Key Insights

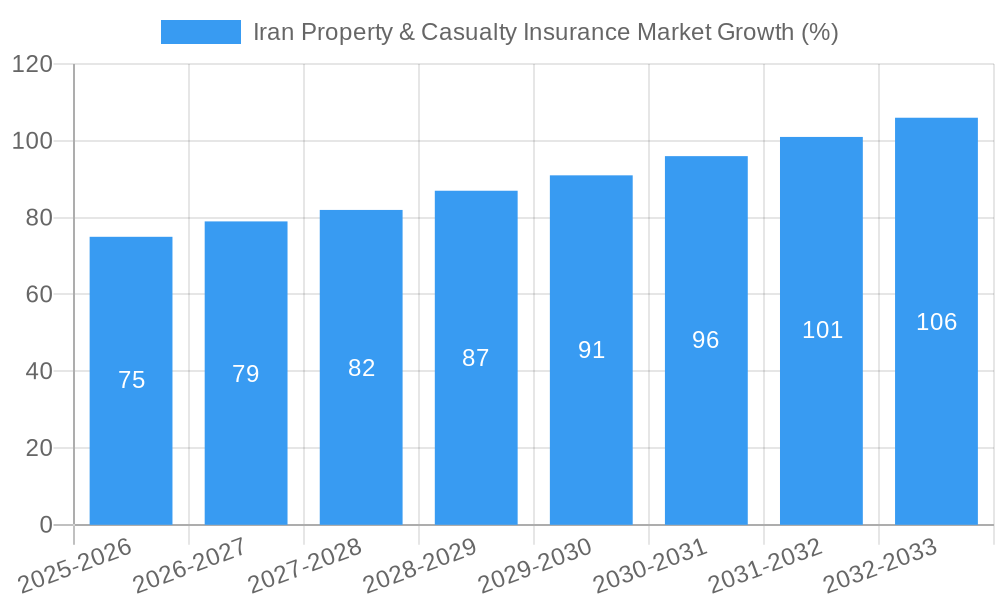

The Iran Property & Casualty (P&C) insurance market, while facing unique challenges due to geopolitical factors and economic sanctions, presents a complex landscape with significant growth potential. The market's historical performance (2019-2024) indicates a period of fluctuating growth, likely influenced by sanctions and economic instability. However, a positive Compound Annual Growth Rate (CAGR) from 2019 to 2024 suggests underlying resilience and an increasing demand for insurance products within the country. The base year of 2025 is crucial, serving as a benchmark to project future growth (2025-2033). Assuming a conservative CAGR of 5% from 2025 onwards (a figure informed by regional trends and consideration of potential economic improvements), substantial market expansion is anticipated. This growth will be driven by factors such as increasing urbanization, rising awareness of risk mitigation, and the gradual expansion of the middle class, fostering a greater need for insurance coverage in areas like property, auto, and liability. Government initiatives promoting financial sector development could also play a significant role in bolstering market expansion. However, challenges like limited insurance penetration, inflation, and regulatory hurdles remain crucial factors influencing the market's trajectory. The market will need to adapt to fluctuating exchange rates and navigate economic uncertainties to reach its full potential.

The forecast period (2025-2033) offers a compelling outlook, contingent on macroeconomic stability and positive regulatory changes. The estimated market size in 2025 serves as a springboard for future projections based on the projected CAGR. Sustained growth requires addressing infrastructural limitations, promoting financial literacy, and fostering greater trust in the insurance sector among the population. Further diversification of product offerings to meet evolving customer needs will also be crucial for maximizing market penetration and growth. The long-term potential of the Iranian P&C insurance market hinges on a combination of successful economic reforms, regulatory support, and increased consumer confidence.

Iran Property & Casualty Insurance Market: 2019-2033 Forecast Report

This comprehensive report provides an in-depth analysis of the Iranian Property & Casualty (P&C) insurance market, offering invaluable insights for industry stakeholders, investors, and strategic planners. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market structure, competitive dynamics, industry trends, and future growth prospects. The report analyzes key segments including Fire Insurance, Motor PD, Motor TPL, Liability Insurance, Marine, Aviation & Engineering, and Other P&C, across various distribution channels like Direct Sales, Agents, Brokers, and Banks. Key players like Kowsar Insurance Company, Day Insurance, Karafarin Insurance, Razi Insurance, Persian Insurance, Asia Insurance, Alborz Insurance, Pasargad Insurance Company, Moallem Insurance Company, and Iran Insurance Company are profiled, providing a granular understanding of the market landscape. The report quantifies market values in Millions.

Iran Property & Casualty Insurance Market Market Structure & Competitive Dynamics

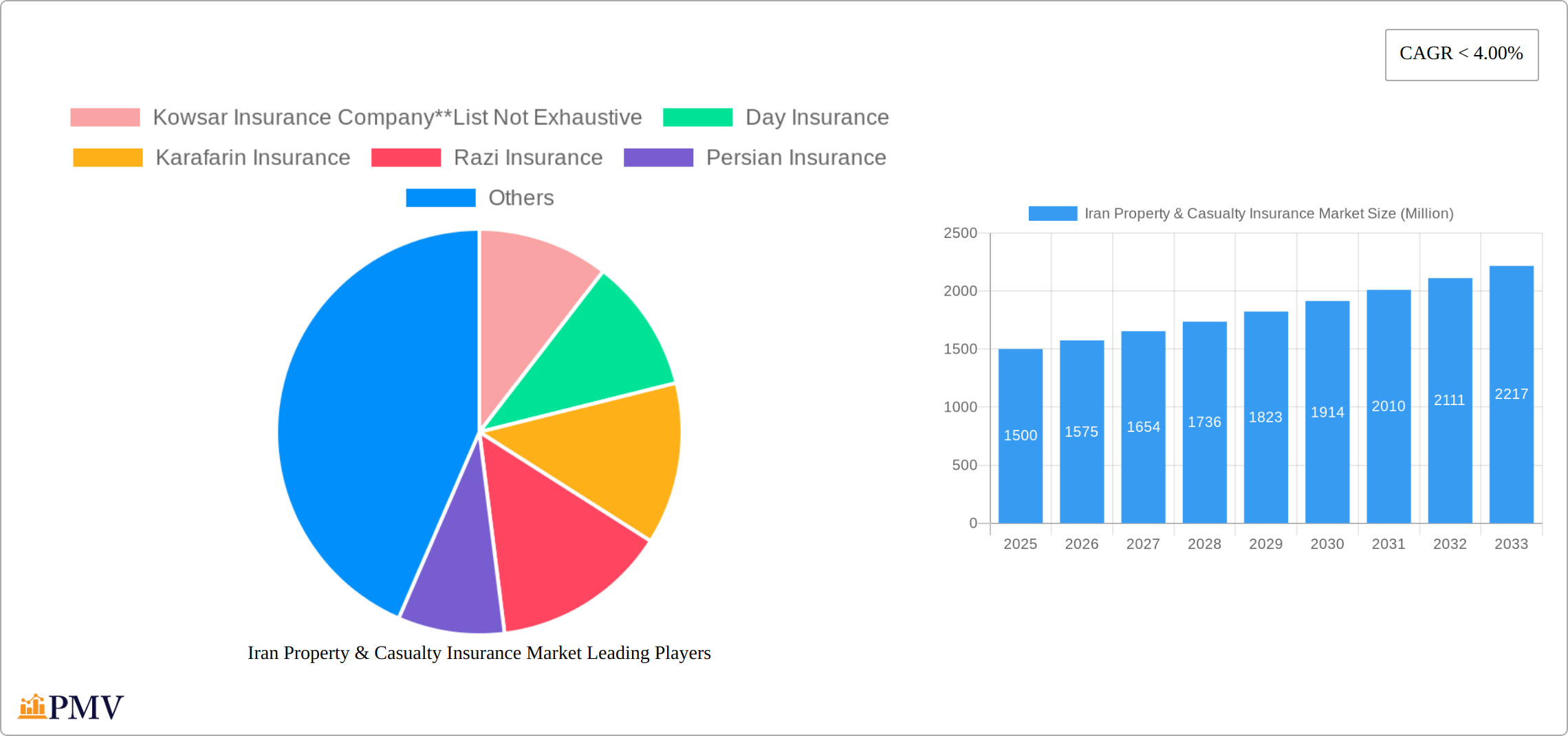

The Iranian P&C insurance market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. The market share of the top five players in 2024 is estimated to be approximately xx%. Innovation within the sector is gradually increasing, driven by the adoption of digital technologies and the need to enhance customer experience. However, regulatory frameworks remain a significant factor shaping market dynamics. Product substitution is limited due to the nature of insurance products, but competitive pressures exist in terms of pricing and service offerings. End-user trends indicate a growing demand for specialized insurance products tailored to specific needs, particularly in the motor and liability segments. M&A activity has been relatively limited in recent years, with total deal values in the historical period estimated at xx Million. However, future consolidation is anticipated as companies seek to expand their market reach and enhance their product portfolios.

Iran Property & Casualty Insurance Market Industry Trends & Insights

The Iranian P&C insurance market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is primarily driven by factors such as increasing vehicle ownership, expanding construction activity, and a rising awareness of insurance among the population. Technological disruptions, particularly in areas like telematics and digital distribution channels, are reshaping the competitive landscape. Consumer preferences are shifting towards greater convenience, transparency, and personalized insurance solutions. This necessitates insurance companies to adapt their service offerings and leverage technology to meet changing expectations. Intense competition is stimulating innovation and pushing companies to offer competitive pricing and enhanced customer service. Market penetration remains relatively low compared to other emerging markets, indicating significant untapped potential for growth.

Dominant Markets & Segments in Iran Property & Casualty Insurance Market

- By Product Type: The Motor TPL segment is currently the dominant segment within the Iranian P&C insurance market, driven by the increasing number of vehicles on the road and mandatory insurance requirements. The Fire Insurance segment is also experiencing substantial growth, fueled by rising construction activities and increased awareness of property protection needs.

- By Distribution Channel: Agents continue to be the dominant distribution channel, owing to their wide reach and established relationships with customers. However, the direct sales channel is witnessing significant growth due to technological advancements and the increasing preference for online platforms.

The dominance of the Motor TPL segment is attributed to stringent government regulations mandating its purchase for all vehicles. Economic policies aimed at promoting infrastructure development are indirectly supporting growth in the Fire Insurance segment. Key drivers for the growth of Direct Sales channels include the increasing smartphone penetration and the rising adoption of online services.

Iran Property & Casualty Insurance Market Product Innovations

Recent product innovations include the introduction of bundled insurance packages targeting specific customer segments and the utilization of telematics to offer usage-based insurance pricing. These developments improve market fit by addressing the specific needs of customers and enhancing the overall value proposition. The adoption of Insurtech solutions is improving efficiency and customer experience.

Report Segmentation & Scope

This report provides detailed segmentation of the Iranian P&C insurance market based on product type (Fire Insurance, Motor PD, Motor TPL, Liability Insurance, Marine, Aviation & Engineering, Other P&C) and distribution channel (Direct Sales, Agents, Brokers, Banks, Other Distribution Channels). Each segment’s market size, growth projections, and competitive dynamics are extensively analyzed. The projected market size for the Motor TPL segment in 2033 is estimated at xx Million, while the Fire Insurance segment is expected to reach xx Million. Competition is intense within each segment, with companies employing various strategies to gain market share.

Key Drivers of Iran Property & Casualty Insurance Market Growth

The Iranian P&C insurance market's growth is fueled by several factors. Increasing disposable incomes and a growing middle class are expanding the insurance-buying population. Government initiatives to promote economic development and infrastructure projects stimulate demand for insurance products. Technological advancements and the digitalization of the insurance sector are enhancing accessibility and efficiency.

Challenges in the Iran Property & Casualty Insurance Market Sector

The market faces challenges, including regulatory complexities, fluctuating exchange rates impacting pricing strategies, and limited insurance awareness in certain segments of the population. Competition from both domestic and international players also creates pricing pressures. These factors constrain the market’s overall growth potential.

Leading Players in the Iran Property & Casualty Insurance Market Market

- Kowsar Insurance Company

- Day Insurance

- Karafarin Insurance

- Razi Insurance

- Persian Insurance

- Asia Insurance

- Alborz Insurance

- Pasargad Insurance Company

- Moallem Insurance Company

- Iran Insurance Company

Key Developments in Iran Property & Casualty Insurance Market Sector

- October 2022: Introduction of a new telematics-based motor insurance product by a leading insurer.

- March 2023: Acquisition of a smaller insurance company by a larger player.

- June 2024: Launch of a new online insurance platform by a major insurer.

These developments are significant because they reflect the ongoing transformation of the Iranian P&C insurance market, driven by technological advancements and increased competition.

Strategic Iran Property & Casualty Insurance Market Market Outlook

The Iranian P&C insurance market presents significant growth opportunities for both established players and new entrants. Strategic investments in digital technologies, expansion into underserved segments, and development of innovative product offerings will be crucial for achieving success. The increasing demand for personalized insurance solutions and the potential for expansion into niche areas such as cyber insurance present further strategic opportunities. The market is poised for considerable expansion in the coming decade.

Iran Property & Casualty Insurance Market Segmentation

-

1. Product Type

- 1.1. Fire Insurance

- 1.2. Motor PD

- 1.3. Motor TPL

- 1.4. Liability Insurance

- 1.5. Marine, Aviation & Engineering

- 1.6. Other P&C

-

2. Distribution Channel

- 2.1. Direct Sales

- 2.2. Agents

- 2.3. Brokers

- 2.4. Banks

- 2.5. Other Distribution Channel

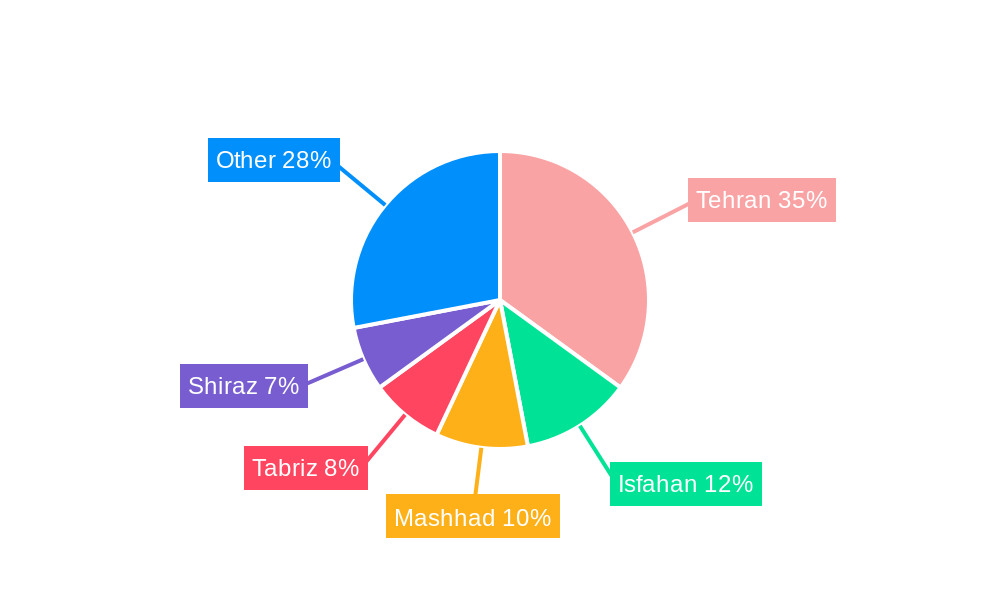

Iran Property & Casualty Insurance Market Segmentation By Geography

- 1. Iran

Iran Property & Casualty Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in consumer spending on buying Asian artworks; The rise in virtual art gallery market

- 3.3. Market Restrains

- 3.3.1. The rising prices of the artwork

- 3.4. Market Trends

- 3.4.1. The Premium Written for Various segment of Property and Casualty Insurance is on Rise.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Iran Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fire Insurance

- 5.1.2. Motor PD

- 5.1.3. Motor TPL

- 5.1.4. Liability Insurance

- 5.1.5. Marine, Aviation & Engineering

- 5.1.6. Other P&C

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct Sales

- 5.2.2. Agents

- 5.2.3. Brokers

- 5.2.4. Banks

- 5.2.5. Other Distribution Channel

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Iran

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. UAE Iran Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Iran Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Iran Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Iran Property & Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Kowsar Insurance Company**List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Day Insurance

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Karafarin Insurance

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Razi Insurance

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Persian Insurance

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Asia Insurance

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Alborz Insurance

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Pasargad Insurance Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Moallem Insurance Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Iran Insurance Company

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Kowsar Insurance Company**List Not Exhaustive

List of Figures

- Figure 1: Iran Property & Casualty Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Iran Property & Casualty Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Iran Property & Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Iran Property & Casualty Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Iran Property & Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Iran Property & Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Iran Property & Casualty Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE Iran Property & Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa Iran Property & Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Iran Property & Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA Iran Property & Casualty Insurance Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Iran Property & Casualty Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: Iran Property & Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Iran Property & Casualty Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Iran Property & Casualty Insurance Market?

The projected CAGR is approximately < 4.00%.

2. Which companies are prominent players in the Iran Property & Casualty Insurance Market?

Key companies in the market include Kowsar Insurance Company**List Not Exhaustive, Day Insurance, Karafarin Insurance, Razi Insurance, Persian Insurance, Asia Insurance, Alborz Insurance, Pasargad Insurance Company, Moallem Insurance Company, Iran Insurance Company.

3. What are the main segments of the Iran Property & Casualty Insurance Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in consumer spending on buying Asian artworks; The rise in virtual art gallery market.

6. What are the notable trends driving market growth?

The Premium Written for Various segment of Property and Casualty Insurance is on Rise..

7. Are there any restraints impacting market growth?

The rising prices of the artwork.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Iran Property & Casualty Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Iran Property & Casualty Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Iran Property & Casualty Insurance Market?

To stay informed about further developments, trends, and reports in the Iran Property & Casualty Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence