating new revenue streams and fostering greater lifecycle support for complex platforms. The push for domestic production capabilities and technology transfer agreements also plays a crucial role in shaping the competitive landscape, ensuring national self-reliance in critical defense technologies.

Dominant Markets & Segments in Japan Aerospace & Defense Industry

The Defense sector demonstrates significant dominance within the Japan Aerospace & Defense Industry, driven by substantial government investment and a focus on national security modernization. Within the Defense sector, the Aerial platform segment is particularly prominent, with ongoing upgrades of fighter jets, patrol aircraft, and the development of new unmanned aerial systems. Key drivers for this dominance include:

- Geopolitical Tensions: Heightened regional security concerns necessitate a robust aerial defense capability, leading to increased procurement and upgrade programs.

- Technological Advancement: Japan's commitment to cutting-edge military technology, particularly in stealth, avionics, and drone warfare, positions the Aerial segment for sustained growth.

- Government Procurement Policies: Favorable policies aimed at strengthening indigenous defense capabilities stimulate demand for domestically produced aerial defense systems.

In terms of Service Type, Manufacturing commands a substantial share, reflecting the significant investment in building and producing advanced aerospace and defense platforms domestically. This is complemented by a growing emphasis on MRO (Maintenance, Repair, and Overhaul) services, which are crucial for ensuring the operational readiness and longevity of complex defense assets. The Terrestrial platform segment, encompassing ground vehicles and associated defense systems, also represents a vital area of growth, particularly in the development of advanced armored vehicles and missile systems.

Japan Aerospace & Defense Industry Product Innovations

Product innovation in the Japan Aerospace & Defense Industry is characterized by a strong focus on advanced materials, artificial intelligence, and unmanned systems. Companies are investing heavily in developing next-generation composite materials for lighter and more fuel-efficient aircraft, as well as advanced alloys for high-stress defense applications. The integration of AI is revolutionizing sensor technologies, enabling intelligent threat detection and autonomous navigation for both aerial and terrestrial platforms. Innovations in stealth technology and electronic warfare systems are also critical for maintaining a competitive edge. The development of advanced MRO solutions, including predictive maintenance powered by AI and data analytics, offers significant competitive advantages by reducing downtime and operational costs.

Report Segmentation & Scope

This report segments the Japan Aerospace & Defense Industry market into key categories for comprehensive analysis.

- Sector: Aerospace: This segment encompasses civil aviation manufacturing, space exploration technologies, and related components and services. Projections indicate steady growth, driven by global demand for commercial aircraft and advancements in satellite technology. Market size for this segment is estimated at approximately 50 Billion in 2025.

- Sector: Defense: This segment focuses on military aircraft, naval vessels, terrestrial combat vehicles, missiles, and associated defense systems. It is expected to witness robust growth due to increasing defense spending and modernization initiatives. Market size for this segment is estimated at approximately 70 Billion in 2025.

- Service Type: Manufacturing: This segment covers the production of aircraft, defense equipment, and related components. It is a core driver of the industry, with significant investments in advanced manufacturing techniques.

- Service Type: MRO: This segment includes maintenance, repair, and overhaul services for aerospace and defense platforms. Its growth is closely tied to the increasing installed base of existing fleets.

- Platform: Terrestrial: This segment focuses on ground-based defense systems, including armored vehicles, artillery, and related logistics support.

- Platform: Aerial: This segment covers military and civil aircraft, including fighter jets, helicopters, transport planes, and unmanned aerial vehicles (UAVs).

- Platform: Naval: This segment includes warships, submarines, naval aircraft, and associated maritime defense technologies.

Key Drivers of Japan Aerospace & Defense Industry Growth

The growth of the Japan Aerospace & Defense Industry is propelled by several key factors:

- Technological Advancement: Continuous investment in R&D fuels innovation in areas like AI, advanced materials, and autonomous systems, creating demand for cutting-edge products.

- Geopolitical Landscape: Evolving regional security dynamics and Japan's strategic defense posture necessitate modernization of military capabilities, driving procurement and upgrades.

- Government Initiatives: Supportive government policies, including increased defense budgets and emphasis on indigenous technological development, foster market expansion.

- Economic Stability: A strong domestic economy provides the financial resources for significant investments in both civil aerospace and defense sectors.

- Focus on MRO: Increasing complexity of modern platforms and a drive for operational efficiency are boosting the demand for comprehensive MRO services.

Challenges in the Japan Aerospace & Defense Industry Sector

Despite robust growth, the Japan Aerospace & Defense Industry faces several challenges:

- High R&D Costs: The development of advanced aerospace and defense technologies requires substantial upfront investment, posing a barrier for smaller players.

- Stringent Regulatory Hurdles: Navigating complex and evolving national and international regulations for defense procurement and technology transfer can be time-consuming and costly.

- Global Supply Chain Vulnerabilities: Disruptions in global supply chains, as witnessed in recent years, can impact production timelines and component availability, potentially affecting cost and delivery schedules.

- Intense International Competition: Competition from established global defense contractors and emerging players can put pressure on pricing and market share.

- Talent Acquisition and Retention: A shortage of highly skilled engineers and technicians in specialized fields can hinder innovation and production capacity.

Leading Players in the Japan Aerospace & Defense Industry Market

- THALES

- ShinMaywa Industries Ltd

- Lockheed Martin Corporation

- Toshiba Corporation

- Toray Industries Inc

- Japan Steel Works Ltd

- RTX Corporation

- Komatsu Ltd

- BAE Systems plc

- Kawasaki Heavy Industries Ltd

- Northrop Grumman Corporation

- The Boeing Company

- Mitsubishi Heavy Industries Ltd

Key Developments in Japan Aerospace & Defense Industry Sector

- 2023 October: Mitsubishi Heavy Industries Ltd announces a significant expansion of its aerospace manufacturing facility to support increased production of next-generation fighter components.

- 2024 January: Kawasaki Heavy Industries Ltd secures a multi-million dollar contract for the development of advanced unmanned aerial vehicle (UAV) technology for reconnaissance missions.

- 2024 March: Toray Industries Inc unveils a new high-performance composite material for aerospace applications, offering enhanced strength and reduced weight, projected to impact aircraft efficiency.

- 2024 May: ShinMaywa Industries Ltd delivers its latest amphibious aircraft to the Japan Maritime Self-Defense Force, enhancing maritime patrol capabilities.

- 2024 July: Toshiba Corporation announces strategic investment in AI-powered predictive maintenance solutions for defense platforms, aiming to improve operational readiness.

- 2024 September: Komatsu Ltd showcases its innovative autonomous ground vehicle technology, with potential applications in military logistics and support operations.

- 2025 February: BAE Systems plc and Mitsubishi Heavy Industries Ltd announce a joint research initiative to explore advanced cybersecurity solutions for integrated defense systems.

- 2025 April: RTX Corporation secures a significant contract for next-generation engine components, highlighting ongoing advancements in aerospace propulsion.

- 2025 June: Lockheed Martin Corporation and Northrop Grumman Corporation collaborate on a new missile defense system, reflecting increasing integration in defense technology development.

- 2025 August: The Boeing Company partners with a Japanese consortium to explore advanced sustainable aviation fuels, aligning with global environmental initiatives.

Strategic Japan Aerospace & Defense Industry Market Outlook

The strategic outlook for the Japan Aerospace & Defense Industry remains highly positive, driven by a confluence of factors including sustained government investment, technological innovation, and a commitment to national security. Growth accelerators include the increasing demand for advanced unmanned systems, the integration of AI across platforms, and the continued modernization of both civil and military aviation fleets. Strategic opportunities lie in the expansion of MRO services, the development of dual-use technologies with civilian applications, and increased international collaboration in research and development. The industry is poised for further growth by focusing on advanced manufacturing techniques, cybersecurity, and sustainable aerospace solutions, solidifying Japan's position as a key global player.

Japan Aerospace & Defense Industry Segmentation

-

1. Sector

- 1.1. Aerospace

- 1.2. Defense

-

2. Service Type

- 2.1. Manufacturing

- 2.2. MRO

-

3. Platform

- 3.1. Terrestrial

- 3.2. Aerial

- 3.3. Naval

Japan Aerospace & Defense Industry Segmentation By Geography

- 1. Japan

Japan Aerospace & Defense Industry Regional Market Share

Geographic Coverage of Japan Aerospace & Defense Industry

Japan Aerospace & Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Manufacturing Segment Accounted for a Major Share in 2023

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Aerospace

- 5.1.2. Defense

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Manufacturing

- 5.2.2. MRO

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Terrestrial

- 5.3.2. Aerial

- 5.3.3. Naval

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 THALES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ShinMaywa Industries Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toshiba Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toray Industries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Japan Steel Works Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RTX Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Komatsu Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BAE Systems plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kawasaki Heavy Industries Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Northrop Grumman Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 The Boeing Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Mitsubishi Heavy Industries Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 THALES

List of Figures

- Figure 1: Japan Aerospace & Defense Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Aerospace & Defense Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Aerospace & Defense Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Japan Aerospace & Defense Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Japan Aerospace & Defense Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Japan Aerospace & Defense Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Japan Aerospace & Defense Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 6: Japan Aerospace & Defense Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Japan Aerospace & Defense Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Japan Aerospace & Defense Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Aerospace & Defense Industry?

The projected CAGR is approximately 5.28%.

2. Which companies are prominent players in the Japan Aerospace & Defense Industry?

Key companies in the market include THALES, ShinMaywa Industries Ltd, Lockheed Martin Corporation, Toshiba Corporation, Toray Industries Inc, Japan Steel Works Ltd, RTX Corporation, Komatsu Ltd, BAE Systems plc, Kawasaki Heavy Industries Ltd, Northrop Grumman Corporation, The Boeing Company, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Japan Aerospace & Defense Industry?

The market segments include Sector, Service Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.60 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Manufacturing Segment Accounted for a Major Share in 2023.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Aerospace & Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Aerospace & Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Aerospace & Defense Industry?

To stay informed about further developments, trends, and reports in the Japan Aerospace & Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence