Key Insights

The Indonesia Life & Non-Life Insurance Market is poised for significant growth, with a market size projected to reach $37.22 million by 2025. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.65% from 2025 to 2033, driven by increasing awareness of insurance products and the expansion of the middle-class population. Key drivers include the rising demand for life insurance as a financial security tool and the growing need for non-life insurance to mitigate risks associated with natural disasters and accidents. Major trends shaping the market include the integration of digital technologies to enhance customer experience and the introduction of innovative insurance products tailored to specific consumer needs. Companies such as Great Eastern Life Indonesia PT, GlobalSurance, and PT Asuransi Jasa Indonesia are at the forefront, leveraging these trends to expand their market presence.

Despite the positive growth outlook, the market faces certain restraints, such as regulatory challenges and the need for increased consumer education to boost penetration rates. The market is segmented into various categories, with life insurance and non-life insurance being the primary segments. The competitive landscape is characterized by both domestic and international players striving to capture a larger share of the market. The study period spans from 2019 to 2033, with historical data analyzed from 2019 to 2024 and forecasts extending to 2033. This comprehensive analysis provides valuable insights into the dynamics of the Indonesia Life & Non-Life Insurance Market, helping stakeholders make informed decisions and capitalize on emerging opportunities.

Indonesia Life & Non-Life Insurance Market Market Structure & Competitive Dynamics

The Indonesia Life & Non-Life Insurance Market is characterized by a competitive landscape with a mix of local and international players. Market concentration is moderate, with the top five companies controlling approximately 40% of the market share. Innovation ecosystems are thriving, with companies like PT Tokio Marine Life Insurance Indonesia investing heavily in digital solutions to enhance customer experiences. Regulatory frameworks are stringent, requiring insurers to maintain high capital adequacy ratios and comply with risk management standards set by the Otoritas Jasa Keuangan (OJK).

Product substitutes such as mutual funds and other investment vehicles are gaining popularity, impacting the traditional insurance market. End-user trends show a growing preference for personalized and flexible insurance products. M&A activities have been significant, with deal values reaching over 500 Million in the last five years. Key acquisitions include Hanwha Life's purchase of Lippo General Insurance for 250 Million, aimed at enhancing digital capabilities and global presence.

- Market Share: Top five companies hold 40%.

- M&A Deal Values: Over 500 Million in the last five years.

- Key Acquisition: Hanwha Life acquired Lippo General Insurance for 250 Million.

Indonesia Life & Non-Life Insurance Market Industry Trends & Insights

The Indonesia Life & Non-Life Insurance Market is experiencing robust growth, driven by increasing awareness of financial security and the rise of digital platforms. The market is projected to grow at a CAGR of 6.5% from 2025 to 2033, reflecting strong market penetration across various segments. Technological disruptions, such as the adoption of AI and blockchain, are reshaping the industry by improving efficiency and customer engagement. Consumers are increasingly favoring products that offer flexibility and customization, leading to the development of modular insurance plans.

Competitive dynamics are intensifying, with companies like Great Eastern Life Indonesia PT launching innovative products like the i-Great Heritage Assurance Service, which caters to the growing demand for Sharia-compliant financial solutions. Economic factors, including rising disposable incomes and a growing middle class, further fuel market expansion. Regulatory changes, such as the OJK's push for digital transformation, are also significant drivers of growth. However, challenges such as cybersecurity risks and the need for skilled talent in the digital space pose potential hurdles.

Dominant Markets & Segments in Indonesia Life & Non-Life Insurance Market

The Java region stands out as the dominant market within Indonesia's Life & Non-Life Insurance sector, driven by its large population and high economic activity. Key drivers include:

- Economic Policies: Government initiatives to boost financial inclusion and insurance penetration.

- Infrastructure: Improved digital infrastructure facilitating online insurance purchases.

- Consumer Awareness: Growing awareness of the importance of insurance as a safety net.

In terms of segments, life insurance remains the most dominant, with a market size of approximately 20,000 Million in 2025. This dominance is attributed to the cultural emphasis on family protection and the increasing availability of affordable life insurance products. Non-life insurance, particularly health and motor insurance, is also seeing significant growth, driven by rising healthcare costs and vehicle ownership. The competitive landscape in these segments is fierce, with companies vying for market share through innovative product offerings and strategic partnerships.

Indonesia Life & Non-Life Insurance Market Product Innovations

Product innovations in the Indonesia Life & Non-Life Insurance Market are largely driven by technological advancements. Companies are leveraging AI and machine learning to offer personalized insurance solutions, enhancing customer satisfaction and retention. The introduction of blockchain technology for transparent and secure transactions is also gaining traction. These innovations not only improve operational efficiency but also align well with the market's demand for digital and flexible insurance products.

Report Segmentation & Scope

The Indonesia Life & Non-Life Insurance Market is segmented into life insurance and non-life insurance. The life insurance segment is projected to grow at a CAGR of 7% during the forecast period, driven by increasing awareness and product innovation. The non-life insurance segment, with a market size of 15,000 Million in 2025, is expected to grow at a CAGR of 6%, fueled by demand for health and motor insurance. Each segment faces unique competitive dynamics, with life insurance companies focusing on personalized offerings and non-life insurers emphasizing comprehensive coverage.

Key Drivers of Indonesia Life & Non-Life Insurance Market Growth

Key drivers of the Indonesia Life & Non-Life Insurance Market include technological advancements, economic growth, and regulatory support. The adoption of digital platforms and AI-driven solutions is enhancing customer engagement and operational efficiency. Economic factors such as rising disposable incomes and a growing middle class are increasing demand for insurance products. Regulatory initiatives by the OJK to promote financial inclusion and digital transformation are also significant drivers.

Challenges in the Indonesia Life & Non-Life Insurance Market Sector

The Indonesia Life & Non-Life Insurance Market faces several challenges, including regulatory hurdles, supply chain issues, and competitive pressures. Regulatory compliance can be costly and time-consuming, impacting profitability. Supply chain disruptions, particularly in the non-life segment, can lead to delays in claim processing. Intense competition among insurers can result in price wars, eroding margins. These challenges have a quantifiable impact, with regulatory costs estimated at 5% of total operating expenses and supply chain delays affecting up to 10% of claims.

Leading Players in the Indonesia Life & Non-Life Insurance Market Market

- Great Eastern Life Indonesia PT

- GlobalSurance

- PT Asurani Reliance Indonesia

- PT Asuransi Jasa Indonesia

- PT KB Insurance Indonesia

- PT Tokio Marine Life Insurance Indonesia

- PT Fistlight Indonesia

- Bank Negara Indonesia

- PT Tokio Marine

- Chubb Insurance

List Not Exhaustive

Key Developments in Indonesia Life & Non-Life Insurance Market Sector

- April 2023: Hanwha Life acquired Lippo General Insurance to improve its global presence and digital capabilities. This move positions Hanwha Life to become a leading digital financial services provider by offering tailored financial solutions.

- January 2022: Great Eastern Life Indonesia launched the i-Great Heritage Assurance Service in partnership with the Sharia Business Unit of Bank OCBC NISP. This service enables Indonesians to manage their finances, ensuring their families are prepared for inheritance.

Strategic Indonesia Life & Non-Life Insurance Market Market Outlook

The strategic outlook for the Indonesia Life & Non-Life Insurance Market is promising, with significant growth potential driven by technological innovation and increasing consumer demand for personalized financial solutions. Companies are poised to capitalize on digital transformation trends, leveraging AI and blockchain to enhance customer experiences and operational efficiency. Strategic opportunities include expanding into untapped regions, developing new product lines, and forming strategic partnerships to enhance market reach and competitiveness.

Indonesia Life & Non-Life Insurance Market Segmentation

-

1. Insurance Type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non - Life Insurance

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Health

- 1.2.4. Rest of Non-Life Insurance

-

1.1. Life Insurance

-

2. Channel of Distribution

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Online

- 2.5. Other Distribution Channels

Indonesia Life & Non-Life Insurance Market Segmentation By Geography

- 1. Indonesia

Indonesia Life & Non-Life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.65% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growing Awareness of the Importance of Insurance

- 3.3. Market Restrains

- 3.3.1. The Growing Awareness of the Importance of Insurance

- 3.4. Market Trends

- 3.4.1. Life Insurance Holds the Largest Segment in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Life & Non-Life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non - Life Insurance

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Health

- 5.1.2.4. Rest of Non-Life Insurance

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Channel of Distribution

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Online

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Great Eastern Life Indonesia PT

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GlobalSurance

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Asurani Reliance Indonesia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Asuransi Jasa Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT KB Insurance Indonesia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Tokio Marine Life Insurance Indonesia

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Fistlight Indonesia

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bank Negara Indonesia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Tokio Marine

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Chubb Insurance**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Great Eastern Life Indonesia PT

List of Figures

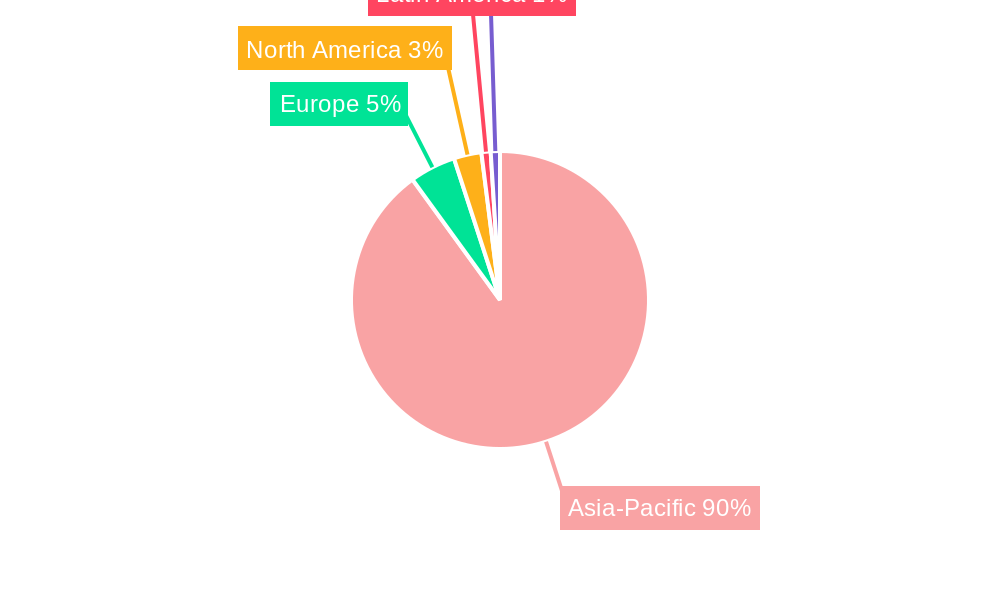

- Figure 1: Indonesia Life & Non-Life Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Life & Non-Life Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 4: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Insurance Type 2019 & 2032

- Table 5: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 6: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Channel of Distribution 2019 & 2032

- Table 7: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 10: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Insurance Type 2019 & 2032

- Table 11: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Channel of Distribution 2019 & 2032

- Table 12: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Channel of Distribution 2019 & 2032

- Table 13: Indonesia Life & Non-Life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Indonesia Life & Non-Life Insurance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Life & Non-Life Insurance Market?

The projected CAGR is approximately 4.65%.

2. Which companies are prominent players in the Indonesia Life & Non-Life Insurance Market?

Key companies in the market include Great Eastern Life Indonesia PT, GlobalSurance, PT Asurani Reliance Indonesia, PT Asuransi Jasa Indonesia, PT KB Insurance Indonesia, PT Tokio Marine Life Insurance Indonesia, PT Fistlight Indonesia, Bank Negara Indonesia, PT Tokio Marine, Chubb Insurance**List Not Exhaustive.

3. What are the main segments of the Indonesia Life & Non-Life Insurance Market?

The market segments include Insurance Type, Channel of Distribution.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.22 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growing Awareness of the Importance of Insurance.

6. What are the notable trends driving market growth?

Life Insurance Holds the Largest Segment in the Market.

7. Are there any restraints impacting market growth?

The Growing Awareness of the Importance of Insurance.

8. Can you provide examples of recent developments in the market?

In April 2023, Hanwha Life acquired Lippo General Insurance to improve its global presence and digital capabilities. Hanwha Life plans to become a leading digital financial services provider by offering tailored financial solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Life & Non-Life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Life & Non-Life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Life & Non-Life Insurance Market?

To stay informed about further developments, trends, and reports in the Indonesia Life & Non-Life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence