Key Insights

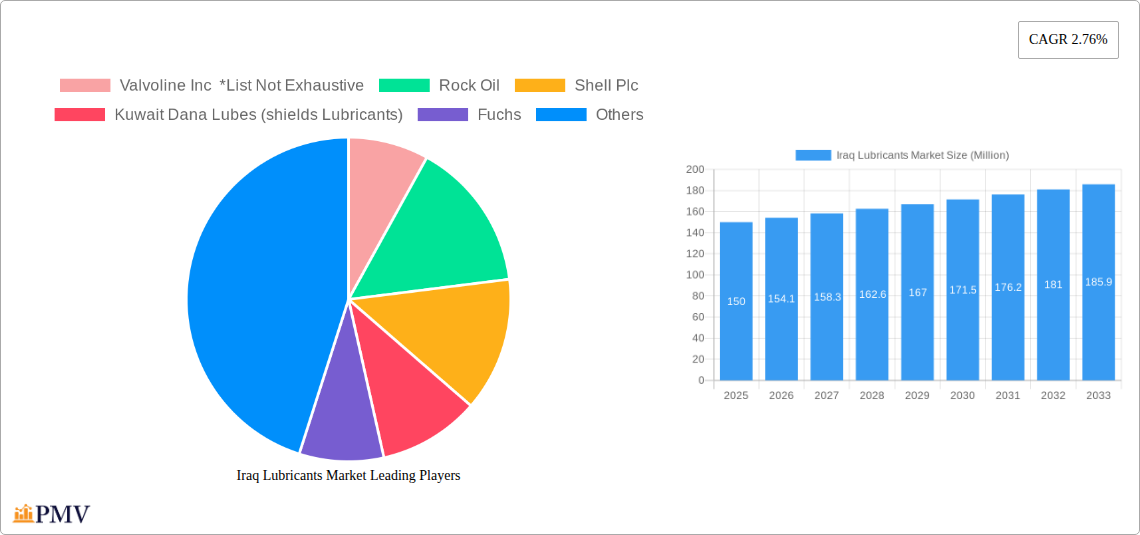

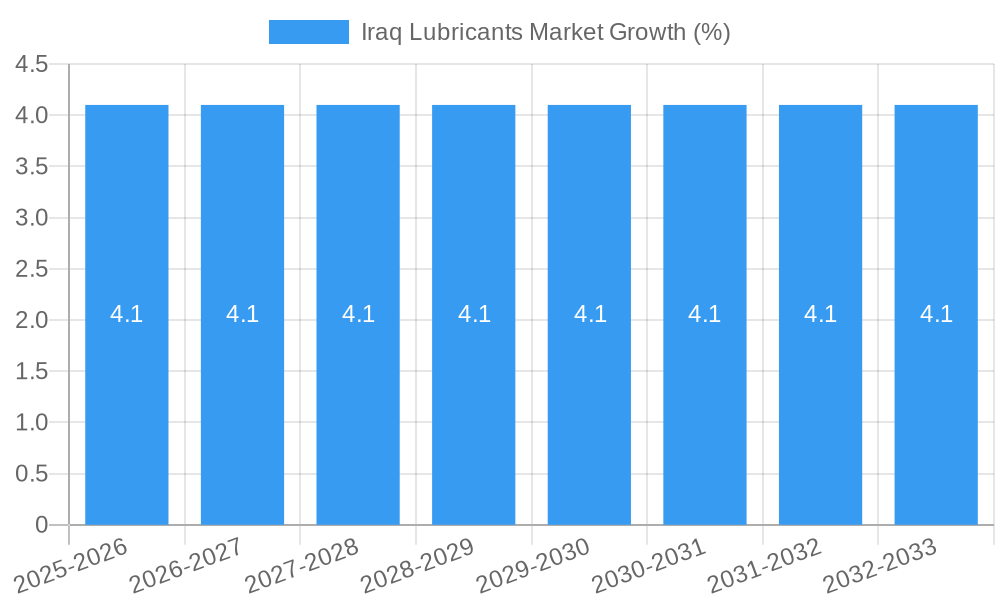

The Iraq lubricants market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by the expansion of the automotive, power generation, and heavy equipment sectors. A Compound Annual Growth Rate (CAGR) of 2.76% from 2025 to 2033 indicates a consistent, albeit moderate, increase in demand. This growth is fueled by rising vehicle ownership, increased industrial activity, and infrastructure development projects within the country. Key lubricant types driving market expansion include engine oils, transmission and gear oils, and hydraulic fluids, catering to the diverse needs of various end-user industries. While the market faces potential restraints such as fluctuating oil prices and economic volatility inherent to the region, the long-term outlook remains positive, bolstered by government investments in infrastructure and ongoing efforts to diversify the Iraqi economy. The competitive landscape is characterized by a mix of international players like Shell Plc, TotalEnergies, and Fuchs, alongside local companies such as Kuwait Dana Lubes and Petrol Ofisi AS. This blend of domestic and international brands caters to the varied needs and price sensitivities within the market.

The segmentation of the Iraqi lubricants market reveals a significant contribution from the automotive sector, owing to the increasing number of vehicles on the road. Growth within the power generation and heavy equipment segments is closely linked to government investment in infrastructure projects and energy production. The metallurgy and metalworking industries also contribute substantially to the demand for specialized lubricants. Ongoing efforts to improve the efficiency and longevity of machinery across various sectors are contributing factors to sustained demand. Although precise market size figures for previous years are unavailable, the consistent CAGR coupled with industry trends allows for a reliable projection of future growth, creating a significant opportunity for both established and emerging players within the lubricant market in Iraq. The market will continue its steady growth, driven by the aforementioned factors, presenting lucrative opportunities for businesses in the coming decade.

Iraq Lubricants Market: A Comprehensive Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the Iraq lubricants market, offering invaluable insights for industry stakeholders. The study covers the period 2019-2033, with 2025 serving as the base year and estimated year. The report meticulously examines market segmentation, competitive dynamics, growth drivers, and challenges, presenting a robust forecast for 2025-2033. This analysis empowers businesses to make informed decisions, capitalize on emerging opportunities, and navigate the complexities of this dynamic market. The total market size in 2025 is estimated at xx Million.

Iraq Lubricants Market Structure & Competitive Dynamics

The Iraq lubricants market exhibits a moderately consolidated structure, with several international and regional players competing for market share. Market concentration is influenced by factors including brand recognition, product quality, distribution networks, and pricing strategies. Key players actively participate in mergers and acquisitions (M&A) to expand their market reach and product portfolios. The value of M&A deals in the past five years has totaled approximately xx Million, reflecting a moderate level of consolidation activity. Innovation within the sector is driven by the demand for advanced lubricants that enhance fuel efficiency and engine performance. The regulatory framework plays a significant role in shaping market dynamics, impacting product standards and environmental regulations. The presence of substitute products, such as bio-based lubricants, also poses a competitive challenge. Finally, end-user trends, especially within the automotive and heavy equipment sectors, significantly influence demand for specific types of lubricants.

- Market Share: Shell Plc and Fuchs hold significant market share, estimated at xx% and xx% respectively in 2025. Other key players such as Valvoline Inc., TotalEnergies, and Kuwait Dana Lubes (shields Lubricants) collectively account for approximately xx% of the market.

- M&A Activity: Recent M&A activity has been characterized by strategic acquisitions aimed at expanding product lines and geographical reach. For example, [Insert specific M&A example if available, otherwise remove this bullet point].

- Innovation Ecosystem: The market is witnessing increasing investments in R&D focused on developing eco-friendly and high-performance lubricants. This is driven by stricter environmental regulations and the growing demand for enhanced fuel efficiency.

- Regulatory Framework: The Iraqi government's regulations concerning product standards and environmental protection impact the market's operational landscape. These regulations influence the type of lubricants that can be sold and used in the country.

Iraq Lubricants Market Industry Trends & Insights

The Iraq lubricants market is projected to experience substantial growth during the forecast period (2025-2033), driven by factors such as rising vehicle ownership, increasing industrialization, and expanding infrastructure development. The Compound Annual Growth Rate (CAGR) is estimated to be xx% during this period. Market penetration of advanced lubricants, including those tailored for hybrid and electric vehicles, is gradually increasing. Technological advancements in lubricant formulation are leading to improved performance characteristics, such as enhanced fuel efficiency and reduced emissions. Consumer preferences are shifting towards high-quality, eco-friendly lubricants, influencing product development and marketing strategies. Competitive dynamics are shaped by pricing strategies, product differentiation, and brand building activities. The increasing adoption of synthetic lubricants is a notable trend, with the market penetration rate expected to reach xx% by 2033. Furthermore, the expanding power generation and heavy equipment sectors fuel the demand for specialized lubricants, contributing significantly to overall market growth.

Dominant Markets & Segments in Iraq Lubricants Market

The automotive segment is currently the dominant end-user industry for lubricants in Iraq, accounting for approximately xx% of the total market in 2025. This is primarily driven by the increasing number of vehicles on the road and the growing demand for high-performance engine oils.

- Key Drivers for Automotive Segment Dominance:

- Rising vehicle ownership rates.

- Increasing disposable incomes.

- Government initiatives to improve road infrastructure.

The engine oils segment holds the largest share within the product type category, representing approximately xx% of the total market value in 2025. This segment's dominance is primarily due to its necessity in almost all vehicles and machinery. Other segments such as grease and hydraulic fluids are also experiencing substantial growth, driven by the expansion of industrial activities.

- Key Drivers for Engine Oils Segment Dominance:

- High demand from the automotive sector.

- Essential for the operation of various types of machinery.

- Technological advancements leading to better fuel efficiency and engine protection.

The Southern region of Iraq currently accounts for the highest market share (xx%), driven by a high concentration of industrial activities and automotive usage in that area.

- Key Drivers for Southern Region Dominance:

- Higher concentration of industrial activities such as oil and gas extraction.

- Significant automotive use in major urban centers.

- Favorable economic policies supporting infrastructure development.

Iraq Lubricants Market Product Innovations

Recent innovations in the Iraqi lubricants market focus on developing environmentally friendly and high-performance lubricants. This includes the introduction of synthetic and bio-based lubricants with enhanced properties like improved fuel efficiency, reduced emissions, and extended drain intervals. Manufacturers are also focusing on specialized lubricants for hybrid and electric vehicles, catering to the growing adoption of these vehicles. These innovations cater to stricter environmental regulations and the increasing demand for enhanced performance and sustainability.

Report Segmentation & Scope

This report segments the Iraq lubricants market by product type (Engine Oils, Transmission and Gear Oils, Hydraulic Fluids, Metalworking Fluids, Greases, Other Product Types) and end-user industry (Power Generation, Automotive, Heavy Equipment, Metallurgy and Metalworking, Other End-user Industries). Each segment's analysis includes historical data (2019-2024), current estimates (2025), and future projections (2025-2033). The report comprehensively analyzes market size, growth rate, and competitive landscape for each segment, offering a granular understanding of market dynamics.

Key Drivers of Iraq Lubricants Market Growth

Several factors are driving the growth of the Iraq lubricants market. These include increasing industrialization and infrastructure development, leading to higher demand from various sectors like automotive, power generation, and construction. The rising vehicle ownership, coupled with government initiatives to improve road infrastructure, further fuels market expansion. Moreover, advancements in lubricant technology, resulting in enhanced fuel efficiency and longer product life, are contributing significantly to market growth.

Challenges in the Iraq Lubricants Market Sector

The Iraq lubricants market faces challenges such as political instability and security concerns, which can disrupt supply chains and impact market operations. Fluctuations in oil prices and currency exchange rates can also influence the cost of production and profitability. Additionally, competition from both domestic and international players adds pressure on market participants, requiring companies to constantly innovate and optimize their operations to maintain a competitive edge. The impact of these factors on market growth can be quantified through analyzing historical data and projecting future scenarios. Specifically, supply chain disruptions can lead to xx% reduction in market growth in certain years (give example).

Leading Players in the Iraq Lubricants Market

- Valvoline Inc. [If available, insert Valvoline Inc. website link here]

- Rock Oil

- Shell Plc [If available, insert Shell Plc. website link here]

- Kuwait Dana Lubes (shields Lubricants)

- Fuchs [If available, insert Fuchs website link here]

- Enoc Company (ALMEAAD Co ) [If available, insert Enoc Company website link here]

- TotalEnergies [If available, insert TotalEnergies website link here]

- AMSOIL Inc. [If available, insert AMSOIL Inc. website link here]

- Behrang Oil Company

- Petrol Ofisi AS

- Petromin Corporation

- Morris Lubricants

Key Developments in Iraq Lubricants Market Sector

- August 2022: Gulf Oil Middle East announced the restructuring of its global lubricants product portfolio, introducing new products based on ThermoShield and Wear-Guard technologies. This development reflects a significant shift towards enhanced performance and protection for modern vehicles, potentially impacting the market share of Gulf Oil and its competitors.

- January 2023: FUCHS launched TITAN GT1 PRO GLV-1 SAE 0W-8 engine oil, a low-viscosity engine oil for hybrid electric vehicles. This product launch demonstrates the industry’s response to the rising demand for specialized lubricants for new vehicle technologies, potentially increasing FUCHS' market share in the specialized segment.

Strategic Iraq Lubricants Market Outlook

The Iraq lubricants market presents substantial growth opportunities driven by continuous infrastructure development and rising vehicle ownership. The increasing demand for high-performance and eco-friendly lubricants presents lucrative opportunities for manufacturers to invest in research and development. Furthermore, strategic partnerships and collaborations can facilitate market penetration and expansion. Addressing the challenges related to supply chain disruptions and political instability will be crucial for sustainable market growth in the long term. The long-term outlook for the Iraq lubricants market is positive, with the market expected to experience sustained growth throughout the forecast period, driven by both long-term economic and technological factors.

Iraq Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Transmission and Hydraulic Fluid

- 1.3. General Industrial Oil

- 1.4. Gear Oil

- 1.5. Grease

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power Generation

- 2.2. Automotive and Transportation

- 2.3. Heavy Equipment

- 2.4. Food and Beverage

- 2.5. Other End-user Industries

Iraq Lubricants Market Segmentation By Geography

- 1. Iraq

Iraq Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption in Automotive Sector; Increasing Investments in Public and Private Construction Projects

- 3.3. Market Restrains

- 3.3.1. Geopolitical Impact; Increasing Demand of Hybrid and Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Engine Oil is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iraq Lubricants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Transmission and Hydraulic Fluid

- 5.1.3. General Industrial Oil

- 5.1.4. Gear Oil

- 5.1.5. Grease

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Generation

- 5.2.2. Automotive and Transportation

- 5.2.3. Heavy Equipment

- 5.2.4. Food and Beverage

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Iraq

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Valvoline Inc *List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rock Oil

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Shell Plc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kuwait Dana Lubes (shields Lubricants)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fuchs

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Enoc Company (ALMEAAD Co )

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TotalEnergies

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AMSOIL Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Behran Oil Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Petrol Ofisi AS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Petromin Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Morris Lubricants

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Valvoline Inc *List Not Exhaustive

List of Figures

- Figure 1: Iraq Lubricants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iraq Lubricants Market Share (%) by Company 2024

List of Tables

- Table 1: Iraq Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iraq Lubricants Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Iraq Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Iraq Lubricants Market Volume Million Forecast, by Product Type 2019 & 2032

- Table 5: Iraq Lubricants Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Iraq Lubricants Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 7: Iraq Lubricants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Iraq Lubricants Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Iraq Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Iraq Lubricants Market Volume Million Forecast, by Country 2019 & 2032

- Table 11: Iraq Lubricants Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: Iraq Lubricants Market Volume Million Forecast, by Product Type 2019 & 2032

- Table 13: Iraq Lubricants Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 14: Iraq Lubricants Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 15: Iraq Lubricants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Iraq Lubricants Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iraq Lubricants Market?

The projected CAGR is approximately 2.76%.

2. Which companies are prominent players in the Iraq Lubricants Market?

Key companies in the market include Valvoline Inc *List Not Exhaustive, Rock Oil, Shell Plc, Kuwait Dana Lubes (shields Lubricants), Fuchs, Enoc Company (ALMEAAD Co ), TotalEnergies, AMSOIL Inc, Behran Oil Company, Petrol Ofisi AS, Petromin Corporation, Morris Lubricants.

3. What are the main segments of the Iraq Lubricants Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption in Automotive Sector; Increasing Investments in Public and Private Construction Projects.

6. What are the notable trends driving market growth?

Engine Oil is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Geopolitical Impact; Increasing Demand of Hybrid and Electric Vehicles.

8. Can you provide examples of recent developments in the market?

January 2023: FUCHS launched TITAN GT1 PRO GLV-1 SAE 0W-8 engine oil with ultra-low viscosity grade for hybrid electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iraq Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iraq Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iraq Lubricants Market?

To stay informed about further developments, trends, and reports in the Iraq Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence