Key Insights

The Indonesian herbicide market, valued at approximately $X million in 2025 (assuming a logical extrapolation based on the provided CAGR and market size), is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.30% from 2025 to 2033. This expansion is driven by several key factors. The increasing intensity of farming practices necessitates effective weed control to maximize crop yields, particularly within the expanding commercial crops, fruits & vegetables, and grains & cereals sectors. Favorable government policies promoting agricultural modernization and sustainable farming techniques also contribute to the market's growth. Furthermore, rising awareness among farmers regarding the benefits of herbicide usage, including improved crop quality and reduced labor costs, fuels market adoption. However, potential restraints include environmental concerns surrounding herbicide use, stricter regulations on chemical application, and the fluctuating prices of raw materials influencing herbicide production costs. The market segmentation reveals a strong demand across various application modes, including chemigation, foliar application, fumigation, and soil treatment, catering to diverse crop types and farming practices. Key players such as Adama Agricultural Solutions Ltd, Bayer AG, Syngenta Group, and UPL Limited are actively competing in this dynamic market, investing in research and development to introduce innovative and environmentally friendly herbicide solutions.

The Indonesian herbicide market's growth trajectory is particularly promising given the country's significant agricultural sector. The increasing adoption of advanced agricultural technologies, combined with growing consumer demand for high-quality food products, is expected to further bolster market growth. However, challenges related to sustainable agricultural practices and environmental regulations will necessitate a shift towards bio-herbicides and integrated pest management strategies. Therefore, companies focused on developing and marketing environmentally friendly herbicides while adhering to stringent regulatory frameworks are likely to gain a competitive advantage in the long term. The market will witness increased focus on personalized herbicide solutions tailored to specific crop types and regional climate conditions in the coming years.

This comprehensive report provides an in-depth analysis of the Indonesia herbicide market, encompassing market size, growth drivers, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for businesses operating in or considering entry into this dynamic market segment.

Indonesia Herbicide Market Market Structure & Competitive Dynamics

The Indonesian herbicide market exhibits a moderately concentrated structure, with a handful of multinational corporations holding significant market share. Key players such as ADAMA Agricultural Solutions Ltd, Bayer AG, BASF SE, Corteva Agriscience, FMC Corporation, Nufarm Ltd, Syngenta Group, and UPL Limited dominate the landscape. PT Biotis Agrindo represents a significant domestic player. Market share fluctuates based on product innovation, pricing strategies, and distribution networks. The market’s innovation ecosystem is driven by both international R&D investment and the adaptation of existing technologies to local conditions.

Regulatory frameworks, primarily managed by the Indonesian Ministry of Agriculture, influence the registration and use of herbicides, impacting market access and product formulations. The market is seeing increased scrutiny on environmentally friendly options, creating pressure for bio-herbicide development and the adoption of sustainable agricultural practices. Substitutes, such as integrated pest management (IPM) techniques and biological controls, pose a gradual challenge. M&A activity has been moderate, with recent deals primarily focusing on enhancing R&D capabilities and expanding market reach. For example, the estimated value of M&A deals in the past five years totaled approximately xx Million, primarily driven by strategic acquisitions. The overall trend points towards consolidation among major players seeking enhanced market share and diversified product portfolios.

Indonesia Herbicide Market Industry Trends & Insights

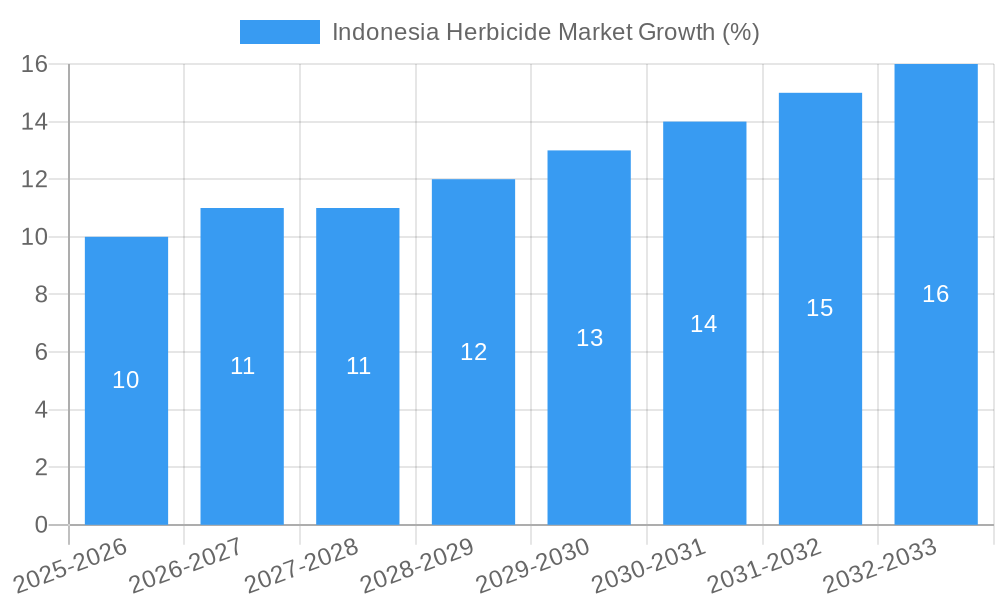

The Indonesian herbicide market is experiencing substantial growth, driven by factors such as rising agricultural production, increasing demand for high-yielding crops, and expanding cultivated land. The market exhibits a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration is steadily increasing across various crop segments, particularly in commercial crops and fruits & vegetables. Technological disruptions, such as the development of more precise application techniques and targeted herbicides, are further stimulating market growth. Consumer preferences are shifting towards eco-friendly and sustainable solutions, pushing manufacturers to invest in bio-herbicides and integrated pest management (IPM) strategies. The competitive landscape is characterized by intense rivalry among multinational corporations and the increasing participation of domestic players. This competition is driving innovation and promoting cost-effective solutions, making herbicides accessible to a wider range of farmers.

Dominant Markets & Segments in Indonesia Herbicide Market

The Indonesian herbicide market displays strong growth across various segments. However, the Foliar application mode currently dominates the market due to its ease of use and effectiveness across numerous crop types. This segment is predicted to represent xx Million in 2025. The Fruits & Vegetables crop type also presents a significant market share owing to the high value of these crops and stringent weed control requirements.

Key Drivers for Foliar Application and Fruits & Vegetables:

- High crop value: Farmers are willing to invest in effective weed control for high-value crops.

- Ease of application: Foliar application is convenient and requires less specialized equipment.

- Targeted weed control: This method allows for efficient control of specific weeds without harming the desired plants.

- Government support: Policies promoting intensive farming and high-value crop production indirectly boost the demand for herbicides.

- Favorable climate: The tropical climate in Indonesia supports the growth of fruits and vegetables, increasing demand for weed control solutions.

The other segments, including Chemigation, Fumigation, Soil Treatment, Commercial Crops, Grains & Cereals, Pulses & Oilseeds, and Turf & Ornamental, each hold considerable but relatively smaller market shares compared to foliar application in fruits and vegetables. However, growth opportunities exist in these segments, especially with increased adoption of advanced technologies and government initiatives promoting sustainable agricultural practices.

Indonesia Herbicide Market Product Innovations

Recent innovations focus on enhancing herbicide efficacy, selectivity, and environmental compatibility. This includes the development of new formulations offering improved weed control, reduced application rates, and minimized environmental impact. Technological advancements are resulting in herbicide products that target specific weed species, reducing the need for broad-spectrum herbicides. These innovations align with increasing consumer demand for environmentally friendly options and stricter regulatory requirements. Furthermore, the development of smart application technologies like precision spraying systems are further contributing to the evolution of the Indonesia herbicide market.

Report Segmentation & Scope

This report segments the Indonesia herbicide market based on application mode (Chemigation, Foliar, Fumigation, Soil Treatment) and crop type (Commercial Crops, Fruits & Vegetables, Grains & Cereals, Pulses & Oilseeds, Turf & Ornamental). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed. For example, the Foliar segment is projected to witness significant growth due to its ease of use, while the Fruits & Vegetables segment is expected to drive substantial herbicide demand due to the high value of these crops. The Chemigation segment may exhibit moderate growth driven by increased adoption in large-scale farming operations. The other segments will show varied growth rates depending on several factors including local farming practices and government incentives.

Key Drivers of Indonesia Herbicide Market Growth

Several factors fuel the growth of the Indonesian herbicide market. Rising agricultural production, driven by a growing population and increasing demand for food, necessitates effective weed control. Government initiatives promoting agricultural modernization and intensification further enhance herbicide usage. Technological advancements resulting in more efficient and targeted herbicides also contribute to market growth. Favorable climatic conditions for crop cultivation increase the demand for weed management. Lastly, the expanding area under cultivation provides additional opportunities for herbicide application.

Challenges in the Indonesia Herbicide Market Sector

The Indonesian herbicide market faces challenges including stringent regulatory approvals for new products, potentially leading to delays in product launches. Supply chain disruptions can impact herbicide availability and pricing. The increasing prevalence of herbicide-resistant weeds necessitates the development of new, more effective herbicide formulations. Furthermore, growing concerns about environmental impact and human health risks related to herbicide use pose significant hurdles. These factors limit the overall potential for market growth.

Leading Players in the Indonesia Herbicide Market Market

- ADAMA Agricultural Solutions Ltd

- Bayer AG

- Wynca Group (Wynca Chemicals)

- Syngenta Group

- UPL Limited

- PT Biotis Agrindo

- BASF SE

- FMC Corporation

- Corteva Agriscience

- Nufarm Ltd

Key Developments in Indonesia Herbicide Market Sector

- October 2021: ADAMA enhanced its R&D capabilities by investing in a new chemist's center, accelerating plant protection research and development.

- August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with advanced weed control solutions.

- January 2023: Bayer partnered with Oerth Bio to develop more eco-friendly crop protection technologies.

These developments highlight the industry's focus on innovation, sustainability, and collaboration to meet the evolving needs of Indonesian farmers.

Strategic Indonesia Herbicide Market Market Outlook

The Indonesian herbicide market holds significant future potential, driven by sustained growth in agricultural production, rising demand for food, and ongoing technological advancements. Strategic opportunities exist for companies to invest in research and development of sustainable and effective herbicides, focusing on environmentally friendly formulations and precision application technologies. Collaboration with local stakeholders, including farmers and government agencies, will be crucial for successful market penetration and sustainable growth. The market's future success hinges on the ability of companies to adapt to evolving consumer preferences and regulatory requirements.

Indonesia Herbicide Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Herbicide Market Segmentation By Geography

- 1. Indonesia

Indonesia Herbicide Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Traditional method of applying herbicides through soil treatment mode and its effectiveness in controlling weeds in early growth stage may increase the adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Herbicide Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ADAMA Agricultural Solutions Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayer AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Wynca Group (Wynca Chemicals

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Syngenta Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 UPL Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Biotis Agrindo

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BASF SE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FMC Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Corteva Agriscience

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nufarm Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADAMA Agricultural Solutions Ltd

List of Figures

- Figure 1: Indonesia Herbicide Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Herbicide Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Herbicide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Herbicide Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Indonesia Herbicide Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Indonesia Herbicide Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Indonesia Herbicide Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Indonesia Herbicide Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Indonesia Herbicide Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Herbicide Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Indonesia Herbicide Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Indonesia Herbicide Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Indonesia Herbicide Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Indonesia Herbicide Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Indonesia Herbicide Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Indonesia Herbicide Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Herbicide Market?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Indonesia Herbicide Market?

Key companies in the market include ADAMA Agricultural Solutions Ltd, Bayer AG, Wynca Group (Wynca Chemicals, Syngenta Group, UPL Limited, PT Biotis Agrindo, BASF SE, FMC Corporation, Corteva Agriscience, Nufarm Ltd.

3. What are the main segments of the Indonesia Herbicide Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Traditional method of applying herbicides through soil treatment mode and its effectiveness in controlling weeds in early growth stage may increase the adoption.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

January 2023: Bayer formed a new partnership with Oerth Bio to enhance crop protection technology and create more eco-friendly crop protection solutions.August 2022: BASF and Corteva Agriscience collaborated to provide soybean farmers with the weed control of the future. By working together, BASF and Corteva aim to satisfy farmers' demand for specialized weed control solutions that are distinct from those that are currently available or being developed.October 2021: By investing in a new chemist's center, ADAMA enhanced its R&D capabilities that are aimed to expand and accelerate its own research and development in the field of plant protection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Herbicide Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Herbicide Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Herbicide Market?

To stay informed about further developments, trends, and reports in the Indonesia Herbicide Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence